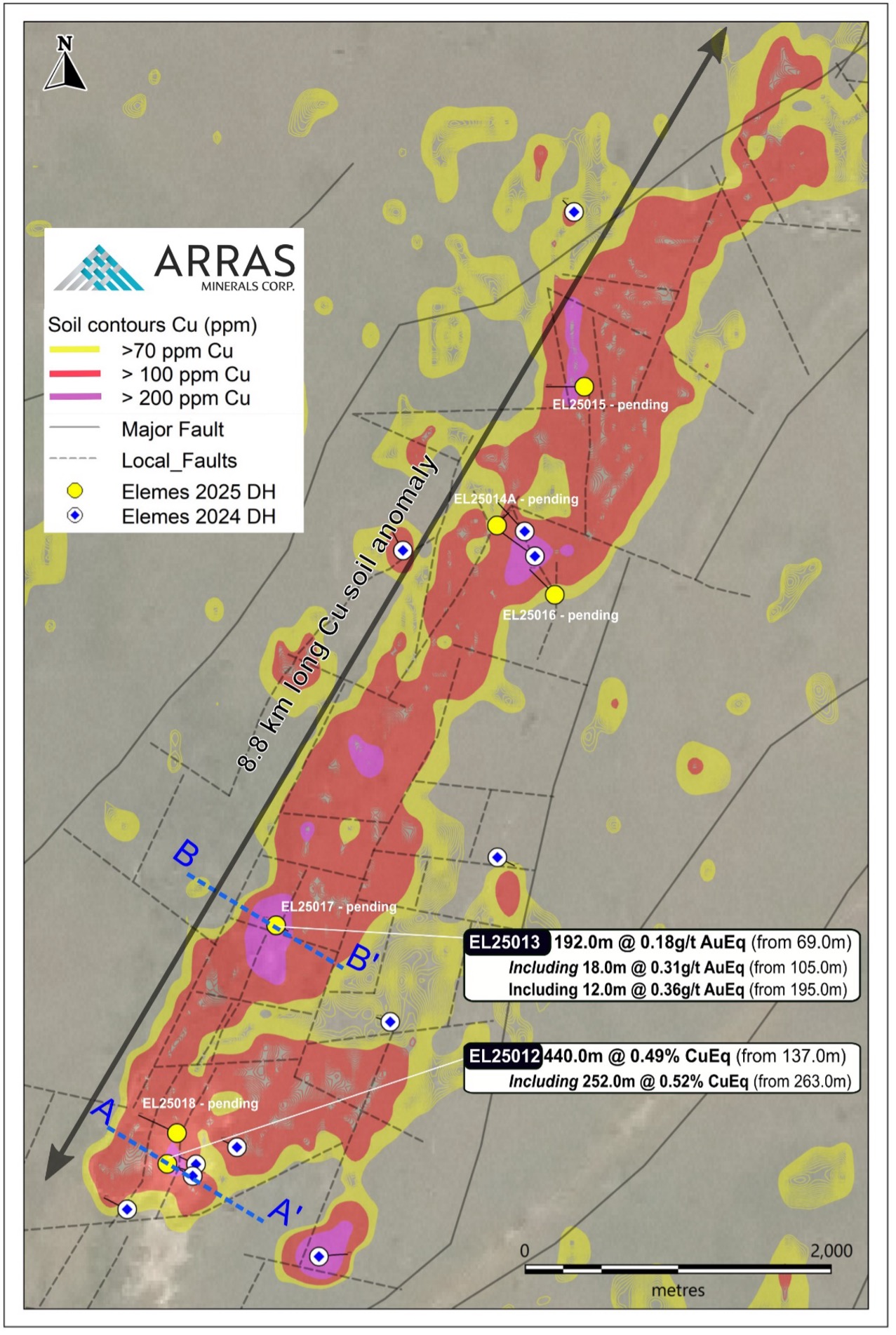

VANCOUVER, BC / ACCESS Newswire / August 13, 2025 / Arras Minerals Corp. (TSXV:ARK) (OTCQB:ARRKF) ("Arras" or "Arras Minerals" or "the Company") is pleased to report results of drillholes EL25012 and EL25013 from the 2025 drill program currently underway on the Elemes Project in Northeast Kazakhstan. The program aims to test widespread targets along the 8.8 kilometre Berezski Trend and the 14 kilometre Aimandai Trend.

Highlights include:

-

EL25012: 578m of mineralization grading 0.41 % copper-equivalent ("CuEq") (0.14% Cu and 0.21 g/t Au), starting at 3m depth; including:

-

440m grading 0.49% CuEq (0.16% Cu and 0.25 g/t Au) starting at 137m depth

-

114m grading 0.53% CuEq (0.22% Cu and 0.20 g/t Au) starting at 147m depth

-

252m grading 0.52% CuEq (0.15% Cu, and 0.29 g/t Au) starting at 325m depth

-

Tim Barry, CEO of Arras Minerals, stated, "Arras has three drill rigs currently turning across our licence package in Northeast Kazakhstan. Two of the drill rigs are working on the Elemes Project and the third is following up targets identified on the Arras-Teck Exploration Alliance properties. The initial pass of the Phase 2 drill campaign currently underway on the Elemes Project aims to build on the success of our 2024 drill campaign and continue to target a wide variety of areas along the 8.8 kilometre Berezski Trend and the 14 kilometre Aimandai Trend. Hole EL25012 represents an excellent start to the Phase 2 program intersecting the thickest interval of gold-copper mineralization encountered to date at Berezski Central, highlighting the scale and depth potential of the system. We now plan to focus one rig at Berezski Central to commence a systematic drilling program with an aim to further enhance understanding of structural controls and build scale at this target."

