October 20, 2017/ JMN Wire / Decade Resources Ltd., TSX-V: DEC (the "Company") is pleased to announce that it has closed its non-brokered private placement of flow-through units.

The Company issued a total of 5,450,000 flow-through units, at a price of $0.10 per flow-through unit, for gross proceeds of $545,000. Each flow-through unit is comprised of one flow-through common share and one transferable non-flow-through warrant, each warrant being exercisable for the purchase of one additional common share, at a price of $0.11 per share, until October 20, 2019.

No finder's fees or commissions were paid in connection with the private placement.

All of the shares, warrants, and any shares issued upon exercise of the warrants comprising the units, are subject to a hold period until February 21, 2018, except as permitted by applicable Canadian securities laws and the TSX Venture Exchange.

The private placement included the following subscription from a "related party" of the Company as defined in Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"): Edward Kruchkowski (the Company's President and Chief Executive Officer) acquired 250,000 flow-through units. The issuance of the flow-through units to Mr. Kruchkowski did not result in a material change in the percentage of securities of the Company held by him. The participation of Edward Kruchkowski in the private placement was exempt from formal valuation and minority shareholder approval requirements pursuant to exemptions contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 on the basis that at the time the private placement was agreed to, neither the fair market value of the securities to be distributed in the private placement nor the consideration to be received for those securities, insofar as the private placement involved the related party, exceeds 25% of the Company's market capitalization.

The Company did not file a material change report more than 21 days before the expected closing of the private placement as the details of the private placement and the participation by the related party was not settled until shortly prior to closing and the Company wished to close the private placement on an expedited basis for sound business reasons.

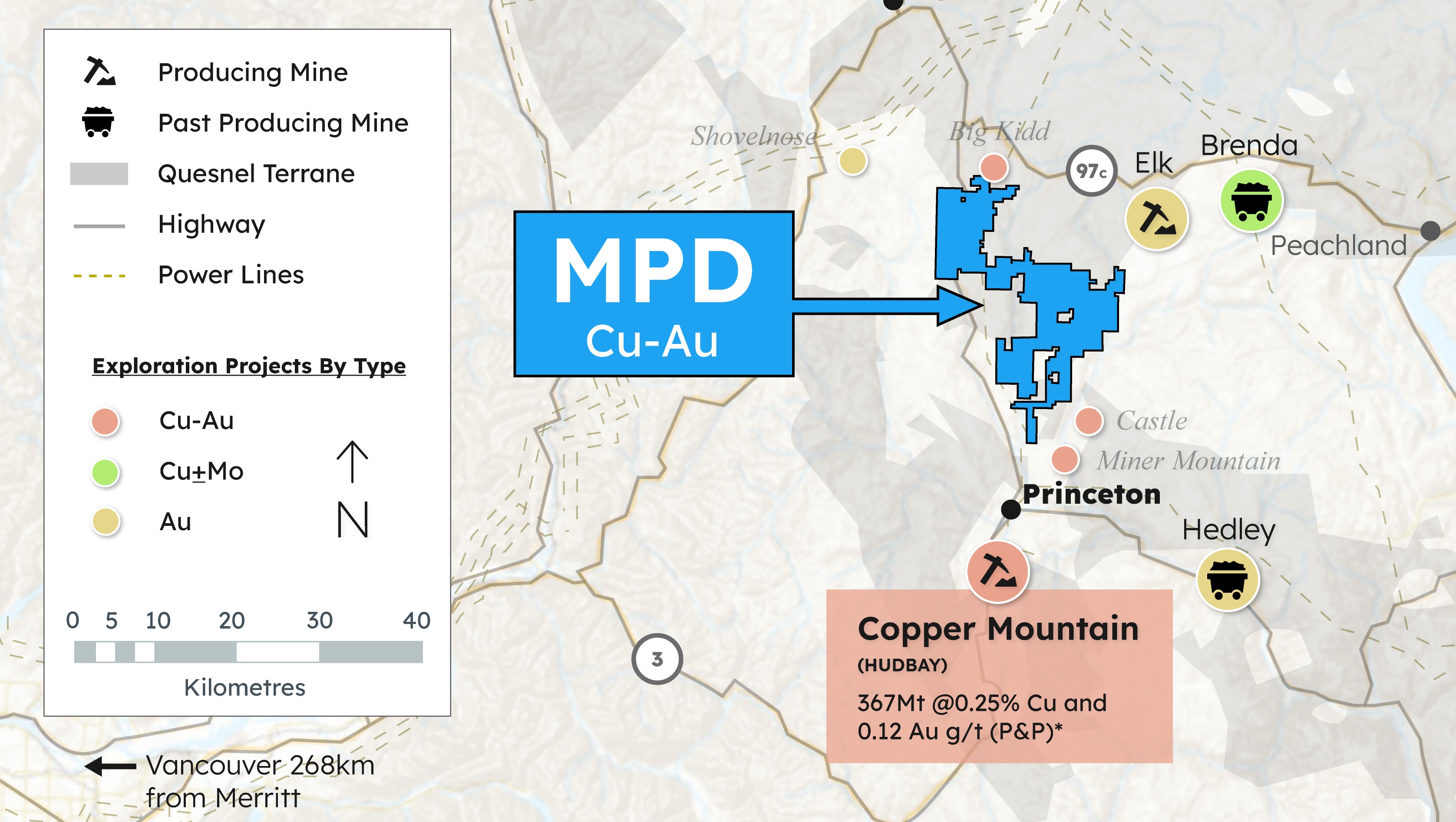

The proceeds from the sale of the flow-through units will be expended on the Company's properties located in British Columbia.