TORONTO, ONTARIO--(Marketwired - Oct. 6, 2017) - Euro Sun Mining Inc. (TSX:ESM) ("Euro Sun" or the "Company") is pleased to announce that it has closed the previously announced non-brokered private placement financing of 6,144,291 common shares at a price of $1.40 per share for gross proceeds of $8.6 million (the "Offering").

Euro Sun intends to use the proceeds from this private placement for the advancement of its wholly-owned Rovina Valley Project, and for general working capital purposes.

Closing of the Company's previously announced concurrent brokered private placement for gross proceeds of up to $2 million is expected to occur on or about October 10, 2017.

All securities issued under the Offering will be subject to a hold period expiring four months and one day from the date hereof.

About Euro Sun Mining Inc.

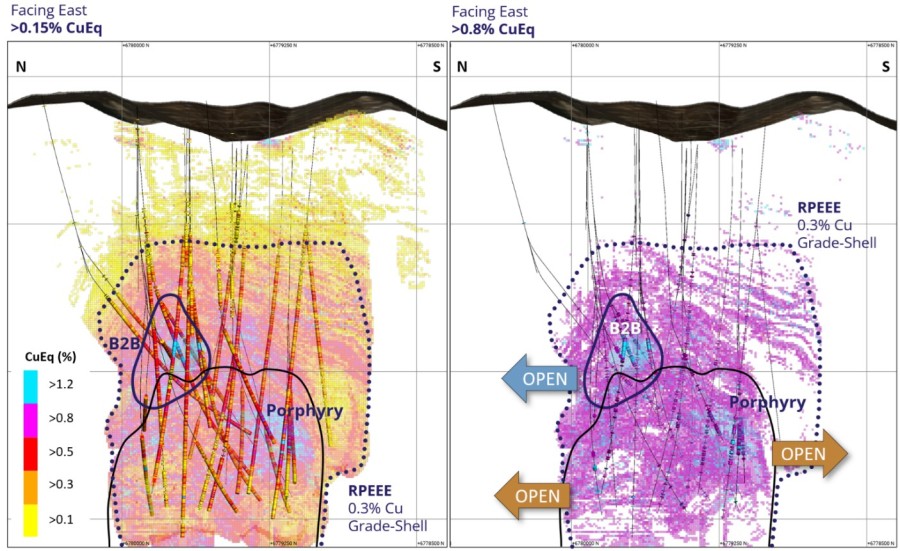

Euro Sun is a Toronto Stock Exchange listed mining company focused on the exploration and development of its 100%-owned Rovina Valley Gold and Copper Project located in west-central Romania. The property hosts 10.84 million gold equivalent ounces (7.19 million ounces of gold grading 0.55 g/t and 1,420 million pounds of copper grading 0.16%*), making it the second largest gold deposit in Europe.

*Notes Related to the Mineral Resource Estimate: Gold equivalent ounces ("AuEq") are determined by using a gold price of US$1,370/oz and a copper price of US$3.52/lb. These prices are the three-year trailing average as of July 10, 2012. Metallurgical recoveries are not taken into account for AuEq. Base case cut-off used in the table are 0.35 g/t AuEq for the Colnic deposit and 0.25% CuEq for the Rovina deposit, both of which are amenable to open-pit mining and 0.65 g/t AuEq for the Ciresata deposit which is amenable to underground bulk mining. For the Rovina and Colnic porphyries, the resource is an in-pit resource derived from a Whittle Shell Model using gross metal values of $1,350/oz Au price and $3.00/lb Cu price, net of payable amounts after smelter charges and royalty for net values of US$1,313/oz Au and US$2.57/lb Cu for Rovina and US$2.27/Ib Cu for Colnic). Rounding of tonnes as required by reporting guidelines may result in apparent differences between tonnes, grade, and contained metal content.

Qualified Person

The mineral resources stated in this press release have been reviewed and approved by Mr. Pierre Desautels, P.Geo. Principal Resource Geologist of AGP, who served as the independent Qualified Person as defined by National Instrument 43-101, responsible for preparing the Mineral Resource Estimate and Technical Report dated August 30, 2012.