- Ivanhoe Mines' reports Q2 2025 profit of $35 million and adjusted EBITDA of $123M, including $128M of attributable EBITDA from Kamoa-Kakula

- Kamoa-Kakula produced 112,009 tonnes of copper in Q2 2025, Phase 1 and 2 operating at 85% design capacity, Phase 3 concentrator operating 30% above design capacity

- Mining rates on the western side of Kakula improve; operations in line with revised 2025 production guidance

- Stage One dewatering of the Kakula Mine advances; Stage Two dewatering to commence imminently

- Kamoa-Kakula capex reviewed for dewatering and ramp-up plan; upper end of 2025 guidance range lowered

- Africa's largest and greenest copper smelter on schedule to commence start-up in September

- Recent rise in platinum and palladium prices improves Platreef NPV8% (10.7 Mtpa PEA) by over 20% to approx. $3.8 billion; first production on schedule for next quarter

- Kipushi operations achieved another record quarter; imminent completion of debottlenecking program to boost processing rates by 20%

- Ivanhoe Mines' balance sheet has $672 million in cash and cash equivalents on hand

- Democratic Republic of the Congo and AFC/M23 sign declaration of principles agreement in Qatar to end fighting in eastern DRC

Johannesburg, South Africa--(Newsfile Corp. - July 30, 2025) - Ivanhoe Mines' (TSX: IVN) (OTCQX: IVPAF) President and Chief Executive Officer, Marna Cloete, and Chief Financial Officer David van Heerden are pleased to announce the company's financial results for the second quarter of 2025, as well as an operations and project development update.

Ivanhoe Mines is a leading Canadian mining company with three principal tier-one mining operations in Southern Africa. The company is primarily focused on operations at the Kamoa-Kakula Copper Complex in the Democratic Republic of the Congo (DRC); ramping up production and debottlenecking the ultra-high-grade Kipushi zinc-copper-lead-germanium mine in the DRC; and soon, commencing the startup of the Platreef platinum, palladium, rhodium, nickel, gold, and copper mine in South Africa.

In addition, Ivanhoe Mines is expanding the Makoko District copper discovery in the Western Forelands, as well as exploring for new sedimentary-hosted copper discoveries across its expansive and highly prospective exploration licence packages across the DRC, Angola, Zambia, and Kazakhstan. All figures are in U.S. dollars unless otherwise stated.

Watch a video highlighting Ivanhoe Mines' second quarter financial results, as well as an operational update: https://vimeo.com/1105228328/945ffda895?share=copy

Founder and Co-Chairman Robert Friedland commented: "More important than the financial results of this second quarter are the milestones achieved beneath the surface at Kakula. Since resuming operations in early June, our underground teams have delivered remarkable outcomes, exceeding our expectations and demonstrating extraordinary dedication under challenging circumstances. Their efforts are driving steady, week-on-week improvements, as we work our way back towards full capacity. Guided by technical assessments and strategic leadership directives, this progress showcases robust momentum and a clear path forward.

"Equally commendable are our colleagues in China, whose exceptional coordination has been instrumental in sourcing, assembling, and shipping four high-capacity submersible pumps. These critical infrastructure components, set to begin operation in August, will expedite the dewatering efforts of Kakula. By the end of 2025, these pumps are expected to enable us access back into the mine's eastern high-grade zones.

"However, the most groundbreaking transformation is yet to come. With the Platreef Mine poised to begin production next quarter, this will be a new frontier for the global platinum group metals industry and South Africa. Platreef signifies the future of sustainable mining, combining large-scale operations, mechanization, cost efficiency, environmental stewardship, and an emphasis on social and community partnership. It is not merely a new mine but a redefinition of how platinum group metals, as well as nickel and copper, are produced responsibly. The dawn of the Platreef era is upon us, and the world is watching."

FINANCIAL HIGHLIGHTS

- Ivanhoe Mines' Q2 2025 adjusted EBITDA was $123 million, compared with $226 million for Q1 2025, which includes an attributable share of EBITDA from Kamoa-Kakula of $128 million. Ivanhoe Mines recorded a profit after tax of $35 million for Q2 2025, compared to $67 million for the same period in 2024 and $122 million in Q1 2025.

- Kamoa-Kakula sold 101,714 tonnes of copper (net of payability) during the second quarter at an average realized copper price of $4.34/lb., compared with 109,963 tonnes in Q1 2025 at an average realized copper price of $4.19/lb. Sales continued to lag production due to a build-up of inventory for the smelter, which is expected to start up in September. At the end of the second quarter, there were approximately 53,600 tonnes of unsold copper in inventory, up from approximately 48,000 tonnes at the end of Q1 2025.

- Kamoa-Kakula recognized revenue of $875 million, an operating profit of $190 million, and EBITDA of $325 million for the quarter, equivalent to an EBITDA margin of 37%. This compares with Q1 2025 EBITDA of $594 million.

- Kamoa-Kakula's cost of sales per pound (lb.) of payable copper sold was $2.85/lb. for the second quarter, compared with $1.87/lb. in Q1 2025. Cash cost (C1) per pound of payable copper produced in the quarter averaged $1.89/lb., compared with $1.69/lb. during Q1 2025. The costs of sales include abnormal costs while Phase 1 and Phase 2 concentrators were temporarily suspended after May 18, 2025.

- Kamoa-Kakula revised its 2025 cash cost (C1) guidance range to $1.90/lb. - $2.20/lb., from previously $1.65/lb. - $1.85/lb. of payable copper produced. Kamoa-Kakula is anticipating higher cash costs during the second half of 2025, which is primarily due to the processing of lower-grade ore. Additionally, the financial benefits of operating the smelter are unlikely to have a significant positive impact until ramp-up is advanced towards the end of the year.

- In June, Kamoa Copper signed an offtake agreement with Trafigura Asia Trading Pte Ltd for the remaining 20% of the smelter's annual anode production. The agreement is over a three-year term and also includes a $200 million offtake-linked advance payment facility. The facility has an interest rate of the 1-month Secured Overnight Financing Rate (SOFR) plus 3.75%. Offtake agreements for the other 80% of anode production were signed in Q1 with CITIC Metal (HK) Limited and Gold Mountains International Mining Company Limited, a subsidiary of Zijin Mining. CITIC Metal and Gold Mountains also provided advance payment facilities totaling $500 million.

- 2025 capital expenditure guidance for Kamoa-Kakula has been comprehensively reviewed with respect to the ongoing dewatering and ramp-up plan. The lower end of guidance is maintained at $1,420 million with the upper end lowered to $1,600 million from $1,670 million. Discretionary Phase 3 optimization expenditure in the original 2025 budget is deferred to 2026, partially offset by increased sustaining costs associated with the rehabilitation and dewatering of Kakula and the ramp-up of Kamoa.

- Despite operational challenges during the second quarter, the Kamoa-Kakula joint venture returned a positive net cash flow of $169 million.

- Kipushi sold 43,348 tonnes of zinc (net of payability) during the quarter, up by almost 45% from the 30,108 tonnes of zinc sold in Q1 2025. Kipushi recognized a quarterly revenue of $97 million, a segmented loss of $6 million and EBITDA of $9 million. Kipushi's cost of sales per pound of payable zinc sold was $1.05/lb. and the cash cost (C1) per pound of payable zinc sold totaled $0.96/lb.

- Kipushi Mine's cash costs (C1) for the first half of 2025 are just below the mid-point of guidance at $0.94/lb. of payable zinc. Ivanhoe Mines maintains Kipushi's 2025 cash cost (C1) guidance of $0.90/lb. to $1.00/lb. of payable zinc.

- Platreef capital expenditure is tracking at the lower end of 2025 guidance, with the Phase 1 project nearing completion. Negotiations are progressing well for a $700 million Phase 2 senior project finance facility, which is expected to close in Q1 2026.

- Ivanhoe Mines has a strong balance sheet with cash and cash equivalents on hand of $672 million and attributable group pro-rata cash and cash equivalents of $774 million on hand, as at June 30, 2025.

OPERATIONAL HIGHLIGHTS

- During the second quarter, Kamoa-Kakula's Phase 1, 2, and 3 concentrators milled 3.62 million tonnes of ore, producing 112,009 tonnes of copper, representing an 11% increase when compared with the same period in 2024. This included a monthly record of approximately 50,000 tonnes of copper in April, prior to the occurrence of seismic activity in May 2025. Copper production for the first half of 2025 totaled 245,127 tonnes.

- Quarterly copper production was significantly impacted by seismic activity on the eastern side of the Kakula Mine, as reported on May 20, 2025. This resulted in the suspension of underground mining activities at the Kakula Mine. Mining recommenced on the western side of the Kakula Mine on June 7, 2025. Kamoa-Kakula's 2025 production guidance was revised to between 370,000 and 420,000 tonnes of copper.

- The Phase 1 and 2 concentrators commenced the processing of ore from the western side of the Kakula Mine on June 8, 2025. For the remainder of the year, the Phase 1 and 2 concentrators are expected to operate at between 80% and 85% of plant capacity, targeting 50% of ore feed from surface stockpiles and 50% from ore mined from the western side of Kakula. The processing of surface stockpiles is expected to continue until they are depleted in Q1 2026.

- The Phase 3 concentrator milled a record 1.6 million tonnes of ore in the second quarter, producing a record 40,608 tonnes of copper. The milling record is equivalent to an annualized rate of 6.5 million tonnes, which is 30% higher than the Phase 3 concentrator's design capacity of 5.0 million tonnes per annum. The average quarterly feed grade for the Phase 3 concentrator was a record 2.92% copper.

- Stage One dewatering continues as planned, with water levels modestly decreasing. The delivery of the four Stage Two, submersible, high-capacity dewatering pumps has recently commenced with the first of three cargo flights arriving in Lubumbashi. Stage Two dewatering is on schedule to start in August.

