VANCOUVER, British Columbia, Aug. 06, 2025 (GLOBE NEWSWIRE) -- Nevada Lithium Resources Inc. (TSXV: NVLH; OTCQB: NVLHF; FSE: 87K) (“Nevada Lithium” or the “Company”) is pleased to announce the results of an updated Preliminary Economic Assessment (“PEA”) on its 100% owned Bonnie Claire lithium project (the “Project” or “Bonnie Claire”), located in Nye County, Nevada.

The PEA has been prepared by Global Resource Engineering Ltd., (“GRE”) of Denver Colorado and Fluor Enterprises, Inc. (“Fluor”) of Greenville, South Carolina, with technical input from Kemetco Research Inc. (“Kemetco”) of Richmond, British Columbia, and Kinley Exploration LLC (“Kinley”) of Overland Park, Kansas. The PEA has an effective date of March 31, 2025. The PEA incorporates a new Mineral Resource Estimate (“Mineral Resource Estimate”), with an effective date of March 31, 2025. The Company will file an updated technical report with respect to the Project, prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") on its public SEDAR+ profile available at www.sedarplus.ca within 45 days of the date of this news release.

Nevada Lithium’s CEO, Stephen Rentschler, comments: “We are pleased to release the results of an updated PEA that reflect the latest work on our lithium/boron project in Nevada. Over the last three years, with the discovery and expansion of the Project’s high-grade lithium/boron lower zone, our technical teams have generated an expanded understanding of the potential value at Bonnie Claire. This understanding is reflected in the results of the PEA we have announced today.

The PEA concludes that Bonnie Claire could produce more than 62,300 tonnes of lithium carbonate and 129,500 tonnes of boric acid annually, over a 61-year mine life. Bonnie Claire’s investment metrics show a 32.3% after tax IRR, a capital payback of 2.8 years, and a capital intensity of $34,080/tonne lithium carbonate. A $1,973/tonne boric acid by-product credit generates a $6,800/tonne lithium carbonate operating cost.”

He continued, “Bonnie Claire has emerged as one of the world’s largest and highest grade sedimentary hosted lithium and boron deposits, and remains open for expansion.1 The potential for even higher grades and volumes could positively impact the PEA economics already demonstrated. In addition, the Company has identified several areas for potential value enhancement, including ore beneficiation, additional critical minerals, and reagent pricing. New tax provisions in the recently passed US HR1 “One Big Beautiful Bill Act” could also potentially enhance the PEA investment metrics.

We remain focused on creating shareholder value with the next steps in the development of this asset, located in one of the world’s premier mining jurisdictions, Nevada, USA.”

1 See: Click Here, Click Here, and Lithium Equity Market Report published by RFC Ambrian dated November 2023, all of which were prepared by arm’s length parties to the Company. Current internal company estimates support the reports referenced above.

| Join Stephen Rentschler, CEO of Nevada Lithium for a LIVE virtual event to learn more about the details of the Company’s newly released Preliminary Economic Assessment, and ask questions during the interactive Q&A. Date and time: Thursday, August 7 at 2 pm EST / 11 am PST |

Bonnie Claire PEA Highlights:

- $6.829 billion after-tax Net Present Value (“NPV”) at an 8% discount rate

- Annual production of 62,354 tonnes of lithium carbonate (Li2CO3) and 129,533 tonnes of boric acid per year over a 61 year mine-life

- 32.3% after-tax Internal Rate of Return (“IRR”)

- $2.125 billion initial capital costs, including $354 million in contingency

- Capital intensity of $34,080/tonne Li2CO3

- Payback period of 2.8 years

- $24,000/tonne Li2CO3 and $950/tonne boric acid price assumptions

- Operating cost of $6,800/tonne Li2CO3

- All-in sustaining cost of $7,936/tonne Li2CO3

- Break-even price (0% IRR) of $8,560/tonne Li2CO3

The Company is evaluating multiple areas for optimization of Project economics. These areas include ore beneficiation, additional critical mineral production, reagent pricing, and tax impacts generated by provisions in the recently enacted US HR1 (“One Big Beautiful Bill Act”).

PEA Overview and Financial Analysis

Bonnie Claire is a sediment-hosted lithium deposit comprising a lower zone (“Lower Zone”) and an upper zone (“Upper Zone”), encountered at different depths. The Lower Zone is characterized by high lithium and high boron grades, while the Upper Zone is characterized by moderate lithium and low boron grades. Because of the relative positive impact to economics of the higher grades, the PEA is based on the mining and extraction of mineralised material from the Lower Zone. The mining and extraction of Upper Zone material is not examined in the PEA but could be revisited as a separate project in the future.

The PEA contemplates an underground operation using a Hydraulic Borehole Mining (“HBHM”) method producing at 8,000 tonnes/day, or 2.92 million tonnes/year of >4,500ppm Li material from the high-grade Lower Zone. Mineralised material will be processed by whole-ore agitated tank leaching using sulfuric acid. After processing, the residual mineralised material will be stored as dry-stack tailings on the Project.

Results for the Project are:

- $6.829 billion after-tax NPV at an 8% discount rate

- Annual production of 62,354 tonnes of Li2CO3 and

129,533 tonnes of boric acid per year, with a potential 61 year mine-life - 32.3% after-tax IRR

- $2.125 billion initial capital costs ($354 million in contingency)

- $24,000/tonne Li2CO3 and $950/tonne boric acid price assumptions

- Payback period of 2.8 years

- Operating cost of $6,800/tonne Li2CO3

- All-in sustaining cost of $7,936/tonne Li2CO3

- Break-even price (0% IRR) of $8,560/tonne Li2CO3

- 85% overall lithium recovery, with 48% overall boron recovery

Cautionary Statement:

The PEA is preliminary in nature and is based on numerous assumptions, and some Inferred mineral resources are used in the economic analysis. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. No mineral reserves have been estimated. There is no guarantee that Inferred resources can be converted to Indicated or Measured resources and, as such, there is no guarantee that the Project economics described herein will be achieved.

Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council (the “CIM Definitions”).

Mineral Resources are stated for the first time under NI 43-101 standards of disclosure and verified by independent Qualified Persons (as such term is defined in NI 43-101). See the section of this news released titled “QP Disclosure” for further details.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves. Inferred Mineral Resources are that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

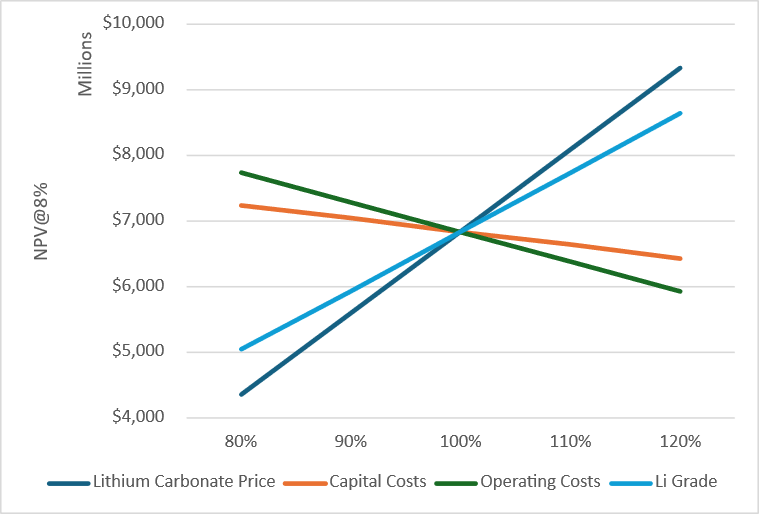

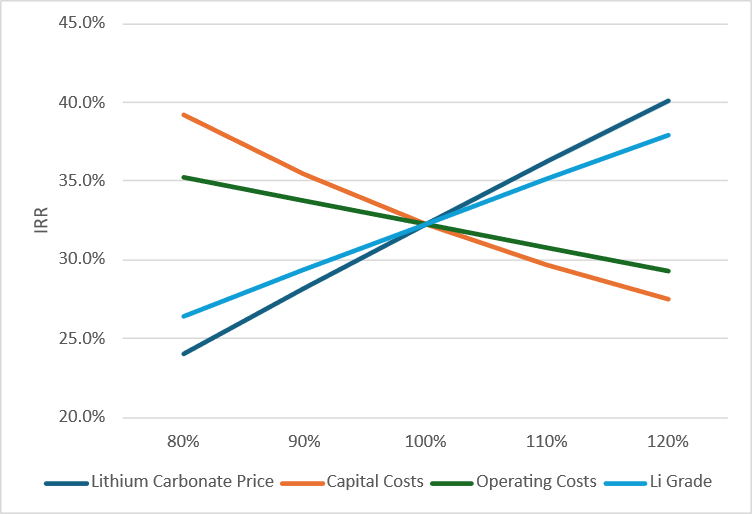

Sensitivity Analyses

Sensitivity of the Project was evaluated to changes in lithium carbonate price, lithium grade, capital costs, and operating costs, these results are shown in Table 1, Figure 2 and Figure 3. The cash flow model is most sensitive to changes in lithium carbonate price and lithium grade, is moderately sensitive to changes in capital cost, and least sensitive to changes in operating costs.

Table 1: Bonnie Claire Lithium Project Sensitivity Analysis

| Variable | % of Base Case | ||||

| 80% | 90% | 100% | 110% | 120% | |

| NPV8 (million $) | |||||

| Capital Cost | $7,238 | $7,033 | $6,829 | $6,624 | $6,420 |

| Operating Cost | $7,732 | $7,280 | $6,829 | $6,378 | $5,926 |

| Lithium Price | $4,337 | $5,583 | $6,829 | $8,075 | $9,321 |

| Lithium Grade | $5,031 | $5,930 | $6,829 | $7,728 | $8,627 |

| IRR | |||||

| Capital Cost | 39.2% | 35.4% | 32.3% | 29.7% | 27.5% |

| Operating Cost | 35.3% | 33.8% | 32.3% | 30.8% | 29.3% |

| Lithium Price | 24.0% | 28.2% | 32.3% | 36.3% | 40.1% |

| Lithium Grade | 26.4% | 29.4% | 32.3% | 35.1% | 37.9% |

| Note: IRR (internal rate of return) and NPV (net present value) are both shown after-tax | |||||

Figure 2: Bonnie Claire Lithium Project NPV@8% Sensitivity to Varying Lithium Carbonate Price, Lithium Grade, Capital Costs, and Operating Costs

Figure 3: Bonnie Claire Lithium Project IRR Sensitivity to Varying Lithium Carbonate Price, Lithium Grade, Capital Costs, and Operating Costs

Capital Costs

The capital costs for the first 40 years of production are summarized in Table 4. The initial capital costs total $2,125 million, which includes $354.1 million in contingency.

Table 4: Bonnie Claire Lithium Project Capital Cost Summary

| Item | 1000s $ |

| Mine Capital | |

| Borehole Mining Production Equipment | $231,900 |

| Borehole Mining Equipment Replacement | $363,030 |

| Support Equipment | $6,182 |

| Support Equipment Replacement | $12,442 |

| Total Mine Capital | $613,554 |

| Infrastructure Capital | |

| Access Roads | $4,000 |

| Facilities | $38,791 |

| Security | $650 |

| Utilities | $116,775 |

| Fuel System | $7,457 |

| Surface Water Management | $10,000 |

| Slurry Transport to Plant | $6,921 |

| Water Return to Mining | $4,455 |

| Tailings Facility | $30,119 |

| Freight and Tax | $23,232 |

| Total Infrastructure Capital | $242,401 |

| G&A Capital | |

| Owner's Costs | $26,815 |

| Bonding | $11,213 |

| Drilling and Metallurgical Testing | $5,000 |

| Feasibility Study/Pilot Project | $30,000 |

| Construction Insurance | $10,000 |

| Permitting | $5,000 |

| Total G&A Capital | $88,028 |

| Laboratory Capital | |

| Facility and Equipment | $4,973 |

| Total Laboratory Capital | $4,973 |

| Plant Capital | |

| Processing Facility | $704,405 |

| Sulfuric Acid Plant | $175,835 |

| Other Costs and Indirects | $489,583 |

| Total Plant Capital | $1,369,824 |

| Working Capital | $90,935 |

| Sustaining Capital | $6,297 |

| Contingency | $476,861 |

| Total Capital Costs | $2,892,873 |

Operating Costs

Operating costs for the Project are summarized in Table 5.

