Transformative agreement to secure control of America's newest porphyry copper district

- Barrick increases its equity stake in the Company and positions Hercules to advance a district-scale exploration strategy moving forward.

- Agreement grants Hercules an option to acquire the 73-kilometre "Olympus" claim belt, extending in both directions from its Leviathan porphyry copper discovery.

- Expands the Company's total land position from 26,000 acres to over 100,000 acres.

Toronto, Ontario--(Newsfile Corp. - July 28, 2025) - Hercules Metals Corp. (TSXV: BIG) (OTCQB: BADEF) (FSE: C0X) ("Hercules" or the "Company") is pleased to announce that Hercules and its wholly-owned U.S. subsidiary, Anglo-Bomarc, U.S., Inc. ("Anglo") have entered into a strategic option agreement (the "Agreement") with Barrick Gold Exploration Inc. ("BGE"), a wholly-owned U.S. subsidiary of Barrick Mining Corporation (NYSE: B) (TSX: ABX) ("Barrick") to lead a consolidated district-scale exploration strategy and earn a 100% interest (the "Option") in over 74,000 acres of unpatented mining claims (the "Olympus Claims") surrounding the Company's Hercules property and the flagship Leviathan porphyry discovery in western Idaho (the "Property"). In exchange, Barrick will increase its equity position in the Company.

Chris Paul, CEO and Director of Hercules Metals, commented, "Consolidating the 73-kilometre Olympus copper belt represents a once-in-a-lifetime opportunity for Hercules shareholders and signifies a strong endorsement of our team's execution and vision. We are honoured by Barrick's confidence as we advance Leviathan alongside a greatly expanded district-scale exploration strategy moving forward."

"The Leviathan system hosts evidence of a rare and exceptional copper-silver enrichment event which formed during a regional tectonic episode that potentially affected the entire Olympus belt of claims, making it one of the largest and most compelling new copper projects in the United States today."

Mr. Paul concluded, "This transaction comes at a time of major change for mining in the United States, with significant tailwinds in the form of streamlined federal permitting and a potential 50% tariff on foreign copper. The impacts of this, alongside rising prices and declining reserves in the U.S., positions Hercules to deliver exceptional value for our shareholders moving forward."

