Para Resources Announces Close of Over-Subscribed Private Placement - $1.6M Raised

Vancouver, British Columbia--(Newsfile Corp. - February 15, 2018) - Para Resources Inc. (TSXV: PBR) (WKN: A14YF1) (OTC Pink: PRSRF) (the "Company" or "Para") is pleased to announce that it has closed its non-brokered private placement (the "Private Placement") for total gross proceeds of $1,557,160. The Private Placement consisted of 7,785,800 units at a price of $0.20 per unit (each a "Unit"). Each Unit is comprised of one common share of the Company and one-half common share purchase warrant (each whole such warrant a "Warrant"). Each Warrant entitles the holder to acquire one common share of the Company for a period of 18 months at a price of $0.30, subject to an accelerated expiry if the closing trading price of the Company's shares is greater than $0.40 for a period of 10 consecutive trading days. The Company will give notice to the holders of the acceleration event and the warrants will expire eight days thereafter.

All securities issued under the Private Placement bear a four month and one day hold period. Proceeds of the Private Placement will be used to complete engineering and process analysis at the Company's Gold Road Project in Arizona, for capital expenditures to complete the upgrade and improve efficiency during the "ramp up" of production at the Company's El Limon mine in Colombia and for general working capital.

Three insiders of the Company participated in the Private Placement and subscribed for an aggregate of 6,330,800 Units for gross proceeds of $1,266,160. Participation of insiders of the Company in the Private Placement constitutes a related party transaction as defined under Multilateral Instrument 61-101 (Protection of Minority Security Holders in Special Transactions). Because the Company's shares trade only on the TSXV, the issuance of securities is exempt from the formal valuation requirements of Section 5.4 of MI 61-101 pursuant to Subsection 5.5(b) of MI 61-101 and exempt from the minority approval requirements of Section 5.6 of MI 61-101.

The Company did not file a material change report 21 days prior to the closing of the private placement as the details of the participation of insiders of the Company had not been confirmed at that time.

ABOUT PARA RESOURCES:

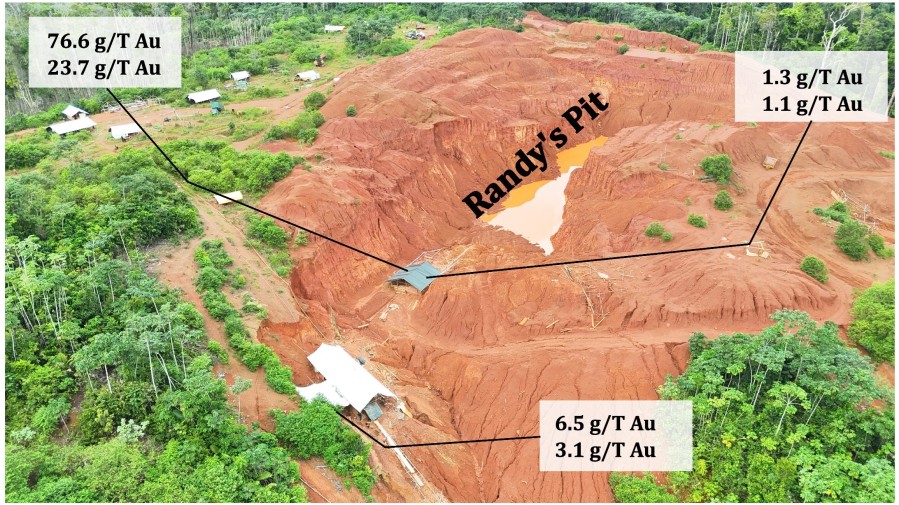

Para is a junior producing gold mining company. Para owns approximately 80% of the El Limon project, in Colombia, which in addition to its current underground operation is purchasing mineralized rock mined by small artisanal miners working on the Company's property. The El Limon and OTU properties also have exploration and development upside. The Company also owns 88% of the Gold Road Mine in the Oatman District of Arizona. The Company has hired RPM Global as consulting engineers to produce a NI 43-101 Technical Report which it expects will establish a current Mineral Resource estimate and anticipates that it will publish a NI 43-101 PEA thereafter. Para will continue to take advantage of current market conditions to acquire and develop additional highly economic, near-term production assets that have strong exploration and development upside.

On behalf of the Board of Directors

"C. Geoffrey Hampson"

C. Geoffrey Hampson, Chairman, Chief Executive Officer and Director

For further information, please contact Andrea Laird, telephone: +1-604-259-0302

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Statements contained in this news release that are not historical facts are "forward-looking information" or "forward-looking statements" (collectively, "Forward-Looking Information") within the meaning of applicable Canadian securities laws. Forward Looking Information includes, but is not limited to, disclosure regarding possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; the timing and costs of future activities on the Company's properties; success of exploration, development and mill processing activities; and the closing of potential new acquisitions. In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as "plans", "expects", "scheduled", "estimates", "forecasts", "intends", "anticipates" or variations of such words and phrases. In preparing the Forward-Looking Information in this news release, the Company has applied several material assumptions, including, but not limited to, that the current exploration, development, mill ramp up and other objectives concerning El Limon can be achieved. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, the Company does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

THIS NEWS RELEASE IS INTENDED FOR DISTRIBUTION IN CANADA ONLY AND IS NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES