VANCOUVER, BC--(Marketwired - September 07, 2017) - Midas Gold Corp. (TSX: MAX) (

Recent Assay Results - Hangar Flats Deposit, Stibnite Gold Project

| Hole-ID | Type | Bearing | Inclination | TD | From | To | Width | Au | Ag | Sb | AuEq |

| (m) | (m) | (m) | (m)(1) | (g/t)(1) | (g/t) | (%) | (g/t)(2) | ||||

| MGI-17-425 | Core | 254 | -45.5 | 222.5 | 35.6 | 46.2 | 10.6 | 1.39 | 0.9 | 0.01 | 1.4 |

| and | 79.8 | 86.0 | 6.1 | 1.71 | 1.2 | 0.00 | 1.7 | ||||

| and | 107.3 | 157.6 | 50.3 | 3.22 | 36.1 | 1.22 | 6.2 | ||||

| including | 143.9 | 157.6 | 13.7 | 4.75 | 100.2 | 3.33 | 12.7 | ||||

| and | 191.1 | 203.3 | 12.2 | 2.05 | 14.9 | 1.37 | 5.0 | ||||

| MGI-17-426 | Core | 258 | -56.0 | 260.6 | 93.6 | 104.2 | 10.7 | 1.74 | 1.0 | 0.00 | 1.8 |

| and | 144.3 | 177.9 | 33.5 | 3.16 | 3.9 | 0.08 | 3.4 | ||||

| and | 183.1 | 243.2 | 60.1 | 2.23 | 3.3 | 0.14 | 2.6 | ||||

| including | 218.3 | 241.4 | 23.1 | 3.68 | 3.4 | 0.23 | 4.2 | ||||

| MGI-17-427 | Core | 355 | -40.0 | 107.0 | No significant intercepts - geotechnical hole | ||||||

(1) Gold composites are generated using a 0.5 g/t Au cutoff grade. Antimony composites are generated using a 0.1% Sb cutoff grade. Composites may include intervals below cutoff grades. True widths are expected to be approximately 90-100% of the reported intercept.

(2) Gold equivalent grades are reported for illustrative purposes only and are calculated using metal prices of $1200/oz Au, $17/oz Ag and $7600/tonne Sb and do not include recovery, transportation, refining or payability. These factors will vary for each metal, ore type and processing method and will affect the economic importance of the various metals.

These most recent results comprise assays from two HQ diameter oriented core holes totalling 483 meters (1,585 feet) drilled for infill and mineral resource conversion purposes, and a single HQ diameter core hole totaling 107 meters (351 feet) drilled for geotechnical purposes.

"Our drilling program, initiated in September 2016, continues to provide positive results that support Midas Gold's goal of enhancing mineral resources prior to feasibility level engineering for the Stibnite Gold Project," said Stephen Quin, President & CEO of Midas Gold Corp. "These latest intercepts from the Hangar Flats deposit further demonstrate the potential to upgrade inferred mineral resources within the PFS pit limits from a cost centre to a source of revenue. Inferred mineral resources were previously treated as development rock in the PFS project economics, as required under NI43-101. The higher-grade nature of these intercepts should provide an attractive margin if these areas are classified as mineral reserves in the feasibility study currently in process."

Resource Optimization Drilling

The two infill holes targeted inferred mineral resources within the Hangar Flats PFS pit shell situated adjacent to former Meadow Creek Mine underground workings, which produced approximately 51,000 ounces Au at an average grade of 5.8 g/t Au between 1928 and 1938. The gold-antimony mineralization intersected in MGI-17-425 and -426 is representative of the high-grade, disseminated mineralization occurring adjacent to the underground workings that was left behind by historical operators. These two holes confirmed the continuity and structural controls of the high-grade mineralization inferred in this area, as well as the geometry of the underground levels and stopes. Both infill holes contain higher gold grades than predicted (by the PFS block model) but over slightly narrower widths. Geological models are currently being refined in preparation for updated resource estimates and feasibility study mine planning.

Geotechnical Drilling

In addition to the mineral resource enhancement drilling program, three geotechnical drill holes totalling 489 meters have been completed in the Hangar Flats deposit as part of the ongoing 2017 geotechnical drilling program. The goal of the geotechnical drilling program is to collect additional oriented core data for pit slope optimization and to complete subsurface investigations in proposed infrastructure areas. Drilling subsequently shifted from core to auger drilling for geotechnical purposes, with the auger being used to test and sample unconsolidated material in proposed infrastructure areas.

Details of the previous news releases, the Project and the 2014 PFS can be found filed under Midas Gold's profile on SEDAR (www.sedar.com) or at www.midasgoldcorp.com.

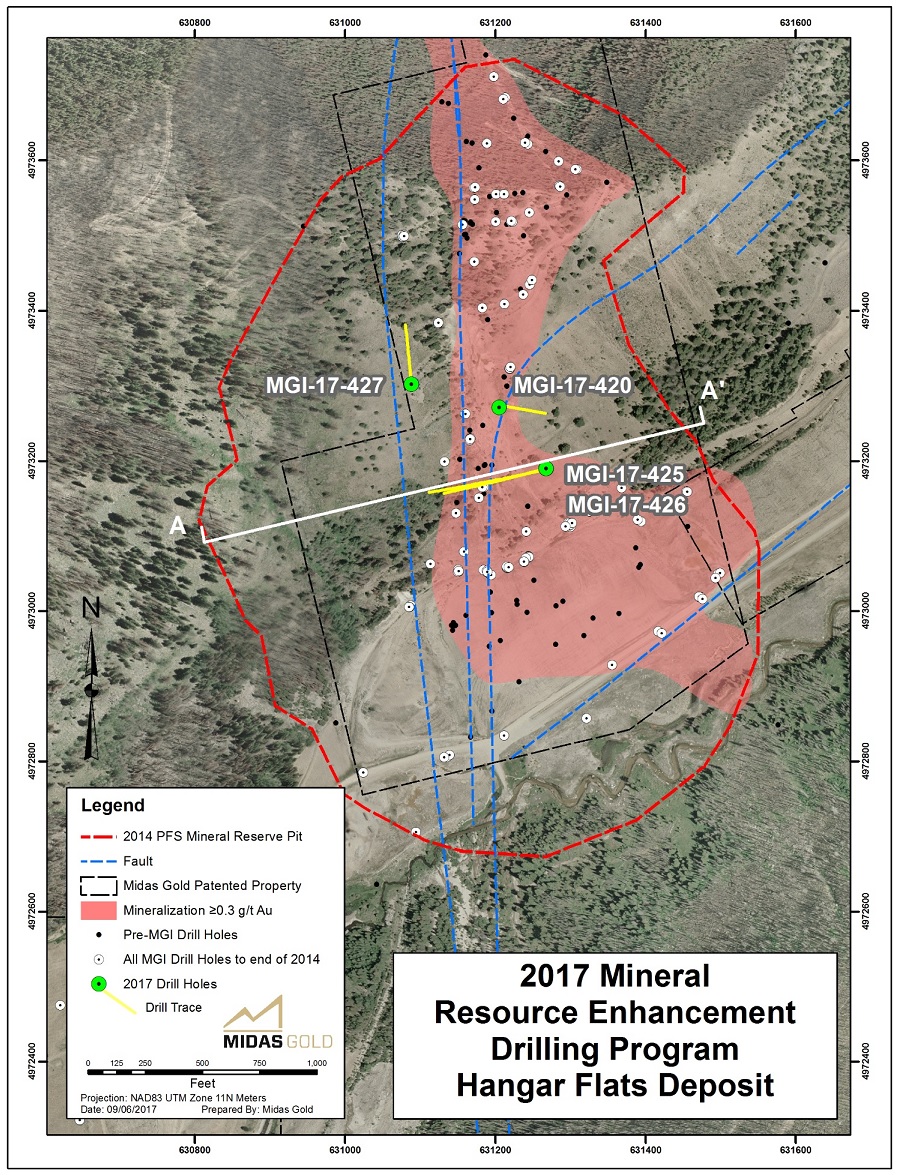

To view a cross section and the locations of drill holes reported in this news release, please see the figures at the end of this release.

Figure 1. Hangar Flats Land Mass

Figure 2. Hangar Flats Cross Section

Sampling Procedures, Quality Control and Quality Assurance

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101 ("NI43-101") and reviewed and approved by Stephen P. Quin, P. Geo., President and CEO of Midas Gold Corp., and a Qualified Person. The exploration activities at the Stibnite Gold Project were carried out under the supervision of Kent Turner, C.P.G., Qualified Person and Consultant for the Stibnite Gold Project. T&J Enterprises, Inc. of Frenchtown MT was contracted for drilling utilizing an AR-65 core drill with HQ3 core with a diameter of 61.1 mm (2-1/2"). All holes were drill oriented using an ACT III core orientation tool from International Directional Services; LLC of Chandler, AZ. Core was photographed in the core barrel split inner tube, marked for orientation and discontinuities measured at the drill site and then recovery and RQD were measured, and logged for rock lithology, alteration, mineralization, and structure. The core was boxed, photographed in the core box, with sample intervals selected on approximately 1.52 meter (5 foot) intervals, which were then marked for cutting and sampled. One half the core was collected for assay and the second half retained in the core box for archival purposes.

All gold assays are by a 30g Fire Assay charge followed by an atomic absorption finish (with a 0.005g/t lower reporting limit). Samples reporting values > 6g/t gold are re-analyzed using a 30g Fire Assay charge followed by a gravimetric finish. Silver is analyzed via a 4-acid digestion followed by an ICP finish (with a 0.5g/t lower reporting limit). Samples reporting values > 10g/t silver are reanalyzed using a 50g Fire Assay charge followed by a gravimetric finish. Antimony is analyzed via a 4-Acid digestion with ICP finish with a 5g/t lower reporting limit. Samples reporting values >500g/t antimony are reanalyzed using XRF fusion. Some intervals may not add or subtract correctly due to rounding, but differences are deemed insignificant. Analyses are carried out by ALS Chemex in their Reno and Elko, Nevada and Vancouver, British Columbia laboratories. Umpire samples are routinely submitted to third party labs and blank and standard samples are inserted at appropriate intervals and used for quality assurance and quality control and a review of the results of analyses of the blanks, standards and duplicates by the Company's Qualified Person indicates values are within normal and acceptable ranges.

About Midas Gold and the Stibnite Gold Project

Midas Gold Corp., through its wholly owned subsidiaries are focused on the exploration and, if warranted, site restoration and development of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by its Stibnite Gold Project.