Tortola, British Virgin Islands--(Newsfile Corp. - July 16, 2025) - Sailfish Royalty Corp. (TSXV: FISH) (OTCQX: SROYF) (the "Company" or "Sailfish") is pleased to announce that on July 15, 2025, the United States Bureau of Land Management ("BLM") approved Solidus Resources, LLC's (the "Operator") Spring Valley Gold Mine Project ("Spring Valley") located in Pershing County, Nevada. The Operator is approved to construct, operate and maintain an open-pit gold mine, three waste rock facilities, and a heap leach facility.

Spring Valley will employ a contractor workforce of approximately 130 employees during the initial two-year construction and approximately 250 full-time employees for the operations period. The total life of the project would be 21 years, including two years of construction, 11 years of mining, three additional years of ore processing, and five years of reclamation and closure activities.

Paolo Lostritto, CEO, stated, "The record of decision providing final approval for construction and eventual operations at Spring Valley is a major milestone for Sailfish as the expected cash flow from this asset should be a material step change from our current base of operations. This approval grants the Operator the ability to start construction on Spring Valley immediately with a view to generating the first gold production within the next two to three years. Sailfish has an up-to 3% net smelter return royalty ("NSR") on Spring Valley. We continue to believe that Spring Valley will need to be optimized for the current gold price environment which is substantially more than the US$1,800/oz gold used in the 2025 feasibility study. A project optimization should result in more gold being produced over the life of mine. The plan of operations approved in this final permit provides approximately 33% more throughput than what was highlighted in the 2025 feasibility study. In addition, it is important to highlight that several benchmark transactions have occurred in the royalty space over the past three months that occurred at substantial premiums to their underlying net asset value."

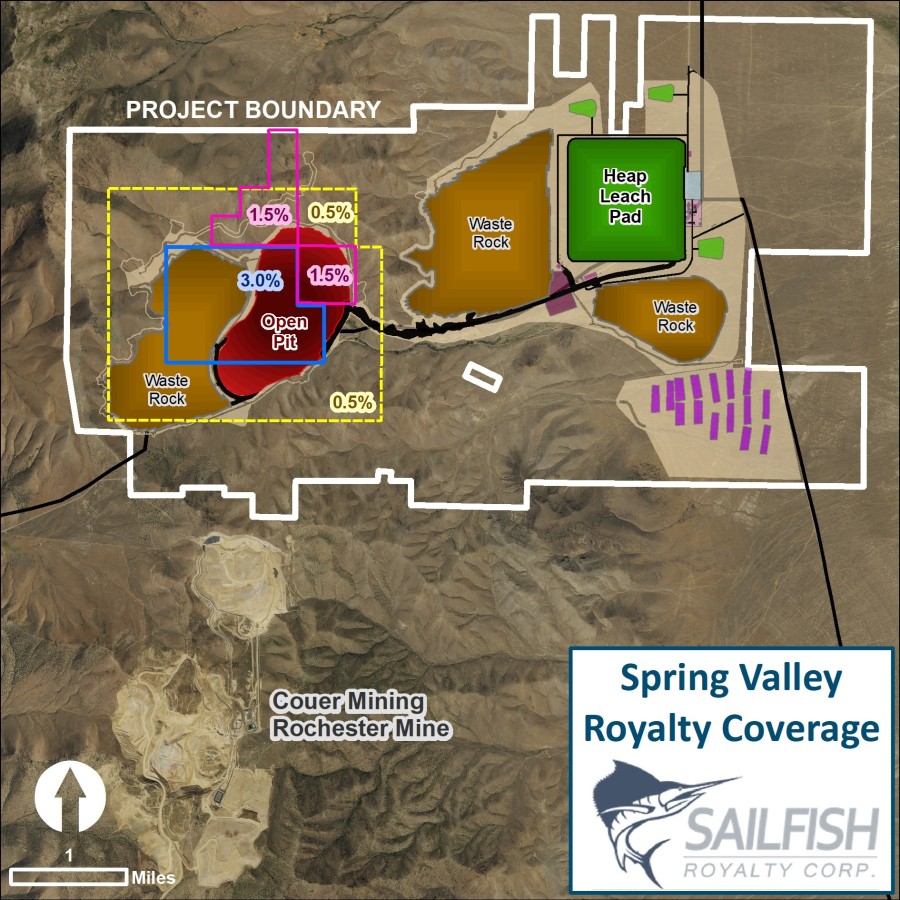

The Company's current royalty portfolio on Spring Valley covers 100% of the open pit as outlined in the plan of operations, with the majority of the acres included in the proposed open pit covered by a 3% NSR at prevailing gold prices. See Figure 1 below.

Sailfish holds the following Spring Valley royalty assets:

- up to a 3% NSR1 on a majority of the acres included in the proposed open pit at Spring Valley (royalty boundary in blue);

- a 1.5% NSR on a portion of the proposed open pit at Spring Valley (royalty boundary in pink); and

- a 0.5% NSR on a portion of the proposed open pit at Spring Valley (royalty boundary in yellow2).

Figure 1 - Sailfish Royalty Corp.'s various Spring Valley royalty holdings (boundaries are approximate).

Figure 1 - Sailfish Royalty Corp.'s various Spring Valley royalty holdings (boundaries are approximate).

1 For clarity, the up to 3% NSR owned by Sailfish is part of a total 7% NSR above $700/oz. Au. The sliding scale NSR royalty is not payable on the first 500,000 ounces of gold recovered from any commercial production.

2 Excluding the areas included in the blue and pink boundaries.

About Sailfish

Sailfish is a precious metals royalty and streaming company. Within Sailfish's portfolio are three main assets in the Americas: a gold stream equivalent to a 3% NSR on the San Albino gold mine (~3.5 sq. km) and a 2% NSR on the rest of the area (~134.5 sq. km) surrounding San Albino in northern Nicaragua; an up to 3% NSR on the multi-million ounce Spring Valley gold project in Pershing County, Nevada; and a 100% interest in the Gavilanes Silver Project located in Durango State, Mexico (currently in the process of being converted into a 2% net smelter royalty).

Sailfish is listed on the TSX Venture Exchange under the symbol "FISH" and on the OTCQX under the symbol "SROYF". Please visit the Company's website at www.sailfishroyalty.com for additional information.

For further information: Paolo Lostritto, CEO, tel. 416-602-2645 or Akiba Leisman, Executive Chairman of the Board, tel. 917-558-5289.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement regarding forward-looking information

Certain disclosures in this release constitute "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by words such as the following: expects, plans, anticipates, believes, intends, estimates, projects, assumes, potential and similar expressions. Forward-looking statements also include reference to events or conditions that will, would, may, could or should occur, including, without limitation, statements regarding: the expectation that Sailfish's shareholders will be positively impacted by an increase in Sailfish's cash-flow as a result of the positive record of decision and optimization of Spring Valley for the current gold price environment and the expectation that production on Spring Valley will start in the next two to three years. In making the forward-looking statements in this news release, the Company has applied certain factors and assumptions that the Company believes are reasonable, including, without limitation: that Sailfish's shareholders will be positively impacted by an increase in Sailfish's cash-flow as a result of the positive record of decision and optimization of Spring Valley for the current gold price environment and the expectation that production on Spring Valley will start in the next two to three years. However, the forward-looking statements in this news release are subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking statements, including without limitation: that Sailfish's NSR on Spring Valley will not positively impact Sailfish's cashflow as expected by Sailfish's management; that Sailfish's shareholders will not be positively impacted by an increase in Sailfish's cash-flow as a result of the positive record of decision and optimization of Spring Valley for the current gold price environment and the expectation that production on Spring Valley will start in the next two to three years as expected by management or at all; and those applicable risks, uncertainties and factors set forth in the Company's disclosure record under the Company's profile on SEDAR+ at www.sedarplus.ca.There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.