Chakana Copper Releases Results of Infill Drilling at Breccia Pipe 5 and Provides Exploration Update, Intersects 140.4 Metres With 0.46% Copper, 1.70 G/T Gold and 23.5 G/T Silver (1.77% Cu_EQ, 2.71 G/T Au_EQ) From 13 Metres

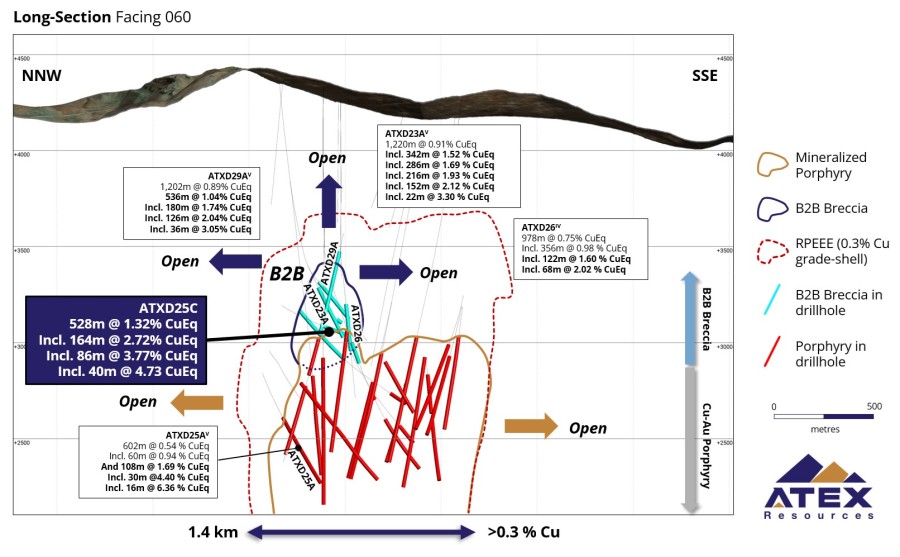

VANCOUVER, British Columbia, Jan. 10, 2019 (GLOBE NEWSWIRE) -- Chakana Copper Corp. (TSX-V: PERU; OTC: CHKKF; FWB: 1ZX) (the “Company” or “Chakana”), is pleased to announce it has completed infill drilling on the upper 340m mineralized extent of Breccia Pipe 5 (Bx 5) at the Soledad copper-gold-silver project in central Peru. All drilling to date has been on the portion of the Soledad Project optioned from Condor Resources Inc. The four holes reported here were designed to explore the upper 200m extent of the breccia pipe from surface (Figs. 1 and 2). Chakana had previously released thirteen drill holes from Bx 5 (see news releases dated February 22, 2018 and November 13, 2018 on www.sedar.com), that included a 264m intercept with 0.71% Cu, 1.30 g/t Au and 24.3 g/t Ag (1.77% Cu_EQ; 2.82 g/t Au_EQ) from surface in hole SDH18-080.

All four holes intersected significant intervals of mineralization. Hole SDH18-084 was drilled to the south from a collar located on the east-central part of the breccia pipe and intersected 103.3m of mineralized breccia from surface with 0.42% Cu, 1.36 g/t Au, and 46.7 g/t Ag. Excluding the oxide zone, primary grades are 0.56% Cu, 1.07 g/t Au, and 31.4 g/t Ag for 72.3m starting at 31m depth. Hole SDH18-086 intersected 140.4m of primary mineralization from 13m with 0.46% Cu, 1.70 g/t Au, and 23.5 g/t Ag. “These results compliment results from the previous thirteen holes in Bx 5 and demonstrate good continuity of mineralization in the breccia. As with Bx 1, mineralization at Bx 5 remains open at depth. In addition, numerous known breccia pipes and exploration targets remain to be tested,” said President and CEO David Kelley. Examples of mineralized breccias from holes in this release are shown in Figure 3.

