Latest drilling demonstrates the continuity and quality of the VMS mineralisation, paving the way for a Mineral Resource upgrade and mining studies

KEY POINTS

-

Outstanding assays from infill drilling continue to show why Green Bay is a top-shelf project with very high-grades, continuous mineralisation and existing infrastructure in a tier-one location

-

The latest results will form part of a Mineral Resource Estimate update later this year, including an upgrade of Inferred Resources to the Measured and Indicated categories

-

These higher-confidence Mineral Resources will be used to underpin mining studies

-

The latest results from drilling of the Volcanogenic Massive Sulphide (VMS) lenses include:

-

11.6m @ 9.3% CuEq1 (6.0% Cu & 3.9g/t Au) in hole MUG24-128 (~ true thickness)

-

5.5m @ 7.1% CuEq (5.4% Cu & 2.0g/t Au) in hole MUG25-014 (~ true thickness)

-

14.6m @ 6.7% CuEq (5.4% Cu & 1.5g/t Au) in hole MUG25-032 (~ true thickness)

-

6.4m @ 6.3% CuEq (3.0% Cu & 3.6g/t Au) in hole MUG25-069W1 (~ true thickness)

-

14.9m @ 5.5% CuEq (3.3% Cu & 2.4g/t Au) in hole MUG25-042 (~ true thickness)

-

-

The broad Footwall Stringer Zone continues to demonstrate thick and consistent copper mineralisation, pointing to the potential for large-scale bulk mining. Intersections include:

-

9.5m @ 6.4% CuEq (6.1% Cu & 0.4g/t Au) followed by a further zone of 24.9m @ 2.4% CuEq (2.2% Cu & 0.1g/t Au) in hole MUG25-073 (~ true thickness)

-

26.2m @ 5.3% CuEq (4.9% Cu & 0.4g/t Au) in hole MUG25-015 (~ true thickness)

-

24.1m @ 3.7% CuEq (3.5% Cu & 0.3g/t Au) in hole MUG25-042 (~ true thickness)

-

32.9m @ 2.8% CuEq (2.7% Cu & 0.1g/t Au) in hole MUG25-006 (~ true thickness)

-

26.7m @ 2.5% CuEq (2.3% Cu & 0.2g/t Au) in hole MUG25-018 (~ true thickness)

-

-

Importantly, these results validate and confirm strong and continuous mineralisation in the areas currently classified as Inferred Resources in the current Mineral Resource Estimate

-

The current Mineral Resource Estimate for Green Bay totals 24.4Mt at 1.9% for 460Kt CuEq of Measured & Indicated Resources and 34.5Mt at 2.0% for 690Kt CuEq of Inferred Resources; see ASX announcement dated 29 October 2024

-

The infill drilling was conducted as part of FireFly's extensive growth program, which has been expanded to eight diamond rigs (six underground and two on surface); This is designed to create value by simultaneously extending known mineralisation, upgrading the Mineral Resource and making new discoveries

-

The latest phase of exploration development drive has now been completed. Two drill rigs have mobilised to the northern extent to conduct step-out drilling to test for high-grade down plunge extensions beyond the current Ming Deposit Mineral Resource; Additional assays are expected in coming weeks

-

Two surface exploration drill rigs continue to test key regional geophysical targets; further results are expected from the nearby Rambler Main mine in coming weeks

-

The Company strengthened its balance sheet as a result of its recently announced equity raising,2 with anticipated cash and liquid investments of ~A$145M3; These funds will be used to accelerate exploration activities and complete the feasibility study on the upscaled Green Bay Project

FireFly Managing Director Steve Parsons said: "These are absolutely superb assays which show why Green Bay is in such an enviable position.

"With investors and metal traders around the world scrambling for exposure to high-quality copper and gold projects in tier-one locations, Green Bay meets all the key criteria.

"We will have eight rigs drilling as part of our plan to keep growing the Mineral Resource and upgrading more of it to the Indicated Resource category. The updated Mineral Resource will then feed into mining studies.

"This multi-pronged strategy is aimed at unlocking the value of what is clearly an exceptional copper-gold asset in a highly desirable location at a time when such projects are in hot demand."

West Perth, Western Australia--(Newsfile Corp. - July 16, 2025) - FireFly Metals Ltd (ASX: FFM) (TSX: FFM) (Company or FireFly) is pleased to announce extremely high-grade assays from its Green Bay Copper-Gold Project.

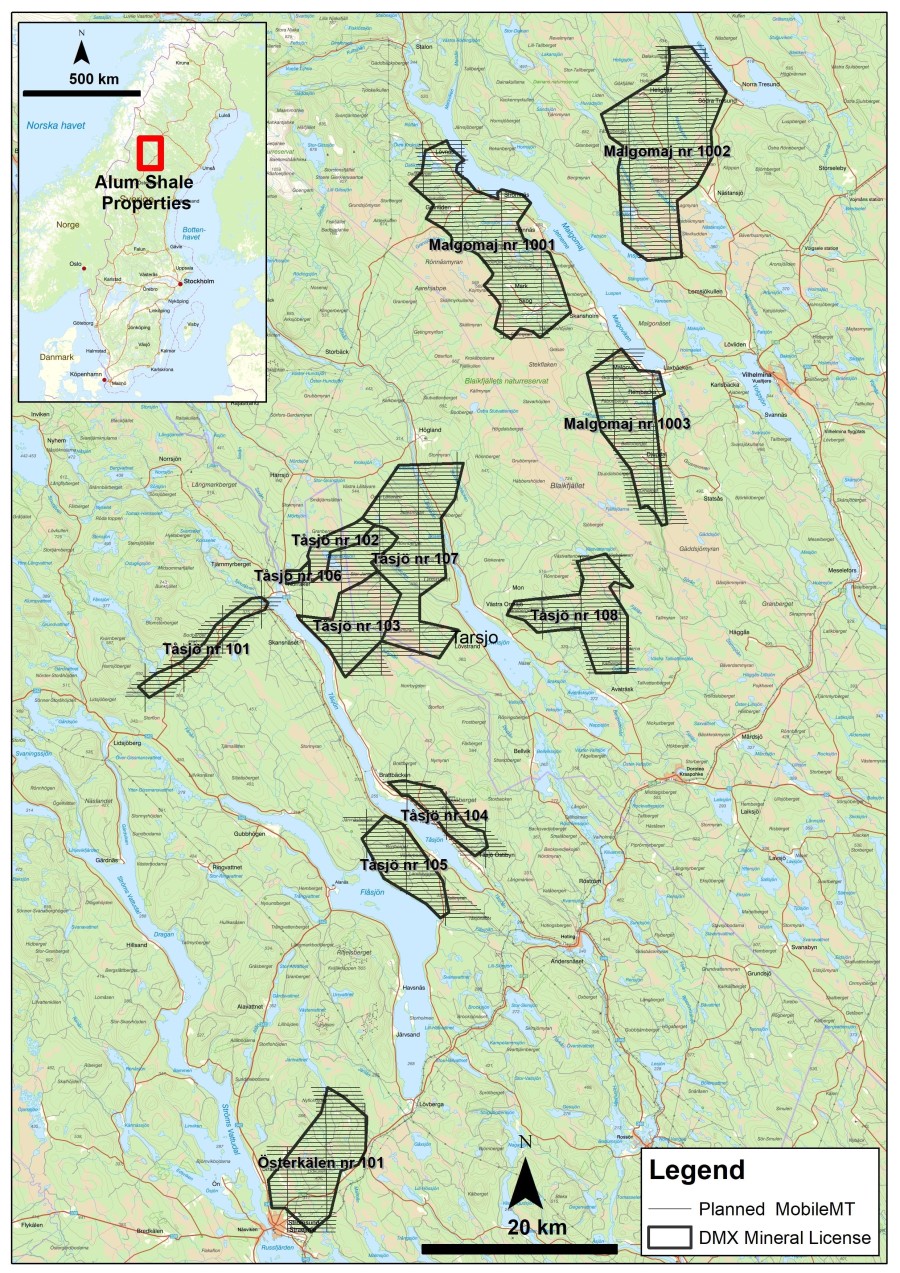

There are two distinct styles of mineralisation at the Ming underground mine at Green Bay. One comprises the upper copper-gold rich Volcanogenic Massive Sulphide (VMS) lenses. This sits above a broad copper stringer zone known as the Footwall Zone (FWZ).

An extensive eight-rig drill campaign is underway with the dual objectives of growing the current Mineral Resource and upgrading more of the Inferred Resources to the comparatively more valuable Measured and Indicated (M&I) categories.

From the results in this announcement, the Company anticipates strong growth in the M&I portion of the Mineral Resource when it next releases the Mineral Resource Estimate later in 2025. This is important because the higher-confidence M&I categories of Mineral Resources will underpin upscaled mining studies scheduled for completion in early 2026.

The current Mineral Resource stands at 24.4Mt @ 1.9% for 460Kt CuEq of M&I Resources and a further 34.5Mt @ 2.0% for 690Kt CuEq of Inferred Resources.

Figure 1: Long section through the Green Bay Ming underground mine showing the location of select drill results from this announcement. Results from both the high-grade copper-gold VMS zone and broad copper Footwall Zone are shown. The green shape is a modelled DHEM anomaly (from hole MUG25-040 - see ASX announcement dated 7 May 2025 for further details) Drill assays >0.5% copper are shown in red.

Figure 1: Long section through the Green Bay Ming underground mine showing the location of select drill results from this announcement. Results from both the high-grade copper-gold VMS zone and broad copper Footwall Zone are shown. The green shape is a modelled DHEM anomaly (from hole MUG25-040 - see ASX announcement dated 7 May 2025 for further details) Drill assays >0.5% copper are shown in red.

Drilling continues to demonstrate continuity of the high-grade copper-gold rich VMS mineralisation, with key intersections including 11.6m @ 9.3% CuEq, 14.6m @ 6.7% CuEq, 14.9m @ 5.5% CuEq and 5.5m @ 7.1% CuEq (~ true widths).

