Toronto, Ontario--(Newsfile Corp. - June 30, 2025) - Signature Resources Ltd. (TSXV: SGU) (OTCQB: SGGTF) (FSE: 3S30) ("Signature" or the "Company") is pleased to announce its initial mineral resource estimate (the "MRE") on its Lingman Lake Gold Deposit in the District of Kenora, Ontario . The MRE is a culmination of a total of 240 diamond drill holes including 33,309 assayed samples, for a combined length of 43,222 metres ("m") and was compiled by Watts, Griffis and McOuat ("WGM"). Highlights of the MRE include:

-

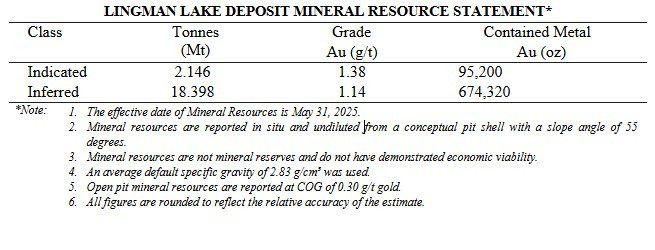

Single resource shell containing more than 20.6 million tonnes of mineralized material and remains open (Table 1). The MRE consists of an Indicated resource of 2.15 million tonnes with an average grade of 1.38 grams-per-tonne gold ("g/t Au") for an estimated 95,200 ounce of gold ("oz Au"), plus an inferred resource of 18.4 million tonnes with an average grade of 1.14 g/t Au totalling 674,320 oz Au. About 5% of the gold ounces are outside of the statistical gold-grade capping and estimation was relatively insensitive to cutoff and modeling methodology. The current resource pit shell extends 1.6 kilometres ("km") (West to East) with a maximum width of ~400 m and a maximum depth of about 340 m below surface.

-

Resource growth potential remains robust. Structures hosting the mineralization remain open to further drilling both east, west and at depth. Modeling indicated the potential for a further mineralization outside the pit shell that could be brought in with additional drilling and an extension of the conceptual pit shell during a future mineral resource update. WGM also recommended that drilling test the potential for veins to converge at depth. Several surface channel samples have been taken near the modelled resource that have contiguous gold intervals that are above the resource cutoff. The Company plans to follow-up with drilling to potentially expand the resource envelope. It is important to highlight that the high-grade intercepts from 1945 drilling were excluded and is a target area for follow-up drilling. The Lingman Lake Gold Deposit is one of many exploration targets identified along the 24,821 hectare greenstone belt project held by Signature (Figure 8).

-

Moderate metrics used for the resource calculation. The resource cap used varied by zone, from a low of 4.5g/t in the 11650 zone to a high of 20 g/t Au in the North zone and a cut-off grade of 0.3 g/t Au was applied. The pit shell wall was constructed with a slope of 55 degrees on all pit wall assumptions and will be subject to future geotechnical review. The estimation of gold grades was performed with the Inverse Distance technique cube (ID³) on capped composites. The block model structure consists of an orthogonal model (no rotation). Ordinary Kriging (OK), Inverse Distance square (ID²) and nearest neighbourhood methods also performed for comparisons and validations. Grade interpolations were carried out in three passes with each successive pass using a larger search radius than the preceding pass and only estimating the blocks that had not been interpolated by the previous pass.

"We are very pleased to announce the results of our initial MRE This was a crucial step in confirming the potential of the Lingman Lake Gold Deposit. In addition, this report demonstrates the depth and quality of the work being done on this project to illustrate the possibilities for this greenstone belt that Signature controls. The work has identified a number of opportunities to expand this initial resource around the historical Lingman Lake mine. The studies we are conducting on the mineralogy characterizations and initial metallurgical work to further characterize the deposit should greatly enhance our knowledge and targeting as we test the extensions and look for satellite deposits. All these steps should provide great confidence that we are advancing this project in the highest quality methods possible." - J. Dan Denbow, CFA - President, CEO and Director

Table 1 shows the results from the initial MRE for the Lingman Lake Gold Deposit. The modeled resource contains a total 20.6 million tonnes of material. Near the historical underground workings, the drill density was reasonable enough for a portion to be classified as indicated. Of the total tonnes, 2.146 million tonnes are in the indicated category with an average grade of 1.38 g/t Au containing 95,200 oz Au. The majority of the resource was categorized as inferred with 18.398 million tonnes at an average grade of 1.14 g/t Au containing an estimated 674,320 oz Au. Overall, the capping of high-grade outliers impacted the overall results by only 5%. The capping was done on a zone-by-zone basis ranging from 20 g/t Au in the North zone and 4.5 g/t in the 11650 zone.

Table 1- Lingman Lake Deposit Mineral Resource Statement **

**A total of 240 diamond drill holes including 33,309 assayed samples, for a combined length of 43,222.59 m were used in mineral resource estimation. 72 historical drill holes from 1945 and one drill hole from 1973 were excluded from the mineral resource estimate. WGM was unable to verify these drill holes due to lack of a core, lack of assay certificates and logs, no physical collar location, and lack of downhole surveys. A zero value was assigned to all unsampled intervals which intersected mineralized zones by WGM. WGM has reviewed the database and is satisfied with the integrity of the drilling database. WGM believes it is suitable for a median mineral resource estimation. The MRE has been prepared for the Lingman Lake Deposit in accordance with NI 43-101 and the current CIM definition Standards for Mineral Resources and Mineral Reserves (November 2019).

Figure 2 shows the distribution of the block model and resource categories in planview relative to the resource pit outline. One of the several opportunities to improve the mineral resource estimate is further drilling west of the diabase dyke. As can be seen in the figure below, many of the mineralized blocks of the west zone are disconnected from the main resource body, with further drilling on the west zone these could be connected to the main resource body capturing the voids in the model. Another opportunity with infill drilling would be capturing areas identified by exploration completed in the 1940's that was not included in this resource estimate. Infill drilling will also benefit the resource as selective assaying in earlier drilling had a negative impact as segments that were not assayed carried a zero value in the model and affected the resource estimate. Infill drilling will also increase drill density which may allow for the upgrading of inferred resources to a higher categorization.

Figure 2. Planview of classified Block Model within Resource Pit Outline

Figure 2. Planview of classified Block Model within Resource Pit Outline

With the higher grades that reside in the upper portion of the deposit the resource is not highly sensitive to changes in the cut-off grade. The MRE is reported using a cut-off grade of 0.30 g/t Au. If the cut-off grade is raised to 1.00 g/t Au, estimated ounces would be approximately 531,000 ounces of gold at a grade of 1.99 g/t Au.

Table 2- Resource Sensitivity to Cut-Off Grade

Figure 3 shows a long section of the MRE in main Mineralized domains vs the pit shell. The MRE pit shell extends 1.6 km from West to East with a maximum width of approximately 400 m with a maximum depth of 340m based upon a cut-off grade of 0.3 g/t Au. As can be seen in this figure there are a number of resource blocks outside of the designed pit shell pointing to another opportunity to potentially improve the resource estimate. Successful drilling at depth could enable a deepening of the pit design and potentially capture these blocks, assuming engineering work confirms the viability of their extraction.

Figure 3 - Pit Shell (In Blue) and Resource Blocks (in Pink) with Insitu Grade (=>0.3 g/t Au)

Figure 3 - Pit Shell (In Blue) and Resource Blocks (in Pink) with Insitu Grade (=>0.3 g/t Au)

It is interpreted that the mineralization is contained in five main zones within the resource (Figure 4). With current exploration, the mineralized zones have been identified covering 2 km in the E-W strike direction in a corridor of approximately 300m width. These mineralized zones are typically dipping 75° to 85°. As can be seen in Table 3 the North and West zone are the largest by volume and these zones on average have a higher grade of 1.61 g/t Au and 1.63 g/t Au respectively.