Previously unreported mineralized intervals from Breccia Pipe 5 are:

| Bx 5 - Infill Holes | |||||||||||

| DDH # | Az | Dip | From - To (m) |

Core Length (m) |

Au g/t |

Ag g/t |

Cu % | Cu-eq %* |

Au- eq g/t* |

Note | |

| SDH18-083 | 61 | -79 | 0.00 | 38.60 | 38.60 | 1.24 | 19.2 | 0.07 | 1.04 | 1.60 | Oxide |

| and | 57.00 | 59.50 | 2.50 | 0.54 | 72.0 | 0.31 | 1.28 | 1.96 | Primary | ||

| and | 83.00 | 112.00 | 29.00 | 1.35 | 18.5 | 0.24 | 1.28 | 1.96 | Primary | ||

| SDH18-084 | 185 | -70 | 0.00 | 103.30 | 103.30 | 1.36 | 46.7 | 0.42 | 1.71 | 2.61 | |

| including | 0.00 | 31.00 | 31.00 | 2.01 | 82.3 | 0.11 | 2.13 | 3.25 | Oxide | ||

| including | 31.00 | 103.30 | 72.30 | 1.07 | 31.4 | 0.56 | 1.53 | 2.34 | Primary | ||

| SDH18-085 | 255 | -68 | 0.00 | 98.00 | 98.00 | 0.73 | 35.0 | 0.34 | 1.12 | 1.71 | |

| including | 0.00 | 42.00 | 42.00 | 0.94 | 53.7 | 0.03 | 1.1 | 1.69 | Oxide | ||

| including | 42.00 | 98.00 | 56.00 | 0.57 | 21.0 | 0.57 | 1.12 | 1.72 | Primary | ||

| SDH18-086 | 300 | -82 | 0.00 | 153.40 | 153.40 | 1.68 | 25.2 | 0.42 | 1.73 | 2.65 | |

| including | 0.00 | 13.00 | 13.00 | 1.42 | 44.4 | 0.03 | 1.34 | 2.05 | Oxide | ||

| including | 13.00 | 153.40 | 140.40 | 1.70 | 23.5 | 0.46 | 1.77 | 2.71 | Primary | ||

* Cu_eq and Au_eq values were calculated using copper, gold, and silver. Metal prices utilized for the calculations are Cu – US$2.90/lb, Au – US$1,300/oz, and Ag – US$17/oz. No adjustments were made for recovery as the project is an early stage exploration project and metallurgical data to allow for estimation of recoveries are not yet available. The formulas utilized to calculate equivalent values are Cu_eq (%) = Cu% + (Au g/t * 0.6556) + (Ag g/t * 0.00857) and Au_eq (g/t) = Au g/t + (Cu% * 1.5296) + (Ag g/t * 0.01307).

Reported mineralized intervals are not true widths given the vertical nature of the breccia pipe and the steep inclination of the holes.

Surface Exploration and Permitting Update

Surface exploration continues throughout Chakana’s 3,085 hectare concession area. Detailed soil sampling covering the entire Soledad cluster of breccia pipes has been completed and downhole electromagnetic (EM) and surface surveys are underway. Two downhole EM surveys as well as 7 out of a planned 17 surface loops have been completed using imported Crone geophysical equipment. Integration of these data sets will be used to prioritize drill targets.

