HIGHLIGHTS

-

52m @ 16.4 g/t gold from 256m downhole in hole OEDD-148, including 11m @ 70.3 g/t gold from 279m

-

33m @ 5.2 g/t gold from 276m downhole in hole OEDD-146, including 16m @ 6.8 g/t gold from 280m

-

10m @ 12 g/t gold from 273m downhole in hole OEDD-145, including 7m @ 16.7 g/t gold from 275m

-

Charger's high-grade gold system continues to expand, with these results extending mineralization 70 metres deeper

-

Improved understanding of structural and mineralization controls guiding ongoing success

-

Additional drilling now underway to test the down-plunge potential to 600 metres depth

Toronto, Ontario--(Newsfile Corp. - June 25, 2025) - Awalé Resources Limited (TSXV: ARIC) ("Awalé" or the "Company") is pleased to report assay results from the latest four diamond drill holes on the Company's Charger discovery, part of the Odienné Project ("Odienné" or the "Project") in Côte d'Ivoire. The four step-back holes drilled 70 metres ("m") below previously reported high-grade intercepts confirm the extension of the mineralized system and reinforce the depth potential at Charger. Additional drilling at Charger is now underway to test the down-plunge extent of the open mineralized system to 600 metres depth.

"We are delighted with the latest results from drilling at the Charger target," commented Andrew Chubb, CEO of Awalé Resources. "Charger continues to deliver some of the best gold drill results in West Africa, and now with a robust model, we see potential for the high-grade to continue at depth. In addition to a sound understanding of the geometry of the mineralization, we are now intercepting parallel zones that we believe can be linked together with further drilling. This, combined with the emergence of untested geophysical targets, highlights the significant upside potential at Charger beyond the current drilling zone. We have initiated the next phase of drilling designed to test the down-plunge continuity of this open high-grade gold system down to 600 metres below surface."

Watch CEO Andrew Chubb Discuss Charger's Latest High-Grade Gold Results

Background on the Charger Discovery

Charger is a high-grade breccia target hosted within a monzodiorite intrusion. The mineralization is controlled by a steeply dipping, northeast-trending structure with internal, wider, and higher-grade shoots that have a sub-horizontal plunge, likely controlled by folding. True widths range from 5 to 40 metres, with the wider zones coinciding with the shallow-plunging, fold-controlled shoots.

The higher-grade zones within the breccia are dominated by hydraulic breccia with quartz-fill and visible gold. Lower grades are generally found in a clinopyroxene matrix breccia, with isolated zones of higher-grade free gold mineralization. Charger drilling has consistently returned very high-grade intercepts, including:

-

57m @ 26 g/t Au from 164m downhole, including 32m @ 45.7 g/t Au from 165 in OEDD-83

-

29m @ 20 g/t Au from 149m downhole, including 8m @ 39.5 g/t Au from 149m in OEDD-88

-

59m @ 14.7 g/t Au from 140 downhole in OEDD 100

-

26m @ 12 g/t Au from 146m downhole in OEDD-120

-

95m @ 1.8 g/t Au from 170m downhole in OEDD-118

-

26m @ 2 g/t Au from 134m downhole in OEDD-137

-

4m @ 18.5 g/t Au from 67m downhole in OEDD-121

-

1.5m @ 13.4 g/t Au from surface in OEDD-136

-

3m @ 3.2 g/t Au from 6.5m downhole in OEDD-136

-

6.5m @ 4.4 g/t Au from 28.5m downhole in OEDD-136

Intercepts from this release:

-

52m @ 16.4 g/t Au from 256m downhole, including 11m @ 70.3 g/t Au from 279m in OEDD-148

-

33m @ 5.2 g/t Au from 276m downhole, including 16m @ 6.8 g/t Au from 280m in OEDD-146

-

10m @ 12 g/t Au from 273m downhole, including 7m @ 16.7 g/t Au from 275m in OEDD-145

The breccia is zoned both vertically and horizontally (see Long Section in Figure 5). Horizontally, there is a transition from a silica-rich, quartz-fill-dominant hydrothermal breccia on the southeast side to a clinopyroxene-dominant breccia on the northwest side of the northeast-trending structure. Vertically, a polymetallic zone extends from the surface to approximately 100 metres depth, below which there is a transition to a free gold-dominant zone that has yielded consistently high-grade mineralization. This deeper zone contains significantly less sulfide (1-5%).

