# SPOTLIGHT

MARKET ACTIVITY

| TSX | +325.07 (1.18%) | 27,895.15 |

| TSX Venture | +0.80 (0.10%) | 784.48 |

| ASX 200 | +73.30 (0.84%) | 8,843.70 |

| S&P 500 | +38.65 (0.61%) | 6,337.84 |

| BMO Junior Gold Index | +1.85 (1.31%) | 143.07 |

| VanEck Jr Miners | +0.82 (1.17%) | 70.40 |

| Sprott Junior Miners | +0.68 (1.31%) | 52.11 |

COMMODITY PRICES

| Gold (US$/oz) | -2.00 (0.06%) | 3,432.70 |

| Silver (US$/oz) | +0.11 (0.3%) | 37.94 |

| Copper (US$/lb) | +0.02 (0.49%) | 4.41 |

| Platinum (US$/oz) | +14.75 (1.11%) | 1,345.35 |

| Palladium (US$/oz) | -52.20 (4.34%) | 1,151.50 |

MARKET MOVERS

| Company | Change | Last Trade |

|---|---|---|

| SSR Mining | 2.85 15.92 | $20.75 |

| Cameco | 2.04 1.98 | $104.82 |

| Lundin Gold | 1.44 2.08 | $70.56 |

| AngloGold Ashanti | 1.10 1.95 | $57.56 |

| Newmont | 0.68 1.01 | $67.92 |

| Minas Buenaventura | 0.64 3.58 | $18.54 |

| Orla Mining | 0.64 4.72 | $14.19 |

| Piedmont Lithium | 0.60 7.45 | $8.65 |

| Franco-Nevada | 0.43 0.18 | $236.07 |

| Nova Minerals | 0.40 3.28 | $12.60 |

| Altius Minerals | 0.36 1.23 | $29.70 |

| Los Andes Copper | 0.36 4.97 | $7.61 |

| Royal Gold | 0.33 0.21 | $160.51 |

| Skeena Gold & Silver | 0.28 1.33 | $21.26 |

| Endeavour Mining | 0.28 0.62 | $45.38 |

HIGH VOLUME

| Company | Volume | Last Trade |

|---|---|---|

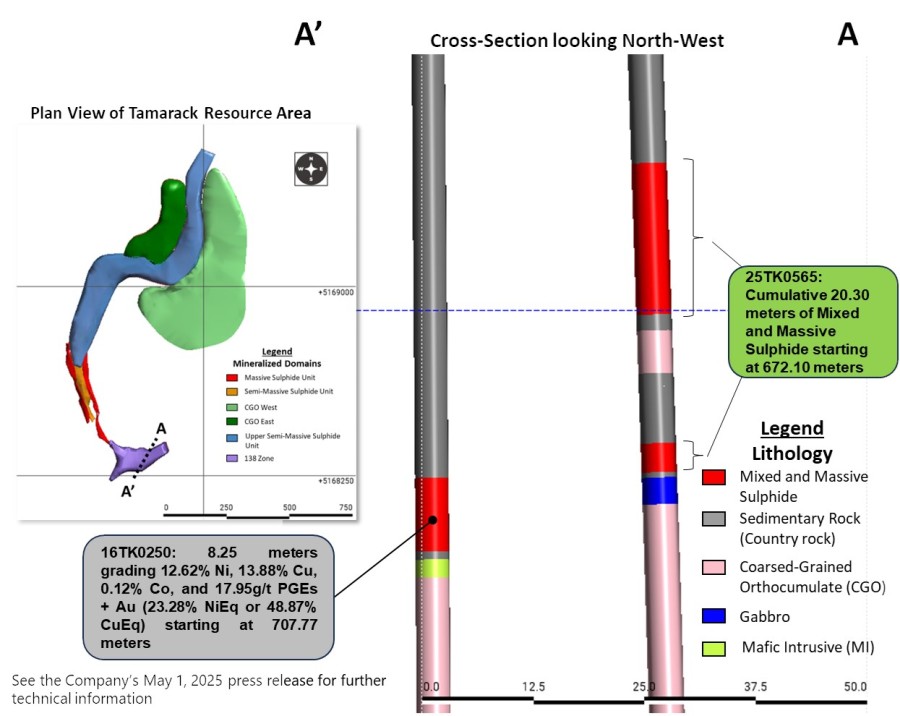

| Talon Metals | 8,492,962 | $0.36 |

| Blende Silver | 6,274,239 | $0.07 |

| Southern Silver Exploration | 2,688,340 | $0.23 |

| Kinross Gold | 1,925,320 | $25.18 |

| White Gold | 1,874,052 | $0.50 |

| Denison Mines | 1,869,278 | $3.10 |

| B2Gold | 1,818,856 | $5.16 |

| Kintavar Exploration | 1,614,576 | $0.04 |

| SSR Mining | 1,444,937 | $20.75 |

| Red Pine Exploration | 1,435,140 | $0.08 |

| Guanajuato Silver | 1,408,382 | $0.32 |

| Churchill Resources | 1,346,800 | $0.10 |

| Capstone Copper | 1,291,709 | $8.63 |

| Excellon Resources | 1,147,234 | $0.26 |

| Abcourt Mines | 1,098,000 | $0.05 |

District Metals

District Metals is a polymetallic exploration and development company focused on the Viken and Tomtebo Properties in Sweden. The Viken Property covers 100% of the Viken Energy Metals Deposit, which contains the largest undeveloped mineral resource estimate of uranium in the world along with significant mineral resource estimates of vanadium, molybdenum, nickel, copper, zinc, and other important and critical raw materials. The advanced exploration stage Tomtebo Property... LEARN MORE