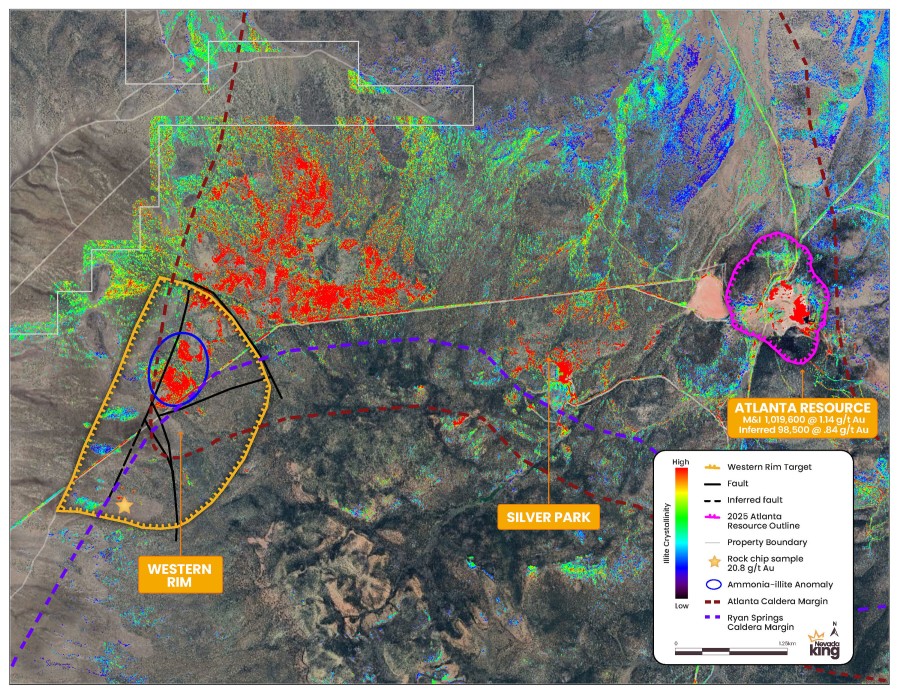

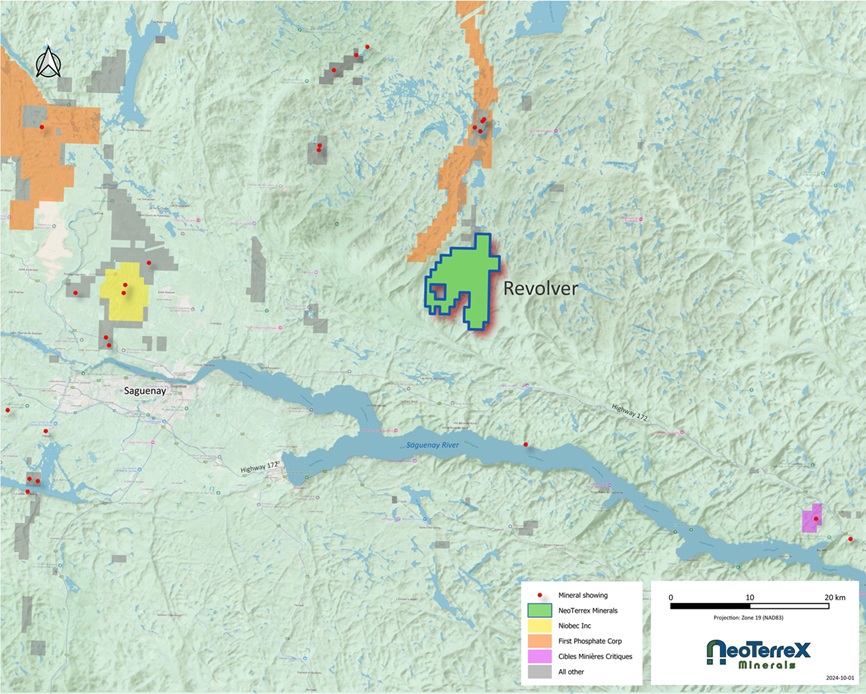

Soil geochemistry results covering the entire Soledad cluster of breccia pipes have been received and further document the extent of mineralization hosted in breccia (Fig. 4). Results previously released (see news release dated November 13, 2018) highlighted an anomalous zone of gold in soil corresponding to several known and potential breccia pipes extending north-northeast from Huancarama to Bx 5. In addition, a very prominent soil anomaly related to Bx 1, and a new breccia pipe, Bx 7, are clearly delineated in the results. New results from extensions of the original soil grid show anomalous gold in soil at the Western and Corral breccias, north of Bx 5, and Cima Blanca. Cima Blanca is an area of silica-illite-paragonite-tourmaline alteration hosted in dacite tuff associated with east-west-trending gold-bearing quartz veins (Fig. 4). “The expanded soil geochemistry results delineate a more complete picture of the additional mineralization at Soledad. In addition to confirming the gold-bearing nature of several known breccias, several areas with anomalous gold in soil highlight other exploration targets for testing. The large anomalous area covering the Western and Corral breccias is particularly exciting, highlighting new targets in this area,” stated Kelley.