Table 5: Operating Cost Summary

| Area | Average Annual (1000s $) |

($/tonne Li2CO3) |

| Mine | $113,614 | $1,822.07 |

| Processing | $376,455 | $6,037.36 |

| G&A | $7,259 | $116.41 |

| Contingency | $49,733 | $797.58 |

| Boric Acid Credit | ($123,056) | ($1973.50) |

| Total Operating Costs | $424,004 | $6,799.92 |

Mineral Resource Estimate

The PEA incorporates a new Mineral Resource Estimate, which has an effective date of March 31, 2025.

Mineralisation remains open to the NW, NE and SE, increasing in grade and overall thickness in those directions.

The Mineral Resource Estimate comprises separate estimates of the Lower Zone, characterised by high grade lithium and boron and the Upper Zone, characterised by moderate-grade lithium and boron.

Lower Zone

The Lower Zone forms a shallowly-dipping sheet approximately 300-350m thick, intersected between approximately 500-850m depth, and remains open to the NW, NE and SE. The mineral resource estimate for the Lower Zone is presented in Table 6. The base-case mineral resource is reported at an 1,800ppm cut-off, based on a reasonable prospect of economic extraction using the underground HBHM method, assuming a 60% HBHM Recovery.

Table 6: Bonnie Claire Lower Zone Mineral Resource Estimate With 60% Borehole Mining Recovery

| Class | Lithium | Boron | ||||||

| Mass (Million Tonnes) | ID2 Li Grade (ppm) | Li (Million Tonnes) | Li Carbonate Equivalent (Million Tonnes) | Mass (Million Tonnes | B Grade (ppm) | B (million Tonnes) | Boric Acid Equivalent (Million Tonnes | |

| Indicated | 275.85 | 3,519 | 0.971 | 5.167 | 275.85 | 10,758 | 2.968 | 16.973 |

| Inferred | 1,561.06 | 3,085 | 4.816 | 25.634 | 1,561.06 | 9,593 | 14.976 | 85.654 |

- The effective date of the Mineral Resource Estimate is March 31, 2025.

- The Qualified Person for the estimate is Terre Lane of GRE.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are reported at a 1,800 ppm Li cutoff, an assumed lithium carbonate (Li2CO3) price of $20,000/tonne, 5.323 tonnes of Li2CO3 per tonne Li.

- The Boric Acid Equivalent calculation assumes 5.719452 tonnes of boric acid per tonne of boron.

- Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

Upper Zone

The Upper Zone forms a sub-horizontal sheet extending from surface to about 425ft (130m) depth, and remains open to the NW, NE and SE. The mineral resource estimate for Upper Zone is presented in Table 7. The base-case resource is reported at a 900ppm cut-off, based on conventional open-pit methods.

Table 7: Bonnie Claire Upper Zone Mineral Resource Estimate Within a Constraining Pit Shell

| Class | Lithium | Boron | ||||||

| Mass (Million Tonnes) | ID2 Li Grade (ppm) | Li (Million Tonnes) | Li Carbonate Equivalent (Million Tonnes) | Mass (Million Tonnes) | B Grade (ppm) | B (Million Tonnes) | Boric Acid Equivalent (Million Tonnes | |

| Indicated | 188.08 | 1,074 | 0.202 | 1.075 | 188.08 | 2,140 | 0.403 | 2.302 |

| Inferred | 451.10 | 1,106 | 0.499 | 2.655 | 449.88 | 1,911 | 0.860 | 4.918 |

- The effective date of the Mineral Resource Estimate is March 31, 2025.

- The Qualified Person for the estimate is Terre Lane of GRE.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are reported at a 900 ppm Li cutoff, an assumed lithium carbonate (Li2CO3) price of $20,000/tonne, 5.323 tonnes of Li2CO3 per tonne Li, 75% recovery, a slope angle of 18 degrees, no royalty, processing and G&A cost of $26.52/tonne, mining cost of $3.52/tonne, and selling costs of $100/tonne Li2CO3.