Infill drilling of the broad copper-rich zone repeatedly intersected thick and continuous zones exceeding 2% copper. Highlights include 26.2m @ 5.3% CuEq, 24.1m @ 3.7% CuEq and 9.5m @ 6.4% CuEq (~ true widths).

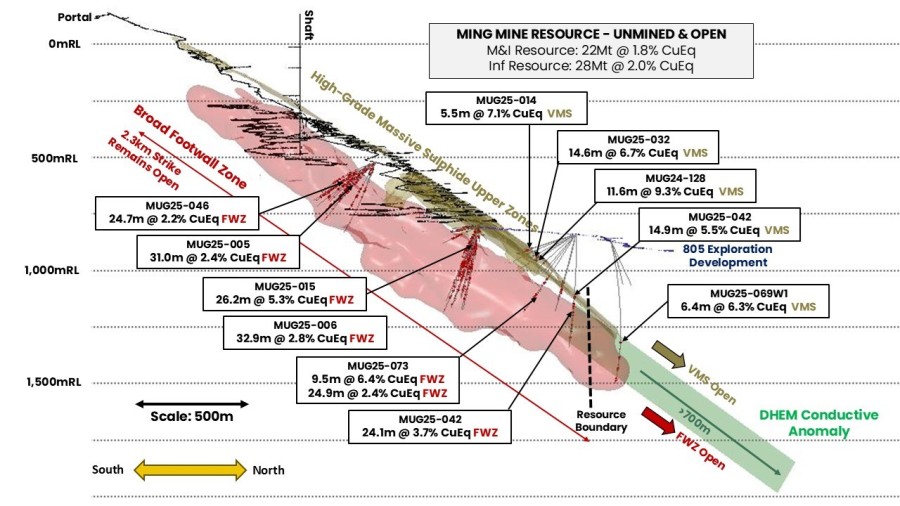

The development of phase two of the 805 exploration drive has now been completed. Two drill rigs have been mobilised to the northern extent of the platform to test for extensions of mineralisation more than 400m beyond the extent of the current Mineral Resource.

A second surface diamond drill rig is now on site to accelerate the regional discovery campaign. Both rigs will systematically test geophysical anomalies generated by the Company's airborne VTEM surveys. Further results from Rambler Main Mine are expected in the coming weeks following the initial intersections4 of 10m @ 6.4% CuEq (5.7g/t Au & 1.3% Cu) and 12.9m @ 4.3% CuEq (4.2g/t Au & 0.5% Cu).

Engineering studies into the resumption of upscaled production from the Ming Mine are well underway. Sector-leading consultants including Entech Mining, Ausenco and Stantec have been engaged to contribute to the studies. Comprehensive metallurgical test results completed by the Company are expected in the coming weeks.

In March 2025, FireFly submitted a registration document (EA Registration) with the Newfoundland and Labrador Department of Environment and Climate Change for environmental assessment of the upscaled Green Bay Copper-Gold Project. Following review of the upscaled Green Bay project by both Provincial and Federal regulators, the Company has been notified by the Government of Newfoundland and Labrador that no further detailed environmental or socio-economic assessment is required for the upscaled project to proceed.

This conditional release from further environmental assessment will enable the Company to apply for permits to commence early works and construction.

FireFly is well funded to accelerate its growth campaign and engineering studies with a recent well supported equity raising which has strengthened the Company's balance sheet, with anticipated cash and liquid investments of ~A$145 million,5 subject to receiving shareholder approval of the issue of securities for the second tranche of the Institutional Placement6 for net proceeds of ~$26.6M.

About the Drill Results

Drilling at the Ming underground copper-gold mine recommenced following the acquisition of the Green Bay Copper-Gold Project by FireFly in October 2023. In total, the Company has completed ~99,700m of underground diamond drilling to 30 June 2025.

Assays have been received for 192 underground holes drilled by FireFly. Logging and analysis of additional drill holes is ongoing, with details to be reported regularly as results are received. This announcement contains the results of 59 drill holes. The drilling reported is predominantly infill drilling as well as drilling of holes targeting the lateral margins of the mineralisation.

There are two distinct styles of mineralisation present at the Green Bay Ming Mine, consisting of a series of upper copper-gold rich Volcanogenic Massive Sulphide (VMS) lenses underlain by a broad copper stringer zone, known as the Footwall Zone (FWZ).

The Footwall Zone is extensive, with the stringer mineralisation observed over thicknesses of ~150m and widths exceeding 200m. The known strike of the mineralisation defined to date is 2.3km and it remains open down-plunge.

Six drill rigs are currently operating underground, with the focus split between both extension and exploration (two rigs) and resource conversion drilling (four rigs).

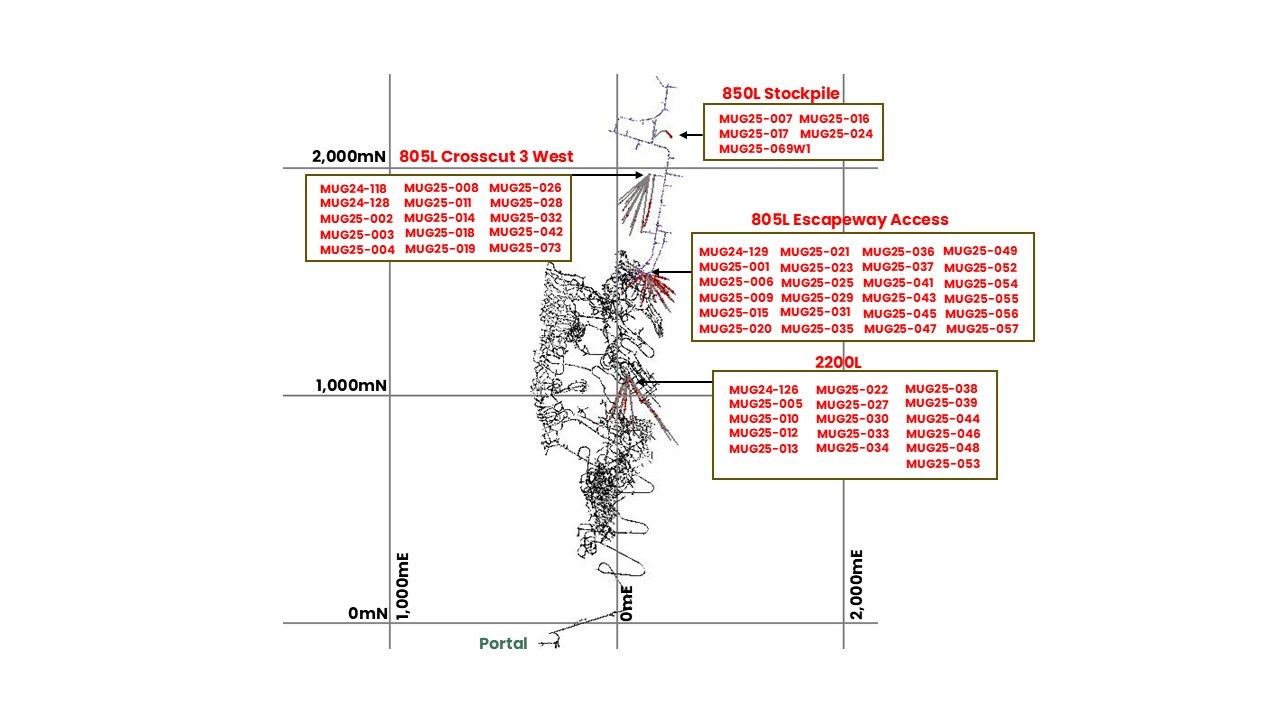

The location of drill positions and holes reported in this announcement is presented in Figure 2. Significant assay results are presented in Appendix B of this announcement.

Figure 2: Long section through the Ming Mine showing the location of drill platforms and drilling reported in this announcement. Assay results greater than 0.5% Cu are shown in red.

Figure 2: Long section through the Ming Mine showing the location of drill platforms and drilling reported in this announcement. Assay results greater than 0.5% Cu are shown in red.

Resource Conversion Drilling from the 805L Exploration Drive

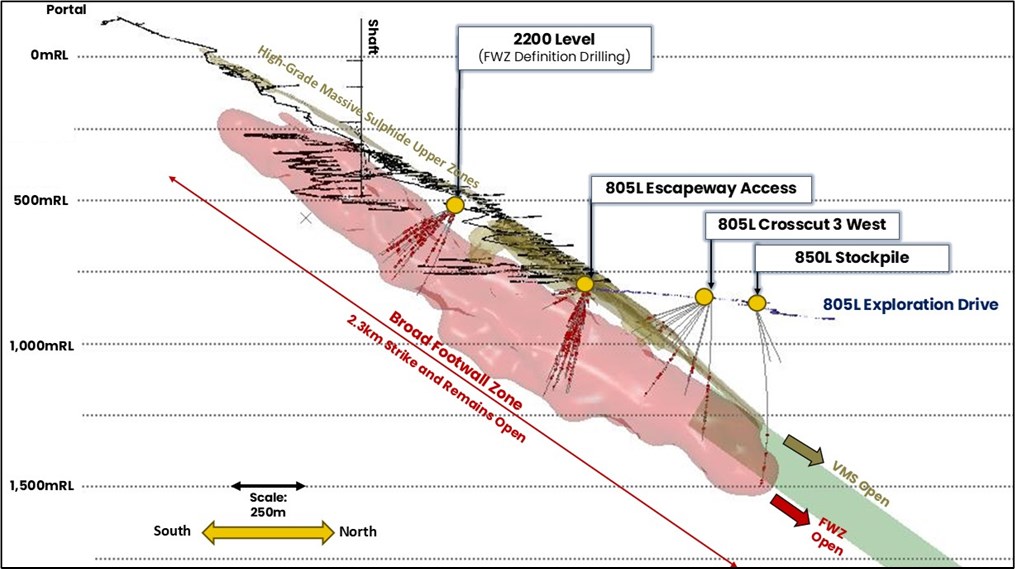

Drilling from the 805L drill drive focused primarily on upgrading the data density in the high-grade copper-gold dominated VMS lenses defined by previously reported exploration drilling. The results demonstrate strong continuity and consistent high grades in the Ming North and South VMS lenses in addition to the footwall zone (where targeted).

Drilling from the 805L was predominantly completed from the 805L Crosscut 3 West, 805 Escapeway Access and, later in the program, the 850L stockpile (Figure 3).

Figure 3: Isometric view of drill positions in the 805L Exploration drill drive. Drill results from this announcement are shown with copper assays >0.5% shown in red.

Figure 3: Isometric view of drill positions in the 805L Exploration drill drive. Drill results from this announcement are shown with copper assays >0.5% shown in red.

805L Crosscut 3 West

Resource definition drilling from the 805L Crosscut 3 west targeted high-grade VMS mineralisation identified by initial wide-spaced drilling in areas that are classified as Inferred Mineral Resource in the current model. Select holes were extended to intersect the broad footwall style mineralisation. Significant intersections7 include, but are not limited to:

Hole MUG24-128 comprised of a thick copper and gold rich massive sulphide zone with local sericite altered stringers immediately beneath, delivering an intersection of:

-

11.6m @ 6.0% Cu, 3.9g/t Au, 11.4g/t Ag, 0.1% Zn (9.3% CuEq) from 187.4m (VMS-style)

Hole MUG25-032 contained an upper copper-gold massive sulphide zone grading into upper footwall style stringers

-

14.6m @ 5.4% Cu, 1.5g/t Au, 11.6g/t Ag, 0.3% Zn (6.7% CuEq) from 214.7m (VMS-style)

Hole MUG25-014 intersected a massive sulphide zone with strong copper-gold mineralisation

-

5.5m @ 5.4% Cu, 2g/t Au, 8.1g/t Ag, 0.4% Zn (7.1% CuEq) from 208m (VMS-style)

Hole MUG25-042 intersected an upper high-grade VMS zone underlain by multiple thick zones of copper-rich footwall-style mineralisation

-

14.9m @ 3.3% Cu, 2.4g/t Au, 15.2g/t Ag, 0.6% Zn (5.5% CuEq) from 269.6m (VMS-style)

-

24.1m @ 3.5% Cu, 0.3g/t Au, 3.6g/t Ag, 0.05% Zn (3.7% CuEq) from 299.5m (FW Stringer-style) including:

-

9.4m @ 7.1% Cu, 0.5g/t Au, 7.3g/t Ag, 0.08% Zn (7.6% CuEq) from 299.5m

-

-

5.5m @ 3.2% Cu, 0.2g/t Au, 3g/t Ag, 0.1% Zn (3.4% CuEq) from 339.7m (FW Stringer-style)

-

36.1m @ 1.6% Cu, 0.1g/t Au, 1.6g/t Ag, 0.1% Zn (1.7% CuEq) from 393.6m (FW Stringer-style) including:

-

4.9m @ 3.2% Cu, 0.2g/t Au, 3g/t Ag, 0.1% Zn (3.3% CuEq) from 411.2m

-

-

8.5m @ 1.2% Cu, 0.1g/t Au, 1.8g/t Ag, 0.1% Zn (1.3% CuEq) from 448.9m (FW Stringer-style)

Hole MUG25-073 includes the upper copper-gold VMS zone underlain by a high-grade sericite altered stringer zone followed by multiple intersections of broad lower footwall style mineralisation

-

2.3m @ 6.3% Cu, 0.8g/t Au, 9g/t Ag, 0.3% Zn (7.1% CuEq) from 213.2m (VMS-style)

-

9.5m @ 6.1% Cu, 0.4g/t Au, 6.3g/t Ag, 0.1% Zn (6.4% CuEq) from 227.6m (UFWZ-style)

-

4.9m @ 2.1% Cu, 0.2g/t Au, 3.1g/t Ag, 0.1% Zn (2.3% CuEq) from 252m (FW Stringer-style)

-

24.9m @ 2.2% Cu, 0.1g/t Au, 2.4g/t Ag, 0.1% Zn (2.4% CuEq) from 309m (FW Stringer-style)

Hole MUG25-018 intersected an upper copper-gold VMS horizon underlain by consistent stringer-style mineralisation:

-

4.8m @ 1.6% Cu, 2g/t Au, 8.5g/t Ag, 0.3% Zn (3.3% CuEq) from 217.1m (VMS-style)

-

26.7m @ 2.3% Cu, 0.2g/t Au, 2.6g/t Ag, 0.05% Zn (2.5% CuEq) from 240.8m (FW Stringer-style)

Hole MUG25-011 was drilled to test the margins of the sulphide channel, and intersected strong copper and gold mineralisation:

-

2.9m @ 4.4% Cu, 1g/t Au, 8.7g/t Ag, 0.2% Zn (5.3% CuEq) from 190m (VMS-style)

805L Escapeway Access

Drilling from the 805L Escapeway Access focused on improving definition of the footwall zone style mineralisation identified in previous campaigns. Drilling was also completed to test the margins of the mineralisation which have no defined hard contact in the footwall zone.

Significant intersections8 include, but are not limited to:

Hole MUG25-015 intersected a thick zone of very high-grade stringer-style mineralisation, with chalcopyrite routinely exceeding 10% of the zone:

-

26.2m @ 4.9% Cu, 0.4g/t Au, 7g/t Ag, 0.03% Zn (5.3% CuEq) from 167m (FW Stringer-style)

Hole MUG25-006 included numerous zones of copper stringer-style mineralisation, including but not limited to:

-

32.9m @ 2.7% Cu, 0.1g/t Au, 2.9g/t Ag, 0.04% Zn (2.8% CuEq) from 154.2m (FW Stringer-style)

-

21.8m @ 2.0% Cu, 0.1g/t Au, 2.4g/t Ag, 0.01% Zn (2.1% CuEq) from 213m (FW Stringer-style)

Hole MUG25-009 intersected multiple thick zones of footwall stringer style mineralisation, including, but not limited to:

-

8.0m @ 2.1% Cu, 0.2g/t Au, 2.6g/t Ag, 0.01% Zn (2.3% CuEq) from 120m (FW Stringer-style)

-

4.3m @ 1.5% Cu, 0.1g/t Au, 2.4g/t Ag, 0.01% Zn (1.7% CuEq) from 155m (FW Stringer-style)

-

12.6m @ 2.2% Cu, 0.2g/t Au, 3.2g/t Ag, 0.01% Zn (2.4% CuEq) from 196.6m (FW Stringer-style)

-

31.5m @ 1.7% Cu, 0.1g/t Au, 2.1g/t Ag, 0.01% Zn (1.7% CuEq) from 221.5m (FW Stringer-style)

Hole MUG25-001 contained multiple zones of copper-dominated footwall stringer style mineralisation, including, but not limited to:

-

14.0m @ 1.8% Cu, 0.3g/t Au, 2.7g/t Ag, 0.04% Zn (2.1% CuEq) from 86m (FW Stringer-style)

-

15.6m @ 1.4% Cu, 0.1g/t Au, 2g/t Ag, 0.02% Zn (1.5% CuEq) from 150.9m (FW Stringer-style)

-

2.1m @ 2.3% Cu, 0.1g/t Au, 3.2g/t Ag, 0.02% Zn (2.4% CuEq) from 303m (FW Stringer-style)

-

5.5m @ 2.1% Cu, 0.1g/t Au, 2.4g/t Ag, 0.01% Zn (2.2% CuEq) from 318.9m (FW Stringer-style)

Hole MUG25-041 exhibited strong mineralisation throughout the hole with localised high-grade zones, including but not limited to:

-

6.5m @ 2.4% Cu, 0.2g/t Au, 3.3g/t Ag, 0.26% Zn (2.6% CuEq) from 105.4m (FW Stringer-style)

-

6.1m @ 2.1% Cu, 0.2g/t Au, 2.9g/t Ag, 0.01% Zn (2.3% CuEq) from 203.1m (FW Stringer-style)

-

9.9m @ 2.9% Cu, 0.3g/t Au, 4g/t Ag, 0.01% Zn (3.2% CuEq) from 216.2m (FW Stringer-style)

Hole MUG25-037 intersected multiple mineralised zones consistently throughout the drill hole, with intersections including:

-

7.0m @ 1.8% Cu, 0.2g/t Au, 2.9g/t Ag, 0.02% Zn (2.0% CuEq) from 126m (FW Stringer-style)

-

6.0m @ 1.6% Cu, 0.2g/t Au, 2g/t Ag, 0.01% Zn (1.7% CuEq) from 174m (FW Stringer-style)

-

3.5m @ 1.6% Cu, 0.3g/t Au, 1.8g/t Ag, 0.01% Zn (1.8% CuEq) from 201m (FW Stringer-style)

-

10.2m @ 2.6% Cu, 0.2g/t Au, 3.7g/t Ag, 0.01% Zn (2.8% CuEq) from 234.2m (FW Stringer-style)

850L Stockpile

Drilling commenced from the 850L stockpile as an interim drill position whilst the reaming lateral development was completed. This is the northernmost drilling completed to date.

