TORONTO, ONTARIO--(Marketwired - July 25, 2017) - Cordoba Minerals Corp. (TSX VENTURE:CDB) (OTCQX:CDBMF) ("Cordoba" or the "Company") and its joint venture partner, High Power Exploration Inc. ("HPX"), a private mineral exploration company indirectly controlled by mining entrepreneur Robert Friedland's Ivanhoe Industries, LLC, are pleased to announce that ongoing drilling at the San Matias Project in Colombia has continued to encounter high-grade copper-gold mineralization outside of the current resource shell, demonstrating significant potential to expand the current resource estimate.

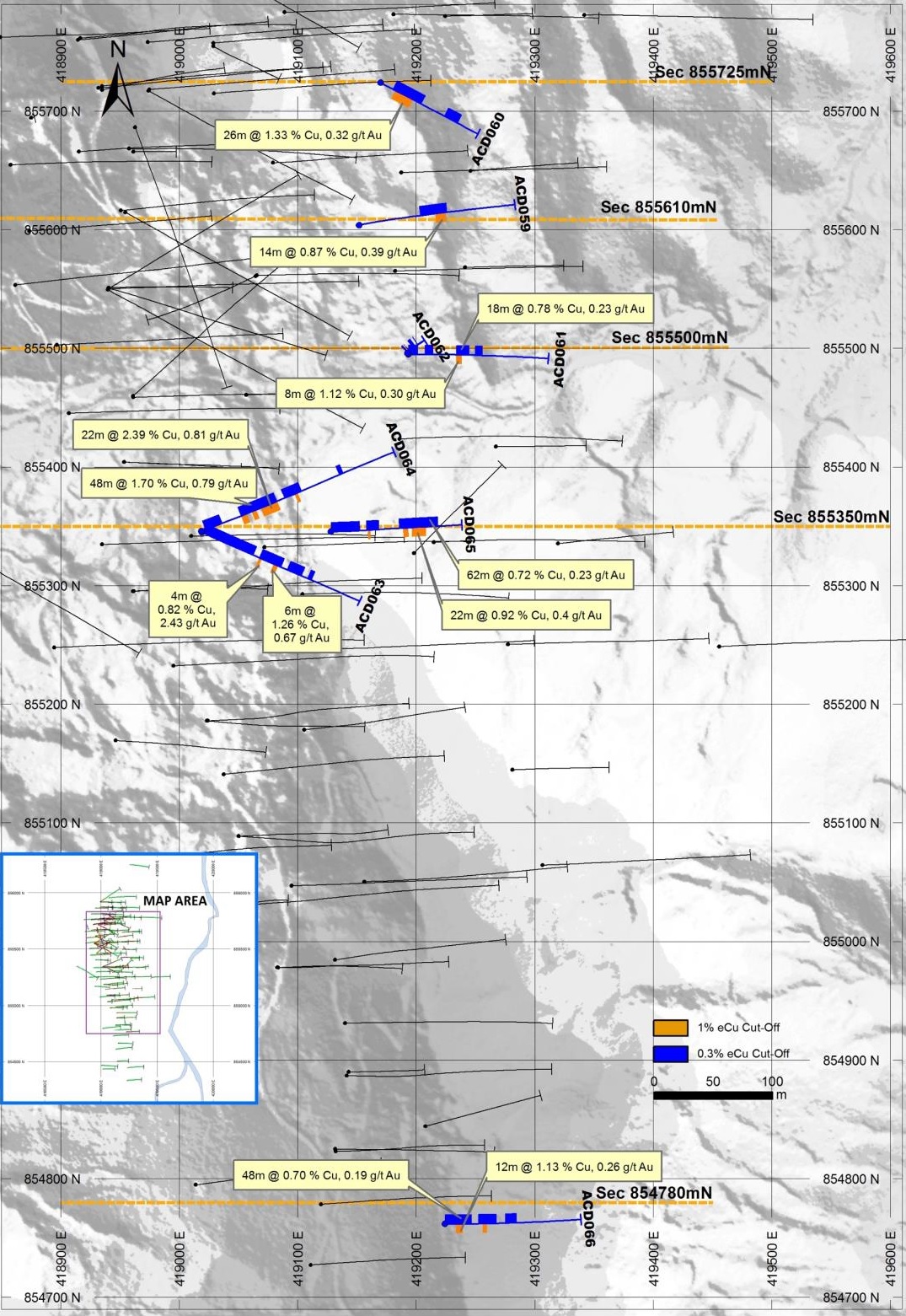

Drilling in this campaign was conducted over 900 metres of strike length within the central and southern parts of the Alacran Deposit. Importantly, drillhole ACD066 indicates that previous drilling in the southern-most part of the property was collared too far west and that the copper-gold deposit is offset to the east by post-mineralization faulting. This indicates potential for undrilled strike extensions of almost 500 metres.

