TORONTO, ON / October 9, 2019 / JMN Wire / Junior Mining Network host Cory Fleck sits down with Prophecy Development Corp. (TSX: PCY) (OTCQX: PRPCF) Executive Chairman Mr. John Lee to discuss recent developments at the Company’s 100% owned high-grade Pulacayo Silver-Lead-Zinc Project in Bolivia’s Silver Triangle.

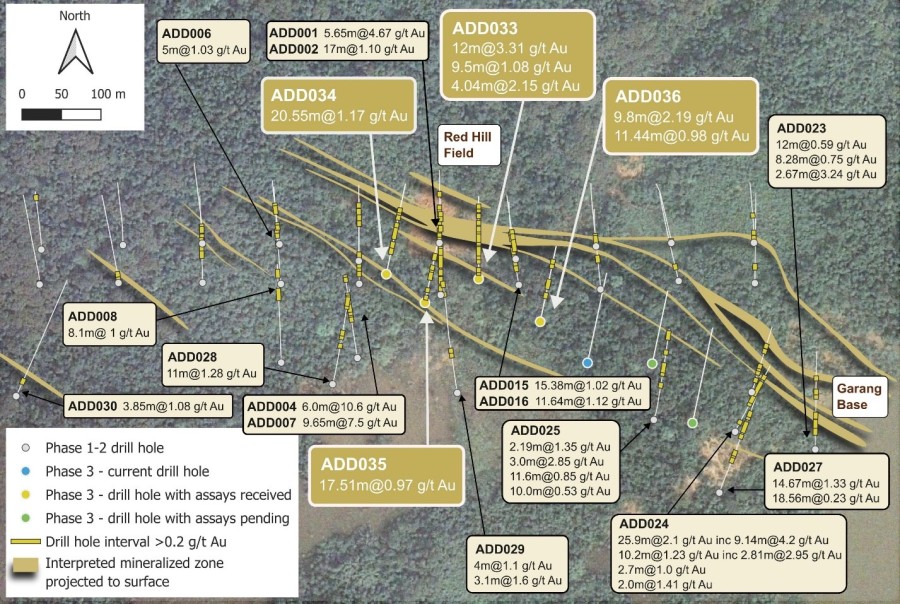

Prophecy has commenced a 5,000 meter diamond drill program that will look to expand the current N.I. 43-101 compliant mineral resource at the Paca deposit. Previous drilling within this zone returned 42 meters of 406 g/t silver near the edge of the resource envelope (see Company’s press release dated September 30th, 2019).

Additionally, Prophecy has recently entered into a mining production contract with the Bolivian Ministry of Mining and Metallurgy. The contract allows Prophecy to develop and mine the Pulacayo and Paca concessions for up to 30 years and represents a landmark milestone for the Company in advancing the Pulacayo project towards production (see Company’s press release dated October 7th, 2019).

Located 185km southwest of Coeur Mining’s (NYSE: CDE) San Bartolome mine and 135km north Pan American Silver’s (NASDAQ: PAAS) San Vicente mine, Prophecy’s Pulacayo project is an advanced stage project hosting two known silver-lead-zinc mineral deposits. Prophecy’s Pulacayo deposit has access to water, power and toll milling facilities, meaning it can be commissioned on a trial mining basis for minimal lead time and startup costs. The deposit comprises a NI 43-101 mineral resource estimate that host 30.4 million ounces of silver in the Indicated category at an average grade of 594 g/t silver equivalent and 6.3 million ounces of silver in the Inferred category (see Tables 1 and 2 below). Meanwhile, the nearby Paca deposit contains a NI 43-101 Inferred mineral resource estimate totaling 20.9 million ounces of silver at an average grade of 342 g/t silver equivalent (see Tables 3 and 4 below). The stated resources have an effective date of October 20th, 2017 (see Company’s press release dated November 22nd, 2017). The resource estimates are based on over 98,000 meters of diamond drilling since 2005.

About Prophecy Development Corp.

Prophecy is developing Pulacayo silver project in Bolivia and Gibellini vanadium project in Nevada. Further information on Prophecy can be found at www.prophecydev.com.

Qualified Person

Danniel Oosterman, VP Exploration for Prophecy has prepared, review and approved the scientific and technical information in this press release. Mr. Oosterman is a non-independent Qualified Person within the meaning of National Instrument 43-101 Standards.

Appendix

Table 1. Pulacayo Indicated and Inferred Mineral Resource Statement Details

|

Pulacayo Mineral Resource Statement – Effective October 20, 2017 |

||||||

|

Ag Eq. Cut-Off (g/t) |

Category |

Tonnes* |

Ag (g/t) |

Pb (%) |

Zn (%) |

Ag Eq. (g/t) |

|

400 |

Indicated |

2,080,000 |

455 |

2.18 |

3.19 |

594 |

|

Inferred |

480,000 |

406 |

2.08 |

3.93 |

572 |

|

Notes:

(1) Mineral resources are estimated in conformance with the CIM Standards referenced in NI 43-101.

(2) Raw silver assays were capped at 1,700 g/t, raw lead assays were capped at 15% and raw zinc assays were capped at 15%.

(3) Silver equivalent Ag Eq. (g/t) = Ag (g/t)*89.2% + (Pb% *(US$0.94/ lb. Pb /14.583 Troy oz./lb./US$16.50 per Troy oz. Ag)*10,000*91.9%) + (Zn% *(US$1.00/lb. Zn/14.583 Troy oz./lb./US$16.50 per Troy oz. Ag)*10,000*82.9%).

(4) Metal prices used in the silver equivalent calculation are US$16.50/Troy oz. Ag, US$0.94/lb Pb and US$1.00/lb. Zn. Metal recoveries used in the silver equivalent equation reflect historic metallurgical results disclosed by Apogee Silver Ltd. (Porter et al., 2013).

(5) Metal grades were interpolated within wire-framed, three-dimensional silver domain solids using Geovia-Surpac Ver. 6.6.1 software and inverse distance squared interpolation methods. Block size is 10m(X) by 10m(Z) by 2m(Y). Historic mine void space was removed from the model prior to reporting of resources.

(6) Block density factors reflect three-dimensional modeling of drill core density determinations.

(7) Mineral resources are considered to have reasonable expectation for economic development using underground mining methods based on the deposit history, resource amount and metal grades, current metal pricing and comparison to broadly comparable deposits elsewhere.

(8) Rounding of figures may result in apparent differences between tonnes, grade and contained ounces.

(9) Mineral resources that are not mineral reserves do not have demonstrated economic viability.

(10) * Tonnes are rounded to nearest 10,000.

Table 2: Contained Metals Based on October 20, 2017 Pulacayo Deposit** Mineral Resource Estimate

|

Metal |

Indicated Resource |

Inferred Resource |

|

Silver |

30.4 million oz. |

6.3 million oz. |

|

Lead |

100.0 million lbs. |

22.0 million lbs. |

|

Zinc |

146.3 million lbs. |

41.6 million lbs. |

**Based on the resource estimate Ag Eq. cut-off value of 400 g/t and 100% recovery; figures are rounded to the nearest 100,000th increment

Table 3. Paca Inferred Mineral Resource Statement Details

|

Paca Mineral Resource Statement – Effective October 20, 2017 |

||||||

|

Ag Eq. Cut-Off (g/t) |

Category |

Tonnes* |

Ag (g/t) |

Pb (%) |

Zn (%) |

Ag Eq. (g/t) |

|

200 |

Inferred |

2,540,000 |

256 |

1.03 |

1.10 |

342 |

Notes:

(1) Mineral resources are estimated in conformance with the CIM Standards referenced in NI 43-101.

(2) Raw silver assays were capped at 1,050 g/t, raw lead assays were capped at 5% and raw zinc assays were capped at 5%.

(3) Silver equivalent Ag Eq. (g/t) = Ag (g/t) + (Pb% *(US$0.94/ lb. Pb /14.583 Troy oz./lb./US$16.50 per Troy oz. Ag)*10,000) + (Zn% *(US$1.00/lb. Zn/14.583 Troy oz./lb./US$16.50 per Troy oz. Ag)*10,000). 100 % metal recoveries are assumed based on lack of comprehensive metallurgical results.

(4) Metal prices used in the silver equivalent calculation are US$16.50/Troy oz. Ag, US$0.94/lb Pb and US$1.00/lb Zn and reflect those used for the Pulacayo deposit mineral resource estimate reported above.

(5) Metal grades were interpolated within wire-framed, three-dimensional solids using Geovia-Surpac Ver. 6.7 software and inverse distance squared interpolation methods. Block size is 5m (X) by 5m (Z) by 2.5m (Y). Historic mine void space was removed from the model prior to reporting resources.

(6) A block density factor of 2.26g/cm³ was used and reflects the average of 799 density measurements.

(7) Mineral resources are considered to have reasonable expectation for economic development using combined underground and open pit methods based on the deposit history, resource amount and metal grades, current metal pricing and comparison to broadly comparable deposits elsewhere.

(8) Mineral resources that are not mineral reserves do not have demonstrated economic viability.

(9) *Tonnes are rounded to nearest 10,000.

The contained metals estimated by the Company based on the October 20, 2017 resource estimate by Mercator are presented in Table 4.

Table 4. Contained Metals Based On October 20, 2017 Paca Deposit** Mineral Resource Estimate

|

Metal |

Inferred Resource |

|

Silver |

20.9 million oz. |

|

Lead |

57.7 million lbs. |

|

Zinc |

61.6 million lbs. |

**Based on the resource estimate Ag Eq. cut-off value of 200 g/t and 100% recovery; figures are rounded to the nearest 100,000th increment

- The Qualified Person for the estimate is Mr. E.J.C. Orbock III, RM SME, a Wood employee. The Mineral Resources have an effective date of 29 May, 2018.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are reported at various cut-off grades for oxide, transition, and reduced material.

- Mineral Resources are reported within a conceptual pit shell that uses the following assumptions: Mineral Resource V2O5 price: $14.64/lb; mining cost: $2.21/ton mined; process cost: $13.62/ton; general and administrative (G&A) cost: $0.99/ton processed; metallurgical recovery assumptions of 60% for oxide material, 70% for transition material and 52% for reduced material; tonnage factors of 16.86 ft3/ton for oxide material, 16.35 ft3/ton for transition material and 14.18 ft3/ton for reduced material; royalty: 2.5% net smelter return (NSR); shipping and conversion costs: $0.37/lb. An overall 40º pit slope angle assumption was used.

- Rounding as required by reporting guidelines may result in apparent summation differences between tons, grade and contained metal content. Tonnage and grade measurements are in US units. Grades are reported in percentages.

- 43-101 Pulacayo Report dated Oct 20, 2017 By Mercator Geological Services Limited on SEDAR.

Cautionary Statements:

Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the PEA representing a viable development option for the project; (ii) construction of a mine at the project and related actions; (iii) estimates of the capital costs of constructing mine facilities and bringing a mine into production, of sustaining capital and the duration of financing payback periods; (iv) the estimated amount of future production, both produced and metal recovered; and (vi) life of mine estimates and estimates of operating costs and total costs, cash flow, net present value and economic returns including internal rate of return estimates from an operating mine constructed at the project.

Junior Mining Network (''JMN'') is not a financial advisory or advisor, investment advisor or broker-dealer and does not undertake any activities that would require such registration. The information contained herein is not intended to be used as the basis for investment decisions and should not be considered as investment advice or a recommendation, nor is the information an offer or solicitation to buy, hold or sell any security. JMN does not represent or warrant that the information posted is accurate, unbiased or complete and make no representations as to the completeness or timeless of the material provided. JMN receives fees for producing content on financial news and has been compensated $11,500 by Prophecy Development Corp. to publish interviews and promote press releases for a period of 6 months. Investors should consult with an investment advisor, tax and legal consultant before making any investment decisions. All materials are subject to change without notice.