- Ivanhoe Mines is targeting to provide in September 2025 an update on Kamoa-Kakula's recovery plan and ramp-up to steady-state operations over the medium term. Work has also commenced on an updated life-of-mine integrated development plan, which is targeted for completion in the first quarter of 2026.

- Kamoa-Kakula's 500,000-tonne-per-annum on-site, direct-to-blister copper smelter, the largest in Africa, is expected to commence start up in September. All concentrates produced by Phase 1, 2, and 3 concentrators are expected to be treated by the on-site smelter.

- Site clearance and early earthworks for Kamoa-Kakula's 60-megawatt (MW), on-site solar (PV) facility with battery storage have commenced. The solar facility is expected to be operational in mid-2026, supplying up to 25% of Kakula's energy requirements.

- Mechanical and electrical equipment installation for the refurbished Turbine #5 at the Inga II hydroelectric facility is now completed. Pre-commissioning activities have already commenced and are expected to be completed early in the fourth quarter.

- At Kipushi, during Q2 2025, the concentrator milled a record 153,342 tonnes of ore at a record average grade of 33.4% zinc, producing a near-record 41,788 tonnes of zinc in concentrate at a contained grade of over 51% zinc.

- The first phase of Kipushi's debottlenecking program was completed in June with the second phase on schedule to be completed in the coming weeks, requiring a shutdown to tie in the newly installed equipment. In mid-July following completion of the first phase, Kipushi achieved a daily production record equivalent to 327,000 tonnes of zinc in concentrate on an annualized basis, and a weekly production record equivalent to 289,000 tonnes of zinc in concentrate on an annualized basis.

- Kipushi produced 84,524 tonnes of zinc during H1 2025. The production rate in H2 2025 is expected to significantly improve following improved availability of the dense media separation (DMS) circuit and the imminent completion of the debottlenecking program. Kipushi's 2025 production guidance is maintained at 180,000 to 240,000 tonnes of zinc in concentrate.

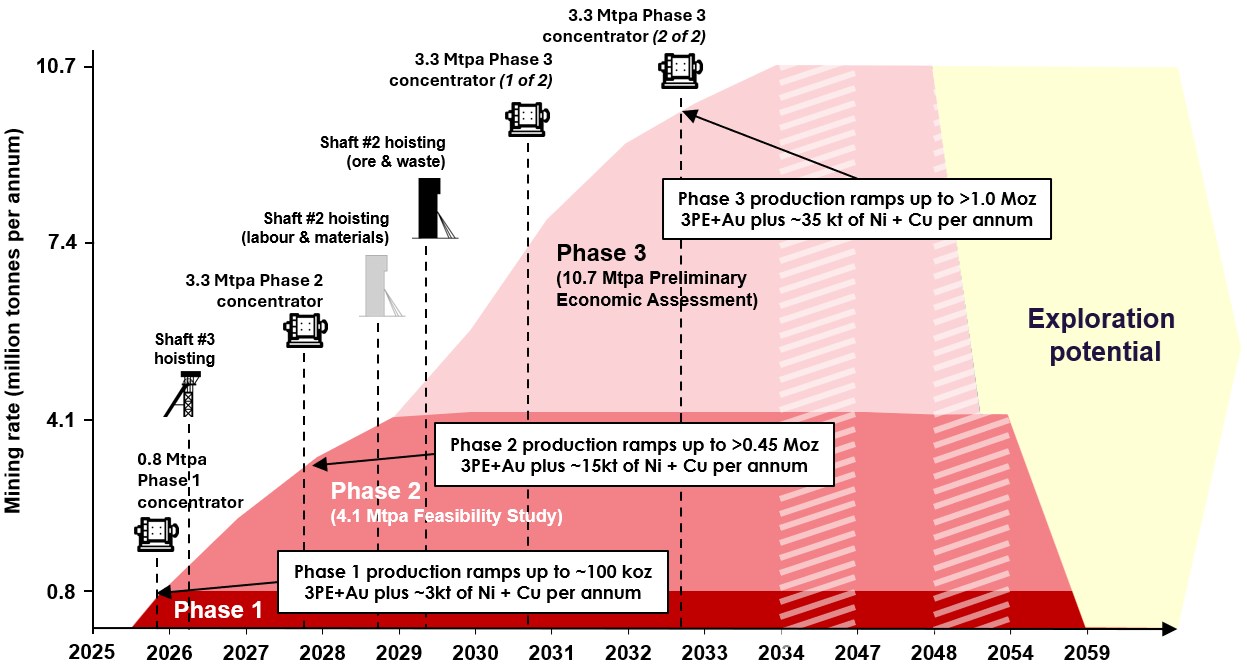

- At Platreef, the first feed of ore into the Phase 1 concentrator is on schedule to take place in Q4 2025. Phase 1 is the first step of a three-phase expansion plan, which aims to make the Platreef Mine one of the world's largest producers of platinum, palladium, rhodium, and gold, with significant copper and nickel credits.

- Phase 2 expansion activities are underway and on track for first production in Q4 2027. Platreef's Phase 2 expansion is expected to produce over 460,000 ounces of platinum, palladium, rhodium, and gold per annum, plus approximately 9,000 tonnes of nickel and 6,000 tonnes of copper.

- The Platreef Mine is projected to be the lowest-cost primary platinum-group-metals producer globally. The Phase 2 life-of-mine total cash cost is estimated to be $599 per ounce of 3PE+Au, net of nickel and copper by-product credits. This compares very favourably with a basket spot price of approximately $1,600 per ounce of 3PE+Au, as at July 29, 2025.

- On May 8, 2025, mining crews at the Platreef Mine started underground development into the high-grade polymetallic Flatreef orebody for the first time, as the mine rapidly advances to commercial production later this year. This significant milestone comes 15 years after the discovery of the 26-metre thick, flat-lying Flatreef orebody was made. Development ore is being stockpiled on the surface and will be used in the ramp-up of the Phase 1 concentrator. The Ivanplats team aims to accumulate a stockpile of approximately 60,000 tonnes of development ore ahead of the first feed of ore into the Phase 1 concentrator.

- Equipping of Shaft #3 is progressing well. Installation of the rock winder has commenced, with the mechanical and electrical work nearing completion. Shaft #3 is expected to be "ready to hoist" from Q1 2026 with a capacity of approximately 4 million tonnes per annum.

- In the Western Forelands, Ivanhoe continues exploration across its vast licence area, adjacent to Kamoa-Kakula. Drilling activity increased as the wet season ended in late April, with the deployment of four more rigs. In total, nine contractor-operated diamond drill rigs were active during the quarter, which completed a total of 14,843 meters of drilling.

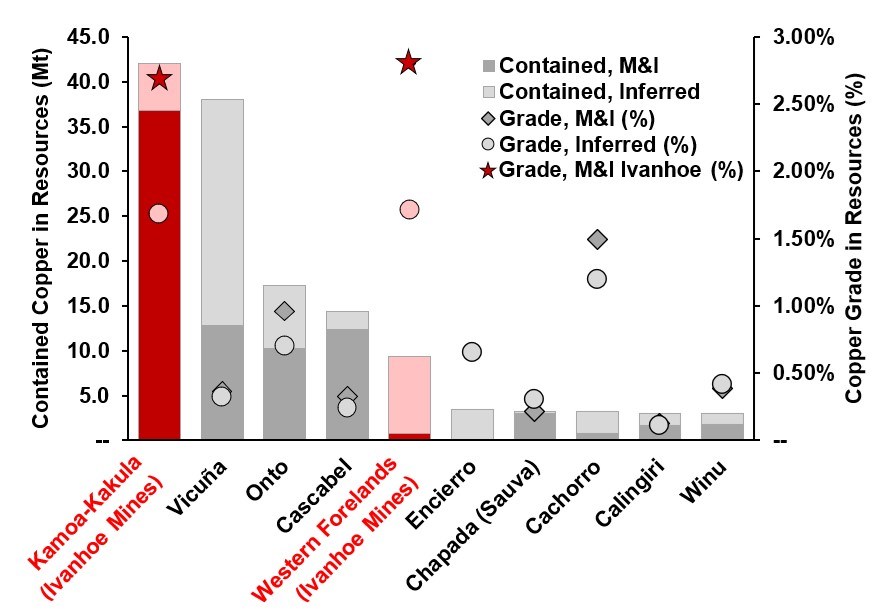

- On May 14, 2025, Ivanhoe announced its independently verified, updated Mineral Resource estimate for the Makoko District in the Western Forelands. The total copper contained in the Makoko District has approximately doubled in the past 18 months, during which 86,000 metres of diamond drilling were completed. The Makoko District ranks as the world's fifth-largest copper discovery since Kakula in 2015.

- In Kazakhstan, drilling commenced in July on Ivanhoe's joint venture licences. Two rigs have been deployed for the 17,500-metre maiden diamond drilling program. In addition, over 95% of the planned 16,911 km² in licences have now been fully granted. Concurrent with the drilling program, extensive geophysical and geochemical programs are underway across the licence package.

- On July 19, 2025, representatives from the DRC and the Congo River Alliance/March 23 Movement (AFC/M23) signed a declaration of principles in Doha, Qatar. The declaration is intended as a roadmap towards a permanent settlement. Both parties agree to implement the terms of the deal by July 29, 2025. In addition, a final peace deal is expected to be agreed by August 18, 2025, and must align with last month's US-brokered Peace Agreement signed on June 27, 2025, between the DRC and Rwanda.

Africa's largest and greenest copper smelter at Kamoa-Kakula is expected to commence start-up in September.

Africa's largest and greenest copper smelter at Kamoa-Kakula is expected to commence start-up in September.

