COEUR D’ALENE, IDAHO / ACCESSWIRE / September 4, 2019 / Timberline Resources Corporation (OTCQB:TLRS)(TSXV:TBR) (“Timberline” or the “Company”) reports that exploration has commenced on its Lookout Mountain, Nevada joint venture (JV) project with PM & Gold Mines, Inc. (“PM&G”). As previously announced (see press release dated July 11, 2019 at http://timberlineresources.co/press-releases), PM&G can earn an initial 51% interest in the project by funding US$6 million over a 2-year period.

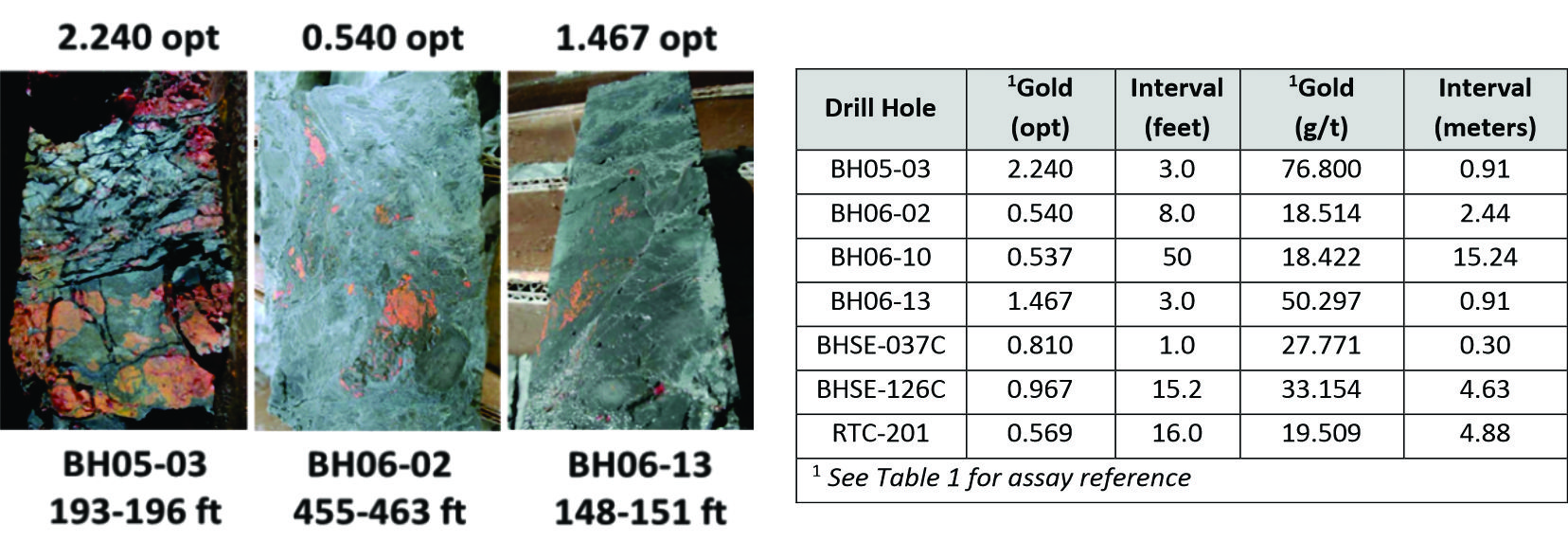

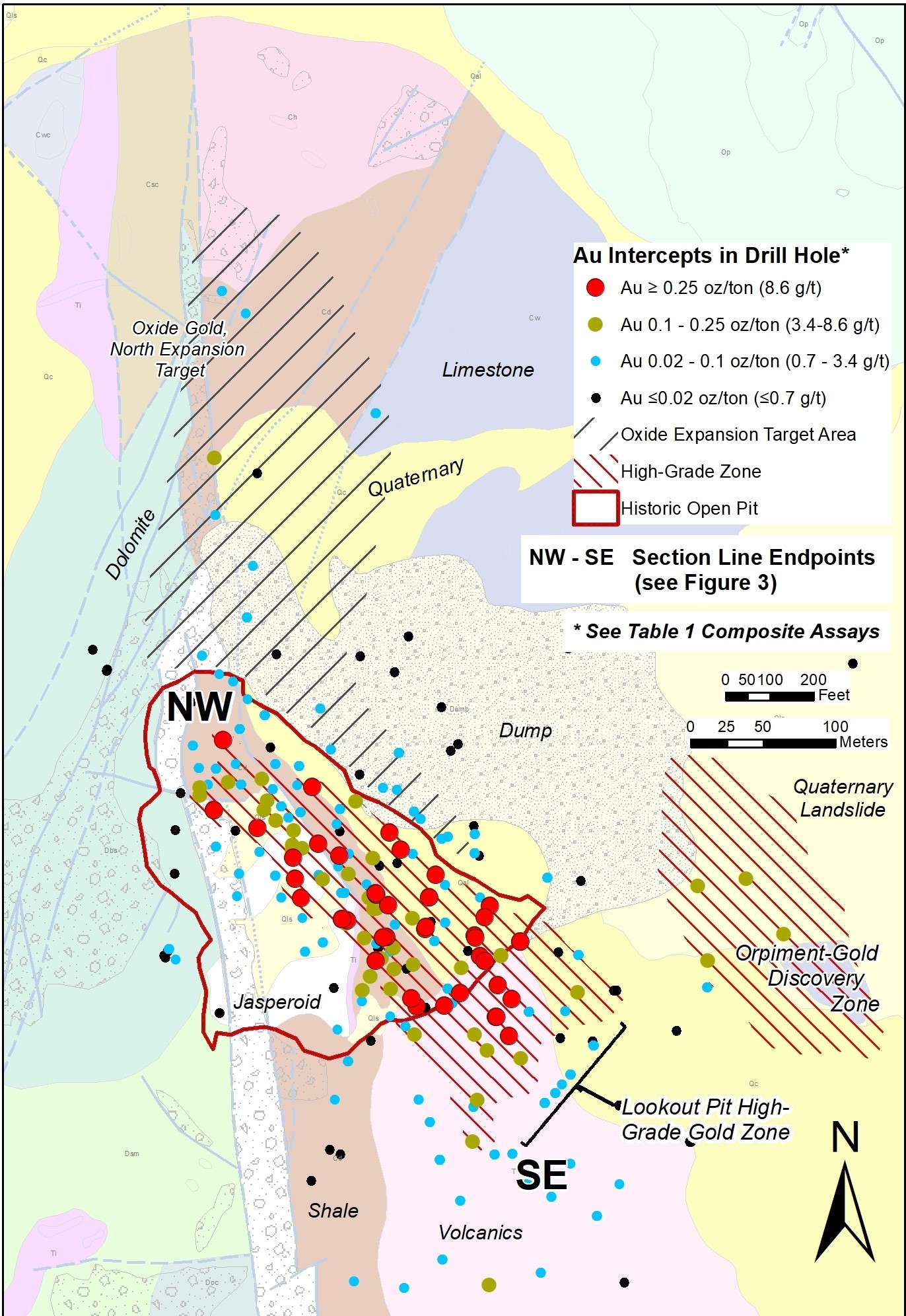

Past core and rotary drilling have partially delineated a NW-SE trend of high-grade (defined as drill hole intercepts of ≥0.10 ounces/ton (opt) (3.43 grams/tonne (g/t)), Carlin-style gold mineralization in the Lookout Mountain historical open pit mine area, where 17,700 ounces of gold averaging 0.12 opt (4.11 g/t) were produced in 1987. These include 48 intercepts (Table 1) of ≥0.25 oz/ton ((8.6 gram/tonne (g/t), and 64 intercepts of 0.10 - 0.25 opt (3.4 - 8.6 g/t) (Figures 1, 2, 3)(see also press release dated July 11, 2019 at http://timberlineresources.co/press-releases and Updated Technical Report on the Lookout Mountain Project, MDA, Effective March 1, 2013, Filed on SEDAR April 12, 2013).