Hole MUG25-069W1 from the 850L Stockpile confirmed the presence of strong VMS-style mineralisation underlain by a broad footwall stringer zone. This stringer zone is at the projected margins of the lower footwall zone. Key intersections included:

-

6.4m @ 3.0% Cu, 3.6g/t Au, 25.6g/t Ag, 0.9% Zn (6.3% CuEq) from 458.7m (VMS-style)

-

20m @ 1.3% Cu, 0.1g/t Au, 1.3g/t Ag, 0.06% Zn (1.4% CuEq) from 572m (FW Stringer-style)

Resource Conversion Drilling from the 2200L Exploration Drive

Resource conversion drilling from the historical 2200 level of the Ming Mine is targeting an area of low drill density higher up in the mine down-plunge of the historical shaft. (~500m RL). Significant intersections9 include, but are not limited to:

Hole MUG25-046 contained numerous mineralised zones throughout the hole, headlined by the broad intersection of:

-

24.7m @ 2.1% Cu, 0.2g/t Au, 2.3g/t Ag, 0.02% Zn (2.2% CuEq) from 201m (FW Stringer-style), including:

-

9.7m @ 2.8% Cu, 0.2g/t Au, 3.2g/t Ag, 0.02% Zn (3.0% CuEq) from 216m

-

Hole MUG25-005 intersected multiple zones of stringer-style copper dominated mineralisation, including:

-

5.4m @ 1.8% Cu, 0.1g/t Au, 2.0g/t Ag, 0.04% Zn (2.0% CuEq) from 130m (FW Stringer-style) and

-

31.0m @ 2.2% Cu, 0.3g/t Au, 2.3g/t Ag, 0.02% Zn (2.4% CuEq) from 156m (FW Stringer-style)

Hole MUG25-034 drilled multiple zones of stringer-style chalcopyrite rich veins, with key intersections including:

-

8m @ 2.0% Cu, 0.2g/t Au, 2.5g/t Ag, 0.01% Zn (2.2% CuEq) from 138.7m (FW Stringer-style)

-

6.4m @ 1.8% Cu, 0.1g/t Au, 1.7g/t Ag, 0.01% Zn (1.9% CuEq) from 154.7m (FW Stringer-style)

-

13.6m @ 2.2% Cu, 0.1g/t Au, 1.8g/t Ag, 0.01% Zn (2.3% CuEq) from 173.7m (FW Stringer-style)

Hole MUG24-126 intersected frequent mineralised stringer zones, with thicker lower-grade intersections including:

-

5.3m @ 2.2% Cu, 0.2g/t Au, 5.3g/t Ag, 0.23% Zn (2.5% CuEq) from 48m (FW Stringer-style)

-

1.5m @ 2.9% Cu, 0.8g/t Au, 7.7g/t Ag, 0.59% Zn (3.7% CuEq) from 65.5m (FW Stringer-style)

-

4.3m @ 1.6% Cu, 0.1g/t Au, 1.6g/t Ag, 0.04% Zn (1.7% CuEq) from 171.9m (FW Stringer-style)

-

11.7m @ 1.5% Cu, 0.1g/t Au, 1.5g/t Ag, 0.01% Zn (1.6% CuEq) from 198m (FW Stringer-style)

-

26.1m @ 1.2% Cu, 0.1g/t Au, 1g/t Ag, 0.02% Zn (1.2% CuEq) from 213.5m (FW Stringer-style)

-

6.4m @ 1.2% Cu, 0.1g/t Au, 0.8g/t Ag, 0.02% Zn (1.3% CuEq) from 249.3m (FW Stringer-style)

-

3.0m @ 1.6% Cu, 0.1g/t Au, 1.6g/t Ag, 0.02% Zn (1.7% CuEq) from 290.0m (FW Stringer-style)

Forward Work Plan

Near-term drilling activities at the Green Bay Copper-Gold Project will continue to focus on three key areas: Resource Growth, Upgrading the Resource (with infill drilling results) and New Discoveries from both underground and surface. At 30 June 2025, the Company had completed 192 drill holes for ~99,700 metres of underground diamond drilling. A total of six underground rigs will continue to advance the underground Mineral Resource growth and development activities. Additionally, a second surface drill rig has been mobilised to fast-track surface regional discovery.

Green Bay (Ming Mine) Resource Growth and Development

The low-cost Mineral Resource growth strategy is underpinned by the 805L exploration drill drive at the Ming Mine. The Company has invested in 2,335 metres of underground exploration and ancillary development since acquisition of the project in October 2023 to provide drill platforms to accelerate growth and discovery from underground. The second phase of 805L Exploration drive has been completed, providing locations for both infill drilling and further down-plunge Mineral Resource extension. Underground drilling from the drill drive during the current quarter is planned to test the Ming mineralisation more than 400m beyond the current Mineral Resource boundary.

Development of additional platforms for further ongoing exploration and infill drilling will continue at Ming throughout 2025.

Upgrading the Mineral Resource Estimate remains a key priority for the Company's plans to resume upscaled mining at Green Bay. Infill drilling will upgrade the Inferred Resource (34.5Mt @ 2.0% CuEq) to the higher quality Measured and Indicated (M&I) Resource category which currently stands at 24.4Mt @ 1.9% CuEq10.

Based on results to date, it is likely that the amount of mineralisation classified as M&I will increase in the Mineral Resource Estimate update currently planned for Q4 2025. This is important because only M&I Mineral Resources can be considered in future feasibility studies.

Economic evaluation of the rescaled resumption of production at Green Bay is well underway. Key consultants have been appointed to complete the economic studies, including Entech Mining, Ausenco, Stantec and Knight Piesold. SGS Laboratories are currently nearing completion of comprehensive metallurgical test work on samples of both VMS and footwall stringer-style mineralisation. The results are expected in coming weeks and will be a catalyst for further discussions with potential offtake groups interested in securing the high-quality copper-gold concentrate expected to be produced from the Ming Mine.

Various scenarios for an up-scaled restart to operations are being evaluated. With the huge success of the drilling programs to date, the Company wishes to avoid unnecessarily limiting the size of any future potential upscaled mining operation until it has completed the next phase of growth drilling.

In March 2025, FireFly submitted a registration document (EA Registration) with the Newfoundland and Labrador Department of Environment and Climate Change for environmental assessment of the upscaled Green Bay Copper-Gold Project. Following review of the upscaled Green Bay project by both Provincial and Federal regulators, the Company has been notified by the Government of Newfoundland and Labrador that no further detailed environmental or socio-economic assessment is required for the upscaled project to proceed.

This conditional release from further environmental assessment will enable the Company can apply for permits to commence early works and construction.

The first economic studies are planned for completion in Q1 2026 once the M&I Mineral Resource upgrade drilling has been completed.

Green Bay (Ming Mine) Regional Discovery

Regional exploration is underway with a two surface drill rigs testing high-priority targets across the Company's 346km2 surface exploration claims.

One of the drill rigs will continue to test high-priority targets close to the Ming Mine. Drilling will initially focus on the historical mines within 5km of the Ming deposit that have recently returned results such as 10m @ 6.4% CuEq (5.7g/t Au & 1.3% Cu) and 12.9m @ 4.3% CuEq (4.2g/t Au & 0.5% Cu) from the Rambler Main Mine (see ASX announcement dated 15 May 2025). Further results are expected in the coming weeks.

The second drill rig will systematically test early-stage Greenfields targets generated by airborne VTEM and magnetic surveys completed in 2024. Ground geophysical crews continue to validate and refine multiple anomalies identified with close-spaced electromagnetic surveys.

Funding of Growth Activities

FireFly is well funded to complete its large-scale accelerated growth campaign at Green Bay. The Company has undertaken an ~A$98.1M equity raising in conjunction with a A$10M Share Purchase Plan. As a result of the equity raising, the Company has strengthened its balance sheet, with anticipated cash and liquid investments of ~A$145 million,11 subject to receiving shareholder approval of the issue of securities for the second tranche of the Institutional Placement.12 The Company's strong balance sheet is expected to fund exploration activities and economic evaluation studies through to final investment decision.

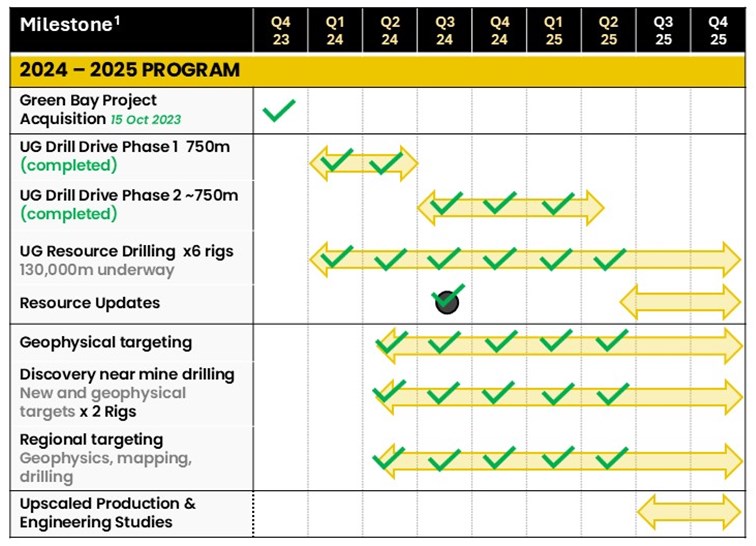

Figure 4: Key 2024-2025 milestones for the Green Bay Copper-Gold Project.

Figure 4: Key 2024-2025 milestones for the Green Bay Copper-Gold Project.

1. Please note that timelines are indicative and may be subject to change.

| Steve Parsons Managing Director FireFly Metals Ltd +61 8 9220 9030 |

Jessie Liu-Ernsting Chief Development Officer FireFly Metals Ltd +1 709 800 1929 |

Media Paul Armstrong Read Corporate +61 8 9388 1474 |

ABOUT FIREFLY METALS

FireFly Metals Ltd (ASX: FFM) (TSX: FFM) is an emerging copper-gold company focused on advancing the high-grade Green Bay Copper-Gold Project in Newfoundland, Canada. The Green Bay Copper-Gold Project currently hosts a Mineral Resource prepared and disclosed in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012) and Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) of 24.4Mt of Measured and Indicated Resources at 1.9% for 460Kt CuEq and 34.5Mt of Inferred Resources at 2% for 690Kt CuEq. The Company has a clear strategy to rapidly grow the copper-gold Mineral Resource to demonstrate a globally significant copper-gold asset. FireFly has commenced a 130,000m diamond drilling program.

FireFly holds a 70% interest in the high-grade Pickle Crow Gold Project in Ontario. The current Inferred Resource stands at 11.9Mt at 7.2g/t for 2.8Moz gold, with exceptional discovery potential on the 500km2 tenement holding.

The Company also holds a 90% interest in the Limestone Well Vanadium-Titanium Project in Western Australia.

For further information regarding FireFly Metals Ltd please visit the ASX platform (ASX: FFM) or the Company's website www.fireflymetals.com.au or SEDAR+ at www.sedarplus.ca.

COMPLIANCE STATEMENTS

Mineral Resources Estimate - Green Bay Project

The Mineral Resource Estimate for the Green Bay Project referred to in this announcement and set out in Appendix A was first reported in the Company's ASX announcement dated 29 October 2024, titled "Resource increases 42% to 1.2Mt of contained metal at 2% Copper Eq" and is also set out in the Technical Reports for the Ming Copper Gold Mine titled "National Instrument 43-101 Technical Report, FireFly Metals Ltd., Ming Copper-Gold Project, Newfoundland" with an effective date of 29 November 2024 and the Little Deer Copper Project, titled "Technical Report and Updated Mineral Resource Estimate of the Little Deer Complex Copper Deposits, Newfoundland, Canada" with an effective date of 26 June 2024, each of which is available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Mineral Resources Estimate - Pickle Crow Project

The Mineral Resource Estimate for the Pickle Crow Project referred to in this announcement was first reported in the Company's ASX announcement dated 4 May 2023, titled "High-Grade Inferred Gold Resource Grows to 2.8Moz at 7.2g/t" and is also set out in the Technical Report for the Pickle Crow Project, titled "NI 43-101 Technical Report Mineral Resource Estimate Pickle Crow Gold Project, Ontario, Canada" with an effective date of 29 November 2024, as amended on 11 June 2025, available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Metal equivalents for Mineral Resource Estimates

Metal equivalents for the Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Individual Mineral Resource grades for the metals are set out in Appendix A of this announcement. Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% on the basis of historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase precious metal recoveries.

In the opinion of the Company, all elements included in the metal equivalent calculations have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, the Company's operational experience and, where relevant, historical performance achieved at the Green Bay project whilst in operation.

Metal equivalents for Exploration Results

Metal equivalents for the Exploration Results have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Individual grades for the metals are set out in Appendix B of this announcement.

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% based on historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase recoveries. Zinc recovery is applied at 50% based on historical processing and potential upgrades to the mineral processing facility.

In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, and the Company's operational experience.

Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038).

Exploration Results

Previously reported Exploration Results at the Green Bay Project referred to in this announcement were first reported in accordance with ASX Listing Rule 5.7 in the Company's ASX announcements dated 31 August 2023, 11 December 2023, 16 January 2024, 4 March 2024, 21 March 2024, 29 April 2024, 19 June 2024, 3 September 2024, 16 September 2024, 3 October 2024, 10 December 2024 and 12 February 2025.

Original announcements

FireFly confirms that it is not aware of any new information or data that materially affects the information included in the original announcements and that, in the case of estimates of Mineral Resources, all material assumptions and technical parameters underpinning the Mineral Resource Estimates in the original announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons' and Qualified Persons' findings are presented have not been materially modified from the original market announcements.

COMPETENT PERSON AND QUALIFIED PERSON STATEMENTS

The information in this announcement that relates to new Exploration Results is based on and fairly represents information compiled by Mr Darren Cooke, a Competent Person who is a member of the Australasian Institute of Geoscientists. Mr Cooke is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Cooke has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Cooke consents to the inclusion in this announcement the matters based on his information in the form and context in which it appears.

All technical and scientific information in this announcement has been reviewed and approved by Group Chief Geologist, Mr Juan Gutierrez BSc, Geology (Masters), Geostatistics (Postgraduate Diploma), who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Mr Gutierrez is a Qualified Person as defined in NI 43-101. Mr Gutierrez is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Gutierrez has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Qualified Person as defined in NI 43-101. Mr Gutierrez consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

FORWARD-LOOKING INFORMATION

This announcement may contain certain forward-looking statements and projections, including statements regarding FireFly's plans, forecasts and projections with respect to its mineral properties and programs. Forward-looking statements may be identified by the use of words such as "may", "might", "could", "would", "will", "expect", "intend", "believe", "forecast", "milestone", "objective", "predict", "plan", "scheduled", "estimate", "anticipate", "continue", or other similar words and may include, without limitation, statements regarding plans, strategies and objectives.

Although the forward-looking statements contained in this announcement reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements and projections are estimates only and should not be relied upon. They are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors many of which are beyond the control of the Company, which may include changes in commodity prices, foreign exchange fluctuations, economic, social and political conditions, and changes to applicable regulation, and those risks outlined in the Company's public disclosures.

The forward-looking statements and projections are inherently uncertain and may therefore differ materially from results ultimately achieved. For example, there can be no assurance that FireFly will be able to confirm the presence of Mineral Resources or Ore Reserves, that FireFly's plans for development of its mineral properties will proceed, that any mineralisation will prove to be economic, or that a mine will be successfully developed on any of FireFly's mineral properties. The performance of FireFly may be influenced by a number of factors which are outside of the control of the Company, its directors, officers, employees and contractors. The Company does not make any representations and provides no warranties concerning the accuracy of any forward-looking statements or projections, and disclaims any obligation to update or revise any forward-looking statements or projections based on new information, future events or circumstances or otherwise, except to the extent required by applicable laws.

APPENDIX A

Green Bay Copper-Gold Project Mineral Resources

Ming Deposit Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade | Metal | Grade | Metal | Grade | Metal | Grade | |

| (%) | ('000 t) | (g/t) | ('000 oz) | (g/t) | ('000 oz) | (%) | ||

| Measured | 4.7 | 1.7 | 80 | 0.3 | 40 | 2.3 | 340 | 1.9 |

| Indicated | 16.8 | 1.6 | 270 | 0.3 | 150 | 2.4 | 1,300 | 1.8 |

| TOTAL M&I | 21.5 | 1.6 | 340 | 0.3 | 190 | 2.4 | 1,600 | 1.8 |

| Inferred | 28.4 | 1.7 | 480 | 0.4 | 340 | 3.3 | 3,000 | 2.0 |

Little Deer Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade | Metal | Grade | Metal | Grade | Metal | Grade | |

| (%) | ('000 t) | (g/t) | ('000 oz) | (g/t) | ('000 oz) | (%) | ||

| Measured | - | - | - | - | - | - | - | - |

| Indicated | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| TOTAL M&I | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| Inferred | 6.2 | 1.8 | 110 | 0.1 | 10 | 2.2 | 430 | 1.8 |

GREEN BAY TOTAL MINERAL RESOURCE ESTIMATE

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade | Metal | Grade | Metal | Grade | Metal | Grade | |

| (%) | ('000 t) | (g/t) | ('000 oz) | (g/t) | ('000 oz) | (%) | ||

| Measured | 4.7 | 1.7 | 80 | 0.3 | 45 | 2.3 | 340 | 1.9 |

| Indicated | 19.7 | 1.7 | 330 | 0.2 | 154 | 2.6 | 1,600 | 1.9 |

| TOTAL M&I | 24.4 | 1.7 | 400 | 0.3 | 199 | 2.5 | 2,000 | 1.9 |

| Inferred | 34.6 | 1.7 | 600 | 0.3 | 348 | 3.1 | 3,400 | 2.0 |

- FireFly Metals Ltd Resource Estimates for the Green Bay Copper-Gold Project, incorporating the Ming Deposit and Little Deer Complex, are prepared and reported in accordance with the JORC Code 2012 and NI 43-101.

- Mineral Resources have been reported at a 1.0% copper cut-off grade.

- Metal equivalents for the Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Metallurgical recoveries have been set at 95% for copper and 85% for both gold and silver. Copper equivalent was calculated based on the formula: CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

- Totals may vary due to rounding.

APPENDIX B - Significant Intersection Table

Collar co-ordinates and orientation are listed in the local Ming Mine grid, which is rotated +35 degrees from NAD83 True North. Significant intersections reported are those above a 1% copper cut-off or 0.5g/t gold, and contain a maximum of 6 metres of internal waste. Please refer to the compliance statements for further details on parameters used in the copper equivalent calculation. All results are approximate true thickness.

| Hole Number | Easting | Northing | RL | Azi | Dip | Drilled Length (m) | From (m) | To (m) |

Width (m) |

Assay | CuEq % | |||

| Cu % | Au g/t | Ag g/t | Zn % | |||||||||||

| MUG24_018 | 1140.0 | 1973.4 | -844.0 | 220 | -75 | 300 | 212.0 | 224.0 | 12.0 | 2.27 | 0.6 | 4.9 | 0.14 | 2.79 |

| 233.0 | 239.1 | 6.1 | 1.19 | 0.2 | 2.0 | 0.09 | 1.42 | |||||||

| MUG24_126 | 1044.0 | 1092.7 | -522.5 | 170 | -27 | 318 | 48.0 | 53.3 | 5.3 | 2.18 | 0.2 | 5.3 | 0.23 | 2.45 |

| 65.5 | 67.0 | 1.5 | 2.91 | 0.8 | 7.7 | 0.59 | 3.73 | |||||||

| 147.0 | 152.0 | 5.0 | 1.14 | 0.1 | 1.2 | 0.03 | 1.22 | |||||||

| 171.9 | 176.3 | 4.3 | 1.61 | 0.1 | 1.6 | 0.04 | 1.70 | |||||||

| 198.0 | 209.7 | 11.7 | 1.50 | 0.1 | 1.5 | 0.01 | 1.63 | |||||||

| 213.5 | 239.6 | 26.1 | 1.16 | 0.1 | 1.0 | 0.02 | 1.23 | |||||||

| 249.3 | 255.7 | 6.4 | 1.18 | 0.1 | 0.8 | 0.02 | 1.26 | |||||||

| 265.0 | 271.0 | 6.0 | 1.07 | 0.1 | 1.5 | 0.02 | 1.20 | |||||||

| 290.0 | 293.0 | 3.0 | 1.59 | 0.1 | 1.6 | 0.02 | 1.66 | |||||||

| MUG24_128 | 1140.0 | 1973.4 | -844.0 | 198 | -28 | 288 | 187.4 | 199.0 | 11.6 | 6.03 | 3.9 | 11.4 | 0.10 | 9.34 |

| MUG24_129 | 1124.7 | 1533.5 | -811.6 | 238 | -73 | 369 | 16.0 | 17.5 | 1.5 | 4.27 | 0.5 | 4.6 | 0.02 | 4.75 |

| 26.7 | 28.0 | 1.3 | 2.24 | 0.5 | 2.7 | 0.28 | 2.73 | |||||||

| 83.0 | 94.0 | 11.0 | 1.36 | 0.2 | 2.1 | 0.03 | 1.51 | |||||||

| 138.0 | 154.3 | 16.3 | 1.03 | 0.0 | 1.3 | 0.01 | 1.08 | |||||||

| 159.0 | 166.0 | 7.0 | 1.57 | 0.2 | 2.9 | 0.10 | 1.77 | |||||||

| 294.2 | 296.3 | 2.1 | 2.01 | 0.2 | 2.1 | 0.01 | 2.19 | |||||||

| 336.4 | 339.0 | 2.6 | 1.74 | 0.1 | 2.5 | 0.01 | 1.84 | |||||||

| MUG25_001 | 1124.7 | 1533.5 | -811.7 | 255 | -79 | 375 | 14.7 | 17.0 | 2.3 | 2.26 | 0.2 | 2.4 | 0.01 | 2.45 |

| 23.8 | 28.7 | 5.0 | 1.31 | 0.2 | 1.4 | 0.16 | 1.55 | |||||||

| MUG25_001 | 86.0 | 100.0 | 14.0 | 1.82 | 0.3 | 2.7 | 0.04 | 2.07 | ||||||

| Continued | 107.0 | 110.0 | 3.0 | 1.37 | 0.1 | 2.3 | 0.03 | 1.45 | ||||||

| 136.9 | 139.9 | 3.1 | 1.48 | 0.1 | 2.8 | 0.01 | 1.62 | |||||||

| 150.9 | 166.5 | 15.6 | 1.36 | 0.1 | 2.0 | 0.02 | 1.46 | |||||||

| 303.0 | 305.1 | 2.1 | 2.25 | 0.1 | 3.2 | 0.02 | 2.36 | |||||||

| 318.9 | 324.4 | 5.5 | 2.09 | 0.1 | 2.4 | 0.01 | 2.18 | |||||||

| MUG25_002 | 1140.0 | 1973.4 | -844.0 | 197 | -18 | 15 | Hole abandoned due to deviation - redrilled | |||||||

| MUG25_003 | 1140.0 | 1973.4 | -844.0 | 197 | -18 | 15 | Hole abandoned due to deviation - redrilled | |||||||

| MUG25_004 | 1140.0 | 1973.4 | -844.0 | 197 | -18 | 305 | No Significant Intersections | |||||||

| MUG25_005 | 1044.0 | 1092.7 | -522.5 | 180 | -46 | 342 | 33.6 | 35.7 | 2.1 | 1.64 | 1.8 | 4.0 | 0.64 | 3.25 |

| 46.3 | 47.9 | 1.6 | 2.01 | 0.5 | 4.4 | 0.35 | 2.52 | |||||||

| 120.0 | 122.0 | 2.0 | 1.25 | 0.1 | 1.8 | 0.04 | 1.36 | |||||||

| 130.0 | 135.5 | 5.4 | 1.83 | 0.1 | 2.0 | 0.04 | 1.95 | |||||||

| 156.0 | 187.0 | 31.0 | 2.17 | 0.3 | 2.3 | 0.02 | 2.41 | |||||||

| MUG25_006 | 1124.7 | 1533.5 | -811.6 | 175 | -72 | 402 | 88.0 | 91.0 | 3.0 | 1.27 | 0.4 | 1.3 | 0.01 | 1.57 |

| 95.0 | 101.0 | 6.0 | 1.27 | 0.4 | 1.5 | 0.01 | 1.58 | |||||||

| 133.0 | 137.0 | 4.0 | 1.38 | 0.2 | 2.1 | 0.01 | 1.53 | |||||||

| 154.2 | 187.0 | 32.9 | 2.67 | 0.1 | 2.9 | 0.04 | 2.80 | |||||||

| 213.0 | 234.8 | 21.8 | 2.00 | 0.1 | 2.4 | 0.01 | 2.08 | |||||||

| 275.0 | 282.0 | 7.0 | 1.64 | 0.0 | 2.1 | 0.01 | 1.69 | |||||||

| 331.0 | 334.0 | 3.0 | 1.97 | 0.1 | 3.2 | 0.02 | 2.12 | |||||||

| MUG25_007 | 1160.2 | 2129.6 | -862.3 | 4 | -71 | 209 | Hole abandoned due to deviation - no samples taken | |||||||

| MUG25_008 | 1140.0 | 1973.4 | -844.0 | 215 | -29 | 228 | 193.9 | 195.5 | 1.5 | 1.25 | 1.5 | 4.9 | 0.11 | 2.56 |

| MUG25_009 | 1124.7 | 1533.5 | -811.6 | 151 | -72 | 375 | 92.0 | 103.0 | 11.0 | 1.27 | 0.1 | 2.1 | 0.02 | 1.39 |

| 109.0 | 113.7 | 4.7 | 1.33 | 0.1 | 1.7 | 0.01 | 1.44 | |||||||

| 120.0 | 128.0 | 8.0 | 2.12 | 0.2 | 2.6 | 0.01 | 2.29 | |||||||

| MUG25_009 | 155.0 | 159.3 | 4.3 | 1.52 | 0.1 | 2.4 | 0.01 | 1.66 | ||||||

| Continued | 196.6 | 209.2 | 12.6 | 2.18 | 0.2 | 3.2 | 0.01 | 2.37 | ||||||

| 221.5 | 253.0 | 31.5 | 1.66 | 0.1 | 2.1 | 0.01 | 1.72 | |||||||

| MUG25_010 | 1044.0 | 1092.68 | -522.5 | 185 | -33 | 270 | 173.5 | 180.6 | 7.1 | 1.46 | 0.2 | 1.4 | 0.01 | 1.66 |

| MUG25_011 | 1140.0 | 1973.41 | -844.0 | 209 | -24 | 255 | 190.0 | 193.0 | 2.9 | 4.39 | 1.0 | 8.7 | 0.18 | 5.29 |

| MUG25_012 | 1044.0 | 1092.68 | -522.5 | 187 | -74 | 342 | 132.0 | 138.0 | 6.0 | 1.44 | 0.1 | 1.1 | 0.03 | 1.51 |

| 162.1 | 166.8 | 4.7 | 1.95 | 0.1 | 1.9 | 0.02 | 2.08 | |||||||

| MUG25_013 | 1044.0 | 1092.7 | -522.5 | 188 | -20 | 273 | 27.0 | 28.7 | 1.7 | 5.65 | 4.0 | 17.9 | 0.60 | 9.17 |

| 117.6 | 119.9 | 2.3 | 0.89 | 0.1 | 1.4 | 0.05 | 1.00 | |||||||

| 129.3 | 131.3 | 2.0 | 1.75 | 0.1 | 2.1 | 0.02 | 1.87 | |||||||

| 152.9 | 156.0 | 3.2 | 3.19 | 0.3 | 3.3 | 0.02 | 3.49 | |||||||

| 184.4 | 187.3 | 2.9 | 1.49 | 0.1 | 1.4 | 0.01 | 1.57 | |||||||

| 203.0 | 208.2 | 5.2 | 1.46 | 0.1 | 1.5 | 0.03 | 1.56 | |||||||

| MUG25_014 | 1140.0 | 1973.4 | -844.0 | 206 | -15 | 252 | 208.0 | 213.5 | 5.5 | 5.39 | 2.0 | 8.1 | 0.37 | 7.13 |

| MUG25_015 | 1124.7 | 1533.5 | -811.6 | 144 | -61 | 372 | 8.3 | 14.0 | 5.7 | 1.07 | 0.2 | 1.5 | 0.02 | 1.26 |

| 167.0 | 193.2 | 26.2 | 4.92 | 0.4 | 7.0 | 0.03 | 5.29 | |||||||

| MUG25_016 | 1160.2 | 2129.6 | -862.3 | 5 | -72 | 22 | Hole abandoned due to deviation - redrilled | |||||||

| MUG25_017 | 1160.2 | 2129.6 | -862.3 | 5 | -72 | 165 | Hole abandoned due to drillers error - no samples taken | |||||||

| MUG25_018 | 1140.0 | 1973.4 | -844.0 | 186 | -81 | 351 | 217.1 | 222.0 | 4.8 | 1.56 | 2.0 | 8.5 | 0.29 | 3.34 |

| 240.8 | 267.5 | 26.7 | 2.27 | 0.2 | 2.6 | 0.05 | 2.46 | |||||||

| MUG25_019 | 1140.0 | 1973.4 | -844.0 | 218 | -45 | 240 | No Significant Intersections | |||||||

| MUG25_020 | 1124.7 | 1533.5 | -811.7 | 130 | -70 | 18 | 9.9 | 16.7 | 6.8 | 2.51 | 0.4 | 3.7 | 0.03 | 2.89 |

| MUG25_021 | 1124.7 | 1533.5 | -811.6 | 130 | -70 | 9 | Hole abandoned due to drillers error - no samples taken | |||||||

| MUG25_022 | 1044.0 | 1092.7 | -522.5 | 195 | -27 | 270 | 101.5 | 103.4 | 1.9 | 1.39 | 0.1 | 2.4 | 0.08 | 1.50 |

| 143.0 | 144.5 | 1.5 | 2.58 | 0.5 | 2.4 | 0.03 | 3.01 | |||||||

| 149.4 | 151.7 | 2.3 | 1.52 | 0.4 | 2.1 | 0.05 | 1.84 | |||||||

| MUG25_022 | Continued | 181.5 | 183.0 | 1.5 | 1.37 | 0.1 | 1.5 | 0.01 | 1.44 | |||||

| MUG25_023 | 1124.7 | 1533.5 | -811.6 | 130 | -70 | 18 | 7.2 | 15.0 | 7.9 | 1.61 | 0.4 | 2.3 | 0.02 | 1.93 |

| MUG25_024 | 1160.2 | 2129.6 | -862.3 | 4 | -65 | 227 | Hole abandoned due to drillers error - no samples taken | |||||||

| MUG25_025 | 1124.7 | 1533.5 | -811.6 | 130 | -70 | 327 | 135.8 | 155.8 | 20.0 | 1.26 | 0.1 | 1.5 | 0.03 | 1.35 |

| 183.2 | 188.9 | 5.8 | 1.68 | 0.3 | 2.5 | 0.02 | 1.91 | |||||||

| 195.9 | 200.9 | 5.0 | 1.73 | 0.1 | 3.3 | 0.02 | 1.86 | |||||||

| 291.5 | 295.7 | 4.2 | 4.15 | 0.1 | 6.8 | 0.01 | 4.31 | |||||||

| MUG25_026 | 1140.0 | 1973.4 | -844.0 | 230 | -45 | 249 | 15.0 | 18.0 | 3.0 | 0.96 | 0.4 | 1.9 | 0.04 | 1.34 |

| 94.0 | 97.0 | 3.0 | 2.14 | 0.2 | 3.1 | 0.16 | 2.34 | |||||||

| 117.0 | 118.9 | 1.9 | 1.89 | 0.1 | 1.4 | 0.02 | 1.98 | |||||||

| 137.0 | 139.4 | 2.4 | 1.63 | 0.3 | 2.0 | 0.02 | 1.92 | |||||||

| 170.3 | 171.6 | 1.3 | 1.23 | 0.0 | 1.2 | 0.01 | 1.29 | |||||||

| MUG25_027 | 1044.0 | 1092.7 | -522.5 | 197 | -37 | 270 | 15.0 | 18.0 | 3.0 | 0.96 | 0.4 | 1.9 | 0.04 | 1.34 |

| 94.0 | 97.0 | 3.0 | 2.14 | 0.2 | 3.1 | 0.16 | 2.34 | |||||||

| 117.0 | 118.9 | 1.9 | 1.89 | 0.1 | 1.4 | 0.02 | 1.98 | |||||||

| 137.0 | 139.4 | 2.4 | 1.63 | 0.3 | 2.0 | 0.02 | 1.92 | |||||||

| 170.3 | 171.6 | 1.3 | 1.23 | 0.0 | 1.2 | 0.01 | 1.29 | |||||||

| MUG25_028 | 1140.0 | 1973.4 | -844.0 | 224 | -35 | 250 | No Significant Intersections | |||||||

| MUG25_030 | 1044.0 | 1092.7 | -522.5 | 200 | -45 | 280 | 93.4 | 96.4 | 3.0 | 1.69 | 0.1 | 3.0 | 0.15 | 1.83 |

| 98.5 | 100.3 | 1.8 | 1.90 | 0.1 | 2.8 | 0.04 | 2.03 | |||||||

| 112.1 | 115.0 | 2.9 | 1.36 | 0.1 | 1.5 | 0.03 | 1.46 | |||||||

| 120.0 | 122.0 | 2.0 | 1.59 | 0.1 | 1.6 | 0.02 | 1.70 | |||||||

| 235.8 | 238.7 | 2.9 | 1.72 | 0.2 | 4.7 | 0.11 | 1.94 | |||||||

| MUG25_031 | 1124.7 | 1533.5 | -811.6 | 129 | -54 | 321 | 17.0 | 20.0 | 3.0 | 1.25 | 0.3 | 1.5 | 0.01 | 1.50 |

| 26.0 | 30.0 | 4.0 | 1.41 | 0.2 | 1.8 | 0.02 | 1.61 | |||||||

| 182.0 | 188.0 | 6.0 | 1.03 | 0.1 | 1.8 | 0.01 | 1.12 | |||||||

| MUG25_031 | 195.0 | 198.0 | 3.0 | 1.03 | 0.2 | 1.8 | 0.01 | 1.18 | ||||||

| Continued | 205.2 | 215.0 | 9.8 | 2.45 | 0.1 | 3.5 | 0.01 | 2.60 | ||||||

| 241.4 | 243.3 | 1.9 | 4.33 | 0.3 | 9.2 | 0.14 | 4.68 | |||||||

| MUG25_032 | 1140.0 | 1973.4 | -844.0 | 188 | -17 | 270 | 214.7 | 229.2 | 14.6 | 5.35 | 1.5 | 11.6 | 0.26 | 6.72 |

| 236.1 | 239.6 | 3.5 | 1.12 | 0.2 | 1.6 | 0.02 | 1.32 | |||||||

| 258.8 | 265.8 | 7.0 | 1.69 | 0.2 | 2.0 | 0.06 | 1.87 | |||||||

| MUG25_033 | 1044.0 | 1092.7 | -522.5 | 148 | -55 | 15 | Hole abandoned due to deviation - redrilled | |||||||

| MUG25_034 | 1044.0 | 1092.7 | -522.5 | 148 | -55 | 248 | 138.7 | 146.7 | 8.0 | 2.01 | 0.2 | 2.5 | 0.01 | 2.18 |

| 154.7 | 161.1 | 6.4 | 1.79 | 0.1 | 1.7 | 0.01 | 1.88 | |||||||

| 173.7 | 187.3 | 13.6 | 2.20 | 0.1 | 1.8 | 0.01 | 2.33 | |||||||

| 223.0 | 226.0 | 3.0 | 2.67 | 0.4 | 3.5 | 0.02 | 3.00 | |||||||

| 230.5 | 234.4 | 3.8 | 1.49 | 0.1 | 1.7 | 0.02 | 1.58 | |||||||

| 246.0 | 247.9 | 1.9 | 1.85 | 0.2 | 1.8 | 0.04 | 2.00 | |||||||

| MUG25_035 | 1124.7 | 1533.5 | -811.6 | 112 | -69 | 15 | Hole abandoned due to deviation - redrilled | |||||||

| MUG25_036 | 1124.7 | 1533.5 | -811.6 | 112 | -69 | 15 | Hole abandoned due to deviation - redrilled | |||||||

| MUG25_037 | 1124.7 | 1533.5 | -811.6 | 112 | -69 | 390 | 20.0 | 22.0 | 2.1 | 1.75 | 0.3 | 2.4 | 0.03 | 2.04 |

| 126.0 | 133.0 | 7.0 | 1.82 | 0.2 | 2.9 | 0.02 | 2.04 | |||||||

| 174.0 | 180.0 | 6.0 | 1.55 | 0.2 | 2.0 | 0.01 | 1.70 | |||||||

| 186.0 | 189.0 | 3.0 | 1.19 | 0.0 | 1.1 | 0.01 | 1.22 | |||||||

| 193.0 | 196.0 | 3.0 | 1.59 | 0.1 | 1.8 | 0.01 | 1.73 | |||||||

| 201.0 | 204.5 | 3.5 | 1.59 | 0.3 | 1.8 | 0.01 | 1.81 | |||||||

| 234.2 | 244.4 | 10.2 | 2.60 | 0.2 | 3.7 | 0.01 | 2.82 | |||||||

| 259.6 | 265.2 | 5.5 | 1.30 | 0.1 | 1.4 | 0.01 | 1.39 | |||||||

| 273.5 | 278.5 | 4.9 | 1.17 | 0.2 | 2.1 | 0.01 | 1.37 | |||||||

| MUG25_038 | 1044.0 | 1092.7 | -522.5 | 147 | -17 | 15 | Hole abandoned due to deviation - redrilled | |||||||

| MUG25_039 | 1044.0 | 1092.7 | -522.5 | 147 | -17 | 420 | 262.3 | 264.3 | 2.0 | 1.35 | 0.1 | 1.7 | 0.02 | 1.45 |

| MUG25_041 | 1124.7 | 1533.5 | -811.6 | 115 | -62 | 320 | 30.6 | 31.7 | 1.1 | 1.15 | 0.1 | 1.8 | 0.01 | 1.27 |

| 105.4 | 111.8 | 6.5 | 2.38 | 0.2 | 3.3 | 0.26 | 2.65 | |||||||

| 196.8 | 198.7 | 1.9 | 1.15 | 0.7 | 2.0 | 0.01 | 1.78 | |||||||

| 203.1 | 209.2 | 6.1 | 2.07 | 0.2 | 2.9 | 0.01 | 2.29 | |||||||

| 216.2 | 226.1 | 9.9 | 2.90 | 0.3 | 4.0 | 0.01 | 3.17 | |||||||

| 260.0 | 262.0 | 2.0 | 1.35 | 0.1 | 1.8 | 0.02 | 1.43 | |||||||

| MUG25_042 | 1164.9 | 1967.2 | -844.4 | 25 | -87 | 501 | 269.6 | 284.4 | 14.9 | 3.27 | 2.4 | 15.2 | 0.60 | 5.49 |

| 299.5 | 323.6 | 24.1 | 3.47 | 0.3 | 3.6 | 0.05 | 3.72 | |||||||

| Including | 299.5 | 308.9 | 9.4 | 7.10 | 0.5 | 7.3 | 0.08 | 7.60 | ||||||

| 339.7 | 345.1 | 5.5 | 3.18 | 0.2 | 3.0 | 0.10 | 3.42 | |||||||

| 393.6 | 429.7 | 36.1 | 1.56 | 0.1 | 1.6 | 0.06 | 1.69 | |||||||

| Including | 411.2 | 416.0 | 4.9 | 3.17 | 0.2 | 3.0 | 0.05 | 3.33 | ||||||

| 448.9 | 457.4 | 8.5 | 1.24 | 0.1 | 1.8 | 0.14 | 1.33 | |||||||

| MUG25_043 | 1130.3 | 1531.3 | -811 | 100 | -52 | 180 | 72.0 | 77.0 | 5.0 | 1.50 | 0.1 | 2.0 | 0.02 | 1.64 |

| 87.0 | 101.0 | 14.0 | 1.47 | 0.1 | 2.0 | 0.08 | 1.55 | |||||||

| 120.2 | 122.2 | 2.0 | 3.21 | 0.1 | 4.3 | 0.07 | 3.37 | |||||||

| 128.0 | 130.0 | 2.0 | 1.18 | 0.1 | 1.4 | 0.05 | 1.28 | |||||||

| 136.0 | 144.0 | 8.0 | 1.25 | 0.1 | 1.5 | 0.04 | 1.34 | |||||||

| MUG25_044 | 1044.0 | 1092.7 | -522.5 | 146 | -32 | 15 | Hole abandoned due to deviation - redrilled | |||||||

| MUG25_045 | 1130.3 | 1531.3 | -811.9 | 126 | -45 | 180 | 26.0 | 29.0 | 3.0 | 1.20 | 0.2 | 2.3 | 0.02 | 1.36 |

| 64.3 | 67.5 | 3.2 | 1.65 | 0.1 | 2.1 | 0.02 | 1.75 | |||||||

| 77.0 | 79.0 | 2.0 | 1.52 | 0.1 | 2.0 | 0.06 | 1.64 | |||||||

| 131.0 | 133.0 | 2.0 | 2.36 | 0.2 | 2.9 | 0.01 | 2.53 | |||||||

| MUG25_046 | 1044.0 | 1092.7 | -522.5 | 146 | -32 | 375 | 93.0 | 95.0 | 2.0 | 1.61 | 0.9 | 4.9 | 0.49 | 2.47 |

| 143.0 | 145.0 | 2.0 | 1.85 | 0.2 | 2.1 | 0.01 | 2.07 | |||||||

| 201.0 | 225.7 | 24.7 | 2.05 | 0.2 | 2.3 | 0.02 | 2.19 | |||||||

| MUG25_046 | Including | 216.0 | 225.7 | 9.7 | 2.83 | 0.2 | 3.2 | 0.02 | 3.03 | |||||

| Continued | 256.0 | 265.0 | 9.0 | 1.35 | 0.2 | 1.4 | 0.02 | 1.51 | ||||||

| 365.0 | 367.0 | 2.0 | 1.10 | 0.1 | 1.6 | 0.00 | 1.19 | |||||||

| MUG25_047 | 1127.4 | 1530.7 | -809.8 | 147 | -15 | 216 | 95.0 | 101.0 | 6.0 | 1.06 | 0.1 | 1.7 | 0.03 | 1.16 |

| 108.0 | 111.0 | 3.1 | 2.60 | 0.2 | 4.0 | 0.10 | 2.84 | |||||||

| 126.6 | 131.0 | 4.4 | 1.91 | 0.1 | 2.6 | 0.06 | 2.07 | |||||||

| 142.0 | 145.6 | 3.6 | 1.27 | 0.1 | 1.7 | 0.07 | 1.36 | |||||||

| 153.0 | 156.3 | 3.3 | 1.19 | 0.1 | 1.7 | 0.03 | 1.29 | |||||||

| MUG25_048 | 1044.0 | 1092.7 | -522.5 | 145 | -63 | 105 | 60.5 | 63.5 | 3.0 | 1.42 | 0.6 | 2.7 | 0.07 | 1.95 |

| MUG25_049 | 1127.4 | 1530.7 | -809.8 | 162 | -7 | 131.5 | No Significant Intersections | |||||||

| MUG25_050 | 1055.6 | 1514.1 | -806.9 | 180 | -66 | 351 | Awaiting Assays - Core sent for Acoustic test work for geotechnical mining studies | |||||||

| MUG25_051 | 1164.9 | 1967.2 | -844.4 | 178 | -78 | 471 | Awaiting Assays - Core sent for UCS test work for geotechnical mining studies | |||||||

| MUG25_052 | 1127.4 | 1530.7 | -809.8 | 171 | 0 | 102 | 34.0 | 36.9 | 2.9 | 1.44 | 0.3 | 2.9 | 0.05 | 1.75 |

| MUG25_053 | 1044.0 | 1092.7 | -522.5 | 146 | -27 | 399 | 19.0 | 22.0 | 3.0 | 1.10 | 0.2 | 3.0 | 0.03 | 1.27 |

| 154.0 | 159.8 | 5.8 | 1.30 | 0.2 | 1.4 | 0.04 | 1.45 | |||||||

| 218.0 | 225.5 | 7.4 | 2.37 | 0.4 | 2.4 | 0.02 | 2.72 | |||||||

| 247.0 | 253.0 | 6.0 | 1.10 | 0.1 | 1.2 | 0.01 | 1.19 | |||||||

| MUG25_054 | 1127.4 | 1530.7 | -809.8 | 207 | 0 | 117 | 22.0 | 32.0 | 10.0 | 1.82 | 0.3 | 2.5 | 0.05 | 2.12 |

| MUG25_055 | 1117.5 | 1538.7 | -810.7 | 285 | -13 | 108 | 8.0 | 13.6 | 5.6 | 1.30 | 0.2 | 2.3 | 0.02 | 1.48 |

| 24.0 | 27.0 | 3.0 | 1.48 | 0.3 | 2.6 | 0.02 | 1.73 | |||||||

| MUG25_056 | 1117.6 | 1538.7 | -810.6 | 292 | -47 | 87 | 23.0 | 26.7 | 3.7 | 1.68 | 0.2 | 1.9 | 0.13 | 1.86 |

| 52.4 | 63.0 | 10.6 | 1.45 | 0.2 | 2.1 | 0.12 | 1.65 | |||||||

| MUG25_057 | 1117.5 | 1539.6 | -810.6 | 307 | -29 | 114 | 10.1 | 16.0 | 6.0 | 1.09 | 0.2 | 1.3 | 0.02 | 1.25 |

| 24.4 | 26.4 | 2.0 | 2.58 | 0.8 | 3.0 | 0.06 | 3.26 | |||||||

| MUG25_069W1 | 1160.2 | 2129.6 | -862.3 | 32 | -74 | 645 | 458.7 | 465.2 | 6.4 | 3.00 | 3.6 | 25.6 | 0.91 | 6.30 |

| 572.0 | 592.0 | 20.0 | 1.32 | 0.1 | 1.3 | 0.06 | 1.42 | |||||||

| MUG25_073 | 1164.9 | 1967.2 | -844.4 | 183 | -60 | 414 | 213.2 | 215.4 | 2.3 | 6.32 | 0.8 | 9.0 | 0.27 | 7.10 |

| 227.6 | 237.1 | 9.5 | 6.05 | 0.4 | 6.3 | 0.10 | 6.42 | |||||||

| 243.6 | 246.8 | 3.2 | 1.45 | 0.2 | 1.8 | 0.06 | 1.60 | |||||||

| 252.0 | 256.9 | 4.9 | 2.05 | 0.2 | 3.1 | 0.09 | 2.26 | |||||||

| 290.0 | 292.0 | 2.0 | 1.76 | 0.2 | 1.7 | 0.18 | 1.98 | |||||||

| 309.0 | 333.9 | 24.9 | 2.22 | 0.1 | 2.4 | 0.13 | 2.38 | |||||||

| 355.0 | 358.0 | 3.0 | 1.03 | 0.1 | 1.9 | 0.02 | 1.15 | |||||||

APPENDIX C - JORC CODE, 2012 EDITION

Table 1

Section 1 - Sampling Techniques and Data (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

|

|

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

| Logging |

|

The following steps are completed during the core logging procedure:

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

|

|

| Data spacing and distribution |

|

|

| Orientation of data in relation to geological structure |

|

|

| Sample security |

|

|

| Audits or reviews |

|

|

Section 2 - Reporting of Exploration Results (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

|

|

| Exploration done by other parties |

|

|

| Geology |

|

|

| Drill hole Information |

|

|

| Data aggregation methods |

|

|

| Relationship between mineralisation widths and intercept lengths |

|

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

|

|

Plan view of drilling in this announcement

________________________

1 Metal equivalent for drill results reported in this announcement have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Metallurgical recoveries have been set at 95% for copper, 85% for precious metals and 50% for zinc. CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038). In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, and historical performance achieved at the Green Bay project whilst in operation.

2 See ASX announcements dated 5, 10 and 16 June 2025.

3 Cash, receivables and liquid investments position at 30 June 2025, plus A$10 million proceeds received from the SPP which completed on 14 July 2025, and anticipated net proceeds from the second tranche of the Institutional Placement (T2 Placement) of ~A$26.6 million, which is subject to shareholder approval at a general meeting expected to be held next month, noting that there is no guarantee that shareholders will vote in favour of the T2 Placement.

4 See ASX announcement dated 15 May 2025 for further details on Rambler Main Mine exploration results.

5 Cash, receivables and liquid investments position at 30 June 2025, plus A$10 million proceeds received from the SPP which completed on 14 July 2025, and anticipated net proceeds from the second tranche of the Institutional Placement (T2 Placement) of ~A$26.6 million, which is subject to shareholder approval at a general meeting expected to be held next month, noting that there is no guarantee that shareholders will vote in favour of the T2 Placement.

6 See ASX announcements dated 5, 10 and 16 June 2025.

7 Holes are drilled perpendicular to the mineralisation and approximate true thickness.

8 Holes are drilled perpendicular to the mineralisation and approximate true thickness.

9 Holes are drilled perpendicular to the mineralisation and approximate true thickness.

10 Please refer to ASX announcement dated 29 October 2024 and Appendix A of this announcement for further details on the Mineral Resource Estimate.

11 Cash, receivables and liquid investments position at 30 June 2025, plus A$10 million proceeds received from the SPP which completed on 14 July 2025, and anticipated net proceeds from the second tranche of the Institutional Placement (T2 Placement) of ~A$26.6 million, which is subject to shareholder approval at a general meeting expected to be held next month, noting that there is no guarantee that shareholders will vote in favour of the T2 Placement.

12 See ASX announcements dated 5, 10 and 16 June 2025.