Highlights

(refer to Table 1 for complete drilling results)

- ACD060:

- 42 metres @ 0.92% copper and 0.23 g/t gold (1.10% CuEq; from 18 metres), including:

- 26 metres @ 1.33% copper, 0.32 g/t gold (1.57% CuEq; from 22 metres).

- 42 metres @ 0.92% copper and 0.23 g/t gold (1.10% CuEq; from 18 metres), including:

- ACD063:

- 30 metres @ 0.66% copper and 0.69 g/t gold (1.18% CuEq; from 78 metres), including:

- 4 metres @ 0.82% copper, 2.43 g/t gold (2.66% CuEq; from 78 metres).

- 6 metres @ 1.26% copper, 0.67 g/t gold (1.76% CuEq; from 98 metres).

- 0.5 metres @ 5.97 g/t gold, 0.24% copper (from 67.2 metres) with visible gold in the preserved half-core.

- 30 metres @ 0.66% copper and 0.69 g/t gold (1.18% CuEq; from 78 metres), including:

- ACD064:

- 48 metres @ 1.70% copper and 0.79 g/t gold (2.30% CuEq; from 51 metres), including:

- 8 metres @ 2.04% copper, 1.81 g/t gold (3.41% CuEq; from 51 metres).

- 6 metres @ 1.44% copper, 0.60 g/t gold (1.89% CuEq; from 65 metres).

- 22 metres @ 2.39% copper, 0.81 g/t gold (3.00% CuEq; from 98 metres).

- 24 metres @ 1.10% copper and 0.27 g/t gold (1.31% CuEq; from 109 metres), including:

- 4 metres @ 3.76% copper, 0.67 g/t gold (4.27% CuEq; from 123 metres).

- 48 metres @ 1.70% copper and 0.79 g/t gold (2.30% CuEq; from 51 metres), including:

Mario Stifano, President and CEO of Cordoba, commented: "The discovery of the offsetting fault in the southern part of the Alacran Deposit demonstrates the significant potential for the deposit to grow. Visible gold in ACD063 was confirmed by assay results. This indicates that cross-cutting gold-bearing structures are found over at least 600 metres of the Alacran Deposit's strike."

Discussion

Eight drillholes completed at the Alacran Deposit focused on continuity of copper-gold mineralization in central parts of the deposit and tested southern extensions of the Alacran trend where post-mineral faulting had been interpreted to have offset copper-gold mineralization to the east.

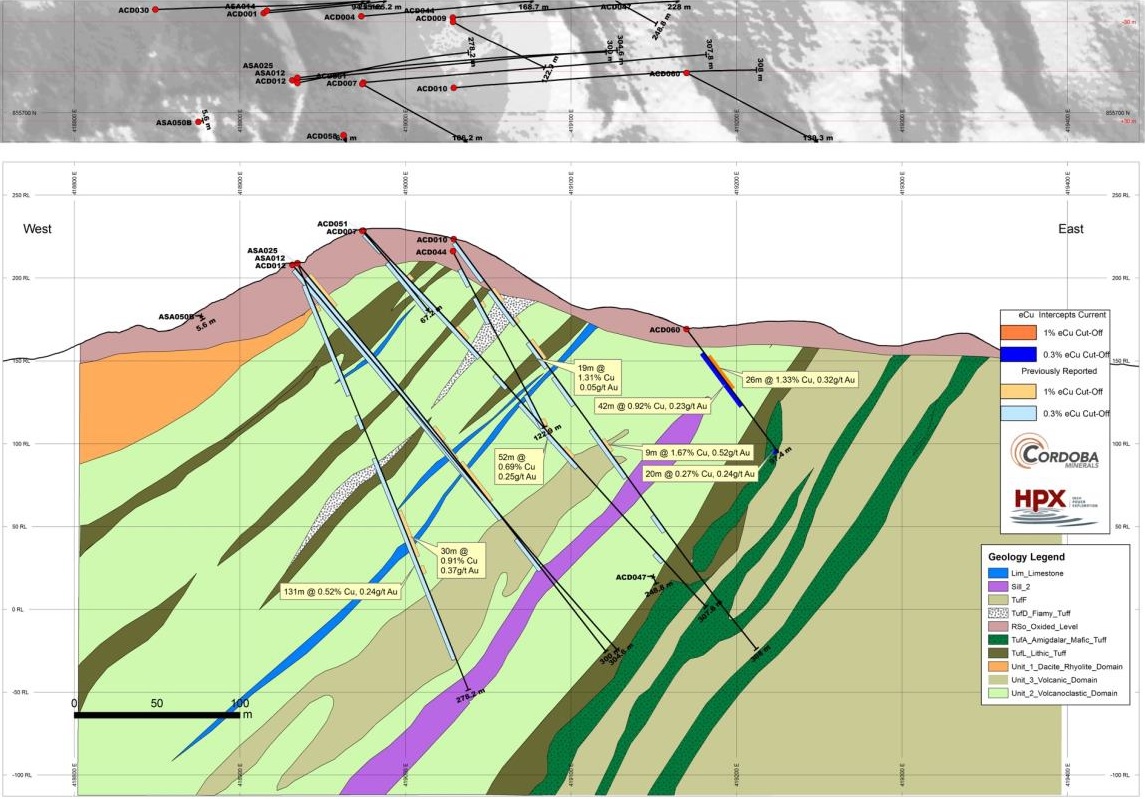

On Section 855700mN:

- ACD060 was drilled obliquely to the south-east to test the up-dip continuity of copper-gold between sections. The drillhole successfully intersected a number of copper-gold rich zones that are significantly higher than the resource grades for both copper and gold and project the mineralization to surface. These are outlined in Table 1 and include:

- 42 metres @ 0.92% copper and 0.23 g/t gold (1.10% CuEq) from 18 metres, including:

- 26 metres @ 1.33% copper and 0.32 g/t gold (1.57% CuEq) from 22 metres.

- 20 metres @ 0.27% copper and 0.24 g/t gold (0.46% CuEq) from 94 metres.

- 42 metres @ 0.92% copper and 0.23 g/t gold (1.10% CuEq) from 18 metres, including:

On Section 855600mN:

- ACD059 was drilled to test the up-dip continuity of copper-gold between sections. The drillhole successfully intersected a copper-gold rich zone and projected the mineralization to surface:

- 36 metres @ 0.61% copper and 0.27 g/t gold (0.81% CuEq) from 84 metres, including:

- 14 metres @ 0.87% copper and 0.39 g/t gold (1.17% CuEq) from 104 metres.

- 36 metres @ 0.61% copper and 0.27 g/t gold (0.81% CuEq) from 84 metres, including:

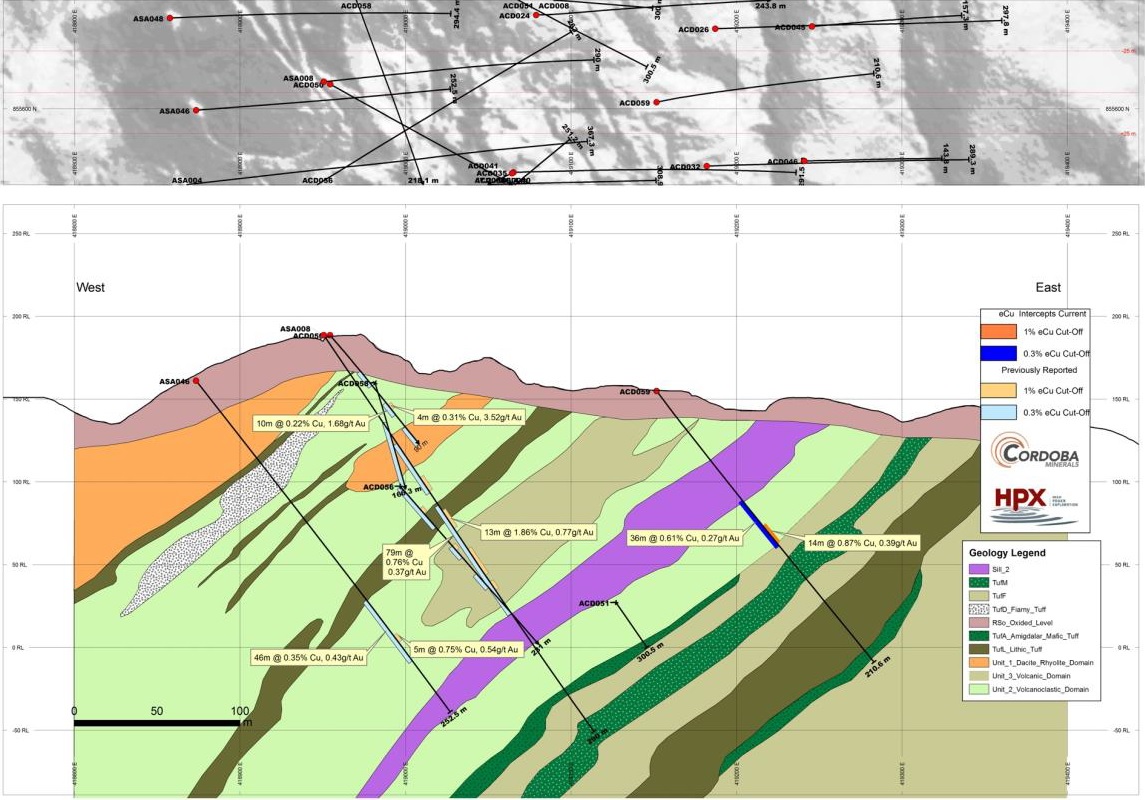

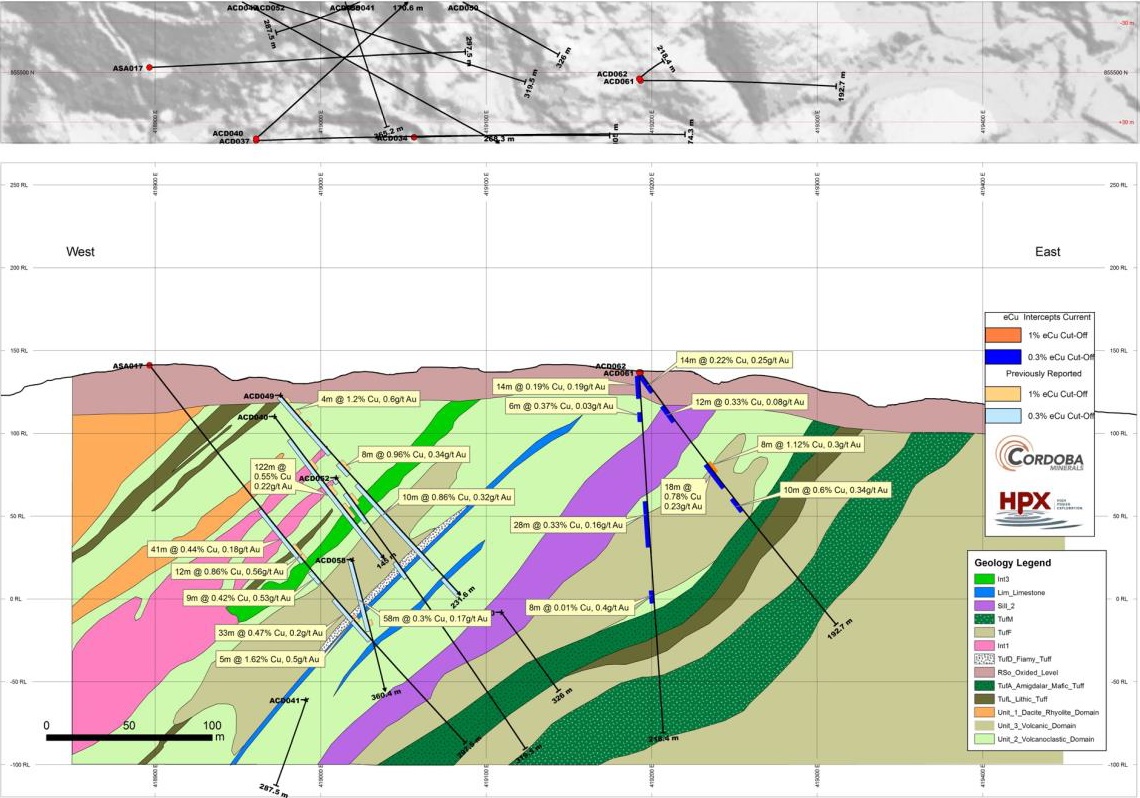

On Section 855500mN:

- Two drillholes were collared on this section. ACD061 was drilled to test the lateral extensions of copper-gold mineralization and was successful in projecting the mineralized zone to surface in multiple individual zones:

- 14 metres @ 0.22% copper and 0.25 g/t gold (0.41% CuEq) from 0 metres.

- 12 metres @ 0.33% copper and 0.08 g/t gold (0.40% CuEq) from 24 metres.

- 18 metres @ 0.78% copper and 0.23 g/t gold (0.96% CuEq) from 68 metres, including:

- 8 metres @ 1.12% copper and 0.30 g/t gold (1.34% CuEq) from 68 metres.

- 10 metres @ 0.60% copper and 0.34 g/t gold (0.86% CuEq) from 94 metres.

- ACD062 was a vertical infill drillhole testing the copper-gold mineralization between drillholes on this section. The drillhole successfully intersected a number of mineralized intervals:

- 14 metres @ 0.19% copper and 0.19 g/t gold (0.33% CuEq) from 2 metres.

- 6 metres @ 0.37% copper and 0.03 g/t gold (0.40% CuEq) from 24 metres.

- 28 metres @ 0.33% copper and 0.16 g/t gold (0.45% CuEq) from 78 metres.

- 8 metres @ 0.01% copper and 0.40 g/t gold (0.32% CuEq) from 132 metres.

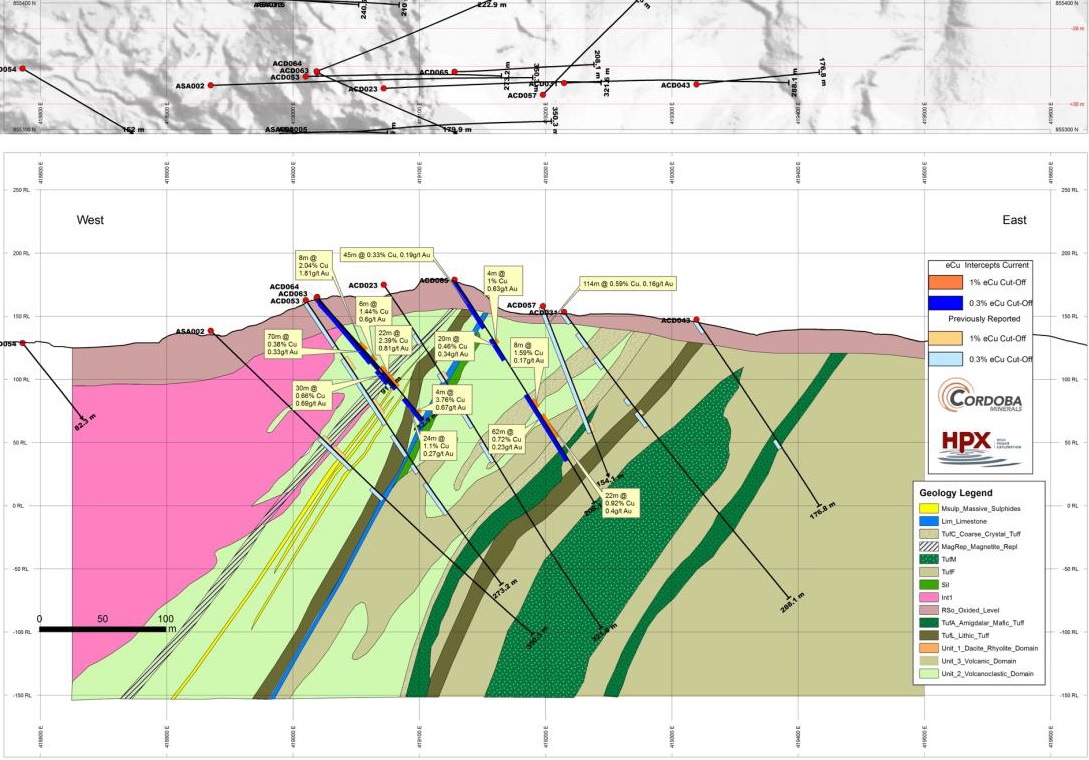

On Section 854350mN:

- Three drillholes were collared on this section (ACD063, ACD064 and ACD065). ACD063 was drilled obliquely to the south-east to test the continuity of mineralization between sections where it successfully intersected a number of high-grade copper-gold mineralized intervals that included:

- 70 metres @ 0.38% copper and 0.33 g/t gold (0.63% CuEq) from 0 metres.

- 30 metres @ 0.66% copper and 0.69 g/t gold (1.18% CuEq) from 78 metres, including:

- 4 metres @ 0.82% copper and 2.43 g/t gold (2.66% CuEq) from 78 metres.

- 6 metres @ 1.26% copper and 0.67 g/t gold (1.76% CuEq) from 98 metres.

- 20 metres @ 0.47% copper and 0.46 g/t gold (0.82% CuEq) from 116 metres.

- 6 metres @ 0.34% copper and 0.19 g/t gold (0.49% CuEq) from 144 metres.

- ACD064 was drilled obliquely to the north-east to test the continuity of mineralization between sections where it successfully intersected a number of high-grade copper-gold mineralized intervals, including:

- 22 metres @ 0.29% copper and 0.21 g/t gold (0.45% CuEq) from 5 metres.

- 48 metres @ 1.70% copper and 0.79 g/t gold (2.30% CuEq) from 51 metres, including:

- 8 metres @ 2.04% copper and 1.81 g/t gold (3.41% CuEq) from 51 metres.

- 6 metres @ 1.44% copper and 0.60 g/t gold (1.89% CuEq) from 65 metres.

- 22 metres @ 2.39% copper and 0.81 g/t gold (3.00% CuEq) from 77 metres.

- 24 metres @ 1.10% copper and 0.27 g/t gold (1.31% CuEq) from 109 metres, including:

- 4 metres @ 3.76% copper and 0.67 g/t gold (4.27% CuEq) from 123 metres.

- ACD065 was drilled on this section to test the continuity of copper-gold mineralization where it successfully intersected a number of high-grade copper-gold mineralized intervals, including:

- 45 metres @ 0.33% copper and 0.19 g/t gold (0.48% CuEq) from 0 metres.

- 20 metres @ 0.46% copper and 0.34 g/t gold (0.72% CuEq) from 55 metres, including:

- 4 metres @ 1.00% copper and 0.63 g/t gold (1.48% CuEq) from 57 metres.

- 62 metres @ 0.72% copper and 0.23 g/t gold (0.89% CuEq) from 107 metres, including:

- 8 metres @ 1.59% copper and 0.17 g/t gold (1.72% CuEq) from 113 metres.

- 22 metres @ 0.92% copper and 0.40 g/t gold (1.22% CuEq) from 127 metres.

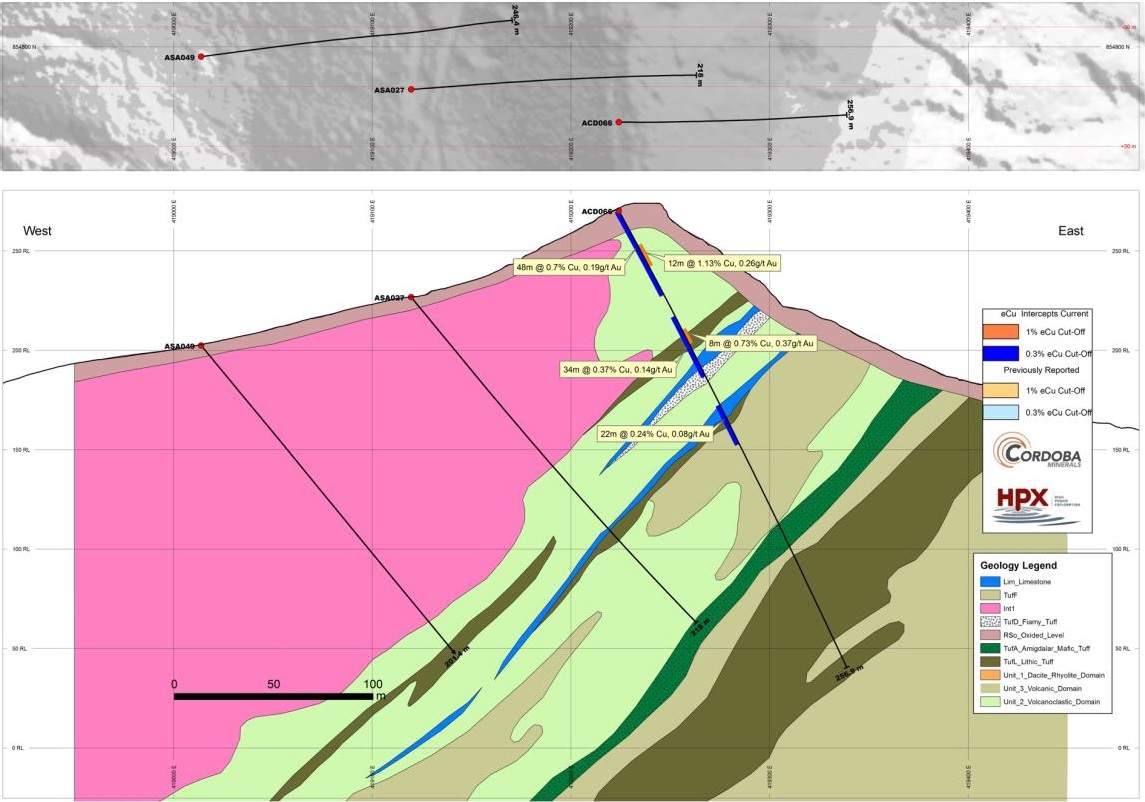

On Section 854800mN:

- ACD066 was drilled to test that the copper-gold mineralization in the southern part of the Alacran trend has been faulted eastwards post-mineralization. The drillhole successfully intersected a number of mineralized intervals, that project to surface, and also indicate the orebody has been moved east and that the bulk of the drilling in southern Alacran was collared too far west of the copper-gold mineralization, including:

- 48 metres @ 0.70% copper and 0.19 g/t gold (0.84% CuEq) from 0 metres, including:

- 12 metres @ 1.13% copper and 0.26 g/t gold (1.32% CuEq) from 20 metres.

- 34 metres @ 0.37% copper and 0.14 g/t gold (0.48% CuEq) from 60 metres, including:

- 8 metres @ 0.73% copper and 0.37 g/t gold (1.01% CuEq) from 57 metres.

- 22 metres @ 0.24% copper and 0.08 g/t gold (0.30% CuEq) from 110 metres.

- 48 metres @ 0.70% copper and 0.19 g/t gold (0.84% CuEq) from 0 metres, including:

Alacran Copper-Gold Deposit

The Alacran Copper-Gold Deposit is located within the Company's San Matias Copper-Gold Project in the Department of Cordoba, Colombia. The Alacran Deposit is located on a topographic high in gently rolling topography, optimal for potential open-pit mining. Access and infrastructure are considered favourable. The Alacran initial, pit-constrained, Inferred Mineral Resource is 53.52 million tonnes at 0.70% copper and 0.37 g/t gold, or 0.95% copper equivalent (CuEq), including 7.37 million tonnes at 2.14% copper and 0.41 g/t gold above 1% copper (Cu) cut off (see news release dated January 5, 2017).

Alacran is approximately two kilometres southwest of the Company's Montiel porphyry copper-gold discovery, where drilling intersected 101 metres of 1.0% copper and 0.65 g/t gold, and two kilometres northwest of the Costa Azul porphyry copper-gold discovery, where drilling intersected 87 metres of 0.62% copper and 0.51 g/t gold. The copper-gold mineralization at Alacran is associated with stratabound replacement of a marine volcano-sedimentary sequence in the core of a faulted antiformal fold structure. The deposit comprises moderately to steeply-dipping stratigraphy that is mineralized as a series of sub-parallel replacement-style or skarn zones and associated disseminations. The copper-gold mineralization is composed of multiple overprinting hydrothermal events with the main ore phase comprised of chalcopyrite-pyrrhotite-pyrite that appears to overprint a large-scale early magnetite metasomatic event.

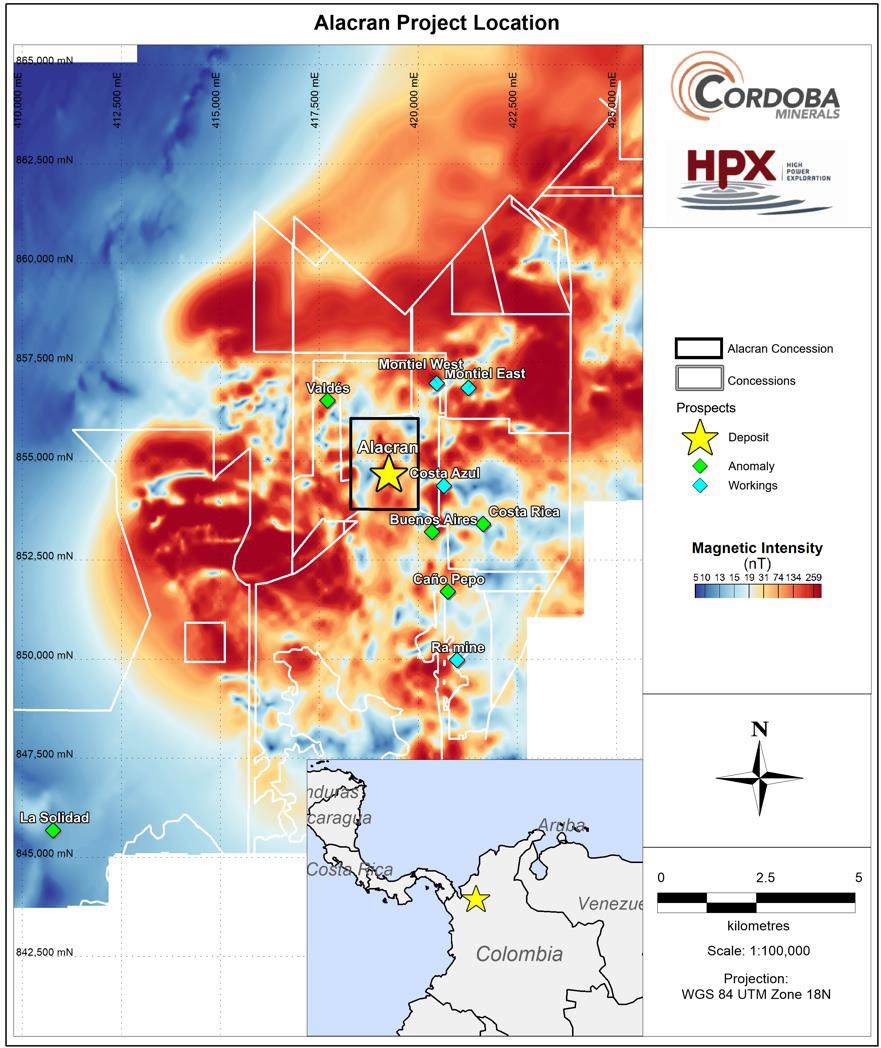

Figure 1: Project location and licences on magnetics

Figure 2: Inclined level plan illustrating high grade intersections aligned on north-south trend

Figure 3: Section 855700N

Figure 4: Section 855600N

Figure 5: Section 855500N

Figure 6: Section 855350N

Figure 7: Section 854800N

| Hole ID | From | To | Interval (m) |

CuEq (%) |

Cu (%) |

Au (g/t) |

Cut-Off (%CuEq) |

True Thickness (approx % of intercept width) |

| ACD059 | 84 | 120 | 36 | 0.81 | 0.61 | 0.27 | 0.30% | 90 - 100% |

| ACD059 | 104 | 118 | 14 | 1.17 | 0.87 | 0.39 | 1.00% | |

| ACD060 | 18 | 60 | 42 | 1.10 | 0.92 | 0.23 | 0.30% | 80 - 90% |

| ACD060 | 94 | 114 | 20 | 0.46 | 0.27 | 0.24 | 0.30% | |

| ACD060 | 22 | 48 | 26 | 1.57 | 1.33 | 0.32 | 1.00% | |

| ACD061 | 0 | 14 | 14 | 0.41 | 0.22 | 0.25 | 0.30% | 90 -100% |

| ACD061 | 24 | 36 | 12 | 0.40 | 0.33 | 0.08 | 0.30% | |

| ACD061 | 68 | 86 | 18 | 0.96 | 0.78 | 0.23 | 0.30% | |

| ACD061 | 94 | 104 | 10 | 0.86 | 0.60 | 0.34 | 0.30% | |

| ACD061 | 68 | 76 | 8 | 1.34 | 1.12 | 0.30 | 1.00% | |

| ACD062 | 2 | 16 | 14 | 0.33 | 0.19 | 0.19 | 0.30% | 50% |

| ACD062 | 24 | 30 | 6 | 0.40 | 0.37 | 0.03 | 0.30% | |

| ACD062 | 78 | 106 | 28 | 0.45 | 0.33 | 0.16 | 0.30% | |

| ACD062 | 132 | 140 | 8 | 0.32 | 0.01 | 0.40 | 0.30% | |

| ACD063 | 0 | 70 | 70 | 0.63 | 0.38 | 0.33 | 0.30% | 80 -90% |

| ACD063 | 78 | 108 | 30 | 1.18 | 0.66 | 0.69 | 0.30% | |

| ACD063 | 116 | 136 | 20 | 0.82 | 0.47 | 0.46 | 0.30% | |

| ACD063 | 144 | 150 | 6 | 0.49 | 0.34 | 0.19 | 0.30% | |

| ACD063 | 78 | 82 | 4 | 2.66 | 0.82 | 2.43 | 1.00% | |

| ACD063 | 98 | 104 | 6 | 1.76 | 1.26 | 0.67 | 1.00% | |

| ACD064 | 5 | 27 | 22 | 0.45 | 0.29 | 0.21 | 0.30% | 80 - 90% |

| ACD064 | 51 | 99 | 48 | 2.30 | 1.70 | 0.79 | 0.30% | |

| ACD064 | 109 | 133 | 24 | 1.31 | 1.10 | 0.27 | 0.30% | |

| ACD064 | 185 | 191 | 6 | 0.35 | 0.04 | 0.41 | 0.30% | |

| ACD064 | 51 | 59 | 8 | 3.41 | 2.04 | 1.81 | 1.00% | |

| ACD064 | 65 | 71 | 6 | 1.89 | 1.44 | 0.60 | 1.00% | |

| ACD064 | 77 | 99 | 22 | 3.00 | 2.39 | 0.81 | 1.00% | |

| ACD064 | 123 | 127 | 4 | 4.27 | 3.76 | 0.67 | 1.00% | |

| ACD065 | 0 | 45 | 45 | 0.48 | 0.33 | 0.19 | 0.30% | 90 -100% |

| ACD065 | 55 | 75 | 20 | 0.72 | 0.46 | 0.34 | 0.30% | |

| ACD065 | 107 | 169 | 62 | 0.89 | 0.72 | 0.23 | 0.30% | |

| ACD065 | 57 | 61 | 4 | 1.48 | 1.00 | 0.63 | 1.00% | |

| ACD065 | 113 | 121 | 8 | 1.72 | 1.59 | 0.17 | 1.00% | |

| ACD065 | 127 | 149 | 22 | 1.22 | 0.92 | 0.40 | 1.00% | |

| ACD066 | 0 | 48 | 48 | 0.84 | 0.70 | 0.19 | 0.30% | 80 - 90% |

| ACD066 | 60 | 94 | 34 | 0.48 | 0.37 | 0.14 | 0.30% | |

| ACD066 | 110 | 132 | 22 | 0.30 | 0.24 | 0.08 | 0.30% | |

| ACD066 | 20 | 32 | 12 | 1.32 | 1.13 | 0.26 | 1.00% | |

| ACD066 | 68 | 76 | 8 | 1.01 | 0.73 | 0.37 | 1.00% |

| Notes: | 0.3% CuEq cutoff with 6m maximum internal dilution and a 6m minimum width. 1.0% CuEq cutoff uses 4m maximum internal dilution and 4m minimum width. True width intervals of the mineralization are estimated in the rightmost column. Copper equivalent (CuEq) calculations assume a US$2.50/lb copper price and a US$1300/Oz gold price. For intercept calculations: sample assays of copper, gold and copper equivalent are all capped to 10% copper, 10 g/t gold, and 10% CuEq. |