Adventus Mining Provides Update on Arrangement with Silvercorp Metals

TORONTO, July 5, 2024 /CNW/ - Adventus Mining Corporation ("Adventus" or the "Company") (TSXV: ADZN) (OTCQX: ADVZF) provides the following update on its plan of arrangement (the "Arrangement") under the Canada Business Corporations Act pursuant to the arrangement agreement dated April 26, 2024 (the "Arrangement Agreement") between Adventus and Silvercorp Metals Inc. ("Silvercorp").

At its annual and special meeting held on June 26, 2024, the Arrangement was approved by approximately 99.975% of the votes cast by Adventus securityholders voting together as a single class, and approximately 99.966% of the votes cast by shareholders, not including those votes cast by shareholders that are required to be excluded pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions. Silvercorp voted its shares in Adventus in favour of approving the Arrangement.

On July 2, 2024, the Ontario Superior Court of Justice granted a final order approving the Arrangement.

Pursuant to the Arrangement Agreement, Adventus and Silvercorp are required to cooperate in order to complete the Arrangement as soon as reasonably practicable. Consistent with this, the Company had been taking steps such that the closing of the Arrangement could occur on July 5, 2024.

In response to the Company's efforts to close the Arrangement, on July 3, 2024, Silvercorp advised Adventus that it believed that one or more of the conditions to closing in its favour under the Arrangement Agreement had not been satisfied. Later on July 3, 2024, Silvercorp advised Adventus that the litigation described in the Company's June 17, 2024 release represented an unmet condition to closing.

The Company's June 17, 2024 press release described a constitutional protective action filed against Ministry of Environment, Water, and Ecological Transition of Ecuador and the office of the Attorney General of Ecuador, challenging an environmental license issued to the Company's Ecuadorian subsidiary, Curimining S.A. ("Curimining"). Curimining was named as an interested third party in the constitutional protective action.

In response to Silvercorp's advice, Adventus advised Silvercorp that it does not agree that the constitutional protective action represents an unmet condition to closing, nor that Silvercorp has any basis under the Arrangement Agreement not to complete the Arrangement.

In response to this advice, by letter dated July 4, 2024, that was received by Adventus on July 5, 2024, Silvercorp advised Adventus that the constitutional protective action constitutes a Material Adverse Effect as defined in the Arrangement Agreement that is an unmet condition to closing. The letter advised that Silvercorp is not prepared to close the Arrangement on July 5, 2024, and will not close until all conditions to closing are met.

Adventus disagrees that the constitutional protective action is a Material Adverse Effect as defined in the Arrangement Agreement, constituting an unmet condition to closing.

Adventus will take all necessary steps to protect the interests of Adventus and its securityholders in connection with the Arrangement. While Adventus may continue to have discussions with Silvercorp about the completion of the Arrangement, Adventus reserves all of its rights in the event that Silvercorp fails to close the Arrangement as required by the Arrangement Agreement, including by the "Outside Date" under the Arrangement Agreement of July 31, 2024.