Figure 4 – Lingman Mineralized Domains

Figure 4 – Lingman Mineralized Domains

Table 3 - Estimate Volumes of Mineralized Domains

| Domain | Domain Code | Volume (m3) |

| North | 100 | 2,936,467 |

| Central | 200 | 2,442,351 |

| South | 300 | 1,560,566 |

| West | 400 | 2,860,775 |

| 11650N | 500 | 356,238 |

Figure 5 is a section that shows the mineralized blocks of the identified gold zones and the MRE pit outline. The higher grades contained in the upper portion of this section underlies the robustness of the resource with higher cutoff grades (Table 2). The mineralized zones extend to the bottom of the pit outline and presents the opportunity to extend these zones at depth with further exploration.

Figure 5. Modeled Blocks and Mineral Pit Outline.

Figure 5. Modeled Blocks and Mineral Pit Outline.

Figure 6 and figure 7 below show typical cross sections of the Lingman Lake mineralized zones. Figure 6 shows the mineralized domains east of the Diabase Dyke. Figure 7 shows the interpreted mineralized West zone.

Figure 6. Cross Section of Lingman Lake Mineralized Zones

Figure 6. Cross Section of Lingman Lake Mineralized Zones

Figure 7. Cross Section of Lingman Lake Mineralized Zones

Figure 7. Cross Section of Lingman Lake Mineralized Zones

Multiple Regional Targets

In 2018 and 2021 the Company conducted a high-resolution airborne Magnetic and Matrix VLF-EM surveys across the Signature claim package. In addition, the Company completed an induced polarization Alpha IPTM Wireless Time Domain and ground magnetic survey in the fall of 2021. With the combination of the induced polarization and magnetic surveys the Company has identified several targets across the project area. The airborne surveys have provided targets areas that are of great interest within the regional context of Signature's Lingman Lake Gold Deposit (Figure 8). While most of the recent work has been focused around the historical Lingman Lake mine site, there is evidence of past field programs that can help guide our future activities when we begin regional exploration work on our extensive 32km, 24,821 hectares project area.

Improved Regional Infrastructure

NW Ontario has seen improve regional infrastructure and the Ontario government is committing more support to mining. In November of 2023 the Ontario government energized the Phase 2 of the Wataynikaneyap Power Project which resulted in a number of 115kV power lines into Northern Ontario, a 40-metre-wide alignment right of way and an associated service road. This Phase 2 development has resulted in high tension power and road access being approximately 45 kilometres away from the Lingman Lake Deposit which has greatly reduced the amount of infrastructure needed should the deposit warrant development. In addition, the Ontario government has recently announced their plans to invest $500 million on a number of initiatives to help support development of critical mineral deposits in Northern Ontario. The province is also investing nearly $3.1 billion in loans, guarantees, grants and scholarships that would support Indigenous participation, partnership and ownership in Ontario's critical mineral supply chain. The provincial government has also introduced legislation designed to cut the red tape and duplicative processes that have held back major infrastructure, mining and resource development projects.

2025 Activities

2025 Drilling Program

With this MRE completed, the Company has identified several opportunities to expand this resource and will begin with a drill program of approximately 6,000 m to be completed by the end of 2025. The Company is currently completing the design of this program but will focus on three key areas: 1) expanding the mineral resource laterally, 2) infilling identified gaps in the existing drilling, and 3) extending our knowledge of the deposit at depth that will allow the mineral resource to capture ounces that fall just outside of the current pit design. Some of these holes will also be designed to test the deeper extensions of the mineralization, as we continue to seek the vector and controls on the high-grade gold mineralization in the Lingman Lake Gold Deposit.

Sample Program and Mineralization Study Activities

In preparation for our 2025 drilling program, the company opened the exploration camp on April 22, 2025 completing several maintenance activities, renovated its core shack to improve material handling and completed a mapping and channel sampling program gathering 110 samples to be evaluated by SGS Labs in Red Lake. These samples were gathered from five areas of interest including following up on promising targets on the North zone discovered last year and testing outcrops that appear to align with intercepts from DDH holes LM 24-09 and LM 24-10. This surface sampling is a very cost-effective method of exploration helping to improve our knowledge of the deposit and we look forward to seeing these results later this summer.

The team also gathered samples from our storage facilities at Red Lake, to be used by SGS for additional studies to be completed this year that will further build our knowledge base regarding the mineralization, associations and lithologies of the deposit. The Company will be undertaking the following studies; Xray diffraction employing RIR (Reference Intensity Ratio) for bulk mineralogy analysis, TESCAN Integrated Mineral Analyzer (TIMA) on selected mineralized samples for bulk mineralogy and sulphide mineral characterization, and a gold deportment study of composite samples from the four identified gold zones. These are very important activities that will provide valuable information for future exploration activities. We expect to have the results from these activities later in 2025.

With the samples collected from the 2025 drill program the company anticipates completing an early-stage metallurgical study to evaluate gold recovery and provide initial insights into processing options.

Updated Corporate Address

The Company has updated its corporate address and contact information. Signature's new corporate address is 66 Wellington St West, Suite 4100, Toronto, Ontario M5K 1B7 and phone number is (800) 259-0150.

Qualified Person

The scientific and technical content of this press release have been reviewed and approved by Mr. Walter Hanych, P. Geo, consultant and Head Geologist, and resource estimate statements have been reviewed by Mr. Jeff Plate, CFA, P. Geo, Vice President WGM, who are a Qualified Persons under NI 43-101 regulations.

The mineral resource estimate presented herein represent the first mineral resource estimate that has been prepared for Lingman Lake deposit in accordance with NI 43-101 and the current CIM definition Standards for Mineral Resources and Mineral Reserves (November 2019). There are 313 drill holes in the database provided to WGM related to Lingman Lake property. The current mineral resource estimate for the Lingman Lake property prepared by WGM utilizes results from 240 core boreholes drilled by previous owners of the property during the period of 1987 to 2024. The mineral resource estimation work was completed by Mr. Farshid Ghazanfari, M.Sc., P.Geo., an independent Qualified Person as such term is defined in NI 43-101. In the opinion of WGM, the resource evaluation reported herein is a reasonable representation of the global gold resources found in the Lingman property at the current level of sampling. The mineral resources were estimated in conformity with generally accepted CIM Estimation of Mineral Resource and Mineral Reserves Best Practices guidelines and are reported in accordance with NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resource will be converted into mineral reserve.

About Signature Resources Ltd.

The Lingman Lake gold property (the "Property") consists of 1,274 single-cell and 13 multi-cell staked claims, four freehold fully patented claims and 14 mineral rights patented claims totaling approximately 24,821 hectares. The Property includes what has historically been referred to as the Lingman Lake Gold Mine, an underground substructure consisting of a 126.5-metre shaft, and 3-levels at depths of 46-metres, 84-metres and 122-metres. There has been over 43,222 metres of drilling done on the Property and four 500-pound bulk samples that averaged 19 grams per tonne of gold. In November 2023, the Ontario government energized a new 115kV high tension transmission line within 40 km of the historic Lingman Lake Mine (https://www.wataypower.ca/).

To find out more about Signature, visit www.signatureresources.ca or contact:

Dan Denbow

Chief Executive Officer

(800) 259-0150

This email address is being protected from spambots. You need JavaScript enabled to view it.

or contact :

Renmark Financial Communications Inc.

John Boidman: This email address is being protected from spambots. You need JavaScript enabled to view it.

Tel: (416) 644-2020 or (212) 812-7680

www.renmarkfinancial.com

Cautionary Notes

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release contains forward-looking statements which are not statements of historical fact. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions and risks associated with infectious diseases and global geopolitical events. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to changes in general economic and financial market conditions, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.