He went on to add, "Hole EL25013 is also very encouraging. While lower grade, it intersected nearly 300 meters of porphyry-style mineralization, 1.7 kilometres north of EL25012, demonstrating widespread thick pervasive mineralization along the Berezski Anomaly. Furthermore, Hole EL25013 is the first drill hole to test the 5 kilometre gap between Berezski Central target and Berezski North target - which drilling, announced in February of this year, intersected 547 meters of 0.70% CuEq starting from 14 metres."

Arras 2025 Drill Program: Since late June, Arras has had two diamond drill rigs operating on the Elemes Project targeting the Berezski Trend. The initial pass on the 20,000 metre Phase 2 drill program has the goal of building on the 2024 drill program through continuing to test a broad suite of known anomalies and new targets across the 8.8 kilometre Berezski Trend. Seven holes have now been completed with the remainder of the assays pending. A Magnetotellurics ("MT") and Gravity geophysical survey is underway across portions of the Berezski and Aimandai Trends. This survey is expected to continue into September-October and once finished will be used to further refine drill targets in both areas.

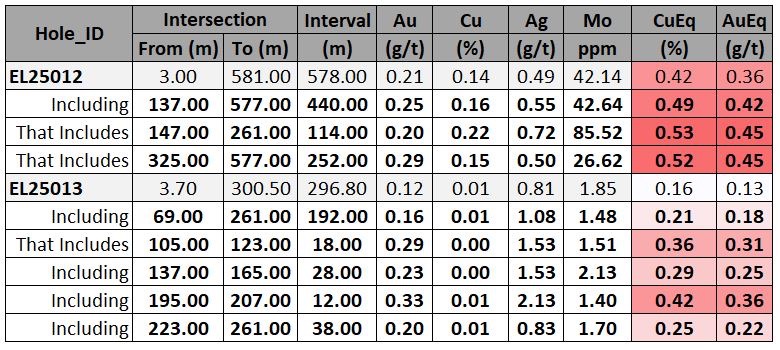

Hole EL25012: Targets the extensive copper-molybdenum soil anomaly first tested with holes EL24001 & EL24002 in 2024. Both holes drilled in 2024 were drilled towards the west, whilst Hole EL24012 drills towards the east with the view of better constraining mineralization and the structures in the area. EL25012 was drilled to a final depth of 724.3m, intersecting andesite and andesite breccias with pervasive argillic alteration overprinting earlier phyllic alteration, along with localized silicification and veining. Below 526m, the intensity of alteration diminishes, transitioning to remnant propylitic and weak phyllic assemblages. At 579.8m, a major fault zone was encountered, marked by structurally controlled weak phyllic alteration and localized silicification.

Mineralization is characterized by pervasive disseminated pyrite (1-3%) with quartz-pyrite veining, along with minor chalcopyrite and molybdenite veins. Following the major fault at 579.8m, quartz veining becomes markedly less common. Near-surface intervals contain zones of disseminated and patchy chalcocite, suggesting the surface has been leached in areas and highlights the presence of potential supergene mineralization at Berezski Central.