- The boric acid equivalent calculation assumes 5.719452 tonnes of boric acid per tonne of boron.

- Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

Mining Methods

The Preliminary Economic Assessment is based on the application of the HBHM method to a high-grade subset of the Lower Zone of the Bonnie Claire deposit. No mining method has been applied to the Upper Zone, due to moderate lithium grades, but this may be revisited in the future.

Kinley was asked to establish a reasonable and economic mining strategy utilizing HBHM within Bonnie Claire lithium resource deposit to extract lithium in a continuous, efficient, cost effective and safe manner in the targeted higher-grade zone from 450 meters to 900 meters deep.

HBHM technology is a surface-based mining method that uses a high-pressure water jet to disaggregate the mineralization and then evacuate the slurrified material back to surface, in this case via a hydraulic airlift method.

Kinley’s analysis took into consideration that the mineralization is highly plastic and with the assistance of jetting and pumping would likely flow. With this information, coupled with the significant cost of backfilling and then the consideration of subsidence, Kinley evaluated HBHM without backfilling and using directional drilling from a stable position.

The current mining application considered would be to directionally drill a single large diameter production well centered under the targeted resource section to be mined (Figure 8). The well would be drilled with an 85-meter offset from the center of the target mine section.

Construction of the production well would be to case the well to within 6 to 18 meters of the projected bottom of the resource to be mined. The bottom section would then be mined out to open an initial cavity. This directionally drilled well would be primarily vertical but turned under the center of the resource.

Next a series of “jet” wells would be drilled and cased to 450 meters in a mining pattern with engineered spacing to maximize the plastic flow condition of the mineralized material between the wells. These would be centered and patterned above the production well. These wells would be drilled vertically in a 85-meters-diameter section. The jet wells would be pilot drilled to total depth, then jetted to initiate caving into the production well for pumping to surface. A continuous hydraulic cutter, mounted on the intake of the production well, would assist in slurrifying the ore for pumping to surface.

Figure 8: Proposed HBHM initial layout at Bonnie Claire. Wells (brown cylinders) are centered and spaced within a 280-foot diameter surveyed section. Slurry is hydraulically airlifted to a single directionally drilled production well offset from mined section center (blue cylinder). Note: the figure depicts 13 wells for illustrative purposes. Actual modelling is based on 32 wells.

Figure 9: 200 Ton Self Walking Drill rig built by Drillmec Inc. It is designed to walk upright from well to well and is similar in design to the rigs planned for this project.

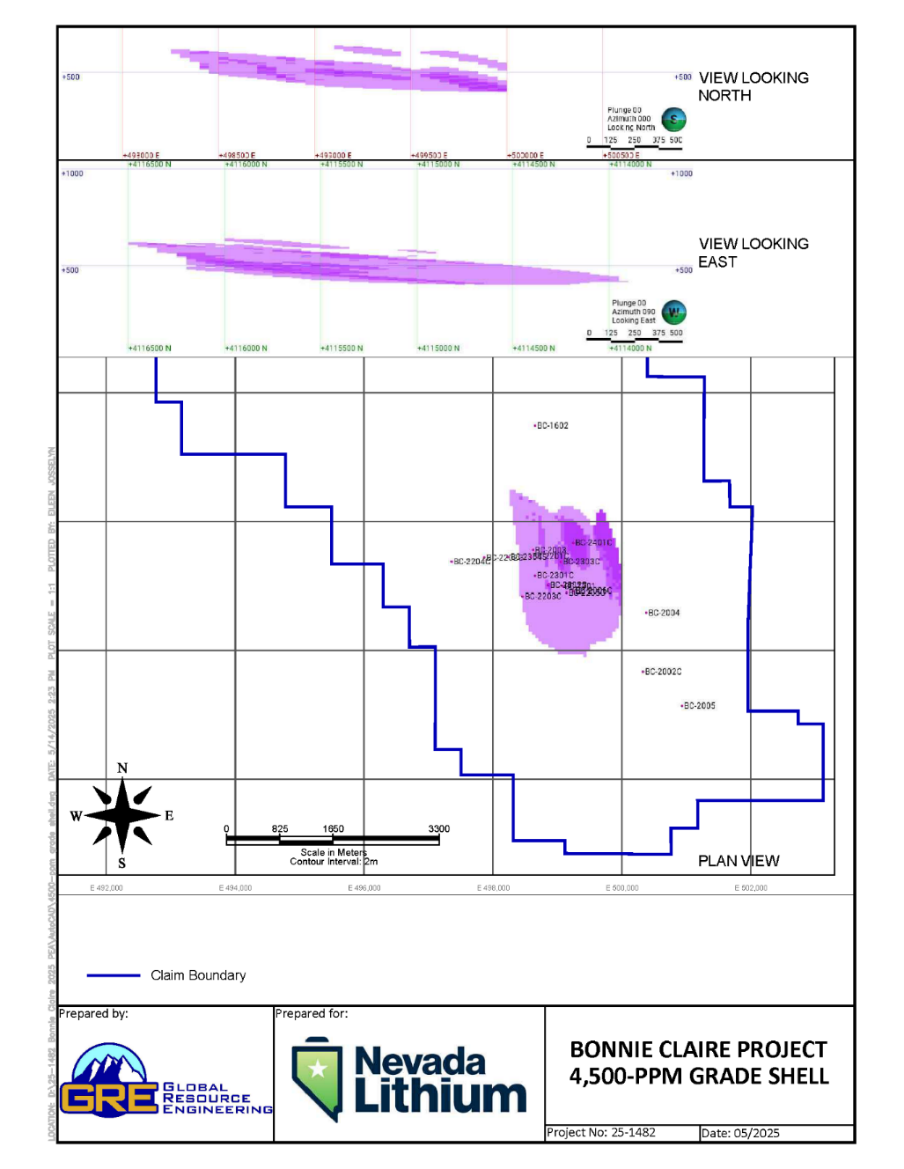

GRE has applied the HBHM method to a high-grade segment of the Lower Zone at Bonnie Claire, focusing on materials with a lithium grade of at least 4,500 ppm and at least 1% boron to increase capital recovery and reduce the Project payback period and risk. The 4,500-ppm lithium grade shell at Bonnie Claire is illustrated in Figure 10, while the available HBHM resource at the 4,500-ppm lithium cutoff is outlined in Table 11. This high-grade segment of the Lower Zone gives a potential a 61 year mine-life.

The PEA is based on a target mining rate of 2.92 M tonnes per year (8000 tonnes/day), to produce 62,354 tonnes of lithium carbonate and 129,533 tonnes of boric acid per year, with a potential 61 year mine-life. After processing, the residual mineralised material will be stored as dry-stack tailings on the Project.

Figure 10: Bonnie Claire Project 4,500 ppm BHBM Grade Shell

Table 11: Bonnie Claire Project Available Resource Within the 4,500-ppm Lithium Grade Shell

| Metal | Mineralized Material above Cutoff (Million tonnes) |

Grade (ppm) |

Contained Metal (Million tonnes) |

| Indicated | |||

| Lithium | 70.98 | 4,757.67 | 0.34 |

| Boron | 16,457.62 | 1.17 | |

| Inferred | |||

| Lithium | 165.16 | 4,703.28 | 0.78 |

| Boron | 16,030.01 | 2.65 | |

Mineral Processing and Metallurgical Testing

From a metallurgical perspective, the Bonnie Claire deposit contains two distinct lithological zones, at different depths. The Lower Zone is characterized by high lithium and high boron grades. While the Upper Zone is characterized by moderate lithium and low boron grades.

Metallurgical testing has been completed on both the Lower Zone and Upper Zone, but the PEA is based on processing and testing of mineralised material from the Lower Zone to optimise economic outcomes. Testing was conducted by Kemetco, under the direction of Fluor.

Mineral processing is focused on whole ore agitated tank leaching using sulfuric acid. This method has demonstrated leach extractions exceeding 95% for lithium and boron. Typical operating conditions are 150 g/L residual free acid, a four-hour residence time, and a temperature of 90°C. The acid addition required was 650-700 kg/t, driven partly by the high free acid requirement. Leach testing was performed on three different composite samples broadly representative of the Lower Zone. All samples demonstrated consistent leach extraction performance.

