Vancouver, British Columbia--(Newsfile Corp. - August 12, 2025) - Kodiak Copper Corp. (TSXV: KDK) (OTCQB: KDKCF) (FSE: 5DD1) (the "Company" or "Kodiak") today announces that it has filed an independent technical report (the "Report") on SEDAR+ prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") in support of initial Mineral Resource estimates for four deposits on the Company's 100%-owned MPD copper-gold project in southern British Columbia. Mineral Estimates on three additional mineralized zones are being developed and are anticipated in the second half of 2025 (see news release June 25, 2025).

Highlights

-

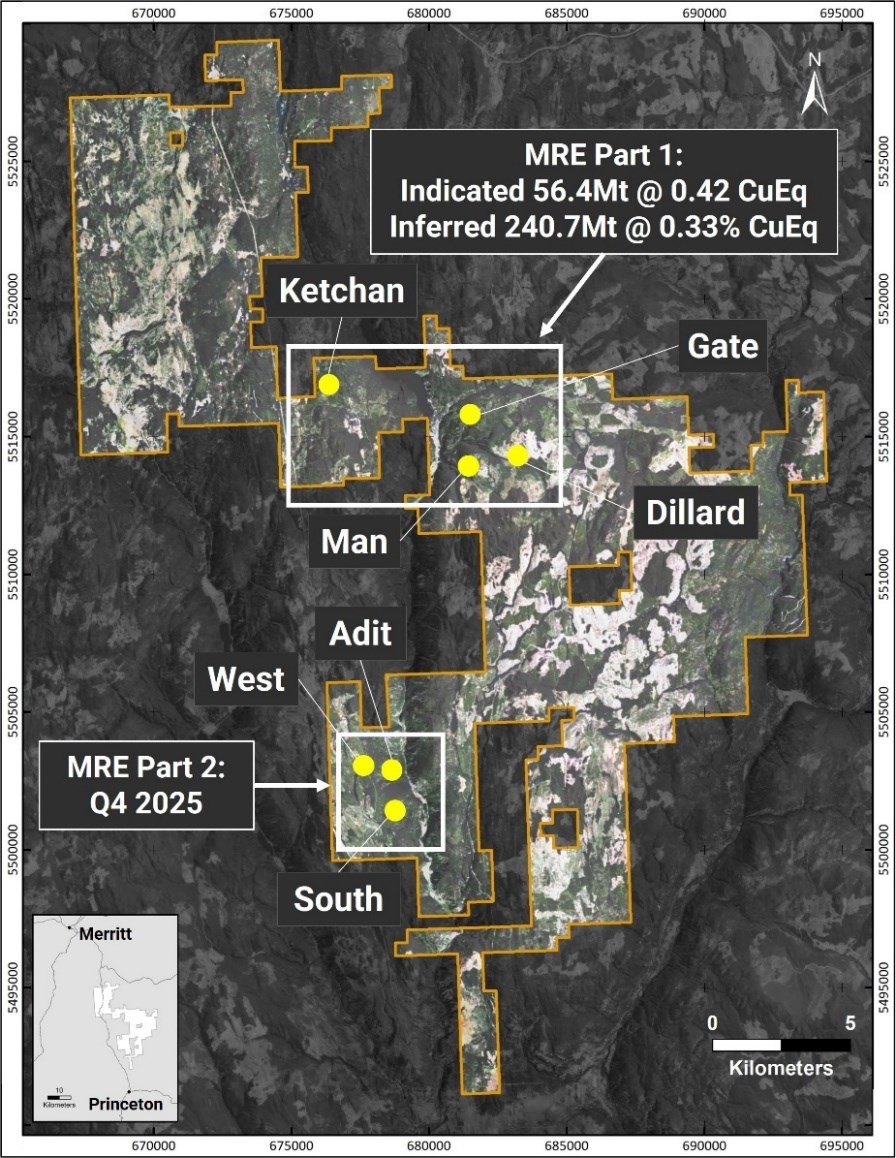

Sizable initial copper-gold Mineral Resource estimate ("MRE") prepared for four of seven mineralized zones outlined to date at MPD: Gate, Ketchan, Man and Dillard. Figure 1

-

Indicated Mineral Resource: 56.4 million tonnes (Mt) grading 0.42% copper equivalent (CuEq) for 385 million pounds (Mlb) of copper (Cu) and 0.25 million ounces (Moz) of gold (Au). Table 1

-

Inferred Mineral Resource: 240.7 million tonnes (Mt) grading 0.33% copper equivalent (CuEq) for 1,291 million pounds (Mlb) of copper (Cu) and 0.96 million ounces (Moz) of gold (Au). Table 1

-

The MRE is defined using open pit design shells to constrain the Resource models and a cut-off grade of 0.2% CuEq. Sensitivity cases using lower cut-of grades have significantly higher tonnages and metal contents. Table 2

-

Mineralization remains open for expansion within and beyond the MRE pit shells, in multiple directions and at depth.

-

The full MRE for all seven mineralized zones at MPD is planned for completion in Q4 with the addition of three further mineralized zones (West, Adit and South), where confirmation and infill drilling is currently under way as part of the Company's 2025 exploration program (see news release June 18, 2025).

-

The higher-grade, near surface mineralization identified at the West, Adit and South zones has the potential to make an important contribution to the full MRE. Figure 1

-

The Report is available on SEDAR+ and on the Company's website.

Figure 1: MPD Project - location map and Mineral Resources/mineralized zones

Figure 1: MPD Project - location map and Mineral Resources/mineralized zones

Initial Mineral Resource Estimate

The drill hole density in the central part of the Gate Zone was sufficient to develop a 56.4 Mt Indicated Resource grading 0.42% CuEq. Inferred Resources at the Man, Dillard, Ketchan and Gate zones total 240.7 Mt with an average grade of 0.33% CuEq (see Table 1). The Inferred Resource at Gate is peripheral to the Indicated Resource. Figure 2 shows the MRE pit shells that support the Reasonable Prospects of Eventual Economic Extraction (RPEEE).

Table 1: MPD Initial Mineral Resource Estimate

| MPD Initial Mineral Resource Estimate - Part 1 (4 of 7 zones) | ||||||||||

| Zone | Resource Category |

Tonnes | Average Grade | Metal Content | ||||||

| (Mt) | Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq (%) |

Cu (Mlbs) |

Au (Moz) |

Ag (Moz) |

CuEq (Mlbs) |

||

| Gate | Indicated | 56.4 | 0.31 | 0.14 | 1.18 | 0.42 | 385 | 0.25 | 2.14 | 522 |

| Gate | Inferred | 114.5 | 0.27 | 0.13 | 1.07 | 0.36 | 681 | 0.48 | 3.94 | 909 |

| Man | Inferred | 8.3 | 0.17 | 0.30 | 0.56 | 0.37 | 31 | 0.08 | 0.15 | 68 |

| Dillard | Inferred | 51.9 | 0.20 | 0.09 | 0.39 | 0.26 | 229 | 0.15 | 0.65 | 298 |

| Ketchan | Inferred | 66.0 | 0.24 | 0.12 | 1.09 | 0.33 | 349 | 0.25 | 2.31 | 480 |

| Total Indicated | 56.4 | 0.31 | 0.14 | 1.18 | 0.42 | 385 | 0.25 | 2.14 | 522 | |

| Total Inferred | 240.7 | 0.24 | 0.12 | 0.91 | 0.33 | 1,291 | 0.96 | 7.05 | 1,754 | |

Notes: 1. The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum(CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee and adopted by CIM Council.

2. A cut-off grade of 0.2% CuEq was applied to the MRE models within the pit shells.

3. Pit shell optimization used average recoveries derived from metallurgical test work of Cu 82%, Au 60% and Ag 54%, exchange rate of 1.35 CAD:USD, mining cost of C$2.3/t, process cost of C$8.5/t, and pit slope of 45 degrees.

4. Copper equivalence (CuEq) and constraining pit shells assume metal prices (US$) of: $4.2/lb copper, $2,600/oz gold, $30/oz silver.

5. The copper equivalency equation used is: CuEq(%) = Cu(%) + Au(g/t) x 0.6606 + Ag(g/t) x 0.0069

6. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves in the future. The MRE may be materially affected by considerations including, but not limited to, permitting, legal, sociopolitical, environmental issues, market conditions or other factors.

7. All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines.

Figure 2: MPD Project - RPEEE shells used to constrain the Initial Mineral Resource Estimate

Figure 2: MPD Project - RPEEE shells used to constrain the Initial Mineral Resource Estimate

Sensitivity Cut-off Grades

In addition to the base case cut-off grade ("COG") of 0.2% CuEq a range of cut-off grades from 0.12% to 0.22% CuEq were applied to the Resource models to evaluate the potential effect on tonnage, grade and metal content (Table 2). Lower cut-off grade sensitivity cases demonstrate a notable increase in tonnage and in-situ metal, with a decrease in average grades. The values in the COG sensitivity cases are for comparison purposes only and should not be considered Mineral Resources.

Table 2: Cut-Off Grade Sensitivity Summary

| MPD Initial Mineral Resource Estimate & Cut-Off Grade Sensitivity Scenarios | ||||||

| Cut-Off Grade | Indicated | Inferred | ||||

| (CuEq %) | Tonnes (Mt) |

CuEq (%) |

CuEq (Mlbs) |

Tonnes (Mt) |

CuEq (%) |

CuEq (Mlbs) |

| 0.22 | 50.6 | 0.44 | 491 | 204.5 | 0.35 | 1,578 |

| 0.20 | 56.4 | 0.42 | 522 | 240.7 | 0.33 | 1,754 |

| 0.18 | 62.4 | 0.39 | 537 | 281.7 | 0.31 | 1,936 |

| 0.15 | 72.3 | 0.36 | 574 | 355.6 | 0.28 | 2,183 |

| 0.12 | 82.4 | 0.33 | 600 | 435.6 | 0.25 | 2,415 |

Notes: 1. Copper equivalence (CuEq) assumes metal prices (US$) of: $4.2/lb copper, $2,600/oz gold, $30/oz silver.

2. CuEq is based on average recoveries derived from metallurgical test work as applied in the pit optimization process. Average recoveries are: Cu 82%, Au 60% and Ag 54%.

3. The copper equivalency equation used is: CuEq(%) = Cu(%) + Au(g/t) x 0.6606 + Ag(g/t) x 0.0069

Qualified Person

The Report was prepared by Alfonso Rodriguez, M. Sc., P.Geo (Apex Geoscience Ltd), James Gray, P.Geo (Advantage Geoservices Ltd) and Shane Tad Crowie, P. Eng. (JDS Energy and Mining Inc.), each of whom are independent Qualified Persons as defined by NI 43-101. The effective date of the report is June 25, 2025.

The MRE was prepared by James Gray, P.Geo., of Advantage Geoservices Ltd., with contributions from Tysen Hantelmann, P.Eng., of JDS Energy & Mining Inc. for cut-off grade and Pit Shell optimization and Shane Tad Crowie, P.Eng., of JDS Energy & Mining Inc., for metallurgical parameters, in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards and Canadian National Instrument 43-101 ("NI 43-101"). James Gray, Tysen Hantelmann and Shane Tad Crowie, are independent Qualified Persons as defined by NI 43-101 and have reviewed and approved the contents of this news release. Dave Skelton, P.Geo. (AB), Vice President Exploration and a Qualified Person as defined by National Instrument 43-101, has approved and verified the technical information used in this news release. The historic work referenced herein is believed to be from reliable sources using industry standards at the time, based on Kodiak's review of available documentation. However, the Company has not independently validated all historic work, and the reader is cautioned about its accuracy.

Stock Option Grant

Kodiak also granted 32,000 stock options (the "Options") to an advisor of the Company. The Options are exercisable at C$0.63 per share for a period of five years from the date of grant with 1/3 vesting immediately and 1/3 every year thereafter. The Options were granted pursuant to the Company's shareholder approved stock option plan and are subject to the policies of the TSX Venture Exchange and any applicable regulatory hold periods.

On behalf of the Board of Directors

Kodiak Copper Corp.

Claudia Tornquist

President & CEO

For further information contact:

Nancy Curry, VP Corporate Development

This email address is being protected from spambots. You need JavaScript enabled to view it.

+1 (604) 646-8362

About Kodiak Copper

Kodiak is focused on its 100% owned copper porphyry projects in Canada and the USA that have been historically drilled and present known mineral discoveries with the potential to hold large-scale deposits. Kodiak Copper's most advanced asset is the 100% owned MPD copper-gold porphyry project in the prolific Quesnel Terrane in south-central British Columbia, Canada, a mining district with producing mines and excellent infrastructure. MPD exhibits all the hallmarks of a major, multi-centered porphyry district with the potential to become a top-tier mine. To date, drilling has outlined seven substantial mineralized zones across the property, and Kodiak is delivering an Initial Resource estimate for MPD in 2025. The estimate for the first four mineralized zones has already highlighted the project's scale and potential. Drill results on the remaining three zones from Kodiak's 2025 exploration program will be incorporated into the full Initial Resource estimate, expected by year end. With known mineralized zones open to expansion and multiple untested targets, Kodiak continues to systematically explore the district-scale potential of MPD to build critical mass and make the next discovery.

Kodiak's founder and Chairman is Chris Taylor who is well-known for his gold discovery success with Great Bear Resources. Kodiak is also part of Discovery Group led by John Robins, one of the most successful mining entrepreneurs in Canada.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement (Safe Harbor Statement)

This press release contains forward-looking statements within the meaning of applicable securities laws. The use of any of the words "anticipate", "plan", "continue", "expect", "estimate", "objective", "may", "will", "project", "should", "predict", "potential" and similar expressions are intended to identify forward-looking statements. In particular, this press release contains forward-looking statements concerning the Company's exploration plans. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company cannot give any assurance that they will prove correct. Since forward-looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with conditions in the equity financing markets, and assumptions and risks regarding receipt of regulatory and shareholder approvals.

Management has provided the above summary of risks and assumptions related to forward-looking statements in this press release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward-looking statements are made as of the date of this press release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or results or otherwise.