Highlights:

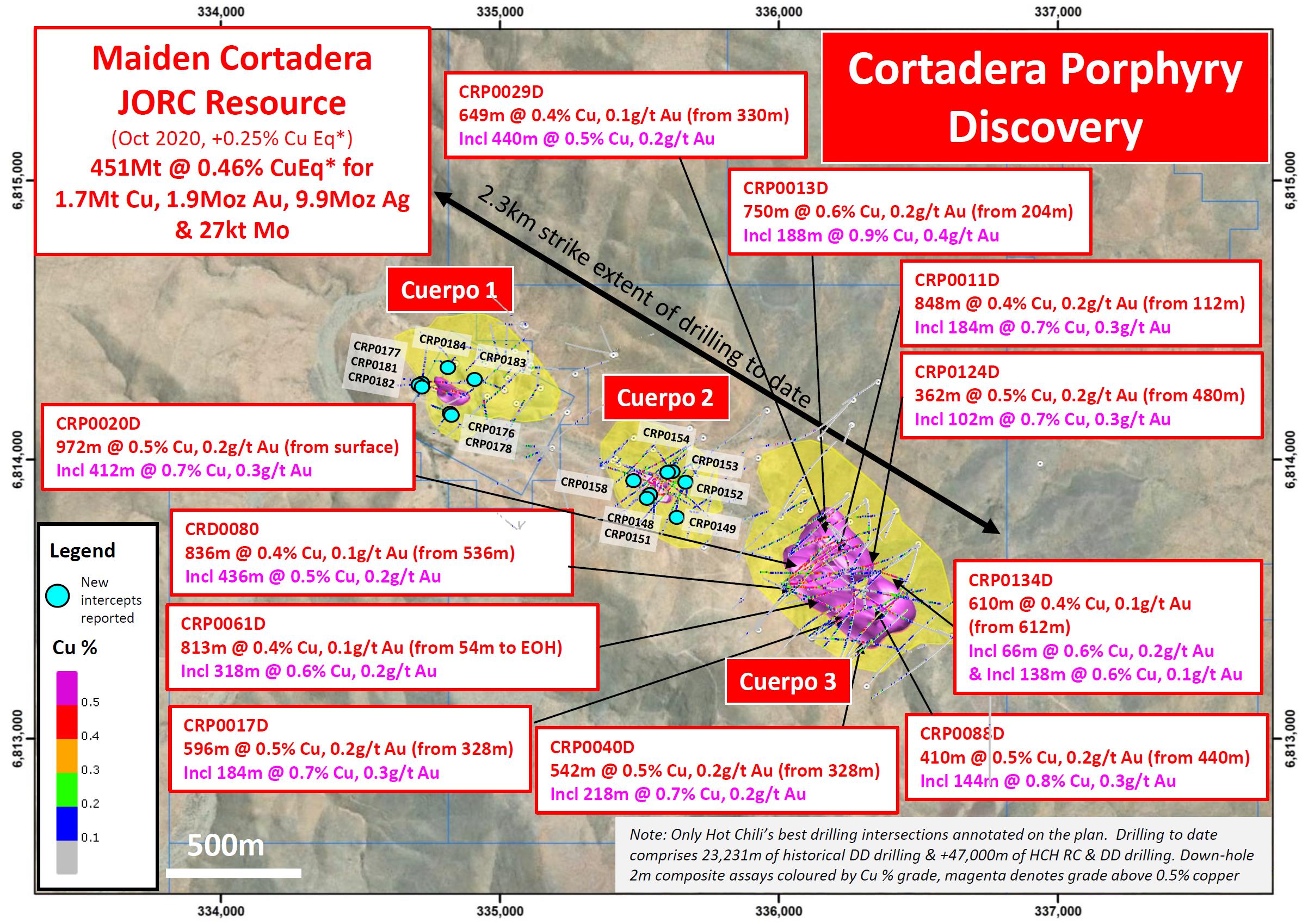

- New drill results from the Cortadera copper-gold porphyry deposit in Chile confirm growth of shallow resources at both Cuerpo 1and 2. These include:

- CRP0148 - 156m grading 0.4% CuEq* (0.4% copper (Cu), 0.1g/t gold (Au)) from surface, including 32m grading 0.6%CuEq* (0.5% copper (Cu), 0.2g/t gold (Au))from 90m depth

- CRP0183 - 80m grading0.4% CuEq* (0.4% copper (Cu),0.1g/t gold (Au)) from 10m depth including 12m grading0.6%CuEq* (0.6% copper (Cu), 0.1g/t gold (Au)) from 44m depth

- CRP0178 - 72m grading0.4% CuEq* (0.4% copper (Cu), 0.1g/t gold (Au)) from surface including 28m grading0.7%CuEq* (0.7% copper (Cu), 0.1g/t gold (Au)) from surface

- CRP0176 - 114m grading 0.3% CuEq* (0.3% copper (Cu), 0.1g/t gold (Au)) from surface including 24m grading0.6%CuEq* (0.6% copper (Cu), 0.1g/t gold (Au)) from surface

- CRP0158 - 62m grading0.4% CuEq* (0.4% copper (Cu), 0.1g/t gold (Au)) from 4m depth including 18m grading0.7%CuEq (0.6% copper (Cu), 0.2g/t gold (Au)) from 26m depth

- Exploration drilling commenced across the Productora central porphyry target, immediately adjacent to the Productora Mineral Resource – several large copper-gold targets scheduled for testing this year

- Further assay results from Cortadera being compiled for release in advance of a major resource upgrade in Q1 this year, following over 46,000m of additional drilling completed in 2021

Hot Chili Limited (ASX: HCH) (TSXV:HCH) (OTCQB: HHLKF) (“Hot Chili” or “Company”) is pleased to announce that recent drill results from its Cortadera copper-gold discovery continue to expand the deposit ahead of a global resource upgrade for the Company’s Costa Fuego coastal copper development in Chile.

Three months of drilling results from the end of the Company’s 2021 drilling campaign at Cortadera are being compiled and further announcements are expected.

Hot Chili’s Managing Director, Christian Easterday, said 2022 is shaping up to be an exciting year following a very strong set of achievements in 2021.

“We commence the year with $34 million in treasury, 100 percent ownership of Cortadera, Glencore as a strategic investor and our Company now consolidated and dual-listed in Canada.

“It is pleasing to see further growth in Cortadera’s open pit potential with these new drill results and we look forward to announcing further results soon.

“A resource upgrade this quarter and a combined pre-feasibility study in the third quarter will position Costa Fuego as a production front-runner in the senior copper development space this year.

“In addition, we have kicked off our next phase of growth, with first drilling well underway across the first of several large exploration targets we will be testing this year, all capable of materially lifting the scale and economics of Costa Fuego even further.”

New Drill Results Expand Shallow Resource Potential at Cortadera

Drilling in late 2021, focussed on expanding any remaining open flanks on each of Cortadera’s three porphyries and completing required in-fill drill holes for upgrading resource classification.

Initial results analysed from shallow Reverse Circulation (RC) drilling across Cuerpo 1 and Cuerpo 2 has confirmed wide intersections of copper-gold mineralisation from surface across both porphyries.

Cuerpo 2 has recorded some of the highest grade copper results at Cortadera and the recent campaign to delineate the shallow mineralisation has proven successful. Expansion of the +0.4% CuEq mineralisation from surface was bolstered by several drillholes, particularly to the south and east of Cuerpo 2.

So far, up to five drillholes have recorded significant intercepts of +0.3% CuEq mineralisation at a maximum of 36 m downhole with the majority from less than 10 m downhole. This material is predominately within the oxidised weathering zone and suggests that an expansion of the +0.4% Cu material laterally and vertically is likely at Cuerpo 2.