Alteration is dominated by a combination of silica (quartz), potassic (biotite and K-feldspar), and calc-silicate (clinopyroxene), with hematite and epidote also present. The breccia zones are "magnetite destructive", where magnetite in the parent rock is overprinted by pyrite and hematite. Dominant sulfides include pyrite, chalcopyrite, and pyrrhotite, with accessory molybdenum, galena, and sphalerite. Tellurides are also present as accessory minerals.

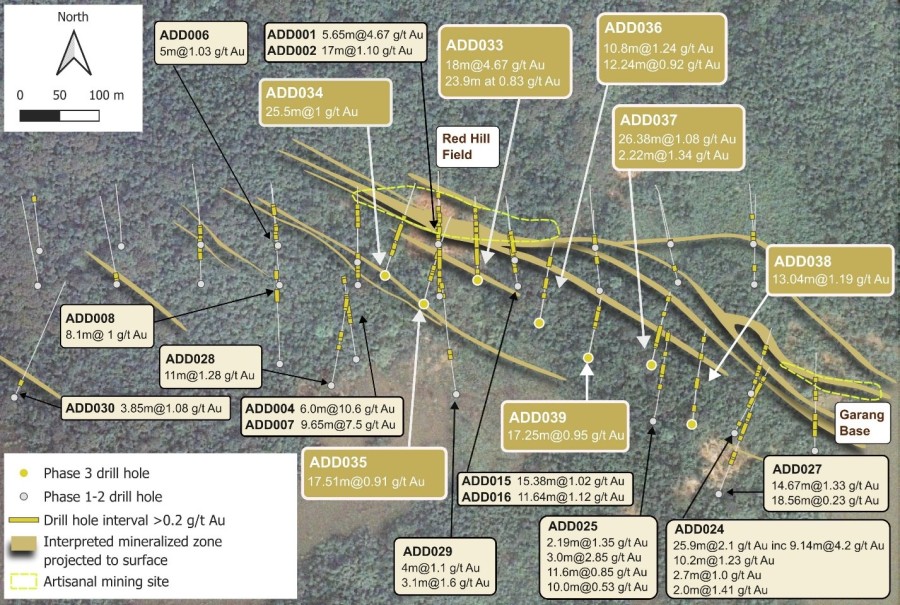

Recent confirmation that mineralization is magnetite destructive opens significant exploration potential at Charger. Several other demagnetized zones have been recognized within the Charger monzodiorite and are now considered new exploration targets (see Drill Plan in Figure 3, where zones labelled 2 to 5 are considered new "demag" targets).

New Deep Drilling Planned

Three deep holes totalling approximately 2000 metres have been planned, ahead of the seasonal rains, with the first hole collared last week. Drilling will be oriented northwest and the holes are designed to intercept the target breccia at vertical depths of approximately 400 and 600 metres below surface. These depths correspond to 150-metre and 350-metre step-backs from the current limit of drilling of 250 metres below surface (see Long Section in Figure 5). Refer to Table 1 for the planned drill collars.

