Vancouver, BC / TheNewswire / July 18 2017 - Emgold Mining Corporation (TSX-V: EMR) ("Emgold" or the "Company"): is pleased to announce that it has executed a non-binding letter of intent (the "LOI") to enter into a definitive option agreement with Nevada Sunrise Gold Corporation ("Nevada Sunrise"; TSX-V: NEV) giving Emgold the right to acquire an 80% interest in the Golden Arrow gold-silver property in Nevada (the "Golden Arrow Property").

The Golden Arrow Property has a historical measured and indicated resource of 12.2 million tons with an average gold equivalent grade of 0.030 ounces per ton (opt) totaling 365,900 gold equivalent ounces and an inferred resource of 3.8 million tons with an average gold equivalent grade of 0.013 opt totaling 72,000 gold equivalent ounces (see details below).

The Golden Arrow Property is an advanced-stage exploration property with a comprehensive exploration database including geochemical sampling, geophysics, and over 190,000 feet of reverse circulation and diamond core drilling. On May 11, 2016, Nevada Sunrise obtained approval of a Plan of Operations (the "Plan") and an Environmental Assessment (the "EA") for the Golden Arrow Property from the U.S. Bureau of Land Management (the "BLM"). The Plan and EA contemplate approximately 240,000 feet (73,170 metres) of drilling in up to 240 holes to explore for new areas of gold mineralization on 1,500 acres of the property and to potentially expand the known gold resources. Having the Plan and EA already in place will allow Emgold to move forward quickly with a major drilling program on the Golden Arrow Property once it has secured the necessary funding.

To date, two main exploration targets have been drilled on the Golden Arrow Property focusing on bulk disseminated mineralization - the Gold Coin and Hidden Hill deposits. Numerous other exploration targets have been identified for exploration. Emgold management believes there is potential to expand both the Hidden Hill and Gold Coin resources and for discovery of other bulk disseminated mineralization on the Golden Arrow Property. In addition, historic underground mine workings lie along the Page Fault and other structures on the Golden Arrow Property that have been subject to very limited modern exploration, if any, to evaluate their potential. Emgold management believes these structures have potential for high grade vein mineralization (i.e. mineralization greater than 0.1 opt gold equivalent).

David Watkinson, Emgold's President and CEO commented, "The Golden Arrow Property transaction is part of our ongoing acquisition and exploration efforts focused in Nevada. We intend to continue to look for additional quality properties in the mining-friendly jurisdiction of Nevada to add to our existing assets in that State, including the Buckskin Rawhide East, Buckskin Rawhide West and Koegel Rawhide properties."

The Company also announces that, subject to acceptance by the TSX Venture Exchange (the "TSX-V"), its board of directors has approved the consolidation of the issued and outstanding common shares of the Company on the basis of one (1) post-consolidation share for every ten (10) pre-consolidation shares, effective on or about August 4, 2017 (the "Consolidation"). Presently, the Company has 79,712,350 common shares issued and outstanding and, if the Consolidation is completed, there will be 7,971,235 common shares issued and outstanding.

No fractional shares will be issued as a result of the Consolidation. Shareholders who would otherwise be entitled to receive a fraction of a common share will be rounded down to the nearest whole number of common shares and no cash consideration will be paid in respect of fractional shares. The exercise price and number of common shares of the Company issuable upon the exercise of outstanding stock options, warrants or other convertible securities will be proportionately adjusted to reflect the Consolidation.

Post-Consolidation, Emgold intends to complete an equity financing (the "Offering") in conjunction with the execution of a definitive option agreement for the Golden Arrow Property. The net proceeds of the Offering would be used to fund the initial acquisition cost of the Golden Arrow Property, to conduct exploration on Golden Arrow and Emgold's other properties, and for general working capital purposes.

Golden Arrow Property Details

The Golden Arrow Property is located approximately 40 miles east of Tonopah in Nye County, Nevada. The property consists of 357 unpatented and 17 patented lode mineral claims covering an area of approximately 5,658 acres (2,300 hectares). It contains the historic Golden Arrow Mining District that was the site of underground production from 1905 through the 1930's. It is situated along the northeastern margin of the Walker Lane Structural Belt and adjacent to the Kawich Caldera.

A National Instrument 43-101 ("NI 43-101") technical report prepared by Steven Ristorcelli, P. G. and Odin D. Christensen, PhD, C. P. G., entitled "Updated Technical Report on Golden Arrow Project Nye County, Nevada, U.S.A." dated May 1, 2009 (the "2009 Report") was filed by Nevada Sunrise on May 15, 2009. The 2009 Report can be found on SEDAR at www.sedar.com under Nevada Sunrise's profile. This report was superseded by a NI 43-101 technical report prepared by Steven Ristorcelli, P.G. and Odin D. Christensen, PhD, C.P.G. entitled "Updated Technical Report on the Golden Arrow Project, Nye County, Nevada, U.S.A." dated June 9, 2010 (the "2010 Report") which was filed by Animas Resources Limited on June 9, 2010 and can be found on SEDAR under Animas Resource's profile. The 2010 Report disclosed the most recent historical resource estimate on the property as follows:

The historic mineral resource contained in the 2010 Report for the Golden Arrow Property was modeled and estimated by evaluating the drill data statistically and utilizing a three-dimensional geological model. Mineral domains were interpreted on NE-SW geological cross sections spaced approximately 100-feet throughout the extent of the property mineralization. The mineral domain interpretations were then rectified to east-west cross sections spaced at 20-foot intervals. Estimation was done by inverse-distance. The authors certified as to making independent investigations that they deemed necessary in their professional judgment to be able to reasonably rely on provided information to make the conclusions and recommendations presented in the 2010 Report.

A qualified person (within the meaning of NI 43-101) has not done sufficient work to classify the historic estimate as a current resource and this estimate is not being treated as a current resource. However, the estimate is believed to be both relevant and reliable as a historical estimate and provides a favorable indication of the potential to generate current resources for the Golden Arrow Property. To the best of Emgold's knowledge, information and belief, there is no new material scientific or technical information that would make the 2010 Technical Report inaccurate or misleading.

Additional drilling information from 2010 and 2012 drill programs would be incorporated into a new resource estimate. A new resource estimate would also update the current gold and silver prices to calculate the gold equivalent cut-off grade. It has also been recommended that some historic drill core and pulps be assayed for silver where assays are not currently available. The authors of the 2010 Report determined that the property merits further exploration, including, additional mapping, geochemical sampling, geophysics, and drilling; continued sample-integrity work on historic reverse-circulation and core sample; check assaying; metallurgical investigations with regard to rock type and oxidation; determination of the optimal metallurgical processes and recoveries; and the location of historic drill collars to confirm collar coordinates.

Emgold management believes that the geology of the Golden Arrow Property is similar in nature to that found at the operating Denton Rawhide Mine in Nevada and Emgold's properties adjacent to or near the Denton Rawhide Mine. Like Denton Rawhide, the Golden Arrow Property has high grade vein mineralization associated with northwest trending Walker Lane faults and shear zones and north-east trending Basin and Range faults and shear zones. Also, like Denton Rawhide, the Golden Arrow Property has hot springs mineralization associated with a nearby caldera.

Golden Arrow Option Terms

The terms of the LOI provide that, subject to certain conditions, including TSX-V acceptance and entry into a definitive option agreement, Emgold (or a wholly-owned subsidiary) would have the exclusive right and option (the "Option") to acquire an 80% interest in the Golden Arrow Property over a three year period (the "Transaction") in consideration of (i) the payment of CDN$250,000 in cash and the issuance of 2.5 million units to Nevada Sunrise and (ii) the incurring of CDN$2.75 million in approved exploration expenditures. Emgold would also have a further option of acquiring a 100% interest in the Golden Arrow Property as outlined below.

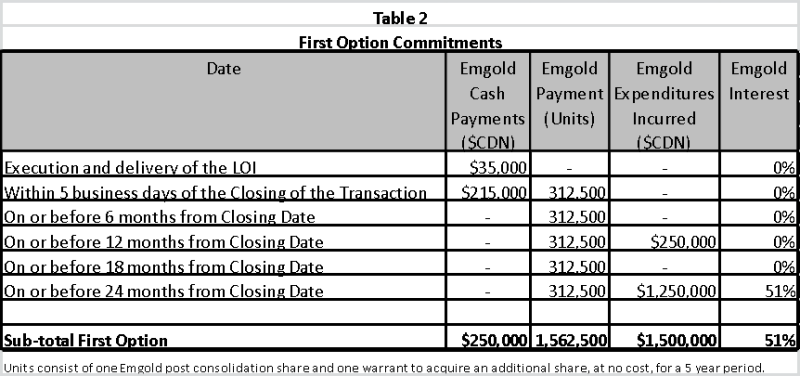

The Option to acquire an 80% interest in Golden Arrow would be structured as a two-part option, the first part of which would give Emgold the exclusive right and option (the "First Option") to acquire a 51% interest in the Golden Arrow Property by making CDN$250,000 in cash payments and issuing 1,562,500 units, each unit consisting of one post-Consolidation share and one special warrant (each, a "Special Warrant"), to Nevada Sunrise over a two year period from the date of TSX-V acceptance of the Transaction (the "Closing Date"). Each Special Warrant, which would be transferable, would allow Nevada Sunrise to receive, at no additional costone fully paid common share in the capital of Emgold, exercisable for a period of five years. Emgold would be required to incur CDN$1.5 million in exploration expenditures over this two year period. Cash payments, share payments, exploration expenditure commitments and percentage interest earned in the First Option are outlined in Table 2. Emgold would be the operator of the Golden Arrow Property during the First Option.

Upon Emgold exercising the First Option, the parties would be deemed to have formed a joint venture (the "Joint Venture") with Emgold holding 51% and Nevada Sunrise holding 49% interest. All mineral claims ownership, private land ownership, permits, reclamation bonds, storage unit leases and data associated with the Golden Arrow Property would be transferred to the Joint Venture.

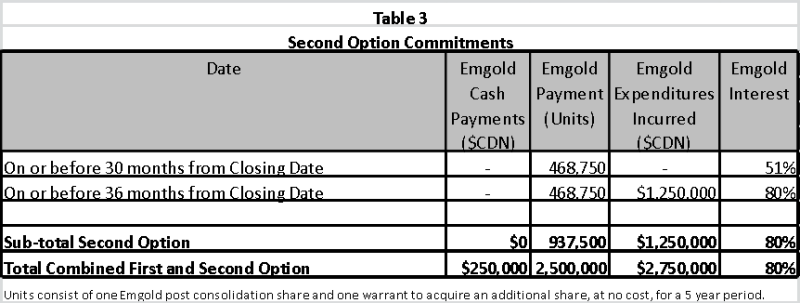

Upon the exercise of the First Option, Emgold would have the further exclusive right and option (the "Second Option") of earning an additional 29% interest (for a total of 80%) in the Golden Arrow Property by issuing 937,500 units, each unit consisting of one post-Consolidation share and one Special Warrant to Nevada Sunrise over a one year period. Emgold would be required to incur CDN$1.25 million in exploration expenditures over this one year period.

Cash payments, share payments, exploration expenditure commitments and percentage interest earned in the Second Option are outlined in Table 3. Should Emgold not have incurred the necessary Second Option exploration expenditures within this 12 month period, then it would have an additional 12 months (the "Extension") to incur these expenditures; provided that its interest in the Joint Venture would be reduced to 75%. During the Extension, Nevada Sunrise would not be required to contribute to the Joint Venture.

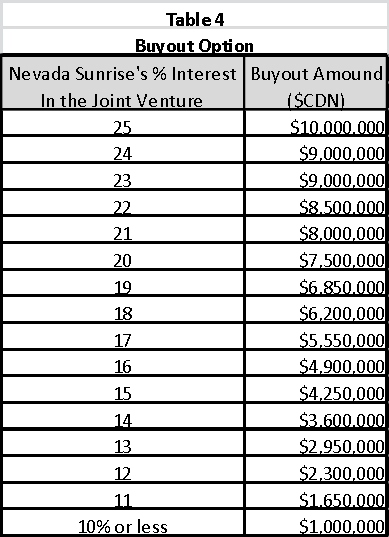

After the exercise in full of the Second Option, and within 12 months of a formal production decision for the Golden Arrow Property or at any time prior to that date, provided that Emgold has at least a 75% interest in the Joint Venture, Emgold would have the option of purchasing Nevada Sunrise's interest in the Joint Venture based on a sliding scale basis, as outlined in Table 4.

Nevada Sunrise would not be required to contribute to the Joint Venture until Emgold exercises the First Option in full. Thereafter if Emgold elects to proceed with the Second Option, Nevada Sunrise would not be required to contribute to the Joint Venture until Emgold exercises the Second Option in full. Subsequently, the parties would be required to contribute to the Joint Venture based on their ownership percentages of the Joint Venture, or their interests therein would be diluted in proportion to their contributions to the Joint Venture. If a diluted party's interest falls below 10% at any time, the other party would have the option of purchasing the diluted party's interest in the Joint Venture for CDN$1.0 million.

The scientific and technical information that forms the basis for portions of this news release was reviewed and approved by Robert Pease, PG, CPG, who is a qualified person as defined by National Instrument 43-101.

About Emgold

Emgold is a junior gold exploration and mine development company that has several exploration properties located in the western U.S. and Canada. These include the Buckskin Rawhide East, Buckskin Rawhide West, and Koegel Rawhide gold and silver properties in Nevada and the Stewart and Rozan poly-metalic properties located in British Columbia.

This news release does not constitute an offer of sale of any of the above-mentioned securities in the United States. None of the foregoing securities have been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any applicable state securities laws and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the 1933 Act) or persons in the United States absent registration or an applicable exemption from such registration requirements. This news release does not constitute an offer to sell or the solicitation of an offer to buy nor will there be any sale of the foregoing securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.