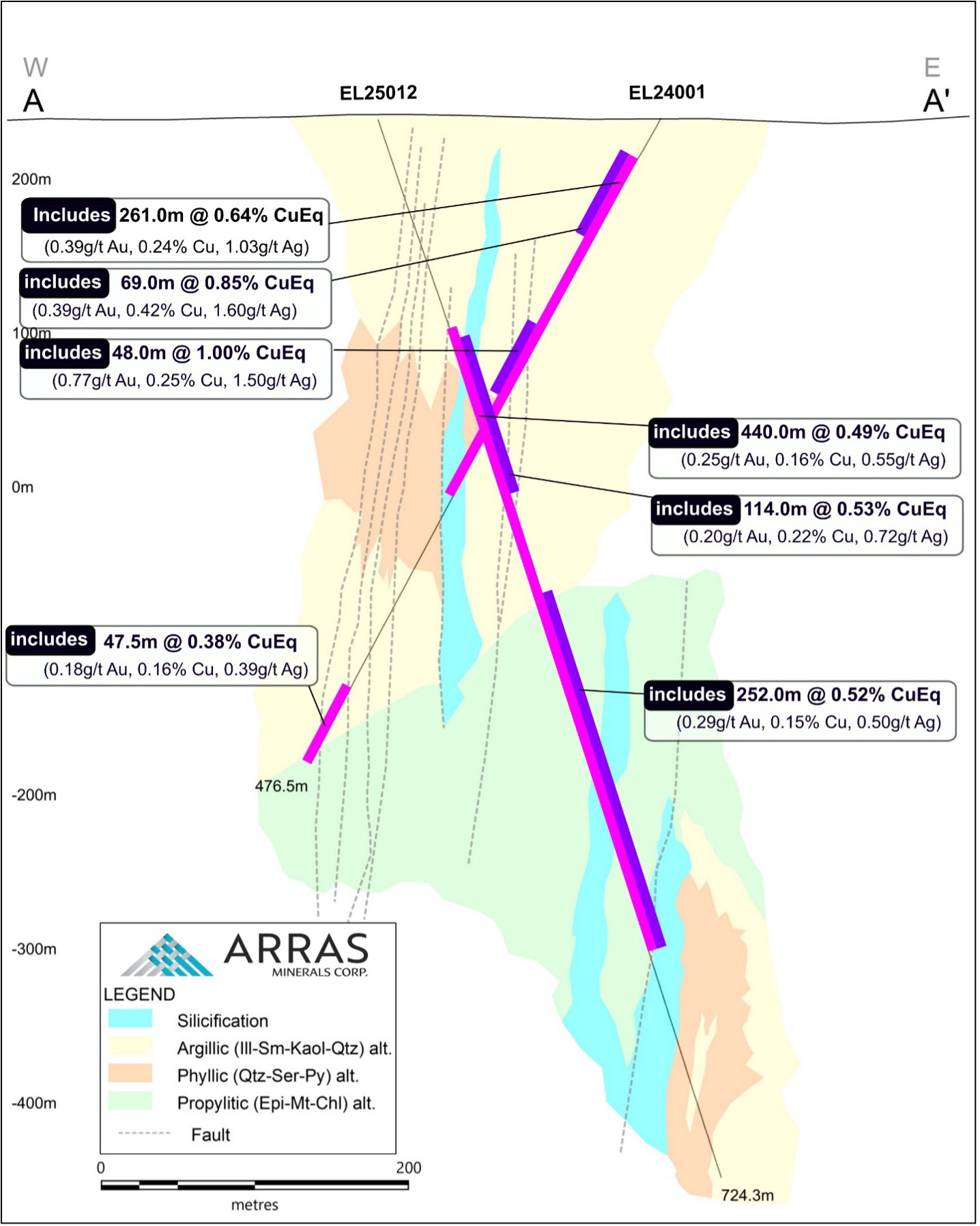

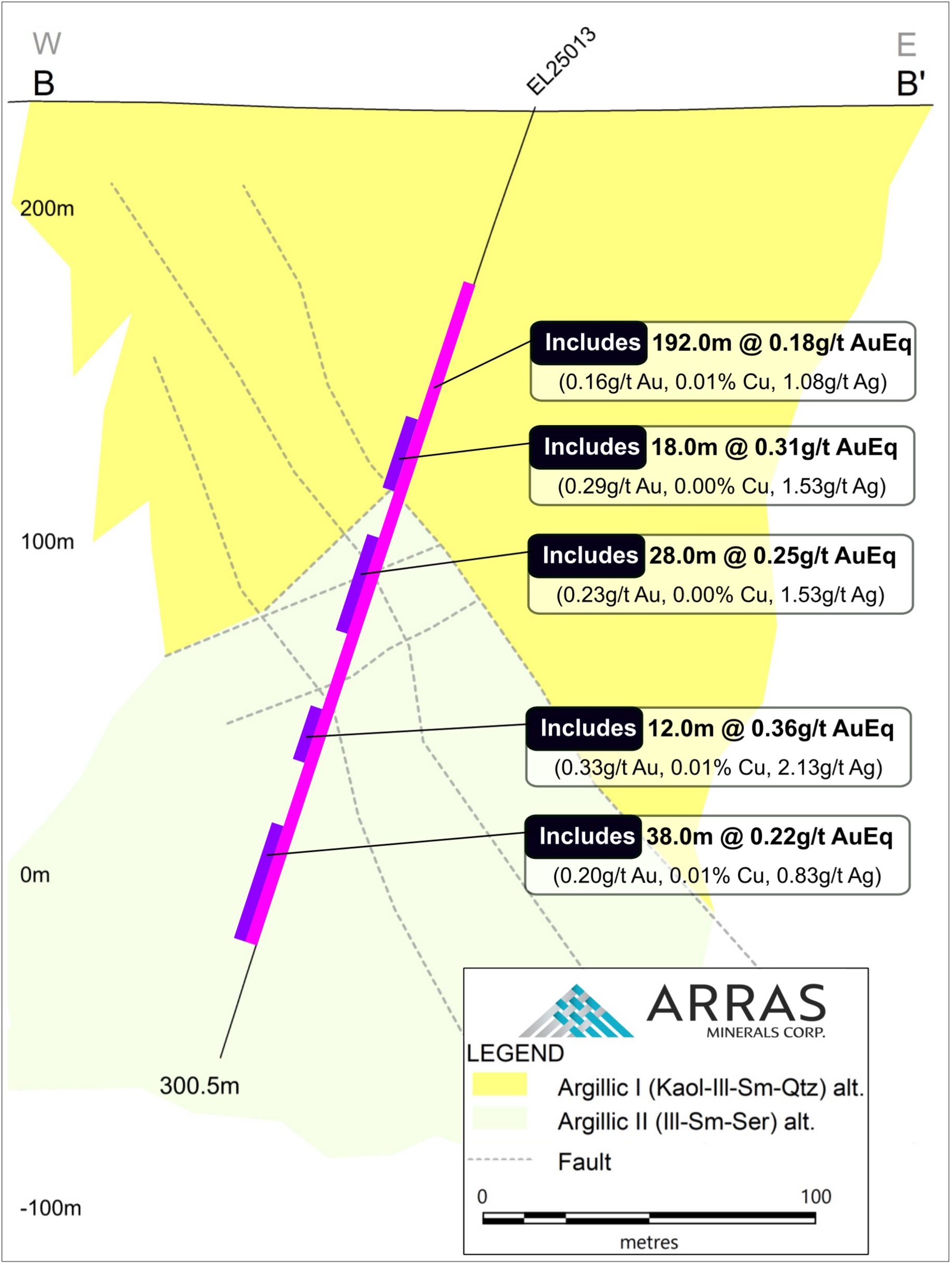

Hole EL25013: Targets a prominent copper-in-soil anomaly located 1.7 kilometres north of EL25012. The hole intersected medium-grained, fractured andesites overprinted by moderate argillic alteration with remnant propylitic alteration. At 86m depth, the hole transitioned into fine to medium-grained diorites. Argillic alteration continues down to 126.9m, transitioning into weaker argillic assemblages, with several narrow zones of phyllic alteration also