Aztec Minerals Intersects 0.71 gpt Gold over 139 m including 2.1 gpt over 20 m in Initial Drill Results from Cervantes Porphyry Gold Property, Sonora, Mexico

Vancouver, BC (FSCwire) - Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF) has intersected long intervals of porphyry gold (copper, silver) mineralization including shorter intervals of high grade gold mineralization in the initial results of its Phase 1, 15 hole, 3,000 metre (m) drill program at the Cervantes Project in Sonora State, Mexico.

Drilling Highlights Include:

- 139.0 m from surface grading 0.71 grams per tonne (gpt) Au, including 2.10 gpt Au over 20.0 m and 2.0m of 5.52 gpt Au in hole 17CER005 at the California zone

- 117.0 m from near surface grading 0.63 gpt Au, including 1.18 gpt Au over 43.0 m and 2.0m of 4.05 gpt Au, in hole 17CER003 at the California zone

Drill Results Table:

|

Hole No. |

From |

To |

Interval (m) |

Gold |

Copper (%) |

Silver (gpt) |

|

1 |

15.8 |

42.5 |

26.7 |

anomalous |

||

|

2 |

7 |

227 |

220 |

anomalous |

||

|

3 |

2 |

119 |

117 |

0.63 |

0.09 |

2.7 |

|

incl. |

46 |

89 |

43 |

1.18 |

0.16 |

5.5 |

|

also |

46 |

48 |

2 |

5.52 |

0.21 |

4.3 |

|

4 |

2 |

56 |

51 |

0.19 |

0.06 |

2.3 |

|

incl. |

34 |

38 |

4 |

0.16 |

0.12 |

2.6 |

|

5 |

0 |

139 |

139 |

0.71 |

0.10 |

2.1 |

|

incl. |

34 |

110 |

76 |

0.79 |

0.15 |

2.7 |

|

also |

26 |

46 |

20 |

2.10 |

0.16 |

1.9 |

|

also |

40 |

42 |

2 |

4.05 |

0.16 |

2.3 |

Joey Wilkins, CEO of Aztec, commented: "These positive results from three of the first five drill holes of our Phase 1 drill program confirm that the California zone has excellent bulk tonnage porphyry gold (copper, silver) potential at Cervantes. Holes 3, 4 and 5 were drilled to test a small part of a large surface geochemical gold anomaly on the hill that forms the California zone.

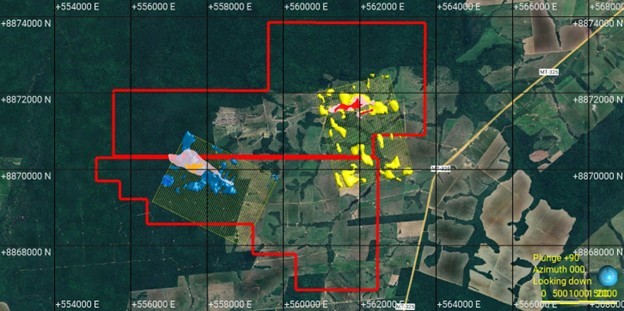

“As expected, we intersected gold oxide mineralization where the copper has been partially leached out as well as mixed oxides-sulfides transitioning to sulfide mineralization at depth. The entire California zone is underlain by a large, strong IP chargeability anomaly from 100 m depth down to at least 500 m that could represent the heart of a porphyry gold (copper, silver) sulfide system.

“A total of 810 m were drilled in the first five holes, and we are currently drilling hole nine. Our first two drill holes intersected anomalous but sub-economic copper-gold-molybdenum oxide mineralization from top to bottom in the Jasper zone west of the California zone. The main focus of our remaining holes in the Phase 1 drill program will be to systematically test the western half of the much larger California zone.”

Brief hole-by-hole descriptions follow below.

17CER001: Jasper zone – to test high grade oxide copper-gold mineralization near a north-south fault

0-15.85m Overburden

15.85-42.5m Polymictic Breccia composed of hornfels sediments and quartz feldspar porphyry, hematite-goethite matrix filling. Hole was lost due to broken ground and fault gouge.

Assays range from trace up to 0.05 gpt gold, 0.09% copper, 6.10 gpt silver

17CER002: Jasper zone – 50 m north of Hole 1

0-7.0m Overburden

7.0-227.0m Polymictic Breccia, hematite to goethite matrix, disseminated and veinlet oxides, scattered minor copper oxides, moderate iron and manganese oxides, locally silicified fragments and matrix, minor chlorite, strong foliation and fracturing, also Quartz Feldspar Porphyry, Aplite Dike

Assays range from trace up to 0.72 gpt gold, 0.20% copper, 3.5 gpt silver, 0.018% molybdenum

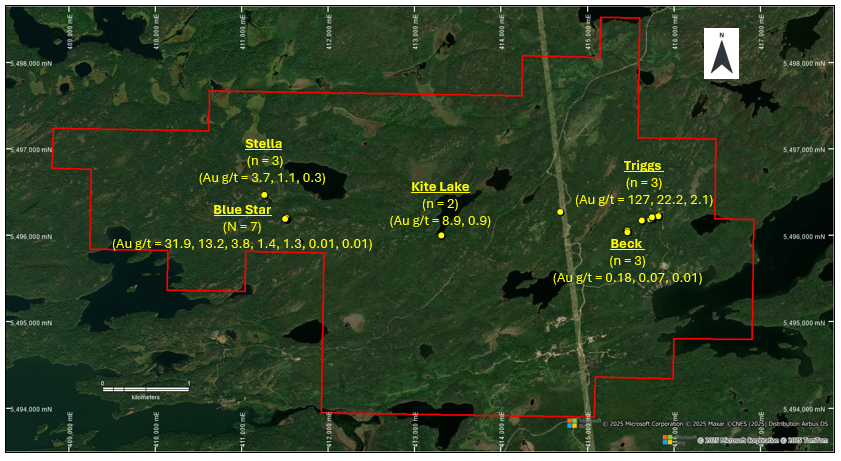

17CER003: California zone – to test large, strong, oxide gold geochemical anomaly