In addition, several wide intersections of mineralisation were recorded across Cuerpo 1, further expanding the +0.3 CuEq* mineralisation extent.

2022 Drilling Campaign Underway

Hot Chili has commenced an initial 20,000m exploration drilling programme to test several prioritised, large copper-gold targets within its combined Costa Fuego landholding in Chile.

RC drilling commenced in late December 2021 across the Productora central target, located immediately adjacent to the Productora resource and measuring 1.2km by 1.0km in dimension.

Three of eight first-pass RC drill holes are complete, and several diamond hole extensions are planned once RC drill results are received.

Additional targets located within the consolidated Costa Fuego landholdings (Productora, Santiago Z and El Fuego) are scheduled for drilling over the coming months. The Company has received regulatory approval for platform clearing at Santiago Z, which is planned to commence in the coming month.

In addition, drilling is planned across multiple extensional targets located within the Cortadera landholding, outside of the Cortadera resource window.

All priority targets have been selected based on their potential to add further bulk tonnage scale to the Costa Fuego development or alternatively provide higher grade ore sources for early production.

News Flow and Key Catalysts in 2022

Hot Chili is fully funded for 18 months to accelerate its growth and development plan for Costa Fuego. The Company expects to provide further news flow over the coming weeks, including:

- Further Cortadera drilling results being received, reviewed and compiled from 2021 resource drilling.

- Development study updates related to advances in mining optimisations and metallurgical workstreams for the Costa Fuego combined Pre-feasibility study,

- Corporate updates, and

- Exploration drilling updates as results are received Key

Catalysts expected this year include:

1. Global Mineral Resource upgrade for Costa Fuego expected in Q1

2. Off-take agreement with Glencore (60% of first 8 years of production) expected in Q1

3. Pre-feasibility study for Costa Fuego expected in Q3

This announcement is authorised by the Board of Directors for release to ASX. For more information please contact:

|

Christian Easterday |

Tel: +61 8 9315 9009 |

|

Managing Director – Hot Chili |

Email: This email address is being protected from spambots. You need JavaScript enabled to view it. |

|

Penelope Beattie |

Tel: +61 8 9315 9009 |

|

Company Secretary – Hot Chili |

Email: This email address is being protected from spambots. You need JavaScript enabled to view it. |

|

ASX Investor |

|

|

Investor & Public Relations (Australia) |

Email: This email address is being protected from spambots. You need JavaScript enabled to view it. |

|

Harbor Access LLC |

This email address is being protected from spambots. You need JavaScript enabled to view it. |

|

Investor & Public Relations (Canada) |

This email address is being protected from spambots. You need JavaScript enabled to view it. |