This press release includes "EBITDA", "Adjusted EBITDA", "EBITDA margin", "Pro-rata cash and cash equivalents" and "Cash cost (C1)", which are non-GAAP financial performance measures. For a detailed description of each of the non-GAAP financial performance measures used herein and a detailed reconciliation to the most directly comparable measure under IFRS Accounting Standards, please refer to the non-GAAP Financial Performance Measures and Pro-Rata Financial Ratios sections of the company's MD&A for the three and six months ended June 30, 2025.

Conference call for investors on Thursday, July 31, 2025

Ivanhoe Mines will hold an investor conference call to discuss the results on Thursday, July 31, 2025, at 10:30 a.m. Eastern time / 7:30 a.m. Pacific time. The conference call will conclude with a question-and-answer (Q&A) session. Media are invited to attend on a listen-only basis.

To view the webcast, use the link: https://meetings.400.lumiconnect.com/r/participant/live-meeting/400-061-613-503

Audience Phone Number:

Local - Toronto (+1) 289 514 5005

Toll Free - North America (+1) 800 206 4400

An audio webcast recording of the conference call, together with supporting presentation slides, will be available on Ivanhoe Mines' website at www.ivanhoemines.com.

After issuance, the condensed consolidated interim financial statements and Management's Discussion and Analysis will be available at www.ivanhoemines.com and www.sedarplus.ca.

Read Ivanhoe's Q2 2025 Sustainability Review

During the second quarter of 2025, the group achieved a combined Lost Time Injury Frequency Rate (LTIFR) of 0.34 and a Total Recordable Injury Frequency Rate (TRIFR) of 1.06 per 1,000,000 hours worked. A breakdown of Ivanhoe's industry-leading health and safety performance can be found in the Q2 2025 Sustainability Review, on the company's website: https://www.ivanhoemines.com/investors/document-library/#sustainability

Principal projects and review of activities

1. Kamoa-Kakula Copper Complex

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Copper Complex is operated as the Kamoa Holding joint venture between Ivanhoe Mines and Zijin Mining. The complex covers a licence area of 400 square kilometres and is approximately 25 kilometres southwest of the town of Kolwezi on the far western edge of the Central African Copperbelt.

Copper production at Kamoa-Kakula commenced in May 2021, following the completion of the Phase 1 concentrator. Since, the Phase 2 and Phase 3 mine and concentrator expansions have been completed, as well as the construction of a 500,000 tonne per annum direct-to-blister copper smelter. A production record was achieved in April 2025, with 50,000 tonnes of copper in concentrate produced during the month, exceeding the target annualized production capacity of 600,000 tonnes. Production since May 18, 2025, has been impacted by the seismic activity and subsequent flooding on the eastern side of the Kakula Mine, which has resulted in production rates being curtailed. Dewatering and rehabilitation work are underway with the target to increase production from underground to meet Phase 1 and 2 concentrator capacity. The Phase 3 concentrator, supplied by the Kamoa mines, continues uninterrupted.

Ivanhoe sold a 49.5% share interest in Kamoa Holding Limited (Kamoa Holding) to Zijin Mining and a 1% share interest in Kamoa Holding to privately owned Crystal River in December 2015. Kamoa Holding holds an 80% interest in the project, and the DRC government holds the remaining 20% interest. Ivanhoe and Zijin Mining, therefore, each hold an indirect 39.6% interest in Kamoa-Kakula, with Crystal River holding an indirect 0.8% interest. Kamoa-Kakula's full-time employee workforce is over 7,300, and approximately 90% are Congolese.

| Kamoa-Kakula summary of operating and financial data | ||||||

| Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 | ||

| Ore tonnes milled (000's tonnes) | 3,622 | 3,723 | 3,655 | 3,266 | 2,381 | |

| Copper ore grade processed (%) | 3.58% | 4.10% | 4.26% | 4.14% | 4.91% | |

| Copper recovery (%) | 85.4% | 87.4% | 86.6% | 85.3% | 86.7% | |

| Copper in concentrate produced (tonnes) |

112,009 | 133,120 | 133,819 | 116,313 | 100,812 | |

| Payable copper sold (tonnes)(1) | 101,714 | 109,963 | 112,811 | 103,106 | 95,900 | |

| Cost of sales per pound ($ per lb.) | 2.85 | 1.87 | 1.94 | 1.80 | 1.53 | |

| Cash cost (C1) ($ per lb.) | 1.89 | 1.69 | 1.75 | 1.69 | 1.52 | |

| Realized copper price ($ per lb.) | 4.34 | 4.19 | 4.08 | 4.16 | 4.34 | |

| Sales revenue before remeasurement ($'000) |

868,846 | 922,411 | 895,758 | 836,871 | 813,817 | |

| Remeasurement of contract receivables ($'000) | 6,443 | 50,986 | (52,428) | (8,983) | 3,256 | |

| Sales revenue after remeasurement ($'000) |

875,289 | 973,397 | 843,330 | 827,888 | 817,073 | |

| EBITDA ($'000) | 325,181 | 594,337 | 431,802 | 469,735 | 547,257 | |

| EBITDA margin (% of sales revenue) | 37% | 61% | 51% | 57% | 67% | |

All figures in the above tables are on a 100%-project basis. Metal reported in concentrate is before refining losses or deductions associated with smelter terms. This press release includes "EBITDA", "Adjusted EBITDA", "EBITDA margin", "Pro-rata cash and cash equivalents" and "Cash cost (C1)", which are non-GAAP financial performance measures. For a detailed description of each of the non-GAAP financial performance measures used herein and a detailed reconciliation to the most directly comparable measure under IFRS Accounting Standards, please refer to the non-GAAP Financial Performance Measures and Pro-Rata Financial Ratios sections of the company's MD&A for the three and six months ended June 30, 2025.

(1) Payable copper sold is net of the payability factor of circa 97%. Copper in concentrate produced net of the payability factor is noted in the non-GAAP Financial Performance Measures section of the company's MD&A for the three and six months ended June 30, 2025.

C1 cash cost per pound of payable copper produced can be further broken down as follows:

| Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 | ||||||||

| Mining | ($ per lb.) | 0.73 | 0.63 | 0.61 | 0.62 | 0.45 | ||||||

| Processing | ($ per lb.) | 0.34 | 0.29 | 0.30 | 0.26 | 0.21 | ||||||

| Logistics charges | ($ per lb.) | 0.49 | 0.41 | 0.40 | 0.42 | 0.48 | ||||||

| TC, RC, smelter charges | ($ per lb.) | 0.14 | 0.19 | 0.27 | 0.26 | 0.25 | ||||||

| General & Administrative | ($ per lb.) | 0.19 | 0.17 | 0.17 | 0.13 | 0.13 | ||||||

| Cash cost (C1) per pound of payable copper produced | ($ per lb.) | 1.89 | 1.69 | 1.75 | 1.69 | 1.52 |

The cost of power, which is allocated between mining and processing in the above cash cost split, can be split out as follows:

| Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 | |||||||

| Power costs included in Mining and Processing cost |

($ per lb.) | 0.20 | 0.24 | 0.22 | 0.19 | 0.12 | |||||

| Power costs as a proportion of cash cost (C1) per pound of payable copper produced |

(%) | 10.6% | 14.2% | 12.6% | 11.2% | 7.9% |

Cash cost (C1) is prepared on a basis consistent with the industry standard definitions by Wood Mackenzie cost guidelines, but is not a measure recognized under IFRS Accounting Standards. In calculating the C1 cash cost, the costs are measured on the same basis as the company's share of profit from the Kamoa Holding joint venture which is contained in the financial statements. C1 cash cost is used by management to evaluate operating performance and includes all direct mining, processing, and general and administrative costs. Smelter charges and freight deductions on sales to the final port of destination, which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of delivered, finished metal. C1 cash cost excludes royalties, production taxes, and non-routine charges as they are not direct production costs.

All figures are on a 100% project basis, and metal reported in concentrate is before refining losses or deductions associated with smelter terms.

Kamoa-Kakula produced 112,009 tonnes of copper in Q2 2025, following disruption from seismic activity in mid-May; rehabilitation plans advancing on track

During the second quarter of 2025, the Phase 1, 2, and 3 concentrators milled 3.62 million tonnes of ore, producing 112,009 tonnes of copper, representing an 11% increase when compared with the same period in 2024. Copper production for the first half of 2025 totaled 245,127 tonnes. Quarterly performance was impacted by the seismic activity on the eastern side of the Kakula Mine as reported on May 20, 2025, which resulted in the suspension of underground mining activities at the Kakula Mine until June 7, 2025.

In June, Kamoa-Kakula's Phase 1, 2, and 3 concentrators produced a total of 28,147 tonnes of copper. During the month, approximately 15,000 tonnes of copper were produced by the Phase 1 and 2 concentrators, at an average grade of 3.3% copper and an average recovery rate of 79%. The lower-than-average recovery rate is primarily due to lower recoveries achieved from processing lower-grade ore from surface stockpiles.

Underground development to a new mining area, located on the far eastern side of the Kakula Mine, commenced in early July. The development of the two new access drives will be conducted from existing underground infrastructure.

| Kamoa-Kakula summary of quarterly production data: | ||||||||

| Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 | ||||

| Phase 1 & 2 | ||||||||

| Ore tonnes milled (000's tonnes) | 1,991* | 2,211 | 2,329 | 2,215 | 2,288 | |||

| Copper ore grade processed (%) | 4.12%* | 5.01% | 5.08% | 4.86% | 5.04% | |||

| Copper recovery (%) | 85.4%* | 88.3% | 87.0% | 86.6% | 87.0% | |||

| Copper in concentrate produced (tonnes) | 71,401* | 97,575 | 102,042 | 94,214 | 99,706 | |||

| Phase 3 | ||||||||

| Ore tonnes milled (000's tonnes) | 1,631 | 1,512 | 1,326 | 1,050 | 93 | |||

| Copper ore grade processed (%) | 2.92% | 2.76% | 2.82% | 2.64% | 1.67% | |||

| Copper recovery (%) | 85.5% | 85.1% | 85.1% | 79.9% | 83.3% | |||

| Copper in concentrate produced (tonnes) | 40,608 | 35,545 | 31,777 | 22,099 | 1,106 | |||

| Combined Phase 1, 2, and 3 | ||||||||

| Ore tonnes milled (000's tonnes) | 3,622 | 3,723 | 3,655 | 3,266 | 2,381 | |||

| Copper ore grade processed (%) | 3.58% | 4.10% | 4.26% | 4.14% | 4.91% | |||

| Copper recovery (%) | 85.4% | 87.4% | 86.6% | 85.3% | 86.7% | |||

| Copper in concentrate produced (tonnes) | 112,009 | 133,120 | 133,819 | 116,313 | 100,812 | |||

Data in bold denotes a quarterly record.

