Vancouver, British Columbia--(Newsfile Corp. - June 2, 2025) - Daura Gold Corp. (TSXV: DGC) (the "Company" or "Daura") is pleased to announce that it has entered into a binding offer letter, dated May 29, 2025 (the "Offer"), with EV Resources Limited ("EVR"), an arms-length party, to acquire the Yanamina gold-silver project (the "Yanamina Project") located in Ancash Department of central Peru (the "Transaction").

Highlights

-

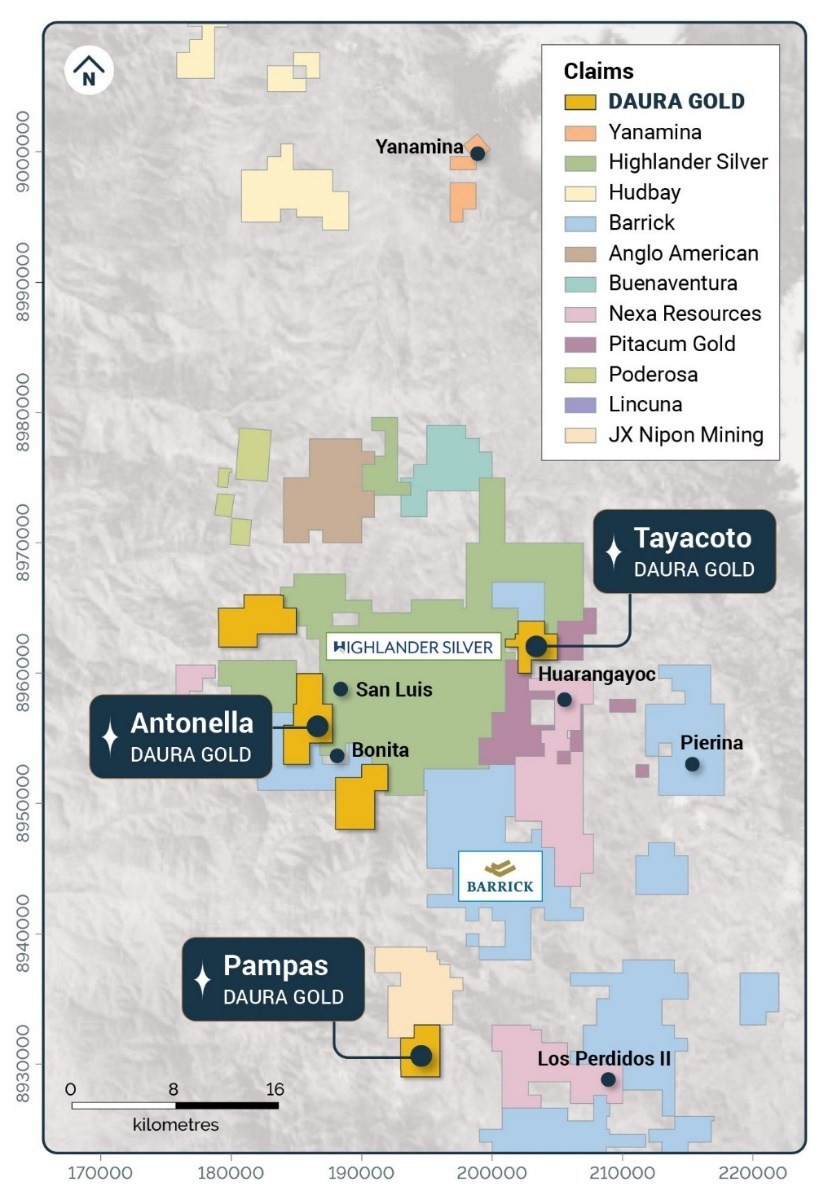

Acquisition of the Yanamina Project, approximately 40km north of Daura's high-grade Antonella target and the bonanza grade San Luis Gold Project owned by Highlander Silver.

-

The Yanamina Project has historical indicated resources of 1,566,900 tonnes at 1.65 g/t Au for a total of 83,100 (oz) of gold (Au) and 3,235,000 tonnes at 1.19 g/t Au for a total of 123,700 ounces of Au. The Company plans to undertake work to verify and update the historical estimate as a priority.

-

Significant exploration upside and multiple drill targets on the property given limited and focused historical drilling. Open extensions to resources at depth and lateral extensions and significant faulted extension target at depth.

-

Previous drilling identified a high-grade core zone locally grading at 5 g/t Au over 5 meters within a mineralized envelope averaging 2.5 g/t Au over intervals from 20-30 meters.

-

Daura has an opportunity to update the Yanamina historical resource estimate and bring a current resource estimate into Daura's resource profile.

-

Yanamina compliments Daura's project portfolio in the Ancash Department, which is well-known for mining in Peru with major historical production from Barrick's Pierina gold mine, approximately 40km from Yanamina. And 94km from the Tier 1 Antamina Mine, owned by Glencore, Teck and Mitsubishi.