Overall metallurgical recoveries were determined based on test results and circuit modeling with a fully integrated heat and mass balance model. Lithium recovery is estimated at 85% and boron recovery at 48%.

Quality Assurance / Quality Control (QAQC)

A quality assurance / quality control protocol following industry best practice was incorporated into the drill program by Nevada Lithium. Drilling was conducted by Major Drilling Group International Inc. (“Major Drilling”). Core was transported by Major Drilling from the collar location and received by Nevada Lithium staff at the Company storage facility in Beatty, NV. The facility is only accessible to Nevada Lithium staff and remains otherwise locked.

Received core was logged and cut at the facility by Nevada Lithium staff. Logging and sampling included the systematic insertion of blanks, duplicates and certified reference material (“CRM”) MEG Li.10.12 and OREAS 750 into sample batches at an insertion rate of approximately 10%.

All core samples collected were transported by Company staff to ALS USA Inc.’s laboratory in Reno, NV. for sample preparation. Sample preparation comprises initial weighing (Code WEI-21), crushing QC Test (CRU-QC), pulverizing QC Test (PUL-QC), fine crushing at 70% <2mm (CRU-31), sample split using Boyd Rotary splitter ((SPL-22Y), pulverizing up to 250g 85% <75 µm (PUL-31), crush entire sample (CRU-21), Pulp Login LOG-24) and a crusher wash (final crusher wash between samples (WSH-21).

Samples were shipped to ALS USA Inc.’s Vancouver laboratory in Burnaby, British Columbia, where the samples were analyzed using 48-element four-acid ICP-MS (ME-MS61) and B/Li N₂O₂ Fusion – ICP-AES high-grade (ME-ICP82b) procedures.

Data verification by GRE staff included: an on-site inspection of the Project site and core, RC and chip tray storage facilities, check sampling, geologic maps and reports, and manual auditing of the Project drill hole database. GRE’s Qualified Persons have been involved with the Project since 2018. They visited the site in 2018 after drilling, and during drilling in each of 2020, 2022 and 2024. The results from the site inspection, visual sample inspection and check sampling for each drilling campaign are given below.

Based on the results of GRE’s Qualified Persons’ check of the sampling practices, verification of drill hole collars in the field, results of the check assay analysis, visual examination of selected core intervals, and the results of both manual and mechanical database audit efforts, GRE considers the collar, lithology, and assay data contained in the project database to be reasonably accurate and suitable for use in estimating mineral resources.

The data verification of the drilling campaigns shows that data from the rotary mud drilling was suspect and not used in the resource estimate. Open pit mining and processing methods, costs and infrastructure needs were verified by Ms. Lane in comparison to other similar sized open pit mines operating in the western USA. Borehole mining costs were developed by Kinley with coordination with GRE.

Other cost data used in the report was sourced from the most recent infomine cost data report. All costs used to determine reasonable prospects for economic extraction were verified and reviewed by GRE and were assessed to be current and appropriate for use.

Data verification of the metallurgical testing consisted of ensuring that the samples selected came from within the area where Mineral Resources were estimated at the Project. A Qualified Person of Fluor checked that the sampling protocol used was applicable for the planned testwork. In the Qualified Person's opinion, the testwork conducted was completed by a reputable metallurgical testing facility and used industry-standard methods.

About Nevada Lithium Resources Inc.

Nevada Lithium Resources Inc. is a mineral exploration and development company focused on shareholder value creation through its core asset, the Bonnie Claire Lithium Project, located in Nye County, Nevada, where it holds a 100% interest.

For further information on Nevada Lithium and to subscribe for updates about Nevada Lithium, please visit its website at: https://nevadalithium.com/

QP Disclosure

The technical information in the above disclosure has been reviewed and approved by the designated Qualified Person under National Instrument 43-101, Dr. Jeff Wilson, PhD, FGC, P.Geo, Vice President of Exploration for Nevada Lithium and is not independent of the Company as defined by Section 1.5 of NI 43-101.

