Latest assays include 43m at 7.6% CuEq and 15m at 16% CuEq; The vast majority of this rich core, which remains open, sits outside the current Mineral Resource

Green Bay Copper-Gold Project, Canada

KEY POINTS

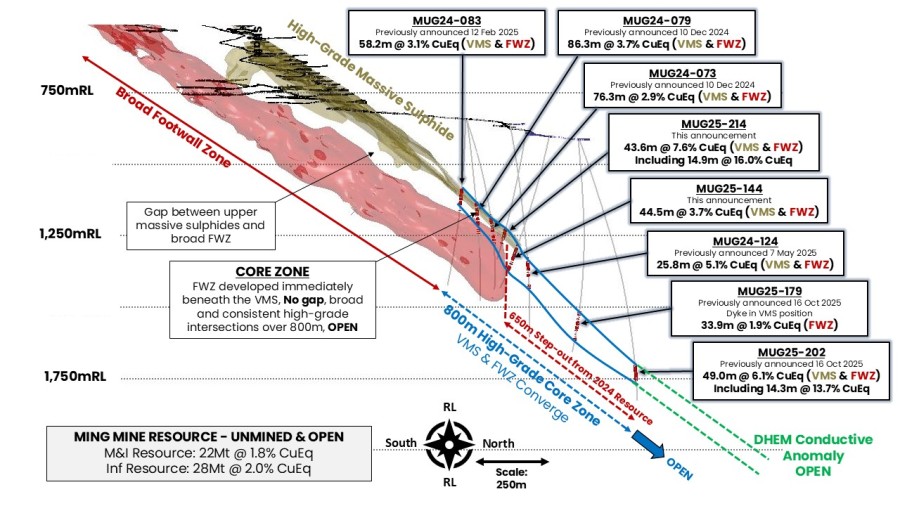

- An extremely high-grade core is emerging at Green Bay, with the drilling results continuing to reveal the presence of this rich copper-gold mineralisation over substantial widths along an 800m length

- This high-grade core, which remains open along strike, stands to significantly impact the Mineral Resource Estimate planned for release this quarter and the subsequent economic studies

- Drilling suggests the core occurs where the Volcanogenic Massive Sulphide (VMS) and Footwall Zone (FWZ) style mineralisation converge

- The latest holes into the high-grade core have returned intersections of:

- 43.6m @ 7.6% copper equivalent (CuEq)1 (5.7% Cu & 2.1g/t Au) in hole MUG25-214 (~ true thickness), including an upper VMS zone grading 14.9m @ 16.0% CuEq (11.5% Cu & 5.0g/t Au)

- 44.5m @ 3.7% CuEq (3.0% Cu & 0.8g/t Au) in hole MUG25-144 (~ true thickness), including a FWZ grading 22.0 @ 4.5% CuEq (4.2% Cu & 0.3g/t Au)

- These results follow other previously announced intersections along the core unit, including:

- 49.0m @ 6.1% CuEq (4.9% Cu & 1.3 Au) in hole MUG25-202 (~ 39.2m true thickness),

including 14.3m @ 13.7% CuEq. This is the furthest step-out hole to date (see ASX announcement dated 16 October 2025). - 86.3m @ 3.7% CuEq (3.1% Cu & 0.6g/t Au) in hole MUG24-079 (~ true thickness),

including 27.6m @ 5.3% CuEq (5.0% Cu & 0.3g/t Au) (see ASX announcement dated 10 October 2024). - 58.2m @ 3.1% CuEq (2.4% Cu & 0.7g/t Au) in hole MUG24-083 (~ true thickness),

including 5.0m @ 6.7% CuEq (4.6% Cu & 2.2g/t Au) (see ASX announcement dated 12 February 2025). - 76.3m @ 2.9% CuEq (2.4% Cu & 0.5g/t Au) in hole MUG24-073 (~ true thickness),

including 20.1m @ 6.1% CuEq (4.9% Cu & 1.3g/t Au) (see ASX announcement dated 10 December 2024).

- 49.0m @ 6.1% CuEq (4.9% Cu & 1.3 Au) in hole MUG25-202 (~ 39.2m true thickness),

- In addition, the latest infill drilling results targeting the upper VMS zones reveal more high-grade mineralisation, including:

- 4.1m @ 17.4% CuEq (14.1% Cu & 3.6g/t Au) in hole MUG25-135 (~ true thickness)

- 16.0m @ 13.5% CuEq (10.7% Cu & 3.0g/t Au) in hole MUG25-126 (~ true thickness)

- 10.1m @ 9.2% CuEq (6.9% Cu & 2.5g/t Au) in hole MUG25-170 (~ true thickness)

- 9.3m @ 5.0% CuEq (2.1% Cu & 3.1g/t Au) in hole MUG25-156 (~ true thickness)

- 20.0m @ 4.5% CuEq (1.8% Cu & 2.5g/t Au) in hole MUG25-147 (~ true thickness)

- Broad intersections of FWZ style copper mineralisation highlight areas of thick and consistent copper mineralisation, indicating potential for large-scale bulk mining. Latest intersections include:

- 82.8m @ 2.5% CuEq (2.4% Cu & 0.1g/t Au) in hole MUG25-156 (~ true thickness)

- 31.0m @ 5.0% CuEq (4.7% Cu & 0.3g/t Au) in hole MUG25-136 (~ true thickness)

- 50.0m @ 2.2% CuEq (2.1% Cu & 0.1g/t Au) in hole MUG25-141 (~ true thickness)

- 55.9m @ 2.0% CuEq (1.9% Cu & 0.1g/t Au) in hole MUG25-158 (~ true thickness)

- The current Mineral Resource Estimate for Green Bay totals 24.4Mt at 1.9% for 460Kt CuEq of Measured & Indicated Resources and 34.5Mt at 2.0% for 690Kt CuEq of Inferred Resources (see ASX announcement dated 29 October 2024)

- Eight diamond rigs continue to operate (six underground and two on surface) to upgrade the current Mineral Resource, extend known mineralisation and make new regional discoveries

- Regional exploration is well underway, with drill rigs systematically testing conductive geophysical anomalies in the central Green Bay leases (see ASX announcement dated 24 July 2025). A VTEM survey is being completed over the Company’s Tilt Cove Project

|

FireFly Managing Director Steve Parsons said: “These results point to the discovery of a long, extremely high-grade core of copper and gold mineralisation over a strike length of at least 800m. "These high grades occur over substantial widths, further highlighting the potential impact on the Mineral Resource and the economic studies now underway. |

PERTH, Australia, Oct. 27, 2025 (GLOBE NEWSWIRE) -- FireFly Metals Ltd (ASX, TSX: FFM) (Company or FireFly) is pleased to announce more exceptional drilling results which point to a high-grade mineralised core over a strike length of at least 800m at its Green Bay Copper-Gold Project in Canada.

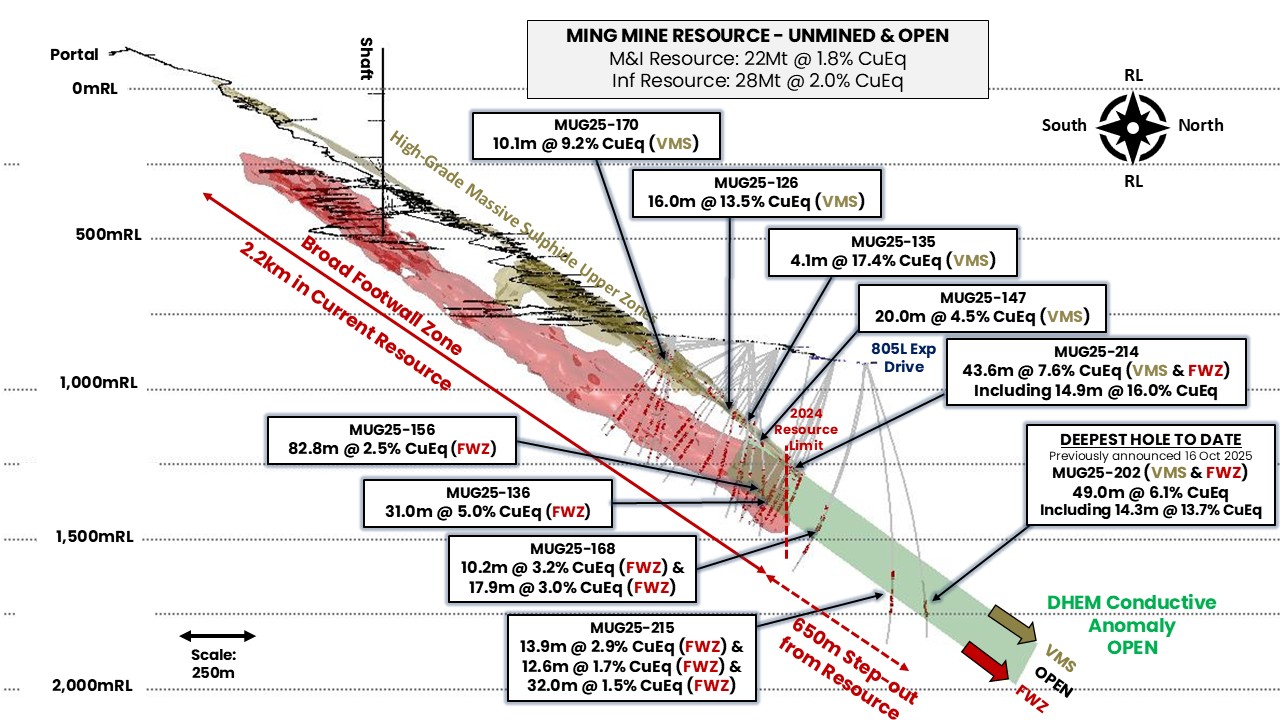

The emerging broad, high-grade copper and gold-rich zone appears to occur where the VMS and FWZ mineralisation zones come together (Figure 1).

This copper and gold rich zone within the main mineralised envelope continues over ~800m strike and remains open with the furthest step out hole of 49.0m @ 6.1% CuEq (4.9% Cu & 1.3 Au) in hole MUG25-202 (~ 39.2m true thickness), and includes an even higher-grade zone of 14.3m @ 13.7% CuEq. This is the furthest step-out hole to date, over 650m from the mineralisation the subject of the previous Mineral Resource Estimate in October 2024 (see ASX announcement dated 16 October 2025).

Recent drilling into the core trend confirms a zone in which the FWZ is well developed directly beneath the upper VMS leading to thick continuous high-grade intersections including 43.6m @ 7.6% CuEq. This included an exceptionally rich upper massive sulphide zone of 14.9m @ 16.0% CuEq (11.5% Cu & 5.0g/t Au).

Importantly, a strong conductive DHEM anomaly extends a further 350m beyond this drill hole and points to the potential for future down-plunge extensions.

Infill drilling continues to confirm the presence of strong and consistent mineralisation in areas previously subject to wide-spaced drilling (Figure 2). Drilling of the upper high-grade copper and gold VMS lenses has returned exceptional intersections, including 16.0m @ 13.5% CuEq, 10.1m @ 9.2% CuEq and 4.1m @ 17.4%CuEq (all approximate true thickness). Additional drilling of the broad copper stringer FWZ continues to highlight thick zones of mineralisation that are likely suitable for large-scale bulk mining. Infill intersections returned recently include exceptional results such as 82.8m @ 2.5% CuEq, 31.0m @ 5.0% CuEq and 22.0m @ 4.5% CuEq.

