Toronto, Ontario--(Newsfile Corp. - June 17, 2025) - New Break Resources Ltd. (CSE: NBRK) ("New Break" or the "Company") is pleased to announce the recent receipt of a $200,000 grant from the Ontario Ministry of Mines under the 2024-2025 Ontario Junior Exploration Program ("OJEP") as reimbursement of 50% of eligible exploration expenditures incurred from April 1, 2024 to February 28, 2025, at the Company's 100% owned Moray gold project located 49 km south of Timmins, Ontario and 32 km northwest of the Young-Davidson gold mine operated by Alamos Gold Inc. Since April 1, 2022, New Break has received aggregate grants under OJEP of $636,224 in respect of Moray expenditures.

Moray Gold Project - Planned 2,000 to 2,500 Metre Summer Drilling Program

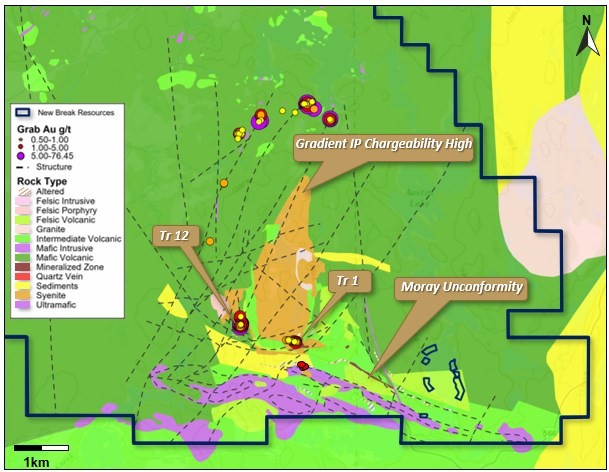

Planned drilling at Moray is expected to target four key areas, none of which have been properly drill tested by previous operators. In addition to new targets, significant analysis of historical exploration results in conjunction with work conducted by New Break, has resulted in the recommendation of new planned drillholes oriented and positioned differently in areas that have demonstrated historical potential. The four key areas to be drill tested include Trench 1 ("Tr1") where gold mineralization hosted in syenite represents the potential for a Young-Davidson analogue, Trench 12 ("Tr12") where gold mineralization is hosted in mafic volcanics and syenite, the Moray Unconformity which will follow up on drilling undertaken by Noranda Exploration Co. Ltd. ("Noranda") in 1965 and lastly, a chargeability high associated with the northwestern margin of the syenite, as identified through the gradient induced polarization ("IP") survey completed by New Break in late 2024.

Figure 1: Key Target Areas for 2025 Planned Drilling Program – Moray Gold Project

Figure 1: Key Target Areas for 2025 Planned Drilling Program – Moray Gold Project

Discussion of gold grade and redacted assays in historical drilling

The significant profitability of gold being mined underground at the Young-Davidson mine from a syenite intrusive, at an average grade mined in 2024 of only 2.08 grams per tonne gold ("g/t Au"), with the average grade of the mineral reserves being only 2.2 g/t Au, has led New Break to conclude that focusing exploration efforts principally on the Moray syenite target areas will provide the best opportunity for discovery of gold mineralization that has the potential to yield an economic orebody. Assays from historical drilling by Noranda in 1965 and by Newmont Exploration Canada Ltd. ("Newmont") in 1980 noted below, were redacted. Those drilling programs were completed in significantly lower gold price environments and without the understanding of how profitable a 2 g/t Au syenite hosted gold deposit can be, as now evidenced by the Young-Davidson gold mine.

Trench 1 – Gold mineralization hosted in Syenite (Young-Davidson analogue)

New Break plans on testing four targets in the Trench 1 area that include the following:

- Extensions of the NOR vein where channel sampling returned 5.16 g/t Au over 1.1 metres and the Shelly vein where grab samples returned 2.3 g/t Au;

- An IP chargeability high north of Trench 1, identified by SGX Resources Ltd. ("SGX") in 2012;

- A new interpreted structure north of Trench 1 which may be related to an anomalous gold intersection of 0.49 g/t Au over 12 metres in the 2012 SGX drillhole ML-12-05; and

- An area drilled by Newmont in 1980 where drillhole Z-80-05 encountered 226.9 metres of mafic syenite with quartz veining, with associated pyrite, chalcopyrite and galena.

Trench 12 – Gold mineralization hosted in mafic volcanics and syenite

New Break plans to test the NE and SW extensions of the shear vein stripped at Trench 12 in 2022, where grab sampling yielded assays of up to 70.6 g/t Au and channel samples up to 5.41 g/t Au over 1.0 metre.

Moray Unconformity Target – Gold mineralization hosted in felsic volcanics

Logs for drillholes NOR 65-1 and NOR 65-4, drilled by Noranda in 1965, describe a felsic tuff/breccia with minor disseminated pyrite while a 1980 Newmont drillhole Z-80-02 details a carbonatized felsic tuff/breccia with 1-3% pyrite over 39.1 metres between the 135.5 and 174.8 metre depth. As noted, assays for drilling conducted by Noranda in 1965 were redacted, except for one instance in the Ontario Government's Mineral Inventory Database which references an assay of 6.17 g/t Au over 3.66 metres in drillhole NOR 65-1.

New Break Gradient IP Survey Chargeability High

New Break completed a 55.7 line-km gradient IP survey from October to December 2024 that covered the entire syenite intrusive, including the balance not covered by the 2012 pole/dipole IP survey completed by SGX. Chargeability highs associated with the northwestern margin of the syenite represent an obvious target for gold mineralization that has never been drill tested. High chargeability results could indicate the presence of pyrite, chalcopyrite and galena (lowest chargeability of the three sulphides) which, in the case of the surface results at Trench 1 carries gold.

Qualified Person

Peter C. Hubacheck, P. Geo., consulting geologist to New Break, and a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical disclosure in this news release.

About the Ontario Junior Exploration Program

Through OJEP, the Ontario Government is investing in early mineral exploration to create meaningful opportunities for junior companies to find the mines of the future and help keep Ontario globally competitive. New Break wishes to offer its appreciation to the Ontario Government for its continued support for junior mineral exploration in Ontario and specifically for its support of New Break's Moray project. Since April 1, 2022, New Break has received aggregate grants under OJEP of $636,224.

About New Break Resources Ltd.

New Break is a proudly Canadian mineral exploration company focused on its Moray gold project located 49 km south of Timmins, Ontario, in a well-established mining camp within proximity to existing infrastructure, 32 km northwest of the Young-Davidson gold mine, operated by Alamos Gold Inc. Shareholders also remain leveraged to exploration success in Nunavut, one of the most up and coming regions in Canada for gold exploration and production through New Break's 20% carried interest in the Sundog gold project. The Company is supported by a highly experienced team of mining professionals. Information on New Break is available under the Company's profile on SEDAR+ at www.sedarplus.ca and on the Company's website at www.newbreakresources.ca. New Break trades on the Canadian Securities Exchange (www.thecse.com) under the symbol CSE: NBRK.

For further information on New Break, please visit www.newbreakresources.ca or contact:

| William Love, Chief Executive Officer Tel: 519-272-6312 This email address is being protected from spambots. You need JavaScript enabled to view it. |

Michael Farrant, President and CFO Tel : 416-278-4149 E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it. |

And follow us on Twitter, LinkedIn and Facebook

No stock exchange, regulation securities provider, securities commission or other regulatory authority has approved or disapproved the information contained in this news release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to receipt of regulatory and stock exchange approvals, grants of equity-based compensation, renouncement of flow-through exploration expenses, property agreements, timing and content of upcoming work programs, geological interpretations, receipt of property titles, an inability to predict and counteract the effects global events on the business of the Company, including but not limited to the effects on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains etc. Forward-looking information addresses future events and conditions and therefore involves inherent risks and uncertainties, including factors beyond the Company's control. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to update publicly or otherwise any forward-looking information, except as may be required by law. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's financial statements and management's discussion and analysis (the "Filings"), such Filings available upon request.