noted. Mineralization is characterized by disseminated pyrite (0.5-3%, locally up to 5%), with minor disseminated chalcopyrite and rare galena.

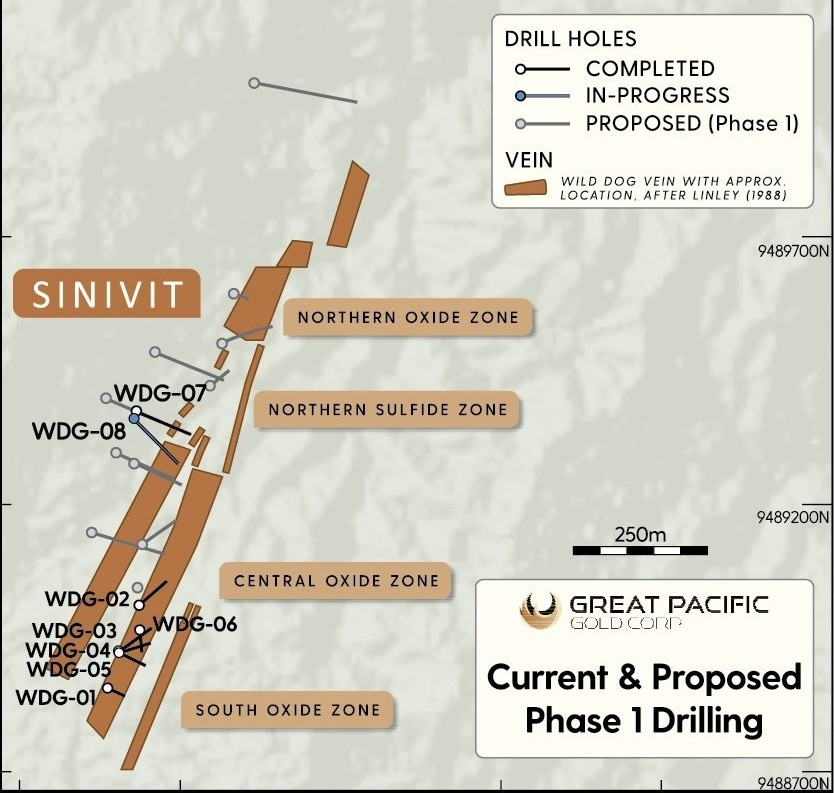

Figure 1. Arras Minerals Elemes Project and project portfolio located in Pavlodar, Kazakhstan along with reference to Kaz Minerals' Bozshakol Copper Mine1 (see reference below).

Figure 1. Arras Minerals Elemes Project and project portfolio located in Pavlodar, Kazakhstan along with reference to Kaz Minerals' Bozshakol Copper Mine1 (see reference below).