Figure 1: Long section through the Ming Mine highlighting the current ~800m strike of the extremely high-grade core zone and remains open. The FWZ stringer style mineralisation is developed directly beneath the upper high-grade VMS. Clipping +/- 30m

Figure 2: Long section through the Green Bay Ming underground mine showing the location of select drill results from this announcement only. Results from both the high-grade copper-gold VMS zone and broad copper Footwall Zone are shown. The green shape is a modelled DHEM anomaly demonstrating the mineralisation remains open at depth ready for drill testing (from hole MUG25-040 - see ASX announcement dated 7 May 2025 for further details). Drill assays >0.5% copper are shown in red. Refer to all drill results and locations further in this ASX announcement.

These infill results, combined with other recently reported drilling, highlight the potential for an increase in both the higher confidence Measured and Indicated (M&I) and Inferred Mineral Resource categories as part of the Mineral Resource Estimate update planned for this quarter.2

The current Mineral Resource Estimate stands at 24.4Mt @ 1.9% for 460Kt CuEq of M&I Resources and a further 34.5Mt @ 2.0% for 690Kt CuEq of Inferred Resources.3

The higher-confidence M&I categories of Mineral Resources are important because they will underpin the economic studies into upscaled production at Green Bay.

Regionally, exploration programmes are also well underway, following the North American summer break period, with two diamond drill rigs continuing to accelerate the regional discovery campaign. Geophysical data collection continues, with a detailed helimagnetic survey completed over the central Green Bay leases. A comprehensive VTEM survey is being completed over the entire 115km2 of the adjacent Tilt Cove Project to the east of the Ming Mine. The new geophysical data is expected to be available in the coming month. The rigs will systematically test geophysical anomalies generated by this new data and the Company’s previous airborne VTEM surveys.

FireFly is well funded to accelerate its growth campaign and engineering studies following a recent well supported equity raising first announced on 5 June 2025.

About the Drilling Results

Drilling at the Ming underground copper-gold mine recommenced following the acquisition of the Green Bay Copper-Gold Project by FireFly in October 2023. In total, FireFly has completed 246 underground holes for a total of ~129,200m of underground diamond drilling to 21 October 2025.

This announcement contains the results of 49 drill holes. The drilling results reported in this announcement are predominantly the results of infill drilling and drilling of holes targeting the lateral margins of the mineralisation. Logging and analysis of additional drill holes is ongoing, and further details will be reported as results are received. In addition, step-out growth drilling is underway with the results due in the coming weeks.

There are two distinct styles of mineralisation present at the Green Bay Ming Mine, consisting of a series of upper copper-gold rich VMS lenses underlain by a broad copper-rich stringer zone, known as the Footwall Zone (or FWZ).

The Footwall Zone is extensive, with the copper stringer mineralisation observed over thicknesses of ~150m and widths exceeding 200m. The known strike of the mineralisation defined to date is 2.8km and it remains open down-plunge.

Six drill rigs are currently operating underground, with the focus split between both step-out extension and exploration (two rigs) and infill Resource conversion drilling (four rigs).

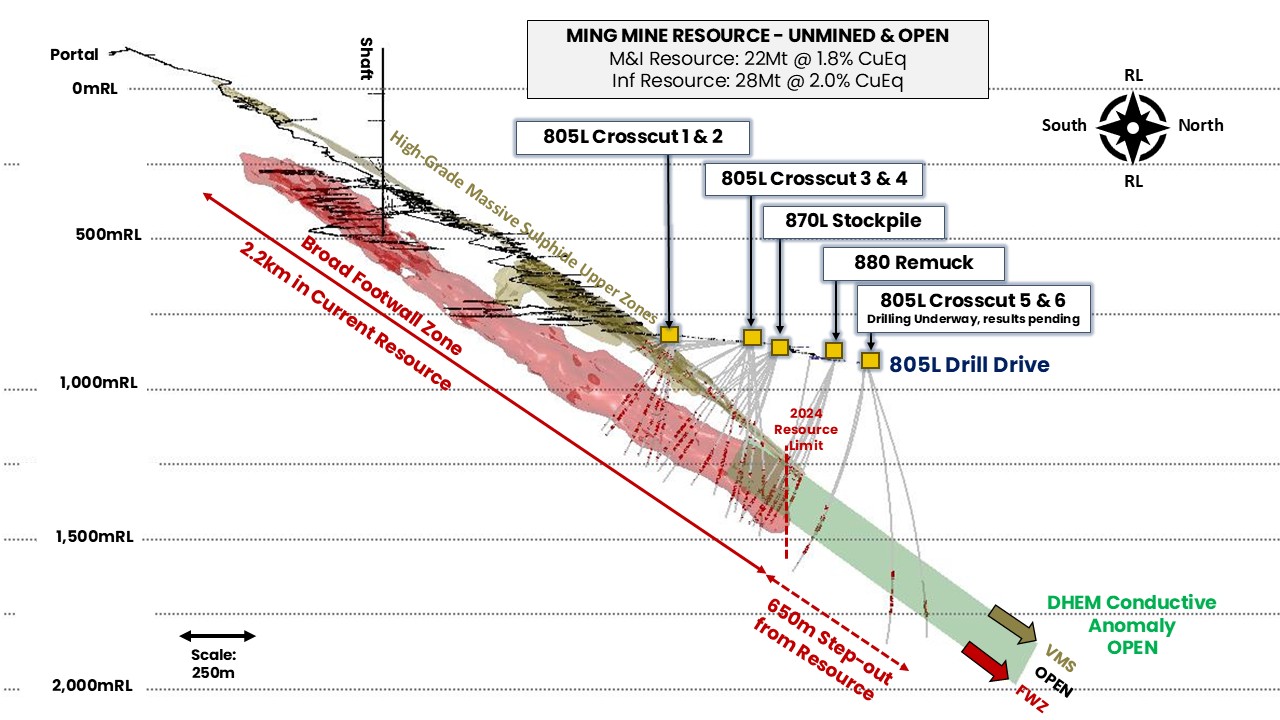

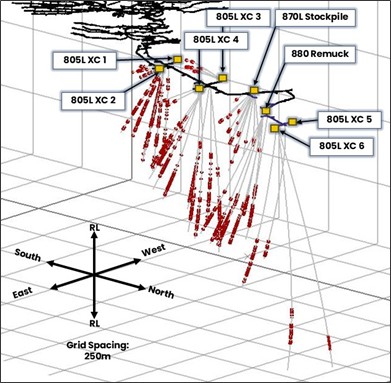

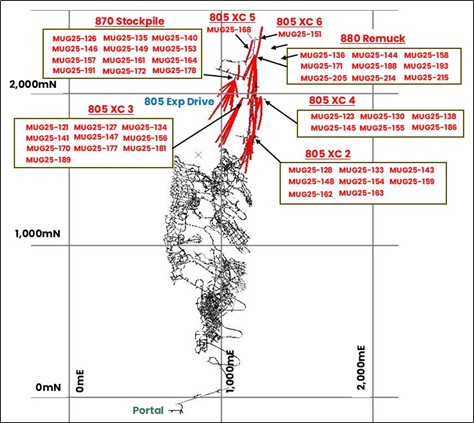

The location of drill positions and holes reported in this announcement is presented in Figure 3. Significant assay results are presented in Appendix B of this announcement.

Figure 3: Long section through the Ming Mine showing the location of drill platforms and drilling reported in this announcement as well as the significant DHEM conductor (see ASX announcement dated 7 May 2025). Assay results greater than 0.5% Cu are shown in red.

Resource Conversion Drilling from the 805L Exploration Drive

All drilling reported in this announcement has been conducted from the 805L drill drive. Whilst this development is currently being utilised for exploration, it will form an important part of the future mine infrastructure for the potential upscaled operation.

The drilling completed from the southern 805L Exploration drive (Crosscuts 1 to 4) focused on upgrading the data density of the Inferred Mineral Resource reported in the October 2024 Mineral Resource Estimate (MRE). This will likely upgrade the areas targeted to the higher confidence M&I category in the MRE planned for later this year.

Drill results are starting to be returned from the northern end of the drill development (880 Remuck, Crosscuts 5 and 6). This is the deepest drilling completed down-plunge at Ming to date and confirmed the mineral system continues at depth. This will likely add to the Inferred Mineral Resources in the upcoming MRE.

Drilling from the 805L is shown in Figure 4.

Figure 4: Isometric view of drill positions in the 805L Exploration drill drive. Drill results from this announcement are shown with copper assays >0.5% shown in red.

Drilling from the Northern 805L Exploration Drive (880 Remuck, Crosscuts 5 & 6)

Drilling completed from the northern extent of the 805L drill platform targeted the zone between the furthest step out hole (49.0m @ 6.1% CuEq – see ASX announcement dated 16 October 2025) and drilling completed from crosscuts 3 and 4. It is expected that this zone will convert into Inferred Mineral Resource in the update planned for later this year. Significant intersections include, but are not limited to (all approximate true thickness):

Hole MUG25-136 intersected a broad gold-rich VMS zone underlain by multiple zones of thick high-grade copper rich FWZ mineralisation:

- 20m @ 1.6% Cu, 0.9g/t Au, 7g/t Ag, 1.26% Zn (2.6% CuEq) from 378m (FW Stringer-style)

- 31m @ 4.7% Cu, 0.3g/t Au, 4.7g/t Ag, 0.07% Zn (5.0% CuEq) from 407m (FW Stringer-style)

- 18.2m @ 3.2% Cu, 0.2g/t Au, 2.9g/t Ag, 0.16% Zn (3.4% CuEq) from 450m (FW Stringer-style)

Hole MUG25-144 confirmed the presence of thick copper-gold mineralisation underlain by multiple zones of high-grade stringer-style mineralisation

- 17.5m @ 2.1% Cu, 1.5g/t Au, 10.2g/t Ag, 1.17% Zn (3.7% CuEq) from 403.5m (VMS-style)

- 22m @ 4.3% Cu, 0.3g/t Au, 5.1g/t Ag, 0.06% Zn (4.5% CuEq) from 426m (FW Stringer-style)

- 18.5m @ 2.2% Cu, 0.1g/t Au, 3.1g/t Ag, 0.1% Zn (2.4% CuEq) from 474.5m (FW Stringer-style)

Hole MUG25-151 contained both VMS and FWZ mineralisation:

- 9.1m @ 1.0% Cu, 1.3g/t Au, 5.9g/t Ag, 0.39% Zn (2.2% CuEq) from 490.5m (VMS-style)

- 23.2m @ 1.4% Cu, 0.1g/t Au, 1.8g/t Ag, 0.13% Zn (1.5% CuEq) from 561.7m (FW Stringer-style) including

- 4.2m @ 3.3% Cu, 0.2g/t Au, 3.9g/t Ag, 0.32% Zn (3.6% CuEq) from 564.1m

- 34.4m @ 1.3% Cu, 0.1g/t Au, 1.7g/t Ag, 0.02% Zn (1.4% CuEq) from 628.6m (FW Stringer-style)

Hole MUG25-158 intersected an upper gold-silver dominated sulphide zone immediately above the more traditional copper-gold VMS style mineralisation. A thick FWZ was then identified lower in the sequence:

- 2.3m @ 0.3% Cu, 1.2g/t Au, 30.7g/t Ag, 0.02% Zn (1.6% CuEq) from 372.8m (VMS-style)

- 6.6m @ 1.2% Cu, 1.1g/t Au, 8.2g/t Ag, 0.44% Zn (2.3% CuEq) from 380.6m (VMS-style)

- 55.9m @ 1.9% Cu, 0.1g/t Au, 1.8g/t Ag, 0.13% Zn (2.0% CuEq) from 457.2m (FW Stringer-style) including:

- 7.6m @ 3.8% Cu, 0.2g/t Au, 3.7g/t Ag, 0.25% Zn (4.0% CuEq) from 457.2m

- 7.1m @ 2.0% Cu, 0.1g/t Au, 3.2g/t Ag, 0.04% Zn (2.2% CuEq) from 543.9m (FW Stringer-style)

Hole MUG25-168 contained two distinct zones of FWZ-style stringer mineralisation:

- 10.2m @ 3.0% Cu, 0.2g/t Au, 3.3g/t Ag, 0.01% Zn (3.2% CuEq) from 530.8m (FW Stringer-style)

- 17.9m @ 2.8% Cu, 0.2g/t Au, 2.6g/t Ag, 0.11% Zn (3.0% CuEq) from 559.2m (FW Stringer-style)

Hole MUG25-171 successfully targeted both the VMS and FWZ Stringer styles of mineralisation, with multiple intersections throughout the hole:

- 6.1m @ 5.1% Cu, 1.6g/t Au, 28g/t Ag, 0.58% Zn (6.7% CuEq) from 396.9m (VMS-style)

- 55.0m @ 1.5% Cu, 0.1g/t Au, 1.4g/t Ag, 0.13% Zn (1.6% CuEq) from 473m (FW Stringer-style) including:

- 7.3m @ 3.2 Cu, 0.2g/t Au, 2.9g/t Ag, 0.24% Zn (3.4% CuEq) from 474.8m; and

- 4.8m @ 3.4% Cu, 0.1g/t Au, 2.9g/t Ag, 0.25% Zn (3.6% CuEq) from 492.0m

Hole MUG25-188 had a gold-rich VMS zone underlain by multiple intersections of FWZ-style mineralisation:

- 4.7m @ 2.6% Cu, 2.5g/t Au, 21.1g/t Ag, 1.76% Zn (5.1% CuEq) from 374.3m (VMS-style)

- 12.6m @ 2.0% Cu, 0.1g/t Au, 2.5g/t Ag, 0.02% Zn (2.1% CuEq) from 495.5m (FW Stringer-style)

- 25.0m @ 1.3% Cu, 0.1g/t Au, 1.4g/t Ag, 0.01% Zn (1.3% CuEq) from 526.0m (FW Stringer-style)

Hole MUG25-193 targeted the area between VMS channels and intersected FWZ-style mineralisation at the margins of the interpreted higher-grade zone:

- 7.0m @ 1.0% Cu, 0.1g/t Au, 0.5g/t Ag, 0.05% Zn (1.1% CuEq) from 475m (FW Stringer-style)

- 27.0m @ 1.4% Cu, 0.1g/t Au, 1.3g/t Ag, 0.02% Zn (1.4% CuEq) from 506m (FW Stringer-style)

- 25.0m @ 1.2% Cu, 0.1g/t Au, 1.4g/t Ag, 0.01% Zn (1.3% CuEq) from 545m (FW Stringer-style)

Hole MUG25-205 intersected mineralisation across multiple intervals. Drilling intersected multiple gold-dominated VMS zones followed by FWZ-style mineralisation:

- 2.4m @ 0.4% Cu, 1.4g/t Au, 31.9g/t Ag, 1.01% Zn (1.9% CuEq) from 380m (VMS-style)

- 2.0m @ 1.88% Cu, 5.7g/t Au, 17.1g/t Ag, 1.01% Zn (6.8% CuEq) from 391m (VMS-style)

- 2.0m @ 1.3% Cu, 1.5g/t Au, 11.5g/t Ag, 0.12% Zn (2.6% CuEq) from 402m (VMS-style)

- 11m @ 1.0% Cu, 0.1g/t Au, 0.6g/t Ag, 0.05% Zn (1.1% CuEq) from 484m (FW Stringer-style)

- 17.3m @ 1.2% Cu, 0.1g/t Au, 1.2g/t Ag, 0.02% Zn (1.3% CuEq) from 505.7m (FW Stringer-style)

- 9m @ 1.4% Cu, 0g/t Au, 1.3g/t Ag, 0.01% Zn (1.4% CuEq) from 532m (FW Stringer-style)

- 2m @ 1.6% Cu, 0.1g/t Au, 2.1g/t Ag, 0.03% Zn (1.7% CuEq) from 547m (FW Stringer-style)

- 5.6m @ 1.9% Cu, 0.1g/t Au, 2.5g/t Ag, 0.01% Zn (2.0% CuEq) from 557m (FW Stringer-style)

- 6.7m @ 1.5% Cu, 0.1g/t Au, 1.9g/t Ag, 0.01% Zn (1.5% CuEq) from 571.3m (FW Stringer-style)

Hole MUG25-214 contained a thick intersection massive sulphide transitioning into the FWZ style mineralisation. Key intersections included:

- 43.6m @ 5.7% Cu, 2.1g/t Au, 13.1g/t Ag, 0.31% Zn (7.6% CuEq) from 336.5m (VMS & FWZ style) including the upper massive sulphide zone that assayed:

- 14.9m @ 11.5% Cu, 5g/t Au, 29g/t Ag, 0.68% Zn (16.0% CuEq) from 336.5m (VMS-style)

- 14.9m @ 11.5% Cu, 5g/t Au, 29g/t Ag, 0.68% Zn (16.0% CuEq) from 336.5m (VMS-style)

Hole MUG25-215 intersected a thick copper-gold VMS zone above multiple intersections of FWZ-stringer style mineralisation:

- 12.1m @ 2.1% Cu, 2g/t Au, 18.3g/t Ag, 0.38% Zn (4.0% CuEq) from 702m (VMS-style)

- 12.6m @ 1.6% Cu, 0.1g/t Au, 1.7g/t Ag, 0.04% Zn (1.7% CuEq) from 759.4m (FW Stringer-style)

- 32m @ 1.4% Cu, 0.1g/t Au, 1.7g/t Ag, 0.01% Zn (1.5% CuEq) from 783m (FW Stringer-style)

- 13.9m @ 2.7% Cu, 0.2g/t Au, 3.1g/t Ag, 0.03% Zn (2.9% CuEq) from 821.6m (FW Stringer-style)

805 Exploration Drive - 870L Stockpile Resource Conversion Drilling

Resource definition drilling was conducted from the 870 stockpile with the aim of testing the VMS mineralisation to the west of crosscut 3 and crosscut 5. Key intersections include, but are not limited to (all approximate true thickness):

Hole MUG25-126 intersected a very high-grade copper and gold VMS zone over an intersection of 16m:

- 16.0m @ 10.7% Cu, 3.0g/t Au, 33g/t Ag, 0.64% Zn (13.5% CuEq) from 250.5m (VMS-style)

Hole MUG25-135 drilled a rich copper and gold VMS horizon:

- 4.1m @ 14.1% Cu, 3.6g/t Au, 33.2g/t Ag, 0.33% Zn (17.4% CuEq) from 251.1m (VMS-style)

Hole MUG25-164 encountered the VMS zone as interpreted, and returned an intersection of:

- 9.8m @ 2.3% Cu, 1.5g/t Au, 14.2g/t Ag, 1.16% Zn (3.8% CuEq) from 285.1m (VMS-style)

Hole MUG25-172 returned significant polymetallic intersection of:

- 10.7m @ 2.5% Cu, 2.5g/t Au, 28.1g/t Ag, 2.34% Zn (5.1% CuEq) from 249.3m (VMS-style)

Hole MUG25-178 contained a consistent copper and gold VMS confirming results from previous drilling completed from the 870 Stockpile:

- 10.4m @ 2.2% Cu, 1.7g/t Au, 14.7g/t Ag, 1.76% Zn (4.0% CuEq) from 266m (VMS-style)

Hole MUG25-191 contained a strong polymetallic VMS intersection grading 5.8% CuEq:

- 3.7m @ 3.7% Cu, 1.7g/t Au, 20.7g/t Ag, 2.98% Zn (5.8% CuEq) from 276.7m (VMS-style)

805L Exploration Drive - Crosscuts 3 &4 Resource Conversion Drilling

Resource definition drilling from the 805L Crosscuts 3 and 4 targeted high-grade VMS mineralisation identified by initial wide-spaced drilling in areas that are classified as Inferred Mineral Resource in the current model. Select holes were extended to intersect the broad footwall style mineralisation. Significant intersections include, but are not limited to (all approximate true thickness):

Hole MUG25-121 intersected a broad gold-rich VMS zone grading:

- 10.2m @ 1.9% Cu, 3.1g/t Au, 22.9g/t Ag, 1.72% Zn (4.9% CuEq) from 196m (VMS-style) including:

- 6.6m @ 2.5% Cu, 3.8g/t Au, 30.5g/t Ag, 1.94% Zn (6.2% CuEq) from 196m (VMS-style)

- 6.6m @ 2.5% Cu, 3.8g/t Au, 30.5g/t Ag, 1.94% Zn (6.2% CuEq) from 196m (VMS-style)

Hole MUG25-123 contained multiple intersections of FWZ-style mineralisation:

- 32m @ 1.5% Cu, 0g/t Au, 1.5g/t Ag, 0.01% Zn (1.5% CuEq) from 377m (FW Stringer-style)

- 10.7m @ 2.1% Cu, 0.1g/t Au, 2.4g/t Ag, 0.01% Zn (2.1% CuEq) from 420.3m (FW Stringer-style)

- 18.5m @ 1.9% Cu, 0.1g/t Au, 2.8g/t Ag, 0.01% Zn (1.9% CuEq) from 436.6m (FW Stringer-style)

Hole MUG25-127 drilled VMS style mineralisation at the margins of the deposit:

- 1.6m @ 4.1% Cu, 1.9g/t Au, 25.3g/t Ag, 1.95% Zn (6.1% CuEq) from 219.8m (VMS-style)

Hole MUG25-130 successfully targeted both styles of mineralisation, and intersected multiple broad zones including:

- 6.0m @ 1.8% Cu, 4.4g/t Au, 23.5g/t Ag, 0.59% Zn (5.7% CuEq) from 218.9m (VMS-style)

- 64.0m @ 1.5% Cu, 0.1g/t Au, 2.1g/t Ag, 0.01% Zn (1.5% CuEq) from 375m (FW Stringer-style)

- 9.0m @ 2.1% Cu, 0g/t Au, 2.7g/t Ag, 0.01% Zn (2.1% CuEq) from 398m (FW Stringer-style)

Hole MUG25-134 contained copper and gold VMS style mineralisation:

- 3.0m @ 2.2% Cu, 2.1g/t Au, 14.2g/t Ag, 0.51% Zn (4.1% CuEq) from 226.4m (VMS-style)

Hole MUG25-138 intersected a gold-dominated VMS zone above multiple FWZ intersections:

- 8.4m @ 1.8% Cu, 3.3g/t Au, 20.2g/t Ag, 0.64% Zn (4.8% CuEq) from 214m (VMS-style)

