Volatile metal markets, battery and mining technology, geopolitics and strategic supply chains: these are some of the key themes for the record number of investors registered to attend the Resourcing Tomorrow 2024 conference in London in December.

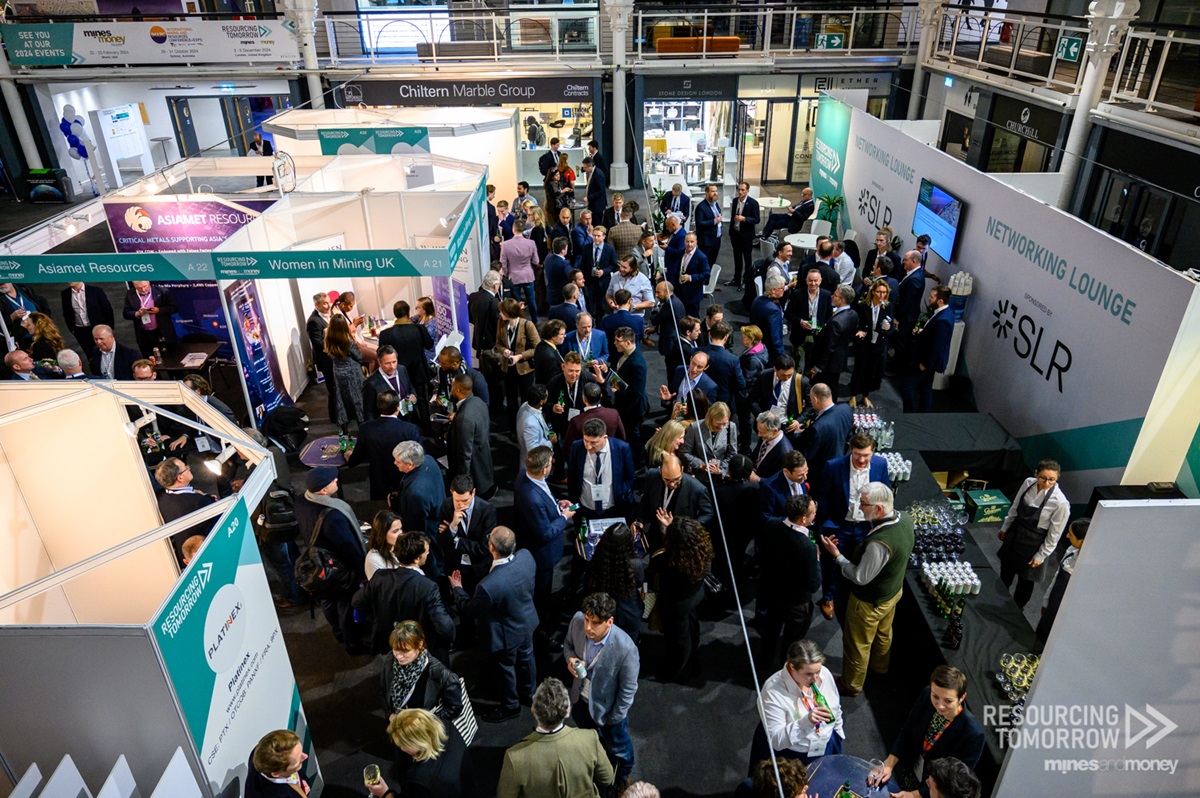

Six weeks out from Europe’s largest annual mining event, which draws the industry’s majors as well more than 100 of the sector’s promising juniors, Resourcing Tomorrow has already passed last year’s circa-500 investor total.

Small and institutional investors from about 40 countries will attend the conference to get the latest vital insights from more than 300 speakers representing governments, miners, metal users and traders, midstream processing companies, financiers and technology firms.

“This is a very valuable gathering because these different communities come together in one place,” says Marcos Camhis, founder and CEO of Swiss private equity firm, FOS Associates.

“The value for investors but also for the companies themselves is understanding how they can … build strategic alliances and get a great view of the policy-making environment that affects them both locally and globally.

“For investors you have the full range of smaller companies; you have representatives from the larger companies, from the majors, from the traders as well as representatives from the governments and the policy makers from around the world.”

VSA Capital analyst Paul Renken says: “Not only do you get to hear from thought leaders but you also get the chance to talk to management teams of these companies and ask them really whatever questions you want to learn more about their projects and their sectors.”

In the wake of a report by the US$15 trillion-backed Global Investor Commission described as a “direct call to investors to reshape the role they play” in mining’s future, commission chair Adam Matthews says the international investment community now has a comprehensive guide to “better understand the mining ecosystem and the levers they can pull to shape the industry and its value chains”.

“Most importantly [the report] provides a direction of travel for investors to collectively address the sector’s systemic risks from conflict to climate and the need for a different approach by investors to the sector if it is to leave a positive legacy for host communities and the environment whilst meeting global demand,” Mathews says.

“It calls for a reset by investors of their relationship with the industry.”