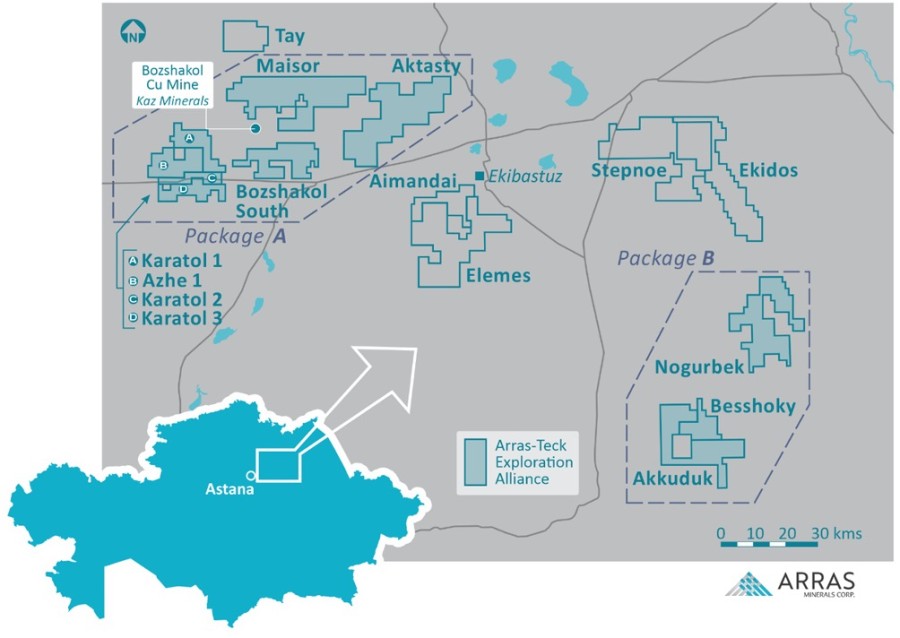

Table 1: Summary results from hole EL25012 and EL25013

Notes: Copper Equivalent ("CuEq") grades reported for the drill holes at Elemes were calculated using the following formula: CuEq % = Copper (%) + (Gold (g/t) x 0.8571) + (Silver (g/t) x 0.0117) + (Molybdenum (ppm) x 6.8568). AuEq grades reported for the drill holes at Elemes were calculated using the following formula: AuEq g/t = Gold (g/t) + (Copper (%) x 1.1667) + (Silver (g/t) x 0.0136) + (Molybdenum (ppm) x 8.0). Assumptions used for the copper and gold equivalent calculations were metal prices of US$3.75/lb. Copper, US$3,000/oz Gold, US$35/oz Silver, US$30/lb Molybdenum, and metallurgical recoveries were assumed to be 100%.

Figure 2. Cross-section A-A' looking NW showing key intercepts in drill-holes EL25012, and 2024 drill hole EL24001. The cross-section demonstrates well developed strong porphyry-epithermal style of alteration hosting significant and consistent mineralization by depth that is starting close to the surface.

Figure 2. Cross-section A-A' looking NW showing key intercepts in drill-holes EL25012, and 2024 drill hole EL24001. The cross-section demonstrates well developed strong porphyry-epithermal style of alteration hosting significant and consistent mineralization by depth that is starting close to the surface.

Figure 3. Cross-section B-B' looking NW showing key intercepts in drill-holes EL25013. The cross-section demonstrates epithermal style of alteration hosting consistent gold mineralization. This Drill Hole is 1.7 km NW from the Berezski Central target.

Figure 3. Cross-section B-B' looking NW showing key intercepts in drill-holes EL25013. The cross-section demonstrates epithermal style of alteration hosting consistent gold mineralization. This Drill Hole is 1.7 km NW from the Berezski Central target.

Figure 4. Map of the Berezski Target highlighting the 8.8 km copper-in-soil anomaly. Drill holes completed by Arras in 2024 are marked in white with a blue center, while holes drilled in 2025 to date are shown in solid yellow.

Figure 4. Map of the Berezski Target highlighting the 8.8 km copper-in-soil anomaly. Drill holes completed by Arras in 2024 are marked in white with a blue center, while holes drilled in 2025 to date are shown in solid yellow.