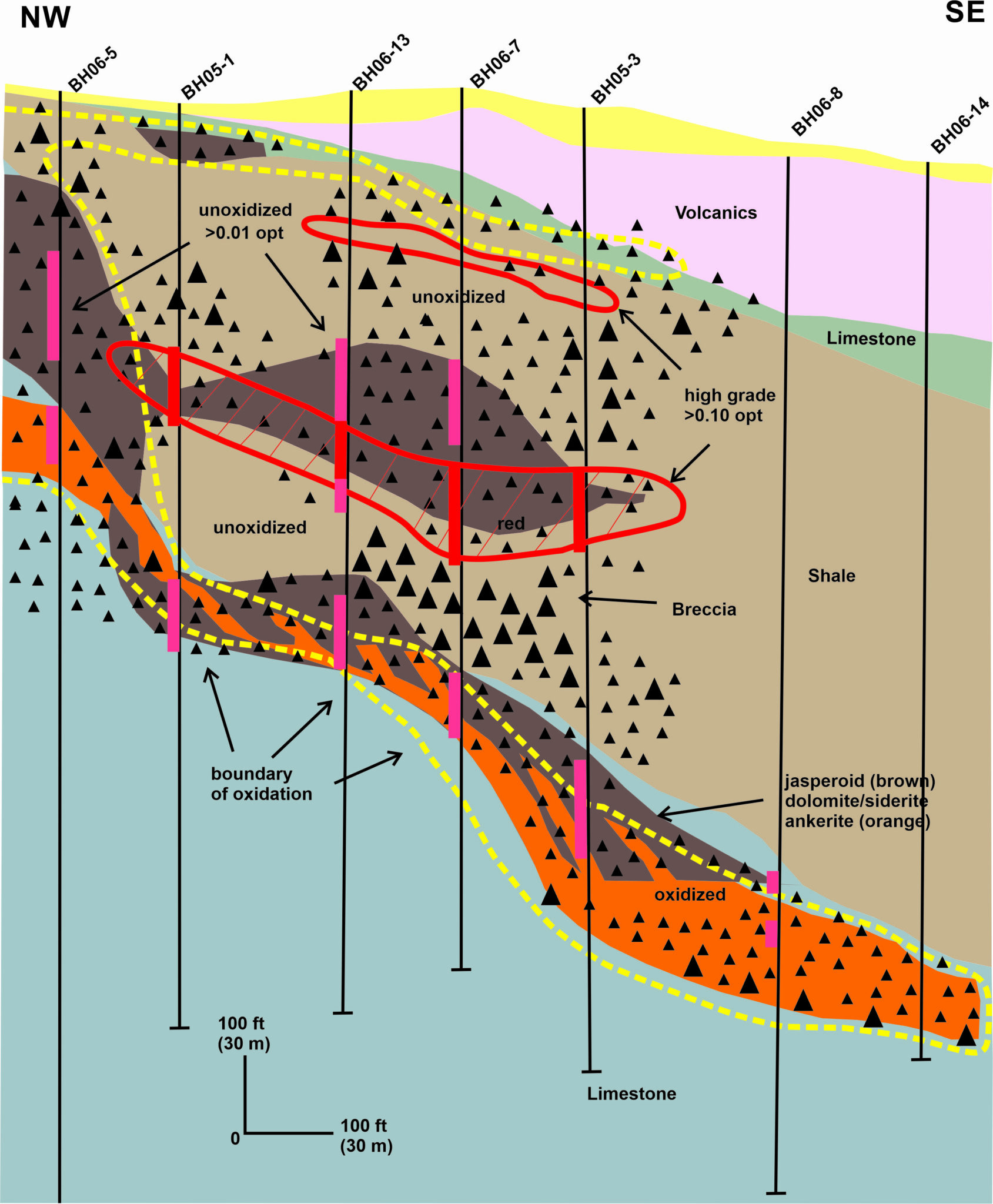

The trend extends approximately 1,000 feet (305 m) within the pit area and is open to the southeast and is 100-300 feet (30-91 m) wide (Figure 2). It includes relatively flat-lying, high-grade zones at multiple elevations (Figure 3) including some exposed in the historic pit. The gold mineralization is constrained at least in part by stratigraphy and zones of collapse breccias. The breccias locally contain orpiment and realgar (arsenic sulfides), which are commonly found in many major Carlin-style gold deposits.

