Toronto, Ontario--(Newsfile Corp. - May 23, 2025) - Omai Gold Mines Corp. (TSXV: OMG) (OTCQB: OMGGF) ("Omai Gold" or the "Company") is pleased to announce that drilling has commenced on a deep hole that is planned to initially drill across the Gilt Creek gold deposit, then to continue to drill in order to test the adjacent Wenot gold deposit at a vertical depth of approximately 1,100m. Gilt Creek and Wenot are two adjacent orogenic gold deposits on the Company's 100%-owned Omai Gold Project in Guyana, South America. The Wenot open pit deposit consists of multiple near-vertical shear-hosted gold zones that have been identified along a 2.5km strike that have been drilled from surface to maximum depths of 450-525m. The Company's 2024-25 drill program, now surpassing 25,000m, has focused on exploring the size potential of this very large Wenot open pit deposit down to a depth of 450-500m.

This new hole (25ODD-122) will provide additional data as it drills across the Gilt Creek gold deposit then, very significantly, is planned to continue a further 600m-800m to explore for the extension of the near-vertical Wenot gold zones at approximately 1,000m to 1,200m vertical depth or roughly 600m below the known deposit. A gold intersection at this depth would not add to the Wenot resources in the short-term, however, would be indicative of the upside and long term mine life potential of this large Omai gold camp.

Elaine Ellingham, President & CEO, commented: "Our 2025 goal is to more fully realize the expansion potential of the gold resources at Omai, with a vision towards a multi-decade mine life. By accelerating our testing of the Wenot deposit starting in 2024, our drilling has provided ample evidence of the continuity of the gold zones down to depths of at least 500m, establishing Omai as one of the largest and fastest-growing gold camps in the Guiana Shield greenstone belt. We believe that we are on the path to maximizing the value of this large, two-deposit gold project with the current resource expansion drill program at Wenot, the updated MRE for Wenot that is underway, and the updated Preliminary Economic Assessment ("PEA") to follow. By testing the Wenot deposit at much greater depths we hope to further unveil the blue-sky expansion potential of the Omai property, which we believe would unlock further value for all stakeholders."

The Company has completed 46 holes totalling 29,050m since the completion of the most recent NI 43-101 Mineral Resource Estimate ("MRE") for Wenot in February 2024. An updated NI 43-101 MRE to incorporate these new results has commenced, while additional assay results are pending for several holes. Drilling continues on the Wenot expansion drill program with two drills.

This new drill hole (25ODD-122) is designed to achieve several objectives: 1) to assist in the Gilt Creek mine planning and metallurgical studies that will facilitate its inclusion into an updated PEA mine plan anticipated later in 2025, 2) to further explore the lateral extent of the Gilt Creek intrusion-hosted gold deposit, and, very significantly, 3) to explore the open depth potential of Wenot well below the known limits of the deposit, that could be indicative of the potential for a multi-decade mine life for the Omai project. This deep hole is expected to be 1,800 to 2,000m in length, well within the capability of the drills on-site, however will be closely monitored for successful completion.

Gilt Creek Deposit Background

The Gilt Creek gold deposit is a 500m by 275m intrusion-hosted orogenic gold deposit. It is located approximately 500m north of the Wenot gold deposit on the Omai property (Figure 1). The MRE for Gilt Creek comprises Indicated Mineral Resources of 1,151,000 ounces gold averaging 3.22 g/t Au and Inferred Mineral Resources of 665,000 ounces gold averaging 3.35 g/t Au, using a 1.5 g/t Au cutoff and a US$1,700/oz gold price. Initial engineering studies anticipate a ramp from surface to access this deposit for underground mining. The very wide mineralized zones are likely amenable to sub-level open stoping and transverse open stoping, with follow-up cut-and-fill mining.

The Gilt Creek gold deposit is relatively shallow with approximately 76% of the MRE gold ounces lying at vertical depths of between 300m and 600m. Limited drilling of the Omai intrusion below 600m continued to encounter gold mineralization down to 967m. Drill hole 24ODD-095 completed in December, 2024 confirmed gold mineralization within the intrusive host rock from just 225m to a depth of 850m below surface.

Wenot Extension Target

The Wenot deposit is a 2.5km long, shear-hosted, orogenic gold deposit with a current Indicated MRE1 of 834,000 ounces grading 1.48 g/t Au and Inferred MRE of 1,614,000 ounces grading 1.99 g/t Au. Gold mineralization at Wenot is dominantly hosted within multiple, parallel, near-vertical zones along the east-west trending shear corridor. Gold zones at Wenot have been identified from surface to a maximum vertical depth of 555m.

A late post-mineralization diabase dike that underlies the Gilt Creek pit extends under Wenot and has been intersected in a few holes from 480m to 510m depth. The Wenot orogenic gold zones pre-date this later dike and therefore most likely continue below. The recent drilling provides ample evidence that the gold grades and zone widths increase with depth and appear to potentially support underground mining at greater depths. There are multiple examples of orogenic gold deposits extending to great depths and confirmation of this for the Wenot deposit could have significant impact for ensuring a longer potential mine life for the Omai gold project. The Gilt Creek deposit is robust and, pending the updated PEA later in 2025, may support an economically attractive underground mining scenario. Therefore, the discovery of Wenot gold zones extending to depth just 500m south of an underground Gilt Creek mine could allow accelerated underground access to a deeper Wenot deposit, far earlier than from surface or an eventual Wenot pit bottom.

With two significant gold deposits, both with indications of continuations at depth, the Omai property offers significant upside potential. Drilling to date has been highly successful and the Company continues to be well-funded with a cash position at Quarter end, March 31, 2025 of approximately C$29 million.