*As announced on May 20, 2025, Phase 1 & 2 production in Q2 2025 was impacted by seismic activity at the Kakula Mine

As revised on June 11, 2025, Kamoa-Kakula's annual production guidance of 370,000 to 420,000 tonnes of copper is maintained.

As at June 30, 2025, Kamoa-Kakula's useable ore surface stockpiles totaled approximately 3.0 million tonnes at an estimated blended average grade of 2.49% copper. Contained copper in the stockpiles at the end of June totaled approximately 76,555 tonnes. At current run rates, surface stockpiles are expected to provide mill feed to the Phase 1 and Phase 2 concentrators until Q1 2026.

Phase 1 and 2 concentrators to operate at between 80% and 85% of design capacity, with approximately 50% of feed coming from the western side of the Kakula Mine

The Phase 1 and 2 concentrators commenced the processing of ore from the western side of the Kakula Mine on June 8, 2025. Kamoa-Kakula's management is targeting that for the remainder of the year, the Phase 1 and 2 concentrators will operate at between 80% and 85% of plant capacity. The ore feed is targeted to be 50% from surface stockpiles and 50% from ore mined from the western side of Kakula. The processing of surface stockpiles is expected to continue until they are depleted in Q1 2026.

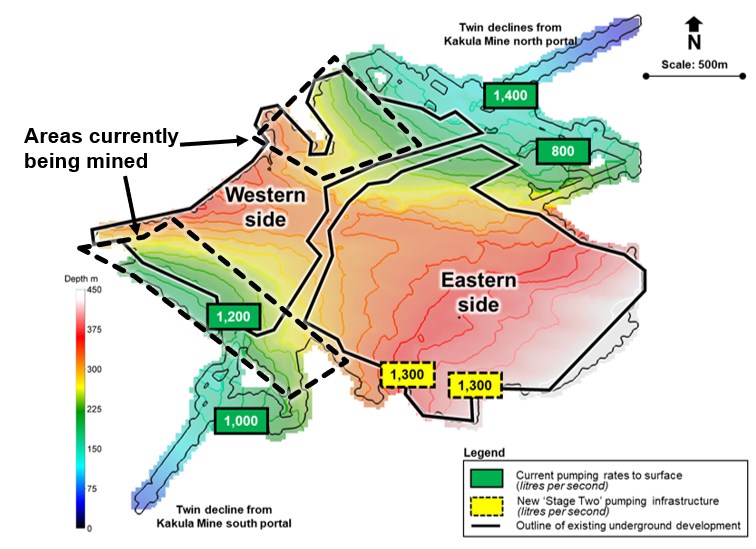

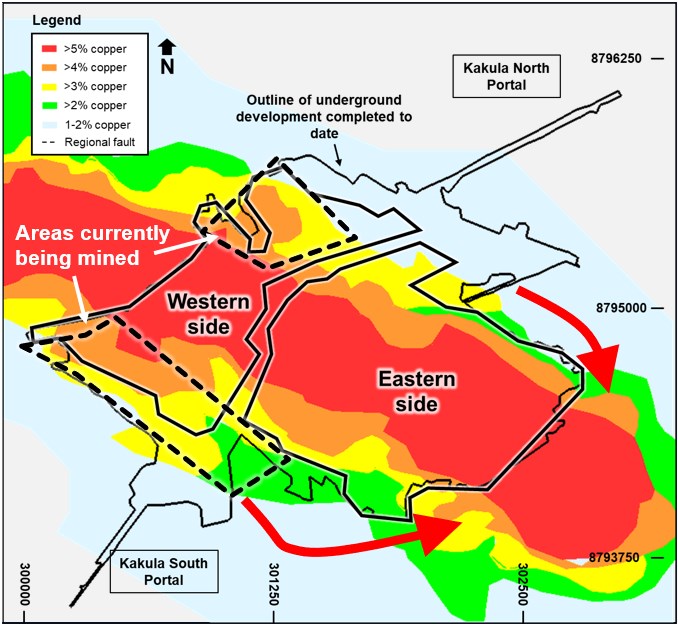

As announced on June 11, 2025, mining on the western side of the Kakula Mine restarted. By mid-June, the mining rate had ramped up to 300,000 tonnes per month (3.6 million tonnes on an annualized basis), with grades ranging from 3% to 4% copper. As previously guided, mining in the western side of the Kakula Mine will initially focus on higher-elevation areas in the north and southwest, as shown in Figure 1 and Figure 2, where copper grades range between 3% and 4%. Mining of these areas will continue into the fourth quarter until Stage Two dewatering of the eastern side of the Kakula Mine is well advanced. From late 2025, mining crews plan to advance deeper into the western side of the Kakula Mine, where copper grades are expected to increase to approximately 5%.

The Phase 3 concentrator milled a record 1.6 million tonnes of ore in the second quarter, producing a record 40,608 tonnes of copper. The milling record is equivalent to an annualized rate of 6.5 million tonnes, which is 30% higher than the Phase 3 concentrator's design capacity of 5.0 million tonnes per annum. The average quarterly feed grade for the Phase 3 concentrator was a record 2.92% copper. For the remainder of 2025, it is expected that the feed grade into the Phase 3 concentrator will average approximately 2.5% copper, as the cut-off grade is lowered to achieve a greater mining rate. Currently, all ore mined at the Kamoa and Kansoko mines is processed by the Phase 3 concentrator.

During the second half of 2025, the combined mining rate from the Kamoa and Kansoko mines will increase, with up to 100,000 tonnes per month of this ore fed into the Phase 1 and 2 concentrators, replacing a portion of the stockpile feed.

Stage One dewatering continues as planned; shipping of Stage Two dewatering pumps has started and expected to arrive

As announced on June 2, 2025, following the seismic activity, Kamoa-Kakula has implemented a two-stage plan to dewater the eastern side of the Kakula Mine. "Stage One" dewatering activities, which involved the installation of temporary underground pumping infrastructure to stabilize and maintain current water levels, have been in place and operating to plan since early June 2025. This has enabled the water levels on the eastern side of the Kakula Mine to decrease modestly, ahead of "Stage Two" dewatering activities that are expected to commence in the coming weeks. In the meantime, the declining water levels have enabled mining crews to access additional areas and commence selective rehabilitation.

"Stage Two" dewatering involves the installation of high-capacity, submersible pumps and new permanent surface infrastructure to fully dewater the eastern side of the Kakula Mine from surface. Kamoa Copper has ordered five high-capacity, submersible pumps, each rated with pumping capacity of 650 litres per second, from Hefei Hengda Jianghai Pump Co., Ltd. of Anhui Province, China.

The transportation of four, out of the five, high-capacity, submersible pumps has commenced. The first of three cargo flights departed China on July 24, 2025, landing into Lubumbashi, DRC, the following day. The first equipment package has since arrived on site at Kamoa-Kakula. Two further cargo flights, carrying the remaining pumping equipment, are scheduled to land in Lubumbashi within the coming days. The remaining, fifth, pump will shipped at a later date and kept in reserve as a spare.

Concurrently, site preparation activities are advancing well. The high-capacity, submersible pumps will be installed in pairs down two adjacent shafts that access a deep section of the eastern side of the Kakula Mine, as shown in Figure 1. The pumps will be connected to piping and lowered down the existing shafts from the surface. Discharged water from the submersible pumps will be fed into existing surface water channels that feed into on-site settling and treatment ponds.

The total capital cost of the Stage One and Stage Two dewatering activities, including the purchase, transport, and installation of the high-capacity, submersible dewatering pumps, is expected to be up to $70 million, including contingency.

Kayembe Mundula Jean, Fitter and Baba Franck, General worker operating one of the nine temporary 'Stage One' dewatering pumps underground at Kakula, which in total are pumping to surface approximately 3,700 litres per second.

Mining Superintendents, Werner Basson and Tony Kongolo, are inspecting the recently installed rehab support underground at Kakula.

Site preparation for the Stage Two dewatering infrastructure is advancing well. Delivery of the submersible, high-capacity pumps has commenced, with pumping expected to commence next month.

On Thursday, July 24, 2025, the first of three flights departed China, carrying the Stage Two dewatering pumping equipment. The flight landed in Lubumbashi, DRC, the following day and the cargo has since arrived on site. The remaining two flights are expected to arrive in Lubumbashi within the coming days.

Figure 1. An illustration of the Kakula Mine's existing underground infrastructure as of July 2025, showing the depth profile of the western and eastern sections and existing Stage One vertical pumping locations (in green) and the new Stage Two vertical pumping locations (in yellow). The areas currently being mined are also highlighted.

Development to the new mining area on the far eastern side of the Kakula Mine has commenced

A new mining area, located on the far eastern side of the Kakula Mine, as indicated by the red arrows in Figure 2, will be initially accessed via two new access drives. The mining crews commenced construction of the access drives in early July.

Development of the new mining area is expected to be initially conducted in waste before entering ore from early 2026. Mining of the area is expected to commence in Q2 2026.