or visit Hot Chili’s website at www.hotchili.net.au

Table 1 New Significant RC Drill Results at Cortadera

|

|

Coordinates |

Azim |

Dip |

Hole |

Intersection |

Interval |

Copper |

Gold |

Silver |

Molybdenum |

Cu Eq |

|||

|

Hole_ID |

Depth |

|||||||||||||

|

North |

East |

RL |

From |

To |

(m) |

(% Cu) |

(g/t Au) |

(ppm Ag) |

(ppm Mo) |

(% Cu Eq) |

||||

|

CRP0148 |

6813870 |

335545 |

993 |

84 |

-61 |

252 |

0 |

252 |

252 |

0.3 |

0.1 |

0.6 |

4 |

0.4 |

|

including |

0 |

156 |

156 |

0.4 |

0.2 |

0.8 |

5 |

0.4 |

||||||

|

or |

|

|

|

|

|

|

|

|

||||||

|

including |

90 |

122 |

32 |

0.5 |

0.2 |

0.9 |

2 |

0.6 |

||||||

|

CRP0149 |

6813791 |

335636 |

1009 |

10 |

-58 |

266 |

112 |

204 |

92 |

0.3 |

0.1 |

0.4 |

3 |

0.3 |

|

CRP0151 |

6813865 |

335540 |

992 |

169 |

-75 |

162 |

0 |

124 |

124 |

0.2 |

0.1 |

0.5 |

15 |

0.3 |

|

CRP0152 |

6813938 |

335679 |

982 |

180 |

-60 |

162 |

10 |

158 |

148 |

0.2 |

0.1 |

0.5 |

10 |

0.2 |

|

CRP0153 |

6813959 |

335619 |

977 |

31 |

-60 |

102 |

36 |

86 |

50 |

0.3 |

0.1 |

0.5 |

18 |

0.3 |

|

CRP0154 |

6813959 |

335619 |

977 |

321 |

-60 |

168 |

8 |

114 |

106 |

0.2 |

0.1 |

0.4 |

17 |

0.2 |

|

CRP0158 |

6813926 |

335491 |

977 |

200 |

-60 |

150 |

4 |

66 |

62 |

0.4 |

0.1 |

0.6 |

11 |

0.4 |

|

including |

26 |

44 |

18 |

0.6 |

0.2 |

1 |

3 |

0.7 |

||||||

|

CRP0176 |

334831 |

6814172 |

953 |

143 |

-71 |

252 |

0 |

114 |

114 |

0.3 |

0.1 |

0.6 |

46.8 |

0.3 |

|

including |

0 |

24 |

24 |

0.6 |

0.1 |

1.2 |

7.7 |

0.6 |

||||||

|

CRP0177 |

334735 |

6814270 |

976 |

10 |

-60 |

294 |

14 |

34 |

20 |

0.3 |

0.1 |

0.5 |

34 |

0.3 |

|

CRP0178 |

334834 |

6814171 |

953 |

210 |

-70 |

312 |

0 |

72 |

72 |

0.4 |

0.1 |

0.8 |

46 |

0.4 |

|

including |

0 |

28 |

28 |

0.7 |

0.1 |

1.5 |

17 |

0.7 |

||||||

|

CRP0183 |

334935 |

6814283 |

960 |

257 |

-74 |

234 |

10 |

90 |

80 |

0.4 |

0.1 |

0.8 |

8 |

0.4 |

|

including |

44 |

56 |

12 |

0.6 |

0.1 |

1.1 |

12 |

0.6 |

||||||

|

and |

192 |

214 |

22 |

0.3 |

0 |

0.7 |

28 |

0.3 |

||||||

|

CRP0184 |

334814 |

6814328 |

957 |

199 |

-75 |

150 |

0 |

80 |

80 |

0.2 |

0.1 |

0.3 |

3 |

0.2 |

|

and |

124 |

150 |

26 |

0.4 |

0.1 |

1.2 |

2 |

0.4 |

||||||

Significant intercepts are calculated above a nominal cut-off grade of 0.2% Cu. Where appropriate, significant intersections may contain up to 30m down-hole distance of internal dilution (less than 0.2% Cu). Significant intersections are separated where internal dilution is greater than 30m down-hole distance. The selection of 0.2% Cu for significant intersection cut-off grade is aligned with marginal economic cut-off grade for bulk tonnage polymetallic copper deposits of similar grade in Chile and elsewhere in the world.

Down-hole significant intercept widths are estimated to be at or around true-widths of mineralisation

* Copper Equivalent (CuEq) reported for the drill holes were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. Average Metallurgical Recoveries used were: Cu=83%, Au=56%, Mo=82%, and Ag=37%