Dryden Gold

Dryden Gold is an exploration company focused on the discovery of high-grade gold mineralization. The Company has a strong management team and Board of Directors comprised of experienced individuals with a track record of building shareholder value. Dryden Gold controls a 100% interest in a dominant strategic land position in the Dryden District of Northwestern Ontario. The property hosts high-grade gold mineralization over 50km of potential strike length along the... LEARN MORE

Core Nickel

Core Nickel, junior exploration company, is advancing responsible exploration in Manitoba’s Thompson Nickel Belt. Focused on discovering high-grade magmatic nickel-sulphide deposits, Core Nickel’s key asset, the Mel deposit, holds a historic estimate of 5.3 million tonnes at 0.85% nickel. Positioned 25 km from the Thompson Mill, Mel benefits from nearby infrastructure. Core Nickel aims to increase responsibly sourced nickel supply for a net-zero, carbon-neutral future... LEARN MORE

EARNINGS / PRODUCTION RESULTS

OMAI GOLD MINES (TSX.V: OMG)

Omai Gold Mines holds a 100% interest in the past-producing Omai gold project in Guyana. The company has completed a Preliminary Economic Assessment that showed a robust after-tax NPV5% of $556 million and 19.8% Internal Rate of Return at... LEARN MORE

Revival Gold

Revival Gold is one of the largest, pure gold, mine developers in the United States. The Company is advancing engineering and economic studies on the Mercur Gold Project in Utah and mine permitting preparations and ongoing exploration at the Beartrack-Arnett Gold Project located in Idaho. Revival Gold is listed on the TSX Venture Exchange under the ticker symbol “RVG” and trades on the OTCQX Market under the ticker symbol “RVLGF”. The Company is headquartered in Toronto... LEARN MORE

ATEX Resources

ATEX Resources is exploring the Valeriano Copper Gold Project located within the emerging copper gold porphyry mineral belt linking the prolific El Indio High-Sulphidation Belt to the south with the Maricunga Gold Porphyry Belt to the north. Valeriano hosts a large copper gold porphyry resource: 1.41 billion tonnes at 0.67% CuEq (0.50% Cu, 0.20 g/t Au, 0.96 g/t Ag and 63.80 g/t Mo), which includes a higher-grade core totaling 200 million tonnes at 0.84% CuEq... LEARN MORE

Newcore Gold

Newcore Gold is advancing the Enchi Gold Project in Ghana. The project’s 248 sq. km land package covers 40 kms of Ghana’s Bibiani Shear Zone, a gold belt which hosts several large, multi-million-ounce, gold deposits. A PEA completed in 2024 highlighted the robust economics of developing an open pit, heap leach mine at Enchi, with low capital intensity and strong leverage to the gold price. Enchi’s longer-term potential benefits from the district-scale exploration opportunity... LEARN MORE

South Pacific Metals

South Pacific Metals is an emerging exploration company operating in Papua New Guinea’s proven gold and copper production corridors. With an expansive 3,000 km² land package and four transformative gold-copper projects contiguous with major producers K92 Mining, PanAust and neighbouring Barrick/Zijin, new leadership and experienced in-country teams are prioritizing thoughtful and rigorous technical programs focused on boots-on-the-ground exploration... LEARN MORE

Freeport Resources

Freeport Resources is advancing one of the largest undeveloped copper deposits in the world. The 100% owned Yandera copper project covers approximately 245 square kilometers and is located in the highly prolific Papua New Guinea Orogenic Belt. Approximately $200 million in exploration and development expenditures have been spent on the project since 2005. The company has commenced work towards completing a Definitive Feasibility Study and has accelerated... LEARN MORE

Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in Vancouver, BC, focused on advancing its flagship, 100%-owned Panuco silver-gold project located in Sinaloa, Mexico. The Company recently completed a Preliminary Economic Study for Panuco which highlights 15.2 Moz AgEq of annual production over an initial 10.6-year mine life, an after-tax NPV5% of US$1.1B, 86% IRR and 9-month payback at US$26/oz Ag and... LEARN MORE

RECENT / RELEVANT

# VAL D'OR CAMP STOCKS

- Eldorado Gold (TSX: ELD)

- Monarch Mining (TSX: GBAR)

- O3 Mining (TSX.V: OIII)

- Cartier Resources (TSX.V: ECR)

- Radisson Mining Resources (TSX.V: RDS)

# SOUTH AFRICA STOCKS

- Gold Fields (NYSE: GFI)

- Platinum Group Metals (TSX: PTM)

- Diamcor Mining (TSX.V: DMI)

- Eastern Platinum (TSX: ELR)

- ZEB Nickel (TSX.V: ZBNI)

# RED LAKE DISTRICT STOCKS

- Kinross Gold (TSX: K)

- Pacton Gold (TSX.V: PAC)

- Prosper Gold (TSX.V: PGX)

- Trillium Gold Mines (TSX.V: TGM)

- West Red Lake Gold Mines (CSE: RLG)