Calgary, Alberta--(Newsfile Corp. - June 21, 2017) - Teras Resources Inc. (TSXV: TRA) ("Teras" or the "Company"): announces that it intends to complete a non-brokered private placement of up to 12,5000,000 units (each a "Unit") at a price of $0.08 per Unit for gross proceeds of up to $1,000,000, subject to approval of the TSX Venture Exchange. Each Unit will consist of one common share (a "Common Share") and one Common Share purchase warrant (a "Warrant"). Each Warrant is exercisable into one Common Share at a price of $0.15 per share for a period of one year from the issuance of such Warrant. A finder's fee and or finder warrants may be paid on the gross proceeds of all or any portion of the private placement.

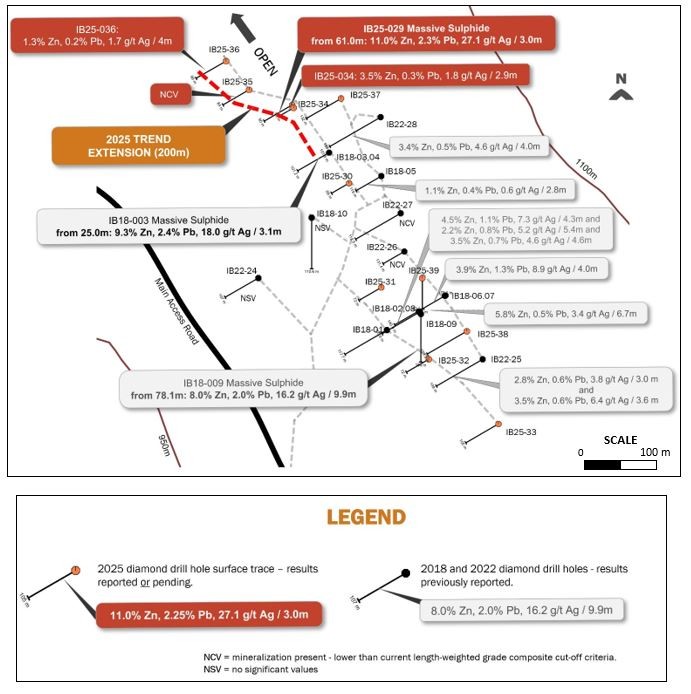

The majority of the proceeds of the private placement will be reserved for a planned Diamond drill program at the Companies Cahuilla gold/silver project. The drilling will be for the purpose of expanding the mineralization outside of the current resource area with focus on the newly identified structures as was discussed in the news release dated April 20th, 2017. The planned, high priority drill targets will be concentrated mainly in the Southwest Expansion area as referenced in the diagram below.

Cahuilla Project

For further details on the private placement, please contact the Company. All securities issued in connection with the private placement will be subject to a hold period of four months and a day from the date of closing.

About Teras

Teras is focused on developing its Cahuilla project located in Imperial County, California. The project encompasses an area of at least 3 km by 1.5 km and Teras believes that the Cahuilla project has the potential to develop into a mining operation consisting of altered and mineralized sedimentary host rocks with numerous sheeted high-grade sheeted quartz veins. Teras filed a NI 43-101 technical report with an indicated resource of 1.0 million ounces of gold and 11.9 million ounces of silver on its Cahuilla project (70 million tons at an average grade of 0.015 ounces per ton gold and 0.17 ounces per ton silver with a cut-off of 0.008 ounces per ton gold) and inferred class of 10 million tons grading 0.011 opt gold and 0.10 opt silver. Gold equivalent ounces are 1.2 million ounces in indicated class and 130,000 ounces in inferred class using a ratio of 55 silver ounces to 1 gold ounce. For further information on the Cahuilla project refer to the NI 43-101 technical report entitled "Cahuilla Property 43-101 Technical Report," filed with Sedar on November 27, 2012.

Dr. Dennis LaPoint, a qualified person under National Instrument 43-101 "Standards of Disclosure for Mineral Projects," and a Director for Teras is the Company's nominated qualified person responsible for monitoring the supervision and quality control of the programs completed on the Company's properties. Dr. LaPoint has reviewed and verified the mining, scientific and technical information contained in this news release. Dr. LaPoint is a registered geologist with the Society of Mining Engineers.