Table 1: Planned Drill Collars for Charger Deep Drilling

| Plan Collar | Easting | Northing | RL (m) | Dip | Azimuth | Depth (m) |

| CD_001 | 647386 | 1032092 | 470 | -65 | 305 | 620 |

| CD_002 | 647869 | 1032109 | 470 | -65 | 305 | 620 |

| CD_003 | 647912 | 1032042 | 469 | -67 | 300 | 850 |

| Note: Collars are planned to take into account expected progressive hole deviation in the course of drilling, these deviations are estimated from previous drilling at the Charger target. Holes are expected to lift and turn toward the west. | ||||||

How Charger Fits into the Odienné Vision for District-Scale Potential

The Odienné Project is being advanced as a district-scale opportunity, and Charger, together with BBM and other discoveries continue to demonstrate the potential of Odienné as a multi-target system with scale. Charger's evolution from early discovery to a more mature system, with well-defined geometry, alteration zoning, and geophysical fingerprints, provides a template for potential repeatability across the Project. Awalé has recognized that Charger-style gold mineralization is associated with magnetite destruction, resulting in low magnetic signatures that have helped pinpoint four new prospective areas. This methodological approach demonstrates that Awalé is not just drilling for discovery, but building a pipeline of targets with a coherent geologic thesis.

Table 2: Charger Drilling Collar Cable - (all collars from this release)

| Hole ID | Easting | Northing | RL (m) | Azimuth | Dip | Depth (m) |

| OEDD0145 | 647691 | 1032120 | 471 | 15 | -55 | 350.44 |

| OEDD0146 | 647686 | 1032090 | 470 | 15 | -55 | 386.2 |

| OEDD0147 | 647651 | 1032062 | 470 | 15 | -55 | 416.22 |

| OEDD0148 | 647658 | 1032094 | 472 | 15 | -55 | 383.14 |

Table 3: Significant Intercepts - (from this release)

