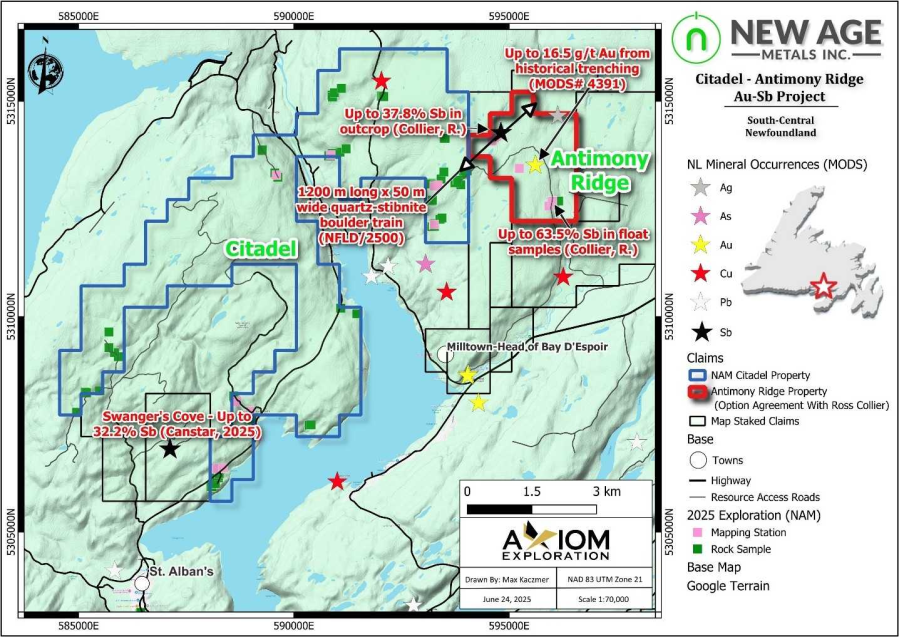

June 26, 2025 – TheNewswire - Rockport, Ontario – New Age Metals Inc. (TSX.V: NAM | OTCQB: NMTLF | FSE: P7J) (“NAM” or the “Company”) is pleased to announce that it has entered into an option agreement (the “Option”) dated June 18, 2025 (“Effective Date”) with Ross Collier, a local prospector (“Collier”), whereby NAM has been granted the exclusive right to acquire up to 100% interest in mineral license 035215M consisting of 20 claims totalling 500 hectares and known as the Antimony Ridge Property (the “Property”). The Property is located approximately 120 km south-southwest of the Town of Gander (Newfoundland), six km north of the community of Milltown, and immediately east adjacent to NAM’s 100% owned Citadel Property, in the St. Alban’s region of south-central Newfoundland (Figure 1).

Highlights

Highlights of the Antimony Ridge Property are:

1. 10% semi-massive stibnite in historical sampling of quartz vein at the Antimony Ridge Showing and coincident antimony (“Sb”) soil geochemistry anomaly and an 1100 m long, 50 m wide float train consisting of angular, semi-massive stibnite-quartz boulders1 (Figure 1);

2. Up to 37.8% Sb in more recent outcrop samples taken by Collier2 from Antimony Ridge;

3. Up to 63.5% Sb in recent float samples taken by Collier2 in from the southern part of the Property (Figure 1);

4. Up to 16.5 g/t Au in historical samples from the Golden Grit Showing3 (Figure 1); and

5. >100 gold grains in some till samples from the Property1.

Some of the above results have been taken directly from Mineral Occurrence Database System (“MODS”) Report descriptions and assessment reports (GeoFiles) filed with the Newfoundland & Labrador government. NAM management cautions the reader that although historical results were collected and reported by past operators and have not been verified nor confirmed by a Qualified Person, they form a basis for planning future work on the subject property.

Figure 1. Location of the Antimony Ridge Property

Figure 1. Location of the Antimony Ridge Property

Notes: The symbols on the Antimony Ridge Property are as follows: Black star= Antimony Ridge antimony (Sb) showing; Yellow Star = Golden Grit gold (Au) showing; and the Grey Star = Southeast Brook silver (Ag) showing. The green and pink symbols in the south-central part of the Property represent the location of the Sb mineralized float samples referred to highlight bullet point 3 above.

1 Pickett, J.W. 1993. The True Grit gold showings and Golden Grit gold-in-till anomaly, Bay D’Espoir area, southern Newfoundland. In Ore Horizons. Geological Survey Branch, Department of Mines and Energy, Government of Newfoundland and Labrador Ore Horizons Volume 2, pages 49-59. (GSB# NFLD/2500).

