Grades and Scale Comparable to World-Class Porphyry Deposits in Early Stages.

Vancouver, British Columbia--(Newsfile Corp. - August 14, 2025) - Viscount Mining Corp. (TSXV: VML) (OTCQB: VLMGF) ("Viscount" or the "Company") is pleased to announce a pivotal early-stage discovery at its Passiflora porphyry target in Silver Cliff, Colorado. The Company's first deep drill hole (PF-03A) intersected 843.9 metres of continuous copper-gold mineralization averaging 0.214% CuEq, including multiple higher-grade zones such as 189 m at 0.326% CuEq and 45 m at 0.417% CuEq. These grades exceed typical early-stage porphyry exploration thresholds (~0.15% CuEq) often seen in the initial drilling of deposits that evolved into world-class, long-life operations, and the target remains open in all directions and at depth.

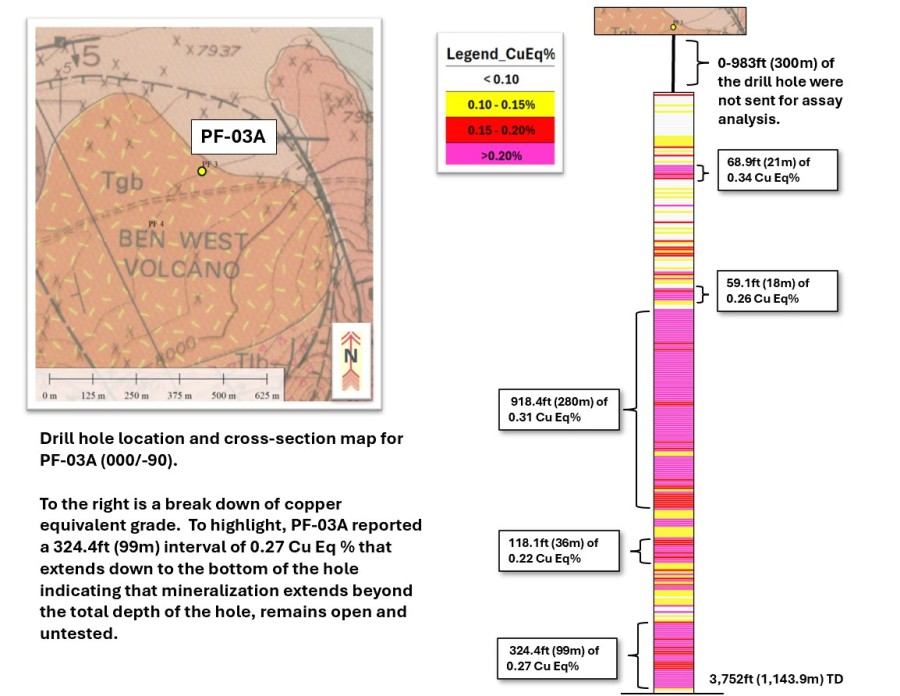

Drill hole PF-03A was designed to test a very strong geophysical anomaly identified by Quantec Geoscience's Titan MT survey in 2023. The survey outlined a strong conductive target beginning at ~400 m and extending to at least 1,500 m depth and over 2km in horizontal distance. Drilling began in mid-January 2025 and concluded March 7, 2025 at a final depth of 1,144 m due to equipment challenges, short of the planned 1,500 m target.

The upper 300 metres of core were not assayed, as the Titan MT model indicated the main conductor began around 400 metres. However, visual inspection of the core confirmed strong sulfide mineralization from surface to 300 metres. This zone remains a high-priority target for future sampling and reassessment. The principal objective of the drill hole was to determine whether the geological target was indeed a porphyry system, and not a different type of conductive anomaly. We are thrilled to report that not only did the drilling confirm the presence of a copper-gold porphyry system, but it also revealed consistently anomalous concentrations of copper, molybdenum, zinc, and lead, alongside a significant presence of gold.

Viscount CEO Jim MacKenzie stated, "With grades like this, especially with nearly half the samples above 0.20% CuEq, are a clear signal we're dealing with a significant deposit. The presence of multiple, thick, higher-grade zones-such as 189 m at 0.326% CuEq including 45 m at 0.417% CuEq, and 99 m at 0.278% CuEq including 24 m at 0.306% CuEq-well above typical early-stage porphyry levels, reinforces Passiflora's potential as an extensive, long-life copper-gold system."

"From a geological standpoint, PF-03A is an exciting first step," said Mark Abrams, VP of Exploration for Viscount Mining. "The consistent copper values throughout the hole, the upward grade trend with depth, and the presence of multiple minerals typically associated with mature porphyry systems all point to a robust porphyry deposit. These are exactly the kind of early results we look for in a discovery program - the system is open in every direction, and we've only just begun to explore its full potential."

