Toronto, Ontario--(Newsfile Corp. - August 9, 2017) - Crown Mining Corporation (TSXV: CWM) ("Crown" or the "Company") announces a proposed non-brokered private placement for aggregate gross proceeds of up to $250,000 comprised of up to 2,500,000 units at a price of $0.10 per unit (each such unit being comprised of one common share and one warrant) (the "Offering"). Each whole warrant will entitle the holder to purchase one common share for $0.15 at any time within 3 years after closing subject to an acceleration clause. All securities issued pursuant to this private placement will be subject to a four (4) month hold period. The Company proposes to pay to eligible finders a finder's fee equal to 10% of the gross proceeds raised. The Company also reserves the right to increase or decrease the size of the Offering.

Completion of the Offering is subject to receipt of all required regulatory and TSX Venture Exchange approvals. The Company will use the proceeds of the offering for work at its Moonlight-Superior Project and for general working capital purposes.

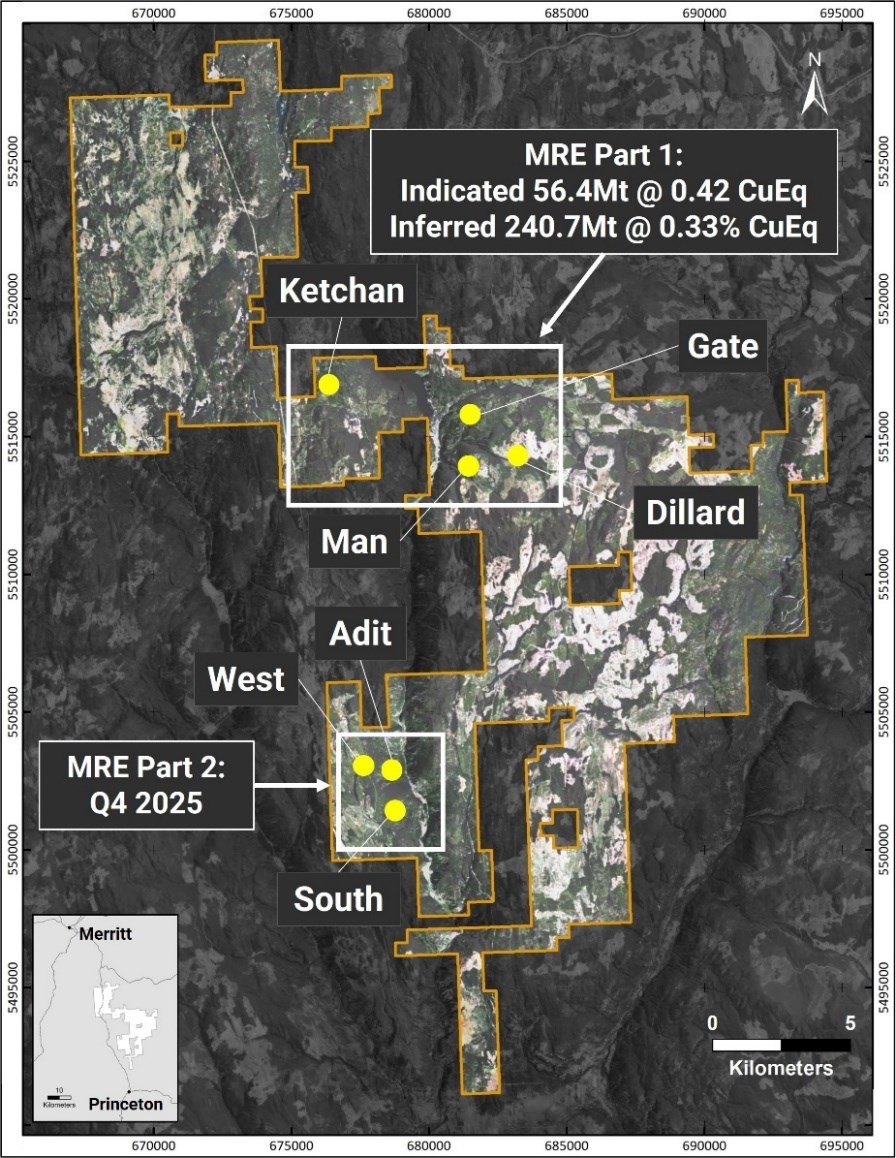

Crown is focused on advancing its 100% controlled Moonlight-Superior Copper Project in Northeast California which includes 4 known copper deposits. The Moonlight deposit hosts a current National Instrument 43-101 ("NI 43-101") indicated resource of approximately 161 million tons (146.5 million tonnes) averaging 0.324% copper, 0.003 ounces of gold and 0.112 ounces of silver per ton for 1.044 billion pounds of copper, and an inferred resource of 88 million tons (80 million tonnes) averaging 0.282% copper per ton for 496 million pounds of copper. Further details of this resource can be found in the Technical Report on the Moonlight Copper Property dated April 12, 2007 at Sedar.com. The Superior and Engels deposits have a current NI 43-101 inferred mineral resource of 57 million metric tonnes at an average copper grade of 0.43% for 547 million pounds of copper. Further details of this resource can be found in the Technical Report on the Superior Project dated November 7, 2014 filed on Sedar which also discloses a historical resource estimate for the fourth deposit.

Mr. George Cole is the Qualified Person pursuant to NI 43-101 responsible for the technical information contained in this news release, and he has reviewed and approved this news release.

For more information please see the Crown website at www.crownminingcorp.com.