0-202.0m Quartz Feldspar Porphyry (QFP) and Intrusive Breccia, strong hematite and goethite after disseminated and veinlet sulphides up to 3%, abundant clay and sericite alteration, quartz veinlets and silicification, locally brecciated to re-brecciated, some Fault Zones, terminated in Hornfels-Siltstone

Assays range from trace up to 5.52 gpt gold, 0.54% copper, 28.8 gpt silver

17CER004: California zone – weaker part of gold geochemical anomaly

0-194.0m QFP, goethite, hematite, quartz veinlets and silicification, manganese oxide, sparse siderite, minor quartzite fragments, Faulted Zones and Intrusive Breccia, pyrite as matrix and disseminated, partly oxidized to hematite and goethite, sericite, clay, silicified with quartz-calcite veinlets, minor patches of Hornfels, Rhyolite, Aplite, terminated in Polymictic Breccia, Hornfels.

Assays range from trace up to 0.76 gpt gold, 0.12% copper, 4.70 gpt silver

17CER005: California zone – stronger part of gold geochemical anomaly

0.0-145.0m QFP, Intrusive Breccia, oxidized with goethite, minor abundant hematite, strong clay and sericite alteration, minor quartz veinlets and silicification, sulphides up to 6%, some Fault Zones, strong sericite-clay alteration, pyrite veins up to 7.0cm wide, some Polymictic Breccias and Hornfels, intense alteration near contact with Diorite Dike, 10-15% pyrite, terminated in Polymictic Breccias, Hornfels

Assays range from trace up to 4.30 gpt gold, 0.70% copper, 7.6 gpt silver

Joey Wilkins, B.Sc., P.Geo., President and CEO of the Company, is the Qualified Person who reviewed and approved the technical disclosures in this news release. All core samples were split in half, placed into plastic bags, labeled with sample number, closed with zip ties, and placed in rice sacks. Samples were typically collected in 2.0m intervals with occasional exceptions of 1.5 or 3.0m intervals. Blanks, duplicates, and certified standards were inserted into the sample stream and subsequently reviewed without any outliers or abnormal results. The samples were delivered to Bureau Veritas Laboratories in Hermosillo and analyzed for gold using a 30gram sample by fire assay fusion with AAS finish. Samples were shipped to Vancouver and analyzed with a 0.25gram sample using 4-acid ICP-MS providing analysis on 45 elements.

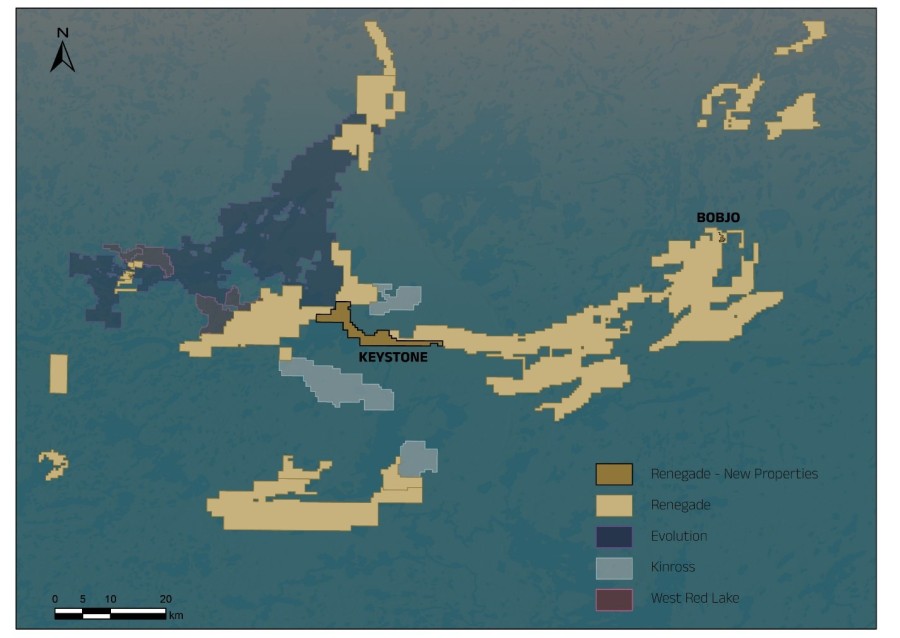

The Cervantes Property is held under an option to purchase agreement with Kootenay Silver Inc. (TSX-V:KTN) whereby Aztec can acquire up to 100% interest in the property in two stages. Additional information can be found on our website.

About Aztec Minerals – Aztec is a mineral exploration company focused on the discovery of large porphyry gold-copper deposits in the Americas. Our first project and core asset is the prospective Cervantes gold-copper property in Sonora, Mexico. The second project is the district-scale historic Tombstone properties in Cochise County, Arizona. Aztec’s shares trade on the TSX-V stock exchange under the symbol AZT and on the OTCQB under the symbol AZZTF.