Vancouver, British Columbia--(Newsfile Corp. - April 19, 2018) - MAX RESOURCE CORP. (TSXV: MXR) (OTC Pink: MXROF) (FSE: M1D) ("MXR" or the "Company") is pleased to announce the results of a second channel sample 45 meters in length at the Cerro de Cobre mineral licenses. The Company is continuing with due diligence in relation to the acquisition of Copperbelt Minerals Corp's Gachala Copper Project, 50 kilometres east of Bogota, Colombia (the "Property"), as detailed in the February 26, 2018 news release. Highlights include:

- 10 metres averaging 3.365% copper; within

- 30 metres averaging 2.140 % copper

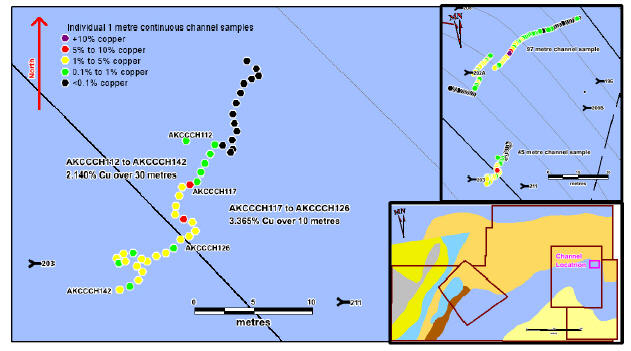

The orientation of the mineralization remains unknown at this time. This outcropping lies approximately 40 metres to the south of the first zone of channel sampling reported in the April 4, 2018 news release; 19 metres of 3.210% copper within 59 metres averaging 1.722% copper.

"Our on-going due diligence continues to confirm the Copperbelt acquisition as a significant advancement in building a technically superior property portfolio, " Brett Matich, MXR Chief Executive Officer, stated. "The second set of channel samples 40 metres to the south of the previous set of 97 metres of channel samples potentially indicate an expansion of the bedrock mineralization at Cerro de Cobre. The LWIR confirmation assays testing previously unknown bedrock copper mineralization remain outstanding. We continue to be persistently focussed on our objective of Pioneering the World's Next Copper Frontier."

A continuous 8 centimetre channel sample was cut in bedrock to a depth of 3 to 4 centimetres and sampled in continuous 1 metre intervals. As shown in the attached figure, the channel locations had to be moved to accommodate topography. The metre by metre assays are shown in the accompanying table.

| Sample ID | % Cu | Sample ID | % Cu | Sample ID | % Cu | ||

| AKCCCH112 | 0.760 | AKCCCH122 | 5.402 | AKCCCH133 | 0.640 | ||

| AKCCCH113 | 0.644 | AKCCCH123 | 4.508 | AKCCCH134 | 4.337 | ||

| AKCCCH114 | 0.466 | AKCCCH124 | 2.091 | AKCCCH135 | 3.361 | ||

| AKCCCH115 | 0.508 | AKCCCH125 | 2.121 | AKCCCH136 | 0.614 | ||

| AKCCCH116 | 0.416 | AKCCCH126 | 1.668 | AKCCCH137 | 2.805 | ||

| AKCCCH117 | 5.413 | AKCCCH127 | 0.269 | AKCCCH138 | 2.348 | ||

| AKCCCH118 | 2.283 | AKCCCH129 | 1.475 | AKCCCH139 | 1.136 | ||

| AKCCCH119 | 3.275 | AKCCCH130 | 1.778 | AKCCCH140 | 2.771 | ||

| AKCCCH120 | 3.468 | AKCCCH131 | 1.483 | AKCCCH141 | 0.436 | ||

| AKCCCH121 | 3.426 | AKCCCH132 | 2.139 | AKCCCH142 | 2.148 |

The orientation of the channel sampled mineralization is unknown at this time.

Plate 1. Second Zone of Channel Sampling

All samples from the Phase I surface program were sent to the ACTLABS COLOMBIA S.A.S. laboratory, an ISO 9001: 2008 certified facility. All samples were collected by Max Resource Corp. contractor personnel and securely stored until delivery to ACTLABS. Third party manufactured standards and blanks were inserted into the sample stream and have not shown any QA/QC anomalies.

About Gachala

The Gachala Copper Project consists of 4 mineral claims and 21 exploration applications, located within the 250km by 120km belt of Devonian through Cretaceous age rocks in a geological setting conducive to hosting sedimentary copper deposits. Mineralization appears to be localized at the contact between the Devonian-Permain red beds and the overlying Cretaceous reducing black shales, one of the settings typical of these copper deposits.

The Gachala Copper Project includes the historic Cerro de Cobre copper mine, where 2008 channel sampling returned 22.8 metres grading 3.16% copper and 15.3 g/t silver. Subsequent Mobile Metal Ion (MMI) soil sampling defined a 1500 metre by 800 metre copper-in-soil anomaly encompassing the two zones, open in all directions. Colombian Mines Corporation felt there was a high potential for repetition on the opposite side of the hosting anticline and further felt the geology suggested mineralization may extend beyond the limits of known anomalous zones. (Source: Colombian Mines Corporation News Releases dated 15-May-2008 and 14-Nov-2012 respectively). The orientation of the channel sampled mineralization is unknown at this time. MXR cautions investors it has not yet fully verified the historical data.

About the Transaction

MXR has signed a binding Letter of Intent ("LOI") to acquire 100% of the outstanding share capital of Copperbelt Minerals Corp., a private Canadian company holding the Property. MXR will issue 12,000,000 common shares to the Copperbelt Minerals' shareholders and take over the obligations of the Cerro de Cobre agreement, requiring the aggregate payment of US$1,060,000 over the next three years to the Cerro de Cobre vendors. Certain shareholders of Copperbelt Minerals will collectively retain a 3-per-cent net smelter returns royalty ("NSR") on the Property. MXR has the sole exclusive right to purchase half of the 3-per-cent NSR for the consideration of US$3-million at any time prior to production. On April 2, 2018, the due diligence period was extended to April 30, 2018.

About Max Resource Corp.

Max Resource Corp., a Canadian-based exploration company, its focussed on acquiring advanced exploration projects which are located within the under-explored northern section of the richly endowed Andean Copper Belt of Colombia.

ON BEHALF OF THE BOARD OF MAX RESOURCE CORP.

"Brett Matich"

Brett Matich, CEO and President

Tim Henneberry, P. Geo (British Columbia), a member of the Max Resource Corp. Advisory Board, is the qualified person who has reviewed and approved the technical content of this news release on behalf of the Company.

Further information regarding the Company can be found on SEDAR at www.SEDAR.com, or by contacting the Company directly at (604) 365 1522.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain statements that may be deemed as "forward-looking statements" within the meaning of applicable Canadian securities laws. All statements in this release, other than statements of historical facts, are forward-looking statements, including, without limitation, statements pertaining to completion of the Acquisition and any approvals required in connection with the Acquisition. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include: changes in market conditions, unsuccessful exploration results, changes in the price of commodities (particularly copper), unanticipated changes in key management personnel and general social, economic or geo-political conditions. Mining exploration and development is an inherently risky business. Accordingly the actual events may differ materially from those projected in the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward—looking statement that may be from time to time by the Company or on its behalf, except in accordance with applicable securities laws. We seek safe harbor.