VANCOUVER, BC--(Marketwired - February 02, 2017) - Almadex Minerals Limited ("Almadex" or the "Company") (TSX VENTURE: AMZ) (OTCQB: AXDDF) is pleased to announce a proposed non-brokered private placement financing (the "Offering") of up to 1,481,500 units (the "Units") to raise approximately $2,000,000 at a price of $1.35 per Unit.

Each Unit will consist of one common share of the Company and one-half of one whole non-transferable common share purchase warrant, each whole share purchase warrant (a "Warrant") entitling the holder thereof to purchase one common share of the Company at a price of $2.00 per share for a period of thirty (30) months following the closing of the Offering.

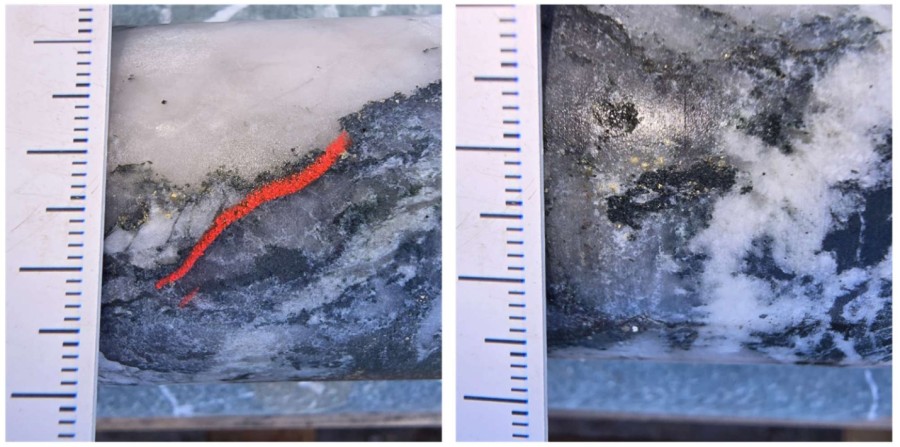

Almadex intends to use the net proceeds of the Offering to continue drilling the El Cobre Au/Cu porphyry targets in Veracruz, Mexico, and for general corporate purposes.

The Company may pay finders' fees in connection with the Offering in cash, shares, warrants or combination thereof. The Offering and payment of finders' fees are subject to regulatory approval.

Morgan J. Poliquin, President and CEO of Almadex noted, "We intend to carry out a large drill program at El Cobre in 2017, and given the low cost of drilling resulting from the excellent project infrastructure and our integrated equipment and drill teams, this modest financing will generate a significant amount of work on the ground. We are looking forward to an exciting and defining year of exploration at El Cobre."

Closing of the Offering is subject to receipt of applicable regulatory approvals including approval of the TSX Venture Exchange. The securities issued will be subject to a standard four month hold period in Canada.

About Almadex

Almadex Minerals Limited is an exploration company that holds a large mineral portfolio consisting of projects and NSR royalties in Canada, the U.S. and Mexico. This portfolio is the direct result of over 35 years of prospecting and deal-making by Almadex and, prior to its spinout, by Almaden Minerals Ltd.