Toronto, Ontario--(Newsfile Corp. - August 14, 2025) - Hercules Metals Corp. (TSXV: BIG) (OTCQB: BADEF) (FSE: C0X) ("Hercules Metals" or the "Company") is pleased to announce that it has closed its previously announced brokered private placement, which was fully subscribed and included the exercise in full of the Agents' option, pursuant to which the Company sold 24,644,500 common shares in the capital of the Company (the "Shares") at a price of C$0.70 per Share, for aggregate gross proceeds to the Company of C$17,251,150 (the "Offering"). The Offering was conducted on a "best efforts" agency basis, with Canaccord Genuity Corp. ("Canaccord Genuity") and BMO Capital Markets (collectively with Canaccord Genuity, the "Co-Lead Agents"), as co-lead agents and co-lead bookrunners, and First Nations Financial Markets Limited Partnership (collectively with the Co-Lead Agents, the "Agents").

The Shares were offered for sale by way of private placement pursuant to the listed issuer financing exemption under section 5A.2 of National Instrument 45-106 - Prospectus Exemptions, as modified by Coordinated Blanket Order 45-935 - Exemptions from Certain Conditions of the Listed Issuer Financing Exemption (the "Listed Issuer Financing Exemption") in each of the Provinces of Canada (other than the Province of Quebec), and in the United States pursuant to exemptions from the registration requirements of the U.S. Securities Act, and in certain other jurisdictions outside of Canada and the United States pursuant to available prospectus or registration exemptions in accordance with applicable laws. The Shares issued under the Listed Issuer Financing Exemption will not be subject to a statutory hold period pursuant to applicable Canadian securities laws (except to the extent that the TSX Venture Exchange's four-month hold period applies).

In consideration for their services, the Agents received a cash commission (the "Agents' Commission") equal to 6.0% of the gross proceeds of the Offering, other than from the sale to certain purchasers on a "president's list" for which a 3.0% Agents' Commission was paid to the Agents.

A director of the Company participated in the Offering. The participation of the Company's director in the Offering constitutes a "related party transaction" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). This transaction is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101, as neither the fair market value of the securities to be distributed nor the consideration to be received for the securities issued to such related party under the Offering will exceed 25% of the Company's market capitalization. The Company's director subscribed for 71,400 Shares for aggregate gross proceeds of C$49,980.

The Company intends to use the net proceeds of the Offering for exploration and development of its 100% owned Hercules property in western Idaho (the "Hercules Property"), and for general working capital purposes.

There is an offering document relating to the Offering and the use by the Company of the Listed Issuer Financing Exemption that can be accessed under the Company's profile at www.sedarplus.ca and at https://www.herculesmetals.com/. Final acceptance by the TSX Venture Exchange of the Offering is subject to the completion of customary post-closing filings.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration requirements is available.

For Further Information Please Contact:

Chris Paul

CEO & Director

Telephone +1 (604) 670-5527

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Greg DiTomaso

Investor Relations

Telephone: +1 (647) 243-4074

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

About Hercules Metals Corp.

Hercules Metals Corp. (TSXV: BIG) (OTCQB: BADEF) (FSE: C0X) is an exploration company focused on developing America's newest porphyry copper district, in Idaho.