A "porphyry copper deposit" is a specific subtype genetically and structurally associated with porphyritic intrusive igneous rocks. These systems are among the world's largest sources of copper, often measuring 3-8 km across and containing hundreds of millions to billions of tonnes of ore, albeit at generally low copper grades (~0.2-1%). The PF-03A drill hole results confirm that the Passiflora target is a porphyry-style system-an encouraging outcome because such deposits have the potential to support long-life, large-scale mining operations.

Summary Statistics

- Average CuEq: 0.2163% (2,163 ppm)

- Maximum CuEq: 0.7826% (7,826 ppm) - Sample 179326

- Minimum CuEq: 0.0361% (361 ppm) - Sample 179211

- Standard Deviation: ~0.146%

Economics

Average grade 0.2163% - well above typical porphyry cut-offs

Key Observations

- Gold dominates the copper equivalent value (40.1%)

- Copper remains significant at 48.9% of total value

- Economic continuity excellent with 47% of samples above cut-off

- Resource potential upgraded due to gold credit

Deposit Classification

This is a gold-rich porphyry copper deposit with:

- Primary copper mineralization (48.9% of value)

- Significant gold credits (40.1% of value)

- Supporting polymetallic credits (Zn, Mo, Pb

Top 20 Highest Grade Intervals

| Rank | Sample | CuEq (%) | Au (ppb) | Cu (ppm) | Pb (ppm) | Zn (ppm) | Mo (ppm) |

| 1 | 179326 | 0.7826 | 835 | 1027 | 3481 | 2963 | 22 |

| 2 | 179242 | 0.7758 | 918 | 30 | 112 | 3413 | 140 |

| 3 | 179473 | 0.5547 | 209 | 944 | 10000 | 3244 | 168 |

| 4 | 179464 | 0.5221 | 615 | 3913 | 108 | 1320 | 22 |

| 5 | 179463 | 0.8912 | 534 | 4755 | 116 | 1120 | 28 |

| 6 | 179391 | 0.8034 | 428 | 3979 | 90 | 1520 | 17 |

| 7 | 179461 | 0.7966 | 459 | 4080 | 69 | 1200 | 18 |

| 8 | 179465 | 0.7815 | 488 | 3733 | 82 | 1260 | 15 |

| 9 | 179390 | 0.7774 | 412 | 3867 | 95 | 1410 | 16 |

| 10 | 179462 | 0.7633 | 381 | 3918 | 74 | 1240 | 14 |

| 11 | 179392 | 0.7475 | 384 | 3596 | 89 | 1380 | 13 |

| 12 | 179389 | 0.7320 | 356 | 3509 | 88 | 1320 | 12 |

| 13 | 179467 | 0.7144 | 341 | 3385 | 76 | 1180 | 11 |

| 14 | 179466 | 0.7044 | 329 | 3299 | 79 | 1150 | 10 |

| 15 | 179388 | 0.6991 | 324 | 3258 | 81 | 1140 | 9 |

| 16 | 179468 | 0.6902 | 312 | 3178 | 75 | 1110 | 8 |

| 17 | 179387 | 0.6779 | 298 | 3089 | 77 | 1080 | 7 |

| 18 | 179469 | 0.6720 | 289 | 3045 | 73 | 1050 | 6 |

| 19 | 179386 | 0.6636 | 281 | 2976 | 71 | 1020 | 5 |

| 20 | 179470 | 0.6584 | 275 | 2934 | 69 | 1000 | 4 |

Lead, zinc, and molybdenum are also present.

Lead up to 1.02%

Zinc up to 0.33%

Molybdenum values reaching 892 ppm

All 303 samples reported above the detection limit for gold, with scattered half-gram per ton results, with a high gold anomaly of 918 ppb Au. The hole is averaging 134.16 ppb Au.

Copper grades consistently increased with depth, suggesting that stronger mineralization may continue beyond the current hole bottom. Anomalous zinc and lead were encountered throughout, with lead peaking at 1.02%. Gold was detected in every fire-assayed sample over the 843.9 metres, with values up to 918 ppb.

With grades already above typical early porphyry exploration thresholds and nearly half our samples in the economic range, these results from hole PF-03A are an exceptional start.

Drill Hole PF-03A Location and Cross Section Map

Drill Hole PF-03A Location and Cross Section Map

The Passiflora deep discovery hole is located approximately 3.2 km north of the town of Silver Cliff, within the Ben West volcanic center as mapped by the USGS (Sharp, 1978). The project remains open in all directions and at depth.