| Hole ID | From (m) | To (m) |

Length (m) | Au (g/t) |

Ag (g/t) |

Cu (ppm) | Mo (ppm) | Composite Trigger (g/t) |

| OEDD0145 | 21.00 | 21.50 | 0.50 | 8.8 | 2.5 | 145 | 1 | 0.5 |

| OEDD0145 | 106.00 | 111.00 | 5.00 | 0.7 | 0.6 | 378 | 3 | 0.5 |

| OEDD0145 | 228.00 | 229.00 | 1.00 | 0.5 | 0.3 | 151 | 2 | 0.5 |

| OEDD0145 | 233.00 | 234.00 | 1.00 | 0.7 | 0.2 | 72 | 1 | 0.5 |

| OEDD0145 | 260.00 | 261.00 | 1.00 | 0.8 | 0.5 | 132 | 1 | 0.5 |

| OEDD0145 | 273.00 | 283.00 | 10.00 | 12.0 | 1.3 | 54 | 2 | 0.5 |

| including | 275.00 | 282.00 | 7.00 | 16.7 | 1.6 | 53 | 2 | 5.0 |

| OEDD0145 | 288.00 | 289.00 | 1.00 | 2.0 | 0.5 | 41 | 2 | 0.5 |

| OEDD0145 | 294.00 | 295.00 | 1.00 | 0.9 | 0.5 | 52 | 2 | 0.5 |

| OEDD0145 | 299.00 | 305.00 | 6.00 | 2.0 | 0.6 | 136 | 4 | 0.5 |

| OEDD0146 | 26.50 | 27.00 | 0.50 | 0.6 | 0.2 | 123 | 1 | 0.5 |

| OEDD0146 | 31.00 | 32.00 | 1.00 | 3.2 | 0.3 | 137 | 2 | 0.5 |

| OEDD0146 | 45.00 | 46.00 | 1.00 | 0.6 | 1.1 | 434 | 17 | 0.5 |

| OEDD0146 | 58.00 | 59.00 | 1.00 | 0.7 | 0.3 | 127 | 2 | 0.5 |

| OEDD0146 | 144.00 | 145.00 | 1.00 | 1.7 | 0.2 | 151 | 1 | 0.5 |

| OEDD0146 | 212.00 | 213.00 | 1.00 | 0.7 | 0.4 | 67 | 1 | 0.5 |

| OEDD0146 | 276.00 | 309.00 | 33.00 | 5.2 | 3.1 | 118 | 7 | 0.5 |

| including | 280.00 | 296.00 | 16.00 | 6.8 | 2.1 | 97 | 14 | 5.00 |

| and | 291 | 293 | 2.00 | 29.0 | 5.6 | 113 | 2 | 10.0 |

| and | 302 | 304 | 2.00 | 20.7 | 27.9 | 549 | 2 | 10.0 |

| OEDD0146 | 313.00 | 321.00 | 8.00 | 1.7 | 1.3 | 62 | 2 | 0.5 |

| OEDD0146 | 331.00 | 332.00 | 1.00 | 0.7 | 0.2 | 83 | 2 | 0.5 |

| OEDD0147 | 262.00 | 281.00 | 19.00 | 2.4 | 1.5 | 105 | 2 | 0.5 |

| including | 277.00 | 278.00 | 1.00 | 12.3 | 0.2 | 72 | 2 | 5.0 |

| OEDD0147 | 286.00 | 291.00 | 5.00 | 3.0 | 1.0 | 145 | 2 | 0.5 |

| including | 286.00 | 287.00 | 1.00 | 12.3 | 1.9 | 193 | 2 | 5.0 |

| OEDD0147 | 301.00 | 315.00 | 14.00 | 1.7 | 0.6 | 56 | 1 | 0.5 |

| including | 314.00 | 315.00 | 1.00 | 9.9 | 0.8 | 70 | 1 | 5.0 |

| OEDD0147 | 320.00 | 321.00 | 1.00 | 0.8 | 0.7 | 127 | 1 | 0.5 |

| OEDD0147 | 322.00 | 339.00 | 17.00 | 2.0 | 0.7 | 72 | 1 | 0.5 |

| including | 332.00 | 333.00 | 1.00 | 5.9 | 1.0 | 47 | 1 | 5.0 |

| OEDD0147 | 353.00 | 354.00 | 1.00 | 3.0 | 0.5 | 93 | 4 | 0.5 |

| OEDD0147 | 362.00 | 364.00 | 2.00 | 2.7 | 2.5 | 114 | 2 | 0.5 |

| OEDD0147 | 415.00 | 416.22 | 1.22 | 3.8 | 4.5 | 391 | 43 | 0.5 |

| OEDD0148 | 22.50 | 23.50 | 1.00 | 0.8 | 2.1 | 452 | 1 | 0.5 |

| OEDD0148 | 153.00 | 154.00 | 1.00 | 0.7 | 0.1 | 116 | 1 | 0.5 |

| OEDD0148 | 256.00 | 308.00 | 52.00 | 16.4 | 6.9 | 1,046 | 2 | 0.5 |

| including | 256.00 | 259.00 | 3.00 | 6.6 | 2.7 | 283 | 3 | 5.0 |

| and | 273.00 | 274.00 | 1.00 | 6.5 | 1.1 | 109 | 1 | 5.0 |

| and | 279.00 | 290.00 | 11.00 | 70.3 | 29.7 | 4,549 | 2 | 5.0 |

| OEDD0148 | 313.00 | 326.00 | 13.00 | 4.4 | 0.9 | 79 | 3 | 0.5 |

| including | 325.00 | 326.00 | 1.00 | 45.9 | 3.6 | 78 | 8 | 5.0 |

About Awalé Resources

Awalé is a diligent and systematic mineral exploration company focused on discovering large high-grade gold and copper-gold deposits. Exploration activities are currently underway in the underexplored regions of Côte d'Ivoire, where the Company is exploring the Odienné Copper-Gold Project ("Odienné" or the "Project"), covering 2,346 km2 across seven permits-five granted and two applications. This includes 797 km2 in two permits held under the Awalé-Newmont Joint Venture ("OJV"). Awalé manages all exploration activities over the OJV, with funding provided by Newmont Joint Ventures Limited ("Newmont").