About Adventus

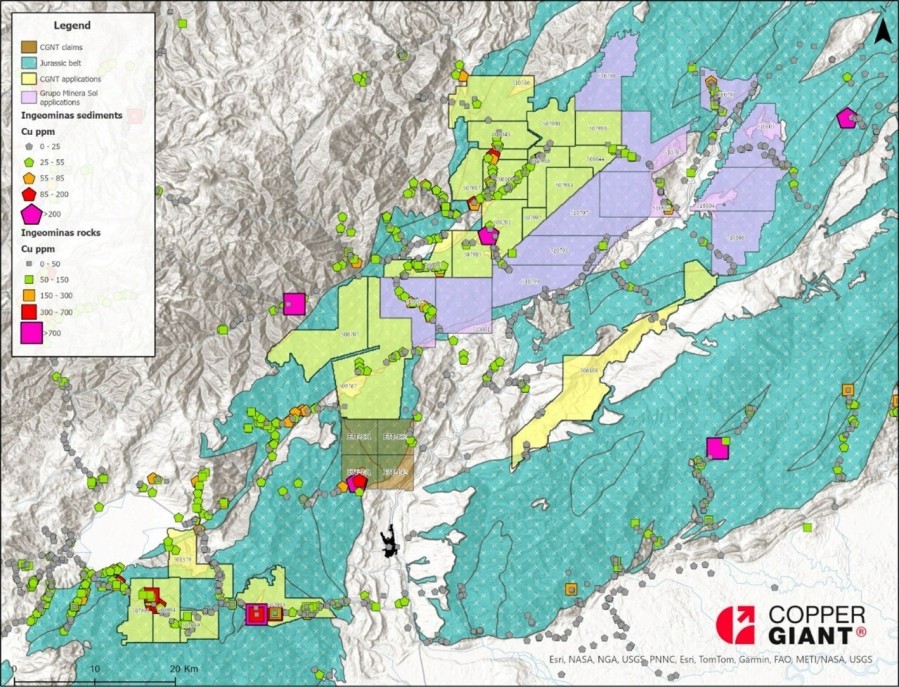

Adventus is an Ecuador-focused copper-gold exploration and development company. Adventus is advancing the majority-owned Curipamba copper-gold project, which has a completed feasibility study on the shallow and high-grade El Domo deposit. With the recent merger with Luminex Resources Corp., Adventus Mining owns the Condor gold project and a large exploration project portfolio that spans over 135,000 hectares – one of the largest holdings in Ecuador. The company's strategic shareholders include Silvercorp, Ross Beaty's Lumina Group, Altius Minerals Corporation, Wheaton Precious Metals Corp., and significant Ecuadorian investors.

Cautionary Note – Forward Looking Statements

Certain statements contained in this news release contain "forward-looking information" within the meaning of applicable Canadian securities laws and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "plans", "targets", "expects", "is expected", "scheduled", "estimates", "outlook", "forecasts", "projection", "prospects", "strategy", "intends", "anticipates", "believes", or variations of such words and phrases or terminology which states that certain actions, events or results "may", "could", "would", "might", "will", "will be taken", "occur" or "be achieved") are not statements of historical fact and may be "forward-looking statements." Forward-looking information and statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to a variety of risks and uncertainties that could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Forward-looking information and statements include, but are not limited to, information and statements regarding the Arrangement, and the timing and ability of Adventus to obtain the final order (if at all), delist the common shares of Adventus and complete the Arrangement (if at all).

Although Adventus believes that the expectations reflected in such forward-looking information and statements are reasonable, such information and statements involve risks and uncertainties, and undue reliance should not be placed on such information and statements. Material factors or assumptions that were applied in formulating the forward-looking information contained herein include, without limitation, the expectations and beliefs of Adventus, and its management and board of directors, as of the date hereof. Adventus cautions that the foregoing list of material factors and assumptions is not exhaustive. Many of these assumptions are based on factors and events that are not within its control, and there is no assurance that they will prove correct. Consequently, there can be no assurance that the actual results or developments anticipated by Adventus will be realized or, even if substantially realized, that they will have the expected consequences for, or effects on, Adventus, the current Voting Securityholders, or its future results and performance of Adventus. For additional information with respect to these and other factors and assumptions underlying the forward-looking statements made in this news release concerning the Arrangement, see the management information circular available on SEDAR+ (www.sedarplus.ca) under Adventus' issuer profile and on Adventus' website (www.adventusmining.com).

Readers, therefore, should not place undue reliance on any such forward-looking statements. There can be no assurance that the Arrangement will be completed or that it will be completed on the terms and conditions contemplated in this news release. The Arrangement could be modified or terminated in accordance with its terms. Further, the forward-looking information and statements in this news release are based on beliefs and opinions of Adventus at the time the statements are made, and there should be no expectation that these forward-looking statements will be updated or supplemented as a result of new information, estimates or opinions, future events or results or otherwise, and Adventus disavows and disclaims any obligation to do so except as required by applicable law. Nothing contained herein shall be deemed to be a forecast, projection or estimate of the future financial performance of Adventus.

Please also visit the Adventus website at www.adventusmining.com and follow us on X/Twitter: https://x.com/AdventusMining and LinkedIn: https://ca.linkedin.com/company/adventus-mining-corporation.