1 NI43-101 Technical Report dated May 21, 2024 "UPDATED MINERAL RESOURCE ESTIMATE AND PRELIMINARY ECONOMIC ASSESSMENT OF THE OMAI GOLD PROPERTY, POTARO MINING DISTRICT NO.2, GUYANA" was prepared by Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc. is available on SEDAR+ and on the Company's website. It includes a Wenot resource of 834,000 indicated ounces of gold averaging 1.48 g/t Au and 1,614,000 inferred ounces of gold averaging 1.99 g/t Au, and the adjacent Gilt Creek resource of 1,151,000 indicated ounces of gold averaging 3.22 g/t Au and 665,000 inferred ounces of gold averaging 3.35 g/t Au.

2 Past production at the Omai Mine (1993-2005) is summarized in several Cambior Inc. documents available on SEDARplus.ca, including March 31, 2006 AIF and news release August 3, 2006.

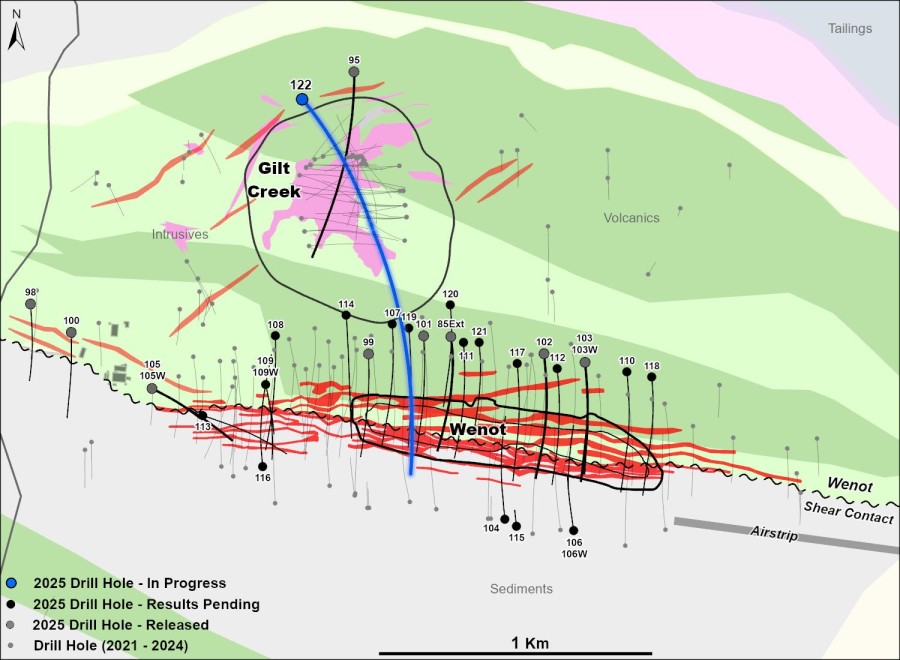

Figure 1. Plan map showing location of Hole 25ODD-122

Figure 1. Plan map showing location of Hole 25ODD-122

Figure 2. Cross-section of deep hole 25ODD-122, looking east

Figure 2. Cross-section of deep hole 25ODD-122, looking east

Qualified Person

Elaine Ellingham is a Qualified Person (QP) under National Instrument 43-101 "Standards of Disclosure for Mineral Projects" and has approved the technical information contained in this news release. Ms. Ellingham is not considered to be independent for the purposes of National Instrument 43-101.

ABOUT OMAI GOLD

Omai Gold Mines Corp. is a Canadian gold exploration and development company focused on rapidly expanding the two orogenic gold deposits at its 100%-owned Omai Gold Project in mining-friendly Guyana, South America. Since 2021, the Company has quickly established the Omai Gold Project as one of the fastest growing and well-endowed gold camps in the prolific Guiana Shield greenstone belt. In February 2024 the Company announced an updated NI 43-101 Mineral Resource Estimate1 ("MRE") of 2.0 million ounces of gold Indicated and 2.3 million ounces Inferred, comprising of both the Wenot open pit deposit and the adjacent Gilt Creek underground deposit. This was followed by an initial baseline Preliminary Economic Assessment ("PEA") in April 2024, which contemplated an open pit-only development scenario and included only 45% of the Omai Gold Project MRE. Subsequent to the 2024 MRE, the Company has been aggressively drilling to expand gold resources at the Wenot deposit and has identified additional wide zones of high-grade gold mineralization. In 2025 Omai Gold plans to continue its impactful drill programs, announce an updated and expanded MRE, and complete an updated PEA which would include an expanded Wenot open pit deposit and an underground mining scenario at Gilt Creek. The Omai Gold Mine produced over 3.7 million ounces of gold from 1993 to 20052, ceasing operations when gold was below US$400 per ounce. The Omai site benefits from much existing infrastructure and will soon be connected to the two largest cities in Guyana, Georgetown and Linden, via paved road.

For further information, please see our website www.omaigoldmines.com or contact:

Elaine Ellingham, P.Geo.

President & CEO

This email address is being protected from spambots. You need JavaScript enabled to view it.

+1.416.473.5351

David Stewart, P.Eng.

VP Corporate Development & Investor Relations

This email address is being protected from spambots. You need JavaScript enabled to view it.

+1.647.294.8361

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the timing of completion of exploration, trenching and drill programs, and the potential for the Omai Gold Project to allow Omai to build significant gold Mineral Resources at attractive grades, and forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements.

Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties; delay or failure to receive regulatory approvals; the price of gold and copper; and the results of current exploration. Further, the Mineral Resource data set out in the Omai Gold news release are estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Further, the Preliminary Economic Assessments and related data discussed in this news release are estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Omai Gold Mines Corp. to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to international operations; actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold, copper and other minerals and metals; general market conditions; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; uncertainty of access to additional capital; delays in obtaining governmental approvals or in the completion of development or construction activities.