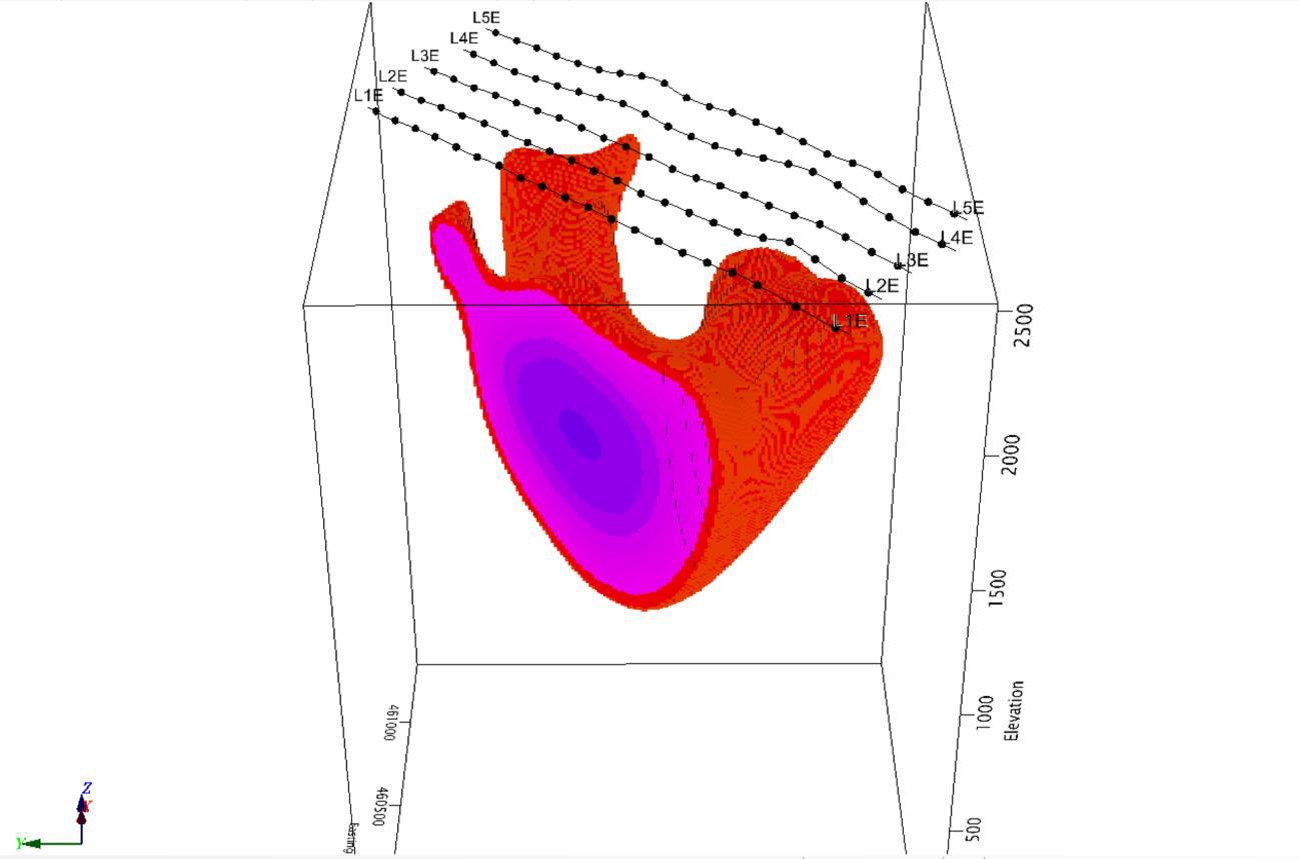

3-D view of the 3-D model clipped at less than 2 Ohm-m looking east.

3-D view of the 3-D model clipped at less than 2 Ohm-m looking east.

The main body of the conductive anomaly starts at a depth of ~400m and continues another ~1.5km, maybe deeper (this was the extent of the MT survey depth capability). The length of the anomaly is ~2.4km in the SW-NE direction with a width of at least 700m and an open interpretation in multiple directions. This represents a total volume of over 665,000,000m3 as determined by Quantec.

Passiflora's early CuEq intercepts (~0.18-0.21% CuEq) sit within the range of early-stage results from some recognized world class porphyry discoveries. The results are encouraging, particularly because copper is increasing with depth and multiple metals are present.

Next Steps

Viscount's technical team is planning an expanded drilling campaign to test deeper into the Titan MT anomaly at the Passiflora and step out laterally to define the system's scale. Further metallurgical work will be undertaken to assess potential recovery rates for all metals.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Harald Hoegberg PG, an independent consulting geologist who is a "Qualified Person" (QP) as such term is defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Sample Handling and Analytical Procedures.