- 12.4m @ 1.4% Cu, 0.1g/t Au, 1.7g/t Ag, 0.01% Zn (1.6% CuEq) from 325m (FW Stringer-style)

- 23m @ 2.6% Cu, 0.1g/t Au, 3.1g/t Ag, 0.04% Zn (2.7% CuEq) from 351m (FW Stringer-style)

- 5.6m @ 2.3% Cu, 0.1g/t Au, 2.5g/t Ag, 0.01% Zn (2.4% CuEq) from 398m (FW Stringer-style)

- 7m @ 1.9% Cu, 0.3g/t Au, 4.1g/t Ag, 0.01% Zn (2.1% CuEq) from 449.2m (FW Stringer-style)

Hole MUG25-141 was extended to intersect both VMS and FWZ mineralised zones, successfully hitting multiple zones of mineralisation:

- 22.6m @ 1.3% Cu, 1.7g/t Au, 14.9g/t Ag, 1.01% Zn (3% CuEq) from 233.2m (VMS-style) including:

- 8.2m @ 2.2% Cu, 2.8g/t Au, 20.6g/t Ag, 1.18% Zn (4.8% CuEq) from 247.6m

- 7.5m @ 2.5% Cu, 0.2g/t Au, 2.2g/t Ag, 0.03% Zn (2.7% CuEq) from 335.7m (FW Stringer-style)

- 50m @ 2.1% Cu, 0.1g/t Au, 1.8g/t Ag, 0.03% Zn (2.2% CuEq) from 360m (FW Stringer-style)

- 25m @ 1.6% Cu, 0.1g/t Au, 1.8g/t Ag, 0.01% Zn (1.7% CuEq) from 429m (FW Stringer-style)

Hole MUG25-145 targeted FWZ at the margins of the interpreted mineralisation:

- 4.0m @ 1.4% Cu, 0.3g/t Au, 2.4g/t Ag, 0.16% Zn (1.7% CuEq) from 398.0m (FW Stringer-style)

- 7.0m @ 1.2% Cu, 0.1g/t Au, 1.9g/t Ag, 0.02% Zn (1.3% CuEq) from 430.0m (FW Stringer-style)

- 11.0m @ 1.5% Cu, 0.1g/t Au, 1.9g/t Ag, 0.01% Zn (1.6% CuEq) from 462.0m (FW Stringer-style)

- 8.5m @ 1.5% Cu, 0.1g/t Au, 1.9g/t Ag, 0.02% Zn (1.6% CuEq) from 488.5m (FW Stringer-style)

- 9.0m @ 1.9% Cu, 0.1g/t Au, 2.6g/t Ag, 0.04% Zn (2% CuEq) from 501.0m (FW Stringer-style)

Hole MUG25-147 encountered a thick upper VMS zone above multiple thick zone of FWZ mineralisation:

- 20.0m @ 1.8% Cu, 2.5g/t Au, 32.1g/t Ag, 2.31% Zn (4.5% CuEq) from 267.9m (VMS-style)

- 42.9m @ 1.9% Cu, 0.1g/t Au, 1.8g/t Ag, 0.13% Zn (2.1% CuEq) from 368.7m (FW Stringer-style)

- 8.8m @ 4.0% Cu, 0.3g/t Au, 3.7g/t Ag, 0.03% Zn (4.2% CuEq) from 429.4m (FW Stringer-style)

- 19.9m @ 1.3% Cu, 0.1g/t Au, 1.7g/t Ag, 0.35% Zn (1.4% CuEq) from 446.5m (FW Stringer-style)

Hole MUG25-145 drilled multiple FWZ intersections near the margins of the interpreted mineralisation, including:

- 36.2m @ 1.2% Cu, 0.1g/t Au, 1.3g/t Ag, 0.02% Zn (1.3% CuEq) from 496.5m (FW Stringer-style)

- 14.0m @ 2.5% Cu, 0.1g/t Au, 3g/t Ag, 0.04% Zn (2.7% CuEq) from 542m (FW Stringer-style)

Hole MUG25-156 intersected the upper VMS zone underlain by thick and consistent FWZ mineralisation:

- 9.3m @ 2.1% Cu, 3.1g/t Au, 29.5g/t Ag, 0.99% Zn (5.0% CuEq) from 332.8m (VMS-style)

- 82.8m @ 2.4% Cu, 0.1g/t Au, 2.3g/t Ag, 0.13% Zn (2.5% CuEq) from 439.2m (FW Stringer-style)

- 16m @ 1.6% Cu, 0.1g/t Au, 2.2g/t Ag, 0.03% Zn (1.7% CuEq) from 544.0m (FW Stringer-style)

Hole MUG25-170 was infilling the upper VMS zone. Intersections included:

- 10.1m @ 6.9% Cu, 2.5g/t Au, 15.5g/t Ag, 0.37% Zn (9.2% CuEq) from 262.5m (VMS-style)

Hole MUG25-177 targeted the upper VMS zone and intersected broad copper and gold mineralisation:

- 12.8m @ 2.0% Cu, 1.8g/t Au, 11g/t Ag, 0.11% Zn (3.6% CuEq) from 247.9m (VMS-style)

Hole MUG25-181 drilled the VMS zone returning a significant intersection of:

- 14.9m @ 2.3% Cu, 1.2g/t Au, 8.3g/t Ag, 0.2% Zn (3.4% CuEq) from 286.5m (VMS-style)

Hole MUG25-186 intersected a broad and continuous zone of FWZ mineralisation:

- 49.1m @ 1.8% Cu, 0.1g/t Au, 2.1g/t Ag, 0.01% Zn (1.9% CuEq) from 401m (FW Stringer-style)

- 5m @ 1.7% Cu, 0.1g/t Au, 2.1g/t Ag, 0.01% Zn (1.8% CuEq) from 463m (FW Stringer-style)

Hole MUG25-189 was designed to infill the margins of the upper VMS zone and intersected:

- 5.4m @ 2.0% Cu, 1.6g/t Au, 11.2g/t Ag, 0.55% Zn (3.5% CuEq) from 265.7m (VMS-style)

805L Exploration Drive - Crosscuts 1 & 2 Resource Conversion Drilling

Crosscuts 1 and 2 are located in the southern part of the 805L drill drive. Drilling from these platforms targeted both VMS and FWZ styles of mineralisation. Significant intersections include, but are not limited to (all approximate true thickness):

Hole MUG25-128 contained strong mineralisation in both the upper VMS and lower FWZ:

- 5.3m @ 1.9% Cu, 1.5g/t Au, 7.7g/t Ag, 0.24% Zn (3.3% CuEq) from 98.8m (VMS-style)

- 29.5m @ 1.8% Cu, 0.1g/t Au, 1.9g/t Ag, 0.02% Zn (1.9% CuEq) from 221.0m (FW Stringer-style)

- 21.0m @ 1.7% Cu, 0.2g/t Au, 2.1g/t Ag, 0.01% Zn (1.9% CuEq) from 282.1m (FW Stringer-style)

- 5.7m @ 2.5% Cu, 0.2g/t Au, 4.2g/t Ag, 0.01% Zn (2.7% CuEq) from 340.3m (FW Stringer-style)

Hole MUG25-132 primarily targeted the upper high-grade VMS zone, and returned a high-grade copper and gold intersection. The hole was extended to test the margins of the FWZ mineralisation:

- 13.6m @ 3.7% Cu, 2.0g/t Au, 16.2g/t Ag, 0.7% Zn (5.6% CuEq) from 55.5m (VMS-style) including:

- 7.3m @ 6.3% Cu, 3.5g/t Au, 28.8g/t Ag, 1.3% Zn (9.6% CuEq) from 55.5m

- 5.0m @ 1.5% Cu, 0.3g/t Au, 2.1g/t Ag, 0.05% Zn (1.8% CuEq) from 94.0m (FW Stringer-style)

- 4.0m @ 1.3% Cu, 0.1g/t Au, 1.7g/t Ag, 0.01% Zn (1.4% CuEq) from 139.4m (FW Stringer-style)

- 18.1m @ 1.2% Cu, 0.1g/t Au, 1.1g/t Ag, 0.01% Zn (1.2% CuEq) from 289.1m (FW Stringer-style)

Hole MUG25-133 intersected two VMS copper-gold horizons in addition to multiple FWZ style stringer zones, including:

- 2.1m @ 2.6% Cu, 2g/t Au, 31.8g/t Ag, 2.02% Zn (4.7% CuEq) from 59.0m (VMS-style)

- 8.6m @ 2.0% Cu, 1.9g/t Au, 8g/t Ag, 0.14% Zn (3.7% CuEq) from 80.8m (VMS-style)

- 8.2m @ 1.1% Cu, 0.2g/t Au, 1.5g/t Ag, 0.03% Zn (1.3% CuEq) from 218.7m (FW Stringer-style)

- 25m @ 1.7% Cu, 0.1g/t Au, 2.1g/t Ag, 0.02% Zn (1.8% CuEq) from 245.0m (FW Stringer-style)

Hole MUG25-143 contained a small gold-dominated VMS horizon at the interpreted margin of the sulphide channel. The FWZ returned numerous zones of mineralisation that exceeded 2% copper, including:

- 2.3m @ 0.8% Cu, 1.4g/t Au, 20g/t Ag, 1.39% Zn (2.2% CuEq) from 57.8m (VMS-style)

- 10.7m @ 1.7% Cu, 0.2g/t Au, 2.3g/t Ag, 0.01% Zn (1.9% CuEq) from 206.0m (FW Stringer-style)

- 10.0m @ 2.6% Cu, 0.2g/t Au, 3.9g/t Ag, 0.01% Zn (2.9% CuEq) from 258.0m (FW Stringer-style)

- 5.0m @ 1.9% Cu, 0.2g/t Au, 4.4g/t Ag, 0.03% Zn (2.1% CuEq) from 305.0m (FW Stringer-style)

- 13.0m @ 2.1% Cu, 0.1g/t Au, 3g/t Ag, 0.01% Zn (2.2% CuEq) from 324.0m (FW Stringer-style)

Hole MUG25-148 drilled a thin VMS zone underlain by FWZ mineralisation:

- 2.6m @ 0.63% Cu, 1.6g/t Au, 11.3g/t Ag, 1.7% Zn (2.3% CuEq) from 72.0m (VMS-style)

- 3.7m @ 1.5% Cu, 0.2g/t Au, 1.8g/t Ag, 0.03% Zn (1.6% CuEq) from 209.3m (FW Stringer-style)

- 5.5m @ 1.8% Cu, 0.1g/t Au, 2.2g/t Ag, 0.02% Zn (2.0% CuEq) from 228.5m (FW Stringer-style)

- 7.4m @ 1.3% Cu, 0.1g/t Au, 1.7g/t Ag, 0.01% Zn (1.4% CuEq) from 244.0m (FW Stringer-style)

- 29.5m @ 1.5% Cu, 0.1g/t Au, 2.1g/t Ag, 0.01% Zn (1.6% CuEq) from 291.0m (FW Stringer-style)

- 3.0m @ 1.8% Cu, 0.2g/t Au, 3.8g/t Ag, 0.02% Zn (2.0% CuEq) from 327.0m (FW Stringer-style)

Hole MUG25-154 drilled a thin VMS zone underlain by FWZ mineralisation:

- 1.8m @ 1.0% Cu, 3.1g/t Au, 17.1g/t Ag, 1.89% Zn (3.9% CuEq) from 59.1m (VMS-style)

- 7.8m @ 1.9% Cu, 0.3g/t Au, 2.4g/t Ag, 0.06% Zn (2.2% CuEq) from 182.0m (FW Stringer-style)

- 11.2m @ 1.3% Cu, 0.1g/t Au, 1.7g/t Ag, 0.02% Zn (1.4% CuEq) from 214.3m (FW Stringer-style)

- 10.4m @ 1.3% Cu, 0.1g/t Au, 1.3g/t Ag, 0.01% Zn (1.4% CuEq) from 241.7m (FW Stringer-style)

- 19.1m @ 2.4% Cu, 0.1g/t Au, 3g/t Ag, 0.01% Zn (2.6% CuEq) from 260.0m (FW Stringer-style)

- 12m @ 2.1% Cu, 0.2g/t Au, 3.6g/t Ag, 0.02% Zn (2.2% CuEq) from 331.0m (FW Stringer-style)

Hole MUG25-159 was specifically drilled to infill the upper VMS. Intersections included:

- 4.6m @ 0.7% Cu, 1.1g/t Au, 7.4g/t Ag, 0.27% Zn (1.7% CuEq) from 75.3m (VMS-style)

- 4.9m @ 1.5% Cu, 1.4g/t Au, 9.0g/t Ag, 0.9% Zn (2.9% CuEq) from 101.0m (VMS-style)

Hole MUG25-162 intersected a gold-dominated VMS zone:

- 7.5m @ 0.9% Cu, 1.5g/t Au, 13g/t Ag, 1.11% Zn (2.4% CuEq) from 101m (VMS-style)

Hole MUG25-163 successfully tested the continuity of the upper VMS zone with two gold-dominated zones identified:

- 5.6m @ 0.9% Cu, 1.9g/t Au, 11.8g/t Ag, 1.11% Zn (2.8% CuEq) from 85.2m (VMS-style)

- 8.6m @ 1.9% Cu, 3.0g/t Au, 21.7g/t Ag, 1.5% Zn (4.8% CuEq) from 108.2m (VMS-style)

Forward Work Plans

Near-term drilling activities at the Green Bay Copper-Gold Project will continue to focus on three key areas: Upgrading the Mineral Resource (with infill drilling results), Mineral Resource Growth, and New Discoveries from both underground and surface. As at 21 October 2025, the Company had completed ~129,200 metres of underground diamond drilling. Six underground rigs will continue to advance the underground Mineral Resource growth and extension activities for the foreseeable future.

Green Bay (Ming Mine) Resource Growth

The low-cost Mineral Resource growth strategy is underpinned by the 805L exploration drill drive at the Ming Mine. The second phase of 805L exploration drive has been completed, providing locations for both infill drilling and further down-plunge Mineral Resource extension. The exploration development is positioned to enable utilisation in potential future upscaled mining operations.

Development of additional platforms for further ongoing exploration and infill drilling will continue at Ming Mine throughout 2025.

Drilling from the northern extent of the 805L confirms the continuity of mineralisation at depth. The deepest hole completed to date returned 49.0m @ 6.1% CuEq and mineralisation down plunge remains open. Drilling is underway to include this area as Inferred Mineral Resources in the upcoming update. The conductive VTEM anomaly that extends more than 350m beyond that hole points to continued future Mineral Resource growth potential.

Upgrading the Mineral Resource Estimate remains a key priority for the Company’s plans to resume upscaled mining at Green Bay. Infill drilling will upgrade the Inferred Resource (34.5Mt @ 2.0% CuEq) to the higher quality Measured and Indicated (M&I) Resource category which currently stands at 24.4Mt @ 1.9% CuEq.4

Based on results to date, it is likely that the amount of mineralisation classified as M&I will increase in the Mineral Resource Estimate update currently planned to be released in the current quarter. This is important because only M&I Mineral Resources can be considered in future feasibility studies.

Green Bay (Ming Mine) Upscaled Project Development

Economic evaluations for the rescaled resumption of production at Green Bay are continuing with the first preliminary study planned for completion in Q1 2026. The study will be underpinned by the updated Mineral Resource Estimate planned to be released this quarter.

Following the announcement of metallurgical testwork results in August (see ASX announcement dated 5 August 2025) in which it was reported that copper recoveries of 98% were returned and preliminary work on gold extraction demonstrated gold recovery of up to 85%, Gold forms an important economic component of the deposit with, so far, 550koz of gold as a byproduct in the current Mineral Resource.

Various scenarios for an upscaled restart to operations are being evaluated. With the huge success of the drilling programs to date, the Company wishes to avoid unnecessarily limiting the size of any future potential upscaled mining operation until it has completed the next phase of growth drilling.

Following the recent conditional release from further Environmental Assessment by the Province of Newfoundland and Labrador for a start-up mining and processing operation (see ASX announcement dated 5 August 2025), the Company has now commenced applying for permits to commence early works and construction. The Company intends to commence selective low-cost seasonal early works in the coming months to prepare the Project for future development and construction.

Green Bay (Ming Mine) Regional Discovery

Regional exploration is underway with two surface drill rigs testing high-priority targets across the Company’s 346km2 surface exploration claims.

One of the drill rigs will continue to test high-priority targets close to the Ming Mine. The second drill rig will systematically test early-stage greenfields targets generated by airborne VTEM and magnetic surveys completed in 2024 and 2025.

FireFly has continued to invest in regional-scale geophysics as a key exploration tool. The Company is completing a detailed VTEM survey over the 115km2 Tilt Cove Project. A detailed helicopter magnetic survey is also being completed over the central Green Bay leases.

Funding and Corporate Activities

As originally announced on 5 June 2025, FireFly has undertaken and completed an ~A$98.1M5 equity raising in conjunction with a A$10M Share Purchase Plan. As a result, the Company has strengthened its balance sheet and is well funded to complete its large-scale accelerated growth campaign at Green Bay.

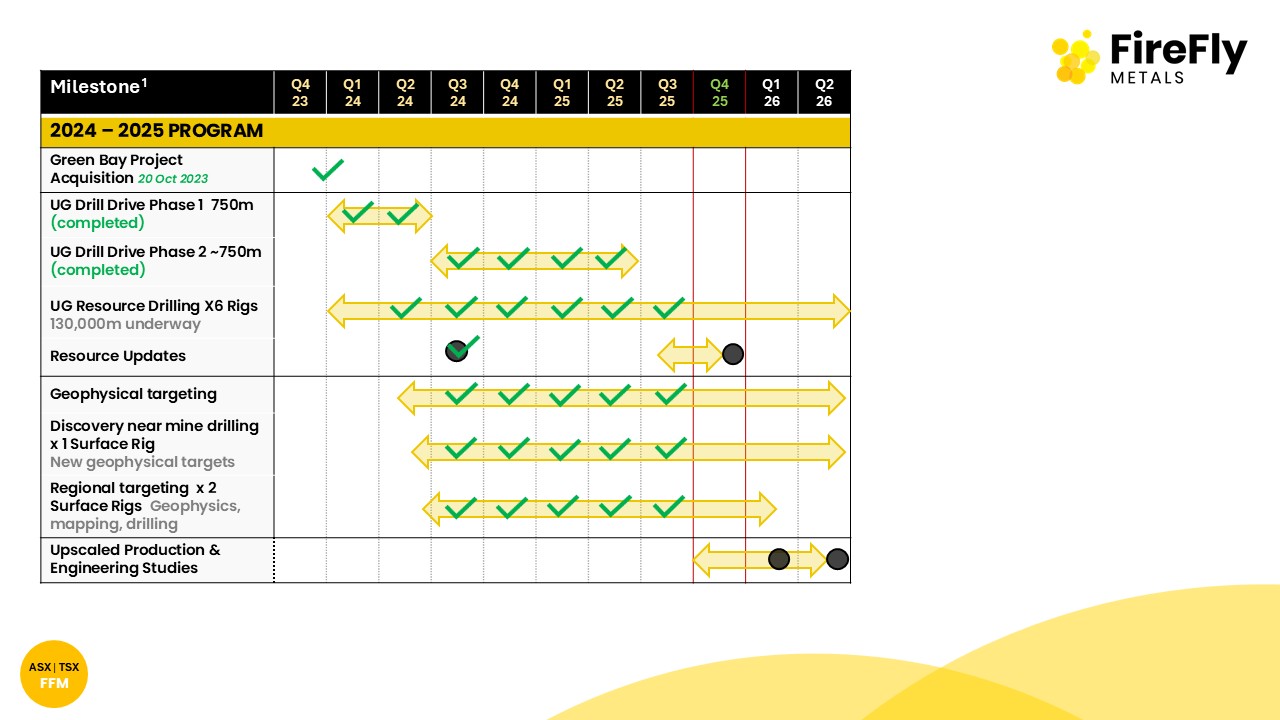

Figure 5: Key 2024-2025 milestones for the Green Bay Copper-Gold Project.

1. Timelines are indicative and may be subject to change.

| Steve Parsons Managing Director FireFly Metals Ltd +61 8 9220 9030 |

Jessie Liu-Ernsting Chief Development Officer FireFly Metals Ltd +1 709 800 1929 |

Media Paul Armstrong Read Corporate +61 8 9388 1474 |

ABOUT FIREFLY METALS

FireFly Metals Ltd (ASX, TSX: FFM) is an emerging copper-gold company focused on advancing the high-grade Green Bay Copper-Gold Project in Newfoundland, Canada. The Green Bay Copper-Gold Project currently hosts a Mineral Resource prepared and disclosed in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012) and Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) of 24.4Mt of Measured and Indicated Resources at 1.9% for 460Kt CuEq and 34.5Mt of Inferred Resources at 2% for 690Kt CuEq. The Company has a clear strategy to rapidly grow the copper-gold Mineral Resource to demonstrate a globally significant copper-gold asset. FireFly has commenced a 130,000m diamond drilling program.

FireFly holds a 70% interest in the high-grade Pickle Crow Gold Project in Ontario. The current Inferred Resource stands at 11.9Mt at 7.2g/t for 2.8Moz gold, with exceptional discovery potential on the 500km2 tenement holding.

The Company also holds a 90% interest in the Limestone Well Vanadium-Titanium Project in Western Australia.

For further information regarding FireFly Metals Ltd please visit the ASX platform (ASX:FFM) or the Company’s website www.fireflymetals.com.au or SEDAR+ at www.sedarplus.ca.

COMPLIANCE STATEMENTS

Mineral Resources Estimate – Green Bay Project

The Mineral Resource Estimate for the Green Bay Project referred to in this announcement and set out in Appendix A was first reported in the Company’s ASX announcement dated 29 October 2024, titled “Resource increases 42% to 1.2Mt of contained metal at 2% Copper Eq” and is also set out in the Technical Reports for the Ming Copper Gold Mine titled “National Instrument 43-101 Technical Report, FireFly Metals Ltd., Ming Copper-Gold Project, Newfoundland” with an effective date of 29 November 2024 and the Little Deer Copper Project, titled “Technical Report and Updated Mineral Resource Estimate of the Little Deer Complex Copper Deposits, Newfoundland, Canada” with an effective date of 26 June 2024, each of which is available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Mineral Resources Estimate – Pickle Crow Project

The Mineral Resource Estimate for the Pickle Crow Project referred to in this announcement was first reported in the Company’s ASX announcement dated 4 May 2023, titled “High-Grade Inferred Gold Resource Grows to 2.8Moz at 7.2g/t” and is also set out in the Technical Report for the Pickle Crow Project, titled “NI 43-101 Technical Report Mineral Resource Estimate Pickle Crow Gold Project, Ontario, Canada” with an effective date of 29 November 2024, as amended on 11 June 2025, available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Metal equivalents for Mineral Resource Estimates

Metal equivalents for Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Individual Mineral Resource grades for the metals are set out in Appendix A of this announcement. Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% on the basis of historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase precious metal recoveries.

