Cardston, Alberta--(Newsfile Corp. - June 26, 2025) - American Creek Resources Ltd. (TSXV: AMK) (OTCQB: ACKRF) (the "Company" or "American Creek") is pleased to announce that it has entered into a definitive arrangement agreement dated June 25, 2025 (the "Arrangement Agreement") with Tudor Gold Corp. ("Tudor") pursuant to which Tudor has agreed to acquire all of the issued and outstanding securities of American Creek with the result that the current securityholders of American Creek will become securityholders of Tudor (the "Transaction"). Each American Creek shareholder will be entitled to receive 0.238 of a common share of Tudor ("Tudor Shares") for each American Creek common share held (the "Exchange Ratio").

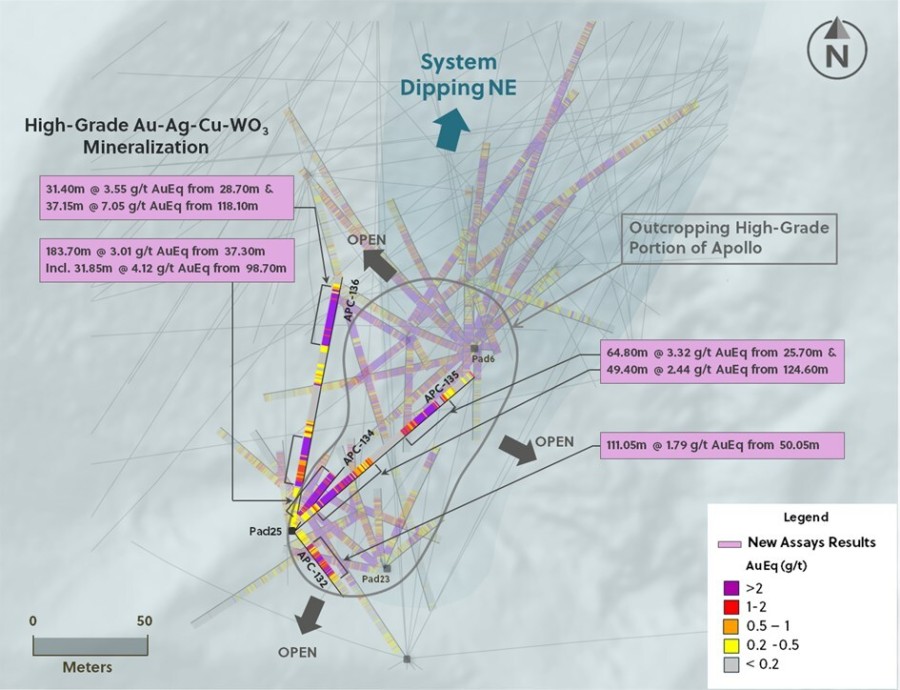

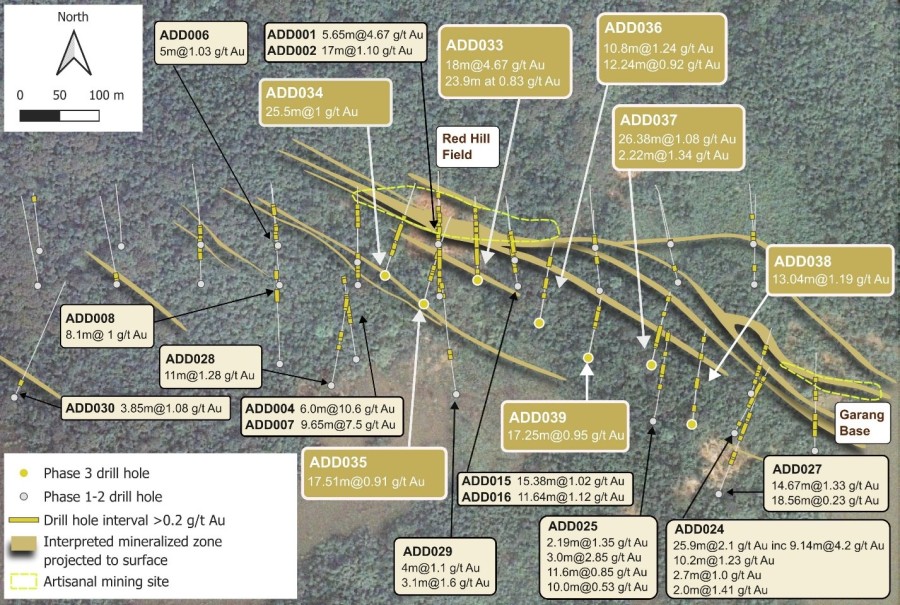

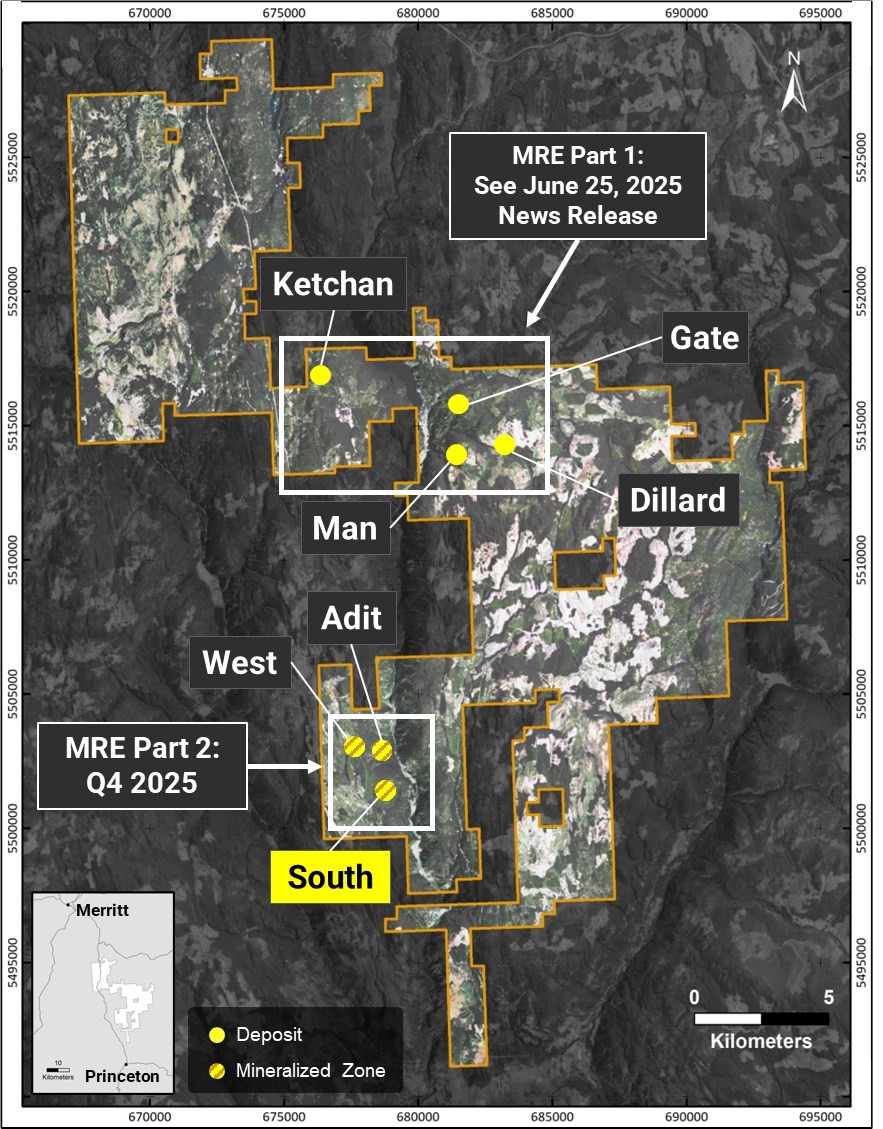

Following completion of the transaction, existing American Creek shareholders will own approximately 30% of the total issued and outstanding share capital of Tudor on a non-diluted basis, and approximately 33% on a fully diluted in-the-money basis. Currently, American Creek holds a 20% carried interest, and Tudor a 60% interest, in the Treaty Creek Project located in northwest British Columbia. On completion of the Transaction, Tudor will hold an 80% interest in the Treaty Creek Project. The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones.

Darren Blaney, President and CEO of American Creek, commented: "We are very pleased to enter into this agreement with Tudor. We believe that this transaction that combines the two companies unlocks significant advantages for our shareholders that have supported us and been part of the Treaty Creek project for many years. In addition to the obvious benefit of the 40% premium offered by Tudor, our joining with Tudor provides our present shareholders with 80% exposure to the full potential of future additional discovery and development as the Treaty Creek asset, and the very large gold resource found within, advances toward production. We believe that through the consolidation of our two companies, that Tudor will be much better positioned to secure future exploration and development capital and will also be much more likely to attract a potential strategic partner to assist in accelerating project development towards production. Further, this transaction will potentially also significantly increase Tudor's attractiveness with respect to becoming a potential takeover target by a larger developer. This is the most logical next step in ensuring that the Treaty Creek project moves forward, while providing additional value to our loyal shareholders. The Treaty Creek project is a world class gold-copper project and we look forward to joining with and supporting Tudor management as they focus on moving this project to the next level."

Transaction Structure

Pursuant to the terms of the Arrangement Agreement, each American Creek shareholder will receive 0.238 of a Tudor Share for each American Creek common share held. Outstanding options to purchase American Creek Shares will become exchangeable for new Tudor options that will be exercisable to acquire Tudor Shares on the same terms and conditions of the American Creek options, on the basis of the Exchange Ratio. Outstanding warrants to purchase American Creek Shares will become exercisable to acquire Tudor Shares on the same terms and conditions, on the basis of the Exchange Ratio.

The Transaction is expected to be completed by way of a court approved Plan of Arrangement under the Business Corporations Act (British Columbia) and will require the approval of (i) at least 66⅔% of the votes cast by American Creek shareholders; and (ii) if applicable, a majority of the votes cast by American Creek shareholders present in person or represented by proxy at the American Creek annual general and special meeting (the "AMK Meeting") to be called to approve, amongst other matters, the Transaction, excluding, for this purpose, votes attached to American Creek shares held by persons described in items (a) through (d) of Section 8.1(2) of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions. The AMK Meeting is expected to be scheduled to take place in late August, 2025.

The shareholders of Tudor are not required to vote on the Transaction. The Transaction is an arm's length transaction in accordance with the policies of the TSXV.

In addition to American Creek shareholder approval and court approval, the Transaction is subject to applicable regulatory approvals including, but not limited to, TSX Venture Exchange ("TSXV") approval and the satisfaction of certain other closing conditions customary in transaction of this nature. The Arrangement Agreement contains customary provisions including non-solicitation, "fiduciary out" and "right to match" provisions. The Transaction is anticipated to be completed on or about August 31, 2025. Upon closing of the Transaction, it is expected that the American Creek common shares will be delisted from the TSXV and that American Creek will cease to be a reporting issuer under applicable Canadian securities laws.

Further information regarding the Transaction will be contained in a management information circular (the "AMK Information Circular") that American Creek will prepare, file and mail to the American Creek shareholders in connection with the AMK Meeting to be held to consider the Transaction, amongst other matters. A copy of the Arrangement Agreement will be filed on each of Tudor's and American Creek's SEDAR+ profiles at www.sedarplus.ca and a copy of the AMK Information Circular will be filed on American Creek's SEDAR+ profile at www.sedarplus.ca.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The Tudor securities to be issued under the Transaction have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), or any state securities laws and may not be offered or sold within the "United States" (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available. It is anticipated that any securities to be issued under the Transaction will be offered and issued in reliance upon the exemption from the registration requirements of the 1933 Act provided by Section 3(a)(10) thereof.

Tudor has agreed with certain insiders of American Creek to settle up to $1,000,000 in severance payments in cash and up to $1,220,000 in severance payments in Tudor Shares at a per share price of $0.537 (the "Settlement Shares"). This settlement remains subject to approval of the TSXV. The Settlement Shares will be subject to a statutory four-month hold period.

Board Approvals and Voting Support

The board of directors of American Creek (the "Board"), having received a unanimous recommendation from a special committee comprised of independent directors of American Creek (the "Special Committee"), and after receiving outside legal and financial advice, has unanimously approved the Transaction and determined that the Transaction is in the best interests of American Creek and is fair to the shareholders of American Creek (the "Shareholders") and other securityholders (warrantholders and optionholders) (the "Other Securityholders").