Figure 1. Representative Lookout Mountain Drill Core ≥ 0.5 opt (17.1 g/t) High-grade Zone Gold Assays

Steven Osterberg, Timberline’s President and CEO, stated, “Our work with the JV has further characterized the high-grade Carlin-style gold mineralization at Lookout Mountain. Detailed pit mapping, core logging and modelling have provided a much clearer understanding of the distribution and controls of the gold mineralization. We plan to aggressively delineate the high-grade zones with core drilling anticipated to begin in September.”

Timberline Director and Nevada Carlin-style gold expert David Mathewson added: “I am excited to see the JV efforts focused on the high-grade gold trend. From my experience on the central Carlin Trend at Rain, the Bullion District, Gold Quarry and Mike deposits, and in the North-area, the mineralization at Lookout is classic Carlin-style gold as found in many of Nevada’s very large gold deposits. There is a clear association of the gold with breccias, secondary dolomite, iron-enrichment, and anomalous arsenic and mercury. I look forward to the fall drilling program.”

Figure 2. Lookout Mountain Open Pit-area Drill Holes with High-grade Gold Intercepts

Figure 3. Northwest-Southeast Vertical Section through Lookout Mountain Open Pit-area High-grade Gold Zone

Program Planning

A 6-month, $2.6 million program and budget include 12,000 ft (3,600 m) of core drilling and 12,500 ft (3,800 m) of reverse circulation (RC) drilling. Drill contractors have been identified and are estimated to begin drilling in September on currently approved sites.

Core drilling will infill to test continuity of the high-grade zones, strategically twin selected historical RC holes for evaluation of relative gold recovery, and test for extensions of the high-grade gold mineralization to the southeast of the pit. RC drilling will test for shallow, oxide gold mineralization to the immediate north and northwest of the pit. Drilling will also test to expand the “orpiment-gold” zone (Figure 2) discovered in drilling by Timberline in 2015 (see press release dated April 20, 2015 at http://timberlineresources.co/press-releases).

Geophysical surveys (IP/resistivity and gravity) are planned to advance exploration for new zones of Carlin style gold mineralization east of the Lookout Mountain open pit, including opportunities in the historical Oswego mine area where nine grab samples collected in 2018 over a 281-foot road-cut ranged from 0.090 opt (3.086 g/t) to 1.135 opt (38.914 g/t)(see press release dated June 12, 2018 at http://timberlineresources.co/press-releases).

Table 1. Lookout Mountain High-grade Gold (≥ 0.25 opt (8.6 g/t)) Drill Intercepts1