Awalé has discovered four gold, gold-copper, and gold-copper-silver-molybdenum mineralized systems within the OJV and has recently commenced exploration on its 100%-owned properties.

The Odienné Project is underexplored and has multiple pipeline prospects with similar geochemical signatures to Iron Oxide Copper Gold (IOCG) and intrusive-related mineral systems with substantial upside potential. The Company benefits from a skilled and well-seasoned technical team that allows it to continue exploring in a pro-mining jurisdiction that offers significant potential for district-scale discoveries.

Quality Control and Assurance

Analytical work for geochemistry samples is being carried out at the independent ALS Laboratories in Ghana and Ireland, an ISO 17025 Certified Laboratory. Samples are prepared and stored at the Company's field camps and put into sealed bags until collected by ALS from the Company's secure Odienné office and transported by ALS to their preparation laboratory in Yamoussoukro, Côte d'Ivoire, for preparation. Samples are logged in the tracking system, weighed, dried, and pulverized to greater than 85%, passing a 75-micron screen. Two pulps are prepared from each sample with one stream to ALS Ghana for fire assay and a second to Ireland where the sample is analyzed by 52 element ICP/MS with a 4-Acid digest. Blanks, duplicates, and certified reference material (standards) are being used to monitor laboratory performance during the analysis. Where visible gold is observed in drill core, a quartz wash is applied between every sample to reduce or eliminate any contamination. Once Fire assay results are received sample over 5 g/t gold are routinely screen fire assayed, samples lower than 5 g/t continued within a high-grade interval are also screen fire assayed.

Mineralized Interval Calculations

Significant intervals reported in this news release are calculated as downhole length-weighted intercepts. For the Charger target, initial mineralized zones are calculated at a 0.5 g/t Au trigger and include up to 3 metres of internal waste for delineating mineralized zones. Included intervals are calculated at 1 g/t, 3 g/t, 5 g/t and 10 g/t Au trigger values, with up to 3 metres of internal waste. Table 1 contains a list of all Charger holes reported in this release. True widths are estimated to be 60% of the downhole widths.

Qualified Person

The technical and scientific information contained in this news release has been reviewed and approved for release by Andrew Chubb, the Company's Qualified Person as defined by National Instrument 43-101. Mr. Chubb is the Company's Chief Executive Officer and holds an Economic Geology degree, is a Member of the Australian Institute of Geoscientists (AIG), and is a Member of the Society of Economic Geoscientists (SEG). Mr. Chubb has over 25 years of experience in international mineral exploration and mining project evaluation.

Abbreviations Used in this Release

| Ag | Silver | |

| Au | Gold | |

| Cu | Copper | |

| g/t | Grams per tonne | |

| km | Kilometres | |

| m | Metres | |

| Mo | Molybdenum | |

| ppm | Parts per million |

AWALÉ Resources Limited

On behalf of the Board of Directors

"Andrew Chubb"

Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Andrew Chubb, CEO

+356 9913 9117

This email address is being protected from spambots. You need JavaScript enabled to view it.

Ardem Keshishian, VP Corporate Development

+1 (416) 471-5463

This email address is being protected from spambots. You need JavaScript enabled to view it.

The Company's public documents may be accessed at www.sedarplus.com. For further information on the Company, please visit our website at www.awaleresources.com.

Forward-Looking Information

This press release contains forward-looking information within the meaning of Canadian securities laws (collectively "forward-looking statements"). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements. Forward-looking statements in this press release include but are not limited to statements regarding, the Company's presence in Côte d'Ivoire and ability to achieve results, creation of value for Company shareholders, achievements under the Newmont JV, works on other properties, planned drilling, commencement of operations. Although the Company believes any forward-looking statements in this press release are reasonable, it can give no assurance that the expectations and assumptions in such statements will prove to be correct. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and other risks involved in the mineral exploration and development industry, including those risks set out in the Company's management's discussion and analysis as filed under the Company's profile at www.sedarplus.ca. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.