In making their respective determinations, the Special Committee and the Board considered, among other factors, the fairness opinion of INFOR Financial Inc. that concluded that, subject to the assumptions, limitations and qualifications contained therein, the consideration to be received by the Shareholders and the Other Securityholders pursuant to the Transaction is fair, from a financial point of view, to such Shareholders and Other Securityholders, respectively. A copy of the fairness opinion will be included in the AMK Information Circular to be mailed to the Shareholders in connection with the AMK Meeting.

Directors and officers of American Creek, American Creek's largest shareholder (being a company controlled by Eric Sprott) and other securityholders, holding in the aggregate approximately 16.5% of the outstanding American Creek shares, have each entered into customary voting and support agreements to, amongst other things, vote in favour of the Transaction at the Meeting.

About Tudor

Tudor Gold Corp. is a precious and base metals exploration and development company with claims in British Columbia's Golden Triangle (Canada), an area that hosts producing and past-producing mines and several large deposits that are approaching potential development. The 17,913 hectare Treaty Creek project (in which Tudor Gold has a 60% interest) borders Seabridge Gold Inc.'s KSM property to the southwest and borders Newmont Corporation's Brucejack property to the southeast.

About American Creek

American Creek is a proud partner in the Treaty Creek Project, a joint venture with Tudor Gold Corp. located in BC's prolific "Golden Triangle". American Creek holds a fully carried 20% interest in the Treaty Creek Project until a production notice is given, meaning that no exploration or development costs are incurred by American Creek until such time as a production notice has been issued. The Company also holds the Austruck-Bonanza gold property located near Kamloops, BC.

ON BEHALF OF AMERICAN CREEK RESOURCES LTD.

"Darren Blaney"

Darren Blaney, President & CEO

For further information please contact Kelvin Burton at:

Phone: (403)752-4040 or Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

In this news release, forward-looking statements relate to, among other things, statements regarding: the Transaction; the receipt of necessary shareholder, court and regulatory approvals for the Transaction; the anticipated timeline for holding the AMK Meeting and completing the Transaction; the terms and conditions pursuant to which the Transaction will be completed, if at all; the anticipated benefits of the Transaction including, but not limited to Tudor having an 80% interest in the Treaty Creek Project and American Creek shareholders owning approximately 30% of the total issued and outstanding share capital of Tudor; and potential future revenue and cost synergies resulting from the Transaction. These forward-looking statements are not guarantees of future results and involve risks and uncertainties that may cause actual results to differ materially from the potential results discussed in the forward-looking statements.

In respect of the forward-looking statements concerning the Transaction, American Creek has relied on certain assumptions that it believes are reasonable at this time, including assumptions as to the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court, shareholder, stock exchange and other third party approvals and the ability of the parties to satisfy, in a timely manner, the other conditions to the completion of the Transaction. This timeline may change for a number of reasons, including unforeseen delays in preparing AMK Meeting materials; inability to secure necessary regulatory, court, shareholder, stock exchange or other third-party approvals in the time assumed or the need for additional time to satisfy the other conditions to the completion of the Transaction. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these times.

Risks and uncertainties that may cause such differences include but are not limited to: the risk that the Transaction may not be completed on a timely basis, if at all; the conditions to the consummation of the Transaction may not be satisfied; the risk that the Transaction may involve unexpected costs, liabilities or delays; the possibility that legal proceedings may be instituted against American Creek, Tudor and/or others relating to the Transaction and the outcome of such proceedings; the possible occurrence of an event, change or other circumstance that could result in termination of the Transaction; risks relating to the failure to obtain necessary shareholder and court approval; other risk factors as detailed from time to time and additional risks identified in American Creek's and Tudor's filings with Canadian securities regulators on SEDAR+ in Canada (available at www.sedarplus.ca). Failure to obtain the requisite approvals, or the failure of the parties to otherwise satisfy the conditions to or complete the Transaction, may result in the Transaction not being completed on the proposed terms, or at all. In addition, if the Transaction is not completed, the announcement of the Transaction and the dedication of substantial resources of American Creek to the completion of the Transaction could have a material adverse impact on each of American Creek's share price, its current business relationships and on the current and future operations, financial condition, and prospects of American Creek.

American Creek expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.