VANCOUVER, BC, July 10, 2025 /CNW/ - Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) (FWB: GGA1) ("Getchell" or the "Company") is pleased to announce that it has engaged a drill contractor to conduct the 2025 drill program at the Company's Fondaway Canyon gold project ("Project") in Nevada.

Key Highlights

- Large gold mineral resource

- Robust preliminary economic assessment

- Mineralization open for expansion

- 10-hole 3,000m (10,000 ft) drill program to commence mid-late July

- Designed to extend gold mineralization and increase mineral resource

Fondaway Canyon

The Project is located 140 kilometers ("km") (87 miles) northeast of Reno, and 58 km (36 miles) northeast of Fallon, Nevada. The Project covers a total claim area of 4,623 acres (1,871 hectares) and extends 7 km east-west encompassing the entirety of the Fondaway Canyon gold corridor. Moreover, the extent of the claim package offers ample area to support resource growth and the infrastructure required for future development.

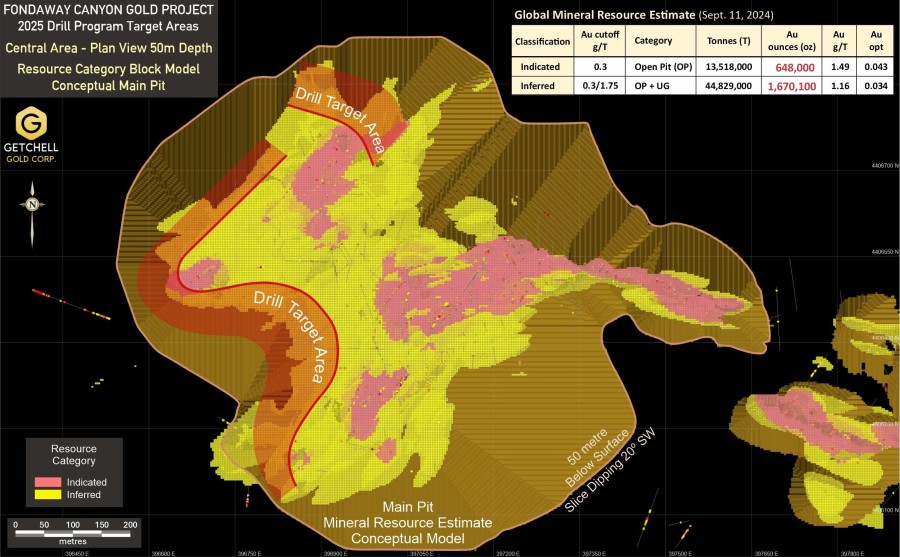

The Project contains a large mineral resource (news release dated September 11, 2024) comprising an Indicated Mineral Resource of 13.5 million tonnes at an average grade of 1.49 g/t Au, totaling 648,000 ounces of gold and an Inferred Mineral Resource estimated at 44.8 million tonnes at 1.16 g/t Au, amounting to 1,670,100 ounces of gold ("MRE"). Notably, gold mineralization starts at surface and remains open in most directions for further expansion.

Following the Mineral Resource Estimate, a positive Preliminary Economic Assessment (PEA) on the Fondaway Canyon gold project was completed and filed (news release dated February 07, 2025). The PEA outlined an open-pit mining operation coupled with a conventional 8,000 tonne per day milling process, projecting an initial mine life of approximately 10.5 years. The economic analysis highlighted robust project economics, with a pre-tax Net Present Value (NPV) of US$ 546 million and 51.2% Internal Rate of Return (IRR), and after-tax NPV of US$ 474 million and 46.7% IRR, at a conservative 10% discount and gold price of US$ 2,250 per ounce.

2025 Drill Program

Given that the mineral resource remains open in most directions, an initial 10-hole 3,000-metre (10,000 foot) drill program has been designed to further extend the mineralization, along strike and dip (Fig. 1), with the intent to increase the mineral resource, enlarge the open pit model, and substantially enhance the Project's overall value.

The Company has engaged Foraco Corp. of Salt Lake City, UT, to conduct the 2025 drill program at Fondaway Canyon. It is anticipated that the drill will mobilize to the Project and commence drilling mid-late July and continue through to the end of the drill season.

Notes on the PEA

The PEA is preliminary in nature, includes Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that PEA results will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

All amounts are in United States dollars unless otherwise specified. Base case parameters assume a gold price of $2,250 per ounce. NPV is calculated as of the commencement of construction and excludes all pre-construction costs. All figures are displayed on a 100% ownership basis.

- Operating costs consist of mining costs, processing costs and mine site G&A.

- Cash costs consist of operating costs plus treatment and refining charges and royalties.

The PEA was prepared by Forte Dynamics Inc., of Fort Collins, Colorado ("Forte Dynamics") as the lead consultant in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Forte Dynamics was the lead study manager for mine planning, design parameters, and operating and capital cost estimates. The PEA was supported by Forte Analytical Inc. (metallurgical studies, process design, process facilities, and plant site infrastructure) and APEX Geoscience Ltd. (mineral resource estimate). The effective date of the PEA is January 15, 2025, and a technical report titled The Preliminary Economic Assessment of the Getchell Gold Corp. Fondaway Canyon Project, Nevada, USA has been filed on the System for Electronic Document Analysis and Retrieval (SEDAR).

Notes on the Mineral Resource Estimate:

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. There has been insufficient exploration to define the Inferred Resources tabulated above as an Indicated or Measured Mineral Resource, however, it is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. There is no guarantee that any part of the Mineral Resources discussed herein will be converted into a Mineral Reserve in the future. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. The Mineral Resources herein were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum standards on mineral resources and reserves, definitions, and guidelines prepared by the CIM standing committee on reserve definitions and adopted by the CIM council (CIM 2014 and 2019).

- The Mineral Resources Estimate is underpinned by data from 527 reverse circulation and diamond drillholes totaling 55,870m of drilling that intersected the mineralized domains.

- The mineral resource is reported at a lower cut-off of 0.3 g/t Au for the conceptual open pit and 1.75 g/t Au for the conceptual underground extraction scenario. The lower cut-off grades and potential mining scenarios were calculated using the following parameters: mining cost = US$2.70/t (open pit); G&A = US$2.00/t; processing cost = US$15.00/t; recoveries = 92%, gold price = US$1,950.00/oz; royalties = 1%; and minimum mining widths = 1.5 metres (underground) in order to meet the requirement that the reported Mineral Resources show "reasonable prospects for eventual economic extraction".

- A density of 2.74 g/cm3 was used for the mineralized zones.

- The author is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues or any other relevant issue not reported in the technical report that could materially affect the mineral resource estimate.

The Qualified Persons

The independent and qualified person for the mineral resource estimate, as defined by NI 43-101, is Michael Dufresne, P.Geol., P.Geo., from APEX Geoscience Ltd.

The qualified person overseeing the minable resource estimate used for the economic analysis is Jonathan R. Heiner, SME-RM, from Forte Dynamics, Inc.

The qualified person overseeing the metallurgical testing and mineral processing is Deepak Malhotra, SME-RM, from Forte Dynamics, Inc.

The qualified person overseeing the overall Preliminary Assessment and the economic analysis is Donald E. Hulse, SME-RM, from Forte Dynamics, Inc.

The Qualified Person (as defined in NI 43-101) who reviewed and approved the scientific and technical information in the news release is Scott Frostad, P.Geo., VP Exploration at Getchell Gold Corp. and is non-independent.

Corporate

The Company further announces that it has granted an aggregate of 325,000 incentive stock options (the "Options") under the Company's omnibus equity incentive plan to a consultant of the Company. The Options are exercisable at a price of $0.30 per common share, have a three year term from the date of grant, and will vest immediately on the date of grant. The Options are subject to the terms and conditions prescribed by the CSE and applicable securities laws.

About Getchell Gold Corp.

The Company is a Nevada focused gold exploration company trading on the CSE: GTCH, OTCQB: GGLDF, and FWB: GGA1. Getchell Gold Corp. is primarily directing its efforts on its most advanced stage asset, Fondaway Canyon, a past gold producer with a large mineral resource estimate and recently published Preliminary Economic Assessment.

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release.

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to drill program commencement, extent, and results. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "will" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Although management of Getchell have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.