VANCOUVER, BC--(Marketwired - December 29, 2017) - Brixton Metals Corporation (TSX VENTURE: BBB) (the "Company" or "Brixton") is pleased to announce that it has closed the second tranche of its private placement of flow-through shares for gross proceeds of $1,420,750 (the "Private Placement"). The Private Placement consisted of the issuance of 5,692,000 flow-through shares ("FT Shares") at a price of $0.25 per FT Share. Certain finders (the "Finders") were paid commissions comprised of a cash fee in the aggregate amount of $99,610 and were issued an aggregate of 398,440finder's warrants in connection with the Private Placement. Each Finder's warrant is exercisable to acquire one common share of the Company at a price of $0.25 for a period of 24 months from closing of the Private Placement.

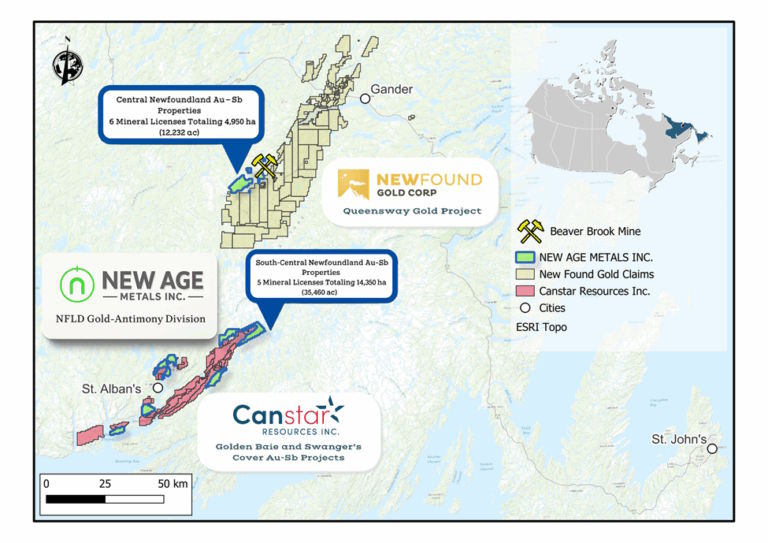

The Company intends to use the gross proceeds from the first tranche (which closed on December 7, 2017) and this closing in the aggregate amount of $3 million to advance the Company's wholly-owned Cobalt properties in the Cobalt Camp of Ontario, Canada and its other Canadian properties.

The FT Shares will be "flow-through" shares pursuant to the Income Tax Act (Canada). All securities issued under the Private Placement, including the securities issuable on exercise thereof, are subject to a hold period expiring four months and one day from the closing date.

About Brixton Metals Corporation

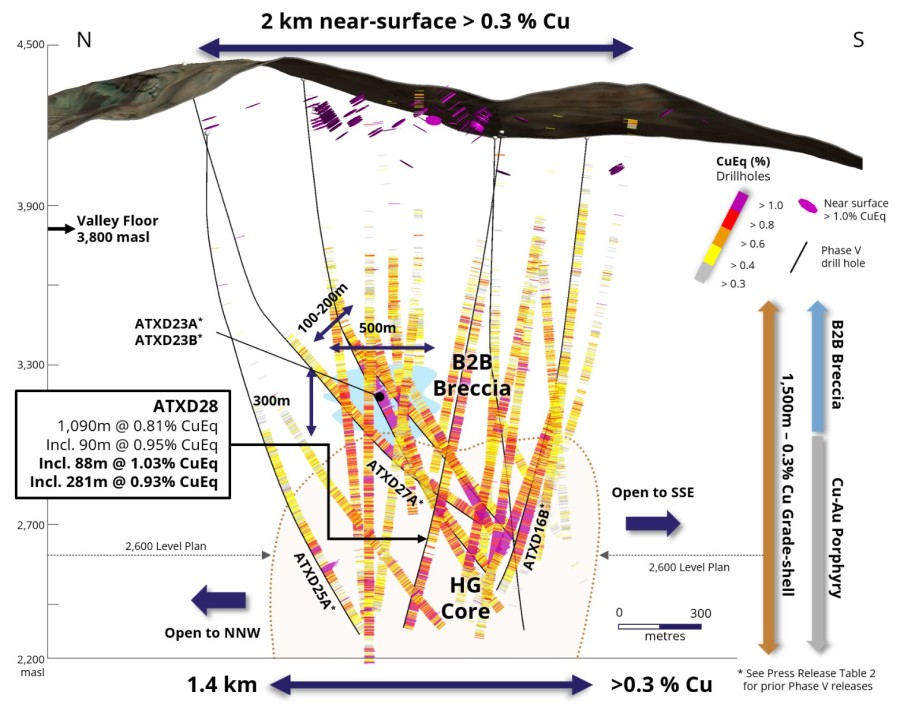

Brixton Metals Corporation is a gold-silver exploration & developing company with assets in Canada and USA. Brixton wholly owns 4 projects. The advanced stage Hog Heaven silver-gold-copper project in NW Montana, USA is a past producer of direct ship ore. Two district scale gold projects, "Thorn" at the northern extent of the Golden Triangle and "Atlin" gold camp in British Columbia, Canada. Lastly, two past producing high-grade silver-cobalt mines, the Langis and Hudson Bay brownfield projects with excellent infrastructure located in Ontario, Canada.