(See "Yanamina Historical Mineral Resource" below for further details.)

A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource and the Company is not treating the historical estimate as a current mineral resource.

Luis Saenz, Daura CEO, commented: "The acquisition of the Yanamina Gold-Silver Project marks an exciting prospect for Daura Gold as we expand our footprint into one of Peru's most prolific mining districts. Only about 40km north of our existing land package at Antonella, Yanamina is a perfect complement to Daura's asset base." said Luis Saenz, CEO of Daura. "With a significant historical resource, clear exploration upside, and proximity to premier deposits like San Luis and Pierina, Yanamina presents a compelling opportunity to unlock value for our shareholders. This transaction aligns with our strategy to build a high-quality portfolio of gold assets with near-term growth potential and strong leverage to rising precious metals prices."

Exploration Upside Potential

The historical work carried out for historical resource estimates highlighted a number of areas at Yanamina which show potential for additional mineralization, both as an extension but also proximal to the existing resource. As a result of the extensive and important surface alteration within the mineralized zone, a number of these target areas can be initially geologically explored, including mapping, sampling and geophysics, among others, to determine their potential.

An additional exploration target which remains open is the potential faulted extension to the existing historical resource. The historical resource is located on a fault scarp and there is sound geological evidence that the top of the resource has been removed by faulting. The extent of the "missing" upper portion of the resource is unknown, offering a straightforward exploration target with upside potential.

In 2006, ASX-listed Latin Gold completed detailed mapping of the geology and alteration, channel sampling, limited adit sampling, digitizing of the historic and current data base and drilled 25 diamond drill holes totaling 1,468 meters. The drilling confirmed the geology and the near surface zone of disseminated gold and silver mineralization, which is locally exposed in outcrop. Gold was intersected in the majority of the drill holes and demonstrated strong continuity along strike.

The drilling also identified a higher-grade core zone locally grading 5gpt Au over 5 meters within a mineralized envelope averaging 2.5gpt Au over intervals ranging from 20 to 30 meters. The drilling also confirmed the coincident silver values reported historically ranging up to 20.3gpt Ag explored over 10 meters.

Only 12 drill holes have been executed in the potential expansion area, where there are open extensions to resources at depth and lateral extensions and significant faulted extension target at depth.

Community Engagement

As a new operator in the Yanamina area of interest, Daura recognizes the opportunity to establish new, long-term mutually beneficial relationships with the local communities and will strive to do this from the outset. Daura's community relations efforts at Yanamina are underway as part of the Company's due diligence process.

Yanamina Project Acquisition

Pursuant to the Offer the Company proposes to purchase the Yanamina Project from EVR in consideration for an initial payment of US$150,000 in cash (the "Initial Consideration").

The Company may make additional payments in cash or shares to EVR as contingent consideration (the "Contingent Consideration") upon completion of certain milestones in relation to the Yanamina Project. The Contingent Consideration is only accrued and payable if and when the following milestones are achieved:

-

On the 12-month anniversary from Closing, the Purchaser will pay to the Vendor US$150,000 in cash;

-

On the obtaining of a social license (that will allow a minimum 10,000 meter drilling campaign) with the communities in the area of influence of Yanamina, the Company will pay EVR US$1,700,000 in cash and/or common shares of the Company at the option of the Company;

-

Within 60 days of the start of construction of Yanamina, the Company will pay EVR US$2,000,000 in cash and/or common shares of the Company at the option of the Company; and

-

Within 60 days of the start of Commercial Production on the Project, the Company will pay EVR US$2,000,000 in cash and/or common shares of the Company at the option of the Company.

Any common shares issuable to the Vendor, at the election of the Company, will be issuable at a deemed price equivalent to the volume-weighted average closing price of the common shares of the Company on the TSX Venture Exchange in the thirty (30) trading days prior to issuance and will be calculated using the applicable exchange rate posted by the Bank of Canada immediately prior to issuance. The deemed price of the common shares will be subject to such minimum pricing as is permitted by the policies of the TSX Venture Exchange and in no case will common shares be issuable at a deemed price of less than (Cdn)$0.05.

