MOKOPANE, South Africa, Nov. 01, 2017 (GLOBE NEWSWIRE) -- Ivanhoe Mines’ (TSX:IVN) (OTCQX:IVPAF) Executive Chairman Robert Friedland, Chief Executive Officer Lars-Eric Johansson and Ivanplats’ Managing Director Dr. Patricia Makhesha announced today that Shaft 1 has reached a depth of 500 metres below surface, more than half way to the planned final depth of 980 metres, at the company’s Platreef platinum, palladium, rhodium, gold, nickel and copper mine.

The 7.25-metre-diameter Shaft 1, which is expected to reach the Flatreef mineralization at a depth of approximately 783 metres in the third quarter of next year, will be used for initial access to the Flatreef Deposit and early underground development.

The first shaft station, completed in September at a depth of 450 metres, will be used as an intermediate location for water pumping and shaft-cable termination. As shaft sinking advances, an additional three shaft stations will be developed at mine working depths of 750 metres, 850 metres and 950 metres.

“Our focus is to keep advancing the Platreef Project along its critical path,” said Mr. Friedland. “Our continued development of shafts 1 and 2 will provide access to the Flatreef Deposit and help to ensure that the project is able to meet the scheduled, first phase start-up of the underground mine and concentrator by 2022.”

Mr. Friedland added, “Our team is dedicated to building a state-of-the-art mine that will produce metals that are essential to our urbanizing planet. It is a mine that matters to all of our stakeholders and an achievement that we will be able to proudly recount to our grandchildren. Building a major, new platinum-group-metals mine in the current market takes long-term vision, unwavering resolve and a clear focus.”

The sinking of Shaft 1 is continuing to advance at a rate of 40 to 50 metres per month. Approximately 40% of Platreef’s shaft-sinking team now is comprised of employees from local communities who had no previous mining experience. New employees received intensive, on-site training for underground-mining and completed a workplace-safety induction program.

“We pride ourselves on having a highly-skilled, safety-focused workforce, and we have been impressed by the willingness of our senior staff to help pass on these skills to the next generation of miners,” said Dr. Makhesha.

Platreef’s Shaft 1 sinking headgear and related surface infrastructure.

Shaft-sinking crew during development of the 450-metre station.

Shaft 2 early-works surface construction advancing to box-cut development

Early-works surface construction for Shaft 2 began last May with initial curtain grouting around the box cut. Further work includes the excavation of a surface box cut to a depth of approximately 29 metres and construction of the concrete hitch for the 103-metre-tall concrete headgear (headframe) that will house the shaft’s permanent hoisting facilities and support the shaft collar. The early-works construction is expected to be completed in the third quarter of next year.

Shaft 2 will have an internal diameter of 10 metres and the capacity to hoist six million tonnes per year. The headgear design for the six-million-tonne-per-year permanent hoisting facility has been completed by South Africa-based Murray & Roberts Cementation.

Shaft 1 expected to intersect the Flatreef mineralized zone at a depth of 783 metres

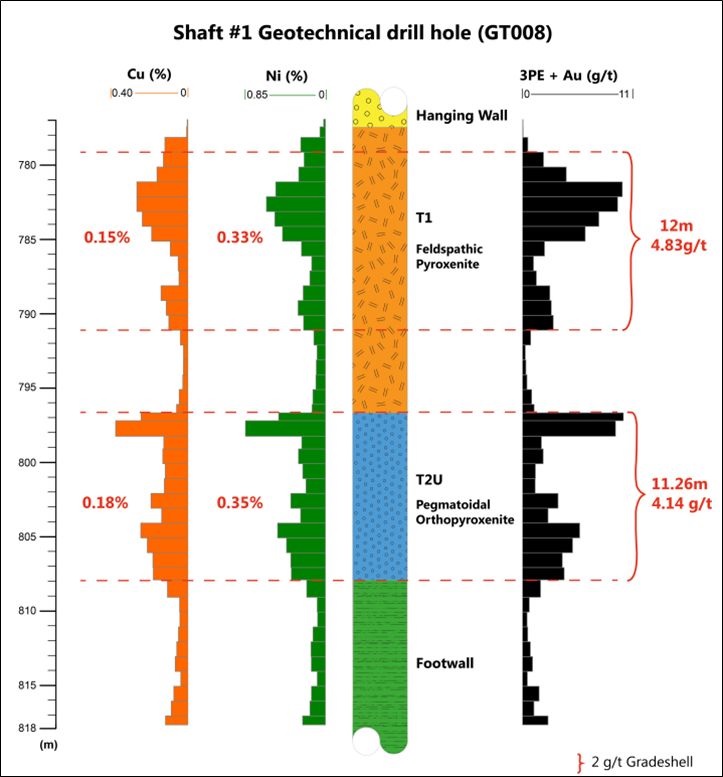

A geotechnical drill hole (GT008) drilled vertically below Shaft 1 indicates that the shaft will intersect the upper contact of the Flatreef Deposit (T1 mineralized zone) at an approximate shaft depth of 783 metres. The grade for the T1 mineralized zone at this location is 4.83 grams per tonne (g/t) 3PE (platinum, palladium and rhodium) plus gold, 0.33% nickel and 0.15% copper over a vertical thickness of 12 metres (see Figure 1).

A well-developed chromitite stringer, marking the stratigraphic contact between the T1 and T2 mineralized zones, is expected to be intersected at a shaft depth of 792.1 metres. This will be followed by the T2 mineralized zone, which grades 4.14 g/t 3PE + gold, 0.35 % nickel and 0.18% copper over a vertical thickness of 11.26 metres (at a 2 g/t 3PE+gold grade cut-off).

Members of Platreef’s shaft-sinking team in Shaft 1 at a depth of 500 metres.

Figure 1: Downhole plot of Shaft 1 geotechnical drill hole GT008 displaying grade shells at a 2 g/t 3PE+Au cut-off grade.

Note: Metres quoted in text are based on depth below shaft bank; metres in Figure 1 are quoted based on drill hole depth below surface.

Development work focused on initial production by 2022

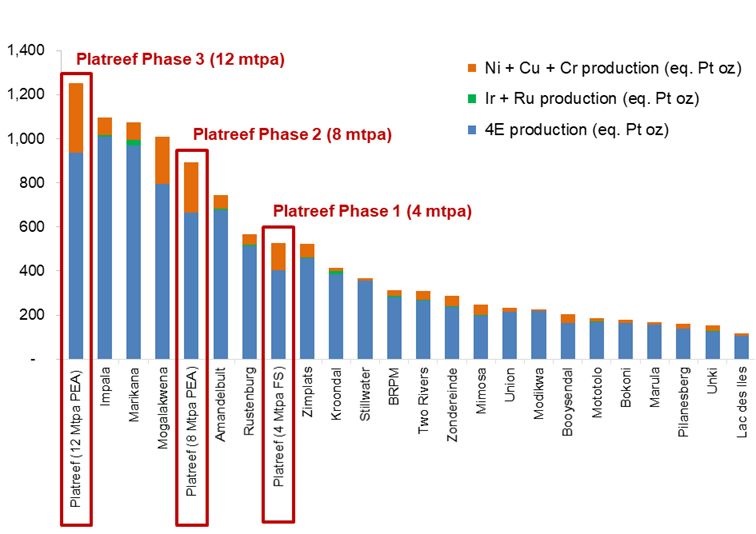

The Platreef Project, which contains the Flatreef Deposit, is a Tier One discovery by Ivanhoe Mines’ geologists on the Northern Limb of South Africa’s Bushveld Igneous Complex, the world’s premier platinum producing region. Ivanhoe plans to develop the Platreef Mine in three phases: 1) An initial rate of four million tonnes per annum (Mtpa) to establish an operating platform to support future expansions; 2) a doubling of production to eight Mtpa; and 3) expansion to a steady-state 12 Mtpa.

On July 30, 2017, Ivanhoe issued an independent definitive feasibility study (DFS) for Platreef that covers the first phase of development that would include construction of a state-of-the-art underground mine, concentrator and other associated infrastructure to support initial production of concentrate by 2022. As Phase 1 is being developed and commissioned, there would be opportunities to refine the timing and scope of subsequent phases of expanded production.

Mr. Johansson said the July study’s results demonstrate Platreef’s robust economics, which first were highlighted in the March 2014 preliminary economic assessment and further reinforced by the January 2015 pre-feasibility study.

Mr. Johansson also noted that the project has shown significant improvement in safety and achieved a Lost Time Injury-Free (LTIF) record in the latest quarter. As of end of October 2017, the project had achieved 132 days without a lost-time-accident. Various initiatives have been implemented by Ivanplats and Aveng Mining to improve the safety culture on site.

Key features of the July 2017 Platreef DFS include:

- Indicated Mineral Resources totalling 346 million tonnes at a grade of 3.77 g/t 3 PE +gold, using a 2 g/t cut-off, contain an estimated 41.9 million ounces of platinum, palladium, rhodium and gold. An additional 52.8 million ounces of platinum, palladium, rhodium and gold are contained in Inferred Resources totalling 506 million tonnes at a grade of 3.24 g/t 3 PE +gold, using a 2 g/t cut-off.

- Enhanced Mineral Reserve totalling 124.7 million tonnes grading 4.40 g/t 3 PE +gold contain 17.6 million ounces of platinum, palladium, rhodium and gold – an increase of 13% compared to the 2015 pre-feasibility study – following stope optimization and mine sequencing work.

- Development of a large, safe, mechanized, underground mine with an initial four Mtpa concentrator and associated infrastructure.

- Planned initial average annual production rate of 476,000 ounces of platinum, palladium, rhodium and gold, plus 21 million pounds of nickel and 13 million pounds of copper.

- Estimated pre-production capital requirement of approximately US$1.5 billion, at a ZAR:USD exchange rate of 13 to 1.

- Platreef would rank at the bottom of the cash-cost curve, at an estimated US$351 per ounce of 3PE+Au produced, net of by-products and including sustaining capital costs, and US$326 per ounce before sustaining capital costs.

- After-tax Net Present Value (NPV) of US$916 million, at an 8% discount rate.

- After-tax Internal Rate of Return (IRR) of 14.2%. The actual return to project equity owners is expected to be higher as a result of the significant amount of project financing that is being raised.

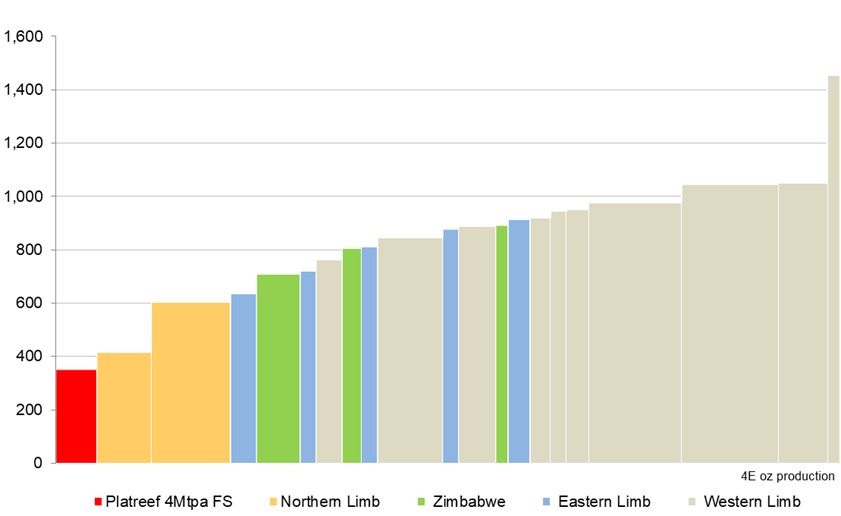

Figure 2: Net total cash cost + SIB capital (2017 mines in production and selected projects), US$/3PE + gold oz.

Source: SFA (Oxford). Data for Platreef Project and Waterberg are based on each project’s reported DFS and PFS parameters respectively, and are not representative of SFA's view.

Figure 3: Total 2017E global primary platinum-equivalent production.

Source: Production estimates for projects other than Ivanhoe’s Platreef Project have been prepared by SFA (Oxford). Production data for the Platreef Project (platinum, palladium, rhodium, gold, nickel and copper) is based on reported DFS and PEA data and is not representative of SFA's view. All metals have been converted by SFA (Oxford) to platinum equivalent ounces at price assumptions of US$1,076/oz platinum, US$761/oz palladium, US$1,235/oz gold, US$821/oz rhodium, US$5.07/lb nickel and US$2.42/lb copper. Note: As the figures are platinum-equivalent ounces of production they will not be equal to 3PE+Au production.

Proposed mining methods

Mining zones in the current Platreef mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface. Primary access to the mine will be by way of a 1,104-metre-deep, 10-metre-diameter production shaft (Shaft 2). Secondary access to the mine will be via a 980-metre-deep, 7.25-metre-diameter ventilation shaft (Shaft 1). During mine production, both shafts also will serve as ventilation intakes. Three additional ventilation exhaust raises (Ventilation Raise 1, 2, and 3) are planned to achieve steady-state production.

Mining will be performed using highly productive mechanized methods, including long-hole stoping and drift-and-fill. Each method will utilize cemented backfill for maximum ore extraction. The current mine plan has been improved over the 2015 PFS mine plan by optimizing stope design, employing a declining Net Smelter Return (NSR) strategy and targeting higher-grade zones early in the mine life. This strategy has increased the grade profile by 23% on a 3PE+Au basis in the first 10 years of operation and 10% over the life of the mine.

The ore will be hauled from the stopes to a series of internal ore passes and fed to the bottom of Shaft 2, where it will be crushed and hoisted to surface.

Future expansion options

Given the size and potential of the Platreef Resource, as demonstrated by the phased expansions outlined in the PEA, Shaft 2 has been engineered with a crushing and hoisting capacity of six Mtpa.

This allows for a relatively quick and capital-efficient first expansion of the Platreef Project to six Mtpa by increasing underground development and commissioning a third, two-Mtpa processing module and associated surface infrastructure as required.

A further expansion to more than eight Mtpa would entail converting Shaft 1 from a ventilation shaft into a hoisting shaft. This would require additional ventilation exhaust raises, as well as a further increase of underground development, commissioning of a fourth, two-Mtpa processing module and associated surface infrastructure, as described in the PEA as Phase 2 of the project.

Platreef Mine illustration of first-phase surface infrastructure and host communities.

Project financing and strategic discussions continuing

On July 19, 2017, Ivanhoe Mines announced the appointment of two leading mine-financing institutions, in addition to the three leading financial institutions appointed earlier this year, to arrange project financing for the development of the Platreef Project. The five Initial Mandated Lead Arrangers (IMLAs) will make best efforts to arrange a total debt financing of up to US$1 billion for the development of Platreef’s first-phase, four Mtpa mine. Preliminary expressions of interest now have been received for approximately US$900 million of the targeted US$1 billion financing. Negotiation of a term sheet is ongoing. In addition, preliminary discussions have commenced with leading financial institutions around the financing of the black economic empowerment partners’ contribution to the development capital.

The IMLAs appointed Export Development Canada (EDC) to direct the technical, environmental and social due diligence phase of the project. Chlumsky, Armbrust & Meyer LLC (CAM) and IBIS ESG South Africa Consulting Pty Ltd (IBIS) were appointed as Independent Technical Consultant (ITC) and Independent Social and Environmental Consultant (ISEC), respectively. Site visits were conducted during July and August 2017, with initial letter reports issued to the potential lenders. The final due diligence reports are expected by the end of this year.

Continuing strategic discussions concerning Ivanhoe Mines and its projects are ongoing with several significant mining companies and investors across Asia, Europe, Africa and elsewhere. Several investors that have expressed interest have no material limit on the provision of capital. There can be no assurance that the company will pursue any transaction or that a transaction, if pursued, will be completed.

Ivanhoe Mines indirectly owns 64% of the Platreef Project through its subsidiary, Ivanplats, and is directing all mine development work. The South African beneficiaries of the approved broad-based, black economic empowerment structure have a 26% stake in the Platreef Project. The remaining 10% is owned by a Japanese consortium of ITOCHU Corporation; Japan Oil, Gas and Metals National Corporation; and Japan Gas Corporation.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, a Qualified Person under the terms of National Instrument (NI) 43-101. Mr. Torr is not independent of Ivanhoe Mines. Mr. Torr has verified the technical data disclosed in this news release.

Detailed information about assay methods and data verification measures used to support the scientific and technical information, are set out in the Platreef 2017 Feasibility Study NI 43-101 Technical Report dated September 2017, available under Technical Reports at www.ivanhoemines.com and on Ivanhoe Mines' SEDAR profile at www.sedar.com.

About Ivanhoe Mines

Ivanhoe Mines is advancing its three principal projects in Southern Africa: 1) Mine development at the Platreef platinum-palladium-gold-nickel-copper discovery on the Northern Limb of South Africa’s Bushveld Complex; 2) mine development and exploration at the tier one Kamoa-Kakula copper discovery on the Central African Copperbelt in the Democratic Republic of Congo (DRC); and 3) upgrading at the historic, high-grade Kipushi zinc-copper-silver-germanium mine, also on the DRC’s Copperbelt. For details, visit www.ivanhoemines.com.

Note: Metres quoted in text are based on depth below shaft bank; metres in Figure 1 are quoted based on drill hole depth below surface.

Development work focused on initial production by 2022

The Platreef Project, which contains the Flatreef Deposit, is a Tier One discovery by Ivanhoe Mines’ geologists on the Northern Limb of South Africa’s Bushveld Igneous Complex, the world’s premier platinum producing region. Ivanhoe plans to develop the Platreef Mine in three phases: 1) An initial rate of four million tonnes per annum (Mtpa) to establish an operating platform to support future expansions; 2) a doubling of production to eight Mtpa; and 3) expansion to a steady-state 12 Mtpa.

On July 30, 2017, Ivanhoe issued an independent definitive feasibility study (DFS) for Platreef that covers the first phase of development that would include construction of a state-of-the-art underground mine, concentrator and other associated infrastructure to support initial production of concentrate by 2022. As Phase 1 is being developed and commissioned, there would be opportunities to refine the timing and scope of subsequent phases of expanded production.

Mr. Johansson said the July study’s results demonstrate Platreef’s robust economics, which first were highlighted in the March 2014 preliminary economic assessment and further reinforced by the January 2015 pre-feasibility study.

Mr. Johansson also noted that the project has shown significant improvement in safety and achieved a Lost Time Injury-Free (LTIF) record in the latest quarter. As of end of October 2017, the project had achieved 132 days without a lost-time-accident. Various initiatives have been implemented by Ivanplats and Aveng Mining to improve the safety culture on site.

Key features of the July 2017 Platreef DFS include:

- Indicated Mineral Resources totalling 346 million tonnes at a grade of 3.77 g/t 3 PE +gold, using a 2 g/t cut-off, contain an estimated 41.9 million ounces of platinum, palladium, rhodium and gold. An additional 52.8 million ounces of platinum, palladium, rhodium and gold are contained in Inferred Resources totalling 506 million tonnes at a grade of 3.24 g/t 3 PE +gold, using a 2 g/t cut-off.

- Enhanced Mineral Reserve totalling 124.7 million tonnes grading 4.40 g/t 3 PE +gold contain 17.6 million ounces of platinum, palladium, rhodium and gold – an increase of 13% compared to the 2015 pre-feasibility study – following stope optimization and mine sequencing work.

- Development of a large, safe, mechanized, underground mine with an initial four Mtpa concentrator and associated infrastructure.

- Planned initial average annual production rate of 476,000 ounces of platinum, palladium, rhodium and gold, plus 21 million pounds of nickel and 13 million pounds of copper.

- Estimated pre-production capital requirement of approximately US$1.5 billion, at a ZAR:USD exchange rate of 13 to 1.

- Platreef would rank at the bottom of the cash-cost curve, at an estimated US$351 per ounce of 3PE+Au produced, net of by-products and including sustaining capital costs, and US$326 per ounce before sustaining capital costs.

- After-tax Net Present Value (NPV) of US$916 million, at an 8% discount rate.

- After-tax Internal Rate of Return (IRR) of 14.2%. The actual return to project equity owners is expected to be higher as a result of the significant amount of project financing that is being raised.

Figure 2: Net total cash cost + SIB capital (2017 mines in production and selected projects), US$/3PE + gold oz.