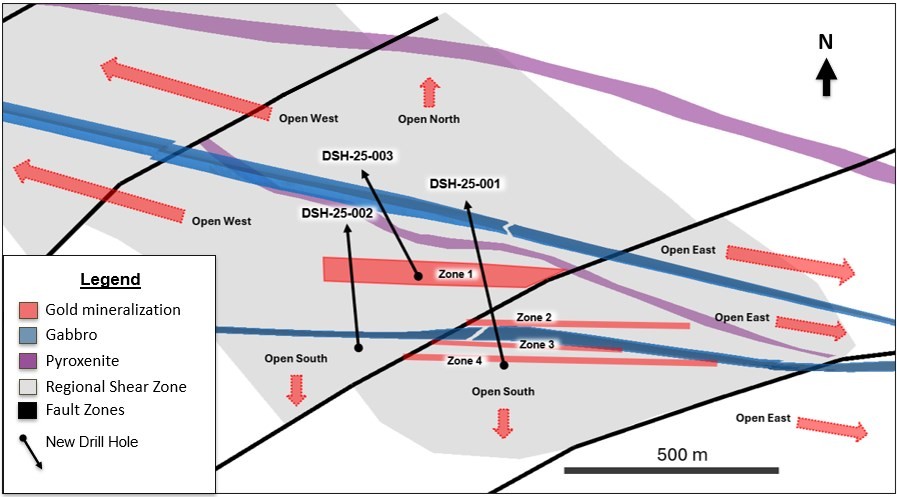

Three component surface time domain EM data was collected over Bx 1 and Bx 7 using transmitter loops designed to preferentially couple with conductive sulfides hosted within known or blind breccia pipes. Data was collected within the transmitter loop along north south oriented lines every 25m with line density of 50m. Results for the vertical component of the measured field for a relatively early time window detected responses from confined conductors that correlate well with known breccias (Fig. 5). “The time domain EM results are outstanding in that this technique confirms a robust response from Bx 1 where we have had excellent high-grade drill results. The response at the untested Bx 7 pipe is even more impressive in comparison to the Bx 1 response,” commented Kelley.

As previously reported, Chakana received government approval for a Semi-detailed Environmental Impact Assessment (EIAsd) covering a portion of the Soledad project (see news release dated November 26, 2018). The approval applies to the original area of the Declaration of Environmental Impact (DIA) on the Soledad exploration permit and includes 120 additional drilling platforms. In order to drill in the new concessions acquired by Chakana, a modification to this permit is required. This modification has been submitted and once approved will allow drilling the Huancarama and Paloma breccia pipes and concession area.

Sampling and Analytical Procedures

Chakana follows rigorous sampling and analytical protocols that meet or exceed industry standards. Core samples are stored in a secured area until transport in batches to the ALS facility in Callao, Lima, Peru. Sample batches include certified reference materials, blank, and duplicate samples that are then processed under the control of ALS. All samples are analyzed using the ME-MS41 (ICP technique that provides a comprehensive multi-element overview of the rock geochemistry), while gold is analyzed by AA24 and GRA22 when values exceed 10 g/t. Over limit silver, copper, lead and zinc are analyzed using the OG-46 procedure. Soil samples are analyzed by 4-acid (ME-MS61) and for gold by Fire Assay on a 30g sample (Au-ICP21).

Results of the previous sixty-six drill holes from the Soledad Project have been released and are also available at www.chakanacopper.com. Additional information concerning the Project is available in a technical report prepared in accordance with National Instrument 43-101 made available on Chakana’s SEDAR profile on www.sedar.com.

Qualified Person

David Kelley, an officer and a director of Chakana, and a Qualified Person as defined by NI 43-101, reviewed and approved the technical information in this news release.

ON BEHALF OF THE BOARD

(signed) “David Kelley”

David Kelley

President and CEO

For further information contact:

Michelle Borromeo, Manager – Corporate Communications

Phone: 604-715-6845

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statement Advisory: This release may contain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Chakana to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward looking statements or information relates to, among other things, the interpretation of the nature of the mineralization at the Project, the potential to grow the Project, the potential to expand the mineralization, the planning for further exploration work, the ability to de-risk the potential exploration targets, and our belief about the unexplored parts of the Project. These forward-looking statements are based on management’s current expectations and beliefs but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward- looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

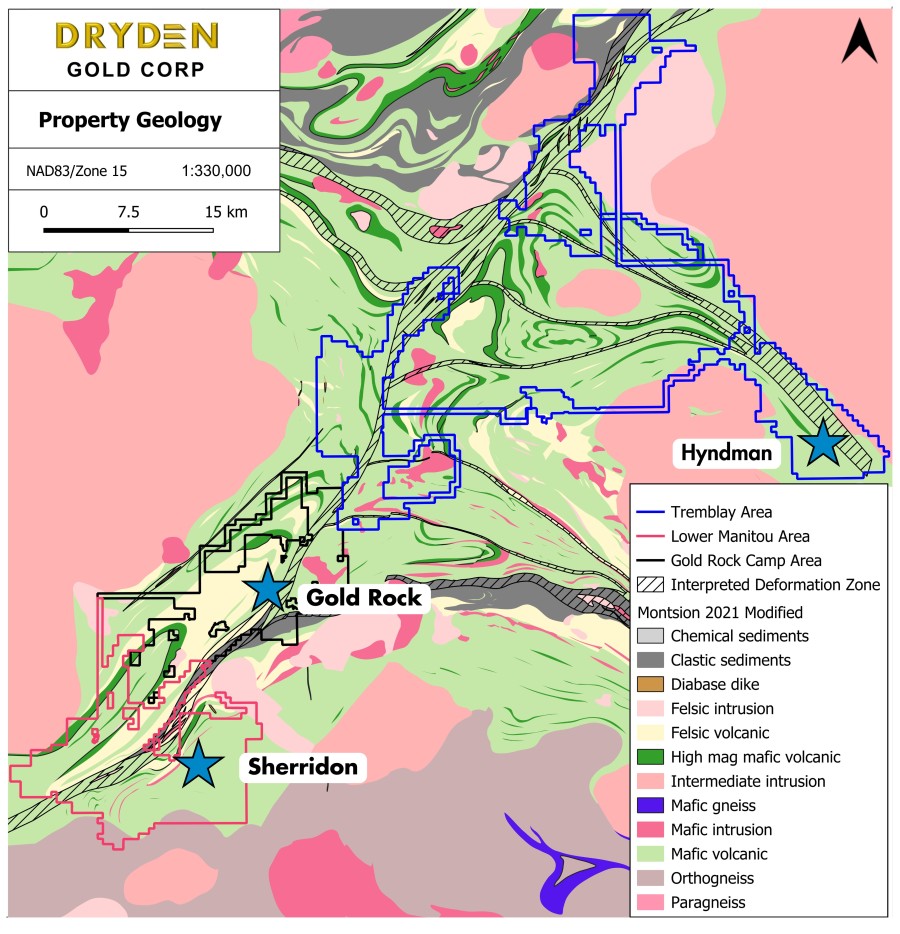

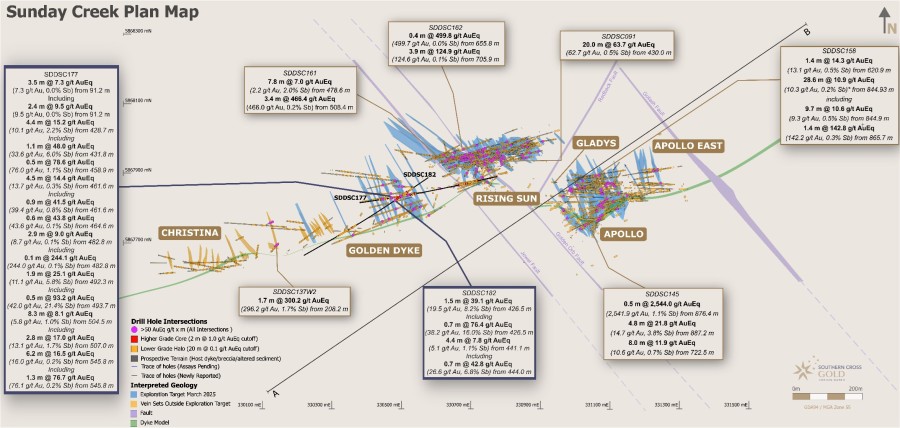

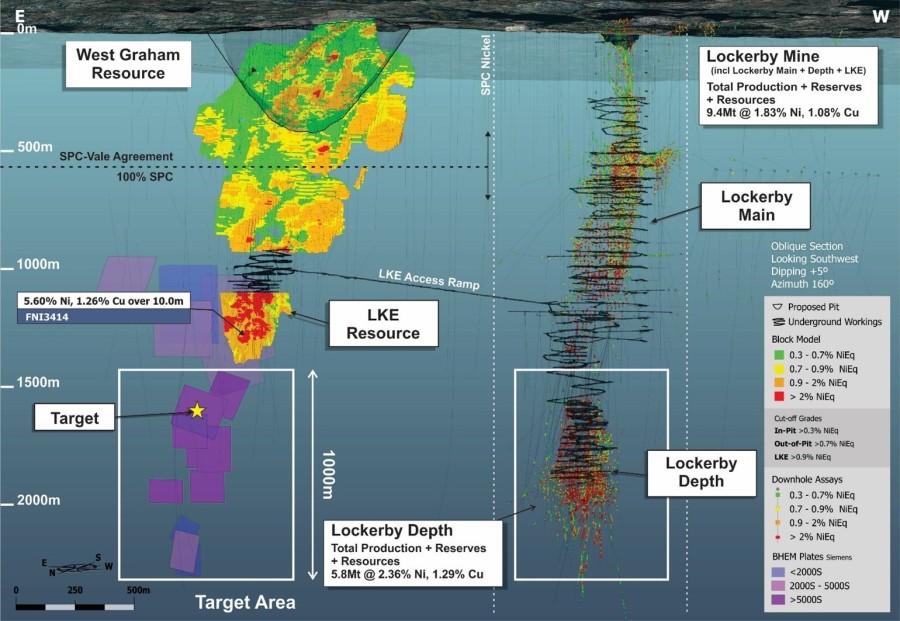

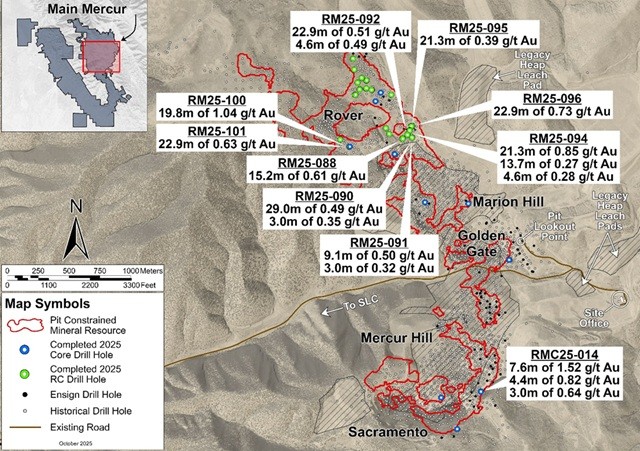

Figure 1 – Map showing drill holes with geology discussed in this release.

Figure 2 – Section looking north showing the breccia pipe at Bx 5 highlighting holes in this release. Light red 3D shapes based on Leapfrog model of breccia from all holes drilled by Chakana. Drill holes show tourmaline breccia (red), andesitic wall rock (green), and other host rocks (other colors). Section includes data from 75m in front of and behind section.

Figure 3 – Mineralized intercepts from drill holes reported in this release showing different styles of mineralization in Bx 5: A) SDH18-083 – shingle breccia with strong tourmaline replacement; the interval 93.85-99m assays 1.79 g/t Au, 0.42% Cu, and 24.1 g/t Ag; B) SDH18-084 – chaotic shingle and mosaic breccia; the interval 49-55m assays 0.49 g/t Au, 1.77% Cu, and 18.86 g/t Ag; C) SDH18-085 – shingle breccia with strong tourmaline replacement; the interval 82-88m assays 0.42 g/t Au, 2.13% Cu, and 27.6 g/t Ag; D) SDH18-086 – shingle breccia with variable clast sizes; the interval 27-33m assays 1.24 g/t Au, 1.43% Cu, and 59.9 g/t Ag; E) breccia with interstitial chalcopyrite and pyrite in SDH18-084 at 37.17m; F) chalcopyrite and pyrite filling open space in shingle breccia; SDH18-086 at 89.6m.

Figure 4 – 3D perspective view looking northeast of the main Soledad breccia pipe cluster showing confirmed breccia pipes (circles) and occurrences (stars). Color image shows gold in soils collected on 50m centers. Anomalous areas without confirmed breccia pipes or occurrences are considered exploration targets. Gold is determined by Fire Assay on a 30g sample.

Figure 5 – Images showing results for the time domain surface EM survey over Bx 1 (A) and Bx 7 (B). Results are for the vertical component, Channel 10 (0.268ms to 0.328ms).