Project Agreement

The Yanamina Project is currently subject to the terms of a project agreement (the "Project Agreement") involving Happy Diamonds Pty. Ltd. ("Happy Diamonds"). Following completion of the Transaction, in addition to the payments outlined above, the Company will assume responsibility for all obligations due and owing under the Project Agreement, including the following payments owing under the Project Agreement:

-

on or before the fifth (5th) business day following the commencement of construction of infrastructure for commercial production at the Yanamina Project, pay to Happy Diamonds the sum of US$1,500,000 in cash;

-

on or before the tenth (10th) business day following the date of the initial gold pour from the Yanamina Project, pay to Happy Diamonds the sum of US$1,000,000 in cash;

-

on or before the tenth (10th) business day following the first (1st) anniversary of the date of the initial gold pour from the Yanamina Project, pay to Happy Diamonds the sum of US$1,000,000 in cash;

-

on or before the tenth (10th) business day following the second (2nd) anniversary of the date of the initial gold pour from the Yanamina Project, pay to Happy Diamonds the sum of US$1,000,000 in cash; and

-

on or before the tenth (10th) business day following the production of 275,000 ounces of gold (or gold products containing the equivalent of such amount of refined gold using, for other precious metals, the gold equivalent ounces thereof) from the Yanamina Project, pay to Happy Diamonds the sum of US$1,000,000 in cash.

Completion of the Transaction remains subject to a number of conditions, including negotiation of definitive documentation and approval of the TSX Venture Exchange. The Transaction cannot be completed until these conditions have been satisfied, and there can be no assurance that the Transaction will be completed as presently contemplated.

The Company does not expect the Transaction to result in a change of control for the Company, or to constitute a "fundamental acquisition" for the Company, within the meanings prescribed by the policies of the TSX Venture Exchange. The Company does not anticipate that the Yanamina Project, if acquired, would represent the majority of the assets of the Company, nor is pit expected to the principal focus of the Company in the next twelve months.

Yanamina Historical Mineral Resource

The historical mineral resource is included in a Technical Report titled "Deposit Modeling, NI 43-101 Resource Estimate, Preliminary Economic Assessment: Yanamina Gold Property" (the "Technical Report"), with an effective date of February 28, 2011. The report was prepared as a National Instrument 43-101 - Standard of Disclosure for Mineral Projects ("National Instrument 43-101") technical report for Coronet Metals Inc. The historical estimate is considered to be relevant and for the purposes of the Company proceeding with the Transaction as it provides an indication of the potential significance of the Yanamina Project.

The Technical Report provides details on mineral resources and reserves, as well a potential development option for the Yanamina Gold Project that considers underground mining and processing using conventional cyanide leach methods. However, the prices, costs, and development strategy and options are no longer current and need to be re-evaluated using assumptions and qualifications that are more reflective of today's environment.

The Yanamina gold and silver deposit is a volcanic hosted, low sulphidation, epithermal quartz system.

The Yanamina historical Mineral Resource data base has a total of 2,643 samples, spanning 3,402 meters from 78 drill holes. The indicated resource covers approximately 17 hectares and is outlined by a search area of 25 metres; within this area, the drill holes intersected similar grade‐thickness composites at a 1g/t Au cut‐off. The inferred resource is outlined by a search area of 50 metres. The holes drilled in this area intersected mineralization defined by 0.5gpt cut‐off composites. Continuous blocks within the 25m search radius have thus been defined as an Indicated Resource while the blocks outside of this zone at a 50m search radius and those blocks above the 0.5 g/t Au cut‐off in Zone 2 are categorized as an Indicated Resource. Further drilling at 25m spacing would be required to define additional Inferred Resources in both zones.

Historical Mineral Resource Summary

| Summary of Historical Mineral Resources Yanamina Gold Deposit (0.50 g/t Au Cut-Off Grade) |

|||

| Resources | Tonnes | Grade (g/t Au) | Total Ounces |

| Indicated | 1,566,900 | 1.65 | 83,100 |

| Inferred | 3,235,000 | 1.19 | 123,700 |

Notes:

- A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource and the Company is not treating the historical estimate as a current mineral resource. Additional work including some re-sampling of historical core and a review of the geological model, will be necessary to verify the historical resource estimate.

Qualified Person

All scientific and technical information contained in this news release has been reviewed, verified and approved by Owen D. W. Miller, Ph.D. Member AIG, a qualified person as defined in National Instrument 43-101. Dr. Miller acts as an independent third-party consultant of the Company.

ABOUT DAURA GOLD CORP.

Listed on the TSX Venture Exchange, Daura Gold Corp is advancing high-impact exploration projects in Peru's renowned Ancash region. Daura Gold owns a 100% undivided interest in over 8,100 hectares of exploration concessions in Ancash, including the 900-hectare Antonella target, which is the primary focus of Daura Gold's current exploration efforts.

For further information please contact:

Daura Gold Corp.

543 Granville, Suite 501

Vancouver BC V6C 1X8

William T.P. Tsang CFO and Secretary

(604) 669-0660

This email address is being protected from spambots. You need JavaScript enabled to view it.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: future prices and the supply of gold and other precious and other metals; future demand for gold and other valuable metals; inability to raise the money necessary to incur the expenditures required to retain and advance the property; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; risks of the mineral exploration industry; delays in obtaining governmental approvals; adverse weather conditions and failure to obtain necessary regulatory or shareholder approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Daura disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.