Drilling on the deep Passiflora target began on January 22, 2025 by Godbe Drilling from Montrose, CO. Core was placed in boxes and moved to Viscount's field camp in Silver Cliff for rock quality determinations and preliminary logging. The core boxes were palletized in the field camp and shipped with Old Dominion Freight to MLD, an independent contractor, based in Carlin, NV. The core was cut in half so 50% could be retained for later examination and analysis. The remaining 50% is the assay split used for the sample. It was photographed by MLD employees, and standards, blanks and duplicates were inserted at regular intervals as determined by Viscount's Silver Cliff "Silver Cliff Drill Program Procedures" by C. Ricks, an independent geologic consultant.

The core samples were bagged and palletized by C. Ricks and shipped by Old Dominion Freight to SGS prep facility in Phoenix AZ. SGS added their QA/QC procedures. The samples then got shipped from SGS Phoenix facility to SGS analytical facility in Burnaby, B.C. Canada for ICP analysis with a method code description of: 4 Acid Digestion (HCL/HCLO4/HF/HNO3) ICP. Fire assay analysis for gold via FAA30V5 with a method code of Au, FAS, exploration grade, AAS.

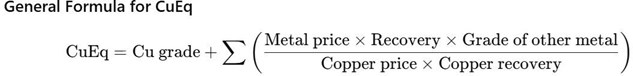

Assumptions for Copper Equivalent % Calculations

Metal Prices – 2024 averages

Cu $4.20/lb | Au $34,888.79/lb ($2,389/oz) | Pb $1.0345/lb | Zn $1.40/lb | Mo $22.50/lb

Recovery Rates: - based on Western North American copper porphyry production disclosures

Cu 90% | Au 70% | Pb 60% | Zn 67% | Mo 80%

Formula Used:

About Viscount Mining (TSXV: VML) (OTCQB: VLMGF)

Viscount Mining is a project generator and an exploration company with a portfolio of silver and gold properties in the Western United States, including Silver Cliff in Colorado and Cherry Creek in Nevada.

The Silver Cliff property in Colorado lies within the historic Hardscrabble Silver District in the Wet Mountain Valley, Custer County, south-central Colorado. It is located 44 miles WSW of Pueblo, Colorado, and has year-around access by paved road. The property consists of 96 lode claims where high grade silver, gold and base metal production came from numerous mines during the period 1878 to the early 1900's. The property underwent substantial exploration between 1967 and 1984. The property is interpreted to encompass a portion of a large caldera and highly altered sequence of tertiary rhyolitic flows and fragmental units which offers potential to host deposits with both precious and base metals. This has been demonstrated in the mineralization historically extracted from the numerous underground and surface mining operations. Based on the accumulated data and feasibility study, Tenneco Minerals made the decision with silver at $5.00 USD an ounce to construct at that time a $35,000,000 USD milling operation for the extraction of the silver reserves at Silver Cliff. Shortly thereafter Tenneco's Mining Unit was sold, and the planned milling operation was abandoned.

The Cherry Creek exploration property is in an area commonly known as the Cherry Creek Mining District, located approximately 50 miles north of the town of Ely, White Pine County, Nevada. Cherry Creek consists of 578 unpatented and 17 patented claims as well as mill rights. Cherry Creek includes more than 20 past producing mines.

For additional information regarding the above noted property and other corporate information, please visit the Company's website at www.viscountmining.com.

ON BEHALF OF THE BOARD OF DIRECTORS

"Jim MacKenzie"

President, CEO and Director

For further information, please contact:

Viscount Investor Relations

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements" within the meaning of applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to Viscount Mining's operations, exploration and development plans, expansion plans, estimates, expectations, forecasts, objectives, predictions and projections of the future. Specifically, this news release contains forward looking statements with respect to the actual size of the anomaly, feasibility, grade of mineralization and the content of the mineralization. Generally, forward-looking statements can be identified by the forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "projects", "intends", "anticipates", or "does not anticipate", or "believes", or "variations of such words and phrases or state that certain actions, events or results "may", "can", "could", "would", "might", or "will" be taken", "occur" or "be achieved". Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Viscount Mining to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the exploration and development and operation of Viscount Mining's projects, the actual results of current exploration, development activities, conclusions of economic evaluations, changes in project parameters as plans continue to be refined, future precious metals prices, as well as those factors discussed in the sections relating to risk factors of our business filed in Viscount Mining's required securities filings on SEDARPlus. Although Viscount Mining has attempted to identify important factors that could cause results to differ materially from those contained in forward-looking statements, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended.

There can be no assurance that any forward-looking statements will prove accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Viscount Mining does not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws.