# SPOTLIGHT

MARKET ACTIVITY

| TSX | -84.52 (0.30%) | 27,908.91 |

| TSX Venture | -5.43 (0.69%) | 781.03 |

| ASX 200 | +46.70 (0.53%) | 8,873.80 |

| S&P 500 | -2.03 (0.03%) | 6,464.55 |

| BMO Junior Gold Index | +0.64 (0.43%) | 150.16 |

| VanEck Jr Miners | -0.01 (0.01%) | 73.04 |

| Sprott Junior Miners | -0.32 (0.61%) | 52.35 |

COMMODITY PRICES

| Gold (US$/oz) | -23.60 (0.69%) | 3,384.70 |

| Silver (US$/oz) | -0.50 (1.30%) | 38.10 |

| Copper (US$/lb) | -0.01 (0.14%) | 4.49 |

| Platinum (US$/oz) | +21.30 (1.59%) | 1,364.10 |

| Palladium (US$/oz) | +27.20 (2.4%) | 1,158.50 |

MARKET MOVERS

| Company | Change | Last Trade |

|---|---|---|

| Aura Minerals | 1.91 5.26 | $38.20 |

| Equinox Gold | 1.47 15.67 | $10.85 |

| Lundin Gold | 1.17 1.49 | $79.80 |

| Perpetua Resources | 0.78 3.34 | $24.16 |

| Contango ORE | 0.76 3.50 | $22.45 |

| MP Materials | 0.69 0.92 | $76.10 |

| Critical Metals | 0.61 12.25 | $5.59 |

| Idaho Strategic Resources | 0.47 1.80 | $26.53 |

| Galiano Gold | 0.45 20.60 | $2.61 |

| Energy Fuels | 0.40 3.06 | $13.48 |

| Endeavour Mining | 0.40 0.88 | $45.77 |

| Dundee Precious Metals | 0.38 1.58 | $24.47 |

| Orla Mining | 0.32 2.39 | $13.70 |

| Piedmont Lithium | 0.28 2.97 | $9.70 |

| NexMetals Mining | 0.26 3.42 | $7.87 |

HIGH VOLUME

| Company | Volume | Last Trade |

|---|---|---|

| Mogotes Metals | 7,521,390 | $0.27 |

| Goldstorm Metals | 6,892,878 | $0.20 |

| Equinox Gold | 6,347,608 | $10.85 |

| Arras Minerals | 5,944,192 | $0.73 |

| Metalex Ventures | 5,886,382 | $0.02 |

| Minera Alamos | 4,816,848 | $0.34 |

| Global Atomic | 4,410,424 | $0.49 |

| Argenta Silver | 4,408,131 | $0.66 |

| Canadian Gold | 4,249,925 | $0.31 |

| Majestic Gold | 4,203,450 | $0.14 |

| Alkane Resources | 3,967,339 | $0.74 |

| Avalon Advanced Materials | 3,788,798 | $0.04 |

| Bocana Resources | 3,686,762 | $0.03 |

| Scorpio Gold | 3,557,839 | $0.34 |

| Emerita Resources | 3,430,645 | $1.04 |

Eagle Plains Resources

Eagle Plains Resources is a well-funded, prolific project generator that continues to conduct research, acquire and explore mineral projects throughout western Canada, with a focus on critical metals integral to an increasingly electrified, decarbonized economy. The Company is committed to steadily enhancing shareholder value by advancing our diverse portfolio of projects toward discovery through collaborative partnerships and development of a highly experienced... LEARN MORE

Core Nickel

Core Nickel, junior exploration company, is advancing responsible exploration in Manitoba’s Thompson Nickel Belt. Focused on discovering high-grade magmatic nickel-sulphide deposits, Core Nickel’s key asset, the Mel deposit, holds a historic estimate of 5.3 million tonnes at 0.85% nickel. Positioned 25 km from the Thompson Mill, Mel benefits from nearby infrastructure. Core Nickel aims to increase responsibly sourced nickel supply for a net-zero, carbon-neutral future... LEARN MORE

Freeport Resources

Freeport Resources is advancing one of the largest undeveloped copper deposits in the world. The 100% owned Yandera copper project covers approximately 245 square kilometers and is located in the highly prolific Papua New Guinea Orogenic Belt. Approximately $200 million in exploration and development expenditures have been spent on the project since 2005. The company has commenced work towards completing a Definitive Feasibility Study and has accelerated... LEARN MORE

EARNINGS / PRODUCTION RESULTS

COLLECTIVE MINING (TSX: CNL)

Collective Mining is a gold, silver, copper and tungsten exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten... LEARN MORE

Collective Mining

Collective Mining is a gold, silver, copper and tungsten exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines. The Company’s flagship project, Guayabales, is anchored by the Apollo system, which hosts the large-scale, bulk-tonnage and high-grade gold-silver-copper-tungsten Apollo system... LEARN MORE

Elemental Altus Royalties

Elemental Altus is an income generating precious metals royalty company with 10 producing royalties and a diversified portfolio of pre-production and discovery stage assets. The Company is focused on acquiring uncapped royalties and streams over producing, or near-producing, mines operated by established counterparties. The vision of Elemental Altus is to build a global gold royalty company, offering investors superior exposure to gold with reduced risk and strong growth... LEARN MORE

ATEX Resources

ATEX Resources is exploring the Valeriano Copper Gold Project located within the emerging copper gold porphyry mineral belt linking the prolific El Indio High-Sulphidation Belt to the south with the Maricunga Gold Porphyry Belt to the north. Valeriano hosts a large copper gold porphyry resource: 1.41 billion tonnes at 0.67% CuEq (0.50% Cu, 0.20 g/t Au, 0.96 g/t Ag and 63.80 g/t Mo), which includes a higher-grade core totaling 200 million tonnes at 0.84% CuEq... LEARN MORE

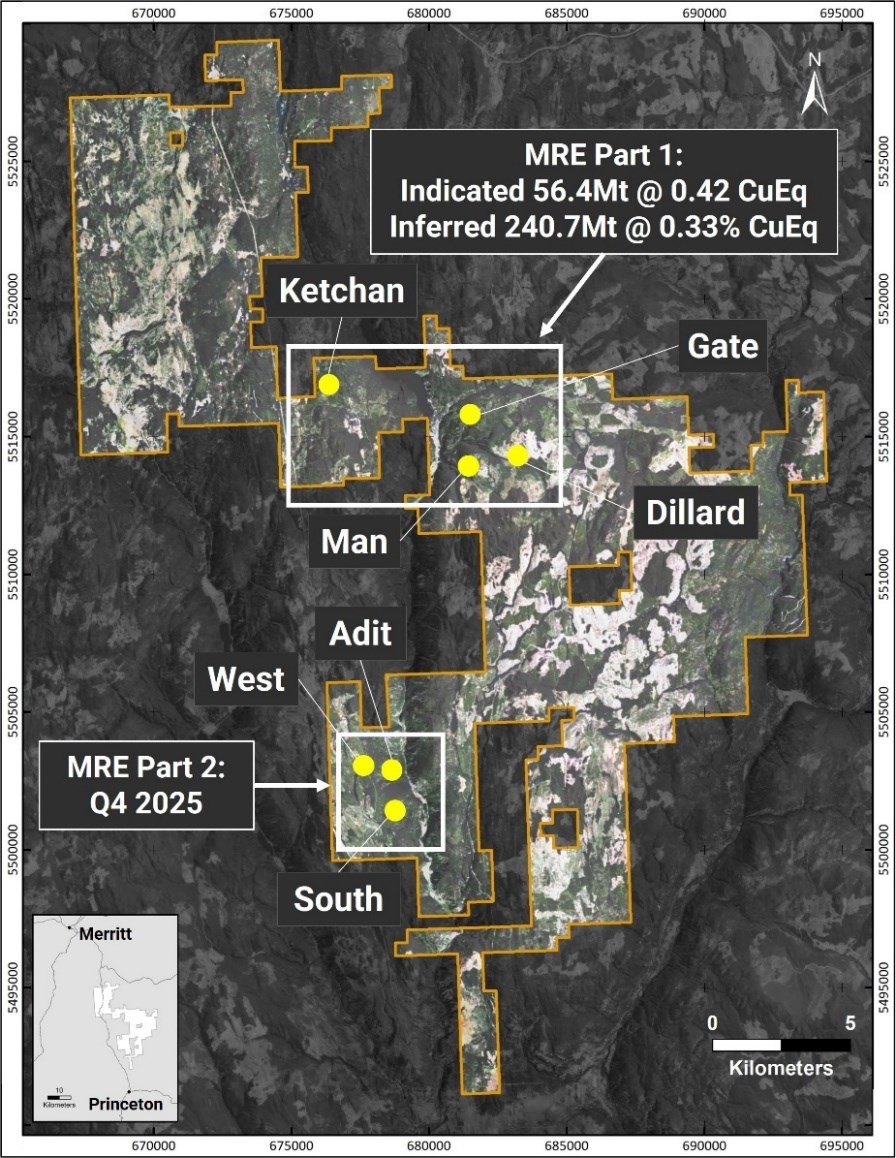

Kodiak Copper

Kodiak Copper is focused on discovering copper, the most critical metal for the energy transition and AI by exploring its projects in Canada and the USA. The Company was founded by Chairman Chris Taylor, the founder and CEO of Great Bear Resources which was acquired by Kinross Gold in 2022 for $1.8B. The Company is led by Claudia Tornquist (former GM at Rio Tinto) and is a member of Discovery Group. Kodiak's MPD copper-gold project in southern British Columbia has... LEARN MORE

Kenorland Minerals

Kenorland Minerals is focused on early to advanced stage exploration in North America. The Company holds a 4% net smelter return royalty on the Frotet Project in Quebec, owned by Sumitomo Metal Mining Canada Ltd. The Frotet Project hosts the Regnault gold system, a greenfields discovery made by Kenorland and Sumitomo Metal Mining Canada in 2020. Kenorland provides investors with exposure to over 1.5 million hectares of mineral rights being explored systematically... LEARN MORE

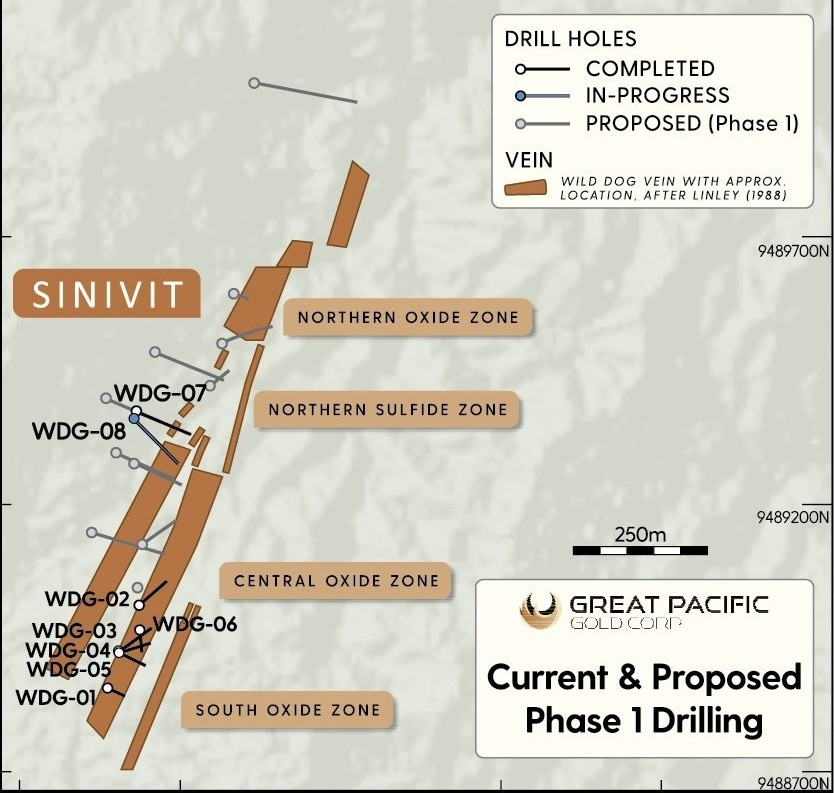

Great Pacific Gold

Great Pacific Gold’s vision is to become the leading gold-coper development company in Papua New Guinea. The Company’s flagship project, Wild Dog, consists of a large-scale epithermal target, the Wild Dog structural corridor, stretching 15km in strike length and potentially over 1,000 meters deep based on a recent MobileMT geophysics survey. Drilling has yielded high-grade results, including 7 m at 11.2 g/t AuEq from 65m. The current drilling program will extend... LEARN MORE

RECENT / RELEVANT

# GRAPHITE STOCKS

- Nouveau Monde Graphite (TSX.V: NOU)

- NextSource Materials (TSX: NEXT)

- Graphite One (TSX.V: GPH)

- Gratomic (TSX.V: GRAT)

- Mason Graphite (TSX.V: LLG)

# BURKINA FASO STOCKS

- Endeavour Mining (TSX: EDV)

- B2 Gold (TSX: BTO)

- IAMGOLD (TSX: IMG)

- Orezone Gold (TSX: ORE)

- Sarama Resources (TSX.V: SWA)

# JAMES BAY TERRITORY STOCKS

- Patriot Battery Metals (TSX.V: PMET)

- Critical Elements (TSX.V: CRE)

- Li-FT Power (CSE: LIFT)

- Brunswick Exploration (TSX.V: BRW)

- Azimut Exploration (TSX.V: AZM)