Vancouver, British Columbia--(Newsfile Corp. - January 30, 2018) - War Eagle Mining Company Inc. (TSXV: WAR) ("War Eagle" or the "Company"), its wholly owned subsidiary and Champagne Resources Limited ("Champagne") are pleased to announce that they have entered into a definitive agreement (the "Amalgamation Agreement") dated January 15, 2018. Champagne, a Toronto-based private company, has a significant land position in the world-class Kirkland Lake gold camp in the Abitibi greenstone belt eight kilometres from the town centre of Kirkland Lake, Ontario. The Amalgamation Agreement was entered into pursuant to a preceding letter agreement between War Eagle and Champagne announced on January 3, 2018.

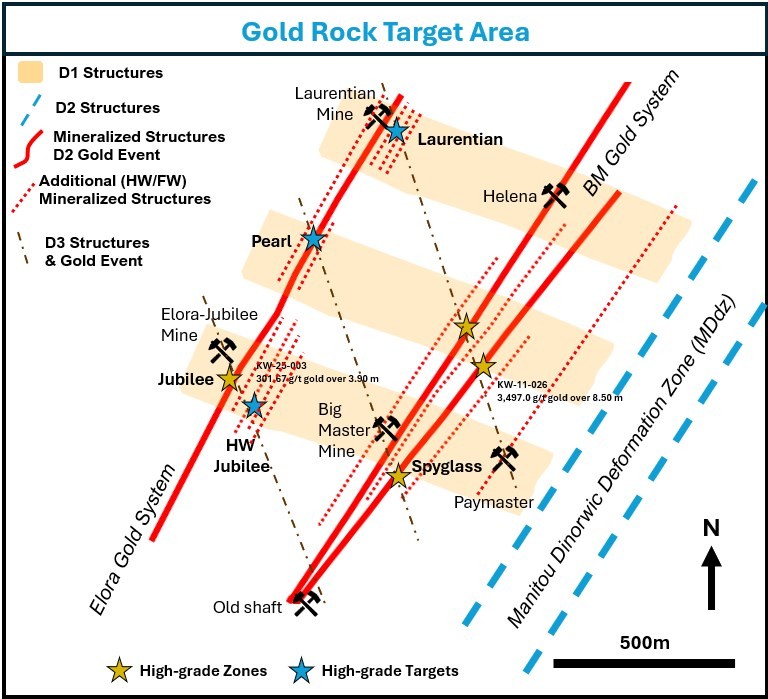

Champagne's significant 3,296 hectare land position in the Kirkland Lake Gold Camp in combination with War Eagle's financial assets will enable the new company to immediately implement the first stage of a comprehensive exploration program.

Paul Carroll, CEO of War Eagle commented, "This transaction is ideal for both parties - it combines a superb, newly amalgamated land position with critical exploration capital and a first-class management team."

Danièle Spethmann, Champagne's CEO stated, "We are pleased to have received significant support from Champagne shareholders for this transaction and we look forward to commencing exploration activities on our Goodfish Kirana project. We plan to immediately assay existing drill cores and to undertake airborne and ground geophysics as well as further drilling on identified targets."

The Amalgamation Agreement provides that, among other things, Champagne will amalgamate with War Eagle's wholly-owned subsidiary, and that Champagne shareholders will receive shares of War Eagle instead of shares of the amalgamated company. War Eagle will issue one common share of War Eagle for each post-consolidation Champagne share held such that the existing shareholders of War Eagle on the completion of the amalgamation will own approximately 50% of the outstanding shares of War Eagle and the shareholders of Champagne will own the remaining 50%. As a condition of the amalgamation, Champagne will consolidate its shares on a 2.6734:1 basis. The amalgamated company, which will be called "Champagne Resources Limited", will continue as a wholly-owned subsidiary of War Eagle. Outstanding Champagne share purchase warrants and options, will be converted into War Eagle securities such that 6,086,046 share purchase warrants and stock options to purchase 1,215,659 common shares will be issued. As a result, on the completion of the amalgamation, the outstanding share capital of War Eagle will be approximately 43,980,552 common shares on a non-diluted basis.

The TSX Venture Exchange ("TSXV") has granted conditional approval of War Eagle's transaction with Champagne. Before closing the amalgamation, as a condition to final TSXV approval, War Eagle will file a National Instrument 43-101 technical report on Champagne's 100% owned Goodfish Kirana Project at Kirkland Lake.

Completion of the transaction is conditional upon, among other things, receipt of Champagne shareholder approval. Champagne will be holding a special meeting of its shareholders on February 8, 2018, at which its shareholders will vote on the amalgamation and approval of the Amalgamation Agreement, as well as a share consolidation which is a pre-condition to the amalgamation. Champagne has received voting support agreements in favour of the amalgamation and share consolidation from shareholders representing 67.2% of Champagne's outstanding shares.

Danièle Spethmann, P. Geo., President and CEO of Champagne, is a "qualified person" within the meaning of National Instrument 43-101 and has reviewed and approved the technical information in this news release.