The technical information in the above disclosure has also been reviewed and approved by Terre Lane, a ‘Qualified Person’. Ms. Lane is Principal Mining Engineer with GRE and considered to be “independent” of the Company under Section 1.5 of NI 43-101.

The technical information in the above disclosure has been reviewed and approved by Kevin Martina, Director I, Process/Specialty Engineering with Fluor. Mr. Martina is the designated Qualified Person for Fluor and is independent of the Company.

On behalf of the Board of Directors of Nevada Lithium Resources Inc.

“Stephen Rentschler”

Stephen Rentschler, CEO

For further information, please contact:

Nevada Lithium Resources Inc.

Stephen Rentschler

CEO and Director

Phone: (647) 254-9795

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Media Inquiries

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Find Nevada Lithium on Twitter and LinkedIn

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this news release. TSX Venture Exchange has not approved or disapproved of the contents of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. These statements relate to matters that identify future events or future performance. Often, but not always, forward looking information can be identified by words such as “could”, “pro forma”, “plans”, “expects”, “may”, “will”, “should”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved.

The forward-looking statements contained herein include, but are not limited to, statements regarding: the performance of the Project and the results and assumptions of the PEA, including projected economics, production rates, mine life, capital costs, operating costs, internal rate of return, net present value, payback period, sensitivity analyses, and the potential for optimization of project economics and value enhancement opportunities; the potential development of the Project, including future permitting, feasibility studies, and development activities; mineral resource estimates, the potential to convert inferred mineral resources to indicated or measured mineral resources, and future exploration activities with the potential to expand mineral resources; mining methods, production targets, and processing strategies; the impact of new tax provisions and regulatory changes, including but not limited to the "One Big Beautiful Bill Act"; market conditions and commodity prices for lithium carbonate and boric acid, including sustained lithium demand and prices; and the Company's ability to finance the development of the Project.

making the forward looking statements in this news release, Nevada Lithium has applied several material assumptions, including without limitation: sustained market fundamentals resulting in continued lithium and boron demand and favorable commodity price assumptions for lithium carbonate and boric acid; the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of Bonnie Claire in a timely manner and Nevada Lithium's ability to comply with all applicable regulations and laws, including environmental, health and safety laws, supported by political and regulatory stability in Nevada, USA; the availability of financing on suitable terms for the development, construction and continued operation of Bonnie Claire; the Project containing mineral resources and the accuracy of the Mineral Resource Estimate; the reliability of the PEA and its underlying assumptions; the successful application of the HBHM method; metallurgical recovery rates of 85% for lithium and 48% for boron; and capital and operating cost estimates.

Investors are cautioned that forward-looking statements are not based on historical facts but instead reflect Nevada Lithium's management's expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although Nevada Lithium believes that the expectations reflected in such forward-looking statements are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements expressed or implied by Nevada Lithium. Among the key risk factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following: fluctuations in commodity prices including lithium and precious metals; uncertainties inherent in mineral resource and reserve estimates, including possible variations in ore grade or recovery rates; risks associated with the development and operation of mining projects, including operating and technical difficulties, possible failures of plants, equipment or processes to operate as anticipated, and accidents; regulatory and permitting risks, including delays or inability to obtain necessary approvals, permits, consents or authorizations, and changes in laws, regulations and policies affecting mining operations; environmental risks and liabilities; financing and liquidity risks, including requirements for additional capital; market and economic conditions, including changes in general economic, business and political conditions and financial markets; competition in the lithium and boron markets; infrastructure and logistics challenges; geopolitical risks and changes in government policies; labour disputes and other risks of the mining industry; currency fluctuations; title disputes or claims; limitations on insurance coverage; timing and possible outcome of pending litigation; risks relating to epidemics or pandemics such as COVID-19, including the impact of COVID-19 on Nevada Lithium's business; as well as those factors discussed under the heading "Risk Factors" in Nevada Lithium's latest Management Discussion and Analysis and other filings of Nevada Lithium filed with the Canadian securities authorities, copies of which can be found under Nevada Lithium's profile on SEDAR+ at www.sedarplus.ca.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Nevada Lithium has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. Nevada Lithium does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.