TORONTO, ONTARIO--(Marketwired - Jan. 23, 2018) - Golden Predator Mining Corp. (TSX VENTURE:GPY) ("Golden Predator Mining Corp." or the "Company") is pleased to announce that, in connection with its previously announced overnight marketed public offering (the "Offering"), it has entered into an underwriting agreement with Clarus Securities Inc. (the "Underwriter") to sell 7,693,000 Flow-Through Share Units at a price of $0.91 per Unit to raise gross proceeds of $7,000,630 pursuant to a short-form prospectus financing (the "Offering"). Each Flow-Through Share Unit will consist of one Class A common share (a "Common Share") and one-half of one (non flow-through) Common Share purchase warrant, exercisable at $1.00 per common share. The Flow-Through Share Units will be issued on a "flow-through" basis for purposes of the Income Tax Act (Canada). Closing of the Offering is expected on or about February 13, 2018 and is subject to regulatory approval including that of the TSX Venture Exchange.

The Underwriter will have an option to purchase up to an additional 1,153,950 Flow-Through Share Units on the same terms of the Offering for aggregate additional proceeds of up to $1,050,095 representing 15% of the Offering, for market stabilization purposes and to cover over-allotments, exercisable within 30 days of the date of closing of the Offering.

The Offering will be conducted in the provinces of British Columbia, Alberta, and Ontario by short form prospectus, and in such other provinces and territories of Canada which are agreed to by the Company and the Underwriters.

In connection with the Offering, PowerOne Capital Markets Limited has been appointed as special advisor to the Company.

The proceeds raised from the sale of Flow-Through Share Units under the Offering will be used by the Company to finance qualified Canadian exploration expenditures as defined in the Income Tax Act (Canada).

The securities being offered have not, nor will they be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons in the absence of U.S. registration or an applicable exemption from the U.S. registration requirements. This release does not constitute an offer for sale of securities in the United States.

ABOUT GOLDEN PREDATOR MINING CORP.

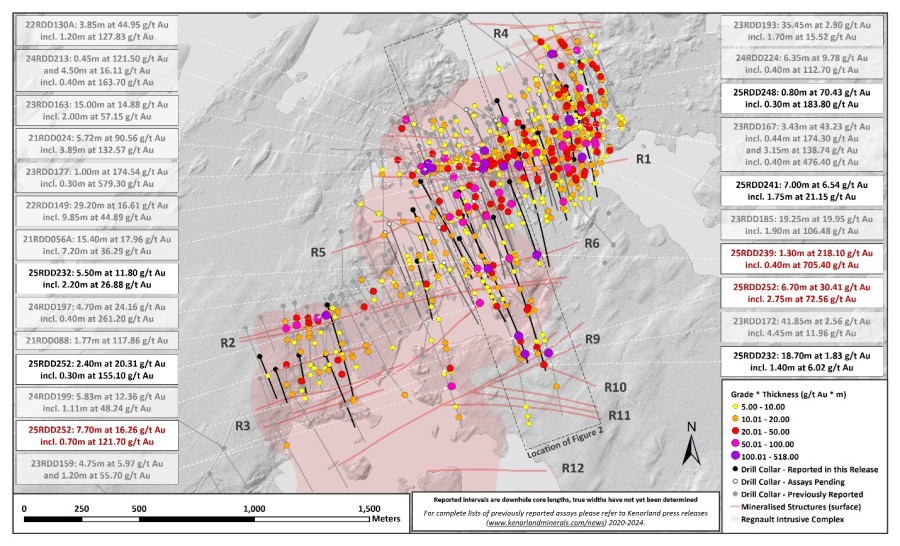

Golden Predator Mining Corp. is a gold exploration company focused on its district scale, orogenic gold-in-quartz 3 Aces Project in Canada's Yukon. The Company also holds 100% of the advanced Brewery Creek Project in Yukon, Canada. With proven management and an experienced technical team, the Company is well positioned for growth.