MONTREAL, Jan. 22, 2018 (GLOBE NEWSWIRE) -- SEMAFO Inc. (TSX:SMF) (OMX:SMF) reports 2017 production of 206,400 ounces at an all-in sustaining cost of $943 per ounce. As a result, the Corporation has beat its revised production and met its cost guidance for the year.

Mana

- In the fourth quarter, Mana produced 49,500 ounces of gold at a total cash cost1 of $667 per ounce and all-in sustaining cost2 of $987 per ounce

- Annual production of 206,400 ounces, slightly ahead of 2017 guidance of 190,000 to 205,000 ounces

- Total cash cost1 for 2017 of $655 per ounce

- All-in sustaining cost2 for 2017 of $943 per ounce, in line with guidance of $920 to $960 per ounce

- Gold sales of 205,300 ounces generated 2017 revenues of $259 million ($1,261 per ounce)

Mining Operations

Mana, Burkina Faso

| Three-month period | Year | |||||||||

| ended December 31, | ended December 31, | |||||||||

| 2017 | 2016 | Variation | 2017 | 2016 | Variation | |||||

| Tonnes processed | 653,500 | 714,200 | (8%) | 2,739,900 | 2,753,300 | - | ||||

| Head grade (g/t) | 2.43 | 2.52 | (4%) | 2.46 | 2.88 | (15%) | ||||

| Recovery (%) | 97 | 95 | 2% | 95 | 94 | 1% | ||||

| Gold ounces produced | 49,500 | 55,100 | (10%) | 206,400 | 240,200 | (14%) | ||||

| Gold ounces sold | 49,200 | 57,100 | (14%) | 205,300 | 240,600 | (15%) | ||||

In 2017, the head grade decreased slightly compared to 2016 as a result of a decision to add 603,800 tonnes of low grade material at an average grade of 0.70 g/t Au to the mix during the year. Without this, the head grade for the year would have been 2.96 g/t Au.

2017 numbers are unaudited and subject to final adjustment. All $ amounts are in US dollars, unless otherwise indicated.

1 Total cash cost is a non-IFRS financial performance measure with no standard definition under IFRS and represents the mining operation expenses and government royalties per ounce sold.

2 All-in sustaining cost is a non-IFRS financial performance measure with no standard definition under IFRS and represents the total cash cost, plus sustainable capital expenditures and stripping costs per ounce sold.

Boungou 80% Complete

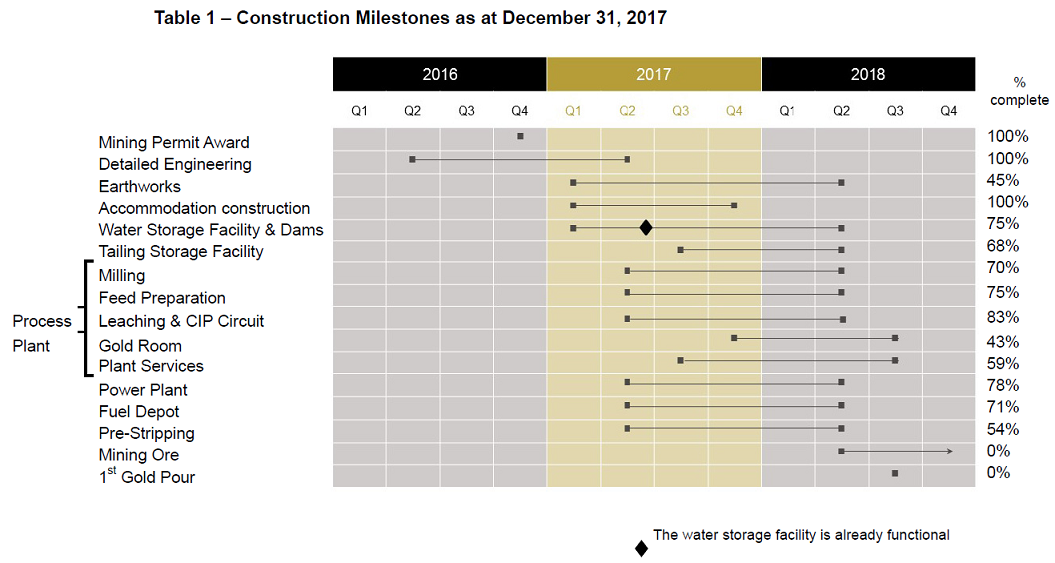

As at December 31, 2017, construction of the Boungou Mine was 80% completed and remained on time for commissioning in the third quarter of 2018. In addition, the following achievements had been made:

- Development on budget with $159 million of the $231 million capital spent

- Cash and restricted cash of $222 million as at December 31, 2017

- Completion of concrete pour, some 70% of structural steel and 55% of mechanical installation

- Erection of CIP tanks completed

- Tailings storage facility was almost 70% completed

- Completion of almost 80% of the power plant and over 70% of the fuel depot

- Pre-stripping was over 50% completed with 9.7 million of the projected 18 million tonnes extracted

- Installation of the SAG mill scheduled for completion at end of January 2018

- 3.7 million person hours worked without lost-time injury

The table below presents the construction milestones for the Boungou Mine and their level of completion:

To follow the construction progress, please view the following link to the Boungou Mine photo and video gallery on our website: Click Here

2018 Outlook and Siou PFS

The 2018 outlook and the pre-feasibility study results for Siou underground will be released after market close on February 15. A conference call will be held at 8 am on February 16 to discuss the results, the details of which will be given in the release.

About SEMAFO

SEMAFO is a Canadian-based gold mining company with production and exploration activities in West Africa. The Corporation operates the Mana Mine in Burkina Faso, which includes the high grade satellite deposit of Siou and is targeting production start-up of the Boungou Mine in the third quarter of 2018. SEMAFO’s strategic focus is to maximize shareholder value by effectively managing its existing assets as well as pursuing organic and strategic growth opportunities.