2 Collier, R. 2020. Golden-Tills Key La-B Property Assessment Report, South-Central Newfoundland, North of Head of Bay d’Espoir (Former “Golden Grit” Area). Submitted April 15, 2020 for Prospecting, Geochemical Rock Sampling & Research Field Work – Fall 2019. 64 pages.

3 Mineral Occurrence Database System Report, Record ID Number 4391 (Golden Grit).

Harry Barr, NAM Chairman and CEO states, “We are very pleased to work with Mr. Collier and to add the Antimony Ridge Property to NAM’s Sb-Au property portfolio. The historical compilation by NAM together with the recent grassroots work by Mr. Collier and field recon work by Axiom have identified attractive Sb and Au target areas in an emerging mineral belt. Historical exploration focused on gold, not antimony and none of the showings have ever been drilled. We very much look forward to working with Mr. Collier to explore and advance the property and to sharing updates with our shareholders as the program progresses.”

The Option Agreement

To exercise the Option, NAM agreed to make a series of cash payments and share issuances to Collier and fund exploration expenditures on the Property. From the effective date of June 18, 2025 to year 3 therefrom, the total payments, share issuance and work expenditures are as follows.

|

Date |

Cash Payment |

NAM Common Shares |

Work Expenditures |

|

Upon signing (Effective Date) |

$20,000 |

40,000 |

N/A |

|

Year 1 (from effective date) |

$10,000 |

40,000 |

$30,000 |

|

Year 2 (from effective date) |

$15,000 |

40,000 |

$40,000 |

|

Year 3 (from effective date) |

$15,000 |

40,000 |

$40,000 |

|

TOTALS |

$60,000 |

160,000 |

$110,000 |

NAM shall be deemed to have acquired 100% undivided interest in the Property (subject to an NSR royalty) on completion of all the payments and expenditures shown above. Collier shall retain a 2% NSR royalty on all mineral production from the Property. The Company shall have the exclusive right to purchase one percent (1%) of the NSR Royalty for $750,000 at any time prior to commercial production.

The transaction and any securities issued in connection with the Agreement are subject to TSX Venture Exchange approval and a four-month plus one day hold period in accordance with applicable Securities Laws.

Antimony Ridge Property

The Antimony Ridge Project lies in the Dunnage Tectonic Zone and is underlain by Ordovician schistose sedimentary rocks of the St. Joseph's Cove Formation with quartz veins, veinlets and stockworks. Three documented MODS mineral showings occur on the Property;

1) Antimony Ridge Showing; 2) Golden Grit Showing; and 3) Southeast Brook Silver Showing. Most of the work (trenching and sampling) has focused on the Golden Grit Showing. However, none of these 3 showings have ever been drilled. Furthermore, an Sb mineralized boulder trains has been outlined. Exploration planning is underway to locate the bedrock source.

Antimony and Gold Markets Commentary

Reuters reported on June 17th, 20253 that China severely restricted antimony exports, including a ban on shipments to the US, sending Antimony price to more than $60,000 per metric tonne, having more than quadrupled over the past year. As a critical metal, antimony's market dynamics are influenced by its applications in various industries and geopolitical factors. China's recent antimony export ban created a supply shock for the strategic metal. Approximately 70% of antimony is produced or refined in China.

Spot gold prices have traded as high as US$3,500 per ounce, likely driven by heightened global uncertainties and increased demand from institutional and retail investors. Central banks have continued their robust gold purchasing in 2025, adding 244 tonnes to their global reserves in Q1 and maintaining a strong pace into Q2, putting them on track for approximately 1,000 tonnes of purchases for the year. This sustained buying action underscores gold's role as a strategic asset amid economic instability and inflation concerns. Retail investors and family offices have also increased their gold holdings, seeking to hedge against market volatility. In Q1 2025, gold ETF inflows surged by 1,114% quarter-over-quarter, reaching 226.5 tonnes. Despite some outflows in May, year-to-date ETF inflows remain strong at over 322 tonnes, reflecting a continued revival in retail appetite for gold.

The convergence of these factors highlights the strategic importance of antimony and gold antimony on the current global economic landscape.

NAM’s Strategic Sb-Au Land Position

NAM’s properties in Newfoundland amount to approximately 19,800 hectares in

11 non-contiguous properties. Six of these properties are in the St. Alban’s area, along Canstar’s Swanger and Little River mineralized trends (Figures 2 and 3). The remaining

5 properties are strategically located along the same geological trend as the past-producing Beaver Brook Antimony Mine and in proximity to New Found Gold’s Queensway South Gold Project (Figures 2 and 4).

