HALIFAX, NS, June 4, 2025 /CNW/ - Axo Copper Corp. (the "Company") today announced the successful closing of its previously announced initial public offering (the "Offering") of units of the Company (the "Units"). Pursuant to the Offering, the Company issued 20,909,300 Units at a price of $0.55 per Unit for total gross proceeds of $11,500,115 (inclusive of the exercise in full of the Over-Allotment Option (as defined herein)). Each Unit consists of one common share in the capital of the Company (a "Common Share") and one-half of one Common Share purchase warrant of the Company (each whole Common Share purchase warrant, a "Warrant"). Each Warrant is exercisable into one Common Share (each a "Warrant Share") at an exercise price of $0.70 per Warrant Share at any time prior to 5:00 p.m. (Toronto time) on June 4, 2027, subject to adjustment in certain events.

The Common Shares are expected to commence trading on the TSX Venture Exchange ("TSXV") at the opening of markets today under the symbol "AXO".

"We are proud to announce the closing of the Company's initial public offering, a significant milestone as the Company advances its high-grade La Huerta copper project. We'd like to thank existing shareholders for continued support, in addition to welcoming new investors, as the Company begins its next exciting chapter" says Jonathan Egilo, President and Chief Executive Officer of the Company.

The Offering was made through a syndicate of underwriters led by Stifel Nicolaus Canada Inc., as co-lead underwriter and sole bookrunner, together with SCP Resource Finance LP, as co-lead underwriter (together, the "Co-Lead Underwriters"), for and on behalf of a syndicate of underwriters that included BMO Nesbitt Burns Inc., Desjardins Securities Inc., Ventum Financial Corp. and Haywood Securities Inc. (collectively, the "Underwriters"). In consideration for the services provided by the Underwriters in connection with the Offering, the Company paid the Underwriters an aggregate cash commission of approximately $490,116.

The Underwriters were granted an over-allotment option, exercisable, in whole or in part, at the sole discretion of the Co-Lead Underwriters, at any time and from time to time, for a period of 30 days from and including the closing of the Offering, to purchase up to an additional 15% of the Units sold under the Offering, to cover the Underwriters' over-allocation position, if any, and for market stabilization purposes (the "Over-Allotment Option"). Prior to closing, the Co-Lead Underwriters exercised the Over-Allotment Option in full and an additional 2,727,300 Units were issued pursuant to the Offering.

Following completion of the Offering, the Company has 130,295,233 Common Shares issued and outstanding, 107,385,933 of which are subject to certain restrictions on transfer.

Following completion of the Offering, the Company has 3,500,000 options issued and outstanding (the "Options"), 2,400,000 of which are subject to certain restrictions on transfer.

Of the 107,385,933 Common Shares subject to restrictions on transfer, 17,133,333 Common Shares are held by principals and of the 2,400,000 Options subject to restriction on transfer, 2,400,000 are held by the principals and are subject to the following release schedule:

|

Release Dates |

Percentage of Total Common |

Total Number of Common |

|

June 4, 2025 |

5 % |

856,666 Common Shares 120,000 Options |

|

December 4, 2025 |

5 % |

856,668 Common Shares 120,000 Options |

|

June 4, 2026 |

10 % |

1,713,333 Common Shares 240,000 Options |

|

December 4, 2026 |

10 % |

1,713,333 Common Shares 240,000 Options |

|

June 4, 2027 |

15 % |

2,570,000 Common Shares 360,000 Options |

|

December 4, 2027 |

15 % |

2,570,000 Common Shares 360,000 Options |

|

June 4, 2028 |

40 % |

6,853,333 Common Shares 960,000 Options |

|

TOTAL |

100 % |

17,133,333 Common Shares 2,400,000 Options |

Of the 107,385,933 Common Shares subject to restrictions on transfer, 33,000,000 Common Shares are held by non-principals and are subject to the following release schedule:

|

Release Dates |

Percentage of Common Shares |

Total Number of Common |

|

June 4, 2025 |

10 % |

3,300,000 Common Shares |

|

December 4, 2025 |

15 % |

4,950,000 Common Shares |

|

June 4, 2026 |

15 % |

4,950,000 Common Shares |

|

December 4, 2026 |

15 % |

4,950,000 Common Shares |

|

June 4, 2027 |

15 % |

4,950,000 Common Shares |

|

December 4, 2027 |

15 % |

4,950,000 Common Shares |

|

June 4, 2028 |

15 % |

4,950,000 Common Shares |

|

TOTAL |

100 % |

33,000,000 Common Shares |

Of the 107,385,933 Common Shares subject to restriction on transfer, 34,939,365 Common Shares are held by non-principals and are subject to the following release schedule:

|

Release Dates |

Percentage of Common Shares |

Total Number of Common |

|

June 4, 2025 |

25 % |

8,734,841 Common Shares |

|

December 4, 2025 |

25 % |

8,734,841 Common Shares |

|

June 4, 2026 |

25 % |

8,734,841 Common Shares |

|

December 4, 2026 |

25 % |

8,734,842 Common Shares |

|

TOTAL |

100 % |

34,939,365 Common Shares |

Of the 107,385,933 Common Shares subject to restriction on transfer, 22,313,235 Common Shares are held by non-principals and are subject to the following release schedule:

|

Release Dates |

Percentage of Common Shares |

Total Number of Common |

|

August 4, 2025 |

50 % |

11,156,618 Common Shares |

|

October 4, 2025 |

50 % |

11,156,617 Common Shares |

|

TOTAL |

100 % |

22,313,235 Common Shares |

Certain insiders of the Company participated in the Offering, acquiring an aggregate of 1,727,271 Units at $0.55 per Unit for a total purchase price of $949,999.05. Participation of such insiders in the Offering constitutes a "related party transaction" as defined under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101") and is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the securities issued to the insiders nor the consideration paid by the insiders exceeded 25% of the Company's market capitalization. The Company did not file a material change report less than 21 days before the expected closing date of the Offering as the insider participation was not settled until shortly prior to closing and the Company wished to close on an expedited basis for sound business reasons.

The Offering was completed pursuant to the Company's final prospectus dated May 23, 2025 (the "Prospectus"), and filed with the securities regulators in each of the provinces of Canada, except Quebec, a copy of which is available under the Company's profile on SEDAR+ at www.sedarplus.ca.

TSXV Passport Listing

In December 2023, the TSXV introduced an innovative listing process ("TSXV Passport") to identify its most advanced new listing applicants and materially accelerate their listing and capital-raising timeline. TSXV Passport is designed to fast-track the listing of advanced applicants meeting specified criteria, including the requirement that (a) either the applicant (i) completes a minimum $10 million majority arm's length equity financing in connection with the listing application, or (ii) has a market capitalization of at least $50 million at the time of listing and (A) has a minimum of $5 million of revenue in the most recent financial year, or (B) completes a majority arm's length equity financing representing not less than 10% of the number of issued and outstanding shares at the time of listing, and (b) a majority of officers and directors of the applicant have at least a two-year positive track record with TSX- or TSXV-listed companies during the ten years preceding the listing application. The Company is proud to be the first company to complete a listing under TSXV Passport.

Early Warning Disclosure

Glenn Jessome, Executive Chairman, Corporate Secretary and Director of the Company, announces that he has filed an early warning report disclosing that, on June 4, 2025, he acquired 454,544 Units under the Offering. The Units were acquired at a price of $0.55 per Unit for a total purchase price of $249,999.20.

Prior to the closing of the Offering, Mr. Jessome beneficially owned, or exercised control or direction over, 16,000,000 Common Shares, representing approximately 14.6% of the issued and outstanding Common Shares. Following the closing of the Offering, Mr. Jessome now beneficially owns, or exercises control or direction over, 16,454,544 Common Shares on a non-diluted basis, representing approximately 12.6% of the issued and outstanding Common Shares on a non-diluted basis, and 16,681,816 Common Shares on a partially diluted basis, representing 12.8% of the issued and outstanding Common Shares on a partially diluted basis.

Mr. Jessome acquired the Units for investment purposes. Depending on market conditions and other factors, Mr. Jessome may from time to time acquire and/or dispose of securities of the Company or continue to hold his current position.

No securities regulatory authority has either approved or disapproved the contents of this news release. This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities of the Company in any jurisdiction in which such offer, solicitation or sale would be unlawful.

The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any U.S. state securities laws, and may not be offered, sold or delivered, directly or indirectly, to, or for the account or benefit of, persons in the "United States" or "U.S. persons" (as defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and all applicable U.S. state securities laws, or in compliance with an exemption therefrom.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

About the Company

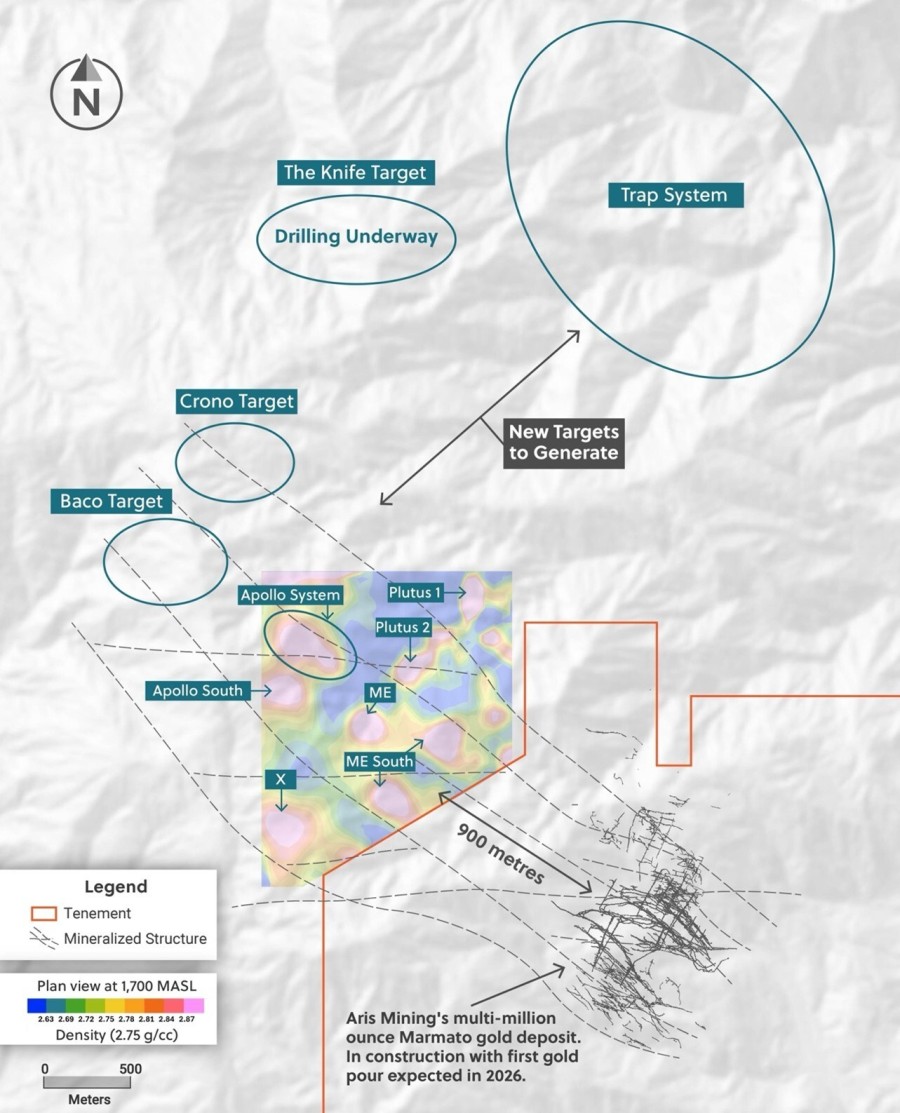

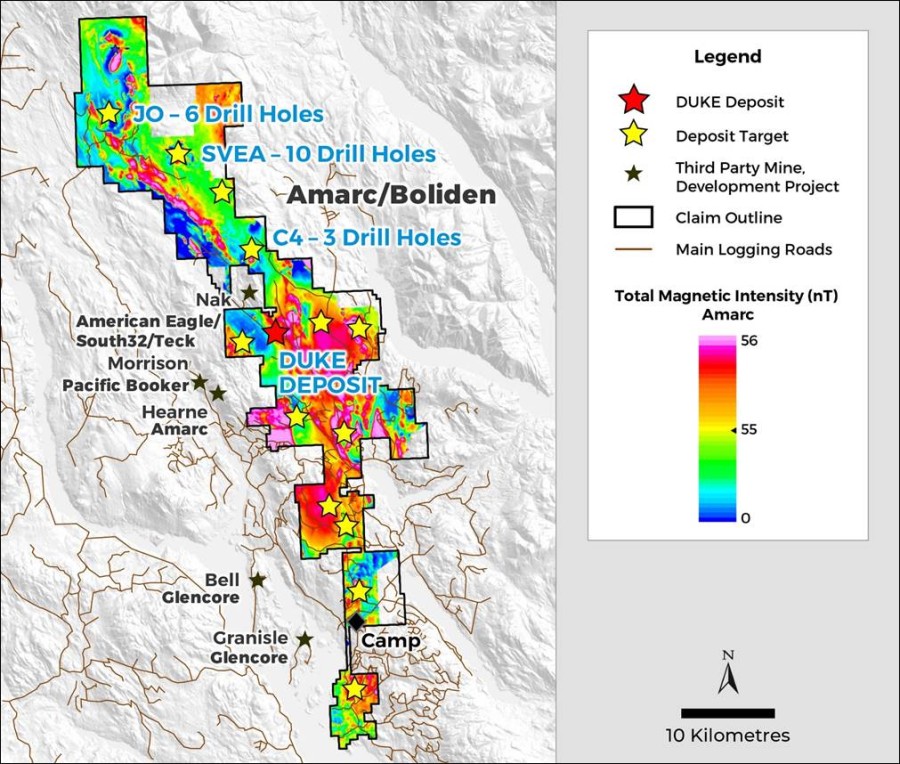

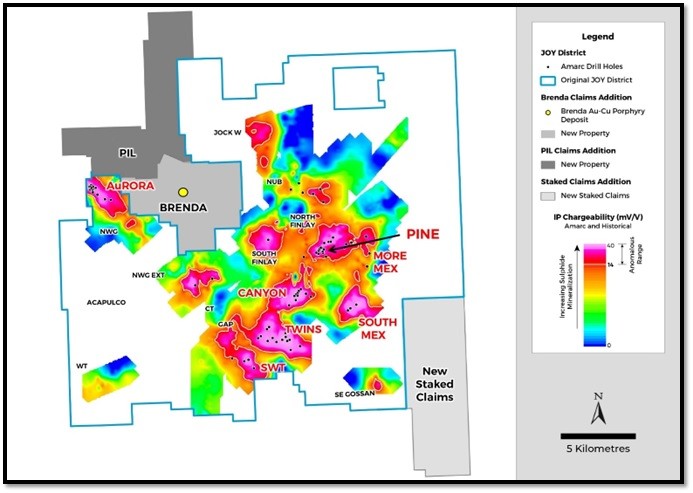

Axo Copper Corp. is a Canadian mineral exploration company engaged in the exploration and development of the La Huerta property, a new copper discovery in Jalisco, Mexico. Initial exploration has yielded high-grade copper both at surface through sampling programs, and at depth through initial drilling. The Company is focused on continuing to define near-surface mineralization along the La Huerta Trend, expanding mineralization at depth, and targeting new discoveries in an underexplored district.

The Company's head office is located at 2446 Purcells Cove Road, Halifax, Nova Scotia, B3P 2E6.

Additional information can be found at the Company's website: www.axocopper.com.

Forward-Looking Information

This news release includes certain "forward-looking statements". All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Offering, the Company's plans in respect of the La Huerta property and receipt of all necessary regulatory approvals, are forward-looking statements that involve various risks and uncertainties. Forward-looking statements are frequently characterized by words such as "will", "propose", "may", "is expected to", "subject to", "anticipates", "estimates", "intends", "plans", "projection", "could", "vision", "goals", "objective", "focus" and "outlook" and other similar words. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including, but not limited to, general business and economic conditions will not change in a materially adverse manner; the potential of high grade copper mineralization at the Company's properties; the results (if any) of further exploration work to define and expand mineral resources; the ability of exploration work (including drilling) to accurately predict mineralization; and the ability to generate additional drill targets. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include environmental risks, limitations on insurance coverage, risks and uncertainties related to exploration, development, operations, commodity prices and global financial volatility including as a result of tariffs, risk and uncertainties of operating in a foreign jurisdiction as well as additional risks described from time to time in the filings made by the Company with securities regulators. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.