In the opinion of the Company, all elements included in the metal equivalent calculations have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, the Company’s operational experience and, where relevant, historical performance achieved at the Green Bay project whilst in operation.

Metal equivalents for Exploration Results

Metal equivalents for Exploration Results have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Individual grades for the metals are set out in Appendix B of this announcement.

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% based on historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase recoveries. Zinc recovery is applied at 50% based on historical processing and potential upgrades to the mineral processing facility.

In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, and the Company’s operational experience.

Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038).

Exploration Results

Previously reported Exploration Results at the Green Bay Project referred to in this announcement were first reported in accordance with ASX Listing Rule 5.7 in the Company’s ASX announcements dated 31 August 2023, 11 December 2023, 16 January 2024, 4 March 2024, 21 March 2024, 29 April 2024, 19 June 2024, 3 September 2024, 16 September 2024, 3 October 2024, 10 December 2024 and 12 February 2025.

Original announcements

FireFly confirms that it is not aware of any new information or data that materially affects the information included in the original announcements and that, in the case of estimates of Mineral Resources, all material assumptions and technical parameters underpinning the Mineral Resource Estimates in the original announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons’ and Qualified Persons’ findings are presented have not been materially modified from the original market announcements.

COMPETENT PERSON AND QUALIFIED PERSON STATEMENTS

The information in this announcement that relates to new Exploration Results is based on and fairly represents information compiled by Mr Darren Cooke, a Competent Person who is a member of the Australasian Institute of Geoscientists. Mr Cooke is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Cooke has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Cooke consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

All technical and scientific information in this announcement has been reviewed and approved by Group Chief Geologist, Mr Juan Gutierrez BSc, Geology (Masters), Geostatistics (Postgraduate Diploma), who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Mr Gutierrez is a Qualified Person as defined in NI 43-101. Mr Gutierrez is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Gutierrez has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Qualified Person as defined in NI 43-101. Mr Gutierrez consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

FORWARD-LOOKING INFORMATION

This announcement may contain certain forward-looking statements and projections, including statements regarding FireFly’s plans, forecasts and projections with respect to its mineral properties and programs. Forward-looking statements may be identified by the use of words such as “may”, “might”, “could”, “would”, “will”, “expect”, “intend”, “believe”, “forecast”, “milestone”, “objective”, “predict”, “plan”, “scheduled”, “estimate”, “anticipate”, “continue”, or other similar words and may include, without limitation, statements regarding plans, strategies and objectives.

Although the forward-looking statements contained in this announcement reflect management’s current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements and projections are estimates only and should not be relied upon. They are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors many of which are beyond the control of the Company, which may include changes in commodity prices, foreign exchange fluctuations, economic, social and political conditions, and changes to applicable regulation, and those risks outlined in the Company’s public disclosures.

The forward-looking statements and projections are inherently uncertain and may therefore differ materially from results ultimately achieved. For example, there can be no assurance that FireFly will be able to confirm the presence of Mineral Resources or Ore Reserves, that FireFly’s plans for development of its mineral properties will proceed, that any mineralisation will prove to be economic, or that a mine will be successfully developed on any of FireFly’s mineral properties. The performance of FireFly may be influenced by a number of factors which are outside of the control of the Company, its directors, officers, employees and contractors. The Company does not make any representations and provides no warranties concerning the accuracy of any forward-looking statements or projections, and disclaims any obligation to update or revise any forward-looking statements or projections based on new information, future events or circumstances or otherwise, except to the extent required by applicable laws.

APPENDIX A

Green Bay Copper-Gold Project Mineral Resources

Ming Deposit Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade | Metal | Grade | Metal | Grade | Metal | Grade | |

| (%) | (‘000 t) | (g/t) | (‘000 oz) | (g/t) | (‘000 oz) | (%) | ||

| Measured | 4.7 | 1.7 | 80 | 0.3 | 40 | 2.3 | 340 | 1.9 |

| Indicated | 16.8 | 1.6 | 270 | 0.3 | 150 | 2.4 | 1,300 | 1.8 |

| TOTAL M&I | 21.5 | 1.6 | 340 | 0.3 | 190 | 2.4 | 1,600 | 1.8 |

| Inferred | 28.4 | 1.7 | 480 | 0.4 | 340 | 3.3 | 3,000 | 2.0 |

Little Deer Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade | Metal | Grade | Metal | Grade | Metal | Grade | |

| (%) | (‘000 t) | (g/t) | (‘000 oz) | (g/t) | (‘000 oz) | (%) | ||

| Measured | - | - | - | - | - | - | - | - |

| Indicated | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| TOTAL M&I | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| Inferred | 6.2 | 1.8 | 110 | 0.1 | 10 | 2.2 | 430 | 1.8 |

GREEN BAY TOTAL MINERAL RESOURCE ESTIMATE

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade | Metal | Grade | Metal | Grade | Metal | Grade | |

| (%) | (‘000 t) | (g/t) | (‘000 oz) | (g/t) | (‘000 oz) | (%) | ||

| Measured | 4.7 | 1.7 | 80 | 0.3 | 45 | 2.3 | 340 | 1.9 |

| Indicated | 19.7 | 1.7 | 330 | 0.2 | 154 | 2.6 | 1,600 | 1.9 |

| TOTAL M&I | 24.4 | 1.7 | 400 | 0.3 | 199 | 2.5 | 2,000 | 1.9 |

| Inferred | 34.6 | 1.7 | 600 | 0.3 | 348 | 3.1 | 3,400 | 2.0 |

- FireFly Metals Ltd Mineral Resource Estimates for the Green Bay Copper-Gold Project, incorporating the Ming Deposit and Little Deer Complex, are prepared and reported in accordance with the JORC Code 2012 and NI 43-101.

- Mineral Resources have been reported at a 1.0% copper cut-off grade.

- Metal equivalents for the Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Metallurgical recoveries have been set at 95% for copper and 85% for both gold and silver. Copper equivalent was calculated based on the formula: CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

- Totals may vary due to rounding.

APPENDIX B – Significant Intersection Table

Collar co-ordinates and orientation are listed in the local Ming Mine grid, which is rotated +35 degrees from NAD83 True North. Significant intersections reported are those above a 1% copper cut-off or 0.5g/t gold, and contain a maximum of 6 metres of internal waste. Please refer to the compliance statements for further details on parameters used in the copper equivalent calculation. All results are approximate true thickness.

