The parties will host a joint conference call on July 7, 2025 at 7:00 a.m. PDT to discuss the Transactions, the details of which are included at the end of this release. All dollar figures are expressed in U.S. currency unless otherwise indicated.

VANCOUVER, BC, July 7, 2025 /CNW/ - Sandstorm Gold Ltd. ("Sandstorm Gold Royalties", "Sandstorm", or the "Company") (NYSE: SAND) (TSX: SSL) is pleased to announce that the Company has entered into a definitive arrangement agreement with Royal Gold Inc. ("Royal Gold"), pursuant to which Royal Gold will acquire all of the issued and outstanding common shares of Sandstorm (the "Sandstorm Shares") in an all-share transaction with an implied value of approximately $3.5 billion (the "Sandstorm Transaction"). Sandstorm shareholders will receive 0.0625 of a share of common stock of Royal Gold (each whole share, a "Royal Gold Share") for each Sandstorm Share held, implying a 21% premium to the 20-day volume-weighted average price ("VWAP") of the Sandstorm Shares for the period ended July 3, 2025, and a 17% premium to the closing price of the Sandstorm Shares on the New York Stock Exchange (the "NYSE") on July 3, 2025. Upon closing, existing Royal Gold and Sandstorm shareholders will own approximately 77% and 23%, of the issued and outstanding Royal Gold Shares on a fully diluted basis.

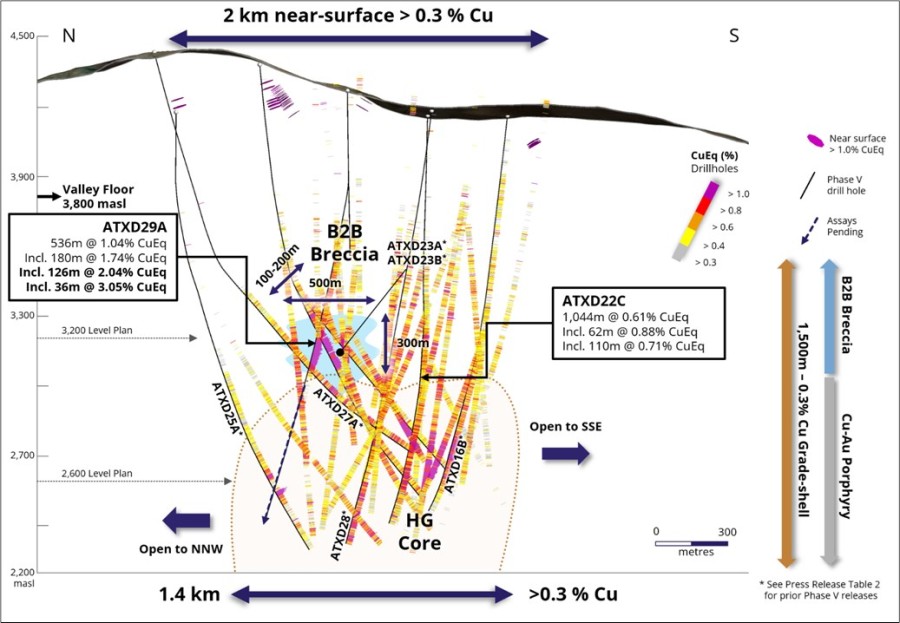

Concurrent with the Sandstorm Transaction, Royal Gold has entered into a definitive arrangement agreement with Horizon Copper Corp. ("Horizon Copper"), pursuant to which Royal Gold will acquire all of the issued and outstanding common shares of Horizon Copper (the "Horizon Shares") in an all-cash transaction valued at approximately $196 million (the "Horizon Transaction"). Horizon Copper shareholders will receive C$2.00 for each Horizon Share held, implying an 85% premium to the 20-day VWAP of the Horizon Shares for the period ended July 4, 2025, and a 72% premium to the closing price of the Horizon Shares on the TSX Venture Exchange (the "TSX-V") on July 4, 2025. For further details of the Horizon Transaction, refer to Royal Gold's and Horizon Copper's respective press releases dated July 7, 2025.

Upon completion of both the Sandstorm Transaction and the Horizon Transaction (together, the "Transactions"), Royal Gold will continue under the name "Royal Gold, Inc." and will host a robust precious metals streaming and royalty portfolio with industry-leading diversification and growth profile.

Strategic Rationale

The Sandstorm Transaction is poised to create significant value for Sandstorm shareholders by delivering multiple benefits:

- Attractive and immediate premium to the current price of Sandstorm Shares, which are trading at 10-year highs;

- Maintains exposure to Sandstorm's gold-focused, high-quality, long-life portfolio with significant built-in growth from its principal assets;

- Daylights intrinsic value of Sandstorm's royalty portfolio, closing the valuation gap between Sandstorm and mid-tier royalty peers;

- Improves pro-forma portfolio maturity, reducing relative concentration of development assets;

- Enhanced access to institutional investors via an attractive, larger, diversified, gold-focused streaming and royalty company with strong trading liquidity;

- Equity participation in a large-scale precious metals streaming and royalty company poised for meaningful long-term re-rating potential with industry-leading diversification and a strong track record of shareholder capital returns.

President & CEO of Sandstorm, Nolan Watson, commented, "Today is a significant milestone for Sandstorm and its shareholders, marking the beginning of an exciting new chapter. Over the past 15 years, we've built a company that has not only delivered consistent growth and value but has helped shape the royalty sector through innovation. This transaction rewards Sandstorm shareholders in the near term while also offering a compelling opportunity to own a large-scale, world-class streaming and royalty company with continued upside potential.

"Personally, I would like to thank the Sandstorm team for their tireless commitment to excellence and hard work over the last decade and a half. I am incredibly proud of what this team has accomplished—from our early foundational deals to the transformative acquisitions that positioned Sandstorm as a leader in this space. Joining forces with Royal Gold will amplify the strengths of Sandstorm's portfolio and unlock new opportunities for our shareholders. I also want to thank the Royal Gold team, for building a leading streaming and royalty company with remarkable assets. I am confident that the legacy we've built at Sandstorm will continue to thrive in this next phase as we combine to create a truly extraordinary streaming and royalty company."

The combined portfolios under Royal Gold are expected to create:

- The world's most diversified, large-scale precious metals streaming and royalty company with a mature, Americas-focused portfolio of 393 royalties and streams, including 80 cash-flowing assets, of which, no single asset is expected to account for more than 13% of net asset value ("NAV")1;

- Industry-leading, gold-dominated stream and royalty portfolio with pro-forma 2025 revenue mix expected to be approximately 87% precious metals (with 75% of total revenues being from gold2) and material gold-focused growth assets via Sandstorm's development portfolio;