HOLE EL25012 PHOTOS

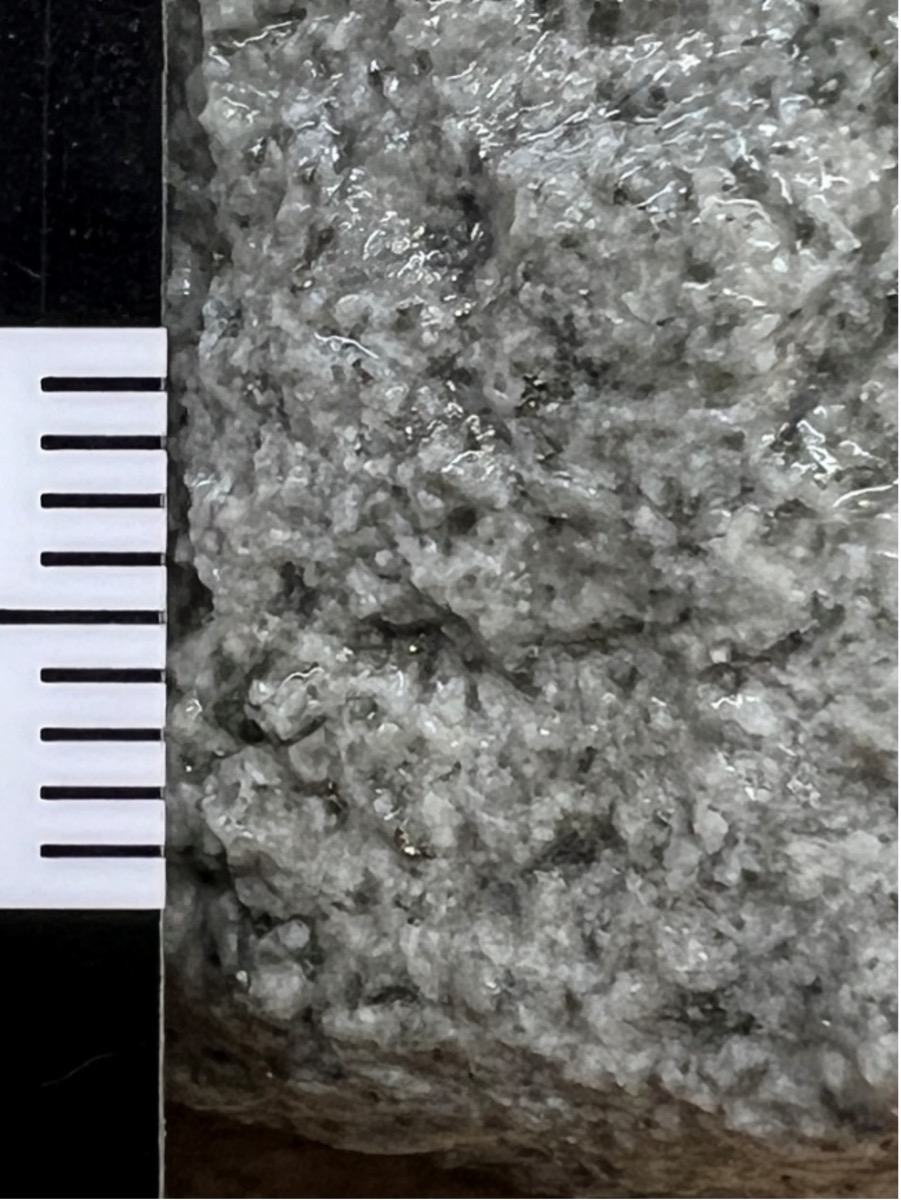

EL25012 - 54m depth - disseminated chalcocite and pyrite in strongly altered andesites

EL25012 - 54m depth - disseminated chalcocite and pyrite in strongly altered andesites

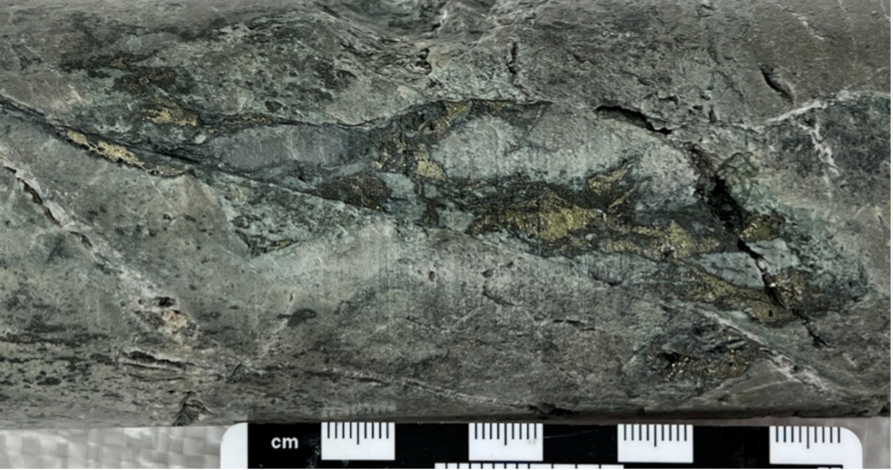

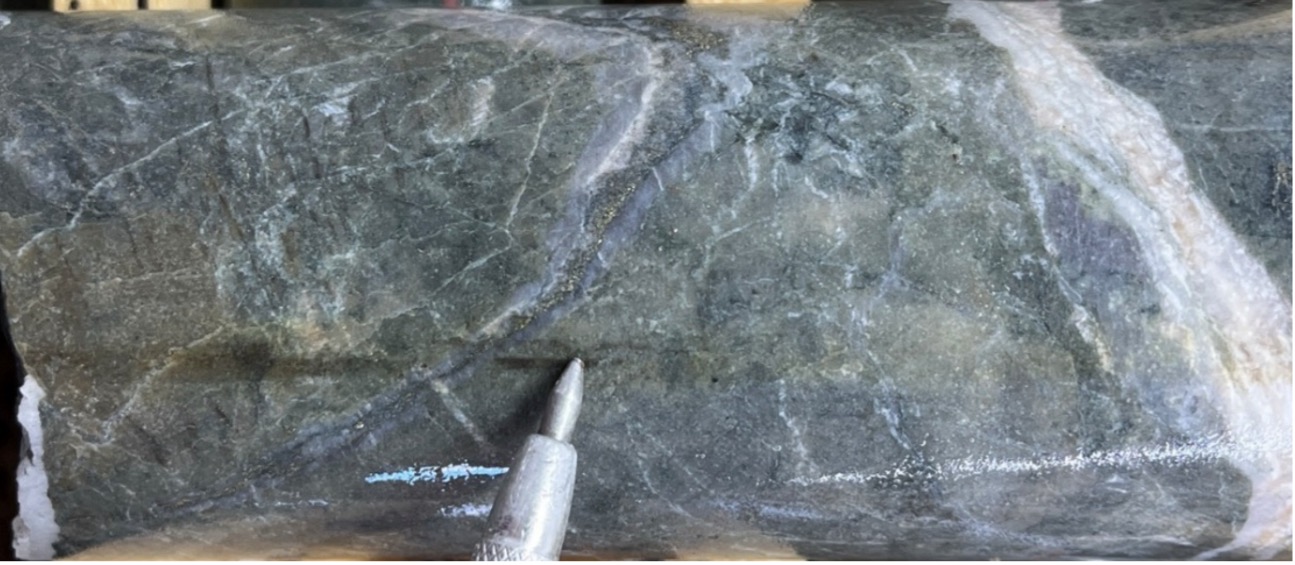

EL25012 - 187.5m - Chalcopyrite-pyrite-molybdenite patches in brecciated and silicified andesites