| Hole Number | Easting | Northing | RL | Azi | Dip | Drilled Length (m) |

From (m) |

To (m) |

Width (m) |

Assay | CuEq % |

|||

| Cu % | Au g/t | Ag g/t | Zn % | |||||||||||

| MUG25_121 | 1199.7 | 1964.8 | -845.1 | 184 | -50 | 240 | 196.0 | 206.2 | 10.2 | 1.86 | 3.1 | 22.9 | 1.72 | 4.88 |

| Including | 196.0 | 202.6 | 6.6 | 2.49 | 3.8 | 30.5 | 1.94 | 6.16 | ||||||

| MUG25_123 | 1233.5 | 1974.1 | -845.7 | 178 | -60 | 531 | 357.0 | 360.0 | 3.0 | 1.29 | 0.1 | 1.6 | 0.04 | 1.39 |

| 377.0 | 409.0 | 32.0 | 1.46 | 0.0 | 1.5 | 0.01 | 1.50 | |||||||

| 420.3 | 431.0 | 10.7 | 2.06 | 0.1 | 2.4 | 0.01 | 2.14 | |||||||

| 436.6 | 455.0 | 18.5 | 1.85 | 0.1 | 2.8 | 0.01 | 1.95 | |||||||

| MUG25_126 | 1085.6 | 2086.8 | -868.6 | 164 | -73 | 351 | 250.5 | 266.5 | 16.0 | 10.65 | 3.0 | 33.0 | 0.64 | 13.51 |

| 308.0 | 312.8 | 4.8 | 2.43 | 0.6 | 3.8 | 0.17 | 2.95 | |||||||

| MUG25_127 | 1199.7 | 1964.8 | -845.1 | 184 | -27 | 267 | 219.8 | 221.4 | 1.6 | 4.09 | 1.9 | 25.3 | 1.95 | 6.11 |

| MUG25_128 | 1191.4 | 1724.0 | -825.6 | 178 | -77 | 420 | 98.8 | 104.0 | 5.3 | 1.92 | 1.5 | 7.7 | 0.24 | 3.27 |

| 213.0 | 215.0 | 2.0 | 1.51 | 0.1 | 2.0 | 0.07 | 1.60 | |||||||

| 221.0 | 250.5 | 29.5 | 1.79 | 0.1 | 1.9 | 0.02 | 1.88 | |||||||

| Including | 221.0 | 231.0 | 10.0 | 2.03 | 0.1 | 2.3 | 0.02 | 2.11 | ||||||

| 282.1 | 303.0 | 21.0 | 1.70 | 0.2 | 2.1 | 0.01 | 1.86 | |||||||

| 317.0 | 319.0 | 2.1 | 2.25 | 0.3 | 4.0 | 0.02 | 2.53 | |||||||

| 333.0 | 336.0 | 3.0 | 1.34 | 0.9 | 3.0 | 0.01 | 2.13 | |||||||

| 340.3 | 346.0 | 5.7 | 2.49 | 0.2 | 4.2 | 0.01 | 2.68 | |||||||

| MUG25_130 | 1233.5 | 1974.1 | -845.7 | 180 | -55 | 531 | 218.9 | 224.8 | 6.0 | 1.83 | 4.4 | 23.5 | 0.59 | 5.69 |

| 342.0 | 349.0 | 7.0 | 0.97 | 0.1 | 1.3 | 0.01 | 1.03 | |||||||

| 375.0 | 439.0 | 64.0 | 1.47 | 0.1 | 2.1 | 0.01 | 1.55 | |||||||

| Including | 398.0 | 407.0 | 9.0 | 2.05 | 0.0 | 2.7 | 0.01 | 2.11 | ||||||

| MUG25_132 | 1154.4 | 1713.2 | -822.9 | 173 | -88 | 405 | 55.5 | 69.0 | 13.6 | 3.69 | 2.0 | 16.2 | 0.70 | 5.57 |

| Including | 55.5 | 62.7 | 7.3 | 6.25 | 3.5 | 28.8 | 1.29 | 9.55 | ||||||

| Including | 66.7 | 69.0 | 2.3 | 1.77 | 0.6 | 3.6 | 0.05 | 2.27 | ||||||

| 94.0 | 99.0 | 5.0 | 1.52 | 0.3 | 2.1 | 0.05 | 1.75 | |||||||

| 139.4 | 143.4 | 4.0 | 1.33 | 0.1 | 1.7 | 0.01 | 1.42 | |||||||

| 289.1 | 307.2 | 18.1 | 1.14 | 0.1 | 1.1 | 0.01 | 1.21 | |||||||

| MUG25_133 | 1191.4 | 1724.0 | -825.6 | 185 | -51 | 399 | 59.0 | 61.0 | 2.1 | 2.54 | 2.0 | 31.8 | 2.02 | 4.74 |

| 80.8 | 89.4 | 8.6 | 2.03 | 1.9 | 8.0 | 0.14 | 3.65 | |||||||

| 155.2 | 158.0 | 2.8 | 1.55 | 0.1 | 2.1 | 0.13 | 1.71 | |||||||

| 218.7 | 226.9 | 8.2 | 1.12 | 0.2 | 1.5 | 0.03 | 1.29 | |||||||

| 245.0 | 270.0 | 25.0 | 1.68 | 0.1 | 2.1 | 0.02 | 1.81 | |||||||

| 283.3 | 285.5 | 2.2 | 2.61 | 0.2 | 3.5 | 0.01 | 2.79 | |||||||

| MUG25_134 | 1199.7 | 1964.8 | -845.1 | 175 | -23 | 285 | 226.4 | 229.4 | 3.0 | 2.18 | 2.1 | 14.2 | 0.51 | 4.07 |

| MUG25_135 | 1085.6 | 2086.8 | -868.6 | 185 | -70 | 270 | 251.1 | 255.2 | 4.1 | 14.07 | 3.6 | 33.2 | 0.33 | 17.38 |

| MUG25_136 | 1222.1 | 2255.1 | -906.4 | 203 | -70 | 468 | 378.0 | 398.0 | 20.0 | 1.62 | 0.9 | 7.0 | 1.26 | 2.65 |

| 407.0 | 438.0 | 31.0 | 4.74 | 0.3 | 4.7 | 0.07 | 5.01 | |||||||

| 450.0 | 468.1 | 18.2 | 3.23 | 0.2 | 2.9 | 0.16 | 3.43 | |||||||

| MUG25_138 | 1233.5 | 1974.1 | -845.7 | 184 | -51 | 492 | 214.0 | 222.4 | 8.4 | 1.81 | 3.3 | 20.2 | 0.64 | 4.78 |

| 325.0 | 337.4 | 12.4 | 1.43 | 0.1 | 1.7 | 0.01 | 1.56 | |||||||

| 351.0 | 374.0 | 23.0 | 2.61 | 0.1 | 3.1 | 0.04 | 2.71 | |||||||

| 378.0 | 384.3 | 6.3 | 1.08 | 0.0 | 1.2 | 0.01 | 1.13 | |||||||

| 398.0 | 403.6 | 5.6 | 2.34 | 0.1 | 2.5 | 0.01 | 2.42 | |||||||

| 449.2 | 456.2 | 7.0 | 1.87 | 0.3 | 4.1 | 0.01 | 2.15 | |||||||

| MUG25_140 | 1085.6 | 2086.8 | -868.6 | 185 | -61 | 273 | 253.0 | 256.0 | 3.0 | 1.22 | 1.0 | 8.0 | 0.14 | 2.15 |

| MUG25_141 | 1199.7 | 1964.8 | -845.1 | 180 | -81 | 522 | 233.2 | 255.8 | 22.6 | 1.31 | 1.7 | 14.9 | 1.01 | 3.00 |

| Including | 233.2 | 242.0 | 8.8 | 1.30 | 1.8 | 18.8 | 1.48 | 3.16 | ||||||

| MUG25_141 | Including | 247.6 | 255.8 | 8.2 | 2.17 | 2.8 | 20.6 | 1.18 | 4.81 | |||||

| Continued | 335.7 | 343.2 | 7.5 | 2.48 | 0.2 | 2.2 | 0.03 | 2.66 | ||||||

| 349.5 | 351.5 | 2.0 | 2.44 | 0.1 | 2.2 | 0.01 | 2.52 | |||||||

| 360.0 | 410.0 | 50.0 | 2.11 | 0.1 | 1.8 | 0.03 | 2.20 | |||||||

| 418.0 | 422.0 | 4.0 | 2.54 | 0.1 | 2.5 | 0.01 | 2.62 | |||||||

| 429.0 | 454.0 | 25.0 | 1.61 | 0.1 | 1.8 | 0.01 | 1.68 | |||||||

| 471.0 | 474.0 | 3.0 | 1.42 | 0.0 | 2.1 | 0.02 | 1.48 | |||||||

| MUG25_142 | 1085.6 | 2086.8 | -868.6 | 185 | -51 | 264 | No significant intersections | |||||||

| MUG25_143 | 1191.4 | 1724.0 | -825.6 | 191 | -57 | 402 | 57.8 | 60.0 | 2.3 | 0.75 | 1.4 | 20.0 | 1.39 | 2.23 |

| 113.0 | 115.0 | 2.0 | 1.26 | 0.3 | 4.3 | 0.38 | 1.62 | |||||||

| 206.0 | 216.7 | 10.7 | 1.74 | 0.2 | 2.3 | 0.01 | 1.92 | |||||||

| 258.0 | 268.0 | 10.0 | 2.63 | 0.2 | 3.9 | 0.01 | 2.85 | |||||||

| 305.0 | 310.0 | 5.0 | 1.90 | 0.2 | 4.4 | 0.03 | 2.08 | |||||||

| 314.8 | 316.8 | 2.0 | 2.88 | 0.1 | 4.5 | 0.02 | 3.02 | |||||||

| 324.0 | 337.0 | 13.0 | 2.14 | 0.1 | 3.0 | 0.01 | 2.25 | |||||||

| MUG25_144 | 1222.1 | 2255.1 | -906.4 | 209 | -77 | 558 | 403.5 | 448.0 | 44.5 | 3.0 | 0.8 | 6.6 | 0.45 | 3.66 |

| Including | 403.5 | 421.0 | 17.5 | 2.13 | 1.5 | 10.2 | 1.17 | 3.66 | ||||||

| Including | 426.0 | 448.0 | 22.0 | 4.25 | 0.3 | 5.1 | 0.06 | 4.51 | ||||||

| 461.4 | 466.0 | 4.6 | 0.94 | 0.1 | 1.7 | 0.02 | 1.01 | |||||||

| 474.5 | 493.0 | 18.5 | 2.22 | 0.1 | 3.1 | 0.10 | 2.38 | |||||||

| MUG25_145 | 1260.4 | 1969.8 | -845.4 | 2 | -89 | 594 | 398.0 | 402.0 | 4.0 | 1.40 | 0.3 | 2.4 | 0.16 | 1.72 |

| 430.0 | 437.0 | 7.0 | 1.17 | 0.1 | 1.9 | 0.02 | 1.27 | |||||||

| 462.0 | 473.0 | 11.0 | 1.53 | 0.1 | 1.9 | 0.01 | 1.61 | |||||||

| 488.5 | 497.0 | 8.5 | 1.46 | 0.1 | 1.9 | 0.02 | 1.57 | |||||||

| 501.0 | 510.0 | 9.0 | 1.89 | 0.1 | 2.6 | 0.04 | 1.97 | |||||||

| MUG25_146 | 1085.6 | 2086.8 | -868.6 | 185 | -40 | 264 | No significant intersections | |||||||

| MUG25_147 | 1199.7 | 1964.8 | -845.1 | 0 | -87 | 570 | 267.9 | 287.8 | 20.0 | 1.79 | 2.5 | 32.1 | 2.31 | 4.47 |

| 368.7 | 411.6 | 42.9 | 1.94 | 0.1 | 1.8 | 0.13 | 2.07 | |||||||

| 429.4 | 438.2 | 8.8 | 3.98 | 0.3 | 3.7 | 0.03 | 4.23 | |||||||

| 446.5 | 466.4 | 19.9 | 1.32 | 0.1 | 1.7 | 0.35 | 1.44 | |||||||

| MUG25_148 | 1191.5 | 1724.0 | -825.6 | 197 | -80 | 441 | 72.0 | 74.6 | 2.6 | 0.63 | 1.6 | 11.3 | 1.70 | 2.31 |

| 158.0 | 160.0 | 2.0 | 1.27 | 0.1 | 2.3 | 0.03 | 1.37 | |||||||

| 209.3 | 213.0 | 3.7 | 1.48 | 0.2 | 1.8 | 0.03 | 1.64 | |||||||

| 228.5 | 234.0 | 5.5 | 1.84 | 0.1 | 2.2 | 0.02 | 1.95 | |||||||

| 244.0 | 251.5 | 7.4 | 1.28 | 0.1 | 1.7 | 0.01 | 1.35 | |||||||

| 291.0 | 320.5 | 29.5 | 1.53 | 0.1 | 2.1 | 0.01 | 1.63 | |||||||

| 327.0 | 330.0 | 3.0 | 1.82 | 0.2 | 3.8 | 0.02 | 2.00 | |||||||

| MUG25_149 | 1085.6 | 2086.8 | -868.6 | 208 | -68 | 321 | 253.0 | 258.0 | 4.9 | 2.47 | 0.5 | 6.7 | 0.07 | 2.95 |

| MUG25_151 | 1255.5 | 2355.8 | -916.9 | 187 | -81 | 738 | 490.5 | 499.6 | 9.1 | 1.04 | 1.3 | 5.9 | 0.39 | 2.25 |

| 561.7 | 584.9 | 23.2 | 1.40 | 0.1 | 1.8 | 0.13 | 1.53 | |||||||

| Including | 564.1 | 568.3 | 4.2 | 3.28 | 0.2 | 3.9 | 0.32 | 3.55 | ||||||

| 628.6 | 663.0 | 34.4 | 1.32 | 0.1 | 1.7 | 0.02 | 1.40 | |||||||

| MUG25_153 | 1085.6 | 2086.8 | -868.6 | 201 | -58 | 282 | No significant intersections | |||||||

| MUG25_154 | 1191.4 | 1724.0 | -825.6 | 197 | -70 | 432 | 59.1 | 60.8 | 1.8 | 0.95 | 3.1 | 17.1 | 1.89 | 3.95 |

| 160.5 | 164.4 | 4.0 | 1.36 | 0.2 | 1.7 | 0.03 | 1.57 | |||||||

| 182.0 | 189.9 | 7.8 | 1.90 | 0.3 | 2.4 | 0.06 | 2.16 | |||||||

| 214.3 | 225.5 | 11.2 | 1.31 | 0.1 | 1.7 | 0.02 | 1.40 | |||||||

| 241.7 | 252.0 | 10.4 | 1.27 | 0.1 | 1.3 | 0.01 | 1.36 | |||||||

| 260.0 | 279.0 | 19.1 | 2.43 | 0.1 | 3.0 | 0.01 | 2.58 | |||||||

| 316.0 | 318.0 | 2.0 | 1.32 | 0.1 | 3.4 | 0.02 | 1.46 | |||||||

| 331.0 | 343.0 | 12.0 | 2.05 | 0.2 | 3.6 | 0.02 | 2.22 | |||||||

| MUG25_155 | 1261.1 | 1971.0 | -845.4 | 5 | -84 | 603 | 438.0 | 443.5 | 5.5 | 1.10 | 0.2 | 1.9 | 0.01 | 1.30 |

| MUG25_155 | 496.5 | 532.6 | 36.2 | 1.24 | 0.1 | 1.3 | 0.02 | 1.32 | ||||||

| Continued | 542.0 | 556.0 | 14.0 | 2.54 | 0.1 | 3.0 | 0.04 | 2.66 | ||||||

| MUG25_156 | 1200.1 | 1966.9 | -845.1 | 12 | -78 | 651 | 332.8 | 342.1 | 9.3 | 2.06 | 3.1 | 29.5 | 0.99 | 5.00 |

| 439.2 | 522.0 | 82.8 | 2.38 | 0.1 | 2.3 | 0.13 | 2.53 | |||||||

| 529.0 | 531.7 | 2.7 | 1.42 | 0.2 | 1.5 | 0.02 | 1.57 | |||||||

| 544.0 | 560.0 | 16.0 | 1.58 | 0.1 | 2.2 | 0.03 | 1.72 | |||||||

| MUG25_157 | 1085.6 | 2086.8 | -868.6 | 200 | -48 | 291 | No significant intersections | |||||||