| Drill Hole | Gold (opt) |

From (feet) |

To (feet) |

Interval(Feet) | Gold (g/t) |

From (meters) |

To (meters) |

Interval (Meters) | |

| BH05-01 | 0.370 | 270 | 330 | 60 | 12.669 | 82.32 | 100.61 | 18.29 | |

| BH05-03 | 2.240 | 193 | 196 | 3 | 76.800 | 58.84 | 59.76 | 0.91 | |

| BH06-02 | 0.360 | 445 | 472 | 27 | 12.356 | 135.67 | 143.90 | 8.23 | |

| BH06-10 | 0.537 | 0 | 50 | 50 | 18.422 | 0.00 | 15.24 | 15.24 | |

| BH06-13 | 1.467 | 148 | 151 | 3 | 50.286 | 45.12 | 46.04 | 0.91 | |

| BH06-13 | 0.277 | 385 | 409.5 | 24.5 | 9.509 | 117.38 | 124.85 | 7.47 | |

| BH06-16 | 0.376 | 0 | 32.7 | 32.7 | 12.881 | 0.00 | 9.97 | 9.97 | |

| BHSE-029C | 0.349 | 391 | 449 | 58 | 11.953 | 119.21 | 136.89 | 17.68 | |

| BHSE-032 | 0.425 | 140 | 150 | 10 | 14.571 | 42.68 | 45.73 | 3.05 | |

| BHSE-034 | 0.460 | 135 | 140 | 5 | 15.771 | 41.16 | 42.68 | 1.52 | |

| BHSE-037C | 0.810 | 222 | 223 | 1 | 27.771 | 67.68 | 67.99 | 0.30 | |

| BHSE-126C | 0.967 | 31 | 46.2 | 15.2 | 33.138 | 9.45 | 14.09 | 4.63 | |

| BR-1 | 0.424 | 35 | 75 | 40 | 14.537 | 10.67 | 22.87 | 12.20 | |

| BR-1 | 1.315 | 65 | 75 | 10 | 45.086 | 19.82 | 22.87 | 3.05 | |

| BR-19 | 0.370 | 35 | 45 | 10 | 12.686 | 10.67 | 13.72 | 3.05 | |

| BR-19 | 1.315 | 65 | 75 | 10 | 45.086 | 19.82 | 22.87 | 3.05 | |

| BR-19 | 0.323 | 220 | 235 | 15 | 11.086 | 67.07 | 71.65 | 4.57 | |

| BR-19 | 0.319 | 385 | 450 | 65 | 10.945 | 117.38 | 137.20 | 19.82 | |

| BR-26 | 0.323 | 440 | 460 | 20 | 11.057 | 134.15 | 140.24 | 6.10 | |

| EFL-4 | 0.270 | 95 | 100 | 5 | 9.257 | 28.96 | 30.49 | 1.52 | |

| EFL-5 | 0.250 | 0 | 5 | 5 | 8.571 | 0.00 | 1.52 | 1.52 | |

| LM-05 | 0.259 | 0 | 65 | 65 | 8.888 | 0.00 | 19.82 | 19.82 | |

| LM-13 | 0.360 | 10 | 15 | 5 | 12.343 | 3.05 | 4.57 | 1.52 | |

| RTC-201 | 0.317 | 0 | 46 | 46 | 10.885 | 0.00 | 14.02 | 14.02 | |

| RTC-201 | 0.504 | 57 | 65 | 8 | 17.263 | 17.38 | 19.82 | 2.44 | |

| RTR-020 | 0.520 | 20 | 25 | 5 | 17.829 | 6.10 | 7.62 | 1.52 | |

| RTR-044 | 0.338 | 0 | 65 | 65 | 11.578 | 0.00 | 19.82 | 19.82 | |

| RTR-044a | 0.290 | 0 | 10 | 10 | 9.943 | 0.00 | 3.05 | 3.05 | |

| RTR-044a | 0.310 | 85 | 90 | 5 | 10.629 | 25.91 | 27.44 | 1.52 | |

| RTR-048 | 0.400 | 180 | 185 | 5 | 13.714 | 54.88 | 56.40 | 1.52 | |

| RTR-049 | 4.760 | 110 | 115 | 5 | 163.200 | 33.54 | 35.06 | 1.52 | |

| RTR-049 | 0.820 | 240 | 250 | 10 | 28.114 | 73.17 | 76.22 | 3.05 | |

| RTR-059 | 0.600 | 95 | 105 | 10 | 20.571 | 28.96 | 32.01 | 3.05 | |

| RTR-071 | 0.283 | 0 | 45 | 45 | 9.714 | 0.00 | 13.72 | 13.72 | |

| RTR-095 | 0.368 | 25 | 65 | 40 | 12.600 | 7.62 | 19.82 | 12.20 | |

| RTR-098 | 0.370 | 0 | 45 | 45 | 12.686 | 0.00 | 13.72 | 13.72 | |

| RTR-133 | 0.507 | 235 | 250 | 15 | 17.371 | 71.65 | 76.22 | 4.57 | |

| RTR-134 | 0.350 | 415 | 470 | 55 | 12.000 | 126.52 | 143.29 | 16.77 | |

| RTR-153 | 0.325 | 30 | 60 | 30 | 11.143 | 9.15 | 18.29 | 9.15 | |

| RTR-153 | 0.360 | 240 | 245 | 5 | 12.343 | 73.17 | 74.70 | 1.52 | |

| RTR-156 | 0.300 | 55 | 60 | 5 | 10.286 | 16.77 | 18.29 | 1.52 | |

| RTR-159 | 0.250 | 15 | 25 | 10 | 8.571 | 4.57 | 7.62 | 3.05 | |

| RTR-163 | 0.920 | 60 | 65 | 5 | 31.543 | 18.29 | 19.82 | 1.52 | |

| RTR-180 | 0.340 | 365 | 375 | 10 | 11.657 | 111.28 | 114.33 | 3.05 | |

| RTR-181 | 0.265 | 265 | 335 | 70 | 9.086 | 80.79 | 102.13 | 21.34 | |

| RTR-190 | 0.329 | 475 | 525 | 50 | 11.280 | 144.82 | 160.06 | 15.24 | |

| RTR-191 | 0.557 | 440 | 485 | 45 | 19.086 | 134.15 | 147.87 | 13.72 | |

| RTR-258 | 0.410 | 500 | 510 | 10 | 14.057 | 152.44 | 155.49 | 3.05 |

1 See Updated Technical Report on the Lookout Mountain Project, MDA, Effective March 1, 2013, Filed on SEDAR April 12, 2013 for sample preparation, analyses, and security, and data verification

Lookout Mountain Gold Resource