The new access drives will be developed simultaneously, advancing east from existing underground infrastructure. The new mining area will not require new mine access from the surface. The area will be accessed from existing underground infrastructure that is not affected by the ongoing dewatering activities.

Figure 2. An illustration of the Kakula Mine's existing underground infrastructure, showing the areas on the western side of the mine currently being mined, the copper grade profile, as well as the location of the two access drives (red arrows) to the new far eastern mining area.

Notes: Existing underground development as at July 2025. Illustration is based on the 2023 Kamoa-Kakula IDP showing the estimated average grade of each vertical stack of blocks above a 2% total copper cut-off. A minimum 6-metre thickness is applied.

Smelter heat-up on schedule for start-up in September

The heat-up of Kamoa-Kakula's state-of-the-art, 500,000-tonne-per-annum direct-to-blister copper smelter is expected to commence in September 2025. The smelter can operate at a minimum operating capacity of 50%, or approximately 250,000 tonnes of copper on an annualized basis. Kamoa-Kakula's management team expects to prioritize the processing of all concentrates produced by the Phase 1, 2, and 3 concentrators through the on-site smelter, with any excess concentrate toll-treated at the nearby Lualaba Copper Smelter.

At the end of June, Kamoa-Kakula held approximately 53,600 tonnes of unsold copper in concentrate, compared to approximately 48,000 tonnes at the end of Q1 2025. Of the 53,600 tonnes of unsold copper in concentrate, approximately 31,500 tonnes are located at Kamoa-Kakula's on-site copper smelter. Kamoa-Kakula expects to hold at the smelter up to 35,000 tonnes of copper in stockpiles at the end of the third quarter as a buffer during ramp-up. Total unsold copper in concentrate at the smelter, held in stockpiles and the smelting circuit, is expected to reduce to approximately 17,000 tonnes as the smelter reaches full ramp-up.

Approximately 18,500 tonnes of the remaining unsold copper at the end of the second quarter were stored at the nearby Lualaba Copper Smelter (LCS) awaiting toll treatment. The stored copper in concentrate at LCS is expected to be treated throughout the remainder of 2025.

Kamoa-Kakula's on-site copper smelter, with the concentrate blending facility in the foreground. A buffer stockpile of up to 35,000 tonnes of copper in concentrate is being accumulated on-site in anticipation of the smelter start-up in September.

Kamoa-Kakula's Project 95 is approximately 55% complete, with completion expected in Q2 2026

Kamoa-Kakula's Project 95 is advancing well at 55% complete with completion now expected in early Q2 2026. The "Project 95" initiative for Kamoa-Kakula's Phase 1 and 2 concentrators aims to increase the overall recovery rate to 95%, up from the design recovery rate of 87%, based on a high-grade feed of 5% copper.

During the interim period, while the Kakula Mine is undergoing turnaround, a portion of the ore feed to the Phase 1 and 2 concentrators, sourced from both the Kakula and Kamoa mines, will be of lower grade. Kamoa-Kakula's engineering team aims to maintain a recovery rate from the lower-grade sources of at least 90%.

Project 95 construction works are advancing well, with completion expected in early Q2 2026. The foreground shows the civil works for the new thickeners, with the adjacent Phase 1 and 2 concentrator storage shed in the background, and the on-site copper smelter further behind.

Final offtake agreement signed for copper anode production from Kamoa-Kakula's on-site smelter; offtake-linked advance payment facility of $200 million also signed

In June, an agreement for the remaining 20% of the smelter's anode offtake was signed over a three-year term with Trafigura Asia Trading Pte Ltd. The offtake agreement with Trafigura also included a $200 million offtake-linked advance payment facility. The facility has an interest rate of the 1-month SOFR plus 3.75%.

As previously announced on January 8, 2025, CITIC Metal Limited and Gold Mountains International Mining Company Limited, a subsidiary of Zijin Mining, signed offtake agreements with Kamoa Copper for a combined 80% of the copper anode production from the Kamoa-Kakula smelter. The CITIC Metal and Gold Mountains anode offtake agreements also included offtake-linked advance payment facilities totalling $500 million. This facility was in addition to a $300 million Phase 3 concentrate offtake-linked advanced payment facility signed with both offtakers in 2024.

Also in June, Kamoa Copper's existing $200 million loan facility with Standard Bank has been extended for a further 12 months on favourable terms. The funding arrangements will provide balance sheet flexibility in supporting the ongoing turnaround of the Kakula Mine.

Site clearance and early earthworks for Kamoa-Kakula's 60-megawatt, on-site solar (PV) facility with battery storage have commenced

During late March and early April 2025, Kamoa Copper signed power purchase agreements (PPA) with CrossBoundary Energy DRC of Nairobi, Kenya, and La Societe Green World Energie SARL of Beijing, China, to provide up to 60 MW in baseload clean energy to Kamoa-Kakula's operations from an on-site solar facility. The facilities, which will be owned, operated, and funded by CrossBoundary Energy and Green World Energie, will comprise a total peak of 406 MW of solar photovoltaic (PV) capacity, with up to 1,107 megawatt hours (MWh) of battery energy storage (BESS) capacity. Kamoa Copper will be the sole off-taker of the electricity produced by both facilities.

Kamoa-Kakula plans to expand the on-site solar facilities further over time, targeting a capacity of up to 120 MW.

Early construction works commenced in the second quarter with geotechnical surveying of the site, site clearing, and the ordering of long-lead items, including the BESS, E-house, and mounting structures. Construction completion is expected in mid-2026.

Map of Kamoa-Kakula's licence package, showing the existing powerlines (in blue) and the site of the on-site 60 MW solar PV power plant, battery storage, and substation (in red). The facility is scheduled for completion in mid-2026 and aims to supply up to 25% of Kamoa-Kakula's energy requirements.

Refurbishment of Inga II Hydroelectric facility nearing completion; mechanical installation complete and commissioning underway

Mechanical and electrical equipment installation for the refurbished Turbine #5 at the Inga II hydroelectric facility is now completed. Pre-commissioning activities have already commenced and are expected to be completed early in the fourth quarter. In addition, the replacement of the resistor banks at the Inga substation was completed during the quarter. The new resistors are expected to improve voltage stability and reliability of the network supply of electricity from the Inga hydroelectric facilities.

COPPER PRODUCTION, CAPITAL EXPENDITURE AND CASH COST GUIDANCE FOR 2025

| Kamoa-Kakula 2025 Guidance | Previous | Revised | |

| Cash cost (C1) ($ per pound of payable copper produced) | 1.65 – 1.85 | 1.90 – 2.20 | |

| Capital expenditure ($ million) | 1,420 – 1,670 | 1,420 – 1,600 | |

| Contained copper in concentrate (tonnes) | 520,000 – 580,000 | 370,000 – 420,000 |

Guidance figures are on a 100% project basis.

Kamoa-Kakula's 2025 guidance is based on several assumptions and estimates. It involves estimates of known and unknown risks, uncertainties, and other factors that may cause the actual results to differ materially.

The 2025 production guidance, as revised on June 11, 2025, takes into account the probable effect of seismic activity as reported on May 20, 2025, and associated interruptions in mining operations at the Kakula Mine. Although mining in the western side of the Kakula Mine has restarted, risk factors remain, including that it is too early to accurately predict potential disruption caused by further unexpected seismic activity, the integrity of underground infrastructure, the ability to ramp up underground operations, the ability to complete dewatering activities and the time required to access the new mining areas. The updated 2025 production guidance is based on an assessment of these factors that management believes are reasonable at this time, given all available information. Metal reported in concentrate is before refining losses or deductions associated with smelter terms.

Cash cost (C1) guidance is based primarily on assumptions, including tonnes of ore mined, feed grades of processed copper ore, concentrator recoveries, as well as the timing and ramp-up of the on-site smelter, among other variables.

Cash cost (C1) is a non-GAAP measure used by management to evaluate operating performance and includes all direct mining, processing, stockpile rehandling charges, and general and administrative costs. Smelter charges and freight deductions on sales to the final port of destination (typically China), which are recognized as a component of sales revenues, are added to cash cost (C1) to arrive at an approximate cost of delivered finished metal.

For historical comparatives and a reconciliation to the most directly comparable measure under IFRS, see the non-GAAP Financial Performance Measures section of this release and the company's MD&A for the three and six months ended June 30, 2025.

Revised 2025 cash cost (C1) guidance for Kamoa-Kakula

The increase in cash cost (C1) guidance to $1.90 to $2.20 per pound of payable copper produced is primarily driven by an expected lower feed grade of ore into the concentrators for the remainder of 2025. Average feed grades into the Phase 1 and 2 concentrators of approximately 3% copper are expected to continue until year-end, sourced from both surface stockpiles, as well as ore from the western side of the Kakula Mine. In addition, the cost benefits of the smelter are expected to positively impact cash costs from the end of 2025, as the smelter ramp-up advances.

Revised 2025 capital expenditure guidance for Kamoa-Kakula

The guidance ranges provided reflected uncertainty in the turnaround of the Kakula underground mine during 2025 and 2026.

Kamoa-Kakula's revised 2025 capital expenditure of $1,420 million to $1,600 million includes the deferral of approximately $170 million in project capital including $100 million in various surface infrastructure projects, $50 million in Phase 3 debottlenecking and $20 million relating to Project 95. Sustaining capital has increased by $110 million, including $70 million relating to Stage One and Two pumping activities and $40 million relating to mining activities including a new box cut and decline at Kansoko, decline at Kamoa 2 and increased underground development at Kamoa, partially offset by reduced underground development at Kakula. All capital expenditure figures are presented on a 100%-project basis.

The capital expenditure guidance range for 2026, as issued on February 19, 2025, has been widened from between $680 million and $930 million, to between $700 million and $1,200 million. Kamoa-Kakula intends to narrow the guidance range in due course as the recovery and ramp-up plan is completed.

2. Kipushi Mine

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The ultra-high grade Kipushi underground zinc-copper-germanium-silver-lead mine in the DRC is located adjacent to the town of Kipushi on the Zambian border, approximately 30 kilometres southwest of Lubumbashi on the Central African Copperbelt. Kipushi is approximately 250 kilometres southeast of the Kamoa-Kakula Copper Complex. Ivanhoe acquired a 68% interest in the Kipushi Mine in November 2011, through Kipushi Holding, which is 100%-owned by Ivanhoe Mines. The balance of 32% in the Kipushi Mine was held by the DRC state-owned mining company, Gécamines. As per the updated joint venture agreement signed in late 2023, Gécamines' ownership increased to 38% during Q1 2025.

Ivanhoe, together with its joint-venture partner, restarted the Kipushi zinc mine in mid-2024, with the ramp-up to steady state operations continuing during the quarter. On November 17, 2024, His Excellency Félix Tshisekedi, President of the Democratic Republic of the Congo, along with a government delegation, officially reopened the Kipushi zinc mine. Ramp up of Kipushi is ongoing, with the completion of a debottlenecking program expected to be completed in Q3 2025.

| Kipushi summary of operating and financial data | |||||||

| Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | ||||

| Ore tonnes milled (tonnes) | 153,342 | 151,403 | 119,619 | 108,065 | |||

| Feed grade of ore processed (% zinc) | 33.37% | 32.16% | 31.72% | 32.12% | |||

| Zinc recovery (%) | 85.22% | 87.93% | 85.07% | 75.78% | |||

| Zinc in concentrate produced (tonnes) |

41,788 | 42,736 | 32,490 | 18,946 | |||

| Payable zinc sold (tonnes) | 43,348 | 30,108 | 16,999 | – | |||

| Cost of sales per pound ($ per lb.) | 1.05 | 1.23 | 1.38 | – | |||

| Cash cost (C1) ($ per lb.) | 0.96 | 0.93 | 1.13 | – | |||

| Realized zinc price ($ per lb.) | 1.23 | 1.29 | 1.38 | – | |||

| Sales revenue before remeasurement ($'000) | 92,875 | 79,713 | 41,600 | – | |||

| Remeasurement of contract receivables ($'000) | 3,882 | (2,693) | (782) | – | |||

| Sales revenue after remeasurement ($'000) | 96,757 | 77,020 | 40,818 | – | |||

| EBITDA ($'000) | 9,295 | 10,508 | 4,050 | – | |||

| EBITDA margin (% of sales revenue) | 10% | 14% | 10% | – | |||

C1 cash cost per pound of payable zinc can be further broken down as follows:

| Q2 2025 | Q1 2025 | Q4 2024 | |||

| Mining | ($ per lb.) | 0.16 | 0.16 | 0.26 | |

| Processing | ($ per lb.) | 0.08 | 0.12 | 0.12 | |

| Logistics charges | ($ per lb.) | 0.50 | 0.47 | 0.48 | |

| Treatment charges | ($ per lb.) | 0.07 | 0.05 | 0.17 | |

| Support services | ($ per lb.) | 0.15 | 0.13 | 0.10 | |

| Cash cost (C1) per pound of payable zinc sold | ($ per lb.) | 0.96 | 0.93 | 1.13 |

Cash cost (C1) is prepared on a basis consistent with the industry standard definitions by Wood Mackenzie cost guidelines, but cash cost per pound for the Kipushi Mine has been presented on a per ton sold basis to eliminate the impact of unsold tonnes of zinc concentrate in inventory. Cash cost (C1) and cash cost per pound are not measures recognized under IFRS Accounting Standards. C1 cash cost is used by management to evaluate operating performance and includes all direct mining, processing, and general and administrative costs. Smelter charges and freight deductions on sales to the final port of destination, which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of delivered, finished metal. C1 cash cost excludes royalties, production taxes, and non-routine charges as they are not direct production costs.

All figures are on a 100% project basis, and metal reported in concentrate is before refining losses or deductions associated with smelter terms.

Kipushi produced a near-record 41,788 tonnes of zinc; zinc production rates expected to significantly improve in the second half of 2025

Summary of quarterly production data from Kipushi

| Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | |||||

| Kipushi Concentrator | ||||||||

| Ore tonnes milled (tonnes) | 153,342 | 151,403 | 119,619 | 108,065 | ||||

| Feed grade of ore processed (% zinc) | 33.37 | 32.16 | 31.72 | 32.12 | ||||

| Zinc recovery (%) | 85.22 | 87.93 | 85.07 | 75.78 | ||||

| Zinc in concentrate produced (tonnes) | 41,788 | 42,736 | 32,490 | 18,946 |

Data in bold denotes a quarterly record.

Zinc production from the Kipushi concentrator continued to improve during the second quarter as the ramp-up advances to steady state. Multiple production records were achieved in May, with a record 60,182 tonnes of ore processed, producing a record 18,305 tonnes of zinc. In June, only 41,107 tonnes of ore were processed due to a temporary feed of lower-grade ore for the three weeks ahead of a planned shutdown, and a nine-day shutdown to integrate the first phase of the debottlenecking program.

The first phase of the debottlenecking program focused on improving the tailings pumping systems to enable the concentrator to consistently operate at its nameplate capacity. This work is now complete.

Since the completion of the first phase of debottlenecking program, the Kipushi concentrator has achieved a number of additional production records. The daily zinc production record of 898 tonnes of zinc in concentrate, which was achieved in mid-July, is equivalent to 327,000 tonnes of zinc on an annualized basis. The weekly zinc production record of 5,545 tonnes of zinc in concentrate, which was also achieved in mid-July, is equivalent to 289,000 tonnes of zinc on an annualized basis.

The second and final phase of the debottlenecking program will upgrade certain processing equipment within the concentrator to boost the throughput by 20%, from 800,000 to 960,000 tonnes of ore per annum. This phase is on track to be complete in the third quarter, with a 7-day shutdown planned in August to integrate all remaining equipment upgrades.

Concurrent with the integrations of the debottlenecking program, the June shutdown also included upgrades to the concentrator's DMS circuit. As reported on October 7, 2024, excessive fine material in the ore (fines) was causing unscheduled shutdowns due to blockages in the DMS circuit. Following the completion of the upgrades, the availability of the DMS has increased from approximately 6 hours per day to 16 hours per day, resulting in a significant reduction in lost operating time. Further upgrades will take place during the planned August shutdown, after which DMS circuit availability is expected to further increase up to 22 hours per day.

Based on the completion of the above initiatives, Kipushi's 2025 production guidance remains unchanged at between 180,000 and 240,000 tonnes of zinc.

Fitters Albert Mukendi and Honoré Mwilambwe are installing piping and instrumentation as part of Kipushi's debottlenecking program. The debottlenecking program is nearing completion and is expected to increase concentrator processing capacity by 20% from late Q3 2025.

Kipushi's project engineering team continues its strong track record of safe and reliable project delivery. The debottlenecking program, which commenced in Q3 2024, continues to advance on schedule with zero lost time injuries (LTI) reported. Since September 2022, when construction of the Kipushi concentrator commenced, up until today, the project engineering team has not recorded a single LTI, an incredibly rare industry feat.

3. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is located on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province – approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane in South Africa. The project is owned by Ivanplats (Pty) Ltd. (Ivanplats), which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats' historically disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees, and local entrepreneurs. The remaining 10% interest is held by a Japanese consortium, consisting of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation (JOGMEC), and Japan Gas Corporation.

Platinum-group metals (PGM) mineralization in the Northern Limb is primarily hosted within a 30-kilometre mineralized sequence called the Platreef. The Platreef Project is contiguous with, and along strike from, Valterra's (formerly known as Anglo Platinum) Mogalakwena PGM operations. The Platreef Project hosts an underground deposit of platinum-group metals, nickel, copper, and gold mineralization, called the Flatreef deposit. The Flatreef is a thick, relatively flat-lying and high-grade orebody, which is amenable to highly mechanized, highly productive, underground bulk mining methods.

Since 2007, Flatreef has become one of the largest undeveloped precious metals deposits globally, with 56 million ounces in platinum equivalent Indicated Mineral Resources and 74 million ounces in platinum equivalent Inferred Mineral Resources, at a 2.0 g/t platinum, palladium, rhodium, and gold (3PE + AU) cut-off. The Flatreef is also host to one of the world's largest undeveloped nickel sulphide mineral resources.

Aerial view of the Platreef Mine, showing the central shaft infrastructure, the Phase 1 concentrator (right), the dry stack tailings facility (top left), as well as the reef development ore stockpiles (bottom left).

Platreef, one of the world's largest undeveloped precious metals deposits, set to be lowest cost platinum, palladium, rhodium, and gold producer, with significant nickel and copper

On February 18, 2025, two independent studies were completed on the three-phase development of the Platreef Mine. This included an updated Feasibility Study on the Phase 2 expansion to 4.1 million tonnes per annum (Mtpa) of processing capacity, as well as a Preliminary Economic Assessment covering a new Phase 3 expansion to 10.7 Mtpa of processing capacity. The excellent results from both studies reinforce the industry-leading margins of the multi-generational Platreef Mine.

The Platreef Mine is projected to be the lowest-cost primary platinum-group-metals producer globally. The Phase 2 life-of-mine total cash cost is estimated to be $599 per ounce of 3PE+Au, net of nickel and copper by-product credits. Life-of-mine total cash costs are projected to fall further to $511 per ounce of 3PE+Au following the Phase 3 expansion. This compares very favourably with a basket spot price of approximately $1,600 per ounces. of 3PE+Au, as at July 29, 2025. The Platreef Mine's low cash costs are primarily due to its unique thick orebody, which enables economies of scale, as well as the high grades of nickel and copper that are payable by-products.

Following the Phase 3 expansion, as shown in Figure 3, the Platreef Mine is expected to be one of the world's largest primary platinum group metal producers on a platinum-equivalent basis.

First production from the Phase 1 concentrator is expected in Q4 2025, ramping up to an annualized production of approximately 100,000 ounces of 3PE+Au. Development has already commenced on the Phase 2 expansion, which is expected to be completed 2 years later in Q4 2027. Annualized production increases almost five-fold following the Phase 2 expansion to over 460,000 ounces. of 3PE+Au, plus approximately 9,000 tonnes of nickel and 6,000 tonnes of copper. The Phase 3 expansion further doubles annualized production to over 1 million ounces of 3PE+Au, plus approximately 22,000 tonnes of nickel and 13,000 tonnes of copper.

Figure 3: Phased development schematic of the Platreef Mine, showing the annualized mining rate over life of mine.

First production from the Platreef Mine's Phase 1 concentrator is on schedule for first production in the fourth quarter

As announced on May 8, 2025, underground development of the Flatreef orebody on the 850-metre level commenced on April 30, 2025. Since then, a total of 90 metres of reef development in ore has been completed. From now on, the rate of reef development is expected to increase to 80 metres per month. Reef development at the 750-metre level is scheduled to commence in October 2025.

Development ore is being hoisted to the surface and stored in stockpiles. The Ivanplats team aims to accumulate a stockpile of approximately 60,000 tonnes of development ore ahead of the first feed into the Phase 1 concentrator. First production from the Platreef Phase 1 concentrator remains on track to take place in the fourth quarter. The concentrator will be fed primarily by development ore during the initial stages of ramp-up. Stoping (production mining) is expected to commence in Q1 2026, following the completion of Shaft #3. The proportion of ore from stoping will gradually increase, compared with development ore, as the ramp-up advances.

The underground delineation drilling program, which commenced last year, is progressing well. The first ore block on the 850-metre level, where the initial stoping will take place, has been drilled, and the assays reconcile well with Ivanplats' grade models.

Equipping of Shaft #3 continues to progress well and is on schedule to be 'ready to hoist' ore in Q1 2026. The shaft's 5.1-metre-diameter barrel support is complete from surface to shaft bottom at 950 metres depth, and the excavation for the shaft loading box has also been completed. The head-gear assembly and rock winder installation are advancing well, with the rock winder mechanical installation nearing completion.

As the mining rate increases, as shown in Figure 3, the number of mining crews at Platreef is expected to double over the next 18 months. Currently, there are five development crews, primarily focused on reef development at the 850-metre and 950-metre levels. Two additional mining crews will be added during the second half of 2025, with a further three crews to be added in 2026. The increased number of crews aims to increase the mining development rate across all three levels from 500 metres per month at the end of 2025 to over 800 metres per month by the end of 2026.

Significant increase in platinum and palladium prices boosts project value

On February 18, 2025, Ivanhoe Mines announced the results of the 2025 Platreef Integrated Development Plan, which included two completed independent studies covering the three-phase development of the Platreef mine. This comprised the 4.1 Mtpa (Phase 2) expansion Feasibility Study, and the 10.7 Mtpa (Phase 3) expansion Preliminary Economic Assessment (PEA).

Since the 2025 Platreef Integrated Development Plan was released, the spot prices of platinum and palladium have risen by 42% and 26%, respectively. In reference to the sensitivity tables included in the reports, as filed on March 31, 2025, the net present values (NPV8%) of the Feasibility Study and PEA have increased by over 20% to $1.7 billion and $3.8 billion, respectively.

Negotiations for the Platreef Mine's Phase 2 project finance are advancing well

In December 2023, Ivanplats concluded a $150 million senior debt facility with Société Générale and Nedbank Limited to fund the construction of Phase 1. An initial $70 million was drawn, with a further $30 million draw in the second quarter of 2025.

Following the completion of the 4.1 Mtpa feasibility study, Ivanhoe Mines has been focused on arranging an enlarged project finance package for the majority of the expansion capital requirements for Phase 2.

Negotiations are advancing well for a $700 million Phase 2 senior project finance facility.

Ivanhoe is anticipating that the new financing will be in place during Q1 2026.

Financing for the future Phase 3 expansion is expected to be underpinned by cash flow generated from Platreef's Phase 1 and 2 operations.

Shaft #3 head gear assembly and rock winder installation are advancing well, with the mechanical installation of the rock winder (pictured below) nearing completion. Shaft #3 is on schedule to be ready to hoist in Q1 2026.

Structural steel and cladding to house the winder at the top of the Shaft #2 headgear were recently completed, taking the total height of Shaft #2 to 96 metres.

4. Global Exploration Portfolio

Western Forelands Exploration Project, DRC

54%- to 100%-owned by Ivanhoe Mines

The Western Forelands Exploration Project consists of a licence package covering 2,390 km2 adjacent to the Kamoa-Kakula Copper Complex. The area of the Western Forelands licence package is approximately six times larger than that of the Kamoa-Kakula Copper Complex.

Drilling efforts during the second quarter focused on the Makoko, Makoko West, and Kitoko areas, now called the Makoko District. The drilling program employed wide-spaced drilling to delineate the extent of the mineralized envelope. At Kitoko, mineralization remains open down-dip to the southeast. The deepest hole drilled to date in 2025 intersected mineralization, indicating strong potential for further resource expansion. Additionally, drilling south of Makoko West has confirmed mineralization between Makoko and Kitoko.

During the second quarter, nine contractor-operated diamond drill rigs were active, completing a total of 14,843 meters of drilling across 27 holes. This included four wedge holes, which were deviated from the original drill holes at depth. These wedges are used to collect additional mineralized samples for future metallurgical testing and to bypass difficult ground conditions.

An Audio-frequency Magnetotellurics (AMT) survey began in May and continued through June, covering two lines extending from the Kibaran basement across the Western Foreland Shelf. Completion is expected during the third quarter. A ground gravity survey is scheduled to begin in August.

Drilling doubles the size of Makoko-Kitoko copper discoveries in 18 months

On May 14, 2025, the company announced the independently verified, updated Mineral Resource estimate for the Makoko District. Since the maiden Mineral Resource on Makoko and Kiala was announced on November 13, 2023, more than 86,000 metres of diamond drilling were completed in the Western Forelands up to February 2025. Since November 2023, the Makoko District has increased by 2 kilometres to 13 kilometres in strike length, and the total contained copper has approximately doubled.

The Makoko District ranks as the world's fifth-largest copper discovery since Kakula in 2015. The Makoko discovery was first made in 2018 when drilling intersected flat-lying, sedimentary-hosted copper mineralization geologically similar, and at comparable depths to the nearby Kamoa and Kakula orebodies. Subsequent drilling has delineated a continuously mineralized region, now called the Makoko District, joining the three discoveries of Makoko, Makoko West, and Kitoko.

Copper mineralization in the Makoko District currently spans a corridor at least 13 kilometres in length and between 1.7 kilometres and 5.8 kilometres wide. The eastern edge of the Makoko District is situated approximately 10 kilometres from the western edge of Kakula. Mineralization remains open to the northeast and downdip of the current footprint, with a high potential for further resource expansion.

There is abundant deposition of copper across the Makoko District, with approximately two-thirds of holes drilled intersecting copper. In addition, there are higher-grade sub-zones at Makoko, Makoko West, and Kitoko, which mirror the style of mineralization of the Kamoa orebody that feeds the Phase 3 concentrator and will feed the future Phase 4 concentrator. The highest-grade section of the Makoko deposit occurs between 300 and 600 metres in depth and coincides with the Indicated Resource area.

The updated Mineral Resource estimate for the Makoko District is based on the results of 147,000 metres drilled in 311 holes, of which 86,000 metres in 123 holes have been added since the maiden Mineral Resource was announced in November 2023. The total area of the updated Mineral Resource has increased by 37.4 km2, with the Indicated Resource covering 1.6 km2 and the Inferred Resource covering 57 km2. The average dip of the mineralized zone in the Mineral Resource is between 11 and 18 degrees, dipping to the southeast.

Figure 4: The Makoko District ranks as the world's fifth-largest copper discovery of the past decade. Ivanhoe's geologists have discovered a total of 52.5 million tonnes (115.7 billion pounds) of contained copper in the Western Foreland Shelf, including Kamoa-Kakula.

Source: Company filings, S&P Global Market Intelligence.

Notes: Chart ranks all other new copper discoveries made since 2015 based on contained copper in resources on a 100% basis. Kamoa-Kakula Copper Complex consists of the deposits of Kamoa (discovered in 2008) and Kakula (discovered in 2015). Vicuña consists of the deposits of Filo Del Sol and Josemaria. Information based on public disclosure as of May 9, 2025. Mineral Resources estimates for the Western Forelands include the Makoko District (consisting of Makoko, Makoko West, Kitoko) and Kiala at a 1.0% cut-off grade. Data has not been reviewed by S&P Global.

Highlights of the interim, updated Mineral Resource estimate for the Makoko District

The interim, updated Mineral Resource estimate for the Makoko District, which has an effective date of May 1, 2025, was prepared by Ivanhoe Mines under the direction of the MSA Group of Johannesburg, South Africa, in accordance with the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves:

- Indicated Resources total 27.7 million tonnes at a grade of 2.79% copper, containing 773,000 tonnes (1.7 billion pounds) of copper at a 1% copper cut-off. At a higher 1.5% copper cut-off, Indicated Resources total 25.3 million tonnes at a grade of 2.93% copper, containing 741,000 tonnes (1.6 billion pounds) of copper.

- Inferred Resources total 494 million tonnes at a grade of 1.70% copper, containing 8.38 million tonnes (18.4 billion pounds) of copper, at a 1% copper cut-off. At a higher 1.5% copper cut-off, Inferred Resources total 221 million tonnes at a grade of 2.23% copper, containing 4.93 million tonnes (10.9 billion pounds) of copper.

The Makoko District spans a mineralized strike length of 13 kilometres, with the Kitoko area extending laterally down-dip, to the southeast for approximately six kilometres. The stratiform copper lies close to surface along the western edge of Makoko and Makoko West, dipping down towards the southeast to Kitoko. Mineralization depth from surface ranges from 200 metres to as deep as 1,250 metres.

The highest-grade zone at Makoko lies between 400 and 700 metres below surface and coincides with the Indicated Resource area, which has been drilled on a 200-metre by 200-metre grid. A second, sub-parallel zone of shallower mineralization occurs up-dip across a strike extent of approximately 11 kilometres. Closer-spaced drilling in 2023 connected these two zones, allowing the entire area to be classified in the Inferred category of the 2025 Mineral Resource update.

North-Western Province, Zambia

100%-owned by Ivanhoe Mines

As announced on April 2, 2025, the Government of the Republic of Zambia granted Ivanhoe Mines a 7,757-square-kilometre package of new exploration licences in the highly-prospective North-Western Province of Zambia. Ivanhoe's thesis behind the strategically selected licence package is to explore for an extension of the Central African Copperbelt. The award of licences follows a memorandum of understanding (MOU) that was signed between Ivanhoe Mines and the Republic of Zambia's Ministry of Mines and Minerals Development (Ministry of Mines) on September 10, 2024.

The new licence package is strategically located between Ivanhoe's Western Forelands Exploration Project (230 km to the northeast) and the company's Angolan exploration licence package (130 km southwest). The Zambia licences cover an area over three times larger than the Western Forelands Exploration Project.

Ivanhoe's geological team are targeting copper mineralization associated with Basement Domes, Katangan-age sediment-hosted copper systems, and iron-oxide-copper-gold (IOCG) systems. The western edge of the Central African Copperbelt in the DRC hosts the Western Foreland Shelf, where the Kamoa-Kakula Copper Complex and the Mineral Resources of Makoko and Kiala in the Western Forelands are located. Ivanhoe's geological team believes that the Western Foreland Shelf facies of the Nguba Group sediments continue to arc southwest into Zambia and Angola.

During the quarter, work was mostly focussed on recruitment of key personnel and establishing a local core storage warehouse. Stakeholder engagement on the licence area commenced after quarter end, which started with meeting many of the traditional leaders and district administrators across the licence area. In parallel, desktop work continues on the recovery of historical geophysical and geological data on the licence area, which was conducted by the previous licence holders, such as BHP and Anglo American.

Moxico and Cuando Cubango Provinces, Angola

100%-owned by Ivanhoe Mines

Ivanhoe's exploration team is also targeting Western-Forelands-style sedimentary copper mineralization in Angola. The team is deploying its exploration expertise developed from its discoveries in the Western Forelands and from Kamoa-Kakula to its vast greenfield exploration package in Angola.

The team has developed an exploration thesis that the DRC's Western Forelands Shelf extends into eastern Angola. As announced on November 27, 2023, Ivanhoe acquired approximately 22,000 km2 of prospecting rights in the Moxico and Cuando Cubango provinces of Angola. Concurrently, Ivanhoe signed a mining investment contract with the Angolan National Agency for Mineral Resources.

After receiving the required permitting, access to the licenses was first made by Ivanhoe's geologists in August 2024. The team undertook a mapping and baseline soil geochemical sampling program over an area of 600 km2, which covered the same portion of the license flown by the airborne electromagnetic survey. A ground-based geophysics program was also completed, including Audio-frequency (AMT) and Magnetotellurics (MT) in conjunction with a Passive Seismic survey, down the eastern portion of the license area.

Results from the 2024 work streams have been analyzed, with several targets generated for drilling. The contract for 2025 diamond drilling program was recently awarded with mobilization expected in the coming weeks. Two diamond core drill rigs will conduct an initial 6,400-metre stratigraphic diamond drill program.

The Chu-Sarysu Basin Exploration Joint Venture, Central Kazakhstan

20%-owned by Ivanhoe Mines

Ivanhoe Mines has formed an exploration joint venture with UK-based private company Pallas Resources to explore the Chu-Sarysu Copper Basin in Kazakhstan, the world's third-largest sediment-hosted copper district. The joint venture covers a highly prospective licence package of up to 16,911 km2, which spans an accumulated dataset of Soviet-era exploration data.

As announced on February 12, 2025, Ivanhoe has committed to fund $18.7 million in exploration activities over an initial two-year period, with earn-in rights to further increase ownership up to 80% over time.

Exploration activities began on the joint venture licences in the first quarter of 2025, including the hiring of an exploration team and tendering of the drilling and airborne geophysics contracts. Drilling subsequently commenced in July 2025, with the mobilization of two rigs for a maiden 17,500-metre diamond drilling program. In addition, over 95% of the planned 16,911 km² in licences have now been fully granted. Concurrent with the drilling program, the extensive geophysical and geochemical programs are now underway across the licence package.

Mokopane Feeder Project, South Africa

100%-owned by Ivanhoe Mines

Ivanhoe Mines is exploring the Northern Limb of South Africa's Bushveld Complex, adjacent to Ivanplats' Platreef Project. Ivanhoe's geologists are testing a large gravity-high anomaly based on wide-spaced historical Council for Geoscience data. The anomaly is interpreted to represent. The working hypothesis is that the large gravity-high anomaly is interpreted by scientific research to represent a potential primary feeder zone of magma and mineralization into the Northern Limb of the Bushveld Complex, essentially the sources of mineralization that make up the Platreef and other Northern Limb deposits.

The collection, interpretation, and review process of all geological and geophysical data was completed early in 2024. The geological understanding of the anomaly continues to evolve, with numerous targets identified for drilling.

Following the completion of heritage surveys and community engagement around the proposed drilling sites, Geosearch, a diamond drilling contractor, commenced a 6,000-metre diamond-core drill program in Q1 2025. By the end of the second quarter, the drilling of the first hole of 2,000 metres was completed. The drill rig is currently being mobilized to a new site nearby, while downhole geophysics is being conducted on the completed hole. Completion of the program is expected by the end of 2025.

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Revenue from commercial production at the Kipushi Mine commenced in Q4 2024. All revenue from production at Kamoa-Kakula is recognized within the Kamoa Holding joint venture. Ivanhoe did not declare or pay any dividend or distribution in any financial reporting period.

| Three months ended | ||||||

| June 30, | March 31, | December 31, | September 30, | |||

| 2025 | 2025 | 2024 | 2024 | |||

| $'000 | $'000 | $'000 | $'000 | |||

| Revenue | 96,757 | 77,020 | 40,818 | – | ||

| Cost of sales | (100,217) | (81,771) | (51,563) | – | ||

| Share of profit from joint venture | 15,704 | 107,948 | 73,620 | 83,507 | ||

| Finance income | 43,583 | 41,623 | 56,041 | 60,164 | ||

| Deferred tax recovery | 7,842 | 4,374 | 12,663 | 575 | ||

| General administrative expenditure | (10,378) | (9,957) | (19,633) | (10,573) | ||

| Exploration and project evaluation expenditure | (8,585) | (9,145) | (15,845) | (12,813) | ||

| Finance costs | (4,947) | (7,838) | (6,849) | (471) | ||

| Share-based payments | (4,447) | (2,418) | (2,977) | (7,504) | ||

| Loss on fair valuation of embedded derivative liability | – | – | – | (4,171) | ||

| Profit (loss) attributable to: | ||||||

| Owners of the Company | 44,051 | 129,760 | 99,344 | 117,942 | ||

| Non-controlling interests | (8,726) | (7,560) | (11,338) | (9,760) | ||

| Total comprehensive income (loss) attributable to: | ||||||

| Owners of the Company | 60,900 | 135,033 | 60,964 | 141,525 | ||

| Non-controlling interest | (7,066) | (7,161) | (15,158) | (7,469) | ||

| Basic profit per share | 0.03 | 0.10 | 0.07 | 0.09 | ||

| Diluted profit per share | 0.03 | 0.10 | 0.07 | 0.09 | ||

| Three months ended | ||||||

| June 30, | March 31, | December 31, | September 30, | |||

| 2024 | 2024 | 2023 | 2023 | |||

| $'000 | $'000 | $'000 | $'000 | |||

| Share of profit from joint venture | 89,616 | 45,165 | 49,272 | 69,829 | ||

| Finance income | 62,873 | 62,457 | 63,110 | 56,671 | ||

| (Loss) gain on fair valuation of embedded derivative liability | (20,727) | (139,271) | (39,961) | 12,218 | ||

| General administrative expenditure | (12,345) | (14,001) | (14,947) | (9,841) | ||

| Finance costs | (32,871) | (8,944) | (6,741) | (8,752) | ||

| Share-based payments | (8,505) | (8,933) | (7,715) | (6,732) | ||

| Exploration and project evaluation expenditure | (10,589) | (8,901) | (8,637) | (6,264) | ||

| Deferred tax recovery | 1,398 | 3,221 | 4,201 | 1,212 | ||

| (Loss) profit attributable to: | ||||||

| Owners of the Company | 76,401 | (65,552) | 27,739 | 112,510 | ||

| Non-controlling interests | (9,885) | (3,858) | (1,980) | (4,988) | ||

| Total comprehensive (loss) income attributable to: | ||||||

| Owners of the Company | 88,223 | (73,648) | 37,155 | 109,681 | ||

| Non-controlling interest | (8,672) | (4,728) | (1,003) | (5,250) | ||

| Basic (loss) profit per share | 0.06 | (0.05) | 0.02 | 0.09 | ||

| Diluted (loss) profit per share | 0.06 | (0.05) | 0.02 | 0.08 | ||

DISCUSSION OF RESULTS OF OPERATIONS

Review of the three months ended June 30, 2025, vs. June 30, 2024