| MUG25_158 | 1222.1 | 2255.1 | -906.4 | 187 | -69 | 618 | 372.8 | 375.2 | 2.3 | 0.32 | 1.2 | 30.7 | 0.02 | 1.58 |

| 380.6 | 387.2 | 6.6 | 1.23 | 1.1 | 8.2 | 0.44 | 2.26 | |||||||

| 457.2 | 513.0 | 55.9 | 1.91 | 0.1 | 1.8 | 0.13 | 2.03 | |||||||

| Including | 457.2 | 464.7 | 7.6 | 3.76 | 0.2 | 3.7 | 0.25 | 4.00 | ||||||

| 525.7 | 527.7 | 2.0 | 1.89 | 0.1 | 2.0 | 0.06 | 2.03 | |||||||

| 543.9 | 551.0 | 7.1 | 2.03 | 0.1 | 3.2 | 0.04 | 2.15 | |||||||

| MUG25_159 | 1190.6 | 1721.6 | -826.1 | 173 | -27 | 129 | 75.3 | 79.9 | 4.6 | 0.73 | 1.1 | 7.4 | 0.27 | 1.70 |

| 101.0 | 105.9 | 4.9 | 1.51 | 1.4 | 9.0 | 0.90 | 2.87 | |||||||

| MUG25_161 | 1085.6 | 2086.8 | -868.6 | 198 | -36 | 273 | No significant intersections | |||||||

| MUG25_162 | 1190.6 | 1721.6 | -826.2 | 173 | -8 | 120 | 101.0 | 108.5 | 7.5 | 0.88 | 1.5 | 13.0 | 1.11 | 2.38 |

| MUG25_163 | 1190.6 | 1721.6 | -826.2 | 178 | -16 | 165 | 85.2 | 90.7 | 5.6 | 0.93 | 1.9 | 11.8 | 1.11 | 2.77 |

| 108.2 | 116.8 | 8.6 | 1.91 | 3.0 | 21.7 | 1.50 | 4.79 | |||||||

| 127.1 | 131.4 | 4.4 | 1.11 | 0.5 | 3.4 | 0.08 | 1.56 | |||||||

| MUG25_164 | 1085.6 | 2086.8 | -868.6 | 241 | -69 | 297 | 285.1 | 295.0 | 9.8 | 2.28 | 1.5 | 14.2 | 1.16 | 3.84 |

| MUG25_168 | 1206.9 | 2355.8 | -917.0 | 347 | -90 | 597 | 511.5 | 513.9 | 2.4 | 1.77 | 0.3 | 2.5 | 0.04 | 2.07 |

| 530.8 | 541.0 | 10.2 | 3.03 | 0.2 | 3.3 | 0.01 | 3.24 | |||||||

| 559.2 | 577.0 | 17.9 | 2.76 | 0.2 | 2.6 | 0.11 | 2.97 | |||||||

| MUG25_170 | 1137.5 | 1972.0 | -842.4 | 201 | 2 | 336 | 262.5 | 272.6 | 10.1 | 6.92 | 2.5 | 15.5 | 0.37 | 9.17 |

| 319.6 | 322.4 | 2.8 | 1.44 | 0.9 | 5.0 | 0.10 | 2.23 | |||||||

| MUG25_171 | 1222.1 | 2255.1 | -906.3 | 189 | -76 | 588 | 396.9 | 403.0 | 6.1 | 5.09 | 1.6 | 28.0 | 0.58 | 6.71 |

| 473.0 | 528.0 | 55.0 | 1.50 | 0.1 | 1.4 | 0.13 | 1.59 | |||||||

| Including | 474.8 | 482.0 | 7.3 | 3.21 | 0.2 | 2.9 | 0.24 | 3.40 | ||||||

| Including | 492.0 | 496.8 | 4.8 | 3.40 | 0.1 | 2.9 | 0.25 | 3.57 | ||||||

| 533.0 | 536.0 | 3.0 | 1.42 | 0.1 | 1.7 | 0.03 | 1.55 | |||||||

| 550.0 | 556.0 | 6.0 | 1.21 | 0.1 | 2.1 | 0.05 | 1.31 | |||||||

| MUG25_172 | 1085.6 | 2086.8 | -868.6 | 208 | -32 | 300 | 249.3 | 259.9 | 10.7 | 2.46 | 2.5 | 28.1 | 2.34 | 5.11 |

| MUG25_177 | 1137.5 | 1972.0 | -842.4 | 206 | -4 | 303 | 247.9 | 260.6 | 12.8 | 2.03 | 1.8 | 11.0 | 0.11 | 3.58 |

| MUG25_178 | 1085.6 | 2086.8 | -868.6 | 227 | -61 | 300 | 266.0 | 276.3 | 10.4 | 2.20 | 1.7 | 14.7 | 1.76 | 3.97 |

| MUG25_181 | 1137.5 | 1972.0 | -842.4 | 204 | 5 | 349 | 286.5 | 301.3 | 14.9 | 2.27 | 1.2 | 8.3 | 0.20 | 3.39 |

| MUG25_186 | 1259.7 | 1967.3 | -845.4 | 167 | -77 | 519 | 401.0 | 450.0 | 49.1 | 1.80 | 0.1 | 2.1 | 0.01 | 1.88 |

| 463.0 | 468.0 | 5.0 | 1.71 | 0.1 | 2.1 | 0.01 | 1.85 | |||||||

| MUG25_188 | 1222.1 | 2255.1 | -906.4 | 174 | -62 | 597 | 374.3 | 379.0 | 4.7 | 2.61 | 2.5 | 21.1 | 1.76 | 5.08 |

| 474.0 | 477.0 | 3.0 | 2.14 | 0.6 | 3.0 | 0.01 | 2.62 | |||||||

| 495.5 | 508.0 | 12.6 | 2.00 | 0.1 | 2.5 | 0.02 | 2.12 | |||||||

| 526.0 | 551.0 | 25.0 | 1.25 | 0.1 | 1.4 | 0.01 | 1.31 | |||||||

| MUG25_189 | 1137.5 | 1972.0 | -842.4 | 210 | 1 | 348 | 265.7 | 271.0 | 5.4 | 1.95 | 1.6 | 11.2 | 0.55 | 3.48 |

| MUG25_191 | 1085.6 | 2086.8 | -868.6 | 209 | -20 | 339 | 276.7 | 280.4 | 3.7 | 3.73 | 1.7 | 20.7 | 2.98 | 5.76 |

| MUG25_193 | 1222.1 | 2255.1 | -906.4 | 175 | -67 | 618 | 475.0 | 482.0 | 7.0 | 1.02 | 0.1 | 0.5 | 0.05 | 1.11 |

| 506.0 | 533.0 | 27.0 | 1.38 | 0.1 | 1.3 | 0.02 | 1.45 | |||||||

| 545.0 | 570.0 | 25.0 | 1.24 | 0.1 | 1.4 | 0.01 | 1.32 | |||||||

| MUG25_205 | 1222.1 | 2255.1 | -906.4 | 176 | -73 | 609 | 380.0 | 382.3 | 2.4 | 0.36 | 1.4 | 31.9 | 1.01 | 1.93 |

| 391.0 | 393.0 | 2.0 | 1.88 | 5.7 | 17.1 | 1.01 | 6.82 | |||||||

| 402.0 | 404.0 | 2.0 | 1.28 | 1.5 | 11.5 | 0.12 | 2.61 | |||||||

| 484.0 | 495.0 | 11.0 | 1.01 | 0.1 | 0.6 | 0.05 | 1.08 | |||||||

| 505.7 | 523.0 | 17.3 | 1.23 | 0.1 | 1.2 | 0.02 | 1.30 | |||||||

| MUG25_205 | 532.0 | 541.0 | 9.0 | 1.36 | 0.0 | 1.3 | 0.01 | 1.40 | ||||||

| Continued | 547.0 | 549.0 | 2.0 | 1.62 | 0.1 | 2.1 | 0.03 | 1.70 | ||||||

| 557.0 | 562.6 | 5.6 | 1.88 | 0.1 | 2.5 | 0.01 | 1.99 | |||||||

| 571.3 | 578.0 | 6.7 | 1.45 | 0.1 | 1.9 | 0.01 | 1.53 | |||||||

| MUG25_214 | 1117.0 | 2190.3 | -894.0 | 174 | -80 | 450 | 336.5 | 380.0 | 43.6 | 5.73 | 2.1 | 13.1 | 0.31 | 7.61 |

| Including | 336.5 | 351.3 | 14.9 | 11.54 | 5.0 | 29.0 | 0.68 | 16.02 | ||||||

| MUG25_215 | 1255.5 | 2355.8 | -918.4 | 10 | -77 | 939 | 702.0 | 714.1 | 12.1 | 2.09 | 2.0 | 18.3 | 0.38 | 3.98 |

| 759.4 | 772.0 | 12.6 | 1.56 | 0.1 | 1.7 | 0.04 | 1.66 | |||||||

| 783.0 | 815.0 | 32.0 | 1.44 | 0.1 | 1.7 | 0.01 | 1.55 | |||||||

| 821.6 | 835.6 | 13.9 | 2.73 | 0.2 | 3.1 | 0.03 | 2.94 | |||||||

APPENDIX C – JORC CODE, 2012 EDITION

Table 1

Section 1 - Sampling Techniques and Data (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

|

|

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

| Logging |

|

The following steps are completed during the core logging procedure:

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

|

|

| Data spacing and distribution |

|

|

| Orientation of data in relation to geological structure |

|

|

| Sample security |

|

|

| Audits or reviews |

|

|

Section 2 - Reporting of Exploration Results (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

|

|

| Exploration done by other parties |

|

|

| Geology |

|

|

| Drill hole Information |

|

|

| Data aggregation methods |

|

|

| Relationship between mineralisation widths and intercept lengths |

|

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

|

|

Plan view of drilling in this announcement

1 Metal equivalent for drill results reported in this announcement have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Metallurgical recoveries have been set at 95% for copper, 85% for precious metals and 50% for zinc. CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038). In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, and historical performance achieved at the Green Bay project whilst in operation.

2 Timeframes are indicative and may be subject to change.

3 See ASX announcement dated 29 October 2024.

4 Refer to ASX announcement dated 29 October 2024 and Appendix A of this announcement for further details on the Mineral Resource Estimate.

5 See ASX announcement dated 11 July 2025.