EL25012 - 187.5m - Chalcopyrite-pyrite-molybdenite patches in brecciated and silicified andesites

HOLE EL25012 PHOTOS Continued

EL25012 - 465.1m - B-vein - Quartz vein with pyrite and chalcopyrite along center line of quartz vein

EL25012 - 465.1m - B-vein - Quartz vein with pyrite and chalcopyrite along center line of quartz vein

PHOTOS FROM HOLE EL25013

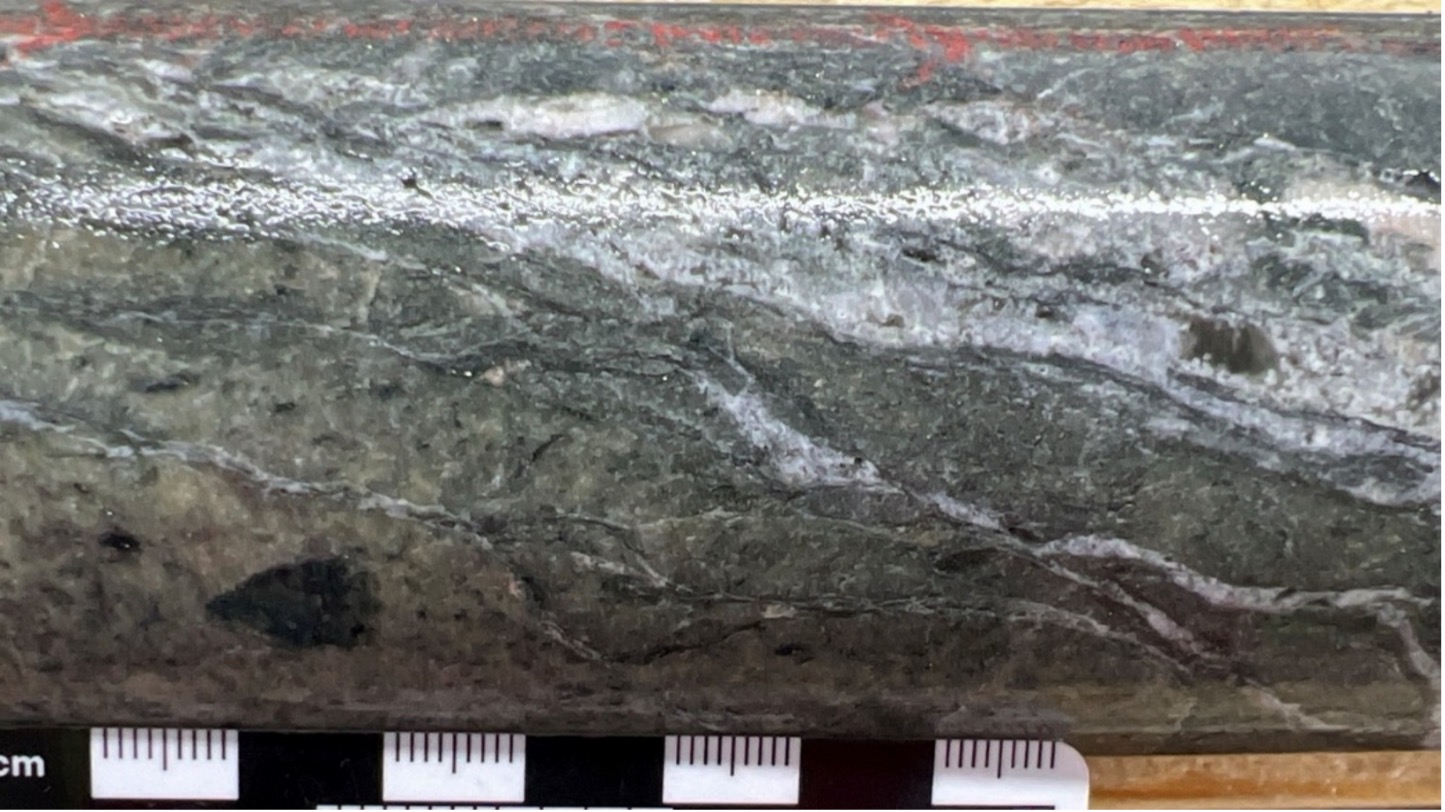

EL25013 - 32.8m depth - smoky quartz-pyrite vein

EL25013 - 32.8m depth - smoky quartz-pyrite vein

EL25013 - 257.9m - disseminated chalcopyrite in highly altered andesites

EL25013 - 257.9m - disseminated chalcopyrite in highly altered andesites

EL25013 - 266.6m - Carbonate-chlorite-pyrite vein

EL25013 - 266.6m - Carbonate-chlorite-pyrite vein

Elemes Project Overview: The Elemes Project comprises two exploration licenses covering 531 square kilometres in northeast Kazakhstan, located approximately 13 km southwest of Ekibastuz and just 20 km from Arras's operational base. The project benefits from exceptional infrastructure, with a paved highway crossing the licence, and access to 1100 KVA power lines, heavy rail, and other utilities within a 15 km radius.