Plans are to incorporate the results of the delineation of the NW-SE trending high-grade gold mineralization into an updated resource model. This high-grade trend is distinct from an existing N-S trending resource which was prepared by Mine Development Associates (“MDA”) of Reno, Nevada in 2013 (Table 2).

Table 2. Lookout Mountain Gold Resource(1)(2)(3)

|

Resource Category |

Tons |

Tonnes |

Gold (opt) |

Gold (g/t) |

Gold Ounces |

|

Measured |

3,043,000 |

2,761,000 |

0.035 |

1.200 |

106,000 |

|

Indicated |

25,897,000 |

23,493,000 |

0.016 |

0.549 |

402,000 |

|

Measured & Indicated |

28,940,000 |

26,254,000 |

0.018 |

0.617 |

508,000 |

|

Inferred |

11,709,000 |

10,622,000 |

0.012 |

0.411 |

141,000 |

Notes:

- 0.006 opt (0.21 g/t) cut-off applied to oxidized material to capture mineralization potentially available to open pit extraction and heap leach processing. 0.030 opt (1.03 g/t) cut-off applied to unoxidized material to capture mineralization potentially available to open pit extraction and lower heap leach recoveries or sulfide processing.

- Rounding may cause apparent discrepancies.

- Refer to Updated Technical Report on the Lookout Mountain Project, MDA, effective March 1, 2013, Filed on SEDAR April 12, 2013.

The full MDA resource study can be seen at http://timberlineresources.co/wp-content/uploads/2015/07/LookoutMt_-43-101_2013.pdf.

About Timberline Resources

Timberline Resources Corporation is focused on advancing district-scale gold exploration and development projects in Nevada. These include its 23 square-mile Eureka property, comprising the Lookout Mountain, Windfall, and Oswego projects which lie along three separate structural-stratigraphic trends defined by distinct geochemical gold anomalies, as well as being operator of both the Paiute joint venture project with a subsidiary of Barrick Gold, and the Elder Creek joint venture with McEwen Mining. All of these properties lie on the prolific Battle Mountain-Eureka gold trend. Timberline also controls the Seven Troughs property in Northern Nevada, which is one of the state's highest-grade former producers. Timberline has increased its owned and controlled mineral rights in Nevada to over 43 square miles (27,500 acres). Detailed maps and NI 43-101 estimated resource information for the Eureka property may be viewed at http://timberlineresources.co/.

Timberline is listed on the OTCQB where it trades under the symbol "TLRS" and on the TSX Venture Exchange where it trades under the symbol "TBR".

Steven Osterberg, Ph.D., P.G., Timberline’s President and Chief Executive Officer, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this release.

Forward-looking Statements

Statements contained herein that are not based upon current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements reflect the Company's expectations about its future operating results, performance and opportunities that involve substantial risks and uncertainties. These statements include but are not limited to statements regarding the intended Agreement and the joint venture contemplated thereby, anticipated exploration and potential of the Project, completion of the Offering, and the size of the Company’s owned and controlled mineral rights. When used herein, the words "anticipate," "believe," "estimate," “upcoming,” "plan," “target”, "intend" and "expect" and similar expressions, as they relate to Timberline Resources Corporation, its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors that could cause the Company's actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, risks related to changes in the Company’s business resulting in changes in the use of proceeds, and other such factors, including risk factors discussed in the Company's Annual Report on Form 10-K for the year ended September 30, 2018. Except as required by law, the Company does not undertake any obligation to release publicly any revisions to any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.