GOLDEN, Colo., Sept. 07, 2017 (GLOBE NEWSWIRE) -- Golden Minerals Company (NYSE American:AUMN) (TSX:AUMN) (“Golden Minerals”, “Golden” or “the Company”) is pleased to announce the start of a new drill program at its Santa Maria silver and gold project located near Santa Barbara in Chihuahua State, Mexico.

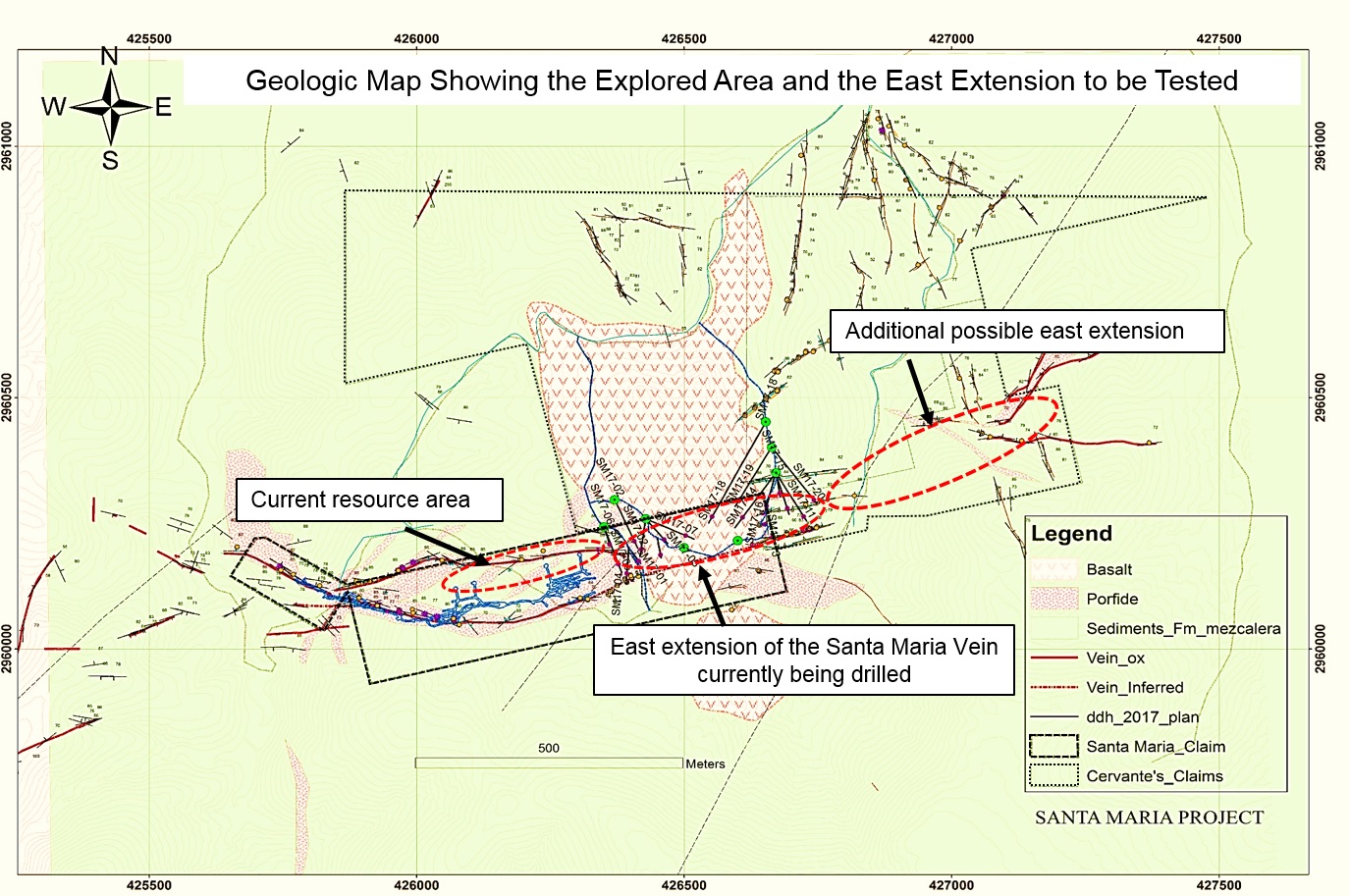

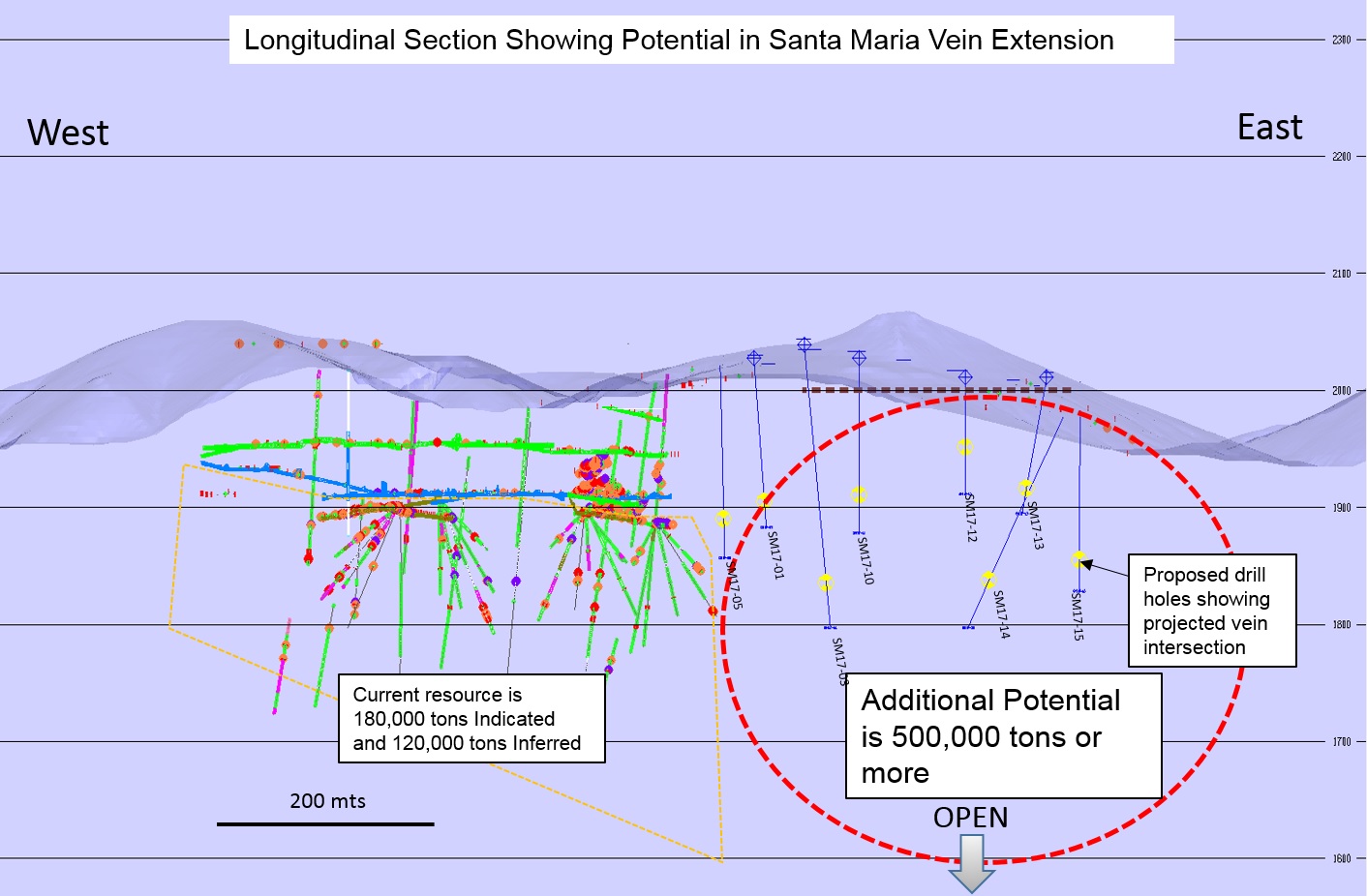

The drill program targets extensions of the vein deposit described in the previous Preliminary Economic Assessment (“PEA”) and resource update reported March 30, 2017.

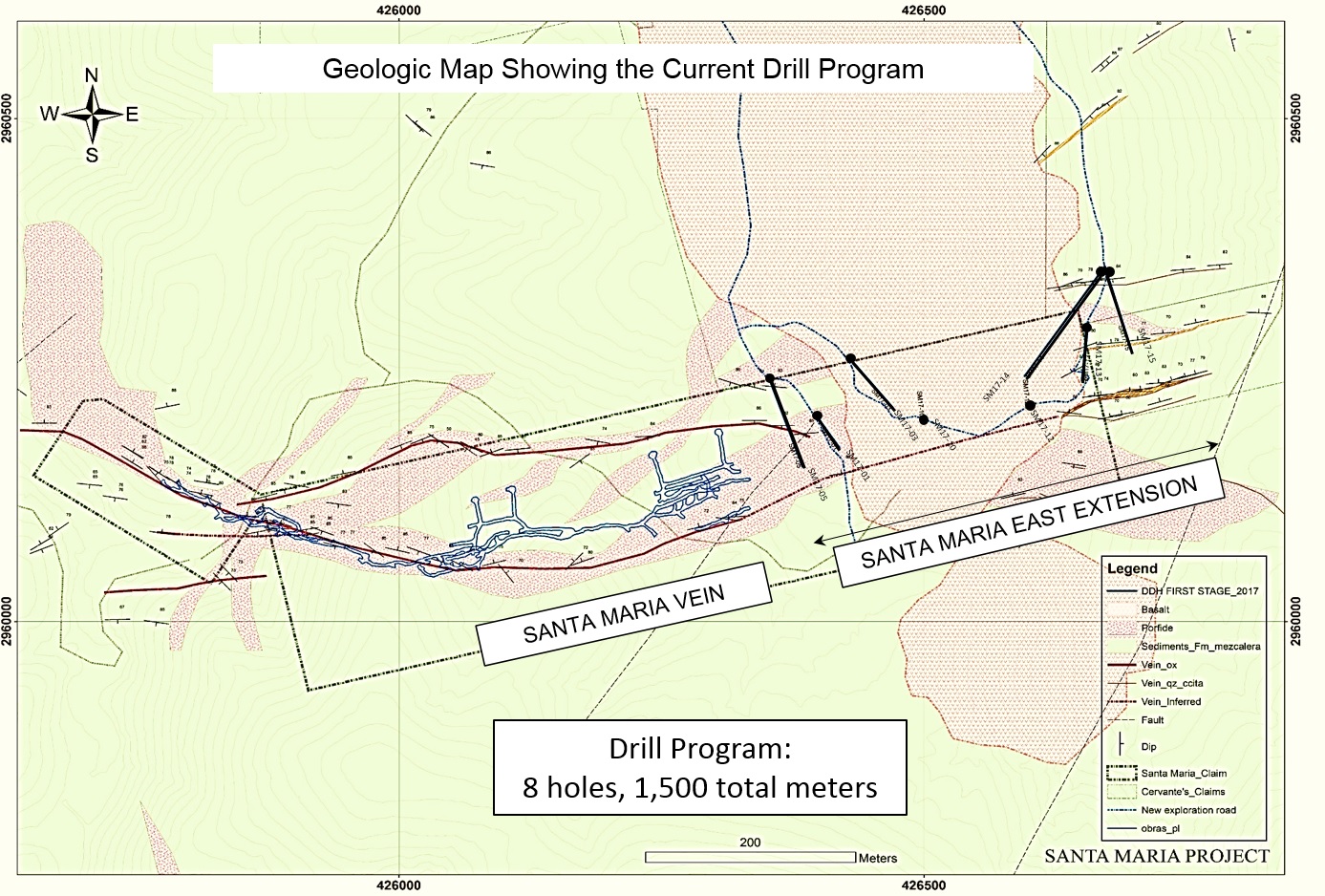

Drilling commenced August 25, 2017. Two holes have been completed to date, SM17-01 and SM17-15, both with visible mineralized intercepts. These two holes bracket the western and eastern limits of the strike extent of the vein currently being tested. Assay results are pending and initial results are expected to be available early in the fourth quarter 2017.

Golden Minerals recently acquired the right to purchase claims that cover the eastward extension of the Santa Maria vein, as reported in August 2017. The new claims provide a 600 meter potential extension to the strike length of the vein system and add substantial downdip expansion potential. Surface exposures of the vein on the new claims have yielded values of silver and gold over potentially minable widths of a magnitude similar to the existing resource grade.

The drill program now underway is designed to expand the current resource by drilling at least eight holes totaling 1,500 meters along 400 meters of the projected strike extension of the vein system adjacent to and east of the existing resource. Golden has begun this drill program with the goal of at least doubling the size of the existing resource.

Santa Maria Mineral Resource Estimate Dated March 30, 2017

Indicated and Inferred mineral resource estimates as previously reported and dated March 30, 2017 for Santa Maria are shown as follows:

| Classification | Cutoff Grade | Tonnes | Ag g/t | Au g/t | AgEq g/t | Ag toz | Au toz | AgEq toz | Dilution% | |

| Recovered AgEq g/t |

(M) | (k) | (M) | |||||||

| Indicated | 175 | 180,000 | 304 | 1.4 | 404 | 1.73 | 8.1 | 2.31 | 10 | % |

| Inferred | 175 | 120,000 | 343 | 1.0 | 411 | 1.37 | 3.9 | 1.64 | 19 | % |

Notes:

(1) Mineral resources are reported as diluted Tonnes and grade;

(2) Cutoff grade and Ag equivalent calculated using metal prices of $17.30 and $1,222 per troy ounce of Ag and Au with a ratio of 70.6:1, the three year trailing average as of the end of December 2016;

(3) Cutoff applied to diluted Ag equivalent blocks grades using recoveries of 90% and 80% Ag and Au;

(4) Reported indicated mineral resources are equivalent to mineralized material under SEC Industry Guide 7, inferred mineral resource is not a recognized category under SEC Industry Guide 7; and

(5) Columns may not total due to rounding.

Property Title and Ownership

Golden has the right to acquire the Santa Maria property under an option agreement that requires approximately $1.4 million more in payments over the next four years, a portion of which will be subject to a two percent Net Smelter Return royalty on production.