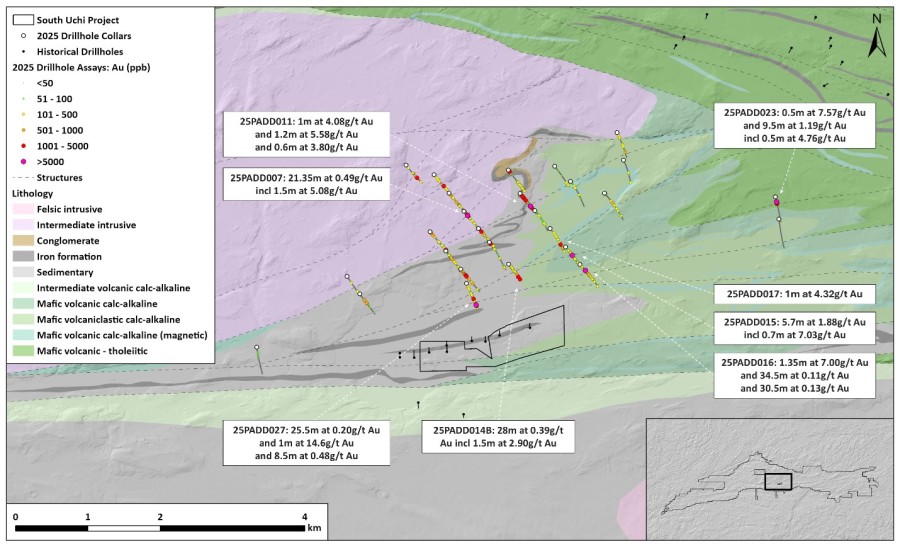

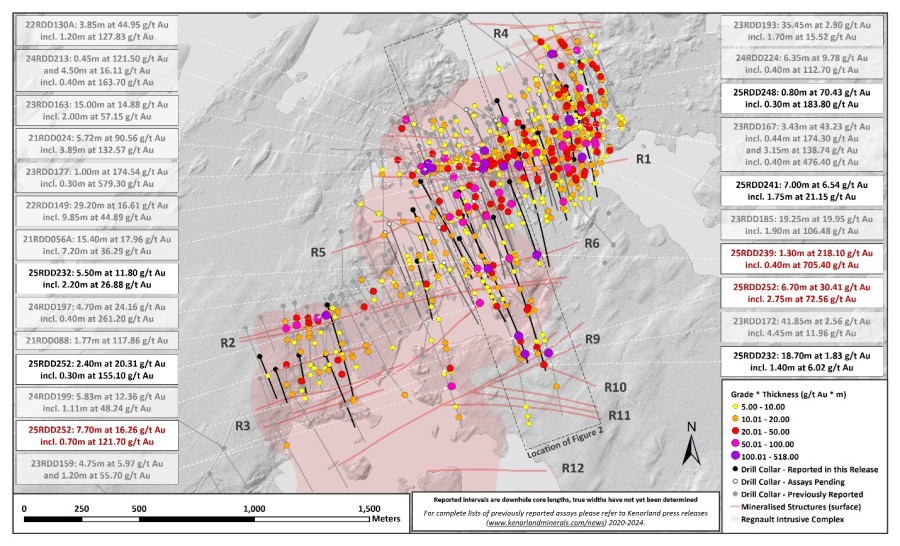

- Attractive growth profile from key development assets including MARA (Glencore), Hod Maden (SSR Mining), Great Bear (Kinross), Platreef (Ivanhoe Mines), and Warintza (Solaris), adding significant organic production growth over the long term;

- Strong balance sheet and robust cash flow, as Royal Gold expects to have a low outstanding debt balance and modest debt to EBITDA at closing, providing financial strength to reinvest and compete for attractive deals;

- High-quality, long-life stream and royalty assets, with built-in optionality, increasing proven and probable attributable gold equivalent ounces ("GEO") to 18 times the expected 2025 GEO sales3, and remaining accretive to consensus NAV on a per share basis;

- Larger-scale and increased liquidity attractive to broader investor base, while enhancing appeal to institutional investors as a leading North American precious metals streaming and royalty company, potentially driving a premium valuation;

- Corporate synergies through the combination of three high-quality portfolios, into a larger, more diversified company, converting a greater proportion of stream and royalty earnings into equity free cash flow, foregoing the need for more complex counterparty structures, particularly at Hod Maden and Antamina.

Bill Heissenbuttel, President & CEO of Royal Gold remarked, "The acquisitions of Sandstorm and Horizon Copper fit our strategic goal of acquiring high-quality and long-life precious metals assets in mining-friendly jurisdictions. Upon completion of these Transactions, Royal Gold will remain firmly positioned as a leading North American precious metal streaming and royalty company. Royal Gold has a 40+ year history of consistently executing a strategy of disciplined growth in gold, and the addition of Sandstorm and Horizon Copper's assets create a global portfolio of precious metals interests that is unmatched in terms of asset diversification, development and organic growth potential, and exploration optionality. These characteristics will position Royal Gold as the go-to vehicle for investors seeking precious metals exposure in the U.S. marketplace, and we welcome Sandstorm shareholders to participate in the formation of a premier growth company in our sector."

Pro-Forma Royal Gold

Upon completion of the Transactions, Royal Gold is expected to be an industry-leading precious metals streaming and royalty company with enhanced scale and liquidity, uniquely positioned to realize valuation premiums typically associated with large-cap streaming and royalty companies while remaining nimble enough to compete across the streaming and royalty industry in accretive ways. Royal Gold's portfolio will comprise 393 streams and royalties, largely focused in the Americas, with 80 cash-flowing assets and 47 in development. Royal Gold will remain precious metals focused, with its 2025 revenue mix expected to be approximately 87% precious metals, and gold contributing approximately 75% of total revenue2. Longer-term, Royal Gold is expected to maintain or exceed this concentration of precious metals revenue. Royal Gold will be well capitalized and generate significant free cash flow, and the combined portfolio is well-positioned for cash flow growth from its robust development pipeline.

Royal Gold will host one of the most diversified streaming and royalty portfolios in the world while benefiting from built-in optionality from high-quality assets. Below are details of the top 10 assets by NAV within the pro-forma portfolio. For more details of the pro-forma portfolio, including full stream and royalty terms, refer to www.royalgold.com, www.sandstormgold.com, and www.horizoncopper.com.

Key Producing Assets4

Board and Special Committee Recommendations

The Boards of Directors of Royal Gold and Sandstorm and a special committee comprised solely of independent directors of Sandstorm (the "Sandstorm Special Committee"), after receiving outside legal and financial advice, have each determined that the Sandstorm Transaction is in the best interests of Royal Gold and Sandstorm, respectively. Additionally, the Boards of Directors of Royal Gold and Horizon Copper and a special committee composed solely of independent directors of Horizon Copper, after receiving outside legal and financial advice, have each determined that the Horizon Transaction is in the best interests of Royal Gold and Horizon Copper, respectively. Accordingly, the Boards of Directors of Royal Gold, Sandstorm, and Horizon Copper recommend that shareholders vote in favor of the Transactions. Nolan Watson—as a director of each of Sandstorm and Horizon Copper with a "disclosable interest" in each case—abstained from voting with respect to the Sandstorm Transaction and the Horizon Transaction. Erfan Kazemi—as the Chief Financial Officer of Sandstorm and the Chief Executive Officer and a director of Horizon Copper with a "disclosable interest" —abstained from voting with respect to the Horizon Transaction.

Summary of Transactions and Timing

The Sandstorm Transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia) (the "Sandstorm Arrangement Agreement"). Under the terms of the Sandstorm Arrangement Agreement, Sandstorm shareholders will receive 0.0625 of a Royal Gold Share for each Sandstorm Share held, implying a 21% premium to the 20-day VWAP of the Sandstorm Shares for the period ended July 3, 2025, and a 17% premium to the closing price of Sandstorm Shares on the NYSE on July 3, 2025.

At closing of the Sandstorm Transaction, Royal Gold expects to issue an aggregate of approximately 19 million Royal Gold Shares to Sandstorm shareholders, and following the completion of the Sandstorm Transaction, former Sandstorm shareholders will own approximately 23% of the issued and outstanding Royal Gold Shares on a fully diluted basis.

Pursuant to the Sandstorm Arrangement Agreement, Royal Gold has the option to make an election under Section 338(g) of the United States Internal Revenue Code. More information on this election will be outlined in Sandstorm's management information circular to be sent to Sandstorm shareholders in connection with the Sandstorm Transaction.

The Sandstorm Transaction will be subject to the approval of 66 2/3% of the votes cast by shareholders of Sandstorm at a special meeting of Sandstorm shareholders (the "Sandstorm Meeting") and the approval of a simple majority of the votes cast by shareholders of Sandstorm at the Sandstorm Meeting excluding votes cast by persons required to be excluded under Canadian Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions.

Royal Gold will require approval by a simple majority of votes cast by Royal Gold shareholders at a special meeting in connection with the share issuance under the Sandstorm Transaction. The full details of the Sandstorm Transaction will be described in Sandstorm management information circular and Royal Gold's proxy statement to be prepared in accordance with applicable securities legislation and made available in connection with the special meetings.

In addition to shareholder approval, the completion of the Sandstorm Transaction is subject to satisfaction of certain conditions and applicable regulatory approvals, including but not limited to (i) completion of the Horizon Transaction (which can be waived by Royal Gold in its sole discretion), (ii) approval by the Toronto Stock Exchange (the "TSX"), Nasdaq Stock Exchange, and NYSE, (iii) approval under the Competition Act (Canada), (iv) approval under the Investment Canada Act, (v) South African antitrust approval (Competition Act), and (vi) the satisfaction of certain other closing conditions customary for a transaction of this nature. Sandstorm, as well as the senior officers and directors of Horizon Copper and certain additional Horizon shareholders, which collectively control 54% of the Horizon Shares on a basic basis, have entered into voting support agreements pursuant to which they have agreed to vote their shares in favor of the Horizon Transaction, subject to certain conditions. The senior officers and directors of Sandstorm, which collectively control 6% of the Sandstorm Shares on a fully diluted basis, have entered into voting support agreements pursuant to which they have agreed to vote their shares in favor of the Sandstorm Transaction, subject to certain conditions.

The Sandstorm Arrangement Agreement contains customary deal protections, including non-solicitation, "fiduciary out", and "right to match" provisions in respect of Sandstorm, and non-solicitation and "fiduciary out" provisions in respect of Royal Gold, as well as a $200 million or $130 million termination fee payable to Sandstorm or Royal Gold, respectively, as the case may be, under certain circumstances.

None of the securities to be issued pursuant to the Sandstorm Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and any securities issued pursuant to the Sandstorm Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Further details of the Sandstorm Transaction will be included in Sandstorm's management information circular and set out in the Sandstorm Arrangement Agreement, each of which will be available in due course on the Company's profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Sandstorm shareholders are encouraged to read these and other relevant materials when they become available.

Timing

Subject to receiving the requisite court, regulatory and shareholder approvals as described above, the Transactions are expected to close in the fourth quarter of 2025. In connection with and subject to closing of the Transactions, it is expected that the Sandstorm Shares and the Horizon Shares will be delisted from the TSX, NYSE, and TSX-V, respectively, that Sandstorm will cease to be a reporting issuer under Canadian and U.S. securities laws, and that Horizon Copper will cease to be a reporting issuer under Canadian securities law.

Financial and Legal Advisors

Sandstorm Gold Royalties

BMO Capital Markets ("BMO") is acting as financial advisor to Sandstorm and its Board of Directors and National Bank Financial ("NBF") is acting as financial advisor to the Sandstorm Special Committee in connection with the Sandstorm Transaction. Each of BMO and NBF have provided a fairness opinion to Sandstorm's Board of Directors and the Sandstorm Special Committee stating that, as of the date of such opinions, and based upon and subject to the assumptions, limitations and qualifications set forth therein, the consideration to be received by the shareholders of Sandstorm pursuant to the Sandstorm Transaction is fair, from a financial point of view, to the shareholders of Sandstorm.

CIBC World Markets Inc. has provided a fixed fee independent fairness opinion to the Sandstorm Special Committee stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications set forth therein, the consideration to be received by the shareholders of Sandstorm pursuant to the Sandstorm Transaction is fair, from a financial point of view, to the shareholders of Sandstorm.

Cassels Brock & Blackwell LLP is acting as Canadian legal counsel to Sandstorm, and Crowell & Moring LLP is acting as U.S. legal counsel in connection with the Sandstorm Transaction. Fasken Martineau DuMoulin LLP is acting as legal advisor to the Sandstorm Special Committee in connection with the Sandstorm Transaction.

Royal Gold

Scotiabank is acting as lead financial advisor to Royal Gold. McCarthy Tétrault LLP, Skadden, Arps, Slate, Meagher & Flom LLP and Richards, Layton & Finger, P.A., are acting as legal advisors to Royal Gold. Raymond James Ltd. is also acting as financial advisor to Royal Gold.

Conference Call

A joint conference call with Royal Gold and Sandstorm will be held on Monday, July 7, 2025 starting at 7:00 am PDT to further discuss the Transactions. To participate in the conference call, use the following dial-in numbers and conference ID, or join the webcast using the link below:

United States Toll-Free: (+1) 833-470-1428

Canada Toll-Free: (+1) 833-950-0062

International: (+1) 929-526-1599

Access Code: 184156

Webcast URL: https://events.q4inc.com/attendee/777831782

|

Notes |

||

|

1. |

Average of available consensus NAV estimates as of June 25, 2025. |

|

|

2. |

Assuming a full year contribution in 2025 and metal prices of $3,025/ounce for gold, $32.95 per ounce for silver and $4.20 per pound of copper. |

|

|

3. |

Based on mid-point of Royal Gold's sales volume guidance and consensus metal prices of US$3,025/oz Au, US$32.95/lb Ag, US$4.20/lb Cu in 2025 and mid-point of Sandstorm's 2025 guidance. |

|

|

4. |

Source: Royal Gold 2024 Asset Handbook and Sandstorm 2025 Asset Handbook. |

|

|

5. |

Source: CapIQ, based on 2024 production of top copper mines |

|

|

6. |

Source: Hod Maden Feasibility Study technical report dated July 13, 2022, available on www.sedarplus.ca under Horizon Copper's issuer profile. |

Qualified Person

Imola Götz (M.Sc., P.Eng, F.E.C.), Sandstorm's Vice President, Mining & Engineering is a Qualified Person as defined by Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Ms. Götz has reviewed and approved the scientific and technical information in this press release.

ABOUT SANDSTORM GOLD ROYALTIES

Sandstorm is a precious metals-focused royalty company that provides upfront financing to mining companies and receives the right to a percentage of production from a mine, for the life of the mine. Sandstorm holds a portfolio of approximately 230 royalties, of which 40 of the underlying mines are producing. For more information visit: www.sandstormgold.com.

CAUTIONARY STATEMENTS TO U.S. SECURITYHOLDERS

The financial information included or incorporated by reference in this press release or the documents referenced herein has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, which differs from US generally accepted accounting principles ("US GAAP") in certain material respects, and thus are not directly comparable to financial statements prepared in accordance with US GAAP.

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

The definitions of these terms, and other mining terms and disclosures, differ from the definitions of such terms, if any, for purposes of the United States Securities and Exchange Commission ("SEC") disclosure rules for domestic United States Issuers (the "SEC Rules"), including the requirements of the SEC in Regulation S-K Subpart 1300 under the United States Securities Exchange Act of 1934, as amended. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multijurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Rules and provides disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information and other technical information contained or incorporated by reference herein or documents incorporated by reference may not be comparable to similar information disclosed by United States companies subject to the SEC's reporting and disclosure requirements for domestic United States issuers.

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Under Canadian rules, estimates of inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them to enable them to be categorized as mineral reserves and, accordingly, may not form the basis of feasibility or pre-feasibility studies, or economic studies except for a preliminary economic assessment as defined under NI 43-101. Investors are cautioned not to assume that part or all of an inferred mineral resource exists or is economically or legally mineable. In addition, United States investors are cautioned not to assume that any part or all of the Company's measured, indicated or inferred mineral resources constitute or will be converted into mineral reserves or are or will be economically or legally mineable.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act, the U.S. Securities Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Sandstorm Gold Royalties (collectively, "forward-looking statements"). Forward-looking statements include the completion of the Transactions and the timing thereof, the realization of synergies and expected premiums in connection with the Transactions, the identification of future accretive opportunities, permitting requirements and timelines, the future price of the Royal Gold Shares, the results of any preliminary economic assessment, Pre-Feasibility Study or Feasibility Study, the receipt of required approvals for the Transaction, the availability of the exemption under Section 3(a)(10) of the U.S. Securities Act to the securities issuable pursuant to the Sandstorm Transaction, the future price of gold, silver, copper, iron ore and other metals, the estimation of mineral reserves and resources, realization of mineral reserve estimates, and the timing and amount of estimated future production. Forward-looking statements can generally be identified by the use of forward-looking terminology such as "may", "will", "expect", "intend", "estimate", "anticipate", "believe", "continue", "plans", or similar terminology.

Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances or achievements of Sandstorm Gold Royalties to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Sandstorm Gold Royalties will operate in the future, including the receipt of all required approvals and the timing thereof, the realization of synergies and premiums, and the price of gold and copper and anticipated costs. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, amongst others, failure to receive necessary approvals or the timing of such approvals, changes in business plans and strategies, market conditions, share prices, best use of available cash, gold and other commodity price volatility, discrepancies between actual and estimated production, guidance produced by third parties, mineral reserves and resources and metallurgical recoveries, mining operational and development risks relating to the parties which produce the gold or other commodity the Company will purchase, regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the global economic climate, dilution, share price volatility and competition.

Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: the impact of general business and economic conditions, the absence of control over mining operations from which the Company will purchase gold, other commodities or receive royalties from, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined, risks in the marketability of minerals, fluctuations in the price of gold and other commodities, fluctuation in foreign exchange rates and interest rates, stock market volatility, as well as those factors discussed in the section entitled "Risks to Sandstorm" in the Company's annual report for the financial year ended December 31, 2024 and the section entitled "Risk Factors" contained in the Company's annual information form dated March 31, 2025 available at www.sedarplus.ca. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements that are contained or incorporated by reference, except in accordance with applicable securities laws.