Overview of the Transaction

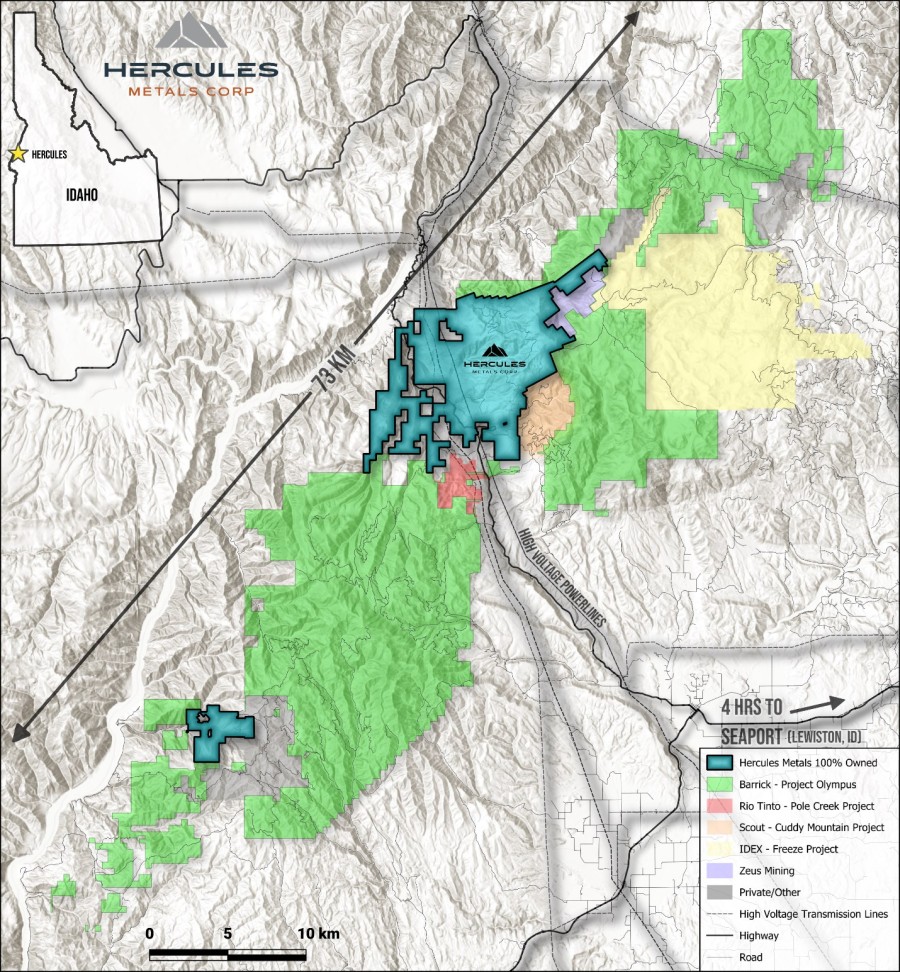

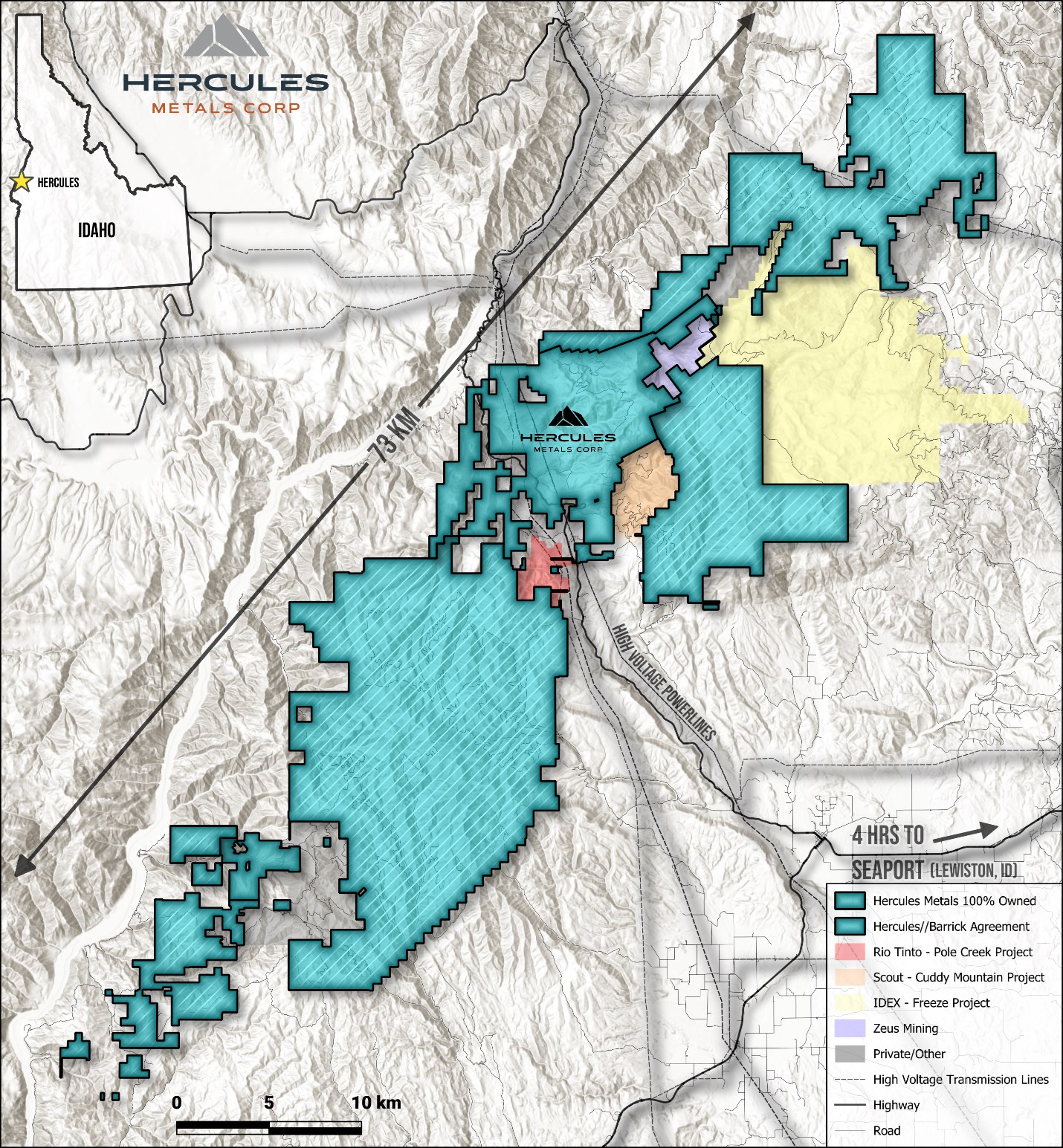

The Option, if exercised, will increase the Company's original 26,000-acre land position to over 100,000 acres and establish Hercules as a controlling claim holder in one of the most prospective new porphyry copper belts in the United States (Figures 1 and 2). The Olympus Claims package encompasses numerous porphyry targets along trend from the Leviathan system, enabling Hercules to deploy its proprietary strategy of specialized mapping and deep-penetrating geophysics to rapidly identify additional porphyry targets for drill testing.

Pursuant to the Agreement, Hercules will make staged payments, either through issuance of common shares in its capital (the "Shares"), or cash, at its election (the "Option Payments"), to BGE or its designee totalling C$8 million, over three years. On exercise of the Agreement, Anglo will grant BGE a net smelter return royalty (the "NSR Royalty") of 1% on the Olympus Claims, which can be bought back and reduced to 0.25%.

Figure 1: The Hercules Copper Belt claim map, before acquisition of the Olympus Claims.

Figure 1: The Hercules Copper Belt claim map, before acquisition of the Olympus Claims.

Figure 2: The Hercules Copper Belt claim map, with the acquisition of the Olympus Claims.

Figure 2: The Hercules Copper Belt claim map, with the acquisition of the Olympus Claims.

Terms of the Agreement

Pursuant to the terms and subject to the conditions of the Agreement, the Company has the Option to earn a 100% interest in the Olympus Claims, subject to the NSR Royalty, by issuing Shares to BGE or its designee according to the following schedule:

| Payment Date | Option Payments (VWAP C$)* |

| Upfront within 5 days of receipt of TSXV Approval | $2,000,000 |

| Unless Hercules terminates the option in advance of an anniversary, Hercules will issue: | |

| First Anniversary | $2,000,000 |

| Second Anniversary | $2,000,000 |

| Third Anniversary | $2,000,000 |

| TOTAL | $8,000,000 |

*The Option Payments issuable pursuant to the Agreement will be: (i) for the first payment, equal to the greater of the 5-day volume weighted average price ("VWAP") of the Shares on the TSX Venture Exchange (the "TSXV") prior to the issuance, and the price reflecting the maximum permitted discount for the Shares under the rules of the TSXV; and (ii) for the remaining Option Payments, equal to the greater of the 10-day VWAP of the Shares on the TSXV prior to each issuance, and the price reflecting the maximum permitted discount for the Shares under the rules of the TSXV.

During the term of the Agreement, the Company may elect to deliver cash payments to BGE, in lieu of share issuances, for the Option Payments. In addition, the Company has the right to accelerate its exercise of the option by making all of the Option Payments at any time.

During the term of the Agreement, the Company shall reimburse BGE for dollar amounts required by the United States Bureau of Land Management and recorders for the counties in which the Olympus Claims are located, to maintain the claims in good standing and record annual notices of intent to hold, for each relevant assessment year.

On exercise of the Agreement, Anglo will also grant BGE a 1% NSR from the sale of all mineral products on the Olympus Claims, of which ¾ (0.75% NSR) can be repurchased for a one-time lump sum payment of US$7.5 million to BGE, reducing the overall NSR to 0.25%.

Hercules will not issue any shares to BGE or its designee which would result in Barrick or its affiliates owning more than 19.9% of the Company's outstanding securities, including convertible securities. If any share issuance would exceed this threshold, Hercules will instead pay BGE or its designee a cash amount equal to the value of the excess shares.

Any Common Shares issued under the Option Agreement will be subject to a four month and one day hold period in accordance with applicable securities laws. The Agreement remains subject to acceptance of the TSXV. No finder fee is payable in connection with the Agreement.

MI 61-101 - Related Party Transaction

At the time the Agreement was agreed to, Barrick Mining Corporation owned 33,556,870 Common Shares, representing 12.82% of the voting rights attached to the issued and outstanding Shares and accordingly the Agreement and related issuances of Shares to Barrick or its affiliates thereunder constitutes a "related party transaction" as defined in Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The related party transaction is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to sections 5.5(a) and 5.7(1)(a), respectively, of MI 61-101 based on the fact that the fair market value of the Common Shares to be issued pursuant to the Agreement does not exceed 25% of the Company's market capitalization, as calculated in accordance with MI 61-101. The Agreement is not subject to disinterested shareholder approval.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved for disclosure by Dillon Hume, P.Geo. and Vice President, Exploration for the Company. Mr. Hume is a "Qualified Person" for Hercules Metals within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Hercules Metals Corp.

Hercules Metals Corp. (TSXV: BIG) (OTCQB: BADEF) (FSE: C0X) is an exploration Company focused on developing America's newest porphyry copper district, in Idaho.

The 100% owned Hercules Project located northwest of Cambridge, hosts the newly discovered Leviathan porphyry copper system, one of the most important new discoveries in the region to date. The Company is well positioned for growth through continued drilling, supported by a strategic investment from Barrick Mining Corporation.

With the potential for significant scale, the Company's management and board of directors aims to build on its proven track record which includes the discovery and development of numerous precious metals projects worldwide.

For further information please contact:

Chris Paul

CEO & Director

Telephone +1 (604) 670-5527

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Greg DiTomaso

Investor Relations

Telephone: +1 (647) 243-4074

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Dillon Hume

VP, Exploration

Telephone: +1 (604) 283-2043

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. Any securities referred to herein have not and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws of an exemption from such registration is available.

Disclaimer for Forward-Looking Information

This news release contains certain information that may be deemed "forward-looking information" with respect to the Company within the meaning of applicable securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Forward-looking information contained in this press release may include, without limitation, the expected closing of the Agreement and issuance of Common Shares, the expected TSXV approval of the Agreement, the execution of future exploration programs on the Property; assay results of future drill holes; results of operations, and the expected financial performance of the Company.

Although the Company believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature, forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; the Covid-19 pandemic; adverse industry events; the receipt of required regulatory approvals and the timing of such approvals; that the Company maintains good relationships with the communities in which it operates or proposes to operate, future legislative and regulatory developments in the mining sector; the Company's ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of the Company to implement its business strategies; competition; the risk that any of the assumptions prove not to be valid or reliable, which could result in delays, or cessation in planned work, risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits, the possibility that results will not be consistent with the Company's expectations, as well as other assumptions risks and uncertainties applicable to mineral exploration and development activities and to the Company, including as set forth in the Company's public disclosure documents filed on the SEDAR+ website at www.sedarplus.ca.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE REPRESENTS THE EXPECTATIONS OF HERCULES METALS AS OF THE DATE OF THIS PRESS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE HERCULES METALS MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.