Situated within the prolific Bozshakol-Chingiz metallogenic belt, Elemes lies near significant regional deposits, including the Beskauga porphyry copper-gold-silver deposit (~80 km east) and KAZ Minerals' Bozshakol mine (~60 km northwest), which produced 104.7 kt Cu and 104 koz Au in 20242.

Geologically, the property is underlain by interbedded intermediate volcanic and sedimentary rocks intruded by multiple phases of diorite and monzodiorite porphyry. Copper-gold mineralization occurs in sheeted and stockwork quartz-chalcopyrite veins associated with these intrusions. In addition, high-grade low-sulphidation epithermal veins have been mapped on the property, representing a secondary exploration target.

Property-wide soil sampling programs in 2022 and 2023 defined two extensive Cu-Mo-As geochemical anomalies: the Berezski and Aimandai Trends, both considered priority targets for follow-up exploration drilling. Initial drilling on the Berezski Trend in late 2024 returned high-grade porphyry/epithermal copper and gold mineralization.

References

1Bozshakol Mine Reserves - Kaz Minerals 2020 annual report

kaz-minerals-annual-report-2020.pdf

2Bozshakol 2024 Production Report

https://www.kazminerals.com/media/23240/q4-2024-production-report_final.pdf

Issuance of DSUs:

The Company has granted an aggregate of 30,936 deferred share units ("DSU") to certain independent directors at a price of C$0.99 per DSU. The DSUs were granted in consideration for services rendered by the directors for the quarter ended July 31, 2025, in lieu of cash. The DSUs were granted in accordance with the Company's Equity Incentive Plan and were priced based on the volume weighted average price of the Company's common shares on the TSX Venture Exchange for the last five trading days immediately preceding the grant date. To date, the Company has issued a total of 70,434 DSUs to its independent directors.

Qualified Person: The scientific and technical disclosure for this news release has been prepared under supervision of and approved by Matthew Booth, Vice President of Exploration, of Arras Minerals Corp., a Qualified Person for the purposes of NI 43-101. Mr. Booth has over 20 years of mineral exploration experience and is a Qualified Person member of the American Institute of Professional Geologists (CPG 12044).

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, MAusIMM CP(Geo)

Chief Executive Officer and Director

INVESTOR RELATIONS:

+1 604 687 5800

This email address is being protected from spambots. You need JavaScript enabled to view it.

Further information can be found on:

-

the Company's website https://www.arrasminerals.com or

-

follow us on LinkedIn: https://www.linkedin.com/company/arrasminerals or

-

follow us on X (formerly Twitter): https://twitter.com/arrasminerals

About Arras Minerals Corp: Arras is a Canadian exploration and development company advancing a portfolio of copper and gold assets in northeastern Kazakhstan, including the Elemes copper-gold porphyry project. The Company has established one of the largest land packages in the country prospective for copper and gold. In December 2023, the Company entered into a strategic alliance with Teck Resources Limited ("Teck") in which Teck may sole fund a US$5 million generative exploration program over a portion of the Arras license package in 2024-2025. The Company's shares are listed on the TSX-V under the trading symbol "ARK" and on the OTCQB under the trading symbol "ARRKF".

Cautionary Note to U.S. Investors concerning estimates of Measured, Indicated, and Inferred Resources: This press release uses the terms "measured resources", "indicated resources", and "inferred resources" which are defined in, and required to be disclosed by, NI43-101. The Company advises U.S. investors that these terms are not recognized by the SEC. The estimation of measured, indicated and inferred resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that measured and indicated mineral resources will be converted into reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. U.S. investors are cautioned not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations, however the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, the information contained in this press release may not be comparable to similar information made public by U.S. companies that are not subject NI 43-101.

Cautionary note regarding forward-looking statements: This news release contains forward-looking statements regarding future events and Arras' future results that are subject to the safe harbors created under the U.S. Private Securities Litigation Reform Act of 1995, the Securities Act of 1933, as amended, and the Exchange Act, and applicable Canadian securities laws. Forward-looking statements include, among others, statements regarding plans and expectations of the exploration program Arras is in the process of undertaking. These statements are based on current expectations, estimates, forecasts, and projections about Arras' exploration projects, the industry in which Arras operates and the beliefs and assumptions of Arras' management. Words such as "expects," "anticipates," "targets," "goals," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "may," variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements. Forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond management's control, including undertaking further exploration activities, the results of such exploration activities and that such results support continued exploration activities, unexpected variations in ore grade, types and metallurgy, volatility and level of commodity prices, the availability of sufficient future financing, and other matters discussed under the caption "Risk Factors" in the Management Discussion and Analysis filed on the Company's profile on SEDAR on February 27, 2025. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Any forward-looking statement made by the Company in this release is based only on information currently available and speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise.