VANCOUVER, British Columbia, July 16, 2025 (GLOBE NEWSWIRE) -- Maxus Mining Inc. (“Maxus” or the “Company”) (CSE: MAXM | FRA: R7V), is pleased to announce that the Company has expanded its land holdings through strategic staking at the Altura Antimony Project (the “Project” or the “Property”) in British Columbia, Canada. The Company is currently undertaking a compilation of all available historic data on the Project to prepare its Phase 1 Exploration Plan for the Project.

Morgan Verge, Technical Advisor of Maxus, commented, “We are excited to announce the acquisition of additional claims via low-cost staking along the antimony-mineralized trend at the Altura Project. Historical work on the Property highlights significant mineral potential along strike, and we are well-positioned to advance exploration on this promising ground.”

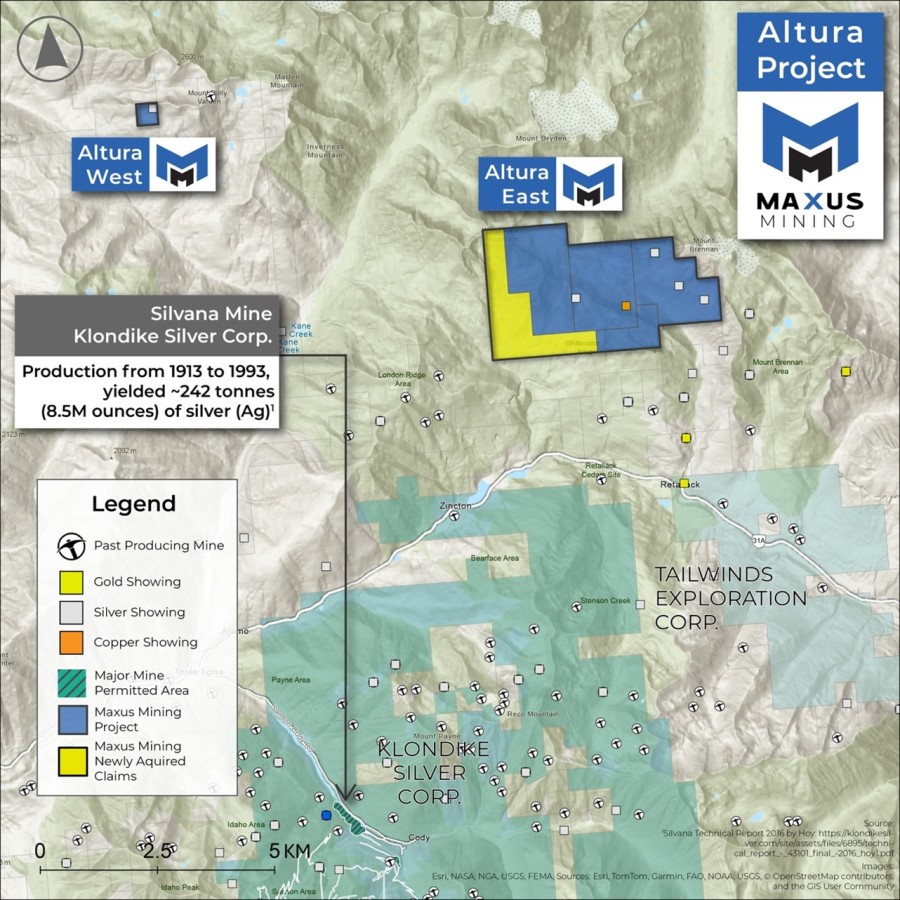

Figure 1. Altura Project Outlining Claim Extension1

Altura Antimony Project

The Project is comprised of two claim blocks, Altura West, positioned on the area of Dolly Varden, and Altura East, positioned between Whitewater and Brennan Mountains roughly 29 kilometres northeast of New Denver, British Columbia. The region is recognized for its strong antimony, silver, and gold potential (Please see Figure 1).

Altura West

The Altura West property covers a shear zone overprinted by quartz veining hosting disseminated pyrite and argentiferous tetrahedrite with minor stibnite and chalcopyrite. The vein system strikes east, dipping 55 degrees north. Quartz veining is 0.6 to 3.6 meters thick and has been traced for 600 meters along strike.2 A 4-kilogram sample of dumped material from a historic adit on the property assayed 1.3 grams per ton Au and 1,596 grams per ton Ag. There is a lack of geological information on the occurrence, however, the 1928 Minister of Mines Annual Report describes a 1.2m quartz vein which carries disseminated to massive stibnite hosted in (or associated with) serpentinite ultramafic rock locally altered to listwanite quartz-carbonate-mariposite.2

The Altura West block is on strike from Equinox Resources Inc.’s recent antimony discovery as announced on November 8, 2024, which saw ultra-high grade naturally occurring antimony at their Alturas Project returning assays up to 69.98% Sb.3

Altura East

The Altura East property is situated two kilometres northwest along strike of the Highland Surprise Mine, a past-producing mine defined by polymetallic veins containing gold, silver, lead, zinc, and copper.4

The extension claim is situated northwest along strike of stratigraphy of Olympus East and West, two historic showings outlined by NE-striking subparallel veins associated with similar mineralization to the Highland Surprise Mine (gold, silver, lead, zinc, and copper), highlighting the multi-element potential of the Altura East claims. Historic surface sampling in the Olympus East and West areas uncovered grades of 6.56 ounces per ton Ag; 0.95% Cu; 3.90% Pb; and 9.32% Zn.5 A shear zone trending 330 degrees has been mapped across the property, intersecting the serpentinite body along its western margin.6

Qualified Person Statement

The scientific and technical information contained in this news release has been reviewed, verified, and approved by Sean Hillacre, P.Geo., Director of the Company and a “qualified person” as defined in NI 43-101 – Standards of Disclosure for Mineral Projects. Mr. Hillacre has examined information regarding the historical exploration at the Project, which includes a review of the historical sampling, analytical, and procedures underlying the information and opinions contained herein.

Management cautions that historical results collected and reported by operators unrelated to Maxus have not been verified nor confirmed by its Qualified Person; however, the historical results create a scientific basis for ongoing work at the Project. Management further cautions that historical results, discoveries and published resource estimates on adjacent or nearby mineral properties, whether in stated current resource estimates or historical resource estimates, are not necessarily indicative of the results that may be achieved on the Project.

References

1 Klondike Silver – Silvana Mine Project https://klondikesilver.com/site/assets/files/7481/ks_top_15_silver_past_producing_mines1.pdf?aut3t

2 Dolly Varden Prospect – 11-Oct-1995, Ron McMillan – MINFILE 0.82KSW130 – https://minfile.gov.bc.ca/summary.aspx?minfilno=082KSW130

3 Equinox Resources – November 8, 2024, ‘Ultra High Grade Naturally Occurring Antimony at Alturas Project with Assays up to 69.98% Sb’ – https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02878498-6A1236703

4 HIGHLAND SURPRISE, PHOENIX (L.3336), FLETCHER (L.5608), CUBA (L.5609), PAISLEY (L.5612), WHISTLER (L.5614), CONNIE FR. NO. 2 (L.5818), COLUMBIA FR., HAVANA (L.5610)- MINFILE 082KSW037 –https://minfile.gov.bc.ca/Summary.aspx?minfilno=082KSW037

5 Olympus West – MINFILE 082KSW175 - https://minfile.gov.bc.ca/Summary.aspx?minfilno=082KSW175

6 Olympus East – MINFILE 082KSW174 - https://minfile.gov.bc.ca/Summary.aspx?minfilno=082KSW174

7 NI 43-101 - Technical Report on the Penny Property British Columbia, NTS 82G/12 49° 55° North Latitude -115° 90° West Longitude, Derrick Strickland P.Geo., August 14, 2024.

8 Open File 1992-11, Map Number 10.

9 MILFILE No: 082FSW228 – Loto 3, 1980 Grab Sample – https://minfile.gov.bc.ca/report.aspx?f=PDF&r=Inventory_Detail.rpt&minfilno=082FSW228

10 Endurance Summarizes Antimony Results From The Reliance Gold Project, BC - Best Intervals Include 19.2% Antimony And 2.16 gpt Au Over 0.5 m In 2024 Drilling – February 24, 2025 - https://endurancegold.com/news-releases/endurance-summarizes-antimony-results-from-the-reliance-gold-project-bc-best-intervals-include-19.2-antimony-and-2.16-gpt-au/

About Maxus Mining Inc.

Maxus Mining Inc. (CSE: MAXM | FRA: R7V) is a mineral exploration company focused on locating, acquiring, and if warranted, developing economic mineral properties in premier jurisdictions. The Company is working towards progressing its diverse portfolio of exploration properties which includes approximately 7,244 hectares of prospective terrane comprising 3,700 hectares of terrane amongst four antimony projects, 3,120 hectares encompassing the Penny Copper Project & the remaining 422 hectares coming from the Lotto Tungsten Project.

The Penny Copper Project covers approximately 3,122 hectares and has seen exploration activity throughout the last 100+ years with recent work including rock sampling and minor geological mapping.7 The Penny Copper Project is located near the major past producing Sullivan Mine at Kimberley, British Columbia, an area that has stimulated both junior and major exploration company activities in the past year. Additionally, the Penny Copper Project saw a 2017 work program return 17 grab samples, which returned copper values up to 1,046 ppm Cu (TK17-149c), 1,808 ppm Cu (TK17-28) and 2,388 ppm Cu (TK17-12)7.

At the Quarry Antimony Project, in well-established British Columbia, Canada, one historical sample taken assayed 0.89 g/t Au, 3.8% Cu, 0.34% Zn, 42.5% Pb, and 0.65% g/t Ag and 20% Sb.8 A selected grab sample taken in 1980 at the Lotto Tungsten Project from a quartz vein with scheelite assayed 10.97% Wo3.9 Additionally, the Altura Antimony Project & the Hurley Antimony projects are strategically positioned; Altura is on strike from Equinox Resources recent antimony discovery which saw high-grade naturally occurring antimony with assays up to 69.98% Sb3; Hurley neighbours Endurance Gold Corp.’s Reliance Gold Project which saw antimony results from 2024 work programs include 19.2% Sb and 2.16 g/t Au over 0.5 m encountered during the 2024 drilling program.10

On Behalf of the Board of Directors

Scott Walters

Chief Executive Officer, Director

+1 (778) 374-9699

This email address is being protected from spambots. You need JavaScript enabled to view it.

Disclaimer for Forward-Looking Information

This news release includes certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, "expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward-looking statements or information.

Forward-looking statements and forward-looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Maxus’, future growth potential for Maxus and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of copper, gold, tungsten, antimony and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Maxus’ ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

This news release contains “forward-looking information” within the meaning of the Canadian securities laws. Statements, other than statements of historical fact, may constitute forward looking information and include, without limitation, statements with respect to the Project and its mineralization potential; the Company’s objectives, goals, or future plans with respect to the Project; further exploration work on the Project in the future. With respect to the forward-looking information contained in this news release, the Company has made numerous assumptions regarding, among other things, the geological, metallurgical, engineering, financial and economic advice that the Company has received is reliable and are based upon practices and methodologies which are consistent with industry standards. While the Company considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies. Additionally, there are known and unknown risk factors which could cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include, among others: fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of well results and the geology, continuity and grade of copper, gold, tungsten, antimony and other metal deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; the need for cooperation of government agencies in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs or in construction projects and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; increased costs and restrictions on operations due to compliance with environmental and other requirements; increased costs affecting the metals industry and increased competition in the metals industry for properties, qualified personnel, and management. All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

The Canadian Securities Exchange (CSE) does not accept responsibility for the adequacy or accuracy of this release.