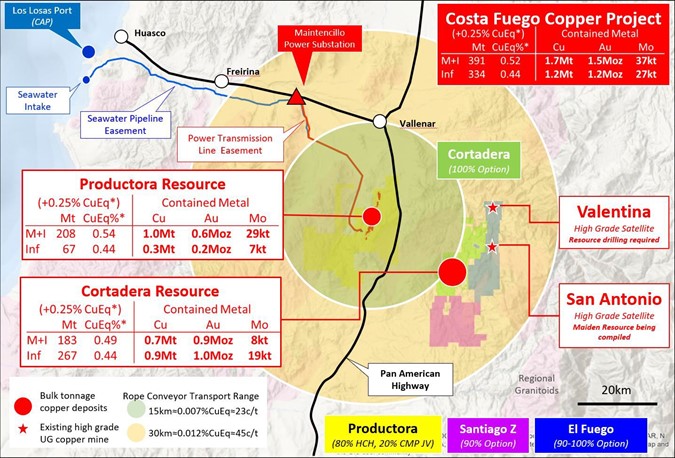

Figure 1 Location of Productora and the Cortadera discovery in relation to the coastal range infrastructure of Hot Chili's combined Costa Fuego copper project, located 600km north of Santiago in ChileRefer to ASX Announcement “Costa Fuego Becomes a Leading Global Copper Project” (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC Consultants

Figure 1 Location of Productora and the Cortadera discovery in relation to the coastal range infrastructure of Hot Chili's combined Costa Fuego copper project, located 600km north of Santiago in ChileRefer to ASX Announcement “Costa Fuego Becomes a Leading Global Copper Project” (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC Consultants

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Reported on a 100% Basis - combining Cortadera and Productora Mineral Resources using a +0.25% CuEq reporting cut-off grade

Figure 2 Plan view across the Cortadera discovery area displaying the location of new RC drill results (cyan) in relations to significant historical copper-gold DD intersections across Cuerpo 1, 2, and 3 tonalitic porphyry intrusive centres (represented by modelled copper envelopes, yellow- +0.1% Cu and magenta +0.4% Cu).

Figure 2 Plan view across the Cortadera discovery area displaying the location of new RC drill results (cyan) in relations to significant historical copper-gold DD intersections across Cuerpo 1, 2, and 3 tonalitic porphyry intrusive centres (represented by modelled copper envelopes, yellow- +0.1% Cu and magenta +0.4% Cu).

Figure 3 Plan view across the Cuerpo 1 of the Cortadera discovery area displaying significant copper-gold DD intersections since the October 2020 resource estimate. The plan view displays the Mineral Resource extents (represented by modelled copper envelope, yellow- +0.1% Cu). Note the new significant results reported including CRP0183, CRP0176 and CRP0178. All new results are shown by cyan collars.

Figure 3 Plan view across the Cuerpo 1 of the Cortadera discovery area displaying significant copper-gold DD intersections since the October 2020 resource estimate. The plan view displays the Mineral Resource extents (represented by modelled copper envelope, yellow- +0.1% Cu). Note the new significant results reported including CRP0183, CRP0176 and CRP0178. All new results are shown by cyan collars.

Figure 4 Plan view across the Cuerpo 2 of the Cortadera discovery area displaying significant copper-gold DD intersections since the October 2020 resource estimate. The plan view displays the Mineral Resource extents (represented by modelled copper envelope, yellow- +0.1% Cu). Note the new significant results reported including CRP0158, and CRP0148. All new results are shown by cyan collars.

Figure 4 Plan view across the Cuerpo 2 of the Cortadera discovery area displaying significant copper-gold DD intersections since the October 2020 resource estimate. The plan view displays the Mineral Resource extents (represented by modelled copper envelope, yellow- +0.1% Cu). Note the new significant results reported including CRP0158, and CRP0148. All new results are shown by cyan collars.

Figure 5 View across Productora resource looking SE. The figure displays the location of the Productora Central target where first-pass RC drilling is underway

Figure 5 View across Productora resource looking SE. The figure displays the location of the Productora Central target where first-pass RC drilling is underway

Qualifying Statements

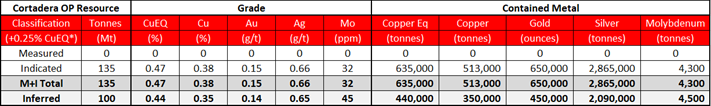

The Mineral Resource summary for the Costa Fuego Project is presented in the following tables.

Productora Mineral Resource Summary - reported by classification (open pit, using +0.25% CuEq cut-off grade), 28 October 2021

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with CIM and NI-101. Metal rounded to nearest thousand, or if less, to the nearest hundred.

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula:: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%

Cortadera Mineral Resource Summary – reported by classification (using +0.25% CuEq cut-off grade) and by open pit (top), underground (middle) and total (bottom), 28th October 2021

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred.

Copper Equivalent (CuEq) reported for the drill holes were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. Average Metallurgical Recoveries used were: Cu=83%, Au=56%, Mo=82%, and Ag=37%

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person’s Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a ‘Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person’s Statement- Productora Mineral Resources

The information in this Announcement that relates to the Productora Project Mineral Resources, is based on information compiled by Mr N Ingvar Kirchner. Mr Kirchner is employed by AMC Consultants (AMC). AMC has been engaged on a fee for service basis to provide independent technical advice and final audit for the Productora Project Mineral Resource estimates. Mr Kirchner is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM) and is a Member of the Australian Institute of Geoscientists (AIG). Mr Kirchner has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (the JORC Code 2012). Mr Kirchner consents to the inclusion in this report of the matters based on the source information in the form and context in which it appears.

Competent Person’s Statement- Cortadera and Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for the Cortadera and combined Costa Fuego Project is based on information compiled by Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed as an associate Principal Geologist of Wood, who was engaged by Hot Chili Limited. Elizabeth Haren has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Elizabeth Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears. For further information on the Costa Fuego Project, refer to the technical report titled "Resource Report for the Costa Fuego Technical Report", dated December 13, 2021, which is available for review under Hot Chili's profile at www.sedar.com.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains “forward-looking statements”. All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake any obligation to release publicly any revisions to any “forward-looking statement” to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person

Disclaimer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Appendix 1. JORC Code Table 1 for Cortadera

Section 1 Sampling Techniques and Data

About Hot Chili

Hot Chili Limited is a mineral exploration company with assets in Chile. The Company's flagship project, Costa Fuego, is the consolidation into a hub of the Cortadera porphyry copper-gold discovery and the Productora copper-gold deposit, set 14 km apart in an excellent location – low altitude, coastal range of Chile, infrastructure rich, low capital intensity.The Costa Fuego landholdings, contains an Indicated Resource of 391Mt grading 0.52% CuEq (copper equivalent), containing 1.7 Mt Cu, 1.5 Moz Au, 4.2 Moz Ag, and 37 kt Mo and an Inferred Resource of 334Mt grading 0.44% CuEq containing 1.2Mt Cu, 1.2 Moz Au, 5.6 Moz Ag and 27 kt Mo, at a cut-off grade of 0.25% CuEq.The Company is working to advance its Costa Fuego Project through a preliminary feasibility study (followed by a full FS and DTM), and test several high-priority exploration targets.

Certain statements contained in this news release, including information as to the future financial or operating performance of Hot Chili and its projects may include statements that are "forward‐looking statements" which may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, and capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions.These forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Hot Chili, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Hot Chili disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this news release or to reflect the occurrence of unanticipated events, other than as may be required by law. The words "believe", "expect", "anticipate", "indicate", "contemplate", "target", "plan", "intends", "continue", "budget", "estimate", "may", "will", "schedule" and similar expressions identify forward‐looking statements.

All forward‐looking statements made in this news release are qualified by the foregoing cautionary statements. Investors are cautioned that forward‐looking statements are not a guarantee of future performance and accordingly investors are cautioned not to put undue reliance on forward‐looking statements due to the inherent uncertainty therein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Contact Details

Investor Relations

Graham Farrell

+1 416-842-9003

This email address is being protected from spambots. You need JavaScript enabled to view it.

Investor Relations

Jonathan Paterson

+1 475-477-9401

This email address is being protected from spambots. You need JavaScript enabled to view it.

Hot Chili, CEO

Christian EasterDay

This email address is being protected from spambots. You need JavaScript enabled to view it.

Company Website