Vancouver, British Columbia--(Newsfile Corp. - May 27, 2025) - AJN Resources Inc. (CSE: AJN) (FSE: 5AT) (AJN or the Company) is pleased to announce that it has signed a conditional heads of agreement (HOA) with Godu General Trading S.C. (Godu) to acquire up to a 70% interest in the 42,8km2 Okote Gold Project located within the same gold belt, roughly 100km south of the c4.5Moz Lega Dembi Gold Mine, which is the largest gold producer in Ethiopia. Work will commence once the agreement and AJN capabilities have been presented to the regional Oromia state authorities who have verbally confirmed their support.

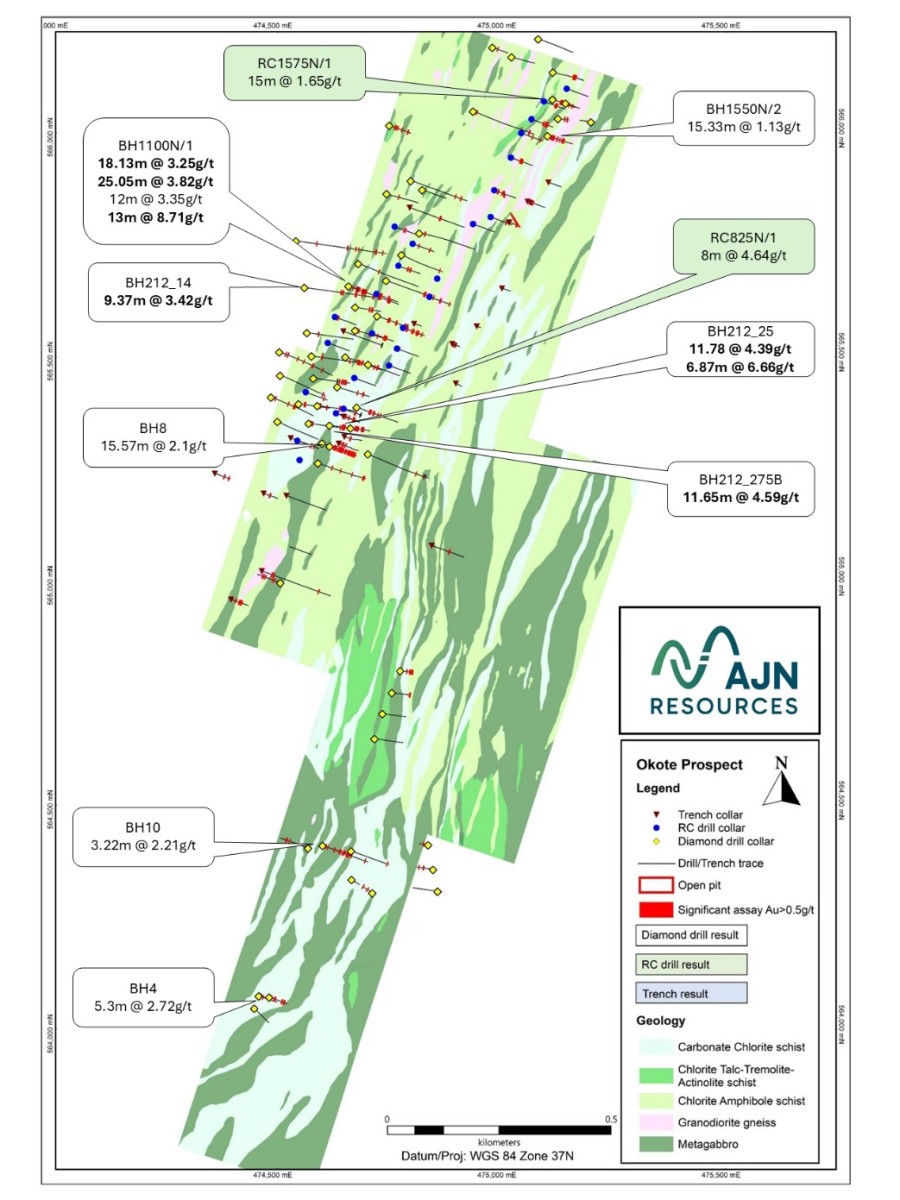

MIDROC held the licence and conducted exploration at Okote up to 2019 and drilled a combination of 88 Reverse Circulation and Diamond holes for a total of 13,761 metres. MIDROC drilling covered a strike length of ~2,400m with the largest concentration of holes covering the northern 1,000m x 400m.

Highlights

- Significant historic drilling results from MIDROC included the following:

- BH1100N/1 : 18.13m at 3.25g/t Au, 25.05m at 3.82g/t Au, 12m at 3.34g/t Au and 13m at 8.71g/t Au

- BH212_25 : 11.78m @ 4.39g/t Au and 6.87m @ 6.66g/t Au

- RC825N/1: 8m @ 4.64g/t Au

- RC1575N/1: 15m @ 1.65g/t Au

- BH8: 15.57m @ 2.1g/t Au

- BH212_275B: 11.65m @ 4.59g/t

Note that these historical results have not been validated by AJN and any such validation will be part of future work programs. It is the Company's understanding that the reported results underwent standard QAQC procedures. AJN intends to review the drill and related data in greater detail, and twin some of these holes to confirm these results.

- Historic drilling covered ~2,400m of strike; largest concentration of drill holes covers 1,000m x 400m in the northern portion of the area drilled.

- Artisanal workings in untested areas in the north suggest mineralisation is open to the north; historic drilling confirms mineralisation open to the south.

- Previous studies1 confirmed multimillion ounce gold potential at the Okote gold project; AJN has not verified the results of these studies.

- AJN to conclude an NI 43-101 report and mineral resource estimate during the due diligence period.

- AJN to conduct 1,500m of drilling during the due diligence period; drilling to confirm historic results, infill drilling to confirm continuity of mineralisation and test potential mineralisation below recent artisanal workings in the north.

Figure 1: Geology and Drill Holes completed by MIDROC on the Okote Prospect.

Figure 1: Geology and Drill Holes completed by MIDROC on the Okote Prospect.

CEO and President Klaus Eckhof commented: "We are extremely excited about the agreement to acquire an interest in the Okote Gold Project, which has been subjected to extensive drilling and trenching by MIDROC, the previous owner and operator of the Lega Dembi mine prior to relinquishment of the Okote licence. Furthermore, the Okote Gold Project lies in the same gold belt as Ethiopia's largest gold producer at Lega Dembi less than 100km to the north. We are particularly interested in conducting our own mapping and sampling in the northern area where artisanal miners are reported to have exposed new areas of mineralisation, which will complement the more than 2km of previously defined mineralisation. Our field crews are ready to mobilise as soon as final presentation has been made to the regional authorities. We also look forward to conducting our own mineral resource estimate where previous consultants have suggested the Okote project has multimillion ounce potential. We look forward to fast tracking our initial due diligence drilling programme in coming months to understand and unleash the true potential of the project."

Geology and Mineralisation of the Okote Gold Project

Figure 2: Location of all known Gold Occurrences within the Renowned Neoproterozoic Arabian-Nubian Shield in Ethiopia and Surrounding Countries

Figure 2: Location of all known Gold Occurrences within the Renowned Neoproterozoic Arabian-Nubian Shield in Ethiopia and Surrounding Countries

The Okote Gold Project is located within the Adola Gold Belt in southern Ethiopia, a geologically complex region composed of highly deformed Precambrian rocks forming part of the world-renowned Arabian-Nubian Shield in which known gold occurrences are shown in Figure 2. The belt is subdivided into several lithostructural domains, with Okote situated in the Megado Terrain, dominated by low-grade metavolcano-sedimentary sequences and associated granitoids. The local geology is characterised by various types of schists, interspersed with remnants of granodiorite and gabbroic intrusions.

Gold mineralisation at Okote is predominantly within a NNE trending shear zone which hosts a series of en-echelon quartz veins containing sulphides, tourmaline and free gold in which veins have limited strike length and little continuity at depth. The style of mineralisation is typical of hydrothermal, shear-hosted gold systems, with multiple deformation phases influencing the distribution and geometry of mineralised zones. The quartz veins were the primary focus of the drilling conducted by MIDROC who struggled to identify continuity of the veins similar to those mined at Lega Dembi. In addition, significant mineralisation including that in BH1100N/1 (18.13m at 3.25g/t Au, 25.05m at 3.82g/t Au, 12m at 3.34g/t Au, and 13m at 8.71g/t Au) was within sheared diorites which were not followed up in any detail.

Subsequent structural analyses conducted on behalf of the licence owner Godu, concluded that future trenching and drilling is required to the north of current area of drilling and drilling at deeper levels in the northern portion of drill coverage. It was further recommended to focus on defining mineralisation within the broader shear zones where previous drilling reported up to 86.09m at 0.38g/t Au (BH6), 91.72m at 0.34g/t Au (BH8) 37.21m at 0.41g/t Au (BH13) and 28.95m at 0.75g/t Au (BH1550N/2) as opposed to defining the extent of quartz veins.

During the 90-day due diligence period, the Company will map all artisanal workings and open trenches and will log selected holes drilled previously to better understand controls on mineralisation. This will be followed up with a 1,500m drilling programme designed to twin selected holes from previous drilling and to test newly identified areas from mapping including following up of potential continuation of sheared diorites.

Deal Structure

AJN can acquire up to a 70% interest in the Okote Gold Project on the following terms:

- AJN will conduct a 90-day due diligence which can be increased by a further 60 days, which includes drilling of a minimum of 1,500m.

- On completion of the due diligence and should AJN wish to continue, AJN and Godu will sign a detailed joint venture agreement and AJN will commit to fund an initial US$2,000,000 exploration programme.

- AJN will make a payment of US$100,000 to Godu within 10 days of the later of (a) signing the HOA, (b) receiving satisfactory confirmation in writing that Godu is the legitimate owner of the Okote Gold Project with no liens or other encumbrances; (c) Board acknowledgement from O-Mining Group (representing the Oronia regional governmental authorities and custodian of the land in the region) and signing of the final HOA by the CEO of Godu.

- On completion of the due diligence and should AJN wish to continue, AJN will make a payment of US$250,000 to Godu within one month of signing the shareholders agreement and a further payment of US$250,000 to Godu within 6 months from signing the shareholders agreement.

- On completion of the exploration phase within 18 months with the option to increase to 24 months, AJN will deliver a JORC or similar internationally accepted mineral resource estimate on the Okote project.

- On completion of the mineral resource estimate, AJN will, if it wishes to continue, make a payment of US$5,000,000 within one month of completion of the exploration phase and, if the parties decide to enter into a mining agreement, AJN will make a further US$5,000,000 payment within one month of completion of the Definitive Feasibility Study (DFS).

- AJN will sole fund all exploration and the parties will ensure all permits are maintained in good standing during the term of the agreement period.

- The parties agree to complete a DFS within 9 months which can be increased to 12 months of completing the exploration phase. AJN will finance all DFS accomplishment works.

- As part of their commitment to social responsibility, the parties agree to provide financial support for community development initiatives in the area surrounding the Okote Gold Project.

QP Statement

Mr. Dylan le Roux (BSc Hons) is an independent consultant of AJN Resources Inc. and a qualified geologist. Mr. le Roux is a registered Professional Natural Scientist (Geological Science) with the South African Council for Natural Scientific Professions (SACNASP Reg. No. 155814). Mr. le Roux is a qualified person (QP) under NI 43-101 and has reviewed and approved the scientific and technical information contained in this news release.

About AJN Resources Inc.

AJN is a junior exploration company. AJN's management and directors possess over 75 years of collective industry experience and have been very successful in the areas of exploration, financing and developing major mines throughout the world, with a focus on Africa, especially the Democratic Republic of Congo.

For further information, please contact Investor Relations:

Sheena Eckhof

Director, Investor Relations

This email address is being protected from spambots. You need JavaScript enabled to view it.

Visit us at www.ajnresources.com

Tel: +44 7496 291547

On Behalf of the Board of Directors

Klaus Eckhof

CEO and President

This email address is being protected from spambots. You need JavaScript enabled to view it.

Cautionary Note Regarding Forward-Looking Statements

The information in this news release may include certain information and statements about management's view of future events, expectations, plans and prospects that may constitute forward-looking statements. Forward-looking statements are based upon assumptions that are subject to significant risks and uncertainties. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance may differ materially from those anticipated and indicated by these forward-looking statements. Although AJN Resources Inc. believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurances that the expectations of any forward-looking statements will prove to be correct. Except as required by law, AJN Resources Inc. disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Not for distribution to United States newswire services or for dissemination in the United States.

Note 1: Venmyn Independent Projects (VIP), a division of Venmyn Rand (Pty) Limited (Venmyn) - Scoping Study on the Okote Gold Project, April 2012; Milliard Andualem - Preliminary Resource Estimate of Okote Primary Gold Deposit, June 2023 (Godu inhouse report)