Figure 2. Overview map showing the location of NAM’s gold-antimony exploration properties in central Newfoundland

Figure 2. Overview map showing the location of NAM’s gold-antimony exploration properties in central Newfoundland

Figure 3. Map showing the location and distribution of NAM’s six gold-antimony properties, including the Antimony Ridge Option, in the St Albans area of south-central Newfoundland.

Figure 3. Map showing the location and distribution of NAM’s six gold-antimony properties, including the Antimony Ridge Option, in the St Albans area of south-central Newfoundland.

Figure 4. Map showing the location of NAM’s five gold-antimony properties in the Beaver Brook Antimony Mine and Queensway South Gold Property area, near the Town of Gander in Central Newfoundland.

Figure 4. Map showing the location of NAM’s five gold-antimony properties in the Beaver Brook Antimony Mine and Queensway South Gold Property area, near the Town of Gander in Central Newfoundland.

Qualified Person

Dr. William Stone, P.Geo. and a Qualified Person for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects and a consultant to NAM, has reviewed and approved the scientific and technical disclosure in this press release.

The Qualified Person has not completed sufficient work to verify the historical information on the neighbouring properties. Nevertheless, the Qualified Person considers that drilling and analytical results were completed to industry standard practices. The reader is cautioned that mineral occurrences, prospects and deposits on neighbouring properties are not necessarily indicative of mineralization on the Company’s properties. This information may provide an indication of the exploration potential of the Properties, but might not be representative of exploration results.

About NAM’s PGE Division

New Age Metals is a junior mineral exploration and development company focused on the discovery, exploration, and development of green metal projects in North America. The Company has three divisions: a Platinum Group Element division, a Lithium/Rare Element division, and a Gold-Antimony Division.

The PGE Division includes the 100% owned, multi-million-ounce, district-scale River Valley Project, one of North America’s largest undeveloped Platinum Group Element Projects, situated 100 km by road east of Sudbury, Ontario. In addition to River Valley, NAM owns 100% of the Genesis PGE-Cu-Ni Property in Alaska.

About NAM’s Lithium Division

The Company’s Lithium Division is one of the largest mineral claim holders in the Winnipeg River Pegmatite Field, where the Company is exploring for hard rock lithium and various rare elements such as tantalum, rubidium, and cesium. NAM is developing its lithium division in conjunction with its Farm-in/Joint Venture agreement with Mineral Resources Ltd. (“MinRes”), one of the world’s largest lithium producers. A minimum budget to maintain the Projects has been approved by Mineral Resources Ltd for May 2025 to April 2026. The Companies agreed to the minimum budget due to current lithium pricing and forest fire dangers in the immediate area

In April 2024, a $1.5M NSERC Alliance grant was awarded to a collaboration led by the University of Manitoba (Drs. Fayek and Camacho), with academic partners from Lakehead University (Dr. Hollings) and industry partners including New Age Metals and Grid Metals. This research is focused on advancing Canada’s critical metals sector, with New Age Metals’ portion targeting its Bird River lithium properties. Approximately $107,000 of work is planned on New Age’s properties in 2025. The early work will include core sampling and field visits starting this summer. The project will likely extend beyond the original 3-year term, due to its delayed start.

New Age Metals Inc. is supporting a successful $180K Mitacs research grant, awarded in 2023, through its $90K contribution (already accounted for and paid under the Mineral Resources joint venture). This academic partnership with the University of New Brunswick and the University of British Columbia is focused on understanding the origin and controls of lithium pegmatite mineralization in the Cat Lake–Winnipeg River field. Fieldwork for the MSc. thesis has been completed, while the post-doctoral phase is ongoing at UNB.

This collaboration provides access to top-tier scientific expertise and equipment, significantly reducing analysis costs and adding long-term value to the project.

Management is currently aggressively seeking new mineral acquisition opportunities. Our philosophy is to be a project generator with the objective of optioning our projects with major and mid-tier mining companies through to production.

The Company is actively seeking an option/joint venture partner for its River Valley Palladium Project and its road-accessible Genesis PGE-Cu-Ni Property in Alaska.

Investors are welcome to visit the New Age Metals website at www.newagemetals.com where they can review the company and its corporate activities. Any questions or comments can be directed to This email address is being protected from spambots. You need JavaScript enabled to view it. or Harry Barr at This email address is being protected from spambots. You need JavaScript enabled to view it. or Farid Mammadov at This email address is being protected from spambots. You need JavaScript enabled to view it. or call 613 659 2773.

Opt-in List

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.