Toronto, Ontario (FSCwire) - Mustang Minerals Corp. (TSX-V: MUM) (" Mustang “ or the "Company") announced that pursuant to its non-brokered private placement (the “Financing”) announced November 27, 2017 it has closed a final tranche of $175,000 consisting of 500,000 units price at $0.35 per unit. The net proceeds from the Financing will be used for general corporate purposes including exploration and development activities at its highly prospective nickel-copper-PGE-cobalt properties located in Manitoba.

Mustang has now raised gross proceeds of $2,655,274 in connection with the Financing consisting of 7,586,498 units. Each unit consists of one common share and one half common share purchase warrant exercisable at $0.45 for a period of three years from closing. Finders fees of $6,563 cash and a total of 18,750 finders warrants were paid in conjunction with the third closing. The finders warrants are exercisable for a period of three years from the date of closing at an exercise price of $0.45.

All securities issued in connection with the Financing subject to a statutory hold period of four (4) months and one day from the date of issuance. The Financing is subject to the final approval of the TSX Venture Exchange.

About Mustang Minerals

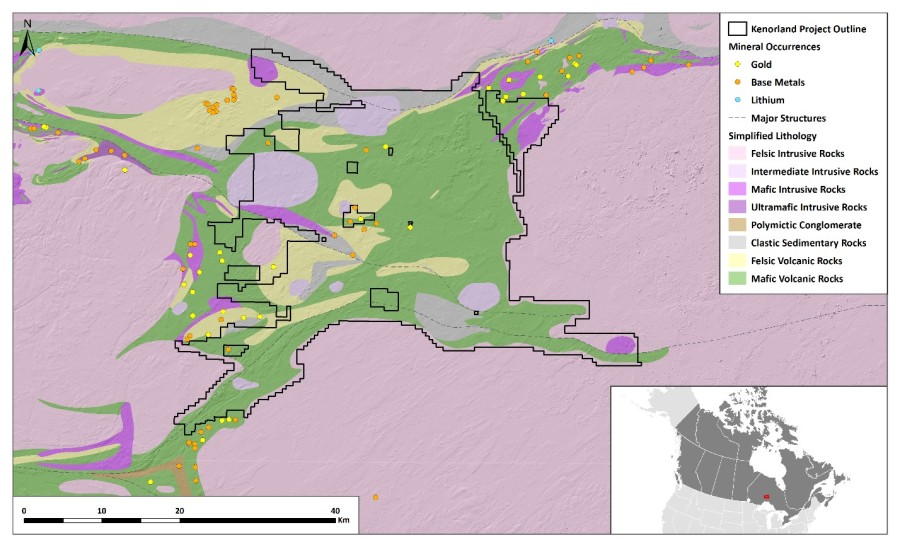

Mustang owns the mineral rights to the Makwa Nickel Property and the Mayville Property both located in the Bird River Greenstone Belt in southeast Manitoba. The Company completed a PEA on the Makwa-Mayville Project in 2014. The Company also controls mineral rights at the East Bull Lake Property west of Sudbury prospective for PGM and the Bannockburn Nickel Property near Matachewan.

Carey Galeschuk P. Geo is the Qualified Person for Mustang Minerals Corp.