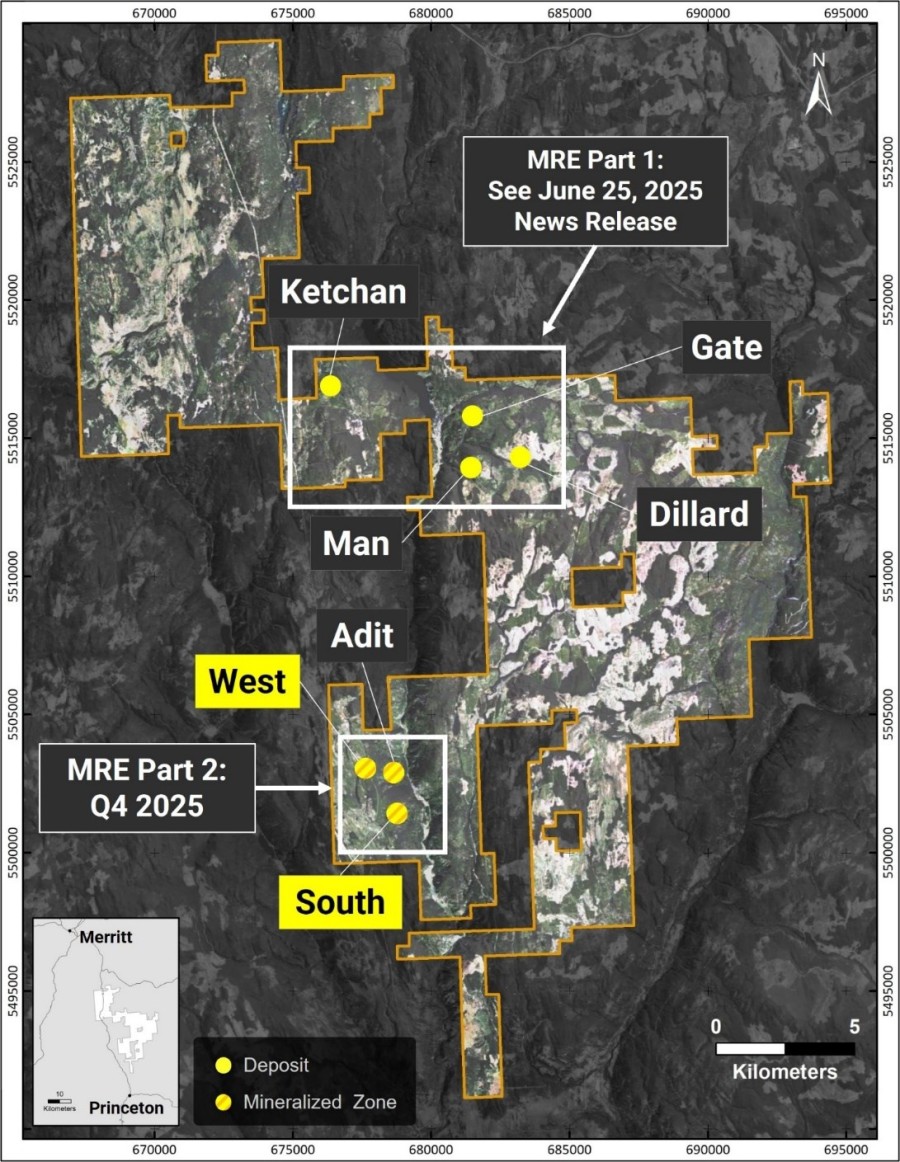

The 100% owned Hercules Property located northwest of Cambridge, hosts the newly discovered Leviathan porphyry copper system, one of the most important new discoveries in the region to date. The Company is well positioned for growth through continued drilling, supported by a strategic investment from Barrick Mining Corporation.

With the potential for significant scale, the Company's management and board of directors aims to build on its proven track record which includes the discovery and development of numerous precious metals projects worldwide.

Caution Regarding Forward-Looking Statements

This news release contains certain information that may be deemed "forward-looking information" with respect to the Company within the meaning of applicable securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Forward-looking information contained in this news release may include, without limitation, statements regarding the proposed use of proceeds of the Offering, the final acceptance of the Offering by the TSX Venture Exchange, and the execution of future exploration programs on the Hercules Property.

Although the Company believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature, forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; adverse industry events; the receipt of required regulatory approvals and the timing of such approvals; that the Company maintains good relationships with the communities in which it operates or proposes to operate; future legislative and regulatory developments in the mining sector; the Company's ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; the mining industry and markets in Canada and generally; the ability of the Company to implement its business strategies; competition; the risk that any of the assumptions prove not to be valid or reliable, which could result in delays, or cessation in planned work; risks associated with the interpretation of data; the geology, grade and continuity of mineral deposits; the possibility that results will not be consistent with the Company's expectations; as well as other assumptions risks and uncertainties applicable to mineral exploration and development activities and to the Company, including as set forth in the Company's public disclosure documents filed on the SEDAR+ website at www.sedarplus.ca.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE REPRESENTS THE EXPECTATIONS OF HERCULES METALS AS OF THE DATE OF THIS PRESS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE HERCULES METALS MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES