Anchorage Alaska, Aug. 07, 2025 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” or the “Company”) (NASDAQ: NVA) (ASX: NVA) (FRA: QM3) ) is pleased to announce results from the Styx antimony ore sorting test work program which in our opinion shows outstanding results and that an upgraded, saleable antimony ore concentrate can be produced onsite for further processing.

Highlights

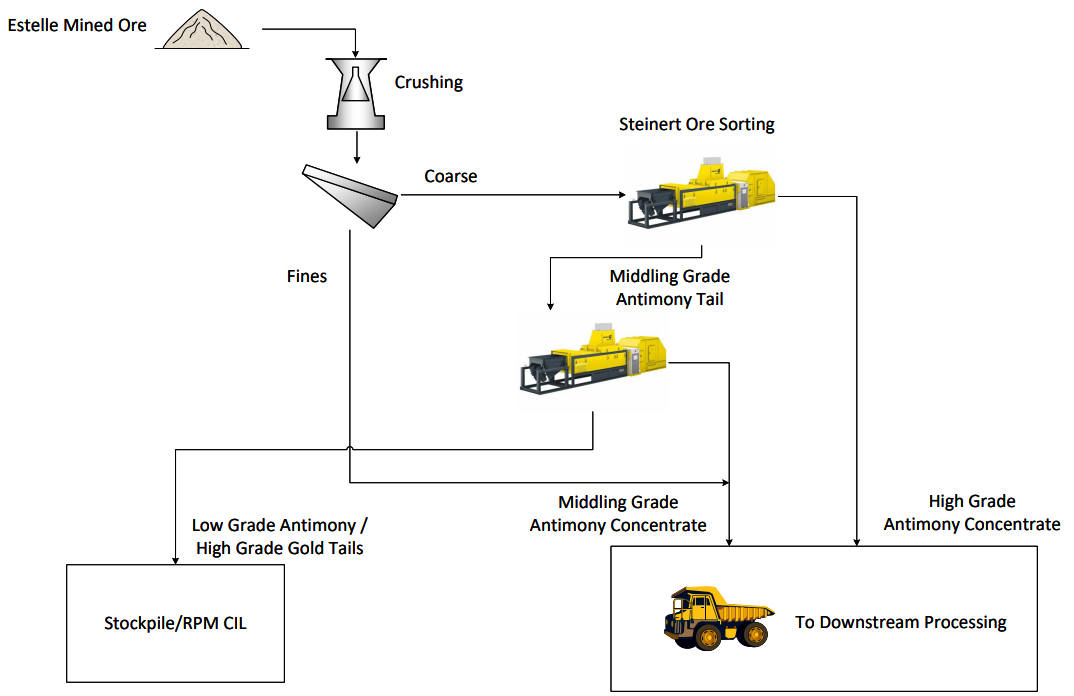

- Conceptual flowsheet outlines clear path for onsite recovery and upgrading of antimony ore using ore sorting (Figure 3).

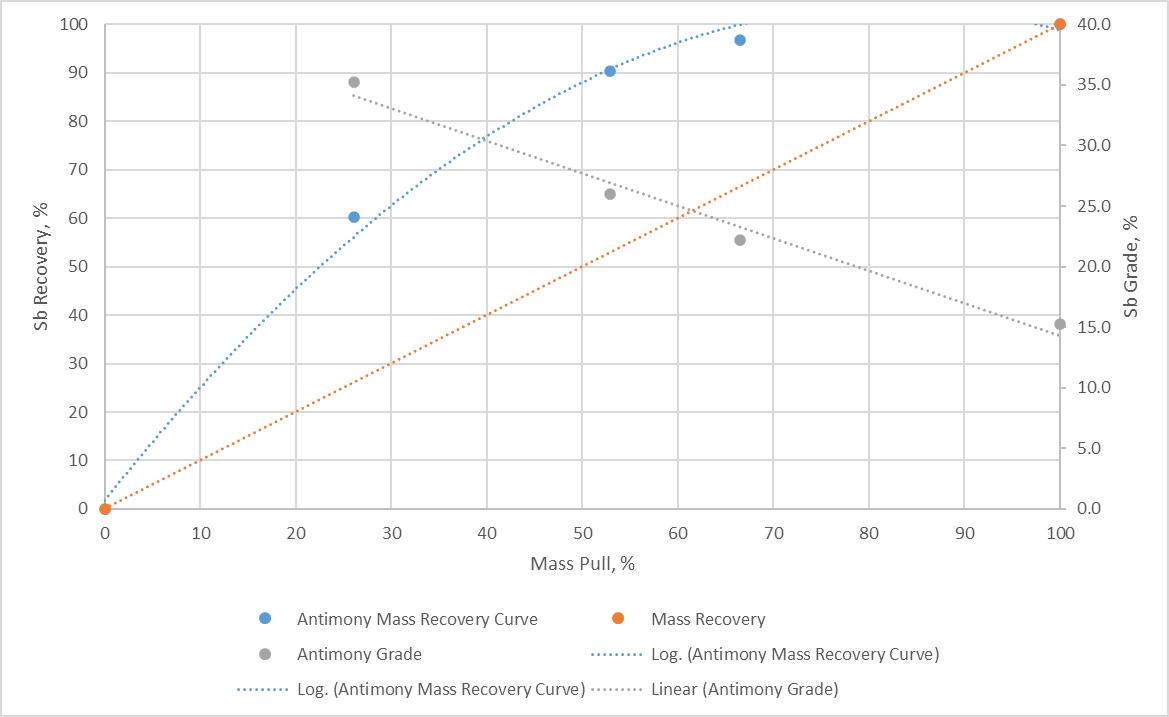

- 500kg bulk ore sorting test work on Styx sample demonstrated positive results from a single pass yielding high antimony recovery of 60.3% in 26.1% of the mass, at a grade of 35.2% Sb (49.1% Sb2S3) – a 2.3 times upgrade from the feed grade 15.2% Sb (24.5% Sb2S3) (Table 1 and Figures 1 and 2).

- Gold is beneficially rejected to the antimony ore sorting tail. Test work results demonstrate a gold recovery of 52.5%, upgrading the grade from 1.90 g/t Au to 2.99 g/t Au – an increase of 57.4% which demonstrates a strong potential for synergy between antimony and gold processing circuits at the Estelle Project (Table 1 and Figure 2).

- The test work confirms that an upgraded, saleable antimony ore concentrate can be produced for further processing, with Nova continuing to explore options to establish a U.S. domestic supply chain for antimony in Alaska.

- Beneficiation and purification test work are underway to develop and refine the rest of the downstream flowsheet.

- Ore sorting test work on the bulk Stibium sample is nearing completion and results will be reported in due course.

- Western Defense Supply Chains Under Pressure — Nova’s high-grade antimony discoveries at Estelle offer a potential strategic U.S. solution.

Nova CEO, Mr Christopher Gerteisen commented: “These ore sorting results from our Styx prospect represent a significant breakthrough in the advancement of Estelle’s critical minerals strategy. Achieving a 132% upgrade to produce a 49.1% antimony trisulfide concentrate from a single pass demonstrates Estelle’s high-grade antimony is amenable to low-cost, scalable, on-site processing. Importantly, we’ve shown that 60.3% of the contained antimony can be recovered in just 26.1% of the mass, with gold beneficiating to the tailings — opening up synergies between the antimony and gold circuits at Estelle. With this success, we believe Nova is rapidly positioning itself to become the first fully integrated U.S. domestic antimony producer at scale.

In the current geopolitical environment, where Western defense supply chains are under immense pressure, we believe our Estelle Project stands out as a truly strategic asset. With Styx and Stibium now confirmed as high-grade, near-term development prospects, and U.S. government engagement well underway through our DIBC membership and DoD grant applications, Nova is fast-tracking a solution to the critical antimony supply gap. We are proud to lead the charge in re-establishing domestic production of this defense-essential mineral, and today’s results mark another key step toward potentially delivering a secure, U.S.-based supply chain — right here in Alaska.”

Ore Sorting Test Work Results

Nova and METS Engineering (METS) partnered with Steinert Mining (Steinert) to evaluate the amenability of the Estelle ore body to sensor-based ore sorting.

Nova provided 500kg of Styx prospect ore for a bulk ore sorting test. The results from the bulk test demonstrated the Estelle antimony ore is amenable to ore sort upgrading with an XRT algorithm. Table 1 shows the results of the ore sorting test work, presented as the three concentrates and tail produced from the test work’s three passes. Figure 2 presents the cumulative recovery, mass pull and grades obtained from the test work.

Figure1. Ore sorted material from a single pass (See Table 1 Con 1) grading 49.1% antimony trisulfide (35.2% Sb)

Figure1. Ore sorted material from a single pass (See Table 1 Con 1) grading 49.1% antimony trisulfide (35.2% Sb)

Table 1. Results of ore sorting test work

| Stream |

Mass | Antimony | Gold | |||

| Recovery (%) | Grade (Sb%) | Trisulfide (Sb2S3%) | Recovery (%) | Grade (g/t Au) |

Recovery (%) | |

| Feed | 100 | 15.2 | 24.5 | 100 | 1.90 | 100 |

| Con 1 | 26.1 | 35.2 | 49.1 | 60.3 | 0.83 | 11.4 |

| Con 2 | 26.8 | 17.1 | 23.9 | 30.1 | 1.48 | 20.8 |

| Con 3 | 13.6 | 7.22 | 10.1 | 6.5 | 2.14 | 15.3 |

| Tailings | 33.5 | 1.45 | 2.02 | 3.2 | 2.99 | 52.5 |

Figure 2. Recovery-mass pull and grade-mass pull curves for the Styx antimony bulk sample

Figure 2. Recovery-mass pull and grade-mass pull curves for the Styx antimony bulk sample

The results presented in Table 1 and Figure 2 demonstrates that a high-grade concentrate can be recovered through ore sorting, in which 60.3% Sb is recovered in a mass yield of 26.1%. This generated a concentrate of 35.2% Sb (49.1% Sb2S3) from a 15.2% Sb (24.5% Sb2S3) feed - a 2.3 times upgrade from a single pass through the ore sorter.

Based on current scenarios being tested, a second pass is employed, a middling with almost the same grade as the feed can be scavenged, producing a grade of 13.8% Sb (19.2% Sb2S3), in 29% of the mass; the stagewise rejection of mass from the feed to the second ore sorter is 45%. The tails stream, containing 33.5% of the original feed mass also contains 52.5% of the original feed gold. This provides potential for the ore body to act as a satellite mine for RPM in addition to its merits as an antimony project.

Conceptual Antimony-Gold Flowsheet

Based on the positive results Nova is pleased to present a high-level conceptual flowsheet for Estelle antimony ore processing, with further test work and engineering underway.

This flowsheet demonstrates the suitability of ore sorting technology to maximise the value of the Estelle ore by concentrating valuables, antimony and gold into concentrates for further processing. The flowsheet is presented in Figure 3.

Figure 3. High level conceptual flowsheet for Estelle antimony ore

Figure 3. High level conceptual flowsheet for Estelle antimony ore

Ore sorters will be installed at the mine site, with high-grade antimony concentrate potentially shipped off-site for downstream processing. This approach enables a low-CAPEX, straightforward on-site processing flowsheet.

By implementing ore sorting technology at the source, Nova should be able to produce a premium-grade antimony concentrate — potentially suitable for direct shipping ore (DSO). This could generate early cash flow while Nova’s downstream processing facilities are being completed.

On-site ore sorting will also make it possible to stockpile lower-grade sorted material for future processing. Once operational, Nova’s potential plant is expected to process ore-sorted middlings combined with pre-screened fines.

Additionally, tailings from ore sorting at the Styx prospect may yield a high-grade gold concentrate, providing supplementary feed for the Estelle RPM CIL/CIP plant.

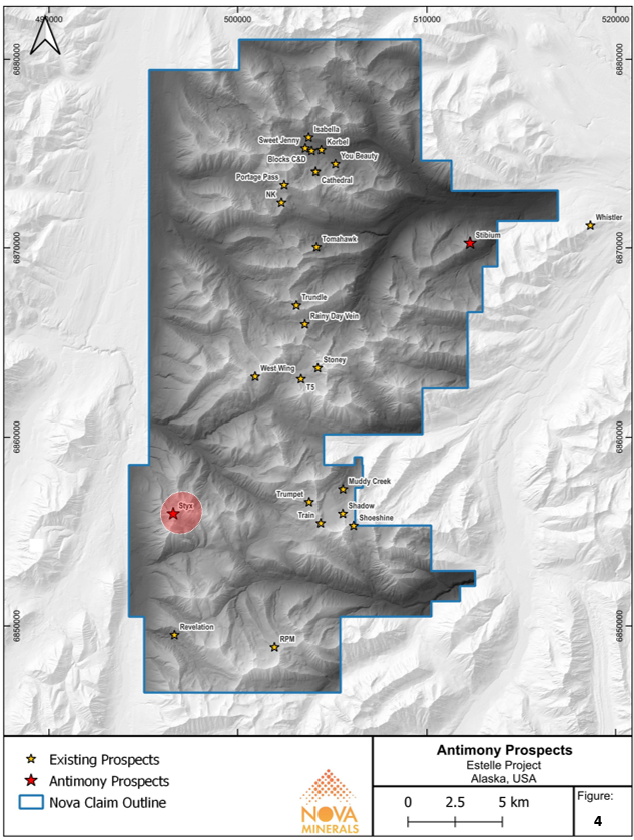

Figure 4. Estelle property map showing primary antimony prospects, with the Styx prospect highlighted, which is the source of the ore for the 500kg bulk sample used in this ore sorting test work.

Figure 4. Estelle property map showing primary antimony prospects, with the Styx prospect highlighted, which is the source of the ore for the 500kg bulk sample used in this ore sorting test work.

Western Defense Supply Chains Under Pressure — Nova’s High-Grade Antimony Discovery at Estelle Offers Strategic U.S. Solution

China’s export restrictions on critical minerals have intensified pressure on Western defense supply chains, particularly for antimony — an essential material in munitions, electronics, and other strategic applications. Nova’s Estelle Gold and Critical Minerals Project in Alaska has emerged as a potential U.S.-based solution, delivering high-grade antimony results from surface samples at numerous prospects across the project area. Surface sample assays from the Styx and Stibium prospects returned exceptional grades of up to 56.7% Sb (ASX Announcement: 5 December 2024), far surpassing the typical commercial range of 2 – 4% Sb, with some samples also containing high-grade gold. An independent report by RFC Ambrian in February 2025 also identified Estelle as one of only nine global projects with near-term antimony production potential.

Nova is now moving quickly to leverage this strategic opportunity. The company has joined the Defense Industrial Base Consortium and is advanced in its U.S. Department of Defense grant applications to potentially fast-track exploration, metallurgical testing, and infrastructure upgrades — aiming to initially produce direct shipping ore to potentially generate early cash flow while downstream processing facilities are completed.

Qualified Persons

The information contained in this report, relating to metallurgical results, is based on, and fairly and accurately represent the information and supporting documentation prepared by Mr Damian Connelly. Mr Connelly is a full-time employee of METS Engineering who are a Contractor to Nova Minerals Limited, and a Fellow of The Australasian Institute of Mining and Metallurgy. Mr Connelly has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration, and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Exploration Targets, Mineral Resources and Ore Reserves and as Qualified Person as defined in Regulation S-K 1300 under the Securities Act of 1933, as amended (S-K 1300). Mr Connelly consents to the inclusion in the report of the matters based on the results in the form and context in which they appear.

About Nova Minerals Limited

Nova Minerals Limited is a Gold, Antimony and Critical Minerals exploration and development company focused on advancing the Estelle Project, comprised of 514 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 advanced Gold and Antimony prospects, including two already defined multi-million ounce resources, and several drill ready Antimony prospects with massive outcropping stibnite vein systems observed at surface. The 85% owned project is located 150 km northwest of Anchorage, Alaska, USA, in the prolific Tintina Gold Belt, a province which hosts a >220 million ounce (Moz) documented gold endowment and some of the world's largest gold mines and discoveries including, Nova Gold and Paulson Advisors Donlin Creek Gold Project and Kinross Gold Corporation's Fort Knox Gold Mine. The belt also hosts significant Antimony deposits and was a historical North American Antimony producer.

Further discussion and analysis of the Estelle Project is available through the interactive Vrify 3D animations, presentations, and videos, all available on the Company’s website. www.novaminerals.com.au

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” "will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Nova Minerals Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions management believes to be reasonable at the time such statements are made, including but not limited to, continued exploration activities, Gold and other metal prices, the estimation of initial and sustaining capital requirements, the estimation of labor costs, the estimation of mineral reserves and resources, assumptions with respect to currency fluctuations, the timing and amount of future exploration and development expenditures, receipt of required regulatory approvals, the availability of necessary financing for the Project, the availability of funding sources, the availability of collaborative relationships, permitting and such other assumptions and factors as set out herein. Apparent inconsistencies in the figures shown in the MRE are due to rounding.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in Gold prices; sources and cost of power and water for the Project; the estimation of initial capital requirements; the lack of historical operations; the estimation of labor costs; general global markets and economic conditions; risks associated with exploration of mineral deposits; the estimation of initial targeted mineral resource tonnage and grade for the Project; risks associated with uninsurable risks arising during the course of exploration; risks associated with currency fluctuations; environmental risks; competition faced in securing experienced personnel; access to adequate infrastructure to support exploration activities; risks associated with changes in the mining regulatory regime governing the Company and the Project; completion of the environmental assessment process; risks related to regulatory and permitting delays; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued exploration and development.

These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the final prospectus related to the public offering filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Nova Minerals Limited undertakes no duty to update such information except as required under applicable law.

For Additional Information Please Contact

Craig Bentley

Director of Finance & Compliance & Investor Relations

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

M: +61 414 714 196