VANCOUVER, BRITISH COLUMBIA--(Marketwired - April 5, 2017) - Lincoln Mining Corporation, (TSX VENTURE:LMG) ("Lincoln" or the "Company") announces its plans to arrange for a non-brokered private placement of up to 10,000,000 units at a price of $0.05 per unit ("Units") for total proceeds of up to $500,000 (the "Offering"). Each Unit will be comprised of one common share of the Company and one non-transferable common share purchase warrant. Each warrant will entitle the holder to acquire one additional common share of the Company at an exercise price of $0.08 for a period of five years after the closing of the Offering.

The Company is pleased to announce that Palisade Global Investments Ltd. ("Palisade") will provide a lead order in the Offering of $220,000 and, as a result, will become one of the largest shareholders of the Company. Palisade is an offshore merchant bank and investment group, specializing in small cap, high growth investments.

Collin Kettell, Co-founder and CEO of Palisade, stated: "Lincoln Mining controls two past producing assets in favorable mining jurisdictions. With debt covenants nearing a resolution, we believe the market will revalue the company. We look forward to working with Paul Saxton and the Lincoln team in advancing both projects towards production decisions."

"We are pleased to welcome Palisade Global Investments. We have developed a strong relationship with the group and look forward to building that ongoing relationship and working closely with Palisade Global Investments as we continue to explore and develop our projects", stated Paul Saxton, President and CEO of Lincoln.

Finders' fees may be payable in connection with the Offering and those qualified persons involved as finders will receive a cash fee of up to 7% of the proceeds raised and such number of warrants (having the same terms as the warrants forming part of the Units) equal to up to 7% of the total number of Units sold.

Lincoln intends to use the proceeds raised from the private placement for permitting on the Pine Grove project, to reduce existing debt and for general working capital purposes.

All securities issued under the private placement will be subject to a four month hold period from the closing date under applicable Canadian securities laws, in addition to such other restrictions as may apply under applicable securities laws of jurisdictions outside Canada. The private placement is subject to all necessary regulatory approvals including from the TSX Venture Exchange.

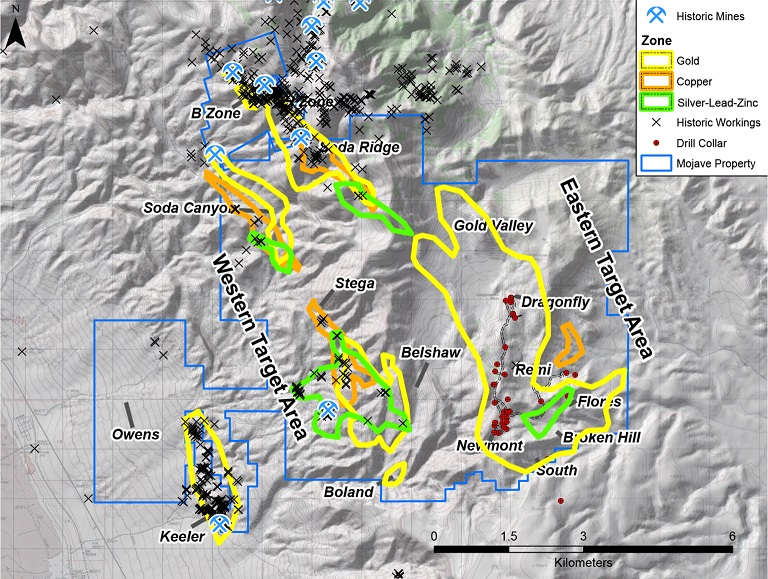

Lincoln Mining Corp. is a Canadian precious metals exploration and development company with two projects in various stages of exploration and development, namely the Pine Grove gold property in Nevada and the Oro Cruz gold property in California. In the United States, the Company operates under Lincoln Gold US Corp. and Lincoln Resource Group Corp., both Nevada corporations.

For further information, please visit the Company's website at www.lincolnmining.com.