Veteran fund manager Nicholas Boyd-Mathews says the GIC report highlights the importance of sustainability in the mining sector and the role that both investors and operators must play in shaping the industry’s future.

“We need to hardwire effective sustainability standards into management systems, and the institutional investment community is ideally placed to do so,” says Eden Asset Management’s executive director and chief investment officer.

Boyd-Mathews sees the oft-maligned junior mining sector as pivotal in driving the future of sustainable mining.

“Unlike larger, established mining companies, juniors are often on the frontlines of exploring new deposits and opening new mines,”

“This positions them not only as pioneers of future growth but also as potential leaders in sustainable practices.

“Junior miners, unburdened by decades of entrenched practices, are in a unique position to adopt and champion modern sustainability standards.

“With the right investment and support, these smaller operators can lead the charge in building greener, more responsible mining operations.”

In an increasingly complex regulatory and funding environment for mine developers, Boyd-Mathews says access to capital is a major issue for smaller resource companies, in particular.

“Mid-sized and larger operators, while better positioned, still face the high costs associated with sustainable practices and regulatory compliance,” he says.

“Access to capital is directly linked to a company’s social license to operate – a growing concern as communities and regulators demand higher environmental and ethical standards. Companies that cannot demonstrate responsible operations are at risk of losing this social license, leading to delays, cost overruns, or even project cancellations.”

Technological change adds to complexity, and opportunities

In parallel with a changing regulatory and compliance picture, a rapidly evolving technology landscape adds to the premium on market insight to be gained from the diverse line-up of experts at an event such as Resourcing Tomorrow.

Brian Menell, CEO of US-government backed TechMet, says the all-important battery energy storage sector is a case in point.

Resourcing Tomorrow 2024 will feature its strongest roster yet of automotive-sector, battery manufacturing supply chain, trading and specialist finance firms.

“I think change is going to continue to be constant,” Menell says.

“There's a lot of work being done in battery chemistry and battery configuration … It’s not static in any way at all.

“The mix of battery metals that is going to be required for the batteries in two years, five years, 10 years’ time is clearly different to the mix today.

“This is a constantly changing equation that we as TechMet obviously feel we have to be very, very focused on in order to plot demand-supply balances two years out, five years out and 10 years out in order to allocate capital correctly today.”

Mark Frayman, managing partner at US-based Orion Industrial Partners, says a recent surge in mining and metals technological innovation and commercialisation, and its potential to reshape industry value chains, is also creating new opportunities for investors.

“New companies targeting each step of the critical minerals value chain are emerging and from ecosystems beyond the traditional mining ones,” Frayman says.

“That is, Silicon Valley, Boston, Tel Aviv, London, as well as, of course, out of Toronto, Perth and Chile.”

Drivers includes a mix of factors including advances in platform technologies such as Generative AI, cloud compute, advanced electrochemistry and even synthetic biology.

“There is also increasing awareness among entrepreneurs, academia and investors of the scale of the opportunity in industrial decarbonisation and the role of critical minerals in that, and the relative underinvestment of this area to date compared to other more-crowded areas of climate-tech,” Frayman says.

“And then there is the success of some start-up companies in crossing the proverbial Rubicon to become large-scale unicorns.

“This attracts the next wave of companies targeting similar opportunities in mining, where the size of the market and the implications of winning just a few contracts from large end customers can make for a very large company.”

Gold a constant in changing world?

Another global organisation with a vision for modernising and repositioning mining for consumers and investors is the World Gold Council, which has launched Gold247 as a banner initiative for digital transformation of gold market infrastructure.

“This initiative aims to enhance trust in gold, and as a consequence, unlock substantial demand,” the WGC says.

David Awram, co-founder and senior executive vice president of global royalty and streaming-sector leader Sandstorm Gold, says modernising trading and management of gold with blockchain technology can help the sector attract a broader base of investors and end-users by making gold trading more efficient and secure while improving transparency, trust, and accessibility for the gold market.

“The timing is critical as the global financial landscape evolves, with increasing demand for digital assets and a need for modernised infrastructure to support gold's role as a reserve asset and investment vehicle,” Awram says.

How does a major metals-sector investor and financier see the role of gold and other precious metals within a broad, critical-minerals focused transition narrative?

“ESG considerations have become a significant factor in attracting investment, even in sectors like gold that are not classified as critical minerals, and we foresee this trend continuing,” Awram says.

“We view ourselves as the ultimate long-term investor in the mining space and are always thinking critically about how a potential investment functions successfully in its jurisdiction and community.

“Beyond the fact that companies with strong ESG practices are likely to secure more favourable financing and partnerships, part of Sandstorm’s strategy is to use precious metal stream financing as a way of financing critical mineral operations like copper.

“In part, this was Sandstorm’s strategy in launching a copper company in 2022.

“Our strategic partnership with Horizon Copper allows Sandstorm to acquire precious metal byproduct streams on significant copper assets around the world, while Horizon contributes to the funding of these critical mining operations.”

For more information visit resourcingtomorrow.com.